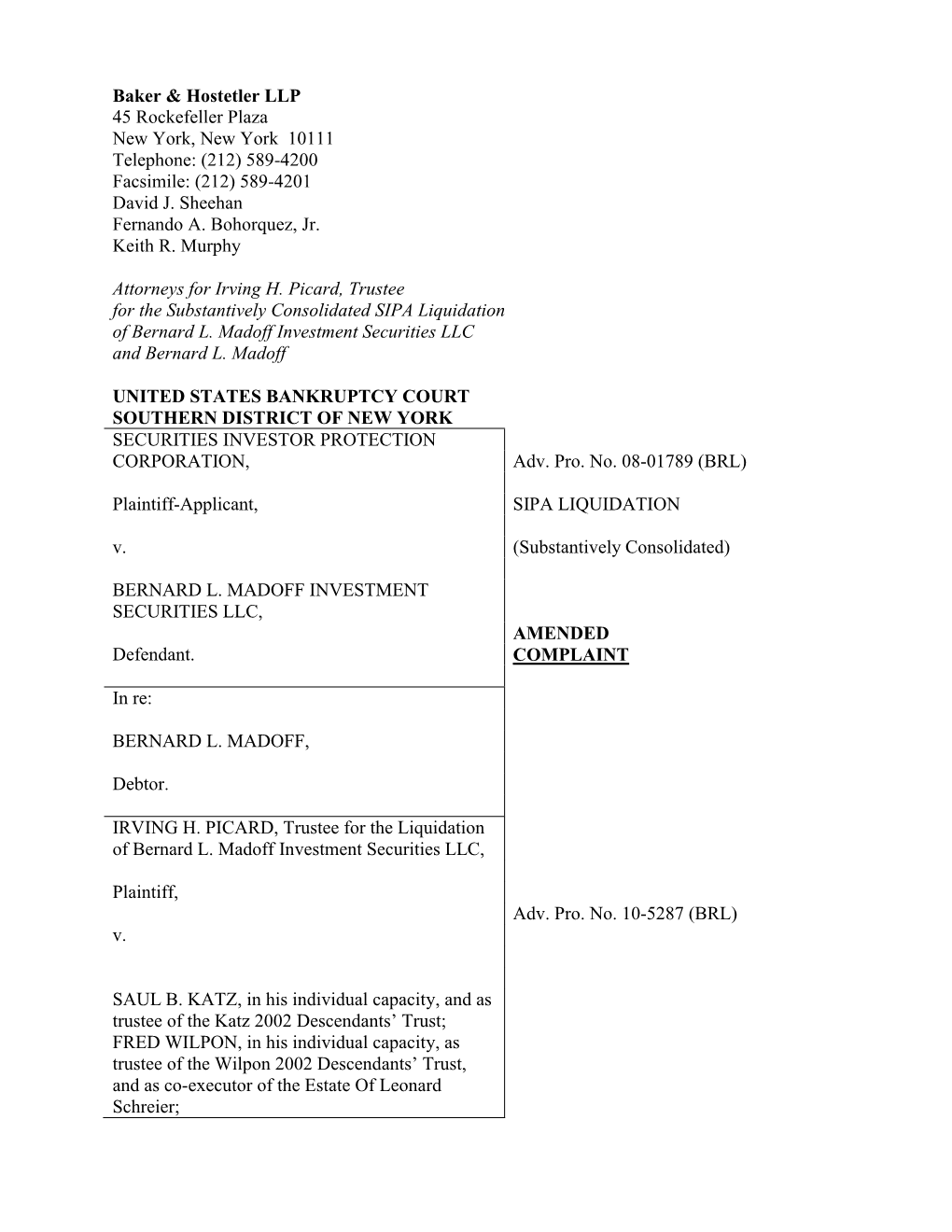

Baker & Hostetler

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

20 MOTION to Dismiss the AMENDED COMPLAINT OR, IN

Irving H. Picard v. Saul B. Katz et al Doc. 26 Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 Telephone: (212) 450-4000 Facsimile: (212) 701-5800 Attorneys for the Sterling Defendants UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ----------------------------------- x : SECURITIES INVESTOR PROTECTION : CORPORATION, : : Plaintiff-Applicant, : Adv. Pro. No. 08-01789 (BRL) : - against - : SIPA LIQUIDATION : BERNARD L. MADOFF INVESTMENT : (Substantively Consolidated) SECURITIES LLC, : : Defendant. : : ----------------------------------- x In re: : : BERNARD L. MADOFF, : : Debtor. : : - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - x IRVING H. PICARD, : : Plaintiff, : : - against - : Adv. Pro. No. 10-05287 (BRL) : SAUL B. KATZ, et al. : : Defendants. : : ----------------------------------- x REPLY MEMORANDUM OF LAW IN FURTHER SUPPORT OF STERLING DEFENDANTS’ MOTION TO DISMISS THE AMENDED COMPLAINT OR, IN THE ALTERNATIVE, FOR SUMMARY JUDGMENT Dockets.Justia.com TABLE OF CONTENTS PAGE PRELIMINARY STATEMENT .........................................................................................1 THE COMPLAINT’S STILL-FALSE ALLEGATIONS AND THE REAL AND UNCONTROVERTED FACTS...................................................3 Newly Highlighted False Allegation #1: The Sterling Partners “Shopped” for Ponzi Scheme Insurance..................................................................3 Newly Highlighted False Allegation #2: David Katz Was “Screaming” for Diversification Because He Viewed -

Exhibit a Pg 1 of 40

09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 1 of 40 EXHIBIT A 09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 2 of 40 Baker & Hostetler LLP 45 Rockefeller Plaza New York, NY 10111 Telephone: (212) 589-4200 Facsimile: (212) 589-4201 Attorneys for Irving H. Picard, Trustee for the substantively consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC and the Estate of Bernard L. Madoff UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, No. 08-01789 (SMB) Plaintiff-Applicant, SIPA LIQUIDATION v. (Substantively Consolidated) BERNARD L. MADOFF INVESTMENT SECURITIES LLC, Defendant. In re: BERNARD L. MADOFF, Debtor. IRVING H. PICARD, Trustee for the Liquidation of Bernard L. Madoff Investment Securities LLC, Plaintiff, Adv. Pro. No. 09-1161 (SMB) v. FEDERICO CERETTI, et al., Defendants. 09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 3 of 40 TRUSTEE’S FIRST SET OF REQUESTS FOR PRODUCTION OF DOCUMENTS AND THINGS TO DEFENDANT KINGATE GLOBAL FUND, LTD. PLEASE TAKE NOTICE that in accordance with Rules 26 and 34 of the Federal Rules of Civil Procedure (the “Federal Rules”), made applicable to this adversary proceeding under the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”) and the applicable local rules of the United States District Court for the Southern District of New York and this Court (the “Local Rules”), Irving H. -

The Nelson Doubleday, Jr. Collection

THE NELSON DOUBLEDAY, JR. COLLECTION Wednesday, January 11, 2017 NEW YORK THE COLLECTION AUCTION Wednesday, January 11, 2017 at 10am EXHIBITION Friday, January 6, 10am – 5pm Saturday, January 7, 10am – 5pm Sunday, January 8, Noon – 5pm Monday, January 9, 10am – 6pm ?? ????????? ??????????????????????????????? LOCATION Doyle New York 175 East 87th Street New York City 212-427-2730 www.Doyle.com wwwwww.Doyle.com/BidLive.DoyleNewYork.com/BidLive Catalogue: $35 CONTENTS Paintings, Watercolor & Sculpture 1-140 Jewelry & Memoribilia 41-58 The Library of Nelson Doubleday, Jr. 59-139 Furniture & Decorations 140-158 Silver & Silver Plate 159-179 Furniture & Decorations 180-271 Carpets 272-273 Glossary I Conditions of Sale II Terms of Guarantee IV Information on Sales & Use Tax V Absentee Bid Form XII The publishing house was known for bringing the living A fixture in the owner's box, Nelson Doubleday, Jr. stood by masters of English literature to America, and Nelson the team through thick and thin in subsequent years, and Doubleday, Jr.'s library contains many of the special New York City was electrified again by the Mets vs. Yankees presentation copies of the books his grandfather published Subway Series of 2000, represented in this collection by the under the family imprint. Those authors became personal owner's National League Championship Series gold ring. friends and were a frequent presence in both the publishing house in Garden City and at the family estate in Oyster Bay. Nelson Doubleday, Jr. was an avid yachtsmen and the owner Nelson Doubleday, Jr. (1933-2015) lived for much of his life in Oyster Bay Doubleday Publishing brought the World War I poetry of of an important world class yacht, the 125-foot Palmer and Locust Valley on Long Island’s storied North Shore. -

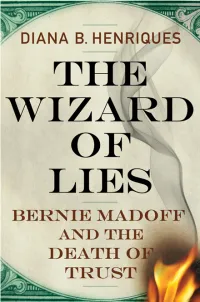

Bernie Madoff After Ten Years; Recent Ponzi Scheme Cases, and the Uniform Fraudulent Transactions Act by Herrick K

Bernie Madoff After Ten Years; Recent Ponzi Scheme Cases, and the Uniform Fraudulent Transactions Act By Herrick K. Lidstone, Jr. Burns, Figa & Will, P.C. Greenwood Village, CO 80111 Remember Bernie? Ten Years Later. On December 11, 2018, the Motley Fool (https://www.fool.com/investing/2018/12/11/3-lessons-from-bernie-madoffs-ponzi-scheme- arrest.aspx) published an article commemorating the tenth anniversary of Bernie Madoff’s arrest in 2008. Prior to his arrest, Madoff was a well-respected leader of the investment community, a significant charitable benefactor, and a Wall Street giant. That changed when Madoff was arrested and his financial empire was revealed to be the biggest Ponzi scheme in history. In March 2009, Madoff pleaded guilty to 11 different felony charges, including money laundering, perjury, fraud, and filing false documents with the Securities and Exchange Commission. Madoff was sentenced to 150 years in federal prison where he remains today at the age of 80. Five of his employees were also convicted and are serving prison sentences, one of his sons committed suicide in December 2010, and his wife Ruth’s lifestyle changed dramatically. (In his plea deal with prosecutors, Ruth was allowed to keep $2.5 million for herself.) [https://nypost.com/2017/05/14/the-sad-new-life-of-exiled-ruth-madoff/]. All of this was chronicled in The Wizard of Lies, a 2017 made-for-television movie starring Robert DeNiro as Bernie Madoff and Michelle Pfeiffer as Ruth Madoff. [https://www.imdb.com/title/tt1933667/]. The Madoff Ponzi Scheme. Bernie Madoff and his sons, as we recall, managed a multibillion dollar Ponzi scheme over a large number of years from Bernie’s Manhattan offices with investors all over the world and here in Colorado. -

Read Chapter 1 As a PDF

1 An Earthquake on Wall Street Monday, December 8, 2008 He is ready to stop now, ready to just let his vast fraud tumble down around him. Despite his confident posturing and his apparent imperviousness to the increasing market turmoil, his investors are deserting him. The Spanish banking executives who visited him on Thanksgiving Day still want to withdraw their money. So do the Italians running the Kingate funds in London, and the managers of the fund in Gibraltar and the Dutch-run fund in the Caymans, and even Sonja Kohn in Vienna, one of his biggest boosters. That’s more than $1.5 billion right there, from just a handful of feeder funds. Then there’s the continued hemorrhaging at Fairfield Greenwich Group—$980 million through November and now another $580 million for December. If he writes a check for the December redemptions, it will bounce. There’s no way he can borrow enough money to cover those with- drawals. Banks aren’t lending to anyone now, certainly not to a midlevel wholesale outfit like his. His brokerage firm may still seem impressive to his trusting investors, but to nervous bankers and harried regulators today, Bernard L. Madoff Investment Securities is definitely not “too big to fail.” Last week he called a defense lawyer, Ike Sorkin. There’s probably not much that even a formidable attorney like Sorkin can do for him at this point, but he’s going to need a lawyer. He made an appointment for 2 | The Wizard of Lies 11:30 am on Friday, December 12. -

RAISING HEALTH RAISES EVERYONE 2020 Annual Report

RAISING HEALTH RAISES EVERYONE 2020 Annual Report Sandra Lindsay, RN, first US recipient of a COVID-19 vaccine. Dear friends, This past year has been an inflection point for Northwell Health. 2020 was filled with pain, sacrifice and heroic achievement as our front-line workers, researchers, administrators and support staff joined together in the fight against COVID-19. But 2020 also held the promise of a return toward normalcy—a new kind of normal, marked by an increased awareness of health disparities and sustained work to increase health equity. It was a year of unprecedented challenges, and Northwell met the moment by raising health. Even before the virus made its presence known in New York, our years-long commitment to emergency planning allowed us to respond quickly to the area’s first cases, stepping up at the request of state government to test and treat people in our area and beyond. Northwell managed the field hospital at Javits Convention Center—the largest field hospital mobilization in U.S. history for a non-wartime pandemic—helping to relieve overcrowding in New York City hospitals. In our own facilities, the strategic deployment of physical resources and the selflessness of our doctors, nurses, technicians and environmental workers enabled us to treat more patients than any other health system in the country. As discoveries by researchers at the Feinstein Institutes produced important insights into COVID-19, the ingenuity of team members throughout the health system led to inventions that eased shortages of supplies like nasal swabs and ventilators, and to new, data-smart ways to predict and plan for the impact of the virus. -

Madoff's Tickets Bid to $2,375 on Ebay 11 April 2009, by RONALD BLUM , AP Baseball Writer

Madoff's tickets bid to $2,375 on eBay 11 April 2009, By RONALD BLUM , AP Baseball Writer other tickets for the first homestand were posted Friday on Picard's Web site, http://www.madofftrustee.com . Two tickets for each of the remaining games against the Padres, on April 15-16, and for the three-game series against Milwaukee from April 17-19 were put on sale on StubHub.com. Those tickets are selling for $450 each. Mets owners Fred Wilpon and Saul Katz were close to Madoff, who pleaded guilty March 12 in federal court to 11 counts, including securities fraud and perjury, stemming from a Ponzi scheme prosecutors said was worth $64.8 billion. The 70-year-old Madoff faces up to 150 years in prison New York Mets pitcher John Maine wipes his face after at sentencing June 16. Florida Marlins' Hanley Ramirez hit a solo home run in the first inning of a baseball game in Miami, Friday, April 10, 2009. (AP Photo/Alan Diaz) Wilpon, Katz and many entities of their company, Sterling Equities, and various affiliated foundations are among the swindled creditors. (AP) -- Bernard Madoff is still making a market - at According to a motion filed with the bankruptcy least his Citi Field seats are. court, Madoff's firm bought two Delta Club Platinum ticket - section 16, row 2, seats 5-6 - for $80,190. The two tickets for Monday's Citi Field opener Those tickets are worth $295-$695 per game, owned by Bernard L. Madoff Investment Securities depending on the opponent and day of the week, were bid up to $2,375 by 11 p.m. -

TWIN PEAKS What You Need to Know About David Lynch’S MICHAEL

Time-Sensitive SPECIAL SEASON FINALES & RENEWALS ISSUE PERIODICALS Channel Guide Class Publication Postmaster please deliver by the 1st of the month NAT magazine May 2017 • $7.99 TWIN PEAKS What You Need To Know About David Lynch’s MICHAEL channelguidemag.com 18-Part Revival JACKSON WHAT REALLY TV’S TOP HAPPENED? TREASURE HUNTS PREMIERING 5/9 ON DEMAND THE BACHELORETTE PROMISES THE “MOST DRAMATIC THING EVER!” PRINCESS DIANA HER LIFE HER DEATH Robert THE TRUTH ABC GIVES May 2017 May DIRTY DANCING De NIRO A MUSICAL REDO Is “The Wizard Of Lies” WATCH THE 10 MINUTE FREE PREVIEW SHORT LIST For More ReMIND magazine SEASON offers fresh takes on FINALE popular entertainment DATES We Break Down The Month’s See Page 8 from days gone by. Biggest And Best Programming So Each issue has dozens May You Never Miss A Must-See Minute. of brain-teasing 1 16 23 puzzles, trivia quizzes, Lucifer, FOX — New Episodes NCIS, CBS — Season Finale classic comics and Taken, NBC — Season Finale NCIS: New Orleans, CBS — Season Finale features from the 2 NBA: Western Conference Finals, The Mick, FOX — Season Finale Game 1, ESPN 1950s-1980s! Victorian Slum House, PBS Tracy Morgan: Staying Alive, N e t fl i x — New Series American Epic, PBS — New Series 17 < 5 Downward Dog, ABC — New Series Blue Bloods, CBS — Season Finale Downward Dog, ABC — Sneak Peek Bull, CBS — Season Finale The Mars Generation, N e t fl i x Criminal Minds: Beyond Borders, CBS The Flash, The CW — Season Finale Sense8, N e t fl i x — New Episodes — Season Finale NBA: Eastern Conference Finals, Brooklyn -

CM Sept 2012 All Lr

he experiment is to be tried… whether the children of the people, ‘Tthe children of the whole people, can be educated; whether an institution of learning, of the highest grade, can be successfully controlled by the popular will, not by the privileged few, but by the privileged many.” — Horace Webster CUNYMatters Founding Principal, The Free Academy cuny.edu/news • THE CITY UNIVERSITY OF NEW YORK • FOUNDED 1847 AS THE FREE ACADEMY SEPTEMBER 2012 View of GRANTS&HONORS Manhattan from interactive NYC Solar Map launched by Sustainable CUNY as part of the city’s Recognizing commitment Faculty to expedite installation of Achievement solar systems HE UNIVERSITY’S renowned faculty members continually that reduce LaBatto greenhouse Twin professional-achieve- gas emissions. ment awards from prestigious More than 800 organizations as well as research new sustainable grants from government agen- energy cies, farsighted foundations and initiatives will leading corporations. Pictured be launched at are just a few of the recent CUNY campuses Jang honorees. Brief summaries of by 2017. many ongoing research projects start here and continue inside. Queens College has been awarded $1,551,806 from the United States Department of Energy/Steel Workers Charitable and Educational Organization for Mangino “Medical Surveillance of Former Department of Energy Workers,” INVESTING IN OUR FUTURE under the direction of Steven Markowitz. A research project Inspired new Master Plan outlines University advances concerning the “Role of CD14 and Other Innate Immune expected over five years. Receptors in Severe Sepsis,” directed by Sanna Goyert of City Johnson ROUNDBREAKING RESEARCH emerging Regents as required under state Education Law, the 171-page College, has received $377,339 from advanced science laboratories. -

JEWISH PLAYERS and SPORTSPEOPLE LOOKING to DOMINATE the 2015 MLB PLAYOFFS by Daniel Koren - October 8, 2015 # 13832 ! 0

FACEBOOKTWITTERYOUTUBEINSTAGRAM SUBSCRIBE MEMBER CENTRE (ECJN) NEWSLETTER March 19, 2021 - 6 Nissan 5781 NEWS PERSPECTIVES FOOD CULTURE EVENTS SUPPLEMENTS EN FRANÇAIS PODCASTS % SUBSCRIBE Home " News " Here are the Jewish players and sportspeople looking to dominate the 2015... NEWS CULTURE SPORTS VIEW HERE ARE THE JEWISH PLAYERS AND SPORTSPEOPLE LOOKING TO DOMINATE THE 2015 MLB PLAYOFFS By Daniel Koren - October 8, 2015 # 13832 ! 0 The 2015 Major League Baseball playoffs are officially underway, with Toronto setting the stage for the first game of the playoff season as the Blue Jays, playing their first post-season game since they won the World Series 22 years ago, take on the Texas Rangers. As the city’s Jewish members are well aware of, the Blue Jays’ own outfielder Kevin Pillar is a member of the tribe, who showed off his pride by wearing his ‘SuperJew’ undershirt when the Jays clinched the AL East division title. But aside from Pillar, there are several other Jewish athletes and spokespeople actively looking to win the 2015 World Series championship, including a distinguished cadre of owners, players, general managers and presidents of baseball operations. While we pay homage to them with this list, we must also acknowledge that there are far too many Jews in the MLB to mention them all, from batting and pitching coaches to communications directors. As only one team will prove triumphant, there is no doubt that there will be a very tough road ahead for all of you. Allow us to offer these words of encouragement, as spoken by the world’s most interesting man: For the thousands of baseball fans who look forward to this time of year more than anything else in the world, enjoy the wonderment that is the MLB playoffs. -

Journal of American Studies the Madoff Paradox: American Jewish

Journal of American Studies http://journals.cambridge.org/AMS Additional services for Journal of American Studies: Email alerts: Click here Subscriptions: Click here Commercial reprints: Click here Terms of use : Click here The Madoff Paradox: American Jewish Sage, Savior, and Thief MICHAEL BERKOWITZ Journal of American Studies / Volume 46 / Issue 01 / February 2012, pp 189 202 DOI: 10.1017/S0021875811001423, Published online: 09 March 2012 Link to this article: http://journals.cambridge.org/abstract_S0021875811001423 How to cite this article: MICHAEL BERKOWITZ (2012). The Madoff Paradox: American Jewish Sage, Savior, and Thief. Journal of American Studies, 46, pp 189202 doi:10.1017/ S0021875811001423 Request Permissions : Click here Downloaded from http://journals.cambridge.org/AMS, IP address: 144.82.107.48 on 17 Oct 2012 Journal of American Studies, (), , – © Cambridge University Press doi:./S The Madoff Paradox: American Jewish Sage, Savior, and Thief MICHAEL BERKOWITZ Bernie Madoff perpetrated a Ponzi scheme on a scale that was gargantuan even compared with the outrageously destructive Enron and Worldcom debacles. A major aspect of the Madoff story is his rise as a specifically American Jewish type, who self-consciously exploited stereotypes to inspire trust and confidence in his counsel. Styling himself as a benefactor and protector of Jews as individuals and institutional Jewish interests, and possibly in the guise of the Jewish historical trope of shtadlan (intercessor), he was willing to threaten the well-being of all those enmeshed in his empire. The license granted to Madoff stemmed in part from the extent to which he appeared to diverge from earlier Jewish financial titans, such as Ivan Boesky and Michael Milken, in that he epitomized an absolute “insider”–as opposed to an “outsider” or marginal figure. -

79 MOTION for Summary Judgment. (Previously Filed on 2/9/12 As Document Number 120 With

Irving H. Picard v. Saul B. Katz et al Doc. 132 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK In re: Adv. Pro. No. 08-01789 (BRL) BERNARD L. MADOFF INVESTMENT SIPA LIQUIDATION SECURITIES LLC, Debtor, (Substantively Consolidated) IRVING H. PICARD, Trustee for the Liquidation of Adv. Pro. No. 10-05287 (BRL) Bernard L. Madoff Investment Securities LLC, Plaintiff, v. 11 Civ. 03605 (JSR) (HBP) SAUL B. KATZ, et al., Defendants. TRUSTEE’S MEMORANDUM OF LAW IN OPPOSITION TO DEFENDANTS’ MOTION FOR SUMMARY JUDGMENT Baker & Hostetler LLP 45 Rockefeller Plaza New York, New York 10111 Telephone: (212) 589-4200 Facsimile: (212) 589-4201 Attorneys for Irving H. Picard, Esq. Trustee for the Substantively Consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC And Bernard L. Madoff Dockets.Justia.com TABLE OF CONTENTS Page PRELIMINARY STATEMENT ................................................................................................... 1 I. BANKING ON MADOFF’S RETURNS AND ACCOUNTS FOR THEIR BUSINESS FINANCING, THE STERLING DEFENDANTS BECAME DEPENDENT UPON BLMIS ........................................................................................... 4 A. The Sterling Partners’ Business Plans Became Overly-Dependent Upon Their Guaranteed Madoff Returns ......................................................................... 5 B. The Sterling Defendants Exploited the “Madoff Vig” in Ingenious Ways ........... 6 C. Madoff was the Investment Arm of Sterling’s Business and Its Primary Source of Liquidity ...............................................................................................