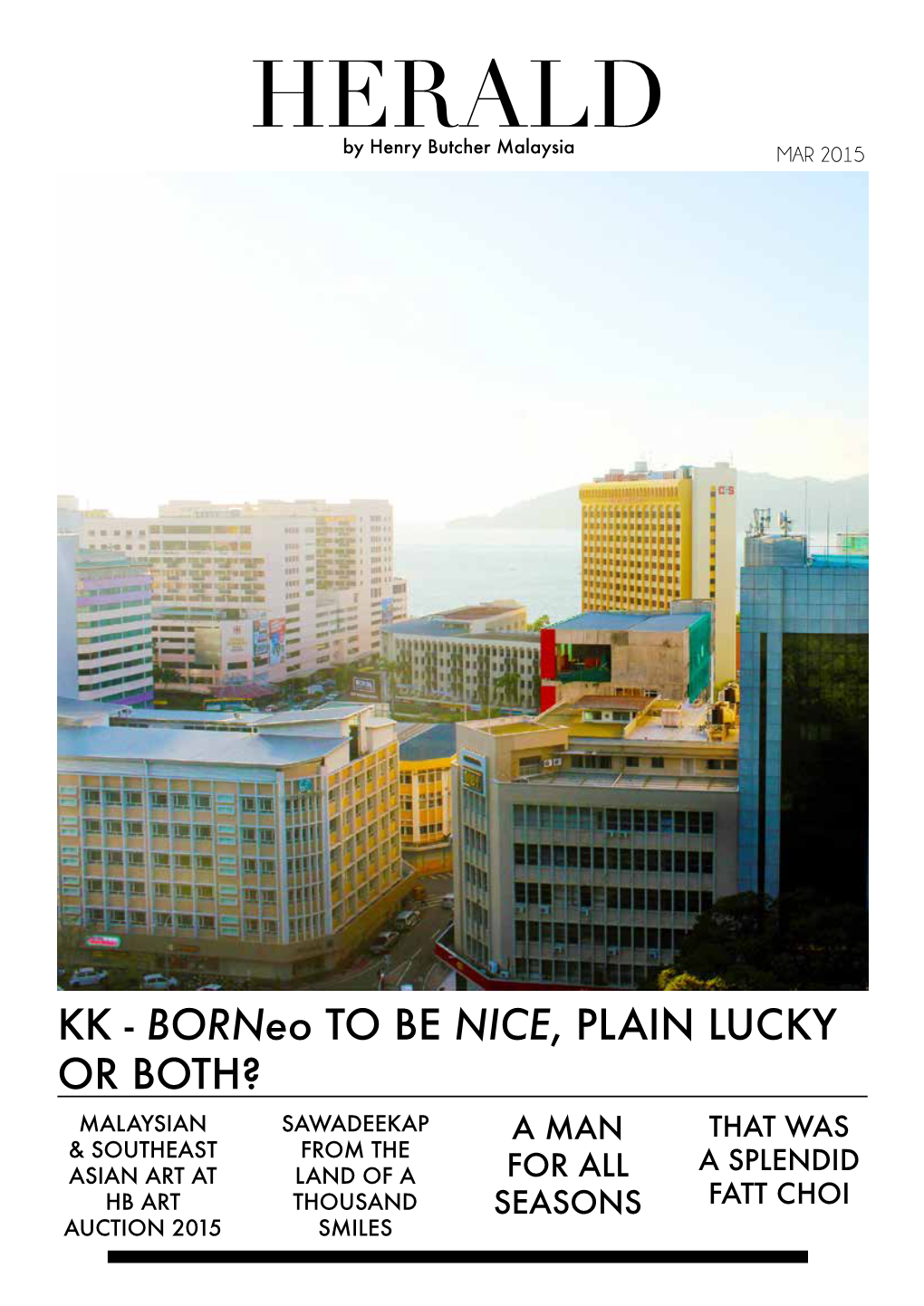

HERALD by Henry Butcher Malaysia MAR 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Property Market 2013

Property Market 2013 www.wtw.com.my C H Williams Talhar and Wong 30.01, 30th Floor, Menara Multi-Purpose@CapSquare, 8 Jalan Munshi Abdullah, 51000 Kuala Lumpur Tel: 03-2616 8888 Fax: 03-2616 8899 KDN No. PP013/07/2012 (030726) Property Market 2013 www.wtw.com.my C H Williams Talhar and Wong 30.01, 30th Floor, Menara Multi-Purpose@CapSquare, 8 Jalan Munshi Abdullah, 51000 Kuala Lumpur Tel: 03-2616 8888 Fax: 03-2616 8899 KDN No. PP013/07/2012 (030726) CH Williams Talhar & Wong established in 1960, is a leading real estate services company in Malaysia & Brunei (headquartered in Kuala Lumpur) operating with 25 branches and associated offices. HISTORY Colin Harold Williams established C H Williams & Co, Chartered Surveyor, Valuer and Estate Agent in 1960 in Kuala Lumpur. In 1974, the company merged with Talhar & Co, a Johor-base Chartered Surveying and Valuation company under the sole-proprietorship of Mohd Talhar Abdul Rahman. With the inclusion of Wong Choon Kee, in a 3-way equal partnership arrangement, C H Williams Talhar and Wong was founded. PRESENT MANAGEMENT The Group is headed by Chairman, Mohd Talhar Abdul Rahman who guides the group on policy de- velopments and identifies key marketing strategies which have been instrumental in maintaining the strong competitive edge of WTW. The current Managing Directors of the WTW Group operations are: C H Williams Talhar & Wong Sdn Bhd Foo Gee Jen C H Williams Talhar & Wong (Sabah) Sdn Bhd Robin Chung York Bin C H Williams Talhar Wong & Yeo Sdn Bhd (operating in Sarawak) Robert Ting Kang Sung -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET The residential market continues to remain lacklustre with lower volume and value of transactions recorded. ECONOMIC AND MARKET INDICATORS Limited project completions and new Malaysia’s economy expanded at a launches of high end condominiums / slower pace in 2015 with Gross Domestic residences during the review period. Product (GDP) growing at an annual rate of 5.0% (2014: 6.0%). For 2016, the Government has trimmed the country’s Growing pressure on rentals amid GDP growth forecast to 4 - 4.5% due to strong supply pipeline (existing and the volatility in crude oil prices and other new completions) and a challenging economic challenges. GDP continued rental market while prices in to moderate in the first quarter of 2016, the secondary market generally posting 4.2% growth, its slowest since continue to remain resilient. 3Q2009 (4Q2015: 4.5%), driven by domestic demand. Private consumption expanded by 5.3% while private Developers adopt innovative ‘push investment moderated to 2.2%. marketing’ strategies to boost Headline inflation for April 2016 registered at sales of selected projects and 2.1%. It is expected to be lower at 2% to 3% improve revenue. this year, compared to an earlier projection Aria of 2.5% to 3.5% and will continue to remain stable in 2017. (432 units) and The Residences at The Meanwhile, labour market conditions St. Regis Kuala Lumpur (160 units). continued to weaken with more retrenchment of workers, particularly in By the second half of 2016, the scheduled the manufacturing, mining and services completions of another five projects will sectors. -

Annual Report 2017 Group Highlights 2017

ANNUAL REPORT 2017 GROUP HIGHLIGHTS 2017 1. SALES 4. SHAREHOLDERS FUND 7. PROFIT ATTRIBUTABLE TO RM4.92 billion RM11.94 BILLION OWNERS OF THE COMPANY RM933 million 2. REVENUE 5. EARNINGS PER SHARE 8. ENLARGED LAND BANKS RM4.52 billion 26.77 Sen 9,606 acres 3. PROFIT BEFORE TAX 6. DIVIDEND PER SHARE 9. STRONG GDV IN THE PIPELINE RM1.27 billion 15.5 sen RM128.37 billion 10. ON-GOING PROJECTS 44 projects TOTAL SALES 11. UNBILLED SALES ACHIEVED RM7.72 billion FOR FY2017 IS 12. TOTAL STRONG DYNAMIC & DIVERSIFIED EMPLOYEES RM4.92 BILLION 2,300 people COVER RATIONALE At S P Setia, the sky is not the limit. In fact, we believe that the future is limitless. Opened to the possibilities of tomorrow, we embarked on a journey of strengthening growth, anchored by the dynamic and highly-talented Team Setia and our wide range of products. Guided by our ethos, we worked together, embraced change and demonstrated our resilience in the face of challenges while at the same time, boosting our capabilities today to fortify tomorrow’s opportunities. We will continue to reinforce our strong foundations, define our path forward to build a meaningful, sustainable future, for us and for our stakeholders. CONTENT OUR BUSINESS OUR LEADERSHIP AND PEOPLE Vision, Mission & Values 3 Board of Directors 36 Corporate Profile 4 Directors’ Profiles 38 Global Presence 6 Senior Management Team Profiles 48 Corporate Structure 8 Corporate Information 11 OUR ACHIEVEMENTS AND ACCOLADES Achievements 54 OUR PERFORMANCE REVIEW Accolades 60 Chairman’s Message 12 Management Discussion -

Aip Malaysia Ad 2-Wmka-1-1 Civil Aviation Authority Of

AIP MALAYSIA AD 2-WMKA-1-1 16 AUG 2018 AD 2. AERODROMES WMKA AD 2.1 AERODROME LOCATION INDICATOR AND NAME WMKA - ALOR SETAR/SULTAN ABDUL HALIM WMKA AD 2.2 AERODROME GEOGRAPHICAL AND ADMINISTRATIVE DATA 1 ARP coordinates and site at AD LAT 061140.1N LONG 1002403.0E 2 Direction and distance from (city) Dist 8.5 KM North-East Brg 25°28'54.8475" from Telekom Tower 3 Elevation/Reference temperature 4.296M (15FT) / 26.60° C 4 Geoid undulation at AD ELEV PSN -12.864M 5 MAG VAR/Annual change 0° West (2016) / 0.0133° 6 AD operator, address, telephone, telefax, e-mail Operator: address, AFS and website address Malaysia Airports Sdn Bhd Sultan Abdul Halim Airport 06550 Alor Setar Kedah Darul Aman Malaysia TEL:+604 - 7142994 / +604 - 7146876 Telefax:+604 - 7145345 ATC Services: Civil Aviation Authority Of Malaysia. CAAM Complex, Sultan Abdul Halim Airport, 06550 Alor Setar, Kedah. TEL:+604 - 7145413 / +604 - 7145414 Telefax:+604 - 7143970 7 Types of traffic permitted (IFR/VFR) IFR / VFR 8 Remarks NIL WMKA AD 2.3 OPERATIONAL HOURS 1 AD Operator 2230 - 1430 UTC Daily 2 Customs and immigration Customs: 2200 - 1600UTC Immigration: By prior arrangement 3 Health and sanitation NIL 4 AIS Briefing Office NIL 5 ATS Reporting Office (ARO) 2200 - 1600 UTC Daily 6 MET Briefing Office H24 7 ATS 2200 - 1600 UTC Daily 8 Fuelling NIL 9 Handling Malaysia Airline : 2230 - 1430 MNM (FireFly) : 2230 - 1430 Air Asia Sdn. Bhd. (SelfHandling) : 2230 - 1430 Malindo Airways (Self Handling) : 2230 - 1430 One Aviation (Private Aircraft) : 2230 - 1430 SNI Maju Aviation (Private Aircraft) : 2230 - 1430 10 Security H24 11 De-icing NIL 12 Remarks OPS beyond 1430 UTC to notify movements only,except for scheduled flights CIVIL AVIATION AUTHORITY OF MALAYSIA AMDT 03/2018 AD 2-WMKA-1-2 AIP MALAYSIA 16 AUG 2018 WMKA AD 2.4 HANDLING SERVICES AND FACILITIES 1 Cargo-handling facilities Prior arrangement with Malaysia Airlines. -

The Financial Year 2012 Was, Without Doubt, Another Challenging Period for Tenaga Nasional Berhad (Tnb)

KEEPING THE LIGHTS ON YOU SEE Tenaga Nasional Berhad www.tnb.com.my No. 129, Jalan Bangsar, 59200 Kuala Lumpur Tel: 603 2180 4582 Fax: 603 2180 4589 Email: [email protected] Annual Report Annual 2012 Tenaga Nasional Berhad Tenaga 200866-W annual report 2012 WE SEE... OUR COMMITMENT TO THE NATION >OH[ `V\ ZLL PZ Q\Z[ VUL ZTHSS WPLJL VM [OL IPN WPJ[\YL 6\Y YVSL PZ [V WYV]PKL TPSSPVUZ VM 4HSH`ZPHUZ ^P[O HMMVYKHISL YLSPHISL LMMPJPLU[ HUK \UPU[LYY\W[LK HJJLZZ [V LSLJ[YPJP[` -YVT WV^LYPUN [OL UH[PVU»Z HKTPUPZ[YH[P]L JHWP[HS [V SPNO[PUN \W OV\ZLOVSKZ HUK LTWV^LYPUN HSS ZLJ[VYZ VM [OL LJVUVT` ^L OH]L OLSWLK YHPZL [OL X\HSP[` VM SPML PU [OL JV\U[Y` HUK ZW\Y [OL UH[PVU»Z WYVNYLZZ V]LY [OL `LHYZ 4VYL [OHU Q\Z[ SPNO[PUN \W OVTLZ HUK Z[YLL[Z ;5) PZ JVTTP[[LK [V LUZ\YPUN [OH[ L]LY` 4HSH`ZPHU PZ HISL [V LUQV` [OL ILULMP[Z VM LSLJ[YPJP[` LHJO HUK L]LY` KH` VM [OL `LHY I` RLLWPUN [OL SPNO[Z VU KEEPING THE LIGHTS ON INSIDEwhat’s TO BE AMONG THE LEADING VISION CORPORATIONS IN ENERGY AND RELATED BUSINESSES 4 Notice of the 22nd Annual General Meeting 7 Appendix I 9 Statement Accompanying Notice GLOBALLY of the 22nd Annual General Meeting 10 Financial Calendar 11 Investor Relations 14 Share Performance WE ARE 15 Facts at a Glance 16 Chairman’s Letter to Shareholders COMMITTED TO 22 President/CEO’s Review 33 Key Highlights 34 Key Financial Highlights EXCELLENCE 35 Five-Year Group Financial Summary MISSION IN OUR 36 Five-Year Group Growth Summary PRODUCTS AND SERVICES KEEPING THE LIGHTS ON Corporate Framework Operations Review 40 About Us 135 Core Businesses 42 Corporate Information 136 Generation 1 44 Group Corporate Structure 142 Transmission 5 46 Organisational Structure 146 Distribution 47 Awards & Recognition 153 Non-Core Businesses 51 Key Past Awards 154 New Business & Major Projects 54 Media Highlights 160 Group Finance 56 Calendar of Events 163 Planning 62 Milestones Over 60 Years 168 Corporate Affairs & Services 175 Procurement Performance Review Other Services 179 Sabah Electricity Sdn. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 2ND HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET Despite the subdued market, there were noticeably more ECONOMIC INDICATORS launches and previews in the TABLE 1 second half of 2016. Malaysia’s Gross Domestic Product Completion of High End (GDP) grew 4.3% in 3Q2016 from 4.0% Condominiums / Residences in in 2Q2016, underpinned by private 2H2016 The secondary market, however, expenditure and private consumption. continues to see lower volume Exports, however, fell 1.3% in 3Q2016 of transactions due to the weak compared to a 1.0% growth in 2Q2016. economy and stringent bank KL Trillion lending guidelines. Amid growing uncertainties in the Jalan Tun Razak external environment, a weak domestic KL City market and continued volatility in the 368 Units The rental market in locations Ringgit, the central bank has maintained with high supply pipeline and a the country’s growth forecast for 2016 at weak leasing market undergoes 4.0% - 4.5% (2015: 5.0%). correction as owners and Le Nouvel investors compete for the same Headline inflation moderated to 1.3% in Jalan Ampang 3Q2016 (2Q2016: 1.9%). pool of tenants. KL City 195 Units Unemployment rate continues to hold steady at 3.5% since July 2016 (2015: The review period continues to 3.1%) despite weak labour market see more developers introducing conditions. Setia Sky creative marketing strategies and Residences - innovative financing packages Bank Negara Malaysia (BNM) lowered the Divina Tower as they look to meet their sales Overnight Policy Rate (OPR) by 25 basis Jalan Raja Muda KL City target and clear unsold stock. -

Business Name Business Category Outlet Address State 2020 Motor

Business Name Business Category Outlet Address State 2020 Motor Automotive TB 12186 LOT A 13 TAMAN MEGAH JAYA,JALAN APASTAWAU Sabah 616 Auto Parts Co Automotive Kian yap Industrial lot 113 lorong durians 112 Lorong Durian 5 88450 Kota Kinabalu Sabah Malaysia Sabah 88 Bikers Automotive D-G-5, Ground Floor, Block D, Komersial 88/288 Marketplace, Ph.10A, Jalan Pintas, Kepayan RidgeSabah Sabah Alpha Motor Trading Automotive Alpha Motor Trading Jalan Sapi Nangoh Sabah Malaysia Sabah anna car rental Automotive Sandakan Airport Sabah Apollo service centre Automotive Kudat Sabah Malaysia Sabah AQIQ ENTERPRISE Automotive Lorong Cyber Perdana 3 Penampang Sabah Malaysia 89500 Sabah ar rizqi Automotive Beaufort, Sabah, Malaysia Sabah Armada KK Automobile Sdn Bhd Automotive Ground Floor, Lot No.46, Block E, Asia City, Phase 1B Sabah arsy hany car rental Automotive rumah murah peringkat 1 no 54 Pekan Beaufort Sabah Atlanz Tyres Automotive Kampung Keliangau, Kota Kinabalu, Sabah, Malaysia Sabah Autocycle Motor Sdn Bhd Automotive lot 39, grd polytechnic, 8, Jalan Politeknik, Tuaran, Sabah, Malaysia Sabah Autohaven Superstore Automotive kg sin san peti surat 588 Kudat Sabah Malaysia Sabah Automotive Electrical Tec Automotive No 3, Block H, Hakka Building, Mile 5,5, Tuaran Road, Inanam, Kota Kinabalu, Sabah, Malaysia Sabah Azmi Sparepart Automotive Papar Sabah Malaysia Sabah Bad Monkey Garage Automotive Kg Landong Ayang Jln Landong Ayang 2 Kg Landong Ayang Jalan Landong Ayang II Kudat Sabah Malaysia Sabah BANLEE MOTOR Automotive BANLEE MOTORBATU 1 JLN MERINTAMAN98850 -

Property Market Review 2018 / 2019 Contents

PROPERTY MARKET REVIEW 2018 / 2019 CONTENTS Foreword Property Northern 02 04 Market 07 Region Snapshot Central Southern East Coast 31 Region 57 Region 75 Region East Malaysia The Year Glossary 99 Region 115 Ahead 117 This publication is prepared by Rahim & Co Research for information only. It highlights only selected projects as examples in order to provide a general overview of property market trends. Whilst reasonable care has been exercised in preparing this document, it is subject to change without notice. Interested parties should not rely on the statements or representations made in this document but must satisfy themselves through their own investigation or otherwise as to the accuracy. This publication may not be reproduced in any form or in any manner, in part or as a whole, without writen permission from the publisher, Rahim & Co Research. The publisher accepts no responsibility or liability as to its accuracy or to any party for reliance on the contents of this publication. 2 FOREWORD by Tan Sri Dato’ (Dr) Abdul Rahim Abdul Rahman 2018 has been an eventful year for all Malaysians, as Speed Rail) project. This move was lauded by the World witnessed by Pakatan Harapan’s historical win in the 14th Bank, who is expecting Malaysia’s economy to expand at General Election. The word “Hope”, or in the parlance of 4.7% in 2019 and 4.6% in 2020 – a slower growth rate in the younger generation – “#Hope”, could well just be the the short term as a trade-off for greater stability ahead, theme to aptly define and summarize the current year and as the nation addresses its public sector debt and source possibly the year ahead. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2019 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR More market activity in the high-end condominium / HIGH END CONDOMINIUM serviced apartment segment (> RM1 million) in 2018 and MARKET this momentum is expected to continue into 2019. MARKET SUPPLY AND 1H2019 saw the launches of a INDICATIONS DEMAND few high-end condominium / The Malaysian economy continues with As of 1H2019, the completion of 602 units serviced apartment projects in its growth momentum albeit at a slower of high-end condominiums / serviced Kuala Lumpur City. The projects pace of 4.7% in 2018 (2017: 5.9%). It apartments from two projects brought are generally smaller in scale, on continued to expand 4.5% in 1Q2019 the cumulative supply in Kuala Lumpur pockets of land. (4Q2018: 4.7%), supported by private to 56,786(R) units. The completed projects sector expenditure. For the whole year were Opus KL (357 units) and Residensi The prices of new launches of 2019, economic growth is expected Sefina (245 units). remain flattish as the high-end to range between 4.3% and 4.8%. In (Note: (R) The cumulative supply has residential segment continues to May 2019, the Department of Statistics been revised) be challenging. Malaysia (DOSM) rebased of the country’s gross domestic product (GDP), The scheduled completion of Sky Suites In the secondary market, the from year 2010 to 2015. @ KLCC (986 units), 8 Kia Peng (442 units), Tower 1 and Tower 2 @ Star overall transacted price of The current period of low headline Residences (1,039 units), Aria KLCC selected schemes analysed was inflation, recorded at 1.0% in 2018 (2017: (598 units), Stonor 3 (400 units), Novum lower by 1.6% when compared 3.7%), is largely due to key policies such Bangsar (729 units), TWY Mont’ Kiara to 2018 as purchasers continue as the fixing of domestic retail fuel prices (484 units), Arte Mont’ Kiara (1,706 to be spoilt for choice. -

Malaysia 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK | MALAYSIA

CBRE | WTW RESEARCH 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK Malaysia 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK | MALAYSIA FORMATION A B OU T W T W CBRE | WTW entered into an agreement in May 2016 to Colin Harold Williams established C H Williams & Co in form a joint venture to provide a deep, broad service offering Kuala Lumpur in 1960. C H Williams & Company merged for the clients of both firms. This combines Malaysia’s in 1974 with Talhar & Company founded by Mohd Talhar largest real estate services provider, WTW’s local expertise Abdul Rahman and the inclusion of Wong Choon Kee to and in-depth relationships in Malaysia with CBRE’s global form C H Williams Talhar & Wong (WTW). reach and broad array of market leading services. In 1975, C H Williams Talhar Wong & Yeo (WTWY) was The union of CBRE and WTW is particularly significant established in Sarawak. C H Williams Talhar & Wong because of our shared history. In the1970s, CBRE acquired (Sabah) (WTWS) was established in 1977. businesses from WTW in Singapore and Hong Kong, which remain an integral part of CBRE’s Asian operations. The current management is headed by Group Chairman, Mohd Talhar Abdul Rahman. The wider WTW Group comprises a number of subsidiaries and associated offices located in East Malaysia including: The current Managing Directors of the WTW Group operations are: • C H Williams Talhar Wong & Yeo Sdn Bhd (1975) • CBRE | WTW: Mr. Foo Gee Jen • C H Williams Talhar & Wong (Sabah) Sdn Bhd (1977) • C H Williams Talhar & Wong (Sabah) Sdn Bhd: Mr. -

No. Name Address City Postcod State Country Off. No. Email 1 JING

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO. -

Berita1809.Pdf

With Compliments from E3A-3, Block E, Dataran Palma Off Jalan Ampang, 68000 Ampang Selangor, Malaysia Tel: +603-4270 6470, Fax: +603-4270 6471 Email: [email protected] Web: www.gtitec.com.my Ee Jun.pdf 7/14/09 9:32:18 AM LIGHTINGS WITH A DIFFERENCE B e r i t a 16th November 2009 For Members Only ISSUE NO : 18/2009-10 PUDU website:- http://www.rotarypudu.org.my Programme for Today Programme for 23rd November 2009 Speaker : Mr. Wong Henn Kheng Speaker : Rtn James Prophett Subject : Nano Technology & Acupuncture Subject : Off Shore Financing ON DUTY ON DUTY Duty Table : Rtn George Heng Duty Table : Rtn Jeffrey Yap Fellowship : Rtn Suresh Martin Fellowship : Rtn Patrick Lee Finemaster : Rtn C T Heng Finemaster : Rtn Dr. C C Wong Introduce : Rtn James Prophett Introduce : Rtn Alex Chang C Thanking : Rtn Loo Ming Chee Thanking : PP V G Chandran M Y CM Birthdays & Wedding Anniversaries MY Birthdays : Rtn Steven Oon (17th Nov) CY th CMY Spouse’s Birthday : Ann Thavam (17 Nov) K Anniversaries : Nil Lighting changes our environment and the way we feel about our environment. At Ee Jun IMPORTANT NOTICE Lighting we combine a creative and intelligent approach to lighting design with an THE CLUB’S AGM WILL BE HELD AT 6.30 PM ON THE 12TH DECEMBER 2009 AND understanding of the complex technical requirements. We bridge the gap between the IS HOSTED BY PP K H LOW AND ANN EVELYN AT THEIR RESIDENCE. architect and interior designer. As an electrical lighting consultant, our sole focus is on achieving the best possible lighting scheme for our clients – in terms of aesthetics, function, exibility, maintenance and cost.