A Coalfield Reinvestment Formula for the Grand Canyon State

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CO2 Sequestration ■ Mine Water Used for Irrigation, by the Supercritical State of CO in the Subsurface Has Fluid-Like Behavior, Thus Jeffrey C

NONPROFIT ORG. A publication of SAHRA, an NSF Science and Technology Center Technology and Science NSF an SAHRA, of publication A Southwest Hydrology University of Arizona - SAHRA US POSTAGE P.O. Box 210158-B PAID Tucson, AZ TUCSON AZ Sequestration 85721-0158 PERMIT 541 2 CO Address Service Requested September/October 2009 September/October Volume 8/Number 5 8/Number Volume The Resource for Semi-Arid Hydrology Semi-Arid for Resource The Celebrating ten years and two new offices: Offering comprehensive hydrogeologic services in five integrated areas: Groundwater Supply: extensive experience in groundwater development and aquifer storage and recovery including well drilling technology, borehole evaluation, well design and installation oversight, well rehabilitation, plus an Arizona well driller's license. Groundwater Modeling: technical abilities combined with interpretive skill acquired through five decades of collective team experience in creating and interpreting models. Hydrogeologic Investigations: focused It’s an amazing time to be in business application of hydrogeological analyses to resolve groundwater issues, address In the last ten years we have witnessed seismic shifts—changes that have regulatory concerns and water rights affected our personal lives, our communities, and our professional pursuits. issues, and support water-resources Clear Creek Associates began in September 1999 as an Arizona planning. hydrological consulting company with a solid foundation of scientific and Environmental Services: sound relationships with regulators and professional experience. Over the last ten years, we have seen that experience demonstrated experience in developing grow with the emergence of new technology and new perspectives on water remediation strategies and resolving issues. As we mark our first decade in business, our staff, too, has grown by a environmental problems at complex sites in a cost-effective manner; factor of ten. -

Comments – Ngos APS IRP Docket

BEFORE THE ARIZONA CORPORATION COMMISSION Bob Burns, Chairman Boyd Dunn, Commissioner Sandra Kennedy, Commissioner Lea Marquez Peterson, Commissioner Justin Olson, Commissioner RE: APS 2020 RESOURCE PLANNING DOCKET NO. E-00000V-19-0034 AND PROCUREMENT Overview Diné CARE, Tó Nizhóni Ání and Black Mesa Trust (Navajo and Hopi nongovernmental community organizations or NGOs) respectfully submit the following joint comments for your review in response to the Arizona Corporation Commission’s (ACC) consideration of Arizona Public Service Company’s (APS) 2020 integrated resource plan and procurement process in the above-referenced docket. We submitted comments in a previous APS resource planning proceeding, Docket No. E-00000V-15-0094, in 2018, and after reviewing the current plans, we acknowledge the important steps APS has taken to improve on the last iteration of its resource planning. It is notable that in just two short years, the utility has transformed itself from a dramatic over-reliance on coal and natural gas to a commitment to de-carbonizing its generation portfolio over the coming years. That, in itself, is laudable. However, our review of APS’s 2020 IRP still leaves a number of critical issues unaddressed that we first identified in 2018 and which remain deficiencies in the current plan, especially as they relate to the long-term prosperity and wellbeing of the Navajo Nation, the Hopi Tribe and coal-impacted tribal communities. In light of the problems summarized below, we recommend that the Commission take steps to improve this resource plan in ways that provide advantages for both tribes – while still benefiting the utilities’ customers and shareholders. -

ARIZONA WATER ATLAS Volume 1 Executive Summary ACKNOWLEDGEMENTS

Arizona Department of Water Resources September 2010 ARIZONA WATER ATLAS Volume 1 Executive Summary ACKNOWLEDGEMENTS Director, Arizona Department of Water Resources Herbert Guenther Deputy Director, Arizona Department of Water Resources Karen Smith Assistant Director, Hydrology Frank Corkhill Assistant Director, Water Management Sandra Fabritz-Whitney Atlas Team (Current and Former ADWR staff) Linda Stitzer, Rich Burtell – Project Managers Kelly Mott Lacroix - Asst. Project Manager Phyllis Andrews Carol Birks Joe Stuart Major Contributors (Current and Former ADWR staff) Tom Carr John Fortune Leslie Graser William H. Remick Saeid Tadayon-USGS Other Contributors (Current and Former ADWR staff) Matt Beversdorf Patrick Brand Roberto Chavez Jenna Gillis Laura Grignano (Volume 8) Sharon Morris Pam Nagel (Volume 8) Mark Preszler Kenneth Seasholes (Volume 8) Jeff Tannler (Volume 8) Larri Tearman Dianne Yunker Climate Gregg Garfin - CLIMAS, University of Arizona Ben Crawford - CLIMAS, University of Arizona Casey Thornbrugh - CLIMAS, University of Arizona Michael Crimmins – Department of Soil, Water and Environmental Science, University of Arizona The Atlas is wide in scope and it is not possible to mention all those who helped at some time in its production, both inside and outside the Department. Our sincere thanks to those who willingly provided data and information, editorial review, production support and other help during this multi-year project. Arizona Water Atlas Volume 1 CONTENTS SECTION 1.0 Atlas Purpose and Scope 1 SECTION 1.1 Atlas -

Arizona Technical Support Document (PDF)

--------------------------------------------------------------------------------------------------------------------- Technical Support Document ARIZONA Nonattainment Area Designations for the 2010 Sulfur Dioxide (SO2) Primary National Ambient Air Quality Standard Summary Pursuant to section 107(d) of the Clean Air Act (CAA), EPA must initially designate areas as either “nonattainment,” “attainment,” or “unclassifiable” for the 2010 1-hour sulfur dioxide (SO2) primary national ambient air quality standard (NAAQS). The CAA defines a nonattainment area as one that does not meet the NAAQS or that contributes to poor air quality in a nearby area that does not meet the NAAQS. Table 1 below identifies the counties and portions of counties in Arizona that EPA has initially designated “nonattainment” based on monitored violations. EPA is not yet prepared to designate other areas in Arizona, and will address such areas in a subsequent round of final designations. Table 1. Nonattainment Designations for Arizona Arizona’s Recommendation of EPA’s Designated Area (listed alphabetically) Areas/Counties Nonattainment Areas/Counties Hayden Gila County (partial) Nonattainment Nonattainment Pinal County (partial) Nonattainment Nonattainment Miami Gila County (partial) Nonattainment Nonattainment Background On June 2, 2010, EPA revised the primary SO2 NAAQS (75 FR 35520, June 22, 2010) by establishing a new 1-hour standard at a level of 75 parts per billion (ppb), which is met at an ambient air quality monitoring site when the 3-year average of the annual 99th percentile of the daily maximum 1-hour average concentrations is less than or equal to 75 ppb, as determined in accordance with Appendix T of 40 CFR part 50. 40 CFR 50.17(a)-(b). EPA has determined that this is the level necessary to provide protection of public health with an adequate margin of safety, especially for children, the elderly, and those with asthma. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of report (Date of earliest event reported): September 13, 2016 Exact Name of Registrant as Specified in Charter; State of Incorporation; IRS Employer Commission File Number Address and Telephone Number Identification Number 1-8962 Pinnacle West Capital Corporation 86-0512431 (an Arizona corporation) 400 North Fifth Street, P.O. Box 53999 Phoenix, AZ 85072-3999 (602) 250-1000 1-4473 Arizona Public Service Company 86-0011170 (an Arizona corporation) 400 North Fifth Street, P.O. Box 53999 Phoenix, AZ 85072-3999 (602) 250-1000 Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) This combined Form 8-K is separately filed or furnished by Pinnacle West Capital Corporation and Arizona Public Service Company. Each registrant is filing or furnishing on its own behalf all of the information contained in this Form 8-K that relates to such registrant and, where required, its subsidiaries. -

2008 Review Water Quality Standards for Salinity Colorado River System

2008 Review Water Quality Standards For Salinity Colorado River System October 2008 Colorado River Basin Salinity Control Forum 2008 REVIEW WATER QUALITY STANDARDS FOR SALINITY COLORADO RIVER SYSTEM October 2008 Prepared by Colorado River Basin Salinity Control Forum COLORADO RIVER BASIN SALINITY CONTROL FORUM MEMBERS ARIZONA Perri Benemelis, Manager, Office of Colorado River Management Department of Water Resources Joan Card, Director, Water Quality Division Department of Environmental Quality Larry R. Dozier, Deputy General Manager Central Arizona Water Conservation District CALIFORNIA Gerald R. Zimmerman, Executive Director Colorado River Board of California Celeste Cantú, General Manager Santa Ana Watershed Project Authority COLORADO Jennifer L. Gimbel, Director, Colorado Water Conservation Board Department of Natural Resources Steven H. Gunderson, Director, Water Quality Control Division Department of Public Health and Environment David W. Robbins, Attorney at Law NEVADA Anthony Miller, Colorado River Commission of Nevada Leo M. Drozdoff, Administrator, Division of Environmental Protection Department of Conservation and Natural Resources Kay Brothers, Deputy General Manager, Engineering/Operations Southern Nevada Water Authority NEW MEXICO John R. D’Antonio, Jr., P.E., State Engineer New Mexico State Engineer Office UTAH Dennis J. Strong, Director, Division of Water Resources Department of Natural Resources John Whitehead, Assistant Director, Water Quality Division Department of Environmental Quality Randy Crozier, General Manager -

Electric Power Development in the Southwest: a Review and Analysis

Public participation in the planning of coal-fired electric power development in the Southwest: a review and analysis Item Type Thesis-Reproduction (electronic); text Authors Kimball, Dan Belknap. Publisher The University of Arizona. Rights Copyright © is held by the author. Digital access to this material is made possible by the University Libraries, University of Arizona. Further transmission, reproduction or presentation (such as public display or performance) of protected items is prohibited except with permission of the author. Download date 25/09/2021 23:12:58 Link to Item http://hdl.handle.net/10150/191596 PUBLIC PARTICIPATION IN THE PLANNING OF COAL-FIRED ELECTRIC POWER DEVELOPMENT IN THE SOUTHWEST: A REVIEW AND ANALYSIS by Dan Belknap Kimball A Thesis Submitted to the Faculty of the DEPARTMENT OF HYDROLOGY AND WATER RESOURCES In Partial Fulfillment of the Requirements For the Degree of MASTER OF SCIENCE WITH A MAJOR IN WATER RESOURCES ADMINISTRATION In the Graduate College THE UNIVERSITY OF ARIZONA 1 97 4 STATEMENT BY AUTHOR This thesis has been submitted in partial fulfillment of re- quirements for an advanced degree at The University of Arizona and is deposited in the University Library to be made available to borrowers under rules of the Library. Brief quotations from this thesis are allowable without special permission, provided that accurate acknowledgment of source is made. Requests for permission for extended quotation from or reproduction of this manuscript in whole or in part may be granted by the head of the major department or the Dean of the Graduate College when in his judg- ment the proposed use of the material is in the interests of scholar- ship. -

Water Quality Standards for Salinity, Colorado River System, October 2005 Review

Presented below are water quality standards that are in effect for Clean Water Act purposes. EPA is posting these standards as a convenience to users and has made a reasonable effort to assure their accuracy. Additionally, EPA has made a reasonable effort to identify parts of the standards that are not approved, disapproved, or are otherwise not in effect for Clean Water Act purposes. 2005 REVIEW WATER QUALITY STANDARDS FOR SALINITY COLORADO RIVER SYSTEM October 2005 Prepared by Colorado River Basin Salinity Control Forum COLORADO RIVER BASIN SALINITY CONTROL FORUM MEMBERS ARIZONA Thomas G. Carr, Assistant Director, Statewide Conservation and Strategic Planning Department of Water Resources Karen L. Smith, Deputy Director Department of Water Resources Larry R. Dozier, Deputy General Manager Central Arizona Water Conservation District CALIFORNIA Gerald R. Zimmerman, Executive Director Colorado River Board of California Celeste Cantú, Executive Director State Water Resources Control Board Dennis B. Underwood, Chief Executive Officer/General Manager The Metropolitan Water District of Southern California COLORADO Rod Kuharich, Director Colorado Water Conservation Board Department of Natural Resources Mark T. Pifher, Deputy Director of Utilities for Water Resources City of Aurora Kent H. Holsinger, Attorney at Law NEVADA Phillip S. Lehr, Environmental Programs Manager Colorado River Commission of Nevada Allen Biaggi, Director Department of Conservation and Natural Resources Kay Brothers, Deputy General Manager Engineering/Operations Southern Nevada Water Authority NEW MEXICO John R. D’Antonio, Jr., P.E., State Engineer New Mexico State Engineer Office UTAH D. Larry Anderson, Director Division of Water Resources Department of Natural Resources Walt Baker, Director Division of Water Quality Department of Environmental Quality Randy Crozier, General Manager Duchesne County Water Conservancy District WYOMING Patrick T. -

Table A-1. Facilities with Q Greater Than 4,000 Tons Per Year Western

Table A-1. Facilities with Q Greater than 4,000 tons per year Printed 5/17/2019 Western Regional Air Partnership Q/D Analysis Facility ID Facility Name Longitude Latitude region_cd Facility State Facility County SCC NAICS NOx (tpy) PM10 (tpy) SO2 (tpy) Q (tpy) NH3 (tpy) VOC (tpy) Distance to CIA 1073911 Central Compressor Plant (Ccp) -148.487 70.325 2185 AK North Slope 40400316 211111 9,474.57 162.16 118.24 9,754.97 0.00 50.92 > 400 km 7734811 Central Gas Facility (Cgf) -148.5146 70.3303 2185 AK North Slope 40700816 211111 4,847.67 110.62 79.06 5,037.35 0.00 39.09 > 400 km 7735011 Coronado Generating Plant -109.272223 34.577778 4001 AZ Apache 10100501 221112 6,454.09 809.24 908.12 8,171.46 52.80 98.43 Within 400 km 7735111 Tucson Electric Power Co - Springerville -109.16 34.318334 4001 AZ Apache 38500101 221112 6,740.75 2,592.96 6,221.04 15,554.74 118.02 193.54 Within 400 km 862811 Aepco - Apache Generating Station -109.893082 32.061904 4003 AZ Cochise 20100201 221112 5,974.19 301.31 4,811.87 11,087.36 26.02 53.92 Within 400 km 1074511 Asarco Llc - Hayden Smelter -110.76999 33.008056 4007 AZ Gila 50300201 33141 60.17 132.99 17,432.59 17,625.75 0.00 3.11 Within 400 km 14774311 Freeport Mcmoran Miami Smelter -110.85 33.416111 4007 AZ Gila 40715812 33141 210.31 259.43 4,505.02 4,974.76 1.98 92.18 Within 400 km 863011 Aps - Cholla Power Plant -110.3004 34.9409 4017 AZ Navajo 10100212 221112 9,021.09 346.51 3,806.59 13,174.19 66.82 6.43 Within 400 km 2255111 Los Angeles Int Airport -118.40805 33.94249 6037 CA Los Angeles 2275070000 488119 5,677.77 -

Arizona's Renewable Resource and Energy Efficiency Standards

POWERING GROWTH DELIVERING VALUE Investor Meetings | June 24-26, 2015 Powering Growth, Delivering Value FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; variations in demand for electricity, including those due to weather, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation or regulation, including those relating to environmental requirements, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to -

For Utility-Company Reinvestment in Arizona's Coalfield

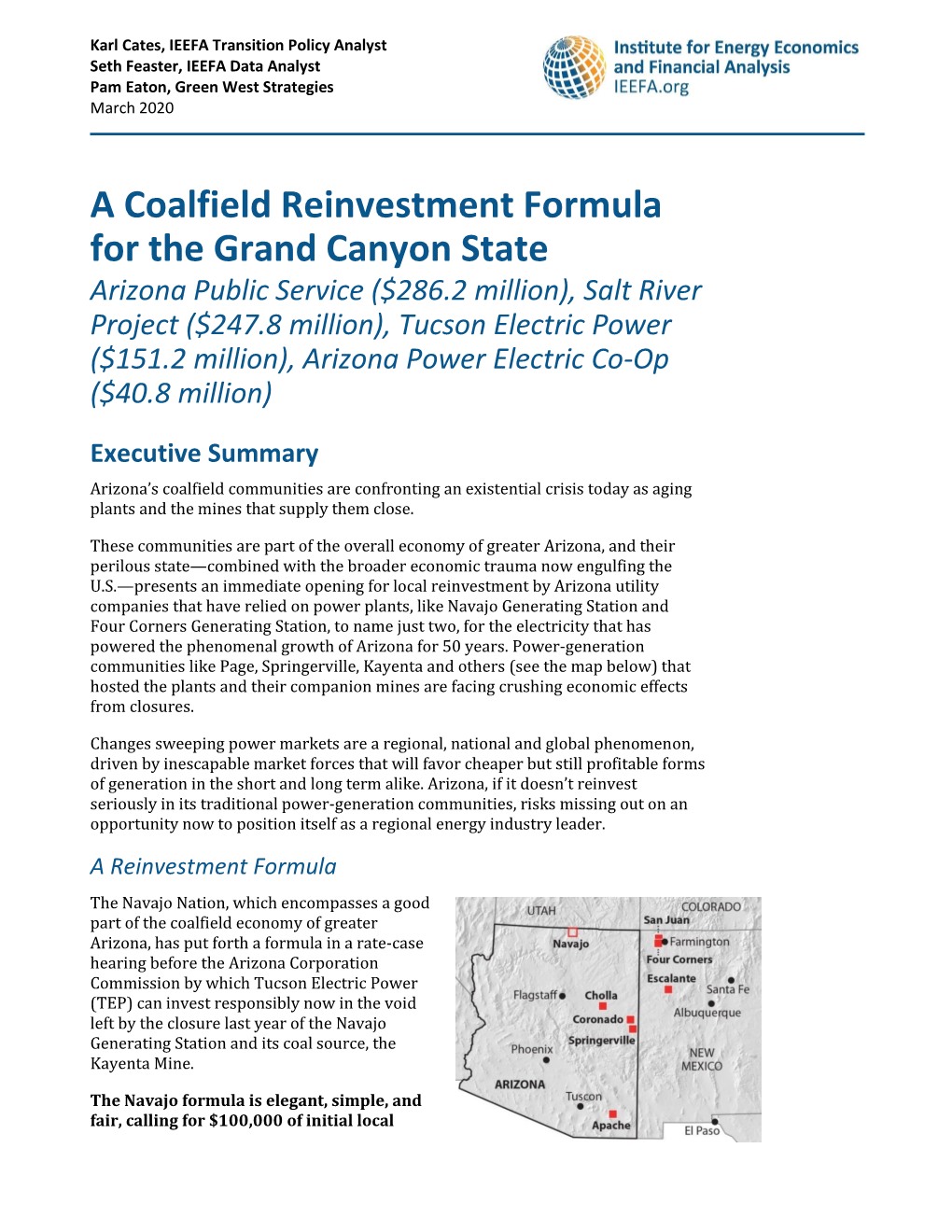

Karl Cates, IEEFA Transition Policy Analyst 1 Amanda Ormond, Ormond Group LLC Seth Feaster, IEEFA Data Analyst Kelli Roemer, Montana State University February 2020 The Case (and the Mechanisms) for Utility-Company Reinvestment in Arizona’s Coalfield Communities Statewide Risk as Fast-Moving Transition Sweeps Power-Generation Industry Executive Summary Coal-fired power plants across America are closing, their disappearance part of a market- driven transition that is occurring faster than widely expected and that signals that now is the time to reinvest in coalfield communities. Nowhere is the issue more pressing than in Arizona, which is at the epicenter of a regional shift in how power is generated. More coal-fired plants will go out of business in the months and years ahead, and the effects will be seen across the state and into northwest New Mexico, an area with which Arizona shares common economic interests. Utilities that are shutting plants can and should reinvest in these communities, where opportunities are abundant, and where timely reinvestment stands to be mutually beneficial to local communities, the state and its citizens. Rural Economies Are Being Upended Overnight Utility-company reinvestment would simultaneously protect the overall Arizona economy and avoid near-term fiscal and financial chaos in two counties, in particular, and two others in the longer term: • Coconino County, where Navajo Generating Station (NGS) closed in November; • Navajo County, where Kayenta Mine ceased production last year and where the shutdown -

Alamo Lake TMDL for Mercury in Fish Tissue

Alamo Lake TMDL for Mercury in Fish Tissue Bill Williams River Watershed Mohave, Yavapai, & Yuma Counties Arizona Department of Environmental Quality October 2012 Open File Report 12-04 Alamo Lake Mercury TMDL October 2012 This page left intentionally blank i Alamo Lake Mercury TMDL October 2012 ACKNOWLEDGEMENTS This TMDL could not have been completed without the competent modeling assistance of the Tetra Tech offices in San Diego, Calif., and Fairfax, Va. Special thanks to Dr. Paul Gremillion from Northern Arizona University for his expertise with sediment coring, sediment analysis and lake bathymetry, and to Environmental Protection Agency Region 9 laboratory for training staff in Clean Hands techniques and low level metals detection. Special thanks also to the Bill Williams Corridor Steering Committee, which graciously provided the forum for public meetings. Several ADEQ staff participated in watershed sampling, making it possible to collect concurrent storm flow data. Your efforts are much appreciated. In no particular order, surface water field staff included: Jason Sutter, Bob Scalamera, Amanda Fawley, Jennifer Hickman, Kyle Palmer, Lee Johnson, Doug McCarty, Roland Williams, Cheri Horsley, and Susan Fitch. Thanks also to Greg Olsen and Patti Spindler for their expertise in assessing the hydrology and biotic potential of Mulholland Wash and Mammoth Wash in the Burro Creek drainage. We appreciate coordination with the Groundwater Unit; groundwater sampling staff leads included Doug Towne and Angela Lucci, with help from Elizabeth Boetcher and members of the surface water staff. Thanks to Nancy Lamascus, Jason Sutter, Debra Daniel and Linda Taunt from ADEQ and Peter Kozelka of EPA Region 9 for their guidance and editing skills.