Provides Second Quarter 2020 Guidance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HP Digital Signage Display

HP LD4220tm and LD4720tm Digital Signage Touch Displays User Guide © 2011 Hewlett-Packard Development Company, L.P. The information contained herein is subject to change without notice. The only warranties for HP products and services are set forth in the express warranty statements accompanying such products and services. Nothing herein should be construed as constituting an additional warranty. HP shall not be liable for technical or editorial errors or omissions contained herein. This document contains proprietary information that is protected by copyright. No part of this document may be photocopied, reproduced, or translated to another language without the prior written consent of Hewlett-Packard Company. Microsoft®, Windows®, and Windows Vista™ are either trademarks or registered trademarks of Microsoft Corporation in the United States and/or other countries. First Edition (September 2011) Document Part Number: 626998-001 About this guide This guide provides information on setting up the display, installing drivers, using the On-Screen Display menu, troubleshooting, and technical specifications. WARNING! Text set off in this manner indicates that failure to follow directions could result in bodily harm or loss of life. CAUTION: Text set off in this manner indicates that failure to follow directions could result in damage to equipment or loss of information. NOTE: Text set off in this manner provides important supplemental information. ENWW iii iv About this guide ENWW Table of contents 1 Product features ............................................................................................................................................ -

Graphics Library Display Drivers

Application Report SPMA039A–December 2011–Revised July 2013 Stellaris® Graphics Library Display Drivers DaveWilson ABSTRACT The Stellaris Graphics Library (grlib) offers a compact yet powerful collection of graphics functions allowing the development of compelling user interfaces on small monochrome or color displays attached to Stellaris microcontrollers. This application report describes how to support a new display device in the Stellaris Graphics Library. Contents 1 Introduction .................................................................................................................. 1 2 Library Structure ............................................................................................................ 2 3 Display Driver API .......................................................................................................... 3 4 Conclusion ................................................................................................................... 8 5 References ................................................................................................................... 9 1 Introduction The Stellaris Graphics Library (grlib) is included in all StellarisWare® firmware development packages supporting evaluation or development kits that include color displays. The Graphics library provides a collection of graphics functions that allow you to develop user interfaces on small monochrome or color displays attached to Stellaris microcontrollers. This list includes ek-lm3s3748, dk-lm3s9b96, rdk-idm, rdk- -

Touch & Display Integration

Latest Advances in Touch and Display Integration for Smartphones and Tablets PN: 507-000167-01 Rev. D Introduction Capacitive touchscreen technology has revolutionized smartphones and tablets, and is now finding its way into laptops, desktop displays, Table of Contents and all-in-one PCs. Because the market for these devices is fiercely competitive, vendors are constantly challenged to design systems Introduction................................................ 1 with high display quality, ease of navigation, high performance, compact form factors, long battery life, and low cost. Because the Integrating touch sensors into the display touchscreen plays such an influential role in the user experience, stack-up ..................................................... 2 the choice of its design can be a determining factor in a product’s ultimate success. Integrating the touch controller and display The ability to turn a display into a “touch pad” requires combining driver ICs ................................................... 4 these two previously distinct functions in seamless fashion. Historically, adding touch sensors to the display has been handled Advantages of In-Cell TDDI solutions ........ 6 in an autonomous fashion by different companies supplying different Engineering, manufacturing, and support layers in a laminated panel “stack-up” that is then assembled by a advantages ................................................ 6 separate manufacturer. Recent advances in technology have made it possible to integrate the touch sensors directly into the display, as Device design advantages ......................... 6 well as to integrate the Touch Controller and Display Driver functions in a single integrated circuit (IC). Conclusion ................................................ 7 This white paper outlines the touch and display integration technologies currently available1, including a new and innovative solution that is expected to dominate designs for new devices in the foreseeable future. -

Chip-On-Glass LCD Driver Technology

Chip-on-Glass LCD Driver Technology Well-proven Approach from NXP Reduces Medical System Design Costs Executive Summary 1 Executive Summary Use of LCD Displays in Medical Imaging 1 Progress in Liquid Crystal Display (LCD) medical imaging technology has The Chip-on-Glass Value Proposition 2 led to its increasing adoption for diagnostic viewing of medical images. Understanding the Conventional Surface Mount Method 2 Although LCD monitors have many advantages over cathode-ray tube The Alternative Chip-on-Glass Concept 3 monitors, cost continues to be a factor when medical professionals choose Comparing Design Effort Associated equipment. The rising overall cost of medical care adds further urgency to with COD and SMD Approaches 4 decrease equipment cost where possible. Cost Benefits of the COG Solutions versus the SMD Approach 5 For systems that require LCD displays, a typical design approach has been Example Case for Cost Comparison 6 to mount the display glass as well as the integrated circuit driving the References 9 display directly onto a printed circuit board (PCB). This approach results Acronyms 9 in a complex and area-intense PCB design. To address this issue, NXP has developed a Chip-on-Glass (COG) LCD driver approach whereby the integrated circuit mounts directly on the display glass, with the overall impact being a reduction in system cost. COG is a very reliable and well- established technology, which is often used in the automobile industry. Use of LCD Displays in Medical Imaging The need for imagery displays in medicine is vast, with technology such as digital X-ray, CT, MRI, and ultrasound just a few examples. -

Division of Polymer Chemistry (POLY)

Division of Polymer Chemistry (POLY) Graphical Abstracts Submitted for the 245th ACS National Meeting & Exposition April 7-11, 2013 | New Orleans, Louisiana Division of Polymer Chemistry (POLY) Table of Contents (Click on a session for link to abstracts) SMTu W Th General Topics: New Synthesis and Characterization of Polymers A P A P A P Bottom‐Up Design of the Next Generation of Biomaterials A P A P A P Excellence in Graduate Polymer Research A P A P P Liquid Crystals and Polymers A P A P A P Undergraduate Research in Polymer Science A P P ACS Award in Polymer Chemistry: Symposium in Honor of Craig J. Hawker P Understanding Complex Macromolecular and Supramolecular Systems using P A P A P A P A Innovative Magnetic Resonance Strategies AkzoNobel North America Science Award* A ACS Award for Creative Invention: Symposium in Honor of Timothy M. Swager A P A P Hybrid Materials* P A P A P A P Sci‐Mix E Carl S. Marvel Creative Polymer Chemistry Award A P Natural and Renewable Polymers P A P A P Polymer Composites for Energy Harvesting, Conversion and Storage P A P A P Polymer Precursor‐Derived Carbon P A P A P POLY/PMSE Plenary Lecture and Awards Reception* E Legend A = AM; P = PM; E = EVE *POLY is the primary organizer of the cosponsored symposium POLY Scott Iacono, Sheng Lin-Gibson, Jeffrey Youngblood Sunday, April 7, 2013 1 - Band-gap engineering of carborane-containing conducting polymers: A computational study Ethan Harak1, [email protected], Bridgette Pretz1, Joseph Varberg1, M. -

PCA85276 Automotive 40 X 4 LCD Driver Rev

PCA85276 Automotive 40 x 4 LCD driver Rev. 3 — 12 November 2018 Product data sheet 1. General description The PCA85276 is a peripheral device which interfaces to almost any Liquid Crystal Display (LCD)1 with low multiplex rates. It generates the drive signals for any static or multiplexed LCD containing up to four backplanes and up to 40 segments. It can be easily cascaded for larger LCD applications. The PCA85276 is compatible with most microcontrollers and communicates via the two-line bidirectional I2C-bus. Communication overheads are minimized by a display RAM with auto-incremented addressing, by hardware subaddressing, and by display memory switching (static and duplex drive modes). For a selection of NXP LCD segment drivers, see Table 23 on page 45. 2. Features and benefits AEC-Q100 grade 2 compliant for automotive applications Single chip LCD controller and driver Selectable backplane drive configuration: static, 2, 3, or 4 backplane multiplexing 1 1 Selectable display bias configuration: static, ⁄2, or ⁄3 Internal LCD bias generation with voltage-follower buffers 40 segment drives: Up to 20 7-segment numeric characters Up to 10 14-segment alphanumeric characters Any graphics of up to 160 segments/elements 40 4-bit RAM for display data storage Auto-incremented display data loading across device subaddress boundaries Display memory bank switching in static and duplex drive modes Versatile blinking modes Independent supplies possible for LCD and logic voltages Wide power supply range: from 1.8 V to 5.5 V Wide logic LCD supply range: From 2.5 V for low-threshold LCDs Up to 8.0 V for guest-host LCDs and high-threshold twisted nematic LCDs Low power consumption Extended temperature range up to 105 C 400 kHz I2C-bus interface May be cascaded for large LCD applications (up to 1280 segments/elements possible) No external components required 1. -

A Hybrid AMOLED Driver IC for Real-Time TFT Nonuniformity Compensation

This article has been accepted for inclusion in a future issue of this journal. Content is final as presented, with the exception of pagination. IEEE JOURNAL OF SOLID-STATE CIRCUITS 1 A Hybrid AMOLED Driver IC for Real-Time TFT Nonuniformity Compensation Jun-Suk Bang, Hyun-Sik Kim, Member, IEEE, Ki-Duk Kim, Student Member, IEEE, Oh-Jo Kwon, Choong-Sun Shin, Joohyung Lee, and Gyu-Hyeong Cho, Fellow, IEEE Abstract—An active matrix organic light emitting diode Fig. 1 shows an AMOLED display system including col- (AMOLED) display driver IC, enabling real-time thin-film tran- umn driver ICs [6]–[8], [10], [11] and pixel circuits [3], [5]. sistor (TFT) nonuniformity compensation, is presented with a The AMOLED display-driving systems have been developed hybrid driving method to satisfy fast driving speed, high TFT current accuracy, and a high aperture ratio. The proposed in terms of three important aspects as follows. hybrid column-driver IC drives a mobile UHD (3840 × 2160) 1) High driving speed: As resolution and panel size increase, AMOLED panel, with one horizontal time of 7.7 µsatascan a one-horizontal (1 H) time for the driver to program frequency of 60 Hz, simultaneously senses the TFT current for data voltages (VDATA) into pixels in a row is continuously back-end TFT variation compensation. Due to external compen- reduced, which means that the driver must have a fast sation, a simple 3T1C pixel circuit is employed in each pixel. Accurate current sensing and high panel noise immunity is guar- driving speed. anteed by a proposed current-sensing circuit. -

Project Number: MQP-SJB-1A09 UTILIZING Leds AS FEEDBACK SENSORS for VIDEO DISPLAYS a Major Qualifying Project Report Submitted T

Project Number: MQP-SJB-1A09 UTILIZING LEDs AS FEEDBACK SENSORS FOR VIDEO DISPLAYS A Major Qualifying Project Report Submitted to the Faculty of WORCESTER POLYTECHNIC INSTITUTE In partial fulfillment of the requirements for the Degree of Bachelor of Science in Electrical and Computer Engineering by ______________________________ Dan Cianfrocco ______________________________ Tuen Hung Lee ______________________________ Eric Renzulli March 5, 2010 Sponsoring Organization: NECAMSID _____________________________________ Professor Stephen J. Bitar, Major Advisor _____________________________________ Professor John A. McNeill, Co-Advisor Abstract The purpose of this project was to demonstrate as a proof of concept that LED emitters within outdoor video displays can also be utilized as optical feedback sensors for self-calibration. The emission and sensing characteristics of new and degraded LEDs were measured and studied to determine the effectiveness of using LEDs as sensors. A small-scale, adjustable LED driver with a closed-loop feedback control system was designed to illustrate self-calibration without extra sensing components. LED current was automatically adjusted to maintain proper LED brightness and color, while utilizing an adjacent LED as a sensor. Test results show that the self- calibration control system is viable and effective. Further work is necessary to determine system proficiency for large scale LED video displays. i Executive Summary LEDs have been universally used in many applications as light emitters in recent years due to rapid technological advancements. They are widely known for their energy efficiency, low heat dissipation, small size, durability, and long lifetime. One of the applications that LEDs have dominated is large-scale outdoor video displays, such as stadium displays, billboards, and large outdoor televisions. -

WO 2008/021821 Al

(12) INTERNATIONAL APPLICATION PUBLISHED UNDER THE PATENT COOPERATION TREATY (PCT) (19) World Intellectual Property Organization International Bureau (43) International Publication Date (10) International Publication Number 21 February 2008 (21.02.2008) PCT WO 2008/021821 Al (51) International Patent Classification: Drive, Gurnee, Illinois 60031 (US). YU, Pinky [CA/US]; G09G 3/20 (2006.01) 842 Amelia Court, Grayslake, Illinois 60030 (US). (21) International Application Number: (74) Agent: VAAS, Randall S., Mobile D ; 600 North US High PCT/US2007/075348 way 45, Libertyville, Illinois 60048 (US). (81) Designated States (unless otherwise indicated, for every (22) International Filing Date: 7 August 2007 (07.08.2007) kind of national protection available): AE, AG, AL, AM, AT,AU, AZ, BA, BB, BG, BH, BR, BW, BY, BZ, CA, CH, (25) Filing Language: English CN, CO, CR, CU, CZ, DE, DK, DM, DO, DZ, EC, EE, EG, (26) Publication Language: English ES, FI, GB, GD, GE, GH, GM, GT, HN, HR, HU, ID, IL, IN, IS, JP, KE, KG, KM, KN, KP, KR, KZ, LA, LC, LK, (30) Priority Data: LR, LS, LT, LU, LY, MA, MD, ME, MG, MK, MN, MW, 11/464,725 15 August 2006 (15.08.2006) US MX, MY, MZ, NA, NG, NI, NO, NZ, OM, PG, PH, PL, PT, RO, RS, RU, SC, SD, SE, SG, SK, SL, SM, SV, SY, (71) Applicant (for all designated States except US): MO¬ TJ, TM, TN, TR, TT, TZ, UA, UG, US, UZ, VC, VN, ZA, TOROLA INC. [US/US]; 1303 East Algonquin Road, ZM, ZW Schaumburg, Illinois 60196 (US). (84) Designated States (unless otherwise indicated, for every (72) Inventors; and kind of regional protection available): ARIPO (BW, GH, (75) Inventors/Applicants (for US only): KAEHLER, John GM, KE, LS, MW, MZ, NA, SD, SL, SZ, TZ, UG, ZM, W. -

Color Display Driver Circuit and Driver Development for Embedded System Based on ARM Microcontroller

International Journal of Science and Research (IJSR) ISSN (Online): 2319-7064 Index Copernicus Value (2016): 79.57 | Impact Factor (2017): 7.296 Color Display Driver Circuit and Driver Development for Embedded System Based on ARM Microcontroller Harini H M1, Ravikumar M N2 1, 2VTU University, Malnad College of Engineering, Salagame Road, 573202, Hassan Abstract: Displays generally handle data input as character maps or bitmaps. In character-mapping mode, a display has a pre- allocated amount of pixel space for each character. In bitmap mode, it receives an exact representation of the screen image that is to be projected in the form of a sequence of bits that describe the color values for specific x and y coordinates starting from a given location on the screen. Displays that handle bitmaps are also known as all-points addressable displays. A display driver supports a particular family of display controllers and all displays which are connected to one or more of these controllers [2]. The drivers can be configured by modifying their configuration files whereas the driver itself does not need to be modified. The configuration files contain all required information for the driver including how the hardware is accessed and how the controllers are connected to the display. EmWin handles all access to the display. Keywords: ST77335 TFT LCD, STM32F103 MCU, STemWin Library 1. Introduction Fourteen-segment display Sixteen-segment display A display is a computer output surface and projecting HD44780 LCD controller a widely accepted protocol for mechanism that shows text and often graphic images to the LCDs. computer user, using a cathode ray tube (CRT), liquid crystal display (LCD), light-emitting diode, gas plasma, or other 2. -

Solution Proposal by Toshiba

R17 IH Rice Cooker Solution Proposal by Toshiba © 2019 Toshiba Electronic Devices & Storage Corporation Toshiba Electronic Devices & Storage Corporation provides comprehensive device solutions to customers developing new products by applying its thorough understanding of the systems acquired through the analysis of basic product designs. © 2019 Toshiba Electronic Devices & Storage Corporation Block Diagram © 2019 Toshiba Electronic Devices & Storage Corporation IH Rice Cooker Overall block diagram IH Coil Lid Torso Steam Temp. Heater Heater Heater Sensor Gate Discrete DC-DC Driver IGBT Isolation Isolation Isolation Speaker Display Display EEPROM Main Control MCU Control LED MCU Key Input Fan © 2019 Toshiba Electronic Devices & Storage Corporation 4 IH Rice Cooker Detail of IH coil drive unit IH coil drive circuit (using gate driver coupler) Criteria for device selection - Fast switching and low saturation voltage Induction Heater characteristics are required for IGBT. - Use of small package enables to reduce the circuit board area. 8 Main 2 1 Gate Discrete Control - Rail-to-Rail output, low voltage driving and low Driver IGBT MCU current consumption are required for gate driver to realize low power consumption of the set. - Monitoring sensor, high speed data processing and various heaters control are needed for system control. IH coil drive circuit (using discreteInduction components) Heater Proposals from Toshiba DC-DC 3 - Fast and high efficiency switching are Bipolar 1 Transistor 1 realized Regulator 3 Discrete Silicon N-ch discrete -

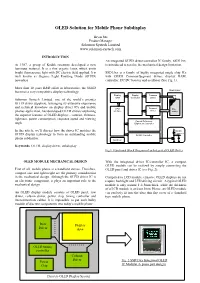

OLED in Mobile Phone

OLED Solution for Mobile Phone Subdisplay Bryan Ma Product Manager Solomon Systech Limited www.solomon-systech.com INTRODUCTION An integrated OLED driver/controller IC family, SSD13xx, At 1987, a group of Kodak scientists developed a new is introduced to resolve the mechanical design limitation. luminous material. It is a thin organic layer, which emits bright fluorescence light with DC electric field applied. It is SSD13xx is a family of highly integrated single chip ICs well known as Organic Light Emitting Diode (OLED) with OLED Common/Segment driver; display RAM, nowadays. controller, DC/DC booster and oscillator (See Fig. 1). More than 10 years R&D effort in laboratories, the OLED becomes a very competitive display technology. OLED Panel Display Display Common RAM Controller Driver Solomon Systech Limited, one of the world’s premier OLED driver suppliers, leveraging its extensive experience and technical knowhow on display driver ICs and mobile CPU Segment Dot- phones application, has developed OLED drivers exploiting Interface Driver matrix the superior features of OLED displays - contrast, thinness, lightness, power consumption, response speed and viewing Current Reference, angle Brightness Controller In this article, we’ll discuss how the driver IC matches the DC/DC Converter OLED display technology to form an outstanding mobile DC/DC Controller phone subdisplay. Oscillator Keywords: OLED, display driver, subdisplay Fig.1 Functional Block Diagram of an Integrated OLED Driver OLED MODULE MECHANICAL DESIGN With the integrated driver IC/controller IC, a compact OLED module can be realized by simply connecting the First of all, mobile phone is a handheld device. Therefore, OLED panel and driver IC (see Fig.