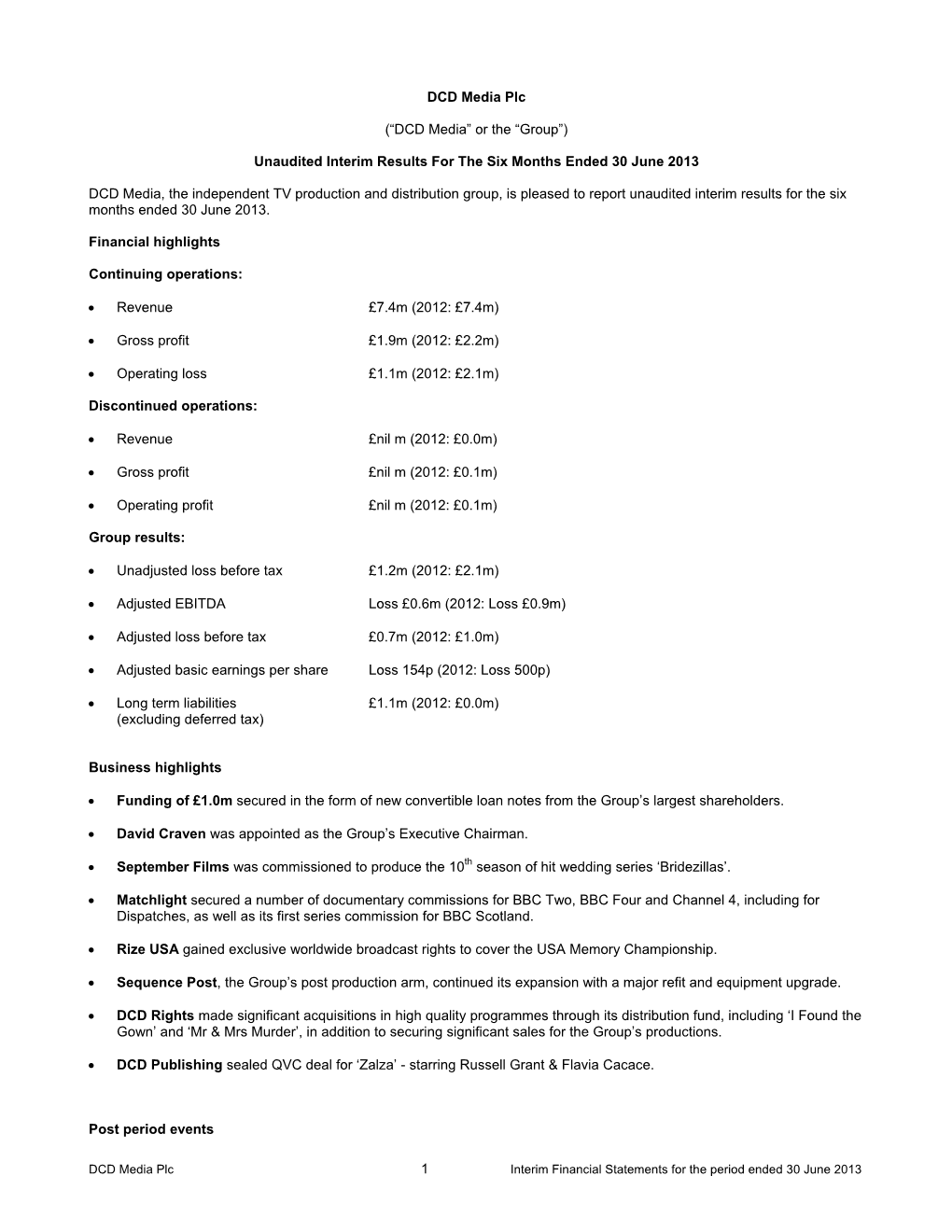

Unaudited Interim Results for the Six Months Ended 30 June 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Drama Drama Documentary

1 Springvale Terrace, W14 0AE Graeme Hayes 37-38 Newman Street, W1T 1QA SENIOR COLOURIST 44-48 Bloomsbury Street WC1B 3QJ Tel: 0207 605 1700 [email protected] Drama The People Next Door 1 x 60’ Raw TV for Channel 4 Enge UKIP the First 100 Days 1 x 60’ Raw TV for Channel 4 COLOURIST Cyberbully 1 x 76’ Raw TV for Channel 4 BAFTA & RTS Nominations Playhouse Presents: Foxtrot 1 x 30’ Sprout Pictures for Sky Arts American Blackout 1 x 90’ Raw TV for NGC US Blackout 1 x 90’ Raw TV for Channel 4 Inspector Morse 6 x 120’ ITV Studios for ITV 3 Poirot’s Christmas 1 x 100’ ITV Studios for ITV 3 The Railway Children 1 x 100’ ITV Studios for ITV 3 Taking the Flak 6 x 60’ BBC Drama for BBC Two My Life as a Popat 14 x 30’ Feelgood Fiction for ITV 1 Suburban Shootout 4 x & 60’ Feelgood Fiction for Channel 5 Slap – Comedy Lab 8 x 30’ World’s End for Channel 4 The Worst Journey in the World 1 x 60’ Tiger Aspect for BBC Four In Deep – Series 3 4 x 60’ Valentine Productions for BBC1 Drama Documentary Nazi Megaweapons Series III 1 x 60’ Darlow Smithson for NGCi Metropolis 1 x 60’ Nutopia for Travel Channel Million Dollar Idea 2 x 60’ Nutopia Hostages 1 x 60’ Al Jazeera Cellblock Sisterhood 3 x 60’ Raw TV Planes That Changed the World 3 x 60’ Arrow Media Nazi Megaweapons Series II 1 x 60’ Darlow Smithson for NGCi Dangerous Persuasions Series II 6 x 60’ Raw TV Love The Way You Lie 6 x 60’ Raw TV Mafia Rules 1 x 60’ Nerd Nazi Megaweapons 5 x 60’ Darlow Smithson for NGCi Breakout Series 2 10 x 60’ Raw TV for NGC Paranormal Witness Series 2 12 x 60’ Raw TV -

The Speakers and Chairs 2016

WEDNESDAY 24 FESTIVAL AT A GLANCE 09:30-09:45 10:00-11:00 BREAK BREAK 11:45-12:45 BREAK 13:45-14:45 BREAK 15:30-16:30 BREAK 18:00-19:00 19:00-21:30 20:50-21:45 THE SPEAKERS AND CHAIRS 2016 SA The Rolling BT “Feed The 11:00-11:20 11:00-11:45 P Edinburgh 12:45-13:45 P Meet the 14:45-15:30 P Meet the MK London 2012 16:30-17:00 The MacTaggart ITV Opening Night FH People Hills Chorus Beast” Welcome F Revealed: The T Breakout Does… T Breakout Controller: T Creative Diversity Controller: to Rio 2016: SA Margaritas Lecture: Drinks Reception Just Do Nothing Joanna Abeyie David Brindley Craig Doyle Sara Geater Louise Holmes Alison Kirkham Antony Mayfield Craig Orr Peter Salmon Alan Tyler Breakfast Hottest Trends session: An App Taskmaster session: Charlotte Moore, Network Drinks: Jay Hunt, The Superhumans’ and music Shane Smith The Balmoral screening with Thursday 14.20 - 14.55 Wednesday 15:30-16:30 Thursday 15:00-16:00 Thursday 11:00-11:30 Thursday 09:45-10:45 Wednesday 15:30-16:30 Wednesday 12:50-13:40 Thursday 09:45-10:45 Thursday 10:45-11:30 Wednesday 11:45-12:45 The Tinto The Moorfoot/Kilsyth The Fintry The Tinto The Sidlaw The Fintry The Tinto The Sidlaw The Networking Lounge 10:00-11:30 in TV Formats for Success: Why Branded Content BBC A Little Less Channel 4 Struggle For The Edinburgh Hotel talent Q&A The Pentland Digital is Key in – Big Cash but Conversation, Equality Playhouse F Have I Got F Winning in F Confessions of FH Porridge Adam Abramson Dan Brooke Christiana Ebohon-Green Sam Glynne Alex Horne Thursday 11:30-12:30 Anne Mensah Cathy -

ALAN DE PELLETTE – Director | Producer | Writer

ALAN DE PELLETTE – Director | Producer | Writer Alan de Pellette is a director from Glasgow with wide ranging credits in TV and film. He began his career in radio and created the long running BBC Scottish comedy, OFF THE BALL, before moving into TV and a range of comedies for BBC Two, Three and BBC Scotland, including the award winning CHEWIN' THE FAT and the critically acclaimed OVERNITE EXPRESS & SHREDDED WEEK. Alan is currently producing a live action children’s television series of Julia Donaldson’s PRINCESS MIRROR BELLE for BBC Children’s Productions in Glasgow. As well as moving into drama, Alan has also made several documentaries for the BBC, including SCOTLAND'S GAME CHANGERS, which was nominated for both an RTS and Celtic Media Award in 2018. He has directed numerous single dramas, including MYSTIQUE NO 375, a children's drama for the BBC that screened in 15 countries around Europe during 2017 and 2018. In the last year, Alan has directed 15 episodes of Channel 4's ground breaking continuing drama, HOLLYOAKS, including major storylines on racism, far right grooming and domestic abuse. Alan has numerous film credits as a writer/director. His first short, THE AFICIONADO, was part of the UK Film Council scheme, '8½', under patron Peter Mullan. It screened in festivals around the world and is shown regularly on TV across Europe by Mini Movie Channel. He has made 4 other successful short films, including a 45’ portmanteau of connected stories, DECLARATIONS , inspired by the 60th anniversary of the UN Declarations of Human Rights. It premiered at the 2009 New York Independent Film Festival, where Alan won Best International Director. -

Fifty Fifty Company Credits.Docx

SELECTED COMPANY CREDITS 4K, UHD & HDR 5.1 PROGRAMMING Sexy Beasts - 6 x 23’ - Lion Television - Netflix The Wedding of the Century - 1 x 90’ - Touchdown Films - Britbox TV UK + Britbox TV US Raise Your Game with Gareth Southgate - 1 x 30’ + 4 x 10’ - Zig Zag Productions - Youtube Originals Everybody’s Game - 1 x 60’ - DocHearts - Amazon Original Jack Whitehall: Travels with my Father, Season 4 - 2 x 60’ - Tiger Aspect - Netflix Jack Whitehall: I’m Only Joking - 1 x 60’ Dolby Vision - Tiger Aspect - Netflix Amazing Animal Friends - 6 x 60’ HDR - Oxford Scientific Films - Love Nature & Sky Nature Jack Whitehall: Christmas with my Father – 1 x 60’ – Full Post – Tiger Aspect - Netflix Jack Whitehall: Travels with my Father, Season 3 – 2 x 60’ – Full Post – Tiger Aspect -Netflix Simon Amstell: Set Free – 1 x 60’- Full Post – Tiger Aspect - Netflix Jack Whitehall: Travels with my Father, Season 2 – 5 x 30’ UHD 5.1 – Full Post – Tiger Aspect/Cave Bear Productions – Netflix Jack Whitehall: At Large – 1 x 70’ – Full Post - Tiger Aspect - Netflix Jack Whitehall: Travels with my Father, Season 1 – 6 x 30’ UHD 5.1 – Full Post – Tiger Aspect/Cave Bear Productions - Netflix HD PROGRAMMING Rogue Tiger Shark - The Hunt for Lagertha - 1 x 60’ - Arrow International Media - Discovery Plus The Full Treatment - 6 x 15’ - Twenty Six 03 - ITV2 & ITV Hub Please Help - 1 x 15’ - Tiger Aspect - BBC Three & BBC iPlayer Inside Tesco 24/7 - 3 x 60’ - Studio Leo, Argonon Group - Channel 5 Chronic Pain: How To Live With It - 1 x 60’ - Doc Hearts - Channel 5 Joey Essex: Grief -

Matchlight Limited

PUBLIC INTEREST TEST ON THE PROPOSED NEW BBC TELEVISION CHANNEL FOR SCOTLAND Response on behalf of Matchlight Limited Introduction Matchlight is a Glasgow based factual production company formed in 2009. Matchlight produces content for BBC Scotland, BBC One, BBC Two and BBC Four as well as BBC Alba, Channel 5 and others. Our work ranges across factual genres and we are particularly known for our award winning documentary, arts and specialist factual output. At the RTS Scotland Awards in 2017 our documentary “Scotland and the Klan” (produced for BBC Scotland) won the Documentary and Specialist Factual: History award and “My Baby, Psychosis and Me”, which we made for BBC One, secured the award for Documentary and Specialist Factual. We recently produced “The Highland Midwife” for Channel 5. This observational documentary series was filmed in locations across the NHS Highland area including Tain, Invergordon, Inverness, Lochgilphead and Campbeltown. Matchlight is very much in favour of the new BBC Scotland channel. We believe Scotland, especially a Scotland with its own national parliament, deserves a non-opt-out national broadcaster that reports the news and commissions content across genres, delivering the representative content Scottish licence fee payers deservedly expect. From an industrial point of view it also delivers a much needed boost to Scotland’s domestic television production market – a market which is currently comparatively weak, with only opt-out slots on BBC One and Two, BBC Alba and very limited opportunities on STV (which is only required to transmit 39 hours of original non-news content in primetime per annum). It will strengthen Scotland’s domestic television broadcast and production market and will lead to more competition for the Scottish audience, thereby improving the offering of the BBC and its competitors to that audience. -

Company Credits

Fifty Fifty info@fiftyfiftypost.com 020 7292 0920 fiftyfiftypost.com SELECTED COMPANY CREDITS 4K & UHD PROGRAMMNG Jack Whitehall: At Large – 1 x 70’ – Full Post - Tiger Aspect - Netflix Jack Whitehall: Travels with my Father, Season 1 – 6 x 30’ UHD 5.1 – Full Post – Tiger Aspect/Cave Bear Productions - Netflix Jack Whitehall: Travels with my Father, Season 2 – 5 x 30’ UHD 5.1 – Full Post – Tiger Aspect/Cave Bear Productions – Netflix HD PROGRAMMING Simon Amstell: Set Free – 1 x 60’ – Tiger Aspect - Netflix The Mind of Herbert Clunkerdunk – 2 x 10’ – Tiger Aspect – BBC Two Death Row: Countdown to Execution – 2 x 60’ – MultiStory Media - ITV Gemma: My Murder – 1 x 30’ – Hey Sonny Films - BBC Three Operation: Live Series 2 – 3 x 120’ – The Garden Productions – Channel 5 World’s Busiest Train Stations – 4 x 60’ – Tim Pritchard Productions – Channel 5 The Stand Up Sketch Show – 6 x 30’ – Spirit Media – ITV2 Royal Documentary – 1 x 60’ - Details under wrap until TX My Life: If I Go Blind – 1 x 30’ – markthreemedia - CBBC Alan Carr’s Christmas Cracker – 1 x 120’ – CPL Productions – Channel 4 This Is My Song – 2 x 60’ – Fremantle Media – BBC One John Torode’s Middle East – 10 x 30’ – Blink Films – Good Food Darcey Bussell: Dancing to Happiness – 1 x 60’ – Matchlight Ltd – BBC The Kinks: Echoes of a World – 1 x 90’ – Special Treats – Sky Arts Operation Live - 3 x 120’ – The Garden Productions – Channel 5 Dispatches: Born on the Breadline – 1 x 60’ – True Vision Productions – Channel 4 Katie Price: My Crazy Life – 2 x 48’ – Shiver - Quest Gordon, Gino -

2010 Annual Report 30 April 2011

DCD Media Plc Financial statements for the period ended 31 December 2010 DCD MEDIA PLC FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31 DECEMBER 2010 Company number 03393610 DCD Media Plc Financial statements for the period ended 31 December 2010 Contents Page Financial highlights 1 Chief Executive’s Overview 3 Financial Director’s Overview 8 Report of the Directors 11 Report of the Auditors 17 Consolidated statement of comprehensive income 19 Consolidated statement of financial position 20 Consolidated statement of cash-flows 21 Consolidated statement of changes in equity 22 Notes to the consolidated accounts 23 Company balance sheet 49 Notes to the company accounts 50 DCD Media Plc Financial statements for the period ended 31 December 2010 DCD Media plc (“DCD” or the “Group”) Final Results for the Eighteen Months Ended 31 December 2010 DCD Media, the independent TV production and distribution group, today reports results for the eighteen months period ended 31 December 2010. Financial Summary (comparatives are twelve months to 30 June 2009) • Revenue £48.4m (2009: £34.5m) • Gross profit £10.2m (2009: £8.7m) • Adjusted Profit Before Tax £1.8 m (2009: £2.4m) • Operating Loss Loss £11.2m (2009: Profit £0.5m) • Adjusted EBITDA £2.3m (2009: £3.0m) Refer to table within the Financial Review section below for a reconciliation of the adjustments: Post Balance Sheet Events • Potential Funding The Group announces that it is currently exploring options to secure additional funding, either in the form of debt or equity. The Board has identified a requirement for further short-term working capital in the order of £1 million. -

Read the Letter from the BBC (24 December

Responses to supplementary questions provided by the Education & Culture Committee Q1 - The amount of income collected from the licence fee in Scotland ? The total Licence Fee income from Scotland in 2014/15 was approximately £323m. Q2 - How the current funding model for the BBC in Scotland breaks down, including BBC Alba, radio, television, online and any other costs? Please refer to the table over: Q3 - The Committee seeks details of how network television production spend in Scotland is calculated at around 9%, including how much of this figure, by volume and value, is accounted for by in-house production and by independent production companies (with separate totals for qualifying and non-qualifying independent producers). The Committee also seeks details of what is spent in Scotland in terms of regional television programming (opt-out and BBC Alba) and how this is broken down between in-house production and independent production companies? Calculation Definition Network television spend in Scotland is calculated by taking the value of content produced in Scotland (numerator) as a proportion of the overall BBC eligible network spend (denominator). Eligible spend is defined as first-run, UK-made Network-commissioned programmes, excluding News. The OFCOM definition of what qualifies as Scottish (the numerator of the calculation) is defined below: Ofcom notes that, in order to qualify as a Regional Production, two out of the three of the following criteria must be met: i) the production company must have a substantive business and -

Britain's Creative Greenhouse

Britain’s Creative Greenhouse Britain’s Creative Greenhouse Channel Four Television Corporation Television Four Channel Report and Financial StatementsReport 2014 and Channel Four Television Corporation Report and Financial Statements 2014 Channel Four Television Corporation Report and Financial Statements 2014 Incorporating the Statement of Media Content Policy Presented to Parliament pursuant to Paragraph 13(1) of Schedule 3 to the Broadcasting Act 1990 02 Channel 4 Annual Report 2014 Explore this report at annualreport.channel4.com Printed by Park Communications on FSC® certified paper. Park is an EMAS certified CarbonNeutral® company and its Environmental Management System is certified to ISO14001. 100% of the inks used are vegetable oil based, 95% of press chemicals are recycled for further use and on average 99% of any waste associated with this production will be recycled. This document is printed on Heaven 42, a paper containing 100% virgin fibre sourced from well-managed, responsible, FSC® certified forests. Some pulp used in this product is bleached using an elemental chlorine free (ECF) process and some using a totally chlorine free (TCF) process. CONTENTS 03 Contents Chairman’s statement 04 Chief Executive’s statement 05 2014 at a glance 06 Statement of Media Content Policy 08–98 The remit and model 08 Investing in innovation 12 Making an impact 22 Spotlights 36 Our programmes 40 Thank you 84 Awards 86 Forward look 92 Assurance report 98 Financial report and statements 99–162 Strategic report 100 Report of the Members 110 Independent -

Tbivision.Com April/May 2017 MIPTV Issue

Television Business International Television Comedy Funny drama Page 30 Mark Linsey Inside BBC Studios Page 20 TBIvision.com April/May 2017 MIPTV Issue MIPTV Issue April/May 2017 MIPTV Stand C20.A pOFC TBI AprMay17.indd 1 22/03/2017 20:23 TBI_COVER_THE BRAVEST_AW.indd 1 20/03/2017 13:52 A New Scripted Series from Executive Producers DOMINIC MINGHELLA and JEREMY RENNER STAND P3.C1 sales.aenetworks.com pIFC-01 A+E Knightfall AprMay17.indd 2 17/03/2017 10:42 TBI_Inside_Front_Cover_Knightfall_FIN.indd 1 3/15/17 2:34 PM TBI Inside Front Cover - Knightfall – FINAL 432mm x 275mm trim size A New Scripted Series from Executive Producers DOMINIC MINGHELLA and JEREMY RENNER STAND P3.C1 sales.aenetworks.com pIFC-01 A+E Knightfall AprMay17.indd 3 17/03/2017 10:42 TBI_Inside_Front_Cover_Knightfall_FIN.indd 1 3/15/17 2:34 PM TBI Inside Front Cover - Knightfall – FINAL 432mm x 275mm trim size DRAMA, 12 x 1 Hour www.redarrowinternational.tv | MIPTV: Booth P4.C10 p02 Red Arrow AprMay17.indd 1 15/03/2017 12:16 CONTENTS APRIL/MAY 2017 30 20 20 TBI Interview: Mark Linsey BBC Studios director Mark Linsey tells Jesse Whittock about his creativity-led plans for the public broadcaster’s new production arm 24 Turner’s European connection Turner’s Hannes Heyelmann tells TBI about being the point-man for European investment in shows from the American mothership 26 OTT strategies 26 Traditional broadcasters, pay TV channel operators and OTT specialists are all launching new, targetted SVOD services. TBI speaks to them about gaining a foothold in the streaming world -

Fifty Fifty Company Credits

Fifty Fifty info@fiftyfiftypost.com 020 7292 0920 fiftyfiftypost.com SELECTED COMPANY CREDITS 4K & UHD PROGRAMMNG Jack Whitehall: At Large – 1 x 70’ – Full Post - Tiger Aspect - Netflix Jack Whitehall: Travels with my Father, Season 1 – 6 x 30’ UHD 5.1 – Full Post – Tiger Aspect/Cave Bear Productions - Netflix Jack Whitehall: Travels with my Father, Season 2 – 5 x 30’ UHD 5.1 – Full Post – Tiger Aspect/Cave Bear Productions – Netflix HD PROGRAMMING Death Row: Countdown to Execution – 2 x 60’ – MultiStory Media - ITV Gemma: My Murder – 1 x 30’ – Hey Sonny Films - BBC Three Operation: Live Series 2 – 3 x 120’ – The Garden Productions – Channel 5 World’s Busiest Train Stations – 4 x 60’ – Tim Pritchard Productions – Channel 5 The Stand Up Sketch Show – 6 x 30’ – Spirit Media – ITV2 Royal Documentary – 1 x 60’ - Details under wrap until TX My Life: If I Go Blind – 1 x 30’ – markthreemedia - CBBC Alan Carr’s Christmas Cracker – 1 x 120’ – CPL Productions – Channel 4 This Is My Song – 2 x 60’ – Fremantle Media – BBC One John Torode’s Middle East – 10 x 30’ – Blink Films – Good Food Darcey Bussell: Dancing to Happiness – 1 x 60’ – Matchlight Ltd – BBC The Kinks: Echoes of a World – 1 x 90’ – Special Treats – Sky Arts Operation Live - 3 x 120’ – The Garden Productions – Channel 5 Dispatches: Born on the Breadline – 1 x 60’ – True Vision Productions – Channel 4 Katie Price: My Crazy Life – 2 x 48’ – Shiver - Quest Gordon, Gino & Fred: Road Trip – 3 x 60’ – Studio Ramsay - ITV Our Shirley Valentine Summer - 4 x 60’ - Two Four Productions - ITV Twin -

Made Outside London Programme Titles Register 2017

Made outside London programme titles register 2017 Publication Date: 17 July 2018 Revised: 14 May 2021 About this document This document sets out the titles of programmes that the BBC, ITV, Channel 4 and Channel 5 reported as ‘Made outside London’ productions broadcast during 2017. The region outside of the M25 that the production qualified as being made in, and the criteria which the production met to qualify as a regional production are included alongside the title. Where the production was made by an external production company, the name of the company is indicated. Where this column is blank, the content was made by the broadcaster. Revisions as of 2021 The 2017 register has been updated to reflect the findings from Ofcom’s increased monitoring of broadcaster Made Outside London returns. Tenable (ITV) has been removed from the register, as the production was found not to have met the criteria necessary to count towards ITV’s Made Outside London hours quota. ITV continues to meet its 2017 Regional Production quota obligations in full. Contents Section 1. Regional production requirements 1 2. Overview 2 3. Made outside London programme titles register 3 Made outside London programme titles register 2018 1. Regional production requirements 1.1 The Communications Act 2003 (Sections 286 and 288) and the BBC Agreement require that a suitable proportion of programmes are made outside the M25. Each public service broadcaster (“PSB”) must meet the quotas for regional productions specified in its licence. Ofcom’s guidance explains that only first-run programmes that qualify as regional productions may count towards these quotas.