SOA/AAA/CIA General Session

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The End-Days War By

THE END-DAYS WAR BY: MICAH BURKHOLDER PROLOGUE A Storm is coming. Mankind faces ruin and despair. The World is changing, yet hope remains in the hearts of the people. We go about our daily lives never knowing the forces that could change our destinies forever. We are oblivious, ignorant like sheep to the slaughter; this very Night, marks the beginning of our journey together, a journey into darkness, into madness. I watch her from the shadows. Is she the one? She has come far already, but she will be tested; tested to the very limits of human endurance and beyond. This night, she walks seeking for a purpose in this life, armed with Ebony Armor, Ebony Boots, Ebony Gauntlets, and an Ebony Greatsword. Tonight, she will begin her journey into utter darkness, into oblivion. The time has come for me, the Writer of this story to bid you all a very fond farewell. The time has come for you to hear for yourself a tale That only I am worthy to tell you. It is unto me to tell you of this moment, a Dark Fantasy of a Warrior who fights her way against the Demons of Hell. A Warrior who risks everything to fight to the Death against those who wish to cut her down. And finally, a Warrior who seeks A Ranger who was cast out of his land and defeats the Evil that corrupts these Lands before her. This is the tale of the Ebony Warrior and a Ranger, both who risk everything to rid the Great Evil of these Lands and stand and fight on against the creatures of the Night. -

The Journal of the Core Curriculum Volume XII Spring 2003 the Journal of the Core Curriculum

The Journal of the Core Curriculum Volume XII Spring 2003 The Journal of the Core Curriculum Volume XII Julia Bainbridge, EDITOR Zachary Bos, ART DIRECTOR Agnes Gyorfi, LAYOUT EDITORIAL BOARD Brittany Aboutaleb Kristen Cabildo Kimberly Christensen Jehae Kim Heather Levitt Nicole Loughlin Cassandra Nelson Emily Patulski Christina Wu James Johnson, DIRECTOR of the CORE CURRICULUM and FACULTY ADVISOR PUBLISHED by BOSTON UNIVERSITY at BOSTON, MASSACHUSETTS, in the month of MAY, 2003 My mother groan'd! my father wept. Into the dangerous world I leapt: Hapless, naked, piping loud: Like a fiend hid in a cloud. ~William Blake Copyright © MMIII by the Trustees of Boston University. Reproduction of any material contained herein without the expressed consent of the authors is strictly forbidden. Printed 2003 by Offset Prep. Inc., North Quincy, Massachusetts. Table of Contents In the Beginning 7 Stephanie Pickman Love 10 Jonathon Wooding Sans Artifice 11 Ryan Barrett A Splintering 18 Jaimee Garbacik Ripeness and Rot in Shakespeare 22 Stephen Miran Interview with the Lunatic: A Psychiatric 28 Counseling Session with Don Quixote Emily Patulski In My Mind 35 Julia Schumacher On Hope and Feathers 37 Matt Merendo Exploration of Exaltation: A Study of the 38 Methods of James and Durkheim Julia Bainbridge Today I Saw Tombstones 43 Emilie Heilig A Dangerous Journey through the Aisles of Shaw’s 44 Brianna Ficcadenti Searching for Reality: Western and East Asian 48 Conceptions of the True Nature of the Universe Jessica Elliot Journey to the Festival 56 Emilie -

![[LB71 LB218 LB397 LB505] the Committee on Banking, Commerce](https://docslib.b-cdn.net/cover/4328/lb71-lb218-lb397-lb505-the-committee-on-banking-commerce-1654328.webp)

[LB71 LB218 LB397 LB505] the Committee on Banking, Commerce

Transcript Prepared By the Clerk of the Legislature Transcriber's Office Banking, Commerce and Insurance Committee February 26, 2013 [LB71 LB218 LB397 LB505] The Committee on Banking, Commerce and Insurance met at 1:30 p.m. on Tuesday, February 26, 2013, in Room 1507 of the State Capitol, Lincoln, Nebraska, for the purpose of conducting a public hearing on LB71, LB397, LB218, and LB505. Senators present: Mike Gloor, Chairperson; Mark Christensen, Vice Chairperson; Kathy Campbell; Tom Carlson; Sue Crawford; Sara Howard; Pete Pirsch; and Paul Schumacher. Senators absent: None. SENATOR GLOOR: Good afternoon and welcome to the Banking, Commerce and Insurance Committee hearing. My name is Mike Gloor, I'm the senator from the 35th District which is Grand Island. The committee will take up the bills in the order posted outside the door and for some of you that may be, if you haven't noticed, a reversal in LB397 and LB218. To better facilitate today's hearing, we have rules and procedures that we follow. They are posted up there on the board, but I will run through them quickly for everybody. The first is, I know you think you turned off your cell phone, but please check to make sure you did or put it on a silent buzz, if you would. The order of testimony for us is the introducer, then proponents, then opponents, then those who would like to speak in a neutral capacity, and finally, we'll allow the introducing senator to close if they would like to do so on their bill. We ask all testifiers to sign in. -

Dance of the Warriors

Dance of the Warriors by Kevin Esser † † † Kevin Esser's Dance of the Warriors is totally hot, it kicks ass, and should be treasured as one of the very few members of that gorgeous hybrid set of radical porno queer SF novels, an exclusive genre presided over by Uncle Bill Burroughs & including Sam Delaney & myself... and that's about it. All right! VAG POWER! - Hakim Bey, author of Crowstone I suspect this book will become the man - boy love statement and a sort of rallying cry to the masses. I've certainly been feeling the urge to scrawl 'VAG POWER!' on every wall I see. - Camilla Copyright 1988 by The Acolyte Press First Edition published in March, 1988 in The Netherlands All rights reserved. Except for brief passages quoted in a newspaper, magazine, radio or television review, no part of this book may be reproduced in any form or by any means, electronic or mechanical, including photocopying and recording, or by any information storage or retrieval system, without permission in writing from the publishers. The Acolyte Press P. O. Box I273I 1100 AS Amsterdam - ZO The Netherlands CIP - GEGEVENS KONINKLUKE BIBLIOTHEEK, DEN HAAG Esser, Kevin Dance of the Warriors / Kevin Esser. - Amsterdam: Acolyte Press ISBN 90 - 6971 - 010 - 2 UDC 82 - 31 Trefw.: romans; oorspronkelijk - Engels. DANCE OF THE WARRIORS by Kevin Esser ebook by the Ghost Book One One Summer was dying. A few leaves were falling from the oak trees in the front yard, fluttering dry and brown to the grass. Teddy sat watching them from the porch, his chin resting on both fists. -

The Evolution Trilogy

1 The Evolution Trilogy Todd Borho 2 Contents Part 1 – James Bong Series - 4 Part 2 – SeAgora Novel - 184 Part 3 – Agora One Novel - 264 3 James Bong Premise: Anarchism, action, and comedy blended into a spoof of the James Bond franchise. Setting: Year: 2028 Characters and Locations: James Bong – Former MI6 asset for special operations. Now an anarchist committed to freeing people from statist hands. 30 years old, well built, steely gray eyes, dirty blond hair. Bong moves frequently. K – Nerdy anarchist hacker in his early twenties based in Acapulco, Mexico. Miss Moneybit – Feisty, attractive blogger in her late twenties and based in Washington, DC. General Small - Bumbling and incompetent General. Former Army Intel and now with the CIA. Sir Hugo Trax – MI6 officer who was involved in training and controlling Bong during Bong’s MI6 days. Episode 1 – Part 1 Scene 1 Bong is driving at a scorching speed down a desert highway in a black open-source 3D printed vehicle modeled after the Acura NSX. K’s voice: Bong! Bong (narrows eyes at encrypted blockchain based smartwatch): K, what the hell? I had my watch off! K (proud, sitting in his ridiculously overstuffed highback office chair): I know, I turned it on remotely. I’ve got great news! Bong (looking ahead at the cop car and the cop’s victim on the side of the road): Kinda busy right now. K (twirling in his chair): It can’t wait! It’s a go! It’s a go! I’m so excited! Bong (sarcastically): You’re breaking up on me. -

A Talented Woman

A Talented Woman A Full-Length Play by Lynda Sturner & Jim Dalglish Play website: http://www.atalentedwoman.com Lynda Sturner 3 Bridge Lane Truro, MA 02666 (917) 573-5869 [email protected] Jim Dalglish 20 Dory Lane Eastham, MA 02642 (617) 308-0788 (m) [email protected] A Talented Woman copyright © by Lynda Sturner & Jim Dalglish It is an infringement of the copyright to give any performance or public reading of this play without permission by the playwright. A Talented Woman !1 A Talented Woman A Full-Length Play Characters Victoria – Tall, attractive, powerful professional woman in her late thirties, early forties. Maxie – Victoria’s mother. She can be quite glamorous and looks ten years younger than her age – 70. Harmony – Victoria’s 13-year-old daughter. She is a handful. Greg – Victoria’s husband and Harmony’s father. He is rather withdrawn, until you bring up his favorite subjects – artificial intelligence and robotics. Christopher – Typical New York recruiter/headhunter who specializes in executive-class recruiting. Peter – Maxie’s boyfriend. Very handsome man is his mid 60s. Setting Place Manhattan, New York, New York. Victoria and Greg’s loft, Christopher’s office and Maxie’s bedroom. Time Winter 2011 and Spring 2012 Synopsis After her husband dies, Maxie discovers she’s spent most of her adult life living in a house of cards. Now she's destitute in a down economy. Her practical daughter – who has her own set of problems with an unemployed husband and hellion daughter – insists that Maxie begin a new life of austerity and sacrifice. She shops at Daffys instead of Bergdorfs. -

Transcription of the Spoken Dialogue and Audio, with Time-Code Reference, Provided Without Cost by 8Flix.Com for Your Entertainment, Convenience, and Study

CREATED BY Vince Gilligan EPISODE 4.03 “Open House” While Walt worries about Gus's interference and Jesse's increasingly fragile state of mind, Skyler steps up the pressure to get what she wants. WRITTEN BY: Sam Catlin DIRECTED BY: David Slade ORIGINAL BROADCAST: July 31, 2011 NOTE: This is a transcription of the spoken dialogue and audio, with time-code reference, provided without cost by 8FLiX.com for your entertainment, convenience, and study. This version may not be exactly as written in the original script; however, the intellectual property is still reserved by the original source and may be subject to copyright. MAIN EPISODE CAST Bryan Cranston ... Walter White Anna Gunn ... Skyler White Aaron Paul ... Jesse Pinkman Dean Norris ... Hank Schrader Betsy Brandt ... Marie Schrader RJ Mitte ... Walter White, Jr. (credit only) Bob Odenkirk ... Saul Goodman Giancarlo Esposito ... Gustavo 'Gus' Fring (credit only) Jonathan Banks ... Mike Ehrmantraut (credit only) Nigel Gibbs ... APD Detective Tim Roberts Jennifer Hasty ... Stephanie Doswell Bill Burr ... Kuby Jeremy Howard ... Sketchy Marius Stan ... Bogdan Wolynetz Lavell Crawford ... Huell Ray Campbell ... Tyrus Kitt Ralph Alderman ... First Realtor Delana Michaels ... Female Homeowner Jonathan Richards ... Male Homeowner Stephen Braddock ... Partygoer 1 00:01:17,703 --> 00:01:19,997 Son of a.... 2 00:02:09,755 --> 00:02:12,257 I'm not leaving. 3 00:02:15,844 --> 00:02:18,847 Walt, I'm not leaving. 4 00:02:20,015 --> 00:02:21,391 Oh, my God. 5 00:02:30,692 --> 00:02:34,696 I can hear your cell phone ringing. 6 00:02:35,989 --> 00:02:39,242 This is ridiculous. -

The Connecticut College Quarterly, Vol. 2 No. 4

Connecticut College Digital Commons @ Connecticut College Quarterly Student Publications 6-1923 The Connecticut College Quarterly, Vol. 2 No. 4 Connecticut College Follow this and additional works at: https://digitalcommons.conncoll.edu/studentpubs_quarterly Recommended Citation Connecticut College, "The Connecticut College Quarterly, Vol. 2 No. 4" (1923). Quarterly. 30. https://digitalcommons.conncoll.edu/studentpubs_quarterly/30 This Magazine is brought to you for free and open access by the Student Publications at Digital Commons @ Connecticut College. It has been accepted for inclusion in Quarterly by an authorized administrator of Digital Commons @ Connecticut College. For more information, please contact [email protected]. The views expressed in this paper are solely those of the author. \ TIlE CONNECTICUT COLLEGE QUARTERLY I_I I THE C. C. QUARTERLY PAGE i O'LEARY'S Hotel and Restaurant Patronize Our AdTertisen PAGE ii THE C. C. QUARTERLY COMPLIMENTS OF THE NEW LONDON CITY NATIONAL BANK NEW LONDON CONNECTICUT THE SAVINGS BANK CEDAR CRAG OF NEW LONDON "The Tea House in The Woods" 63 Main Street Afternoon tea out-at-doors. Birthday and special Suppers by arrangement. Attractive A Big Strong novelties tor sale. Friendly Bank Patronize Our Advertisers THE C. C. QUARTERLY PAGE iii Rockwell & Company 253 State Street WEARING APPAREL There is a lot of satisfaction in being well- dressed and knowing it. Our clothes are as good as they are Confectioner styJish,-but that doesn't mean that they are expen- and Caterer sive. It's your satisfaction that matters here. BISHOP & SPENCER Photo and Music Studio 47 BANK ST. Showing the very latest im- Exclusive Brunswick Agency ported and domestic fabrics, Records released daily. -

CHARLIE FOSTER by Raymond King Shurtz

Excerpt Terms & Conditions This excerpt is available to assist you in the play selection process. You may view, print and download any of our excerpts for perusal purposes. Excerpts are not intended for performance, classroom or other academic use. In any of these cases you will need to purchase playbooks via our website or by phone, fax or mail. A short excerpt is not always indicative of the entire work, and we strongly suggest reading the whole play before planning a production or ordering a cast quantity of scripts. Family Plays Charlie Foster A play about swimming and theatre by Raymond King Shurtz “I sometimes wonder what it would be like to be you for a day.” © Family Plays CHARLIE FOSTER, A play about swimming and theatre by Raymond King Shurtz Charlie Foster was a kid no one knew or cared about until he accidentally drowned in the river. Or was it an accident? Ten young people try to remember, understand, and question each other after his death. They use the emotional tools that they understand to process the tragedy: the rules of swimming and improvisation. Their journey becomes a powerful play about coming of age, and the sensitive nature of walking in someone else’s shoes. Charlie Foster, the kid no one noticed, is the universal part of us all that strives to be understood and loved. Code: CH2. APPROX. RUNNING TIME: 40 MINUTES CAST: 10 ROLES (8F, 2M) THAT MAY BE PLAYED BY AS FEW AS 5. SETTING: 10 CHAIRS FUNCTION AS THE SET. SUITABLE FOR TOURING COSTUMES: CONTEMPORARY PLAYWRIGHT: Raymond King Shurtz is director of the theatre and film program at Metro Arts Institute in Phoenix, Arizona. -

3 16Am Jhene Aiko Mp3 Download

3 16am jhene aiko mp3 download CLICK TO DOWNLOAD Aug 16, · Written by Jhene Aiko “ i was born on March 16th. is a popular bible verse that i believe in but on the contrary 3am is a dark hour strong urges to want to leap off a building. "AM" is a song by American singer-songwriter Jhene Aiko, taken from her debut extended play, Sail Out (). Following the release of Aiko's debut mixtape "Sailing Soul(s)" (), Aiko signed a record deal with ARTium Records where she began work on her debut renuzap.podarokideal.ru: PBR&B. Jhene Aiko Pussy Fairy (OTW) free mp3 download and stream. Mixtape Search. Home Indy Club Contact. 26 This Week 1 Today 21 Unreleased 53 Past Releases. Sign Up; Login. Username or email. Password. Jhene_Aiko- Pussy_Fairy_(OTW).mp3. MB. Members: download. Jhene Aiko Party for Me. American singer and songwriter, Jhene Aiko finally releases her promised studio album titled after herself “Chilombo.” She kicked off her career by contributing vocals and appearing in several music videos for R&B group B2K. In , Aiko met with No I.D., record producer and vice president of A&R at Def Jam, who ended up signing Aiko to his Artium Records imprint through Def Jam. Aiko released the track "AM", which was made available for digital download on iTunes September 4, The song was released as the first single from Sail renuzap.podarokideal.ru , Aiko was also the opening act on the highly anticipated "Life. Jan 20, · Jhene Aiko is here with her new album Chilombo. Titled after her last name (her full name is Jhene Aiko Efuru Chilombo), Aiko is set to release her album which is a follow up to her last album, Trip, released in Since the release, Aiko has released several singles, including “Triggered” and “None Of Your Concern” featuring Big Sean. -

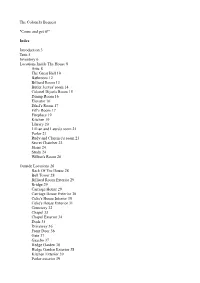

The Colonel's Bequest "Come and Get It!" Index Introduction 3 Trite 5 Inventory 6 Locations Inside the House 8 Attic 8

The Colonel's Bequest "Come and get it!" Index Introduction 3 Trite 5 Inventory 6 Locations Inside The House 8 Attic 8 The Great Hall 10 Bathroom 12 Billiard Room 13 Butler Jeeves' room 14 Colonel Dijon's Room 15 Dining Room 16 Elevator 16 Ethel's Room 17 Fifi's Room 17 Fireplace 19 Kitchen 19 Library 20 Lillian and Laura's room 21 Parlor 21 Rudy and Clarence's room 23 Secret Chamber 23 Stairs 24 Study 24 Wilbur's Room 26 Outside Locations 26 Back Of The House 28 Bell Tower 28 Billiard Room Exterior 29 Bridge 29 Carriage House 29 Carriage House Exterior 30 Celie's House Interior 30 Celie's House Exterior 31 Cemetery 32 Chapel 33 Chapel Exterior 34 Dock 35 Driveway 36 Front Door 36 Gate 37 Gazebo 37 Hedge Garden 38 Hedge Garden Exterior 38 Kitchen Exterior 39 Parlor exterior 39 Playhouse 40 Playhouse exterior 40 Rose Garden 41 Stable 42 Stable exterior 42 Study Exterior 42 South Edges 42 Swamp 43 People 44 Jeeves the Butler 44 Beauregard the Dog 46 Celie the Cook 46 Clarence Sparrow 54 Colonel Henri Dijon 59 Ethel Prune 61 Fifi the Maid 63 Lillian Prune 69 Gertrude Dijon 77 Gloria Swansong 78 Rudy Dijon 83 Dr Wilbur C. Feels 89 Act 1 93 Lillian in bathroom, eavesdropping Act II 96 Gertie's death, Wilbur and Clarence, Lillian and Celie Act III 100 Wilbur's death, Rudy and Fifi, Gloria and Clarence Act IV 101 Gloria's death, Rudy and Clarence, Jeeves and Fifi Act V 103 Ethel's death, Laura and Henri Act VI 105 Fifi's and Jeeves' death, Lillian and Clarence writing Act VII 107 Clarence's death, the basement, the tomb Act VIII 111 Celie praying, Lillian's death, ending sequence. -

AFTER HAPPILY EVER AFTER by Amanda Burris, Julia Grove, and Lauren Ohler

AFTER HAPPILY EVER AFTER By Amanda Burris, Julia Grove, and Lauren Ohler Copyright © MMXIV by Amanda Burris, Julia Grove, and Lauren Ohler, All rights reserved. ISBN: 978-1-61588-330-1 CAUTION: Professionals and amateurs are hereby warned that this Work is subject to a royalty. This Work is fully protected under the copyright laws of the United States of America and all countries with which the United States has reciprocal copyright relations, whether through bilateral or multilateral treaties or otherwise, and including, but not limited to, all countries covered by the Pan-American Copyright Convention, the Universal Copyright Convention and the Berne Convention. RIGHTS RESERVED: All rights to this Work are strictly reserved, including professional and amateur stage performance rights. Also reserved are: motion picture, recitation, lecturing, public reading, radio broadcasting, television, video or sound recording, all forms of mechanical or electronic reproduction, such as CD-ROM, CD-I, DVD, information and storage retrieval systems and photocopying, and the rights of translation into non-English languages. PERFORMANCE RIGHTS AND ROYALTY PAYMENTS: All amateur and stock performance rights to this Work are controlled exclusively by Heuer Publishing LLC. No amateur or stock production groups or individuals may perform this play without securing license and royalty arrangements in advance from Heuer Publishing LLC. Questions concerning other rights should be addressed to Heuer Publishing LLC. Royalty fees are subject to change without notice. Professional and stock fees will be set upon application in accordance with your producing circumstances. Any licensing requests and inquiries relating to amateur and stock (professional) performance rights should be addressed to Heuer Publishing LLC.