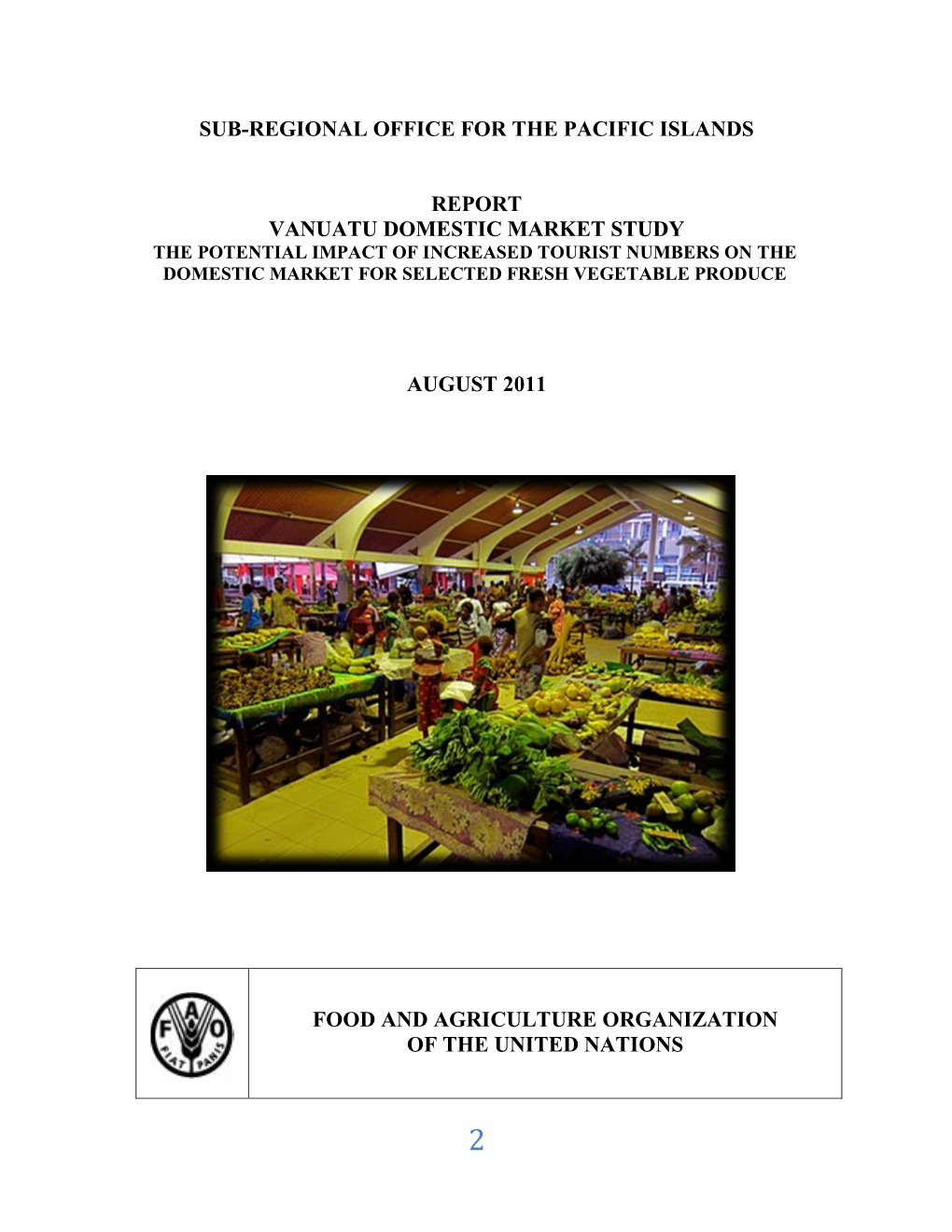

Vanuatu Domestic Market Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix 3: Finding Aid for Vanuatu Material in Scotland

ReviewReview ofof PacificPacific Collections in Scottish Museums Appendix 3: Finding Aid for Vanuatu Material in Scotland Produced as part of Pacific Collections in Scottish Museums: Unlocking their knowledge and potential project 2013-2014. For full information and resources visit www.nms.ac.uk/pacific Artefacts and Archives relating to Vanuatu in public repositories in Scotland (United Kingdom) This finding aid has been compiled as a result of a preliminary survey of Pacific Collections in Scottish Museums undertaken between April 2013 and December 2014. The review scoped the extent of Pacific collections in Scotland and identified key strengths and resources for future research. It also compiled Collections Level Descriptions for each regional island group and to highlight significance. The review was undertaken as a partnership across four museums in Scotland with significant or extensive collections from the Pacific region. These partners were National Museums Scotland (Edinburgh); Glasgow Museums; Perth Museum and Art Gallery and Aberdeen University Museums. Each of these museums hold collections from Vanuatu that have clear associations with islands or regions in Vanuatu and relate to well known Scottish missionaries. How to use this finding aid This finding aid provides an overview of Ni-Vanuatu artefact collections in Scotland and where possible related archives or photographs. The following list provides the names of key individuals through which the collections were acquired. The finding aid enables an initial overview of collections and resources and provides contact details for each of the major museums and libraries so that requests for further information can be made. The finding aid should also be used in conjunction with Excel spreadsheets and photographs of artefacts also deposited with the National Archives of Vanuatu. -

PMB Photo 60 [PDF, 259

PACIFIC MANUSCRIPTS BUREAU Room 4201, Coombs Building College of Asia and the Pacific The Australian National University, Canberra, ACT 0200 Australia Telephone: (612) 6125 0887 E-mail: [email protected] Web site: http://asiapacific.anu.edu.au/pambu ITEM LIST PMB Photo 60 PATON, Frank (1906-2002) and Rita (1904-1982)., Slides and photographs of missionary service on the island of Tangoa, New Hebrides (1931-33) and a trip for the 75th Anniversary Celebrations of the Tangoa Training Institute, (Aug 1970), 1931-1970. Image No. PMB Catalogue Title Description Date N.B.: Black & white photos up to 60_100 have original captions, set off between “ ”; the remaining photos are uncaptioned and the descriptions, set off by [ ], may well need correcting. PMBPhoto60_1 Photograph of men and coconuts Photograph of men and coconuts nd Gift envelopes with photographs made by Frank Paton PMBPhoto60_2 [A small hand lettered card] “With best thoughts for the coming year JANUARY1932 Jan 1932 / From: Mr. and Mrs. Frank J. C. Paton, Tangoa. New Hebrides.” [A small photograph] “The Islands of Elia and Araki: (Tangoa in foreground). Beyond these two islands is open sea without land of any kind for a thousand miles – THEN – Small hand lettered card, front AUSTRALIA!” PMBPhoto60_2a Small hand lettered card, back PMBPhoto60_3 [A small hand lettered card] “just a New Year Remembrance. JANUARY, 1932. Jan 1932 FROM: Mr. and Mrs. Frank J. C. Paton, Tangoa. New Hebrides” [A small photograph, identical to that of 60_336] “The Malinoa” (the Inter-Island Steamer) at anchor Small hand lettered card, front between Tangoa and Santo (in the distance)” 1 PATON, Frank (1906-2002) and Rita (1904-1982)., Slides and photographs of missionary service on the island of Tangoa, New Hebrides (1931-33) and a trip for the 75th Anniversary Celebrations of the Tangoa Training Institute, (Aug 1970), 1931-1970. -

The Geography and History of *R-Loss in Southern Oceanic Languages Alexandre François

Where *R they all? The Geography and History of *R-loss in Southern Oceanic Languages Alexandre François To cite this version: Alexandre François. Where *R they all? The Geography and History of *R-loss in Southern Oceanic Languages. Oceanic Linguistics, University of Hawai’i Press, 2011, 50 (1), pp.140 - 197. 10.1353/ol.2011.0009. hal-01137686 HAL Id: hal-01137686 https://hal.archives-ouvertes.fr/hal-01137686 Submitted on 17 Oct 2016 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Where *R they all? The Geography and History of *R-loss in Southern Oceanic Languages Alexandre François LANGUES ET CIVILISATIONS À TRADITION ORALE (CNRS), PARIS, AND AUSTRALIAN NATIONAL UNIVERSITY Some twenty years ago, Paul Geraghty offered a large-scale survey of the retention and loss of Proto-Oceanic *R across Eastern Oceanic languages, and concluded that *R was “lost in proportion to distance from Western Oceanic.” This paper aims at testing Geraghty’s hypothesis based on a larger body of data now available, with a primary focus on a tightly knit set of languages spoken in Vanuatu. By observing the dialectology of individual lexical items in this region, I show that the boundaries between languages retaining vs. -

Fifth National Report

FIFTH NATIONAL REPORT Executive Summary Vanuatu is an array of 83 volcanic islands that were formed during the Miocene Era. Her geographical location means that Vanuatu’s biological diversity has developed commonalities with Pacific Island Countries in close proximity such as that of Fiji and Solomon Islands. Vanuatu is fundamentally an agricultural society, where the majority of the population is involved in farm and fishing activities, either for subsistence, livelihood or cash income. The Overarching Productive Sector Policy 2012-2017 also identifies agriculture, forestry and fisheries as priority areas for economic development. In 2013, the Vanuatu National Statistics Office estimated the population of Vanuatu to be 264,000 people, with 75% of the population living in the rural areas. A large portion of the population still depends heavily on the Vanuatu productive sector therefore, the Government has a crucial role to play in defining a policy and institutional framework which both enables and encourages good participation and high performance from all sector stakeholders. The country’s development goals and priorities in the Priorities and Action Agenda (PAA) 2006-2015 identify the productive sector as an engine for investment, economic growth and employment. The sector’s contribution to the overall economic growth has required a strategic commitment by the Government. This is so the Government can support and facilitate an enabling environment for private sector operators. The need to protect and conserve the resources that are critical elements of the productive sector saw Vanuatu commit itself internationally to the Convention on Biological Diversity in the 1992. Since its ratification of this Convention, Vanuatu has made significant progress in ensuring it meets all of its obligations. -

VANUATU \ A.A A

MAY 1999 : :w- 22257 _~~~ / Public Disclosure Authorized _. PACIFIC ISLANDS : -s,STAKEHOLDER Public Disclosure Authorized PARTICIPATION ] . ~~~-4 £\ / IN DEVELOPMENT: VANUATU \ A.A a - N ~~~DarrylTyron Public Disclosure Authorized Public Disclosure Authorized PACIFIC ISLANDs DISCUSSION PAPER SERIES _ MBEASTASIA AND PACIFIC REGION PAPUA NEW GUINEAAND PACIFIC ISLANDS COUNTRYMANAGEMENT UNIT DISCUSSION PAPERS PRESENT RESULTS OF COUNTRYANALYSES UNDERTAKENBY THE DEPARTMENTAS PART OF ITS NORMAL WORK PROGRAM. To PRESENTTHESE RESULTS WITH THE LEAST POSSIBLE DELAY, THE TYPESCRIPTOF THIS PAPER HAS NOT BEEN PREPARED IN ACCORDANCEWITH THE PROCEDURES APPROPRIATE FOR FORMAL PRINTED TEXTS, AND THE WORLD BANK ACCEPTS NO RESPONSIBILITY FOR ERRORS. SOME SOURCES CITED IN THIS PAPER MAY BE INFORMAL DOCUMENTS THAT ARE NOT READILYAVAILABLE. THE WORLD BANK DOES NOT GUARANTEETHE ACCURACY OF THE DATA INCLUDED IN THIS PUBLICATION AND ACCEPTS NO RESPONSIBILITY FOR ANY CONSEQUENCESOF ITS USE. PACIFIC ISLANDS STAKEHOLDER PARTICIPATION IN DEVELOPMENT: VANUATU MAY, 1999 A Report for the World Bank Prepared by: Darryl Tyron Funded by the Government of Australia under the AusAID/World Bank Pacific Facility The views, interpretations and conclusions expressed in this study are the result of research supported by the World Bank, but they are entirely those of the author and should not be attributed in any manner to the World Bank, to its affiliated organisations, or to members of its Board of Executive Directors or the countries they represent. For further copies of the report, please contact: Mr. David Colbert Papua New Guinea and Pacific Islands Country Management Unit East Asia and Pacific Region The World Bank 1818 H Street, NW Washington, DC, U.S.A. -

VANUATU – SATELLITE IMAGE DETECTED DAMAGE ESTIMATES Version 1.0 UNOSAT Activation: TC-2015-000023-VUT 20 April 2015 Geneva, Switzerland

VANUATU – SATELLITE IMAGE DETECTED DAMAGE ESTIMATES Version 1.0 UNOSAT Activation: TC-2015-000023-VUT 20 April 2015 Geneva, Switzerland Description On 14 March 2015 tropical cyclone Pam made landfall over the island nation of Vanuatu and caused widespread damage and destruction. The International Charter for Space and Major Disasters was activated on 12 March 2015 by UNITAR/UNOSAT on behalf of UNOCHA. UNITAR/UNOSAT products and geographic datasets are available at http://www.unitar.org/unosat/maps/VUT. The table below provides satellite image detected damage statistics for regions of Vanuatu. Figures are based upon analysis of satellite imagery acquired on 15, 16, 17, 18 and 19 March 2015, as well as data from outside sources such as Open Street Map. It is important to note the presence of limitations in these data sources and that this assessment is not a field survey and should be treated with caution. This document is part of an on-going satellite monitoring program of UNITAR/UNOSAT for the Vanuatu cyclone in support of international humanitarian assistance and created to respond to the needs of UN agencies and their partners. Please send feedback to UNITAR/UNOSAT at the contact information below. Table 1 – UNITAR/UNOSAT Estimated Damage Statistics for Vanuatu Total number Total number of Percentage of potentially Island of buildings buildings within affected buildings in Confidence (Pre-Event) affected zones damaged zones *Ambaé 3,180 800 25% Low Aniwa 90 2 2% Medium Buninga 30 30 100% Medium Efate 18,000 9,000 50% Medium Emae 420 260 62% Medium Epi 3,500 3,000 71% Medium Lamen 260 215 83% High Makura 60 40 67% Medium Pentecost 4,500 650 14% Low *Tanna 14,000 10,500 75% Medium Tongariki 65 50 77% Medium Tongoa 450 350 78% Medium *Erromango 1200 850 70% Medium *Estimate based on a partial analysis. -

Download 15.55 MB

Social Safeguards Due Diligence Report May 2021 Vanuatu: Interisland Shipping Support Project (Construction and Rehabilitation of Selected Domestic Wharves) Prepared by the Ministry of Infrastructure and Public Utilities for the Republic of Vanuatu and the Asian Development Bank. This social safeguards due diligence report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. Updated Social Safeguards Due Diligence Report May 2021 VAN: Vanuatu Interisland Shipping Support Project (Construction and Rehabilitation of Selected Domestic Wharves) Prepared By: Ministry of Infrastructure and Public Utilities (MIPU), Government of Vanuatu for the Asian Development Bank, Republic of Vanuatu, Vanuatu Interisland Shipping Project Prepared For: Ministry of Finance and Economic Management (MEFM) – the Executing Agency, Ministry of Infrastructure and Public Utilities (MIPU) – Implementing Agency, Public Works Department – Implementing Agency This report may not be amended or used by any person other than by the MIPU’s expressed permission. In any event MIPU accepts no liability for any costs, liabilities or losses arising as a result of the use of or reliance of the contents of this report by any person other than MIPU and the project donor agencies, the Asian Development Bank, and NZ MFAT. -

OP6 SGP Vanuatu Country Programme Strategy

VANUATU SGP C OUNTRY P ROGRAMME S TRATEGY FOR OP6 201 5 - 2018 P REPARED BY : V ANESSA O RGANO , L EAH N IMOHO , R OLENAS B AERALEO AND D ONNA K ALFATAK R EVIEWED AND APPROVED BY THE NSC: R EVIEW ED AND APPROVED BY CPMT: 1 Table of Contents Background ………………………………………………………………………………………………….. 3 Section 1: SGP countr y programme - summary background……………………………………………. 4 Section 2: SGP country programme niche………………………………………………………………… 5 Section 3: OP6 strategies .... ……………………………………………………………………………….. 19 Section 4: Expected results framework …………………………………………………………………...3 7 Section 5: Monitoring and evaluation plan ………………………………………………………………. 4 3 Section 6: Resource mobilization plan ……………………………………………… ……………………. 4 6 Section 7: Risk management plan ………………………………………………………………………… 4 7 Section 8: National Steering Committee endorsement ………………………………………………….. 49 Annex 1: OP6 landscape/seascape baseline assessment 2 COUNTRY : VANUATU OP6 resources (estimated US$ ) 1 a. Core funds: TBD b. OP5 remaining balance: OP5 Small Grants Programme funds finished c. STAR funds: Total of $ 6 .2 million consisting of: Government of Vanuatu climate change projects (supported by UNDP): $ 3 million Government of Vanuatu land degradation projects (supported by FAO) : $ 1 million Government of Vanuatu biod iversity projects (supported by IUCN) : $ 2 .6 million d. Other Funds to be mobilized: AusAID SIDS CBA: $210,000 available from OP5 due to be committed by December 2016 Background : As a GEF corporate programme, SGP aligns its operational phase strategies to that of the GEF , and provides a series of demonstration projects for further scaling up , replication and mainstreaming . Action at the local level by civil society, indigenous peoples and l ocal communities is deemed a vital component of the GEF 20/20 Strategy (i.e. -

Tanna Island - Wikipedia

Tanna Island - Wikipedia Not logged in Talk Contributions Create account Log in Article Talk Read Edit View history Tanna Island From Wikipedia, the free encyclopedia Coordinates : 19°30′S 169°20′E Tanna (also spelled Tana) is an island in Tafea Main page Tanna Contents Province of Vanuatu. Current events Random article Contents [hide] About Wikipedia 1 Geography Contact us 2 History Donate 3 Culture and economy 3.1 Population Contribute 3.2 John Frum movement Help 3.3 Language Learn to edit 3.4 Economy Community portal 4 Cultural references Recent changes Upload file 5 Transportation 6 References Tools 7 Filmography Tanna and the nearby island of Aniwa What links here 8 External links Related changes Special pages Permanent link Geography [ edit ] Page information It is 40 kilometres (25 miles) long and 19 Cite this page Wikidata item kilometres (12 miles) wide, with a total area of 550 square kilometres (212 square miles). Its Print/export highest point is the 1,084-metre (3,556-foot) Download as PDF summit of Mount Tukosmera in the south of the Geography Printable version island. Location South Pacific Ocean Coordinates 19°30′S 169°20′E In other projects Siwi Lake was located in the east, northeast of Archipelago Vanuatu Wikimedia Commons the peak, close to the coast until mid-April 2000 2 Wikivoyage when following unusually heavy rain, the lake Area 550 km (210 sq mi) burst down the valley into Sulphur Bay, Length 40 km (25 mi) Languages destroying the village with no loss of life. Mount Width 19 km (11.8 mi) Bislama Yasur is an accessible active volcano which is Highest elevation 1,084 m (3,556 ft) Български located on the southeast coast. -

An Assessment of the Barriers to The

Pacific Islands Renewable SPREP Energy Project A climate change partnership of GEF, UNDP, SPREP and the Pacific Islands Pacific Regional Energy Assessment 2004 An Assessment of the Key Energy Issues, Barriers to the Development of Renewable Energy to Mitigate Climate Change, and Capacity Development Needs for Removing the Barriers VANUATU National Report PIREP our islands, our lives… Currency Equivalent: US$ 1.00 = Vatu (Vt) 110 in March 2004 (but highly variable around the time) Fiscal Year: 1 January – 31 December Time Zone: GMT/UTC +11 hours This report is based on data gathered by a PIREP team consisting of: Mr Ruben Bakeo National PIREP Coordinator Mr Anare Matakiviti SOPAC Energy Adviser / National PIREP Consultant Mr Peter Johnston International PIREP Consultant; and Mr John Vos International PIREP Consultant The consultants visited Vanuatu in January and early February 2004. Because a suitable national consultant was unavailable at that time, SOPAC provided the services of its Energy Adviser. In addition to discussions in Port Vila, there were field trips to visit renewable energy projects (and potential project sites) on the islands of Efate and Espiritu Santo. Unfortunately the head of Government Energy Unit and several other key staff were unavailable for discussions during the mission’s visit. The local offices of the international oil companies were unwilling to provide any information on their product sales, an omission that has hindered some analysis. This report reviews the status of energy sector activities in Vanuatu through February 2004. An earlier draft of this report was reviewed by the Vanuatu National PIREP Committee (the National Advisory Committee on Climate Change), which provided thoughtful, useful and substantive feedback, and by Secretariat Pacific Regional Environment Programme (SPREP), South Pacific Applied Geoscience Commission (SOPAC), United Nations Development Programme and others. -

VANUATU: TROPICAL CYCLONE PAM April 2015

Fall 08 Photo credit: Karina Coates | OCHA Second Phase Harmonized Assessment Report VANUATU: TROPICAL CYCLONE PAM April 2015 SUMMARY OF FINDINGS A. WATER, SANITATION AND HYGIENE KEY FINDINGS 1. Many communities cannot access safe water sources. An estimated 68% of the rainwater harvesting catchment structures are broken, 70% of the wells have been contaminated, and piped water systems have been damaged. Water quality is poor everywhere except Port Vila, resulting in a health risk. 2. 68% of the sanitation superstructures have been destroyed, resulting in an increase in open defecation, which was reported to be up to 45% in some places. Open defecation presents urgent health, protection and dignity risks to children, women, and vulnerable groups. 3. Only 30% of households report hand washing, posing a risk of communicable disease. Some bathing facilities are unsafe. KEY PRIORITIES 1. Provide immediate access to water supply through emergency water distribution and restoration of water systems. 2. Prevent the spread of diseases by providing hygiene messages, household water treatment and safe storage supplies and by ensuring household access to soap. 3. Ensure privacy and safe disposal of human faeces by restoring sanitation structures, complemented with sanitation promotion. 4. Ensure dignity and minimize protection risks by providing safe bathing facilities and access to sanitary protection materials for girls and women. 5. Restore protective environments at schools and health care facilities. B. SHELTER KEY FINDINGS 1. Many communities have received shelter assistance and are recovering fast. 2. Population and damage figures, especially in urban areas, are much higher than estimated. 3. Gaps in coverage remain, especially in Port Vila and Tanna Island. -

A Political Memoir of the Anglo-French Condominium of the New Hebrides

A Political Memoir of the Anglo-French Condominium of the New Hebrides Arrival: Port Vila, Santo and the Condominium I arrived in the New Hebrides by Qantas flying boat on 26 March 1953. As viewed from the harbour the town could not have looked very different from the Port Vila that Edward Jacomb enthused over upon his arrival on a Burns Philp steamer in 1907.1 There was no water-front reclamation, Fila Island canoes were drawn up along the beach and the great majority of the buildings were constructed of wood with red or green roofs, many of them being hidden by the luxuriant vegetation. I had come out from England to take up a junior post at the British Residency (BR). The British Resident Commissioner (BRC) was Brigadier H.J.M. Flaxman, but he was on leave when I arrived and Mr. Bernard Blackwell, an Australian, was acting Resident Commissioner. He had married a sister of the well-known British settler, Geoffrey Seagoe. M. Pierre Anthonioz was then the French Resident Commissioner (FRC) and had moved into a new French Residency (FR) only the year before—into the building which was to become State House, the official residence of the first President of Vanuatu, until it was unfortunately wrecked by Hurricane Uma in 1987. This was a very modern building and quite unlike any other in Port Vila. One witty soul said of it, ‘C’est magnifique, mais ce n’est pas la gare’ (It is beautiful, but it is not the railway station)! The BRC lived in splendid isolation at the top of 185 steps on Iririki Island, in a predominantly wooden structure that dated back to 1903.