Transcript May Not Be 100 Percent Accurate and May Contain Misspellings and Other Inaccuracies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Traub X Crosswalk Report

Understanding the Unprecedented: Quarantine and its Effects on the American Consumer Overview As the Coronavirus crisis takes its toll on both the psyche and wallets of Americans, we conducted a study to address its impact on the consumer. In our first edition of the Coronavirus Consumer Report we addressed the following questions: 1. How has the Coronavirus and related crisis impacted the ways in which consumers engage in 1 digital content and make purchase decisions? 2. How will these trends shift as the crisis continues and we settle into our “new normal”? The 2 first two weeks of the crisis were a shock to the system. What will the next phase look like from a consumer perspective? 3. Will these trends or some of these trends achieve a level of permanence even after the crisis 3 abates? In order to answer these questions, we partnered with data insights analytics firm, Crosswalk, to analyze the digital data of over 5 million consumers. This edition of the Coronavirus Consumer Report covers the first two weeks of the crisis when Americans went from living what were essentially their normal lives to sheltering at home or a version of it within the span of days. We plan to provide pulse check updates throughout the crisis to see how the trends evolve over time. For this report, Traub and Crosswalk conducted a study of 5.29M consumers who provided self- identified information via social media platforms. We sourced parsed data from digital networks, consumption trends, habits, and language. We then applied our proprietary funnel system to filter the data and assign inferences based on proven correlations between specific data points and demographically known characteristics. -

Fourth Edition Crosswalk

Understanding the Unprecedented: Quarantine and its Effects on the American Consumer Fourth Edition: Cautious Reemergence Overview Over the past two months, we have studied how consumers have reacted and adapted to the peaks and valleys of the Coronavirus crisis. In our first edition, we analyzed the impact of the “panic phase” (3/15 – 3/28) on the mindshare and wallet share of the consumer. In the second edition (3/29 – 4/11), we checked in on that consumer to see how their behavior had evolved as they moved from the “panic phase” to the “enrichment phase”. In our third edition (4/12 – 5/2), we looked at how consumers adapted to the situation while also thinking about what comes next. In our final edition, we look back at the past two months of the crisis to help inform how consumers will reemerge as the country reopens. In the final edition of the report, we continue to address the following questions: 1. How has the Coronavirus and related crisis impacted the ways in which consumers engage in 1 digital content and make purchase decisions? 2. How will these trends shift as the crisis continues and we settle into our “new normal”? What will 2 the next phase look like from a consumer perspective? 3. Will these trends, or some of these trends, achieve a level of permanence even after the crisis 3 abates? This edition of the Coronavirus Consumer Report covers the fourth phase of the crisis (May 3rd - May 15th ). For this report, Traub and Crosswalk conducted a study of 5.29M consumers who provided self-identified information via social media platforms. -

Kellogg's Annual Report 2008

KELLOGG COMPANY TWO THOUSAND AND EIGHT ANNUAL REPORT WHAT MAKES ® ™ At Kellogg Company, we have: • For more than a century, Kellogg Company has been dedicated to producing great-tasting, high-quality, nutritious foods that consumers around the world know and love. With 2008 sales of nearly $13 billion, Kellogg Company is the world’s leading producer of cereal, as well as a leading producer of convenience foods, including cookies, crackers, toaster pastries, cereal bars, frozen waffles and vegetarian foods. We market more than 1,500 products in over 180 countries, and our brands include such trusted names as Kellogg’s, Keebler, Pop-Tarts, Eggo, Cheez-It, Nutri-Grain, Rice Krispies, Morningstar Farms, Famous Amos, Special K, All-Bran, Frosted Mini-Wheats, Club, Kashi, Bear Naked, Just Right, Vector, Guardian, Optivita, Choco Trésor, Frosties, Sucrilhos, Vive, Muslix and Zucaritas. Kellogg products are manufactured in 19 countries around the world. We enter 2009 with a rich heritage of success and a steadfast commit- ment to continuing to deliver sustainable and dependable growth in the future. TWO 2008 ANNUAL REPORT A commitment ™ to sustainable and dependable GROWTH ™ 2008 FINANciaL HigHLigHTS / DELIVERING STRONG RESULTS (dollars in millions, except per share data) 2008 Change 2007 Change 2006 Change Net sales $ 12,822 9% $ 11,776 8% $ 10,907 7% Gross profit as a % of net sales 41.9 % (2.1 pts) 44.0 % (0.2 pts) 44.2 % (0.7 pts) Operating profit 1,953 5% 1,868 6% 1,766 1% Net earnings 1,148 4% 1,103 10% 1,004 2% Net earnings per share Basic 3.01 8% 2.79 10% 2.53 6% Diluted 2.99 8% 2.76 10% 2.51 6%(b) Cash flow (net cash provided by operating activities, reduced by capital expenditure)(a) 806 (22%) 1,031 8% 957 24% Dividends per share $ 1.30 8% $ 1.20 5% $ 1.14 8% (a) Cash flow is defined as net cash provided by operating activities, reduced by capital expenditures. -

500.00 Gift Card Giveaway! Beginning August 1, 2020 We Are Giving You the Opportunity to Win a $500.00 Gift Card for Larry’S Foodland

Ad Sale Dates August 10th - August 16th, 2020 Larry's Offers DOUBLE COUPONS UP TO $1.00 EVERY DAY OF THE WEEK! 25¢ = 50¢ 50¢ = $1.00 $1.00 = $2.00 To Our Valued Customers: As we continue as a community to respond to the issues created by the Coronavirus, we want to assure all of you, that Larry’s Foodland will continue all of our efforts to do our part to help the community. Our #1 priority is the health and safety of our employees and customers. As our deliveries arrive daily, we will quickly replenish our grocery, produce, deli and meat departments to continue to serve you. We wish everyone God’s speed for health and safety and we thank each of you for supporting our local business. Larry’s Foodland $ 88 $ 88 lb $ 88 lb Boneless4 Beef lb Fresh2 Ground Beef Top Sirloin Steak Pork Country1 Style Ribs From Hamburger USDA Star Ranch Angus Beef Premium All Natural - Family Pack USDA Inspected - Family Pack AUGUST COULD BE YOUR LUCKY MONTH AT LARRY’S FOODLAND! $500.00 gift card giveaway! Beginning August 1, 2020 we are giving you the opportunity to win a $500.00 gift card for Larry’s Foodland. Simply spend $100.00 in one transaction and your name will be entered into the drawing for a $500.00 gift card. No limit to the amount of entries during the month of August. $ 88lb Drawing will be held on August 30, 2020. $ 88lb Come shop with us and you could be a Baby Back3 Pork Ribs Boneless2 Beef Roast Premium All Natural BIG winner! USDA Star Ranch Angus Banana Tuesday Every Tuesday at Larry’s ¢ 2/$ 2/$ Michigan Full4 Pint lb. -

Kellogg Company (Exact Name of Registrant As Specified in Its Charter)

KELLOGG CO FORM 10-K (Annual Report) Filed 02/26/13 for the Period Ending 12/29/12 Address ONE KELLOGG SQ P O BOX 3599 BATTLE CREEK, MI 49016-3599 Telephone 2699612000 CIK 0000055067 Symbol K SIC Code 2040 - Grain Mill Products Industry Food Processing Sector Consumer/Non-Cyclical Fiscal Year 01/03 http://www.edgar-online.com © Copyright 2013, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 29, 2012 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For The Transition Period From To Commission file number 1-4171 Kellogg Company (Exact name of registrant as specified in its charter) Delaware 38 -0710690 (State or other jurisdiction of Incorporation (I.R.S. Employer Identification No.) or organization) One Kellogg Square Battle Creek, Michigan 49016-3599 (Address of Principal Executive Offices) Registrant’s telephone number: (269) 961-2000 Securities registered pursuant to Section 12(b) of the Securities Act: Title of each class: Name of each exchange on which registered: Common Stock, $.25 par value per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Securities Act: None Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

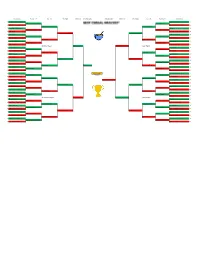

Cereal Bracket

Round of 64 Round of 32 Sweet 16 Elite Eight Final Four Championship Championship Final Four Elite Eight Sweet 16 Round of 32 Round of 64 1 Cinnamon Toast Crunch 51 Frosted Flakes 49 1 Cinnamon Toast Crunch 30 Frosted Flakes 40 16 Blueberry Cheerios 2 Dippin Dots Cereal 4 16 Cinnamon Toast Crunch 24 Frosted Flakes 24 8 Frosted Mini Wheats 42 Kix 34 8 Frosted Mini Wheats 16 Kix 6 9 Alpha-Bits 2 Chocolate Peanut Butter Cheerios 6 9 Cinnamon Toast Crunch 19 Frosted Flakes 33 5 Cheerios 47 Golden Grahams 47 5 Cheerios 23 Golden Grahams 24 12 Bran Flakes 6 Franken Berry 6 12 Cheerios 12 Golden Grahams 12 4 Cocoa Pebbles 35 Fruity Pebbles 39 4 Cocoa Pebbles 22 Fruity Pebbles 22 13 Honey Smacks 18 Kashi Go Lean 14 13 Cinnamon Region Froot Loops 31 Frosted Flakes 28 Sugar Region 6 Count Chocula 30 Corn Pops 41 6 Count Chocula 24 Corn Pops 18 11 Special K Red Berries 23 PB Chex 12 11 Count Chocula 3 Apple Jacks 21 3 Waffle Crisp 42 Apple Jacks 42 3 Waffle Crisp 21 Apple Jacks 27 14 Nilla Cereal 11 Krave 10 14 Froot Loops 27 Apple Jacks 13 7 Raisin Bran 37 Rice Crispy Treats 33 7 Raisin Bran 18 Rice Krispy Treats 26 10 Chocolate Chex 15 Captain Peanut Butter Crunch 20 10 Froot Loops 33 Froot Loops 24 Rice Krispy Treats 15 2 Froot Loops 50 Honey Comb 46 2 Froot Loops 28 Honey Combs 19 15 Twinkies Cereal 3 Donettes Cereal 7 15 1 Lucky Charms 49 Froot Loops Honey Nut Cheerios 48 1 Lucky Charms 37 Champion Honey Nut Cheerios 35 16 Sour Patch Kids Cereal 4 Grape-Nuts 5 16 Lucky Charms 34 Honey Nut Cheerios 23 8 Special K 25 Honey Nut Cheerios 22 Rice -

NYSE K 2006.Pdf

Net Sales (millions $) Operating Profit (millions $) Cash Flow (a) (millions $) ® 10,907 1,750 1,766 950 957 10,177 1,681 924 9,614 1,544 8,812 1,508 2006 Annual Report 8,304 746 769 With 2006 sales of nearly $11 billion, Kellogg Company is the world’s leading producer of cereal and a leading producer of convenience 02 03 04 05 06 02 03 04 05 06 02 03 04 05 06 foods, including cookies, Net sales increased Operating profit increased Cash flow was a strong crackers, toaster pastries, again in 2006, the sixth despite cost inflation, $957 million in 2006. cereal bars, fruit snacks, consecutive year of growth. significant investment in frozen waffles, and veggie future growth, and the effect foods. The Company’s brands of expensing stock options. include Kellogg’s ®, Keebler ®, Dividends Per Share Total Shareowner Return Net Earnings Per Share (diluted) Pop-Tarts®, Eggo®, Cheez-It ®, $2.51 ® ® $1.14 20% $2.36 Nutri-Grain , Rice Krispies , 19% $1.06 $2.14 ® ® $1.01 $1.01 $1.01 17% Murray , Morningstar Farms , 15% $1.92 Austin ®, Famous Amos ®, and $1.75 Kashi™. Kellogg’s products are manufactured in 17 3%5% 18% -1% 16% countries and marketed in Kellogg more than 180 countries S&P Packaged Foods Index -8% around the world. 02 03 04 05 06 02 03 04 05 06 02 03 04 05 06 Dividends per share For the sixth consecutive Earnings per share of $2.51 increased for the year, Kellogg Company’s total were 6% higher than in second consecutive return to shareowners has 2005; growth was 11%, year; the dividend is exceeded that of the S&P excluding the effect of now $1.14 per share. -

Breakfast Cereals Compared Breakfast Cereal Serving Size (Cups)

Breakfast Cereals Compared Serving Total Saturated Carbs Fiber Sugar Protein Contains Contains Breakfast Cereal Size Calories Fat Fat (g) (g) (g) (g) Trans Fat HFCS (cups) (g) (g) Fruit Loops 1 120 1 0.5 26 1 13 1 YES YES (Kellogg's) All-Bran 0.5 80 1 0 23 10 6 4 NO YES (Kellogg's) Apple Jacks 1 120 0.5 0 28 1 15 1 NO YES (Kellogg's) Corn Flakes 1 100 0 0 24 1* 2 2 NO YES (Kellogg's) Corn Pops 1 120 0 0 28 1* 14 1 YES NO (Kellogg's) Crispix 1 110 0 0 25 1* 3 2 NO NO (Kellogg's) Raisin Bran Crunch 1 190 1 0 45 4 20 3 NO YES (Kellogg's) Eggo Cereal Maple Syrup 1 120 1.5 0.5 22 2 13 2 YES YES (Kellogg's) Frosted Flakes 0.75 110 0 0 27 1 11 1 NO YES (Kellogg's) Frosted Mini- 24 Wheats Bite Size 200 1 0 48 6 12 6 NO YES biscuits (Kellogg's) Honey Smacks 0.75 100 0.5 0 24 1 15 2 YES NO (Kellogg's) Smorz 1 120 2 0.5 25 1* 13 1 YES YES (Kellogg's) Mini-Swirlz Cinnamon Bun 1 120 2 0 25 1 12 2 YES NO (Kellogg's) Product 19 1 100 0 0 25 1 4 2 NO YES (Kellogg's) Rice Krispies 1.25 120 0 0 29 0 3 2 NO YES (Kellogg's) Rice Krispies Treats Cereal 0.75 120 1.5 0 26 0 9 1 YES YES (Kellogg's) Smart Start Healthy Heart 1.25 230 3 0.5 46 5 17 7 NO YES (Kellogg's) Special K 1 120 0.5 0 22 1* 4 7 NO YES Breakfast Cereals Compared Serving Total Saturated Carbs Fiber Sugar Protein Contains Contains Breakfast Cereal Size Calories Fat Fat (g) (g) (g) (g) Trans Fat HFCS (cups) (g) (g) (Kellogg's) Special K Red Berries 1 110 0 0 25 1 10 3 NO YES (Kellogg's) Frosted Krispies 0.75 110 0 0 27 0 12 1 NO YES (Kellogg's) Wheaties 0.75 100 0.5 0 22 3 4 3 NO NO (General -

2 These Trademarks Include Kellogg's for Cereals, Convenience Foods And

These trademarks include Kellogg’s for cereals, convenience foods and our other products, and the brand names of certain ready-to-eat cereals, including All-Bran, Apple Jacks, Bran Buds, Choco Zucaritas, Cocoa Krispies, Complete, Kellogg’s Corn Flakes, Corn Pops, Cracklin’ Oat Bran, Crispix, Crunchmania, Crunchy Nut, Eggo, Kellogg’s FiberPlus, Froot Loops, Kellogg’s Frosted Flakes, Krave, Frosted Krispies, Frosted Mini- Wheats, Just Right, Kellogg’s Low Fat Granola, Mueslix, Pops, Product 19, Kellogg’s Origins, Kellogg's Raisin Bran, Raisin Bran Crunch, Rice Krispies, Rice Krispies Treats, Smacks/Honey Smacks, Smart Start, Special K, Special K Nourish, Special K Red Berries and Zucaritas in the United States and elsewhere; Sucrilhos, Krunchy Granola, Kellogg's Extra, Kellness, Musli, and Choco Krispis for cereals in Latin America; Vector in Canada; Coco Pops, Chocos, Frosties, Fruit‘N Fibre, Kellogg’s Crunchy Nut Corn Flakes, Krave, Honey Loops, Kellogg’s Extra, Country Store, Ricicles, Smacks, Start, Pops, Honey Bsss, Croco Copters and Tresor for cereals in Europe; and Guardian, Sultana Bran, Frosties, Rice Bubbles, Nutri-Grain, Kellogg’s Iron Man Food, and Sustain for cereals in Asia and Australia. Additional trademarks are the names of certain combinations of ready-to-eat Kellogg’s cereals, including Fun Pak and Variety. Other brand names include Kellogg’s Corn Flake Crumbs; All-Bran, Choco Krispis, Froot Loops, Special K, Zucaritas and Sucrilhos for cereal bars, Pop-Tarts for toaster pastries; Eggo and Nutri-Grain for frozen waffles -

ANNIVERSARY SALE! SAVE $1.40 Lb

Wednesday, September 23, 2020 1 celebrating our biggest sale of the year! 61 years! ANNIVERSARY SALE! SAVE $1.40 lb. SAVE $1.60 lb. 40 LB. CASE Get the Ad Directly in 60 Your In-Box! $63 Sign Up Online at FRESH NO ANTIBIOTICS EVER TRIMMED FRESH www.karnsfoods.com BONELESS SKINLESS 59 EXTRA LEAN 99 CHICKEN BREASTS CHOPPED STEAK Fresh lb. lb. Picked MUST BUY 5 LBS. 1 MUST BUY 10 LBS. 2 Savings TEMPORARY HOURS: 7AM-8AM SENIOR HOURS • 7AM-9PM KARNS HOURS SAVE $1 lb. GALA, FUJI, GOLDEN SUPREME JONAGOLD, USDA CERTIFIED ANGUS BEEF RED DELICIOUS ¢ USDA CHOICE ADAMS CO. TOP ROUND 99 KARNS $ BONELESS BEEF 29 APPLES 79 lb. LONDON BROILS JUMBO LUMP SHOULDER POT ROASTS ROASTS, STEAKS, FILLED STEAKS 3 LB. CRAB CAKES 4EA. SOLD AS ROASTS ONLY 3 LB. SAVE $3 ea. pit smoker special! custom cut free! USDA CHOICE 3 LB. BAG 12 LB. AVG. WILD CAUGHT 21-25 CT. EZ PEEL CLEMENTINE 99 FRESH WHOLE JUMBO 16 OZ. PASTEURIZED MANDARIN BONE-IN 39 BONELESS 49 PINK SHRIMP 49 $ ORANGES 3 ea. PORK BUTT NEW YORK SOLD IN 2 LB. BAGS LUMP ROASTS 1 LB. STRIPS 6 LB. $14.98 7 LB. CRABMEAT 10EA. SAVE $2 lb. PRE-ORDERS WELCOMED custom cut free! COTTON CANDY, GUM DROP & MOON DROP KARNS USDA CHOICE FRESH 8 LB. AVG. THE GRAPERY 99 DOZEN MARYLAND DOUBLE 29 BONELESS WHOLE SPECIALTY STEAMED $ SMOKED NEW YORK 99 BONELESS 79 GRAPES 3 lb. #1 CRABS 24 DOZ. SLICED BACON 4 LB. STRIP STEAKS 8 LB. PORK LOINS 1 LB. BUY 4 All items are based on availability. -

Baby Boomer Consumer GENDER

Understanding the Unprecedented: Quarantine and its Effects on the American Consumer Second Edition: From Needs to Enrichment Overview The consumer has now spent over a month quarantined in their homes. In our first edition of the Coronavirus Consumer Report we analyzed the impact of the first two weeks of the crisis on the mindshare and wallet share of the consumer. In our latest edition, we check in on that consumer to see how their behavior has evolved as they become accustomed to the “new normal”. In this report, we continue to address the following questions: 1. How has the Coronavirus and related crisis impacted the ways in which consumers engage in 1 digital content and make purchase decisions? 2. How will these trends shift as the crisis continues and we settle into our “new normal”? What will 2 the next phase look like from a consumer perspective? 3. Will these trends, or some of these trends, achieve a level of permanence even after the crisis 3 abates? In order to answer these questions, we partnered with data insights analytics firm, Crosswalk, to analyze the digital data of over 5 million consumers. This edition of the Coronavirus Consumer Report covers the second two weeks of the crisis (March 29th – April 11th) when Americans began to settle into their quarantined lives. We plan to continue to provide pulse check updates throughout the crisis to see how the trends evolve over time. For this report, Traub and Crosswalk conducted a study of 5.29M consumers who provided self- identified information via social media platforms. -

The Place for Fresh MEATS!

DARRELL’S DARRELL’S - The Place for Fresh MEATS! Fresh, Natural, Fresh, Natural, Pork Shoulder USDA Choice Beef USDA Choice, Pork Shoulder Country Boneless Beef Chuck Pork Style New York Boneless Blade Steak Ribs D Strip Steak Chuck Roast Bone-In Bone-In Market & Hardware Our family serving yours 99 99 49 49 lb. lb. lb. lb. since 1945 ~11 ~4 ~2 ~2 Fresh, Natural, Fresh, Natural, Store Hours Grade A Grade A Store Made Monday - Saturday Store-Trimmed Boneless, Boneless, Bratwurst 85/15, Fresh 9 am to 7 pm Skinless Skinless Many Varieties, Sunday: 9 am - 5 pm Including Chicken Ground Beef Chicken Chicken from Chuck Senior and Vulnerable Tenders Breast Breast Brats! Shopping hour Tuesday and Thursday 8:00 am - 9:00 am 99 29 99 49 lb. lb. At the corner of ~2 lb. ~2 lb. ~5 ~4 Columbia & Aurelius Rd. 4520 W. Columbia Rd. Mason, MI 48854 Phone: 517-676-2622 Visit us on line www.darrellsmason.com Bulk Bulk Store-Trimmed, Freshly Ground Jennie-O Bob Evans We accept: 90/10, Fresh in Store, 81/19 Thick Sliced Thick Sliced 85% Extra Lean Home Fries or Ground Beef Ground Beef Ranch Smoked Applewood Ground Turkey Hash Browns from Round 3 lb. pk. Bacon Smoked Bacon 16 oz. 20 oz. 29 99 99 49 99 2 ~5 lb. ~9 ~4 lb. ~5 lb. ~2 /$5 AMEX, Visa, MasterCard, Discover & Bridge Card Counter Fresh Meats featuring USDA Prime and Choice Grade Beef, All Natural Fresh Pork, Grade A, UPS Shipping Natural Fresh Chicken. Store Smoked Jerky and Meat Sticks, Store Made Fresh Bratwurst, Lottery Store Made Bulk Sweet or Hot Italian Sausage, Store Made Sage Breakfast Sausage, Michigan Made Koegel's Products.