What Happened to Goldman Sachs: an Insider’S Story of Organizational Drift and Its

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bill Rogers Collection Inventory (Without Notes).Xlsx

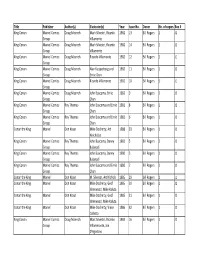

Title Publisher Author(s) Illustrator(s) Year Issue No. Donor No. of copies Box # King Conan Marvel Comics Doug Moench Mark Silvestri, Ricardo 1982 13 Bill Rogers 1 J1 Group Villamonte King Conan Marvel Comics Doug Moench Mark Silvestri, Ricardo 1982 14 Bill Rogers 1 J1 Group Villamonte King Conan Marvel Comics Doug Moench Ricardo Villamonte 1982 12 Bill Rogers 1 J1 Group King Conan Marvel Comics Doug Moench Alan Kupperberg and 1982 11 Bill Rogers 1 J1 Group Ernie Chan King Conan Marvel Comics Doug Moench Ricardo Villamonte 1982 10 Bill Rogers 1 J1 Group King Conan Marvel Comics Doug Moench John Buscema, Ernie 1982 9 Bill Rogers 1 J1 Group Chan King Conan Marvel Comics Roy Thomas John Buscema and Ernie 1981 8 Bill Rogers 1 J1 Group Chan King Conan Marvel Comics Roy Thomas John Buscema and Ernie 1981 6 Bill Rogers 1 J1 Group Chan Conan the King Marvel Don Kraar Mike Docherty, Art 1988 33 Bill Rogers 1 J1 Nnicholos King Conan Marvel Comics Roy Thomas John Buscema, Danny 1981 5 Bill Rogers 2 J1 Group Bulanadi King Conan Marvel Comics Roy Thomas John Buscema, Danny 1980 3 Bill Rogers 1 J1 Group Bulanadi King Conan Marvel Comics Roy Thomas John Buscema and Ernie 1980 2 Bill Rogers 1 J1 Group Chan Conan the King Marvel Don Kraar M. Silvestri, Art Nichols 1985 29 Bill Rogers 1 J1 Conan the King Marvel Don Kraar Mike Docherty, Geof 1985 30 Bill Rogers 1 J1 Isherwood, Mike Kaluta Conan the King Marvel Don Kraar Mike Docherty, Geof 1985 31 Bill Rogers 1 J1 Isherwood, Mike Kaluta Conan the King Marvel Don Kraar Mike Docherty, Vince 1986 32 Bill Rogers -

MARTHA MINOW Inside

inside NEWS Volume 12 Number 2 Fall 2006 Human Rights and Advocacy Author Next Volk Lecturer MARTHA MINOW Jeremiah Smith, Jr. Professor of Law Harvard Law School Should Religious Groups Ever Be Exempt From Civil Rights Laws? Monday October 30 4:30 PM NELSON A. ROCKEFELLER CENTER 3 Rockefeller Hall DARTMOUTH COLLEGE Harvard Professor of Law Martha Minow will deliver the Stephen R. Volk Lecture, “Should Re- ligious Groups Ever Be Exempt From Civil Rights Laws?” on Monday, October 30, at 4:30 pm A Center for Public Policy in 3 Rockefeller Hall. A leading researcher in the areas of equality and inequality, human rights and the Social Sciences and transitional societies, law and social change, and religion and pluralism, Professor Minow will also meet with members of the Dartmouth Law Journal and the Daniel Webster Legal Soci- ety and participate in Philosophy 22, Feminism and Philosophy, taught by Associate Professor of Philosophy Susan Brison. Professor Minow is the author of many books, including Between Vengeance and Forgiveness: Facing History After Genocide and Mass Violence (1998), which was awarded the American Society of International Law Certificate of Merit in 2000. She served on the Independent International t 603-646-3874 Commission on Kosovo and helped to launch Imagine Co-existence, a program of the U.N. High Commissioner for Refugees, to promote peaceful development in post-conflict societies. f 603-646-1329 Established in 2004 by friends and colleagues honoring Stephen R. Volk ’57, the fund supports programs that advance undergraduate study of legal and ethical issues. The lecture is sponsored http://rockefeller.dartmouth.edu in collaboration with the Dartmouth Lawyers Association and Dartmouth Legal Studies faculty. -

Filing Port Code Filing Port Name Manifest Number Filing Date Next

Filing Port Call Sign Next Foreign Trade Official Vessel Type Total Dock Code Filing Port Name Manifest Number Filing Date Next Domestic Port Vessel Name Next Foreign Port Name Number IMO Number Country Code Number Agent Name Vessel Flag Code Operator Name Crew Owner Name Draft Tonnage Dock Name InTrans 5204 WEST PALM BEACH, FL 5204-2021-00375 1/14/2021 - TROPIC MIST FREEPORT, GRAND BAHAMA I J8NZ 8204183 BS 3 400204 TROPICAL SHIPPING CO. VC 333 TROPICAL SHIPPING AND CONSTRUCTION COMPANY LTD. 14 TROPICAL SHIPPING AND CONSTRUCTION 15'0" 548 PORT OF PALM BEACH BERTHS NOS. 8 & 9 (2012) DLX 1803 JACKSONVILLE, FL 1803-2021-00350 1/14/2021 - SLNC MAGOTHY (EX. NORFLOK) GUANTANAMO BAY WDI3067 9418975 CU 3 1262669 CB AGENCIES US 310 ARGENT MARINE OPERATIONS, INC. 17 HS MAGOTHY LLC 27'0" 6089 BLOUNT ISLAND - BERTHS 4 - 6 LY 4601 NEW YORK/NEWARK AREA 4601-2021-01122 1/14/2021 BALTIMORE, MD MAERSK VILNIUS - 9V8503 9408956 - 6 395877 NORTON LILLY INTERNATIONAL SG 310 A.P. MOLLER MAERSK A/S 22 A.P. MOLLER SINGAPORE PTE, LTD 28'3" 8602 PORT NEWARK CONTAINER TERM (PNCT) BERTHS 53, 55, 57, 59 DFL 5301 HOUSTON, TX 5301-2021-01995 1/14/2021 - CHEMSTAR TIERRA ARATU 3EXM9 9827451 BR 2 49547-18 GENERAL STEAMSHIP INC. PA 112 IINO MARINE SERVICE CO., LTD. 24 SIETEMAR, S.A. 34'0" 6474 KINDER MORGAN GALENA PARK L 4601 NEW YORK/NEWARK AREA 4601-2021-01121 1/14/2021 NORFOLK, VA MELCHIOR SCHULTE - 9V3053 9676723 - 6 399740 Turkon America SG 310 BEACH ROAD PARK SHIPPING CO. -

DISH Network Offers Two Customer Appreciation Promotions -- ESPN Classic Experience Sweepstakes to Disney World and FREE HBO Preview

DISH Network Marketing Update: DISH Network Offers Two Customer Appreciation Promotions -- ESPN Classic Experience Sweepstakes to Disney World and FREE HBO Preview LITTLETON, Colo.--(ENTERTAINMENT WIRE)--Aug. 6, 1999--EchoStar Communications Corp. (NASDAQ: DISH, DISHP) is proud to announce today that DISH Network™ is offering two new customer promotions: 1) ESPN Classic is offering DISH Network customers the chance to win a grand prize trip to the ESPN Club at Disney World in Orlando, Fla., and 2) HBO is offering DISH Network customers an eight-day preview of all six HBO channels in August! ESPN Classic Sports Experience Sweepstakes: DISH Network customers who currently receive America's Top 100 CD programming package and customers who upgrade their current programming to America's Top 100 CD by Aug. 31, 1999, will be automatically entered into the ESPN Classic Experience Sweepstakes to win a trip for two to the ESPN Club at Disney World courtesy of ESPN Classic! Prizes include round-trip airfare, hotel accommodations and passes to Disney World. No purchase is necessary and DISH Network customers may enter by mail. Available on DISH Network's America's Top 100 CD package, ESPN Classic televises the greatest sporting events and most memorable stories and heroes of all time. ESPN Classic is the only network that features past Super Bowls, World Series, NBA Championships, Stanley Cups, heavyweight championship fights, NCAA Final Fours, Olympics, NASCAR, Grand Slam tennis events, The Masters and much more. The greatest moments in sports, larger-than-life personalities, history-making games and epic events are available to relive. -

2Q21 GS Earnings Release

Second Quarter 2021 Earnings Results Media Relations: Andrea Williams 212-902-5400 Investor Relations: Carey Halio 212-902-0300 The Goldman Sachs Group, Inc. 200 West Street | New York, NY 10282 Second Quarter 2021 Earnings Results Goldman Sachs Reports Second Quarter Earnings Per Common Share of $15.02 and Increases the Quarterly Dividend to $2.00 Per Common Share “Our second quarter performance and record revenues for the first half of the year demonstrate the strength of our client franchise and our continued progress on our strategic priorities. While the economic recovery is underway, our clients and communities still face challenges in overcoming the pandemic. But, as always, I am proud of the dedication and resilience of our people, who have worked tirelessly to help our clients navigate the ever-changing market environment.” - David M. Solomon, Chairman and Chief Executive Officer Financial Summary Net Revenues Net Earnings EPS 2Q $15.39 billion 2Q $5.49 billion 2Q $15.02 2Q YTD $33.09 billion 2Q YTD $12.32 billion 2Q YTD $33.64 Annualized ROE1 Annualized ROTE1 Book Value Per Share 2Q 23.7% 2Q 25.1% 2Q $264.90 2Q YTD 27.3% 2Q YTD 28.9% YTD Growth 12.2% NEW YORK, July 13, 2021 – The Goldman Sachs Group, Inc. (NYSE: GS) today reported net revenues of $15.39 billion and net earnings of $5.49 billion for the second quarter ended June 30, 2021. Net revenues were $33.09 billion and net earnings were $12.32 billion for the first half of 2021. Diluted earnings per common share (EPS) was $15.02 for the second quarter of 2021 compared with $0.53 for the second quarter of 2020 and $18.60 for the first quarter of 2021, and was $33.64 for the first half of 2021 compared with $3.66 for the first half of 2020. -

General Reflection Manual

Reflection Manual Quotes, prayers, Group reflections for service trips, immersion groups and volunteers Format for Spring Break Reflections Opening Prayer: Spontaneous, or from manual Experience Questions for discussion: • Check-in: how was your day? • What was challenging for you? What was comforting? • Was there a special grace you encountered today? Suggestions for further reflection on experience: ¾ Drawing: your experience, feelings or thoughts you had today ¾ Using clay, poetry, music to express your impressions of the day Social Analysis Questions for discussion: • What justice issue did you encounter today? • What structures are affecting those you met? Suggestions for further reflection with social analysis: ¾ Include information from social analysis section about structural injustice ¾ Name as many larger issues as possible that are at work: welfare, minimum wage, the health care system, public services (trash pick-up, etc) public education, United States government policy, media reporting (or unreporting,) military spending ¾ ASK: how do these issues affect those you’ve met today? Who benefits? Who pays? Theological Reflection Questions for discussion: • In what way did you encounter God today? • What experiences of connection did you have? Suggestions for further theological reflection: ¾ Draw different experiences of God ¾ Include a reading from theological reflection section of manual ¾ Use silence! 3-5 minutes reflecting silently on experience of God with optional sharing Action Questions for discussion: • Wrap-up: How will you remember this day? • What will tomorrow be like? Closing Prayer: Spontaneous or from manual Opening/Closing Prayers We choose struggle Rather than indifference We choose to share the suffering Rather than ignore the pain We choose to make peace Rather than wait for war We choose to proclaim the Good News Rather than sit in silence. -

Blackstone, Goldman Lead $1.25B Bet on City Offices

July 26, 2021 Link to Article Blackstone, Goldman lead $1.25B bet on city offices Blackstone Group Inc. and Goldman Sachs Group Inc. are leading financing for the $1.25 billion redevelopment of a 19th-century warehouse on Manhattan’s west side into a 21st-century office complex. The financing marks the largest construction deal so far this year in Manhattan, according to a statement Friday by L&L Holding Co. and Columbia Property Trust, developers of the Terminal Warehouse, which occupies an entire block in the West Chelsea neighborhood. The project is moving ahead without a major tenant at an uncertain time for New York’s office market. The city has a record amount of space available, and employees have been slow to return from pandemic work-from-home arrangements. Terminal Warehouse is south of Hudson Yards, where new skyscrapers have drawn major financial and technology tenants. “Our ability to secure financing in this current environment is both a testament to the merits of this project as well as a show of the investment community’s continued faith in the future of New York City’s economy,” Robert Lapidus, L&L’s chief investment officer, said in the statement. Blackstone’s real estate debt platform led the financing, with Goldman and KKR & Co. participating in $974 million of senior debt. Oaktree Capital Management led $274 million in junior mezzanine financing in partnership with Paramount Group. “This property is rich in history and we are excited to be part of another high-quality office addition to the growing Hudson Yards and broader west side area of Manhattan,” Michael Eglit, managing director in Blackstone’s Real Estate Debt Strategies group, said in an email. -

Board Meets with Eight Candidates to Replace Prince; Public May Attend

. Price: 500 0792Z nCiO i BERKELEY HEIGHTS LlBKA £-?O PLAINFIELD AVE BFRKELEY HEIGH. NJ 07922 ispat Vll The Berkeley Heights and New Providence edition of the Summit Herald VOLUME 116, No. 2 November 27,2004 teams Board meets with eight candidates jip with grocers |© help liungry to replace Prince; public may attend ' AREA - Concerned residents can assist local emergency By MIKE DeMARCO Dr. Prince resigned in October. Board President Helen Kirsch re- Sincaglia, who introduced a motion Bruno said that each candidate; pantries, senior meal programs, Her term ends in April 2005, at marked that she had not seen so to accept the late application, voted would be given approximately 15 to" •jhelters, low-income day care BERKELEY HEIGHTS — The which time a regular election will many candidates for a single seat on not to make an exception to the 20 minutes for his or her interview ({enters and soup kitchens by sup- township's Board of Education has determine who will occupy her seat the board since she herself first ran deadline. Member Paul Beisser ex- by the members. Mr. Bruno also said porting Check-Out Hunger at scheduled a special meeting, to be- on the school board. for the position more than 20 years pressed concern that making an ex- the board might make its decision, their local supermarkets or at one gin at 7 p.m. at Columbia Middle The remaining board members ago. ception in this case might set an un- during the meeting. ; rf 434 Bank of America banking School on Thursday, Dec. 2, in order announced, during their Nov. -

NPDES WW Power Plant and Industrial with and Without Stormwater

COLOR KEY: Industry not covered by 40 CFR?? Does not appear to be but Double- Look Into. These may not be covered by 40 CFR. Check to be sure. Not appear to be Not sure. Not familiar enough with industry to Steam Electric Turbine. know if they have a Steam Electric Turbine. 40 CFR covers:(vii) Steam electric power generating facilities, including coal handling sites; Needs SW Permit? Is a Power plant, does not have a SW permit but DOES Needs SW Permit? Check to see if there are SW Not a Power Plant - have SW language in it. We need to outfalls. May need SW Permit. Ask the Region if Needs NPDES SW evaluate these. Ask the Region. they have been there… Permit? Look into. Has SW permit but may have coal pile on site - not covered in SW General Permit? Look at site and permit. Contact Region Has SW General or Individual Permit. No Action SW permit expired Has Ken Power plant? Permit Owner Facility County Region Class Expires SW permit SW text? Comments / Action Power Plant? Reviewed? SW language in permit NC0000396 NC0000396 Progress Energy Carolinas, Inc. Asheville Steam Electric Power Plant Buncombe Asheville Major 12/31/2010 none YES Power Plant - Needs NPDES SW Permit? Power plant yes Visual*, 2/yrVisual, 2/yr NC0003433 NC0003433 Progress Energy Carolinas, Inc. Cape Fear Steam Electric Power Plant Chatham Raleigh Major 7/31/2011 none YES Power Plant - Needs NPDES SW Permit? Power plant yes none NC0005363 NC0005363 Progress Energy Carolinas, Inc. Weatherspoon Steam Electric Plant Robeson Fayetteville Minor 7/31/2009 none YES Power Plant - Needs NPDES SW Permit? Power plant yes Visual, TSS, O&G, As, Cu, Fe, Hg, Se, pH: all 2/yrVisual, 2/yr NC0038377 NC0038377 Progress Energy Carolinas, Inc. -

The Commodity Exchange Act TESTIMONY of ROBERT G

Senate Agriculture Committee: The Commodity Exchange Act TESTIMONY OF ROBERT G. EASTON ON BEHALF OF THE MANAGED FUTURES ASSOCIATION BEFORE THE COMMITTEE ON AGRICULTURE, NUTRITION, AND FORESTRY UNITED STATES SENATE Mr. Chairman and members of the Committee: My name is Robert G. Easton and I am the Chairman and Chief Executive Officer of Commodities Corporation Limited located in Princeton, N.J. I also am Chairman of the Government Relations Committee of the Managed Futures Association ("MFA"). I appreciate the opportunity to testify on behalf of MFA at this hearing on the Commodity Exchange Act. MFA, a not-for-profit national trade association with over 600 members, represents the managed futures industry. The objective of the MFA is to enhance the image and understanding of the industry, to further constructive dialogue with regulators in pursuit of regulatory reform, and to improve communication with, and training of, the Association's members through effective conferences and communication programs. MFA is governed by an elected board of directors and has offices in Washington, D.C. and California. MFA membership is composed primarily of commodity pool operators and commodity trading advisors who are responsible for the discretionary management of the vast majority of the estimated $20 billion currently invested in managed futures products, including commodity pools and managed futures accounts. Commodities Corporation Limited is an MFA member and is registered as both a commodity pool operator and a commodity trading advisor, managing client capital and its parent company's proprietary capital since 1969. Currently, our company has over $1.3 billion under management. The business operations of MFA members are subject to regulation under the Commodity Exchange Act (the "Act") by the Commodity Futures Trading Commission ("CFTC") and, pursuant to delegation of certain regulatory functions under the Act, by the industry's self regulatory organization, the National Futures Association ("NFA"). -

Alter Ego #78 Trial Cover

TwoMorrows Publishing. Celebrating The Art & History Of Comics. SAVE 1 NOW ALL WHE5% O N YO BOOKS, MAGS RDE U & DVD s ARE ONL R 15% OFF INE! COVER PRICE EVERY DAY AT www.twomorrows.com! PLUS: New Lower Shipping Rates . s r Online! e n w o e Two Ways To Order: v i t c e • Save us processing costs by ordering ONLINE p s e r at www.twomorrows.com and you get r i e 15% OFF* the cover prices listed here, plus h t 1 exact weight-based postage (the more you 1 0 2 order, the more you save on shipping— © especially overseas customers)! & M T OR: s r e t • Order by MAIL, PHONE, FAX, or E-MAIL c a r at the full prices listed here, and add $1 per a h c l magazine or DVD and $2 per book in the US l A for Media Mail shipping. OUTSIDE THE US , PLEASE CALL, E-MAIL, OR ORDER ONLINE TO CALCULATE YOUR EXACT POSTAGE! *15% Discount does not apply to Mail Orders, Subscriptions, Bundles, Limited Editions, Digital Editions, or items purchased at conventions. We reserve the right to cancel this offer at any time—but we haven’t yet, and it’s been offered, like, forever... AL SEE PAGE 2 DIGITIITONS ED E FOR DETAILS AVAILABL 2011-2012 Catalog To get periodic e-mail updates of what’s new from TwoMorrows Publishing, sign up for our mailing list! ORDER AT: www.twomorrows.com http://groups.yahoo.com/group/twomorrows TwoMorrows Publishing • 10407 Bedfordtown Drive • Raleigh, NC 27614 • 919-449-0344 • FAX: 919-449-0327 • e-mail: [email protected] TwoMorrows Publishing is a division of TwoMorrows, Inc. -

Judge Jim Hely of Westfield Transit Village Review CONTINUED from PAGE 1 CONTINUED from PAGE 1 State Officials Are Present, “The Town Them,” Ms

Ad Populos, Non Aditus, Pervenimus Published Every Thursday Since September 3, 1890 (908) 232-4407 USPS 680020 Thursday, July 23, 2009 OUR 119th YEAR – ISSUE NO. 30-2009 Periodical – Postage Paid at Westfield, N.J. www.goleader.com [email protected] SIXTY CENTS Despite Reports, Westfield Not Pursuing Transit Village Status By MICHAEL J. POLLACK hoods where people can live, shop, very quickly” and noted that a transit Specially Written for The Westfield Leader work and play without relying on village designation is “not front and WESTFIELD – Despite reports to automobiles.” Towns such as center” on the mayor or council’s the contrary, the Town of Westfield is Cranford, Morristown and South Or- agenda. not pursuing a Transit Village desig- ange are considered transit villages. Mayor Andy Skibitsky confirmed nation at present. Though it may study While reports of Downtown that the “impromptu” and “last- the “appropriateness” of such a des- Westfield Corporation (DWC) Ex- minute” meeting took place, but he ignation in the future, town officials ecutive Director Sherry Cronin lead- said there is “no directive to pursue refuted a report that said the town was ing the Transit Village Taskforce on a this…it will never happen without “eyeing” the matter seriously. tour of the town two Fridays ago are mayor and council approval.” According to the New Jersey De- accurate, Frank Arena, the Westfield While the mayor said there was partment of Transportation (DOT) Town Council’s DWC liaison, said it “nothing wrong” with meeting with website, the Transit Village initiative was an “impromptu” meeting. the taskforce, it is not something his creates incentives for municipalities Mr.