Graham & Doddsville

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

October 1, 2001

“Don’t mistake activity for achievement.” –John Wooden April 22, 2021 «Title» «First_Name» «Last_Name» «Job_Title» «Company» «Address1» «Address2» «City» «State_» «Postal_Code» Dear «Salutation»: If Hollywood made a movie based on the events that drove financial markets during 1Q 2021, most viewers would find the plotline too farfetched. (Then again, the same could probably be said for most of 2020’s major headlines!) The year started out with the Georgia senate runoff races securing Democratic control of Congress (via the Vice President’s Senate tiebreaking authority), paving the way for more fiscal stimulus than would have occurred with divided government. Then, on January 6, protesters in support of then-President Donald Trump stormed the Capitol as Congress met to confirm President-elect Joe Biden’s election victory. The protests turned violent, causing lawmakers to shelter in place. Ultimately more than 140 people were injured, and 5 people died, including a police officer. And all this occurred within the first seven days of the year! Then the Reddit/WallStreetBets crowd burst on the scene, with nonprofessional investors informally banding together to buy stocks that in many cases were heavily shorted (presumably by hedge funds), causing a “short squeeze” in certain stocks, most notably mall-based video game retailer GameStop. At one point during January, GameStop shares had advanced 1,741% for the year! This short squeeze destroyed some hedge funds and left former star hedge fund manager Gabe Plotkin of Melvin Capital nursing a 53% loss for January, causing him to seek a capital injection from his former boss, Steven Cohen, and Citadel Securities’ Ken Griffin. -

Introduction: the Carried Interest Loophole 7

Simply stated, the carried interest loophole is the mistreatment of hedge fund and private equity fees as capital gains, rather than ordinary income. CONTENTS 3 | Introduction: the Carried Interest Loophole 7 | What is the Carried Interest Loophole? 10 | The Fight to Hold New Jersey Billionaires Accountable 11 | Meet The Billionaires – MFP Investors, Michael Price – Omega Advisors, Leon Cooperman – Redwood Capital Management, Jonathan Kolatch – Glenview Capital, Larry Robbins 19 | Methodology 22 | Who Are the Hedge Clippers? 23 | Press + General Inquiry Contacts INTRODUCTION: THE CARRIED INTEREST LOOPHOLE Understanding what the Instead, with last year’s new federal tax law, Trump and Republicans chose to increase the trillions of Carried Interest Loophole dollars going to billionaires and corporations while is and why Trump and threatening vital investments in housing, education 2 Congressional Republicans and healthcare. During his presidential campaign, President Donald kept it alive in the Federal Trump pledged to close the loophole, saying that “the Tax Law. hedge fund guys are getting away with murder...I have hedge fund guys that are making a lot of money The carried interest loophole is that aren’t paying anything.” among the most costly and wasteful Now, of course, many of those “hedge fund guys” are tax loopholes out there. in the Trump administration or otherwise advising or funding Trump. It’s a massive giveaway to hedge fund and private equity firms that costs federal taxpayers $18 billion each year. Here’s how it works: These firms charge their investors fees for managing their money, but rather than classifying this as income they deem it carried interest, allowing them to pay lower tax rates. -

The Uptick Rule 3.96 Background Briefing –Is A

defending a market attack - the uptick rule 3.96 CLEARED FOR RELEASE 07/16/2020 [Economic Battle PlanTM points: 100) Background Briefing –Is a planned stock market attack in the works? What we must do now to stop it! A stock market crash can determine an election’s outcome. It has happened before…. On September 11, there was a naked short-selling attack on Lehman Brothers, triggering the worst market collapse since the Great Depression. It was done right before the 2008 election and it literally shifted the outcome. The stock market has been a strength for the Trump administration, but there are indications history could repeat itself soon. Economic Warfare expert Kevin Freeman reviews how the stock market can be used as a secret weapon to influence the 2020 Presidential election. Statistically, the stock market performance in the last three months before an election determines who wins the White House 87% of the time. July through November is the critical point in the financial markets and our adversaries recognize it. Even George Soros warns Trump of a potential economic doom before election. In this briefing Kevin Freeman explains potential attacks adversaries have considered and a simple rule that could prevent a timed economic attack on the US stock market. It is critical action is taken to reinstate this rule now! Your Mission: To understand the economic tactics adversaries have used against the US in the past and to help avoid another economic attack on the US stock market. Also, to help us take on Wall Street to: 1. Reinstate the Uptick Rule 2. -

Teledyne and Dr. Henry Singleton, Case Study in Capital Allocation

Teledyne and Dr. Henry Singleton, Case Study in Capital Allocation Teledyne and a Study of an Excellent Capital Allocator, Mr. Dr. Henry Singleton Case Study Edited by John Chew ([email protected]), Telephone: (203) 622-1422 INTRODUCTION Many students of investing know about the great investment record of Warren Buffett but few even know of the man Buffett called one the greatest capitalists and capital allocators of all-time, Dr. Henry Singleton, who built Teledyne Corporation from scratch during 1960 to 1986. The best investors are avid students of history of the market, companies, and great investors. The more you learn from others, the less expensive your own tuition will be. Not to study the Teledyne story and the managerial success of Dr. Henry Singleton and his management teams would be tragic. Excerpts are from the book, Distant Force, A Memoir of the Teledyne Corporation and the Man who Created it by Dr. George A. Roberts (2007). Dr. Henry Singleton was more than just a great capital allocator, he was a visionary, entrepreneur, and excellent business person who believed that the key to his success was people—talented people who were creative, good managers and doers. Once he had those managers in place, he gave them complete autonomy to meet agreed upon goals and targets. He and his co-founder and initial investor, George Kozmetsky, bootstrapped their investment of $450,000 into a company with annual sales of over $450 million, an annual profit of some $20 million, and a stock market value of about $1.15 billion. An investor who put money into Teledyne stock in 1966 achieved an annual return of 17.9 percent over 25 years, or a 53x return on invested capital vs. -

Jonathan Boyar:Welcome to the World According to Boyar, Where

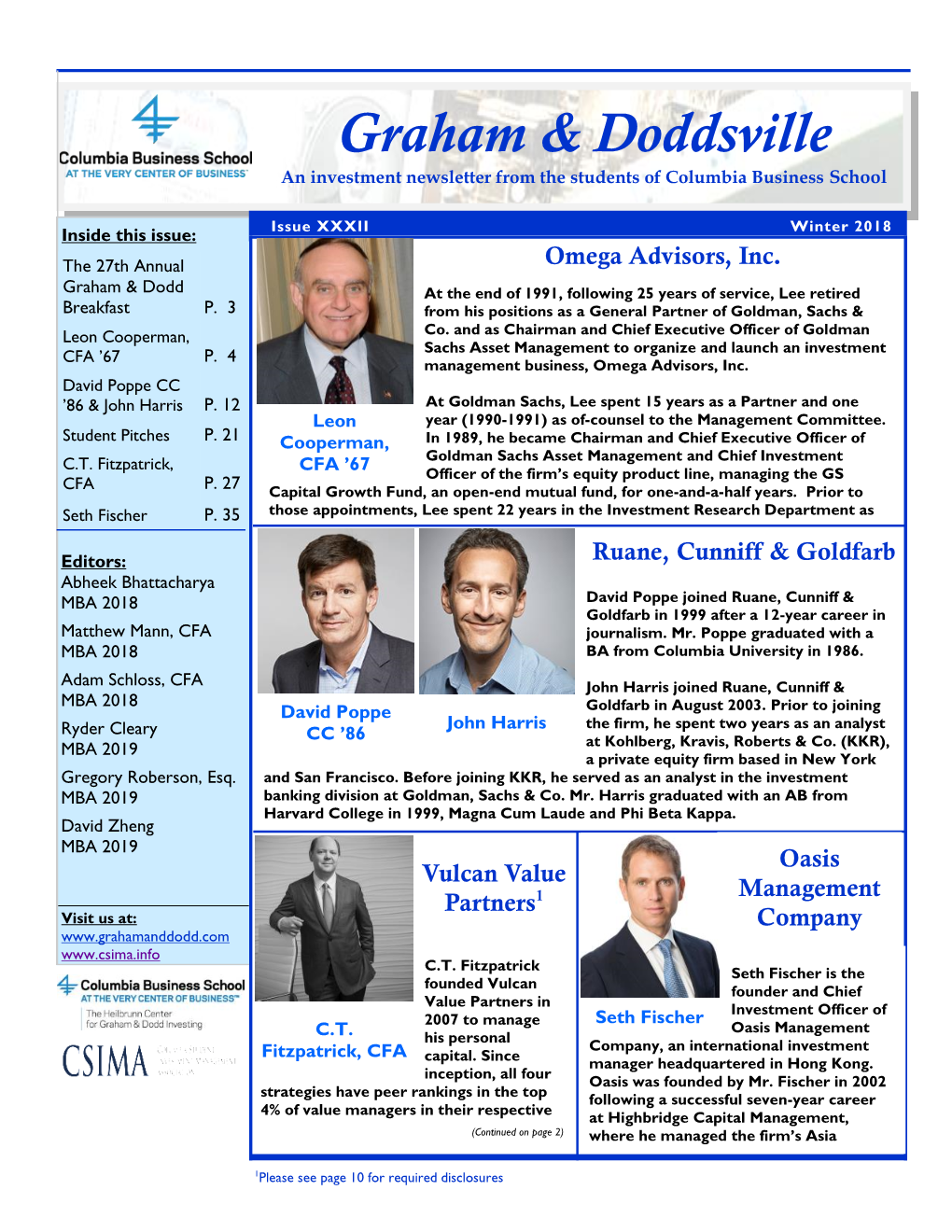

[00:00:00] Jonathan Boyar:Welcome to the World According to Boyar, where we bring top investors, best-selling authors and business leaders to show you the smartest ways to uncover value in the stock market. I'm your host, Jonathan Boyar. Today's guest is Leon Cooperman, one of the most successful money managers in history. If I went through his full professional biography we would run out of time. I'll just go through the highlights. Leon started [00:00:30] his investment career at Goldman Sachs, where he eventually became chairman and CEO of Goldman Sachs asset management. Prior to that he ran the firm's research department. For nine consecutive years, he was voted the number one portfolio strategist in Institutional Investor magazine. At the end of 1991, Leon retired from Goldman to start his own investment management business Omega Advisors which he ran for 27 years before converting it to a family office. At its height Omega managed [00:01:00] more than $10 billion of client funds. Mr. Cooperman and his family are extremely philanthropic. He and his wife, Toby, are signers of The Giving Pledge and have generously made substantial gifts to both Columbia where Leon received his MBA, and Hunter college where he obtained his undergraduate degree. The Cooperman's also made the largest donation in St. Barnabas Medical Center history as well as countless other major donations to help those less fortunate. Leon, welcome to the show. Leon Cooperman: Thank you, [00:01:30] Jonathan. I'm getting so damn old. -

Received by NSD/FARA Registration Unit 02/01/2021 11:58:35 AM

Received by NSD/FARA Registration Unit 02/01/2021 11:58:35 AM 01/29/21 Friday This material is distributed by Ghebi LLC on behalf of Federal State Unitary Enterprise Rossiya Segodnya International Information Agency, and additional information is on file with the Department of Justice, Washington, District of Columbia. Is Dogecoin Next? Robinhood Blocks Skyrocketing Cryptocurrency Championed by Online Traders by Morgan Artvukhina While there are many superficial similarities between the GameStop and Dogecoin online investment frenzies, Wall Street stocks and cryptocurrencies are valued using very different systems. The cryptocurrency Dogecoin is experiencing an unparalleled rise in value amid a push by online investors trying to rally purchases. In response, the trading app Robinhood halted instant deposits for crypto purchases; however, the comparisons with the GameStop affair end there. Dogecoin was begun as a joke in 2013, based on then-popular internet memes about Shiba Inu dogs dubbed “doge.” However, the cryptocurrency amassed a sort of cult following over the years. On Wednesday, Dogecoin’s value began to rise quickly, climbing more than tenfold by Thursday night from $0,007 per coin to $0.78 per coin before declining again. As CNBC reported, the explosion in value was driven by a subreddit called SatoshiStreetBets, named after Satoshi, the mythical founder of bitcoin. Bitcoin has also seen its value spike in recent days amid a flurry of buying. The spike began amid another buying storm cooked up by amateur investors on a Reddit message board site; small-time investors on the WallStreetBets subreddit bought large numbers of GameStop and other stocks that Wall Street investors had taken out substantial short positions on, betting the stocks would soon decline in value. -

A Study of an Excellent Capital Allocator, Dr. Henry Singleton

Tender Offers and Teledyne: a Study of an Excellent Capital Allocator, Dr. Henry Singleton Teledyne Case Study of an Excellent Capital Allocator, Dr. Henry Singleton Many students of investing know about the great investment record of Warren Buffett but few even know of the man Buffett called one the greatest capitalists and capital allocators of all-time, Dr. Henry Singleton, who built Teledyne Corporation from scratch during 1960 to 1986. The best investors are avid history students of the market, companies, and great investors. The more you learn from others, the less expensive your own tuition will be. Not to study the Teledyne story and the managerial success of Dr. Henry Singleton and his management teams would be tragic. Dr. Singleton was both a great operator as well as capital allocator. Excerpts are from the book, Distant Force, A Memoir of the Teledyne Corporation and the Man who created it by Dr. George A. Roberts (2007). Go here: http://www.amazon.com/Distant-Force-Teledyne-Corporation- Created/dp/097913630X/ref=sr_1_1?ie=UTF8&qid=1316530279&sr=8-1 Dr. Henry Singleton was more than just a great capital allocator, he was a visionary, entrepreneur, and excellent business person who believed that the key to his success was people—talented people who were creative, good managers and doers. Once he had those managers in place, he gave them complete autonomy to meet agreed upon goals and targets. He and his co-founder and initial investor, George Kozmetsky, bootstrapped their investment of $450,000 into a company with annual sales of over $450 million, an annual profit of some $20 million, and a stock market value of about $1.15 billion. -

Smart Money Doing?

June 2020 What is the Smart Money doing? Investopedia defines Smart Money as the following: “Smart money is the capital that is being controlled by institutional investors, market mavens, central banks, funds, and other financial S&P 500 vs Mutual Fund Flows $3,500 $850 professionals. Smart money was originally a gambling term that referred Source: Investment Co. $3,000 to the wagers made by gamblers with a track record of success.” Institute / Ycharts, Yahoo $650 $2,500 Finance; Format: CIS $450 Professional traders live by the axiom “Buy on rumor, sell on news.” $2,000 Amateurs follow the financial news, reacting to whatever is hot, and $1,500 $250 often buying after the news is out. The time to buy may have been $1,000 weeks or even months before. Once the news is out now, it can be too $50 late to buy. But buy they do. Amateurs can be buying while pros are $500 $(150) selling. This is what is meant by a stock moving from strong hands $- (well-financed pros) to weak hands (under-financed individuals). S&P 500 Mutual Fund Flows $(500) $(350) Jun-13 Jun-18 Oct-11 Oct-16 Apr-09 Apr-14 Apr-19 Feb-10 Feb-15 Feb-20 Dec-10 Dec-15 This has lead to the study of sentiment indicators. These show how Aug-12 Aug-17 bullish or bearish individuals are. At the extremes, bearish individual This chart shows mutual fund flows compared to the stock investors can be a bullish sign. And when they are bullish, it can be a market. -

What Happened to Goldman Sachs: an Insider’S Story of Organizational Drift and Its

What Happened to Goldman Sachs: An Insider’s Story of Organizational Drift and its Unintended Consequences Steven G. Mandis Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Graduate School of Arts and Science COLUMBIA UNIVERSITY 2014 ©2013 Steven G. Mandis All Rights Reserved Abstract What Happened to Goldman Sachs: An Insider’s Story of Organizational Drift and its Unintended Consequences Steven G. Mandis This is the story of the slow evolution of Goldman Sachs – addressing why and how the firm changed from an ethical standard to a legal one as it grew to be a leading global corporation. In What Happened to Goldman Sachs, Steven G. Mandis uncovers the forces behind what he calls Goldman’s “organizational drift.” Drawing from his firsthand experience; sociological research; analysis of SEC, congressional, and other filings; and a wide array of interviews with former clients, detractors, and current and former partners, Mandis uncovers the pressures that forced Goldman to slowly drift away form the very principles on which its reputation was built. Mandis evaluates what made Goldman Sachs so successful in the first place, how it responded to pressures to grow, why it moved away from the values and partnership culture that sustained it for so many years, what forces accelerated this drift, and why insiders can’t – or won’t – recognize this crucial change. Combining insightful analysis with engaging storytelling, Mandis has written an insider’s history that offers invaluable perspectives to business leaders interested in understanding and managing organizational drift in their own firms. -

Graham & Doddsville

Graham & Doddsville An investment newsletter from the students of Columbia Business School Inside this issue: Issue XIII Fall 2011 Interview: p1 Lee Cooperman Mario Gabelli — “Think Like an Leon Cooperman — “Buying Owner” Interview: p1 Straw Hats in Mario Gabelli Mario Gabelli ’67, CFA, the Winter” started his career as an Interview: p1 automotive and farm Marty Whitman equipment analyst at Loeb Rhodes & Co. In Alumni Profile p25 1977 he founded GAMCO Investors Student Write- p29 (NYSE: GBL), where he is currently Chairman up: GLDD and CEO, as well as a portfolio manager and Student Write- p31 the company’s largest up: MSG shareholder. GAMCO now manages roughly Editors $36 billion dollars across open and closed-end mu- Anna Baghdasaryan tual funds, institutional Mario Gabelli MBA 2012 and private wealth man- sity and his M.B.A. from Joseph Jaspan Leon Cooperman agement, and invest- ment partnerships. Mr. Columbia Business School. MBA 2012 Leon “Lee” Cooperman ’67, Gabelli earned his B.S. (Continued on page 12) CFA, began his post- from Fordham Univer- Mike DeBartolo, CFA business school career in MBA 2013 1967 with Goldman Sachs. In addition to holding a Marty Whitman — “Business Skill Jay Hedstrom, CFA number of key positions MBA 2013 within the firm, Mr. Cooper- Critical to Investment Success” Jake Lubel man was founder, Chairman and Chief Executive Officer Mr. Whitman founded MBA 2013 of Goldman’s Asset Manage- the predecessor to the ment division. In 1991, he Third Avenue Funds in Visit us at: left the firm to launch 1986 and M.J. Whitman, a www.grahamanddodd.com Omega Advisors, Inc., a full service broker-dealer www0.gsb.columbia.edu/students/ value-oriented hedge fund affiliated with Third Ave- organizations/cima/ which now manages roughly nue in 1974. -

Performance Update

Performance Update A Multi-Cap Value Fund Seeking Long-Term Capital Appreciation * Mark Boyar Overview of 1st Quarter 2021 Mark began his career as a securities analyst in 1968. In 1975, he founded Asset Analysis Focus, a subscription-based, institutional If Hollywood made a movie based on the events that drove research service focused on value investing. He quickly began financial markets during 1Q 2021, most viewers would find the managing money for high net worth clients and later formed Boyar plotline too farfetched. (Then again, the same could probably be said Asset Management, a registered investment advisor, in 1983. He began for most of 2020's major headlines!) The year started out with the managing the Boyar Value Fund in1998. His opinions are often sought Georgia senate runoff races securing Democratic control of Congress by such media outlets as Barron’s, Business Week, CNBC, Forbes, (via the Vice President's Senate tiebreaking authority), paving the way Financial World, the New York Times and the Wall Street Journal. for more fiscal stimulus than would have occurred with divided government. Then, on January 6, protesters in support of then- President Donald Trump stormed the Capitol as Congress met to Top Ten Equity Holdings confirm President-elect Joe Biden's election victory. The protests Holdings turned violent, causing lawmakers to shelter in place. Ultimately more than 140 people were injured, and 5 people died, including a police officer. And all this occurred within the first seven days of the year! Then the Reddit/WallStreetBets crowd burst on the scene, with nonprofessional investors informally banding together to buy stocks that in many cases were heavily shorted (presumably by hedge funds), causing a “short squeeze” in certain stocks, most notably mall-based video game retailer GameStop. -

September 8 - 15

This Week in Wall Street Reform | September 8 - 15 Please share this weekly compilation with friends and colleagues. To subscribe, email [email protected], with “This Week” in the subject line. TABLE OF CONTENTS - The Trump Administration, Congress & Wall Street - Consumer Finance and the CFPB - Investor Protection, SEC, Capital Markets - Private Funds - Mortgages and Housing - Student Loans and For-Profit Schools - Systemic Risk T HE TRUMP ADMINISTRATION, CONGRESS & WALL STREET Letter to Congress: AFR Letter in Support of HR 1423, the Forced Arbitration Injustice Repeal Act (FAIR Act) | AFR Americans for Financial Reform writes to express our strong support for H.R. 1423, the Forced Arbitration Injustice Repeal Act (FAIR) Act. Financial companies regularly force consumers into arbitration by slipping it into the fine print of their standard contracts and terms of service and requiring consumers to accept it as a non-negotiable condition to obtain products and services, including bank accounts, credit cards, and student loans. In addition, forced arbitration clauses are often hidden in employment contracts as a condition of employment at many corporations, including financial companies C ONSUMER FINANCE AND THE CFPB New Poll Reveals Bipartisan Opposition to CFPB Debt Collection Rule | Politico Morning Money 1 A recent poll conducted by Lake Research Partners and Chesapeake Beach Consulting shows strong bipartisan opposition among voters to major components of the proposed new CFPB2 debt collection rule. Earlier this year, the Consumer Financial Protection Bureau proposed new rules for debt collectors. The proposal authorizes, for the first time, a specific number of communication attempts to collect past-due debts.