Point and Figure Relative Strength Signals

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Point and Figure Charts

Point and Figure Charts Point-and-figure (P&F) chart is a special type of graphical analysis, which lays stress to prediction of medium-term and long-term trends. Conclusion Let’s single out advantages and disadvantages of Point and Figure charts. Point and Figure Advantages 1. P&F charts send only clear buy or sell signals without any dual nature. 2. P&F charts take into account only “important” price changes and filter out market noise. This being said, the “importance” of changes is set by a trader. 3. P&F charts are not affected by time effect, which sometimes introduces additional element of uncertainty on general charts. 4. P&F charts allow to identify support and resistance levels, and also trend lines. 5. P&F charts are very intelligible. Point and Figure Disadvantages 1. P&F charts send clear signals only for medium-term and long-term periods and are almost not intended for short-term trade. Building Point and Figure Charts The majority of the most popular charts, used for technical analysis, are built in accordance with opening price, closing price, maximum or minimum for a definite period. Only closing price for a period is used for building Point and Figure charts. Point and Figure charts consist of X and O columns, which reflect the filtered price changes. Increase in prices is shown by “X” boxes, and drop in prices is shown by “O” boxes. New boxes are created only in case of price change by the size of a box or more in one of directions. -

Stock Chart Pattern Recognition with Deep Learning

Stock Chart Pattern recognition with Deep Learning Marc Velay and Fabrice Daniel Artificial Intelligence Department of Lusis, Paris, France [email protected] http://www.lusis.fr June 2018 ABSTRACT the number of patterns recognized implies having a human examining candlestick charts in order to deduce signal char- This study evaluates the performances of CNN and LSTM acteristics before implementing the detection using condi- for recognizing common charts patterns in a stock historical tions specific to that pattern. Adding different parameters data. It presents two common patterns, the method used to to modulate ratios allows us to tweak the patterns’ charac- build the training set, the neural networks architectures and teristics. This technique does not have any generalization the accuracies obtained. potential. If the pattern is slightly outside of the defined Keywords: Deep Learning, CNN, LSTM, Pattern recogni- bounds, it will not be detected, even if a human would have tion, Technical Analysis classified it otherwise. Another solution is DTW3 which consists in computing 1 INTRODUCTION the distance between two time series. DTW allows us to Patterns are recurring sequences found in OHLC1 candle- recognize a pattern that could vary in size and length. To stick charts which traders have historically used as buy and use this algorithm, we must use reference time series, which sell signals. Several studies, notably by Bulkowski2, have have to be selected by a human. The references must gener- found some correlation between patterns and future trends, alize well when compared with signals similar to the pattern although to a limited extent. The correlations were found to in order to capture the whole range. -

2021 Mid-Year Outlook July 2021 Economic Recovery, Updated Vaccine, and Portfolio Considerations

2021 Mid-Year Outlook July 2021 Economic recovery, updated vaccine, and portfolio considerations. Key Observations • Financial market returns year-to-date coincide closely with the premise of an expanding global economic recovery. Economic momentum and a robust earnings backdrop have fostered uniformly positive global equity returns while this same strength has been the impetus for elevated interest rates, hampering fixed income returns. • Our baseline expectation anticipates that the continuation of the economic revival is well underway but its relative strength may be shifting overseas, particularly to the Eurozone, where amplifying vaccination efforts and the prospects for additional stimulus reign. • Our case for thoughtful risk-taking remains intact. While the historically sharp and compressed pace of the recovery has spawned exceptionally strong returns across many segments of the capital markets and elevated valuations, the economic expansion should continue apace, fueled by still highly accommodative stimulus, reopening impetus and broader vaccination. Financial Market Conditions Economic Growth Forecasts for global economic growth in 2021 and 2022 remain robust with the World Bank projecting a 5.6 percent growth rate for 2021 and a 4.3 percent rate in 2022. If achieved, this recovery pace would be the most rapid recovery from crisis in some 80 years and provides a full reckoning of the extraordinary levels of stimulus applied to the recovery and of the herculean efforts to develop and distribute vaccines. GDP Growth Rates Source: FactSet Advisory services offered through Veracity Capital, LLC, a registered investment advisor. 1 While the case for further global economic growth remains compelling, we are mindful that near-term base effect comparisons and a bifurcated pattern of growth may be masking some complexities of the recovery. -

Relative Strength Index for Developing Effective Trading Strategies in Constructing Optimal Portfolio

International Journal of Applied Engineering Research ISSN 0973-4562 Volume 12, Number 19 (2017) pp. 8926-8936 © Research India Publications. http://www.ripublication.com Relative Strength Index for Developing Effective Trading Strategies in Constructing Optimal Portfolio Dr. Bhargavi. R Associate Professor, School of Computer Science and Software Engineering, VIT University, Chennai, Vandaloor Kelambakkam Road, Chennai, Tamilnadu, India. Orcid Id: 0000-0001-8319-6851 Dr. Srinivas Gumparthi Professor, SSN School of Management, Old Mahabalipuram Road, Kalavakkam, Chennai, Tamilnadu, India. Orcid Id: 0000-0003-0428-2765 Anith.R Student, SSN School of Management, Old Mahabalipuram Road, Kalavakkam, Chennai, Tamilnadu, India. Abstract Keywords: RSI, Trading, Strategies innovation policy, innovative capacity, innovation strategy, competitive Today’s investors’ dilemma is choosing the right stock for advantage, road transport enterprise, benchmarking. investment at right time. There are many technical analysis tools which help choose investors pick the right stock, of which RSI is one of the tools in understand whether stocks are INTRODUCTION overpriced or under priced. Despite its popularity and powerfulness, RSI has been very rarely used by Indian Relative Strength Index investors. One of the important reasons for it is lack of Investment in stock market is common scenario for making knowledge regarding how to use it. So, it is essential to show, capital gains. One of the major concerns of today’s investors how RSI can be used effectively to select shares and hence is regarding choosing the right securities for investment, construct portfolio. Also, it is essential to check the because selection of inappropriate securities may lead to effectiveness and validity of RSI in the context of Indian stock losses being suffered by the investor. -

Forecasting Direction of Exchange Rate Fluctuations with Two Dimensional Patterns and Currency Strength

FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH A THESIS SUBMITTED TO THE GRADUATE SCHOOL OF NATURAL AND APPLIED SCIENCES OF MIDDLE EAST TECHNICAL UNIVERSITY BY MUSTAFA ONUR ÖZORHAN IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PILOSOPHY IN COMPUTER ENGINEERING MAY 2017 Approval of the thesis: FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH submitted by MUSTAFA ONUR ÖZORHAN in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Computer Engineering Department, Middle East Technical University by, Prof. Dr. Gülbin Dural Ünver _______________ Dean, Graduate School of Natural and Applied Sciences Prof. Dr. Adnan Yazıcı _______________ Head of Department, Computer Engineering Prof. Dr. İsmail Hakkı Toroslu _______________ Supervisor, Computer Engineering Department, METU Examining Committee Members: Prof. Dr. Tolga Can _______________ Computer Engineering Department, METU Prof. Dr. İsmail Hakkı Toroslu _______________ Computer Engineering Department, METU Assoc. Prof. Dr. Cem İyigün _______________ Industrial Engineering Department, METU Assoc. Prof. Dr. Tansel Özyer _______________ Computer Engineering Department, TOBB University of Economics and Technology Assist. Prof. Dr. Murat Özbayoğlu _______________ Computer Engineering Department, TOBB University of Economics and Technology Date: ___24.05.2017___ I hereby declare that all information in this document has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work. Name, Last name: MUSTAFA ONUR ÖZORHAN Signature: iv ABSTRACT FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH Özorhan, Mustafa Onur Ph.D., Department of Computer Engineering Supervisor: Prof. -

W E B R E V Ie W

TRADERS´ TOOLS 37 Professional Screening, Advanced Charting, and Precise Sector Analysis www.chartmill.com The website www.chartmill.com is a technical analysis (TA) website created by traders for traders. Its main features are charting applications, a stock screener and a sector analysis tool. Chartmill supports most of the classical technical analysis indicators along with some state-of-the-art indicators and concepts like Pocket Pivots, Effective Volume, Relative Strength and Anchored Volume Weighted Average Prices (VWAPs, MIDAS curves). First, we will discuss some of these concepts. After that, we will have a look at the screener and charting applications. Relative Strength different manner. This form of Strong Stocks flatten out again. “Strong stocks” Relative Strength is available in Relative Strength was used in The screener supports the filters the nicest steady trends WEBREVIEW different forms at chartmill.com. “Point and Figure Charting” by concept of “strong stocks”, in the market and does a terrific Two Relative Strength related Thomas Dorsey. which are stocks with a high job in mimicking IBD (Investor‘s indicators are available in the Relative Strength. But there is Business Daily) stock lists. charts and screener: Besides these two indicators, more. Not all stocks with a high there is also the Relative Strength Relative Strength ranking are also Effective Volume • Mansfield Relative Strength: Ranking Number. Here, each strong stocks. Relative Strength Effective Volume is an indicator This compares the stock gets assigned a number looks at the performance over that was introduced in the book performance of the stock to between zero and 100, indicating the past year. -

Lesson 12 Technical Analysis

Lesson 12 Technical Analysis Instructor: Rick Phillips 702-575-6666 [email protected] Course Description and Learning Objectives Course Description Learn what technical analysis entails and the various ways to analyze the markets using this type of analysis Lessons and Learning Objectives ▪ Define technical analysis ▪ Explore the history of technical analysis ▪ Examine the accuracy of technical analysis ▪ Compare technical analysis to fundamental analysis ▪ Outline different types of technical studies ▪ Study tools and systems which provide technical analysis 2 What is Technical Analysis Short Description: Using the past to predict the future Long Description: A way to analyze securities price patterns, movements, and trends to extrapolate the ranges of potential future prices 3 History of Technical Analysis The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa during the early 18th century which evolved into the use of candlestick techniques, and is today a technical analysis charting tool. In the 1920s and 1930s, Richard W. Schabacker published several books which continued the work of Charles Dow and William Peter Hamilton in their books Stock Market Theory and Practice and Technical Market Analysis. In 1948, Robert D. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. -

Price Momentum Model Creat- Points at Institutionally Relevant John Brush Ed by Columbine Capital Services, Holding Periods

C OLUMBINE N EWSLETTER A PORTFOLIO M ANAGER’ S R ESOURCE SPECIAL EDITION—AUGUST 2001 From etary price momentum model creat- points at institutionally relevant John Brush ed by Columbine Capital Services, holding periods. Columbine Alpha's Inc. The Columbine Alpha price dominance comes from its exploita- Price Momentum momentum model has been in wide tion of some of the many complex- a Twenty Year use by institutions for more than ities of price momentum. Recent Research Effort twenty years, both as an overlay non-linear improvements to with fundamental measures, and as Columbine Alpha incorporating Summary and Overview a standalone idea-generating screen. adjustments for extreme absolute The evidence presented here sug- price changes and considerations of Even the most casual market watch - gests that price momentum is not a trading volume appear likely to add ers have observed anecdotal evi- generic ingredient. another 100 basis points to the dence of trend following in stock model's 1st decile active return. prices. Borrowing from the world of The Columbine Alpha approach physics, early analysts characterized is almost twice as powerful as the You will see in this paper that this behavior as stock price momen- best simple alternative and war- constructing a price momentum tum. Over the years, researchers and rants attention by any investment model involves compromises or practitioners have developed manager who cares about active tradeoffs driven by the fact that increasingly more sophisticated return. different past measurement peri- mathematical descriptions (models) ods produce different future of equity price momentum effects. Even simple price momentum return patterns. -

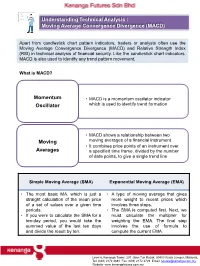

Moving Average Convergence Divergence (MACD)

Understanding Technical Analysis : Moving Average Convergence Divergence (MACD) Apart from candlestick chart pattern indicators, traders or analysts often use the Hi 74.57 Moving Average Convergence Divergence (MACD) and Relative Strength Index Potential supply (RSI) in technical analysis of financial security. Like the candlestickdisruption chart indicators, due to MACD is also used to identify any trend pattern movement. attacks on two oil Brent tankers near Iran What is MACD? WTI Momentum • MACD is a momentum oscillator indicator WTI Oscillator which is used to identify trend formation Lo 2,237.40 (24 Mar 2020) • MACD shows a relationship betweenLo 18,591.93 two (24 Mar 2020) Moving moving averages of a financial instrument. • It combines price points of an instrument over Averages a specified time frame, divided by the number of data points, to give a single trend line Simple Moving Average (SMA) Exponential Moving Average (EMA) • The most basic MA, which is just a • A type of moving average that gives straight calculation of the mean price more weight to recent prices which of a set of values over a given time involves three steps. periods. • The SMA is computed first. Next, we • If you were to calculate the SMA for a must calculate the multiplier for ten-day period, you would take the weighting the EMA. The final step summed value of the last ten days involves the use of formula to and divide the result by ten. compute the current EMA. Level 6, Kenanga Tower, 237 Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia. Tel: (603) 2172 3888 Fax: (603) 2172 2729 Email: [email protected] Website: www.kenangafutures.com.my How MACD works? MACD is generated by subtracting the long term EMAs (26 period) from the short term EMAs (12 periods) to form the main line known as MACD line. -

Candlesticks, Fibonacci, and Chart Pattern Trading Tools

ffirs.qxd 6/17/03 8:17 AM Page iii CANDLESTICKS, FIBONACCI, AND CHART PATTERN TRADING TOOLS A SYNERGISTIC STRATEGY TO ENHANCE PROFITS AND REDUCE RISK ROBERT FISCHER JENS FISCHER JOHN WILEY & SONS, INC. ffirs.qxd 6/17/03 8:17 AM Page iii ffirs.qxd 6/17/03 8:17 AM Page i CANDLESTICKS, FIBONACCI, AND CHART PATTERN TRADING TOOLS ffirs.qxd 6/17/03 8:17 AM Page ii Founded in 1870, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Australia, and Asia, Wiley is globally committed to developing and market- ing print and electronic products and services for our customers’ professional and personal knowledge and understanding. The Wiley Trading series features books by traders who have survived the market’s ever-changing temperament and have prospered—some by re- investing systems, others by getting back to basics. Whether a novice trader, professional, or somewhere in-between, these books will provide the advice and strategies needed to prosper today and well into the future. For a list of available titles, visit our web site at www.WileyFinance.com. ffirs.qxd 6/17/03 8:17 AM Page iii CANDLESTICKS, FIBONACCI, AND CHART PATTERN TRADING TOOLS A SYNERGISTIC STRATEGY TO ENHANCE PROFITS AND REDUCE RISK ROBERT FISCHER JENS FISCHER JOHN WILEY & SONS, INC. ffirs.qxd 6/17/03 8:17 AM Page iv Copyright © 2003 by Robert Fischer, Dr. Jens Fischer. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. PHI-spirals, PHI-ellipse, PHI-channel, and www.fibotrader.com are registered trademarks and protected by U.S. -

Bullish Percent Index – See How to Time Bull and Bear Markets

Bullish percent index – See How to Time Bull and Bear Markets We can all agree that the bullish percent index (BPI) is a market breadth indicator that we can use to gauge market health. But is the indicator something you should use when trading? More importantly, if you do use the indicator when trading, when and how should you place your orders. Wellin this post, we will dissect how the BPI can be used to navigate the waters and some specific techniques you can use to increase your odds. Why Should You Care About the BPI? The BPI indicator is calculated by taking the total number of issues in an index or industry that are generating point and figure buy signals and dividing it by the total number of stocks in that group. The basic rule for using the bullish percent index is when the BPI is above 70%, the market is overbought, and conversely, when the indicator is below 30%, the market is oversold. The most popular BPI is the NYSE Bullish Percent Index, which is the tool of choice for famed point and figure analyst, Thomas Dorsey. The bullish percent index is generally plotted on with a two-point box size. Later in this article, we will cover how to confirm bull and bear markets. Bullish percent index or BPI for short might seem as just another fancy name for a market breadth indicator. Between the BPI and many other similar indicators, one might wonder the need to use this indicator. Well, the BPI is an indicator for the stock markets which is quite unique. -

Accumulation/Distribution Line -- Chart School

Accumulation/Distribution Line -- Chart School Chart School Accumulation/Distribution Line Introduction - Volume and the Flow of Money There are many indicators available to measure volume and the flow of money for a particular stock, index or security. One of the most popular volume indicators over the years has been the Accumulation/Distribution Line. The basic premise behind volume indicators, including the Accumulation/Distribution Line, is that volume precedes price. Volume reflects the amount of shares traded in a particular stock and is a direct reflection of the money flowing into and out of a stock. Many times before a stock advances, there will be period of increased volume just prior to the move. Most volume or money flow indicators are designed to identify early increases in positive or negative volume flow to gain an edge before the price moves. (Note: the terms "money flow" and "volume flow" are essentially interchangeable.) Methodology (Click here to see a live example of the Acc/Dist Line) The Accumulation/Distribution Line was developed by Marc Chaikin to assess the cumulative flow of money into and out of a security. In order to fully appreciate the methodology behind the Accumulation/Distribution Line, it may be helpful to examine one of the earliest volume indicators and see how it compares. In 1963, Joe Granville developed On Balance Volume (OBV), which was one of the earliest and most popular indicators to measure positive and negative volume flow. OBV is a relatively simple indicator that adds the corresponding period's volume when the close is up and subtracts it when the close is down.