Mitsubishi UFJ Financial Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Incoming Letter

I285 AVENUE OFTHE AMERICAS PAUL. WEISS. RIFKIND. WHARTON 8 GARRISON LLP NEWK)RK. IPI 1 0 0 1 ~ TELEPHONE (2 I21 373-5000 FACSIMILE 12 IP) 757-3900 #-)L 70'J 7%2F 7- t-2m#? !J Y2%RS*%*rn**%% 1015 L STREET. NW WASHINGTON. DC 20030-5004 NKOKU SElMEl BUILDING. 2-2 UCHlSAlWAlCHO 2-CHOME. CHIYODA-KU. TOKYO 100-001 I.JAPAN TELEPHONE (202) 223-73W FACSIMILE (202) 223-7420 TELEPHONE (03) 3597-8 I0l FACSIMILE (03)3587-8 120 ORIENTAL PW,TOWER €3 SUITE 1205 NO. I EAST CHANG AN AVENUE DONG CHENG DISTRICT BEIJING. 100738 PEOPLE'S REPUBLIC OF CHINA TELEPHONE (8O- 10) 8518-2700 FACSIMILE (80- t 0) (15 (8-2700/6 1 l2TH FLOOR, HONO KONG CLUB BUILDING 3A CHATER ROAD. CENTRAL HONQ KONG January 23,2006 TELEPHONE 1852) 253ESO35 FACSIMILE 1852) 2530-0022 ALDER CASTLE I0 NOBLE STREET LONDON ECZV 7JU. U.K. TELEPHONE (44 20) 7307 1000 U.S. Securities and Exchange Commission FACSIMILE I44 201 7307 1050 100 F Street, N.E. Washington, D.C. 20549 U.S.A. Attn: Mr. Brian V. Breheny, Chief Ms. Christina Chalk, Special Counsel Office of Mergers and Acquisitions Division of Corporation Finance Mitsubishi UFJ Financial Group, Inc. and Designated Subsidiaries Request to Report on Schedule 13G as Qualified Institutional Investors Ladies and Gentlemen: We are writing on behalf of Mitsubishi UFJ Financial Group, Inc. ("MUFG") and certain of its non-U.S. subsidiaries listed in Annex A attached hereto (the "Designated Subsidiaries") to request assurance that the Division of Corporation Finance (the "Division") will not recommend enforcement action by the U.S. -

Bank of Tokyo

SECURITIES AND EXCHANGE COMMISSION FORM 20-F Annual and transition report of foreign private issuers pursuant to sections 13 or 15(d) Filing Date: 2006-09-28 | Period of Report: 2006-03-31 SEC Accession No. 0001193125-06-198464 (HTML Version on secdatabase.com) FILER BANK OF TOKYO - MITSUBISHI UFJ, LTD Mailing Address Business Address 1251 AVENUE OF THE 7-1 MARUNOUCHI 2-CHOME CIK:852743| IRS No.: 135611741 | Fiscal Year End: 0331 AMERICAS 15TH FLOOR CHIYODA-KU Type: 20-F | Act: 34 | File No.: 033-93414 | Film No.: 061112388 NEW YORK NY 10020-1104 TOKYO 100-8388, M0 00000 SIC: 6029 Commercial banks, nec 2127824547 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Table of Contents As filed with the Securities and Exchange Commission on September 28, 2006 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ¨ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2006 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period to OR ¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Date of event requiring this shell company report Commission file number 333-11072 KABUSHIKI KAISHA MITSUBISHI TOKYO UFJ GINKO (Exact name of Registrant as specified in its charter) THE BANK OF TOKYO- MITSUBISHI UFJ, LTD. -

1 Bay Area Companies That Match Employee Donations*

BAY AREA COMPANIES THAT MATCH EMPLOYEE DONATIONS* To our knowledge, the following local companies offer a matching gift when their employees make a personal donation to a nonprofit organization. This means that your employer may be willing to match all or part of your donation amount with its own donation. A “matching gift” is a donation made by a corporation or foundation on behalf of an employee that matches that employee’s contribution to a nonprofit organization. This can double, triple, or even quadruple your contribution! Our partial list of Bay Area corporations and foundations with matching gift programs is below. Contact your Human Resources department for information about your company’s program. If you find that your unlisted employer does offer a matching gift program, please let us know so that we can add them to our list. Thank you! *Our list was compiled from other lists found online and may not be comprehensive or up to date, so please check with your employer. Your employer will provide you with all the information needed to process your matching gift. 3Com Corporation AOL/Time Warner 3M Foundation AON Foundation Abbott Laboratories Fund Applera Corporation AC Vroman Inc. Applied Materials Accenture Aramark Corp. ACE INA Foundation Archer-Daniels-Midland Company Acrometal Companies Inc. Archie and Bertha Walker Foundation Acuson ARCO Foundation Adaptec, Inc. Argonaut Insurance Group ADC Telecommunications Arkwright Foundation, Inc. Addison Wesley Longman Arthur J. Gallagher Foundation Adobe Systems, Inc. Aspect Communications Corp. ADP Foundation Aspect Global Giving Program Advanced Fibre Communications Aspect Telecommunications Advanced Micro Devices (AMD) AT&T Foundation Advantis ATC AES Corporation ATK Sporting Equipment Aetna Foundation, Inc. -

Lista Azioni Negoziabili Quotate Sul Mercato Americano OTC Pink Marketplace

Lista Azioni Negoziabili Quotate sul Mercato Americano OTC Pink Marketplace Symbol Security CUSIP ISIN AAALY AAREAL BANK AG-UNSPON ADR 00254K108 US00254K1088 AACAY AAC TECHNOLOGIES H-UNSPON AD 304105 US0003041052 AACMZ ASIA CEMENT CORP-144A GDR 04515P104 US04515P1049 AAGIY AIA GROUP LTD-SP ADR 1317205 US0013172053 AAGRY ASTRA AGRO LESTARI-UNSP ADR 46301107 US0463011074 AATP AGAPE ATP CORP 8389108 US0083891087 AATRL [AMG 5.15 10/15/37] AMG CAPITAL TRUST II 00170F209 US00170F2092 AAVMY ABN AMRO BANK NV-UNSP ADR 00080Q105 US00080Q1058 ABBB AUBURN BANCORP INC 50254101 US0502541016 ABLT AMERICAN BILTRITE INC 24591406 US0245914066 ABNC ABN NV-CW50 HANG SENG CHIN 02407R105 US02407R1059 ABTZY ABOITIZ EQUITY VENTURES-ADR 3725306 US0037253061 ABVC AMERICAN BRIVISION HOLDING C 24733206 US0247332069 ABYB AMBOY BANCORPORATION 23226103 US0232261034 ABZPY ABOITIZ POWER CORP-UNSP ADR 3730108 US0037301084 ACCYY ACCOR SA-SPONSORED ADR 00435F309 US00435F3091 ACEEU ACE ETHANOL LLC - UNIT 00441B102 US00441B1026 ACGBY AGRICULTURAL BANK-UNSPON ADR 00850M102 US00850M1027 ACMC AMERICAN CHURCH MORTGAGE CO 02513P100 US02513P1003 ACMT ACMAT CORP 4616108 US0046161081 ACMTA ACMAT CORP -CL A 4616207 US0046162071 ACOPY THE A2 MILK CO LTD-UNSP ADR 2201101 US0022011011 ACSAY ACS ACTIVIDADES CONS-UNS ADR 00089H106 US00089H1068 ACTX ADVANCED CONTAINER TECHNOLOG 00791F109 US00791F1093 ADDC ADDMASTER CORP 6698203 US0066982036 ADDYY ADIDAS AG-SPONSORED ADR 00687A107 US00687A1079 ADERY AIDA ENGINEE LTD-UNSPON ADR 8712200 US0087122000 ADKIL ADKINS ENERGY LLC 7045107 US0070451077 -

Mitsubishi UFJ Financial Group Oprt Eiw2007 Review Corporate

Mitsubishi UFJ Financial Group Mitsubishi UFJ Financial Group Corporate Review 2007 Corporate Review 2007 Year ended March 31, 2007 Mitsubishi UFJ Financial Group (MUFG) is one of the world’s largest and most diversified financial groups with total assets of almost ¥190 trillion as of March 31, 2007. Following the creation of Mitsubishi UFJ NICOS Co., Ltd. and Mitsubishi UFJ Lease & Finance Company Limited in April 2007, the group comprises five primary operating companies, including The Bank of Tokyo-Mitsubishi UFJ, Ltd., Mitsubishi UFJ Trust and Banking Corporation, and Mitsubishi UFJ Securities Co., Ltd. MUFG’s services include commercial banking, trust banking, securities, credit cards, consumer finance, asset management, leasing and many more fields of financial services. The group has the largest overseas network of any Japanese bank, comprising offices and subsidiaries, including Union Bank of California, in more than 40 countries. Contents Major MUFG Companies 1 Disclaimer for Corporate Review 2007 All figures contained in this report are calculated according to Japanese MUFG Worldwide 2 GAAP, unless otherwise noted. Recent History of MUFG 4 This document contains statements that constitute forward-looking state- ments within the meaning of the United States Private Securities Litigation Financial Highlights 5 Reform Act of 1995. Such forward-looking statements represent targets that To Our Shareholders 7 management will strive to achieve by implementing MUFG’s business strate- gies, but are not projections nor a guarantee of future -

Corporate Profile MUFG UNION BANK, N.A

MUFG AMERICAS HOLDINGS CORPORATION Corporate Profile MUFG UNION BANK, N.A. MUFG Union Bank, N.A., is a full-service bank with offices has strong capital reserves, credit ratings, and capital across the United States. We provide a wide spectrum ratios relative to peer banks. MUFG Union Bank is a proud of corporate, commercial, retail banking, and wealth member of the Mitsubishi UFJ Financial Group (NYSE: management solutions to meet the needs of customers. MTU), one of the world’s largest financial organizations The bank also offers an extensive portfolio of value-added with total assets of approximately ¥284.9 trillion (JPY) or solutions for customers, including investment banking, $2.3 trillion (USD),¹ as of June 30, 2015. MUFG Americas personal and corporate trust, capital markets, Holdings Corporation, the financial holding company, global custody, transaction banking, and other services. and MUFG Union Bank, N.A., have corporate headquarters With assets of $113.5 billion as of June 30, 2015, the bank in New York City. Enterprise Summary Retail Banking and Wealth Markets Commercial Banking (cont.) Asian Corporate Banking Retail Banking Project Finance Offices: Branch Banking: branches in Real Estate Industries Atlanta, GA California, Oregon, and Washington Technology Chicago, IL — Banking by Design™ checking Houston, TX — Online Banking & Bill Pay U.S. Corporate Banking Florence, KY — Mobile Text Banking & Commodity Finance Los Angeles, CA Check Deposit Energy Finance New York, NY Consumer Lending: Fixed and adjustable Financial Institutions -

Mitsubishi Research Institute Group Report 2019 Management Philosophy Business Mission

Fiscal Year Ended September 2019 Mitsubishi Research Institute Group Report 2019 Management Philosophy Business Mission The Mitsubishi Research Institute Group (MRI Group) We are leading the way by co-creating a brighter future alongside uses its strengths and carries out business activities customers, aiming to achieve the sustainable development of local communities, corporations, and society at large. based on its unique expertise to contribute to the development of the 21st century civilization. International Community National & Customers Regional Communities 1. 2. 3. Future Co-Creation Business Shareholders Apply integrated strengths Use wisdom and information Maintain integrity and by combining the ability of to contribute to society fairness in business activities 1. Explore and Predict the Future diverse individuals Use our think tank function to map out concepts for customers We demonstrate comprehensive 2. Develop Concrete Policies for the Future We constantly strive to be a We maintain the utmost social trust competence as an organization by knowledge-creation company, and faith from our customers by encouraging each employee to fulfill Use our consulting function to show customers the way ahead contributing to the prosperity of pursuing integrity and fairness in their individual goals using advanced our customers as well as society. business activities. specialist skills and by combining the 3. Realize the Future Co-Creation ability of diverse individuals. Use our IT solution function to make the future a reality for customers -

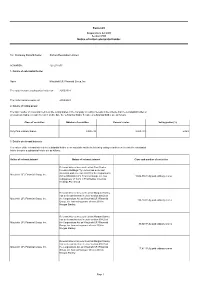

Form 603 Notice of Initial Substantial Holder

Form 603 Corporations Act 2001 Section 671B Notice of initial substantial holder To: Company Name/Scheme: Carbon Revolution Limited ACN/ARSN: 128 274 653 1. Details of substantial holder Name Mitsubishi UFJ Financial Group, Inc. The holder became a substantial holder on: 26/05/2021 The holder became aware on: 28/05/2021 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows: Class of securities Number of securities Person's votes Voting power (%) Fully Paid ordinary shares 9,900,733 9,900,733 5.06% 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities Relevant interest in securities that First Sentier Investors Holdings Pty Limited has a relevant interest in under section 608(3) of the Corporations Mitsubishi UFJ Financial Group, Inc. Act as Mitsubishi UFJ Financial Group, Inc. has 9,604,598 Fully paid ordinary shares voting power of 100% in First Sentier Investors Holdings Pty Limited. Relevant interest in securities that Morgan Stanley has a relevant interest in under section 608(3) of Mitsubishi UFJ Financial Group, Inc. the Corporations Act as Mitsubishi UFJ Financial 188,184 Fully paid ordinary shares Group, Inc. -

The Corporate Culture in a Japanese Bank: Study of the Changing Organizational World

The Corporate Culture in a Japanese Bank: Study of the Changing Organizational World by HIROFUMI HOJO B.A. Law, Keio University (1986) SUBMITTED TO THE MIT SLOAN SCHOOL OF MANAGEMENT IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN MANAGEMENT at the MASSACHUSETTS INSTITUTE OF TECHNOLOGY June 2005 © Hirofumi Hojo 2005. All rights reserved. The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part. ^ /' Ar Signature of Author: 'I (! J MIT SloVn School of Management May 6, 2005 Certified by: I John E. Van Maanen Erwin H. Schell Professor of Organization Studies Thesis Advisor Accepted by: / I I , / Stephen J. Sacca Director, Sloan Fellows Program in Innovation and Global Leadership lMASSACHUSETSINSTITE OF TECHNOLOGY 'A I IX~IFtes SEP 012005 LIBRARIES 2 The Corporate Culture in a Japanese Bank: Study of the Changing Organizational World by HIROFUMI HOJO Submitted to the MIT Sloan School of Management on May 6, 2005 in partial fulfillment of the requirements for the Degree of Master of Science in Management ABSTRACT The environment surrounding companies is constantly changing. and that change forces companies into paradigm shifts. If a company cannot cope with change, it faces the distinct possibility of being be weeded out of the industry. Today, Japanese companies are facing dramatic environmental change. For example, the introduction of new global accounting rules is changing the behavior of equity holders. The long and deep recession following the collapse of the Japanese "bubble" economy continues to sap the economic energy of many Japanese companies, and most leaders of those companies still struggle to find new ways to exit from this dark tunnel. -

Public: Mitsubishi UFJ Financial Group, Inc. Resolution Plan

Mitsubishi UFJ Financial Group, Inc. Public: Mitsubishi UFJ Financial Group, Inc. Resolution Plan Section 165(d) Resolution Plan MUFG U.S. Resolution Plan Table of Contents Table of Contents Public: Section 1 Public Section 1 1 Introduction 10 1.1 Overview of Mitsubishi UFJ Financial Group, Inc. 10 1.2 Overview of Mitsubishi UFJ Financial Group, Inc.’s U.S. Presence 12 2 Material Entities 13 2.1 Union Bank, N.A. 13 2.2 The New York Branch of the Bank of Tokyo-Mitsubishi UFJ, Ltd. 13 2.3 Mitsubishi UFJ Securities (USA), Inc. 13 2.4 The Bank of Tokyo-Mitsubishi UFJ, Ltd. and UnionBanCal Corporation Integrated Business Initiative 14 3 Core Business Lines 15 3.1 Union Bank, N.A. Core Business Lines 15 3.2 The New York Branch of the Bank of Tokyo-Mitsubishi UFJ, Ltd. Core Business Lines 16 3.3 Mitsubishi UFJ Securities (USA), Ltd. Core Business Lines 17 4 Summary Information Regarding Assets, Liabilities, Capital, and Major Funding Sources 18 4.1 Balance Sheet 18 4.2 Capital 23 4.3 Sources of Funding and Liquidity 24 5 Description of Derivative and Hedging Activities 26 5.1 Mitsubishi UFJ Financial Group, Inc. 26 5.2 Union Bank, N.A. 26 6 Memberships in Material Payment, Clearing, and Settlement Systems 27 7 Description of Foreign Operations 29 8 Material Supervisory Authorities 30 9 Principal Officers 31 9.1 Mitsubishi UFJ Financial Group, Inc. 31 9.2 Union Bank, N.A. 31 10 Resolution Planning Corporate Governance and Processes 33 10.1 165(d) Plan 33 10.2 IDI Plan 34 11 Material Management Information Systems 35 12 Resolution Strategy Summary 36 12.1 Union Bank, N.A. -

Mitsubishi UFJ Securities International Plc U.S

Level: 3 – From: 3 – From: 3 – Tuesday, October 13, 2009 – 17:51 – eprint3 – 4154 Intro : 4154 Intro OFFERING CIRCULAR Mitsubishi UFJ Securities International plc A9.4.1.1 (Incorporated with limited liability in England) U.S.$8,000,000,000 Euro Medium Term Note Programme Under this Euro Medium Term Note Programme (the ‘‘Programme’’), Mitsubishi UFJ Securities International plc (the ‘‘Issuer’’) may from time to time A12.1.1 issue in one or more Tranches (as defined on page 58) notes in bearer form (‘‘Bearer Notes’’) or registered form (‘‘Registered Notes’’) (together, the ‘‘Notes’’) A12.4.1.1 denominated in any currency (including euro) agreed by the Issuer and the relevant Dealer(s) (as defined below). Notes will be issued on either an unsubordinated A13.1.1 or a subordinated basis. The Notes will not be guaranteed by The Bank of Tokyo-Mitsubishi UFJ, Ltd. (‘‘BTMU’’) or by Mitsubishi UFJ Financial Group, Inc. (‘‘MUFG’’). The Issuer will have the benefit of a Keep Well Agreement (the ‘‘Keep Well Agreement’’) between MUFG, BTMU, the Issuer and the Trustee (as defined below) as more fully described herein under ‘‘Relationship of the Issuer with BTMU and MUFG’’ on page 106. The maximum aggregate nominal amount of all Notes from time to time outstanding will not exceed U.S.$8,000,000,000 (or its equivalent in other currencies calculated as described herein), subject to increase as provided herein. A description of the restrictions applicable at the date of this Offering Circular relating to the maturity of certain Notes is set out on page 8. -

Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone?

IRLE IRLE WORKING PAPER #188-09 September 2009 Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone? James R. Lincoln, Masahiro Shimotani Cite as: James R. Lincoln, Masahiro Shimotani. (2009). “Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone?” IRLE Working Paper No. 188-09. http://irle.berkeley.edu/workingpapers/188-09.pdf irle.berkeley.edu/workingpapers Institute for Research on Labor and Employment Institute for Research on Labor and Employment Working Paper Series (University of California, Berkeley) Year Paper iirwps-- Whither the Keiretsu, Japan’s Business Networks? How Were They Structured? What Did They Do? Why Are They Gone? James R. Lincoln Masahiro Shimotani University of California, Berkeley Fukui Prefectural University This paper is posted at the eScholarship Repository, University of California. http://repositories.cdlib.org/iir/iirwps/iirwps-188-09 Copyright c 2009 by the authors. WHITHER THE KEIRETSU, JAPAN’S BUSINESS NETWORKS? How were they structured? What did they do? Why are they gone? James R. Lincoln Walter A. Haas School of Business University of California, Berkeley Berkeley, CA 94720 USA ([email protected]) Masahiro Shimotani Faculty of Economics Fukui Prefectural University Fukui City, Japan ([email protected]) 1 INTRODUCTION The title of this volume and the papers that fill it concern business “groups,” a term suggesting an identifiable collection of actors (here, firms) within a clear-cut boundary. The Japanese keiretsu have been described in similar terms, yet compared to business groups in other countries the postwar keiretsu warrant the “group” label least.