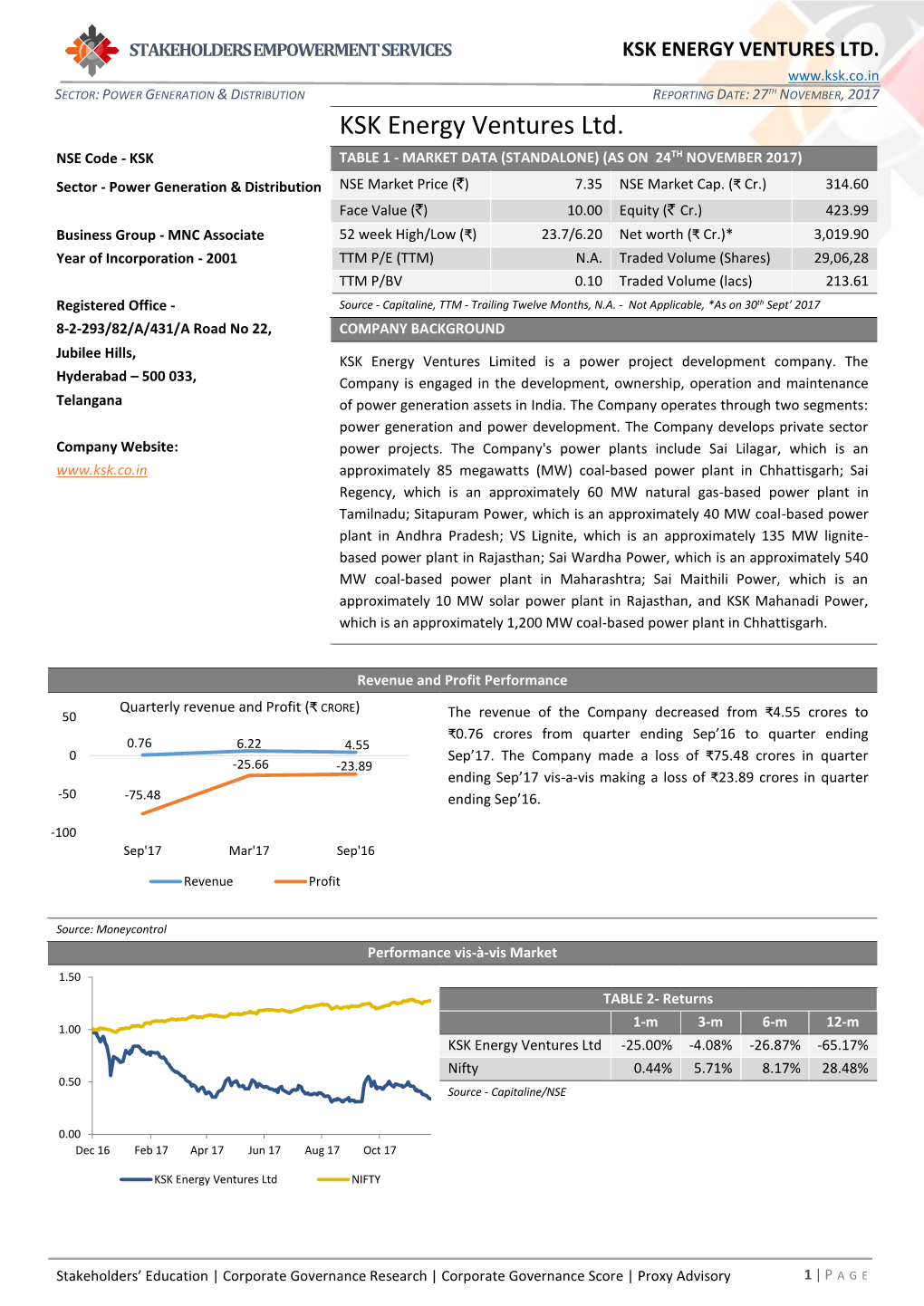

Ksk Energy Ventures Ltd. S Ector: Power Generation & Distribution Reporting Date: 27Th November, 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ksk Energy Ventures Limited

Placement Document Dated June 4, 2014 Not for Circulation and Strictly Confidential Serial Number: [●] KSK ENERGY VENTURES LIMITED Our Company was incorporated as KSK Energy Ventures Private Limited on February 14, 2001 under the Companies Act, 1956. Pursuant to a special resolution of its shareholders passed on February 9, 2002, our Company was converted into a public limited company and the word “private” was deleted from its name. Our Company became a private limited company pursuant to a special resolution of its shareholders passed on July 3, 2006, and the word “private” was added to its name. Subsequently, pursuant to a special resolution of the shareholders of our Company passed on January 19, 2008, our Company became a public limited company and the word “private” was deleted from its name. The Corporate Identification Number (CIN) of our Company is L45204AP2001PLC057199. KSK Energy Ventures Limited (the “Company” or the “Issuer” or “KSK”) is issuing 40,404,040 equity shares of our Company of a face value of `10 each (the “Equity Shares”) at a price of `99 per Equity Share (the “Issue Price”), including a premium of `89 per Equity Share aggregating approximately `4,000 million (the “Issue”)*. ISSUE IN RELIANCE UPON SECTION 42 OF THE COMPANIES ACT, 2013, READ WITH RULE 14 OF THE COMPANIES (PROSPECTUS AND ALLOTMENT OF SECURITIES) RULES, 2014 AND CHAPTER VIII OF THE SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2009, AS AMENDED (THE “SEBI REGULATIONS”) THE ISSUE AND DISTRIBUTION OF THIS PLACEMENT DOCUMENT IS BEING MADE TO QUALIFIED INSTITUTIONAL BUYERS (“QIBs”) AS DEFINED UNDER THE SEBI REGULATIONS IN RELIANCE UPON SECTION 42 OF THE COMPANIES ACT, 2013, READ WITH RULE 14 OF THE COMPANIES (PROSPECTUS AND ALLOTMENT OF SECURITIES) RULES, 2014 (TOGETHER, THE “PRIVATE PLACEMENT REGULATIONS”) AND CHAPTER VIII OF THE SEBI REGULATIONS. -

ONMENTAL COMPLIANCE STATUS REP()R"R : \,)

· (~ ( . ) · / \ ENVIRONMENTAL COMPLIANCE STATUS REP()R"r : \,) 43-MW COAL BASEl) POWER PLANT () OF SITAPI-TRAM POWER LIMITED C) AT DONDAPADU VILLAG,E, MELLACIIERUVU MANDAI.., NALGONI)A I)JSTRICT, A.P. C) o () () · () "() I . (j o o o c> (; I i (~) ,I • o (J c) C) --- -~----- -_._--_._- .----- ~lrl'AI.UIIAM 1."WI~11 IMlrl'I~I. "; 1.. :\ Villu~m ..o ..dulu...... l\1.~II~..~ ..N·.." .. MUlidul. " / :> '\ ,. ~"~'KSK "i~'.z Nul~.....lu 4A. II.• Power 'frOll1 knowl"dglJ ENVIR[INMENTAl C[IMPI.IANCE STATUS REPI]RT - JULY 2011] TIl DECEMBER 2D10 Table of Contents ') Chapter # Title Page# ) Table of Contents TCl List of Figures and List of Tables TC2 " \ } Annexure TC2 Compliance 1-8 ') 1.0 Introduction 9 .() 1.1 Scope of Work 9 1.2 Description of Environment 9 () 1.3 Brief Description of Plant 11 C) 1.3 Pollution Control Measures 12 1.4.1 Air Pollution Control 12 () 1.4.2 Green Belt Development 12 () 1.4.3 Noise Pollution Control 12 2.0 Environment Data Analysis 13 2.1 Meteorology 13 2.1.1 Methodology of Sampling 13 2.1.2 Temperature 13 (j 2.1.3 Relative Humidity 13 2.2 Ambient Air Quality 13 2.2.1 Methodology of Sampling 14 o 2.2.2 Analytical Procedure 14 2.2.3 Presentation of Primary Data 16 o 2.4 Observation on Primary Data 16 2.3 Source Emission Monitoring 25 (j 2.3.1 l'vlethodology of Sampling 25 2.3.2 Results and Discussion 26 (1 2.4 water Quality 29 2.4.1 Methodology of Sampling 29 2.4.2 Analytical Procedure 29 2.4.3 Result and Discussion 30 2.5 Noise Levels 39 2.5.1 Methodology of Sampling 39 2.5.2 Analytical Procedure 39 2.5.3 Results and Discussion 40 Page TC 1 ofTC 2 () o ,------- --_.-' .----. -

Ksk Energy Ventures Limited

Preliminary Placement Document Dated June 2, 2014 Subject to Completion Not for Circulation and Strictly Confidential Serial Number: [●] KSK ENERGY VENTURES LIMITED Our Company was incorporated as KSK Energy Ventures Private Limited on February 14, 2001 under the Companies Act, 1956. Pursuant to a special resolution of its shareholders passed on February 9, 2002, our Company was converted into a public limited company and the word “private” was deleted from its name. Our Company became a private limited company pursuant to a special resolution of its shareholders passed on July 3, 2006, and the word “private” was added to its name. Subsequently, pursuant to a special resolution of the shareholders of our Company passed on January 19, 2008, our Company became a public limited company and the word “private” was deleted from its name. The Corporate Identification Number (CIN) of our Company is L45204AP2001PLC057199. or to any other class of investors to purchase the Equity KSK Energy Ventures Limited (the “Company” or the “Issuer” or “KSK”) is issuing [●] equity shares of our Company of a face value of `10 each (the “Equity Shares”) at a price of `[●] per Equity Share (the “Issue Price”), including a premium of `[●] per Equity Share aggregating `[●] (the “Issue”)*. suchoffer, sale orsubscription is notpermitted. ISSUE IN RELIANCE UPON SECTION 42 OF THE COMPANIES ACT, 2013, READ WITH RULE 14 OF THE COMPANIES (PROSPECTUS AND ALLOTMENT OF SECURITIES) RULES, 2014 AND CHAPTER VIII OF THE SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2009, AS AMENDED (THE “SEBI REGULATIONS”) THE ISSUE AND DISTRIBUTION OF THIS PRELIMINARY PLACEMENT DOCUMENT IS BEING MADE TO QUALIFIED INSTITUTIONAL BUYERS (“QIBs”) AS DEFINED UNDER THE SEBI REGULATIONS IN RELIANCE UPON SECTION 42 OF THE COMPANIES ACT, 2013, READ WITH RULE 14 OF THE COMPANIES (PROSPECTUS AND ALLOTMENT OF SECURITIES) RULES, 2014 (TOGETHER, THE “PRIVATE PLACEMENT REGULATIONS”) AND CHAPTER VIII OF THE SEBI REGULATIONS. -

Eq Solar Map of India

The new standard in PV Maximizes The right solution for module performance Yield with Photovoltaic Power Systems. Minimal More than 600 MW PV projects already measurement Increase equipped with Bonfiglioli Inverters in India. in-cost! Spire’s The Most Proven Spi-Sun Simulator™ 5600SLP Blue Single & Dual Axis The Global Leader In Professional PV Monitoring Contact us to learn more. Trackers in the Four-C-Tron Spire Corporation And Energy Management No 3486, 14th Main, One Patriots Park World! For more information contact: HAL 2nd Stage, Indiranagar, Bedford, MA 01730-2396, Bonfiglioli Renewable Power Conversion India Pvt. Ltd. #543, 14th Cross, 4th Phase, Peenya Industrial Area Bangalore - 560008 USA +91 44 45532153 www.infiniteercam.com www.solar-log.com Bengaluru – 560 058. +91-80-2525-2506 [email protected] Tel.: +91-80-28361014/15/16 [email protected] www.spirecorp.com +91 44 42120230 [email protected] E-mail: [email protected] | Website: www.bonfiglioli.com CONSULTANCY JNNSM PHASE 2 BATCH REC Mechanism : Registered PUNJAB Direct Normal Irradiance (DNI) & TRAINING Source : NREL EQ SOLAR MAP OF INDIA - 4th Edition 1 - 750 MW Solar Tender RE Generators (Solar PV) (Selected Projects from Bidders & Allottes for DCR ROOFTOPS 2MW+ 300MW Solar Tender in 2013) Updated on 31 May 2014 c 2011 First Source Energy India Private Limited. All Rights Reserved UTILITY ANDHRA PRADESH RAJASTHAN SCALE Project Net Tariff Category (Part-A) 21MW+ Bhagyanagar India Limited 5 SNCA Energy & Infrastructure Pvt. Ltd. 1 Company Name Solar Cell Manufacturers SRI City Private Limited 3 Bikaji Foods International Limited 1 Capacity Quoted Sl. Bidder Ntame Bidsubmitted VGF Sought by- www.adsprojects.org (MW) (`/kWh) Andhra Pradesh PV Equiment Manufacturers And Suppliers 200KW+ Heritage Foods Limited 2.04 Murarka Suitings Pvt. -

Thermal Power Plants

HOME ABOUT US OUR OPERATIONS INVESTOR RELATIONS SUSTAINABILITY INITIATIVES GALLERY CAREERS Contact us | Site Map HOME ABOUT US OUR OPERATIONS INVESTOR RELATIONS SUSTAINABILITY INITIATIVES OTHER LINKS CONTACT Thermal Power Plants KSK Energy Ventures Limited We are a power project development company in India, with track record of developing and operating power plants. We were established in 2001 to capitalize on the emerging opportunities in the Indian power sector and focus on developing, operating and maintaining power projects. We supply power to a combination of industrial and state-owned consumers in India. KSK Energy Ventures has current interests in various operational power plants capable of generating 2062 MW of power and is currently involved in constructing 3600 MW KSK Mahanadi Power plant that two units of 600 MW each operational and remaining units under various stages of construction Additionally, the group has an exciting portfolio of planned projects across the fuel spectrum. The key current business interests of KSK Energy Ventures Limited are: 58 MW Sai Regency Power Corporation Private Limited, Tamilnadu 43 MW Sitapuram Power Limited, Andhra Pradesh 86 MW Sai Lilagar Power Genertaion Limited, (Formerly known as Sai Lilagar Power Limited) Chhattisgarh 540 MW Sai Wardha Power Generation Limited, Maharashtra 135 MW VS Lignite Power Private Limited, Rajasthan 3,600 MW KSK Mahanadi Power Company Limited, Chhattisgarh - Partial Commissioning This is a coal based power project approximately 125 kilometers from the Morga II coal block in Chhattisgarh. The original project was a 1,800 MW power project based on coal supplies from the Morga-II coal block by GMDC. -

KSK Mahanadi Power Company Limited

KSK Mahanadi Power Company Limited Instrument Amount Rating Action In Rs. Crore August, 2016 Term loans (Senior-debt) 12142 Revised to [ICRA]D from [ICRA]BB (Negative) Term loans (Sub-debt) 810 Revised to [ICRA]D from [ICRA]BB (Negative) Bank guarantee 773 Revised to [ICRA]D/[ICRA]D from [ICRA]BB(Negative)/[ICRA]A4 Fund based limits 1120 Revised to [ICRA]D from [ICRA]BB (Negative) Non-fund based limits 857 Revised to [ICRA]D from [ICRA]A4 ICRA has revised the long term rating to [ICRA]D (pronounced ICRA D)1 from [ICRA]BB (pronounced ICRA double B) and also revised the short term rating to [ICRA]D (pronounced ICRA D) from [ICRA]A4 (pronounced ICRA A four) for the term loans, fund based and non-fund based facilities of KSK Mahanadi Power Company Limited (KMPCL) aggregating to Rs. 15702 crores2. The rating revision is on account of delays in servicing the interest obligation by KMPCL on the debt availed for setting up the 3600 MW (6 X 600 MW) thermal power project (TPP) in the state of Chhattisgarh. This is owing to delays in implementation of the project caused by execution related challenges, agitation by locals and subsequently, due to delays in securing funding for cost overruns. The scheduled project commissioning date (CoD) has now been revised to December 2017 from December 2015, which was earlier revised from the appraised CoD of December 2013. ICRA notes that the large delays in execution, steep depreciation of rupee against US dollar on imported BTG3 equipment and construction of temporary transmission line, resulted in cost overrun to the extent of 67% of the original appraised cost, thus adversely impacting the cost competitiveness of the project. -

Annual Report 2014-15

CONTENTS Highlights 02 03 04 Corporate Information Highlights of the Year Chairman’s Statement Governance 06 17 31 Management Report on Directors’ Report Discussion and Analysis Corporate Governance Financial Statements STANDALONE FINANCIALS 55 59 61 62 64 Independent Balance Sheet Statement of Cash Flow Statement Notes to Auditors’ Report Profit and Loss Financial Statements CONSOLIDATED FINANCIALS 86 91 93 94 96 Auditors’ Report on Consolidated Consolidated Statement Consolidated Notes to Consolidated Consolidated Financial Balance Sheet of Profit and Loss Cash Flow Statement Financial Statements Statements Corporate Information Board of Directors Mr. T.L. Sankar Mr. S.R. Iyer Mr. Girish Nilkanth Kulkarni Mrs. Shubhalakshmi Panse Mr. K.A. Sastry Mr. S. Kishore Mr. K. Bapi Raju Mr. Anil Kumar Kutty Mr. Tanmay Das Chief Financial Officer Mr. V. Sambasiva Rao Company Secretary Mr. M.S. Phani Sekhar Registered Office 8-2-293/82/A/431/A, Road No.22, Jubilee Hills, Hyderabad - 500 033, Telangana, India Ph: 040-23559922-25 Fax: 040-23559930 E-mail:[email protected] CIN:L45204AP2001PLC057199 Statutory Auditors M/s. Umamaheswara Rao & Co., Chartered Accountants Flat No.5-H, Krishna Apartments, Ameerpet X Roads, Hyderabad - 500 073 Telangana, India Bankers Andhra Bank Bank of India Indian Bank UCO Bank Axis Bank Registrar & Share Transfer Agent Karvy Computershare Private Limited Karvy Selenium Tower B, Plot 31-32, Gachibowli, Financial District, Nanakramguda, Hyderabad - 500 032. Ph: 040-67162222 Fax: 040-23001153 E-mail: [email protected] Shares Listed at National Stock Exchange of India Limited BSE Limited Website www.ksk.co.in 02 KSK ENERGY V ENTURES L IMITED Highlights of the year £ Operating capacity stood at 2072 MW £ Two units of 600 MW each of KSK Mahanadi have been commissioned. -

India's Leading & Oldest Solar Media Group

India’s Leading & Oldest Solar Media Group Richest & Most Diversified Media Portfolio Content Is The King, Best Content Disemination & Readership Magazine, Newsletter, Newsportal, Conferences, Training Programs , Networking Dinner, Buy-Seller Meets, Jobs, Videos, Tenders, Slideshare Etc... Redership Developed Over 9 Years Of Devoted Work & Presence In The Solar Sector. Readership Which Shows Itself In The Events Organised By EQ Which Has Audience Of Unparalleled Quality & Quantity. Less than 1% Bounce Rate on www.EQMagPro.com Very High Quality Parameter...Not Any Overnight Numbers Rs. 100 All It Takes To Download The Financial Statements Of Various Publications To Know Who Is Printing How Much 100000 + Handpicked Subscribers Over Past 9 Years... Readership Of Unparalleled Quality & Numbers Magazine Which Is Not Just A Trade Journal But Distributed To Big Consumers Of Power, High Tax Payers, Hni’s And Read By Professionals In Other Indian Economic & Business Sectors “Rome Wasn’t built in a day & What’s built in a day is not Rome.” - Tony Horton Some Things Makes Real Sense Only When They Are Matured, Aged & Old Enough. INTERNATIONAL Since 2009 India’s Leading & Oldest Solar Media Group Volume # 9 | Issue # 5 | May 2017 | Rs.5/- India’s Oldest & Leading Solar Media Group Volume # 8 | Issue # 4 | April 2016 | Rs.5/- nuevosol.co.in We once took a step unaware of its consequences! INTERNATIONAL www.EQMagPro.com Now, isn't it time we make a conscious and sustainable choice? FIRST TO DELIVER 1 GWp IN INDIA ~ 3.3 billion USD ~ 4.6 GW > 10 GW total > 1 GW > 14 GW revenue 2015 modules solar project solar plants modules delivered delivered 2015 pipeline built since 2001 CANADIAN SOLAR IS THE #1 BRAND FOR SOLAR MODULES IN INDIA. -

Diesel and Gas-Engine Power Plants in India

Diesel and Gas-Engine Power Plants in India Arkay Location: Tamil Nadu Operator: Ind-Barath Energies Ltd Bairabi Location: Mizoram Configuration: 10 X 8.7 MW 20V34SG engines, 1 X Butibori-2 Operator: Mizoram Power & Electricity Dept 8.1 MW steam set Location: Maharashtra Configuration: 4 X 5.75 MW 16V32LN engines Fuel: natural gas Operator: Indo Rama Synthetics Ltd Fuel: heavy oil Operation: 2006 Configuration: 3 X 13.5 MW 16V46 engines Operation: 2004 HRSG supplier: ?? Fuel: heavy oil E/G supplier: Wartsila, BHEL E/G and T/G supplier: Wartsila, Hangzhou Operation: 1996 EPC: BHEL Quick facts: In Mar 2006, Arkay Energy E/G supplier: Wartsila (Rameswarm) Ltd, a unit of Ind-Barath Power, Quick facts: This is the largest power plant in completed this power station at Valantharavai, Mizoram. Ramnad District. The plant uses gas from isolated GAIL wells in Ramanathapuram and at the completion was the largest plant of its kind in India. Haebowal Complex Location: Punjab Operator: Punjab Energy Development Agency Kasargod Location: Kerala Dalmia Cement Configuration: 1 X 1 MW JMC320GS-BL engine Operator: KSK Energy Ventures Ltd Location: Tamil Nadu Fuel: biogas Configuration: 3 X 7 MW CM32 engines Operator: Dalmia Cement Operation: 2004 Fuel: heavy oil Configuration: 2 X 2 MW 6R32, 1 X 4 MW 12V32 E/G supplier: Jenbacher Operation: 2001 engines EPC: Clarke Energy India E/G supplier: MAK Fuel: heavy oil Quick facts: This biogas cogeneration system is at Quick facts: This is the first IPP in Kerala. The Rs Operation: 1983-1987 the 50ac Haebowal dairy complex, one of two 70.70 crore plant has a 15yr PPA with Kerala State E/G supplier: Wartsila centralized facilities in Ludhiana that in total serve 1,490 dairy operations with 150,000 head of cattle. -

Group Corporate Presentation

Group Corporate Presentation June 2014 Disclaimer This presentation has been prepared by KSK Energy Ventures Limited (the “Company”) solely for information purposes without any regard to any specific objectives, financial situations or informational needs of any particular person. This presentation may not be copied, distributed or disseminated, directly or indirectly, in any manner. Failure to comply with this directive may result in a violation of the applicable law in certain jurisdictions. By reviewing this presentation, you agree to be bound by the restrictions contained herein, and to maintain absolute confidentiality, regarding the information disclosed in these materials. This presentation contains statements that constitute forward-looking statements. These statements include descriptions regarding the intent, belief or current expectations of the Company or its directors and officers with respect to the results of operations and financial condition of the Company. These statements can be recognized by the use of words such as “expects,” “plans,” “will,” “estimates,” “projects,” or other words of similar meaning. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in such forward-looking statements as a result of various factors and assumptions which the Company believes to be reasonable in light of its operating experience in recent years. The risks and uncertainties relating to these statements include, but not limited to, risks and uncertainties, regarding fluctuations in earnings, our ability to manage growth, competition, our ability to manage our international operations, government policies, regulations, etc. The Company does not undertake any obligation to revise or update any forward-looking statement that may be made from time to time by or on behalf of the Company including to reflect actual results, changes in assumptions or changes in factors affecting these statements. -

SR.No. FIRM NAME 1 Apollo Tyres Ltd. 2 24/7 Customer 3 24/7

SR.No. FIRM NAME 1 Apollo Tyres Ltd. 2 24/7 Customer 3 24/7 Learning Solutions Private Limited 4 24X7Learning.Com / Avagma Online S" ool # 24X7Learning.Com / Avagma Online S" ool $ 24X7Learning.Com / Avagma Online S" ool 7 3 % &ndia ' 3& &n(ote" ) 3& &n(ote" Limited 1* 3Leads +esour"es &ndia Private Limited 11 3% &ndia Limited 12 3% &ndia Limited 13 A A A People Solutions 14 A , C Consultants 1# A & % A 1$ A.T. -earney 17 A.aris So(te" Ltd 1' A..ott &ndia 1) A..ott &ndia Limited 2* A." Consultant 21 A.ea"on Consulting Pvt. Ltd. 22 A.einsa 23 A.einsa ,usiness Development 24 A.einsa ,usiness Development Pvt Ltd 2# A.g Group 2$ A.g Group (A.g S ipyard Ltd.2 27 A.g S ipyard Limited 2' A.solute So(t3are Te" nologies 2) A"" Con"rete Limited 3* A"" Limited 31 A""el Partners 32 A""el Partners 33 A""enture 34 A""enture 3# A""enture 3$ A""enture Pte Limited 37 A""enture Services Private Limited 3' A""ess Corporate Solutions Pvt Ltd 3) A""man &nsti.!( %gt. 4* A""or Hotels &ndia 41 A""or Services Private Limited 42 A""urate Trans(ormers Ltd 43 A""utest &ndia 44 A"d Pla"ements Private Limited 4# A"g 5orld3ide 4$ A" ievements 47 A"me Solar 6nergy 4' A"nielsen Org - %arg 4) A"reaty #* A"ro Hr Solutions #1 A"ro Paints Ltd #2 A"ropolis Group #3 A"tion 8inan"ial &ndia Ltd #4 A"tion 8or 8ood Produ"tion (A(pro2 ## A"tis ,iologics Private Limited #$ A"tis Te" nologies #7 A"tive Consultants #' Adani 6nterprises Ltd #) Adani 6nterprises Ltd $* Adani Group $1 Adani Port Ltd $2 Adani Po3er Limited $3 Adars Consulting $4 Adde"o $# Ade""o $$ Ade""o &ndia $7 Ade""o &ndia $' Ade""o &ndia Pvt Ltd $) Adept Solutions &ndia Private Limited 7* Adidas &ndia 71 Adidas &ndia %ar9eting Private Limited 72 Aditi Te" nologies Aditya ,irla %anagement Corporation Private 73 Limited 74 Aditya ,irla Group 7# Aditya ,irla Group ( :ltrate" Cement 2 7$ Ado.e Systems &ndia Pvt Ltd 77 Ado.e Systems &ndia Pvt Ltd. -

CO2 Baseline Database for the Indian Power

CO 2 Baseline Database for the Indian Power Sector User Guide Version 14.0 December 2018 Government of India Ministry of Power Central Electricity Authority Sewa Bhawan, R.K.Puram, New Delhi-66 Revision History of the Database Version Date of Publication Main Revisions Compared to Previous Version No. 1.0 Draft October 2006 - Draft for Stakeholder Consultation 1.0 November 2006 - Added data on 10 stations which had been in exclusion worksheet of draft database - Adjusted values to latest IPCC Guidance (IPCC 2006 Guidelines for National Greenhouse Gas Inventories) where IPCC defaults are used 1.1 December 2006 - Adjusted fuel emission factor of lignite to be in line with Initial National Communication fig- ures 2.0 June 2007 - Added data for FY 2005-06, including new stations and units commissioned during 2005-06 - Some retroactive changes to data for FY 2000-01 to 2004-05 3.0 December 2007 - Added data for FY 2006-07, including new stations and units commissioned during 2006-07 - Adapted calculations and User Guide to ensure consistency with new CDM methodologies: ACM0002 Version 07, and Tool to Calculate the Emission Factor for an Electricity System (Version 01.1, EB 35 Annex 12) 4.0 October 2008 - Added data for FY 2007-08, including new stations and units commissioned during 2007-08 - Adjusted delineation of regional grids - Adjusted IPCC-based fuel emission factors to account for uncertainty in line with EB 35 Annex 12 5.0 November 2009 - Added data for FY 2008-09, including new stations and units commissioned during 2008-09 6.0 March