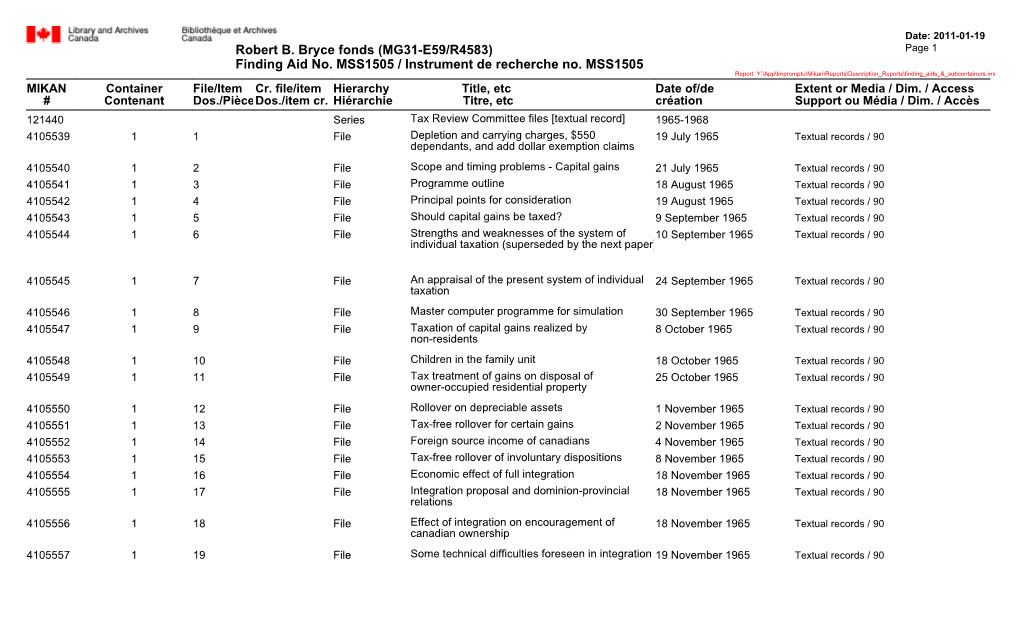

Finding Aid No. MSS1505 / Instrument De Recherche No. MSS1505 Robert B. Bryce Fonds (MG31-E59/R4583)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Tribute to the Honourable R. Gordon Robertson, P.C., C.C., LL.D., F.R.S.C., D.C.L

A Tribute to The Honourable R. Gordon Robertson, P.C., C.C., LL.D., F.R.S.C., D.C.L. By Thomas d’Aquino MacKay United Church Ottawa January 21, 2013 Reverend Doctor Montgomery; members of the Robertson family; Joan - Gordon’s dear companion; Your Excellency; Madam Chief Justice; friends, I am honoured – and humbled – to stand before you today, at Gordon’s request, to pay tribute to him and to celebrate with you his remarkable life. He wished this occasion to be one, not of sadness, but of celebration of a long life, well lived, a life marked by devotion to family and to country. Gordon Robertson – a good, fair, principled, and ever so courteous man - was a modest person. But we here today know that he was a giant. Indeed, he has been described as his generation’s most distinguished public servant – and what a generation that was! Gordon was proud of his Saskatchewan roots. Born in 1917 in Davidson – a town of 300 “on the baldest prairie”, in Gordon’s words, he thrived under the affection of his Norwegian-American mother and grandparents. He met his father – of Scottish ancestry - for the first time at the age of two, when he returned home after convalescing from serious wounds suffered at the epic Canadian victory at Vimy Ridge. He was, by Gordon’s account, a stern disciplinarian who demanded much of his son in his studies, in pursuit of manly sports, and in his comportment. Gordon did not disappoint. He worked his way through drought- and depression-torn Saskatchewan, attended Regina College and the University of Saskatchewan, and in 1938 was on his way to Oxford University, a fresh young Rhodes Scholar. -

OLIGARCHS at OTTAWA, PART II Night a Success

/ Oligarchs at Otta-wa ..: Austin F. Cross ' ' VERY year on budget night, like an to advise the minister (that's the term, E unspectacular star at the tail of but actually our man writes the stuff) on that bright comet, the Hon. Douglas the technical aspects of taxation. His Abbott, there moves into the Press Gal- is the ethical concept of taxation. Not lery ' reception rQom, among others, Ken' immediately has he to be concerned with Eaton. In title, Assistant Deputy Minister such matters as whether the Fisheries of Finance: in fact, he is the fell ow who needs the money, or Trade and Com- wrote a lot of <the budget that the Hon. merce is bungling its administration. Ra- Mr. Abbott has just so entertainingly given. ther would it be his role to assess nicely, There are other tail-stars, of course, to the what for example, would be the effect of Abbott comet. Yet paradoxically none one cent more tax on cigarettes, or the will seem duller, none will be brighter, precise incidence of sales tax. than the same Ken Eaton. For a fellow _He and Harry Perry are a very good who has just heard a lot of his own fiscal team, and when they sit down to write theory and financial policy given to the their share of the budget, you have people of Canada in particular and the a brilliant duet being played. world in general, Ken Eaton is quiet "He's without a peer in his field," said enough. an expert enthusiastically, in discussing There he sits, a man who would pass in Eaton, and this expert is one man rarely a crowd. -

The Political Legitimacy of Cabinet Secrecy

51 The Political Legitimacy of Cabinet Secrecy Yan Campagnolo* La légitimité politique du secret ministériel La legitimidad política del secreto ministerial A legitimidade política do segredo ministerial 内阁机密的政治正当性 Résumé Abstract Dans le système de gouvernement In the Westminster system of re- responsable de type Westminster, les sponsible government, constitutional conventions constitutionnelles protègent conventions have traditionally safe- traditionnellement le secret des délibéra- guarded the secrecy of Cabinet proceed- tions du Cabinet. Dans l’ère moderne, où ings. In the modern era, where openness l’ouverture et la transparence sont deve- and transparency have become funda- nues des valeurs fondamentales, le secret mental values, Cabinet secrecy is now ministériel est désormais perçu avec scep- looked upon with suspicion. The justifi- ticisme. La justification et la portée de la cation and scope of Cabinet secrecy re- règle font l’objet de controverses. Cet ar- main contentious. The aim of this article ticle aborde ce problème en expliquant les is to address this problem by explaining raisons pour lesquelles le secret ministériel why Cabinet secrecy is, within limits, es- est, à l’intérieur de certaines limites, essen- sential to the proper functioning of our tiel au bon fonctionnement de notre sys- system of government. Based on the rele- * Assistant Professor, Common Law Section, University of Ottawa. This article is based on the first chapter of a dissertation which was submitted in connection with fulfilling the requirements for a doctoral degree in law at the University of Toronto. The research was supported by the Social Sciences and Humanities Research Council of Canada. For helpful comments on earlier versions, I am indebted to Kent Roach, David Dyzenhaus, Hamish Stewart, Peter Oliver and the anonymous reviewers of the Revue juridique Thémis. -

Not Easy, Smooth, Or Automatic": Canada-US Relations, Canadian Nationalism, and American Foreign Policy, 1961-1963

mn u Ottawa L'Uiiiversile cnnadienne Canada's university mn FACULTE DES ETUDES SUPERIEURES l^s FACULTY OF GRADUATE AND ET POSTOCTORALES u Ottawa POSDOCTORAL STUDIES L'Universite canadienne Canada's university Asa McKercher AUTEUR DE LA THESE / AUTHOR OF THESIS M.A. History GRADE/DEGREE Department of History FACULTE, ECOLE, DEPARTEMENT/ FACULTY, SCHOOL, DEPARTMENT 'Not Easy, Smooth or Automatic": Canada-Us Relation, Canadian Nationalism and American Foreign Policy. 1961-1963 TITRE DE LA THESE / TITLE OF THESIS Galen Perras DIRECTEUR (DIRECTRICE) DE LA THESE / THESIS SUPERVISOR CO-DIRECTEUR (CO-DIRECTRICE) DE LA THESE / THESIS CO-SUPERVISOR EXAMINATEURS (EXAMINATRICES) DE LA THESE/THESIS EXAMINERS Serge Durflinger Jeffrey Keshen Gary W. Slater Le Doyen de la Faculte des etudes superieures et postdoctorales / Dean of the Faculty of Graduate and Postdoctoral Studies "Not easy, smooth, or automatic": Canada-US relations, Canadian Nationalism, and American Foreign Policy, 1961-1963 Asa McKercher A thesis submitted to the Faculty of Graduate and Postdoctoral Studies in partial fulfilment of the requirements for the Master of Arts degree in History Universite d'Ottawa / University of Ottawa 2009 ©Asa McKercher, Ottawa, Canada, 2009 Library and Archives Bibliotheque et 1*1 Canada Archives Canada Published Heritage Direction du Branch Patrimoine de I'edition 395 Wellington Street 395, rue Wellington OttawaONK1A0N4 OttawaONK1A0N4 Canada Canada Your file Votre reference ISBN: 978-0-494-61316-0 Our file Notre reference ISBN: 978-0-494-61316-0 NOTICE: -

Reconciling Cabinet Secrecy with the Rule of Law

RECONCILING CABINET SECRECY WITH THE RULE OF LAW By Yan Campagnolo A thesis submitted in conformity with the requirements for the degree of Doctor of Juridical Science Faculty of Law University of Toronto © Copyright by Yan Campagnolo, 2018 P a g e | ii Reconciling Cabinet Secrecy with the Rule of Law Doctor of Juridical Science, 2018 Yan Campagnolo Faculty of Law University of Toronto ABSTRACT This dissertation explores the tension between government openness and secrecy. It focuses on Cabinet secrecy, that is, the doctrine protecting the confidentiality of the collective decision-making process at the top of the executive branch in Westminster jurisdictions. I argue that Cabinet secrecy is crucial to the proper functioning of the system of responsible government as it fosters the candour of ministerial discussions, protects the efficiency of the decision-making process, and enables Ministers to remain united in public notwithstanding any disagreement they may have in private. Yet, excessive secrecy can hamper government accountability by depriving citizens, parliamentarians and judges of the information needed to hold public officials responsible for their decisions and actions. An important question is who should have the final authority over the disclosure of Cabinet secrets when a dispute arises, the Government or the Courts? Under the common law, Courts in the United Kingdom, Australia, New Zealand and Canada (at the provincial level) asserted the authority to review and overrule Cabinet immunity claims to prevent abuses of power. In Canada, at the federal level, by the enactment of sections 39 of the Canada Evidence Act and 69 of the Access to Information Act , Parliament deprived the Courts of the power to inspect and order the disclosure of Cabinet secrets. -

Documents Relatifs Aux Relations Extérieures Du Canada

DOCUMENTS RELATIFS AUX RELATIONS EXTÉRIEURES DU CANADA DOCUMENTS ON CANADIAN EXTERNAL RELATIONS CANADA DOCUMENTS RELATIFS AUX RELATIONS EXTÉRIEURES DU CANADA DOCUMENTS ON CANADIAN EXTERNAL RELATIONS VOLUME 28 1961 Sous la direction de Janice Cavell Editor AFFAIRES ÉTRANGÈRES ET COMMERCE INTERNATIONAL CANADA FOREIGN AFFAIRS AND INTERNATIONAL TRADE CANADA © Her Majesty the Queen in Right of Canada, © Sa Majesté la Reine du Chef du Canada, représentée represented by the Minister of Public Works and par le Ministre des Travaux publics et Services Government Services, 2009. gouvernementaux, 2009. Available through your local bookseller or by mail En vente chez votre libraire local ou par la poste auprès from Publishing and Depository Services des Éditions et services de dépôt Public Works and Government Services Canada Travaux publics et Services gouvernementaux Canada Ottawa, Ontario Ottawa (Ontario) K1A 0S5 K1A 0S5 Telephone: (613) 941-5995 Téléphone: (613) 941-5995 Fax: (613) 954-5779 Télécopieur: (613) 954-5779 Orders only: 1-800-635-7943 Commandes seulement: 1-800-635-7943 Internet: http://publications.gc.ca Internet: http://publications.gc.ca Catalogue No : E2-39/28-2009 Catalogue No : E2-39/28-2009 ISBN 978-0-660-64281-9 ISBN 978-0-660-64281-9 TABLE DES MATIÈRES CONTENTS PAGE PAGE INTRODUCTION ............................................... xi INTRODUCTION ............................................... xi PROVENANCE DES DOCUMENTS...................... xxix LOCATION OF DOCUMENTS ............................. xxix LISTE DES ABRÉVIATIONS -

Diefenbaker's Legacy: New Ways of Thinking About Nuclear Weapons

Published as: Erika Simpson, “New Ways of Thinking about Nuclear Weapons and Canada’s Defence Policy,” Diefenbaker’s Legacy, edited by D. C. Story and R. Bruce Shepard, (Regina: Canadian Plains Research Centre, 1998), pp. 27-41 “Diefenbaker’s Legacy: New Ways of Thinking about Nuclear Weapons and Canada’s Defence Policy” Erika Simpson Abstract Prime Minister John Diefenbaker’s initial decision to acquire nuclear weapons systems for the Canadian Forces was followed by much debate within Cabinet. During the Cuban Missile crisis, Cabinet Ministers continued to argue about whether Canada should fulfill its defence commitments. Finally the Prime Minister and his Minister of External Affairs Howard Green publicly opposed the nuclear commitments the government had originally undertaken. This paper asserts that the underlying belief systems of influential decision-makers significantly influenced defence decision-making leading to the Diefenbaker government’s contrasting record of nuclear commitments. The research is based largely on documents arising out of the recently-declassified records of Cabinet; the newly-opened personal papers of the Prime Minister; and the documents available from the Department of National Defence’s Directorate of History (e.g. the recently-opened Raymont series). The paper shows that, contrary to conventional wisdom, senior officials within the Diefenbaker government, including the Prime Minister after 1962, were not altogether confused by the strategic environment nor naive about their defence responsibilities and NATO obligations. Some deliberately attempted to buy time and seek options to delay the acquisition of nuclear weapons. Whereas ‘Defenders’ within the government worked to fulfill the nuclear commitments, ‘Critics’ pursued alternatives which they deemed to be in the best interests of war prevention. -

The Evolving Role of the Commonwealth in Canadian Foreign Policy, 1956 - 1965

THE EVOLVING ROLE OF THE COMMONWEALTH IN CANADIAN FOREIGN POLICY, 1956 - 1965 by Roderick James M acMillan M acLeod London School of Economics and Political Science A dissertation submitted to the University of London for the degree of Doctor of Philosophy June 1994 UMI Number: U062431 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. Dissertation Publishing UMI U062431 Published by ProQuest LLC 2014. Copyright in the Dissertation held by the Author. Microform Edition © ProQuest LLC. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 SZ,^ /\Y S2y British Library of p;,i,i)Ca, and EcorH>:r.ir-Sen : i / ABSTRACT This thesis examines the significance of the Commonwealth in Canadian foreign policy, the motivations behind Canadian policy and the reasons for changes in this policy in the period 1956-1965 in particular. It does so by evaluating Canadian policy towards the development and use of Commonwealth institutions for cooperation. The thesis begins by sketching the development of Canadian policy towards the Commonwealth between 1944 and 1955. It argues that Canadian behaviour during this period set a pattern, which as it evolved in the face of changing conditions, was generally pursued through the period 1956 to 1965. -

Guest Speakers and Themes

FIRST INTERNATIONAL SYMPOSIUM THE GLOBAL WIND INDUSTRY AND ADVERSE HEALTH EFFECTS: Loss of Social Justice? The Waring House Inn and Conference Center, Picton, Prince Edward County, Ontario October 29-31, 2010 Guest Speakers and Themes SESSION I: No Rules, No Caution, No Accountability JOHN HARRISON, PhD John Harrison obtained his PhD. at Leeds (UK) in 1964 and completed post-doctoral fellowships at Cornell (1964–67) and Sussex (UK) (1967–69). He was a member of the Department of Physics at Queen's University from 1969–2002 and is presently retired. Harrison has conducted research, taught physics and engineering physics courses and participated on many national and international committees. He was the Co-Editor and then Editor of the (International) Journal of Low Temperature Physics (1978 - 1992) and served a 2-year term as an Associate Editor of the Canadian Journal of Physics. He has made presentations regarding wind turbine noise to community groups, the International World Wind Energy Conference (2008) and the annual conference of the Canadian Acoustics Association (2009). He is a member of the Ministry of the Environment Stakeholder Focus Group on Wind Turbine Noise. RICHARD R. JAMES, INCE Richard James has been actively involved in the field of noise control since 1969, participating in and supervising research and engineering projects related to control of occupational and community noise. He has performed extensive acoustical testing and development work for a variety of complex environmental noise problems utilizing both classical and computer simulation techniques. Since 2006, he has been involved with noise and health issues related to industrial wind turbines. -

Le Secret Ministériel : Théorie Et Pratique VII VIII Le Secret Ministériel : Théorie Et Pratique

Le secret ministériel Théorie et pratique DIKÈ Collection dirigée par Josiane Boulad-Ayoub et Bjarne Melkevik « Le soleil ne transgressera pas son orbe (métra). Ou alors les Érinyes, aides de la justice, le découvriront. » (Héraclite, Aphorisme 94) Les Érinyes, déesses de la vengeance, dont Héraclite fait les auxiliaires de la justice, se métamorphosent à la fin de l’Orestie d’Eschyle en bien- veillantes Euménides. Fille de Thémis dans la mythologie, DIKÈ, alliée cependant aux nouvelles divinités Athéna et Apollon, s’humanise dans la tragédie, se laïcise, se politise en s’associant aux progrès de la démocratie, du débat juridique et politique, du développement des lois. DIKÈ n’était pas, à Athènes, la mimésis d’une essence de la justice, elle était à la fois l’idée abstraite du droit et, sous de multiples formes, l’action judiciaire. La collection « DIKÈ », comme la Pnyx et l’Agora athéniennes, offre un espace public, un lieu de rencontre pour penseurs venus d’horizons et de disciplines différents, du droit, de la philosophie du droit, de la philosophie politique, de la sociologie, prêts à débattre des questions juridiques urgentes et disposés à une critique aussi polymorphe et diverse que les structures complexes du droit contemporain qu’ils tenteront de mettre à jour. Penseurs persuadés que DIKÈ, élevée à la dignité autonome du concept, est toujours enchaînée au juste et à l’injuste et que, privée de déterminations concrètes, la justice n’est qu’une forme vide. Persuadés aussi que l’ambivalence des structures juridiques invite à procéder à une enquête sur la généalogie des formes historiques du droit. -

In the National Interest: Canadian Foreign Policy and the Department of Foreign Affairs and International Trade, 1909–2009

University of Calgary PRISM: University of Calgary's Digital Repository University of Calgary Press University of Calgary Press Open Access Books 2011 In the National Interest: Canadian Foreign Policy and the Department of Foreign Affairs and International Trade, 1909–2009 University of Calgary Press Donaghy, G., & Carroll, M. (Eds.). (2011). In the National Interest: Canadian Foreign Policy and the Department of Foreign Affairs and International Trade, 1909-2009. Calgary, Alberta, Canada: University of Calgary Press. http://hdl.handle.net/1880/48549 book http://creativecommons.org/licenses/by-nc-nd/3.0/ Attribution Non-Commercial No Derivatives 3.0 Unported Downloaded from PRISM: https://prism.ucalgary.ca University of Calgary Press www.uofcpress.com IN THE NATIONAL INTEREST Canadian Foreign Policy and the Department of Foreign Affairs and International Trade, 1909–2009 Greg Donaghy and Michael K. Carroll, Editors ISBN 978-1-55238-561-6 THIS BOOK IS AN OPEN ACCESS E-BOOK. It is an electronic version of a book that can be purchased in physical form through any bookseller or on-line retailer, or from our distributors. Please support this open access publication by requesting that your university purchase a print copy of this book, or by purchasing a copy yourself. If you have any questions, please contact us at [email protected] Cover Art: The artwork on the cover of this book is not open access and falls under traditional copyright provisions; it cannot be reproduced in any way without written permission of the artists and their agents. The cover can be displayed as a complete cover image for the purposes of publicizing this work, but the artwork cannot be extracted from the context of the cover of this specific work without breaching the artist’s copyright.