Shops at Centerpoint.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sample First Page

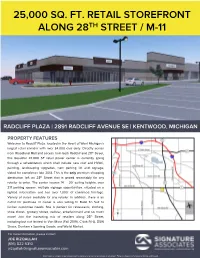

25,000 SQ. FT. RETAIL STOREFRONT ALONG 28TH STREET / M-11 RADCLIFF PLAZA | 2891 RADCLIFF AVENUE SE | KENTWOOD, MICHIGAN PROPERTY FEATURES Welcome to Radcliff Plaza, located in the Heart of West Michigan’s largest retail corridor with over 34,000 cars daily. Directly across from Woodland Mall and access from both Radcliff and 28th Street, this beautiful 47,000 SF retail power center is currently going through a rehabilitation which shall include new roof and HVAC, painting, landscaping upgrades, new parking lot and signage, slated for completion late 2018. This is the only premium shopping destination left on 28th Street that is priced reasonably for any retailer to enter. The center houses 14’ – 20’ ceiling heights, over 217 parking spaces, multiple signage opportunities, situated on a lighted intersection and has over 1,000’ of combined frontage. Variety of suites available for any retailer. In addition, there is an outlot for purchase or owner is also willing to Build To Suit to further customize needs. Site is perfect for restaurants, clothing, shoe stores, grocery stores, cellular, entertainment and so much more! Join the increasing mix of retailers along 28th Street, including but not limited to Von Mour (Fall 2019), Chick Fil-A, DSW Shoes, Dunham’s Sporting Goods, and World Market. For more information, please contact: JOE RIZQALLAH (616) 822 6310 [email protected] Information is subject to verification and no liability for errors or omissions is assumed. Price is subject to change and listing withdrawal. 2,162-25,185 2891 Radcliff Avenue SE – Kentwood, Michigan Square Feet Retail For Sale or Lease AVAILABLE Site Plan For more information, please contact: JOE RIZQALLAH SIGNATURE ASSOCIATES 1188 East Paris Ave SE, Suite 220 (616) 822 6310 Grand Rapids, MI 49546 [email protected] www.signatureassociates.com Information is subject to verification and no liability for errors or omissions is assumed. -

The BG News February 25, 2005

Bowling Green State University ScholarWorks@BGSU BG News (Student Newspaper) University Publications 2-25-2005 The BG News February 25, 2005 Bowling Green State University Follow this and additional works at: https://scholarworks.bgsu.edu/bg-news Recommended Citation Bowling Green State University, "The BG News February 25, 2005" (2005). BG News (Student Newspaper). 7406. https://scholarworks.bgsu.edu/bg-news/7406 This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 License. This Article is brought to you for free and open access by the University Publications at ScholarWorks@BGSU. It has been accepted for inclusion in BG News (Student Newspaper) by an authorized administrator of ScholarWorks@BGSU. State University FRIDAY February 25, 2005 OSCAR NIGHTS The 77th Annual Academy PM SHOWERS Awards will announce HIGH: 33 LOW 20 winners; PAGE 8 www.bgnews.com independent student press VOLUME 99 ISSUE 121 USG: cheating policy unfair Students accused of time the unidentified stu- ^«%^M H\ - \~ r3 ui! dent involved in this case was cheating need more accused of cheating, he is being dismissed from BGSU for two •mt ^ ^»'—' -^ ^LM0V"ll"HB>MIB*m rights, USG says ■-—** years — unfairly, according to Malkin. By Bridget Triarp REPORTER Malkin said this student's work was taken by classmates USG passed a series of reso- and turned in to his instructor lutions this week that defend without his consent. the rights of students who are "Intent is not a defense," accused of cheating under the Malkin said. "You can't say I University academic honesty policy. didn't intend for it to get stolen — that's not a defense. -

Destination Shopping Defining “Destination” Retail in the New American Suburbs

Destination Shopping Defining “Destination” Retail in the New American Suburbs Barrett S. Lane University of Pennsylvania CPLN 500: Prof. Eugenie L. Birch TA: Amy Lynch 8 December 2010 As the suburbanization movement took hold in the years following World War II, so did the way in which retail and commercial centers catered to their audience. For years, the idea of shopping at one location to get all of one’s necessary goods was conceptualized by large downtown department stores, such as Sears & Roebuck or H.M. Macy & Co. But as retailers found more and more of their audience fleeing the cities to the suburbs, they realized that they needed to follow suit in order to maintain profits and keep their companies competitive. Now, just as the way in which individuals and families have changed their patterns of living in the suburbs, retailers and commercial developers have begun to retool their approach to catering to the suburban consumer. In the postwar years and through the 1960s and 1970s, traditional shopping centers and shopping malls were the norm across suburbs, featuring an array of different retailers anchored by one or two big box retailers or department stores. However, by the 1980s and 1990s, commercial developers began to find their niche; setting up different kinds of retail centers for different consumer groups and classes. The evolution of power centers, fashion centers, entertainment centers, and “shopping villages” reflected the changing pattern of suburban growth and the specialization that consumers now demanded from retail. Ultimately, creating retail in the suburbs and later in cities revolved around creating “destinations” in retail, and the change seen in America’s suburbs, cities, and suburban business districts forced retailers and developers to continually challenge and redefine what they saw as “destination shopping”, using consumer markets and tastes to retool their strategy. -

City Commission Agenda Materials

City of East Grand Rapids YouTube Livestream: Regular City Commission Meeting https://bit.ly/2xXlLvn Agenda Begins at 6 pm. June 21, 2021 – 6:00 p.m. (EGR Community Center – 750 Lakeside Drive) Citizens may attend the meeting in person or virtually. 1. Call to Order. Virtual attendance/ participation information: 2. Approval of Agenda. https://www.eastgr.org/CivicAlerts.aspx?AID=781 3. Public Comment. 4. Report of Mayor, City Commissioners and City Manager. Regular Agenda Items 5. Zoning variance hearing on the request of Mark Gurney & Mary Yurko of 910 Rosewood to allow the enlargement of an accessory building to 1,180 sq. feet instead of the 720 sq. feet allowed (public hearing required; action requested). 6. Parks Improvement Debt Millage (public comment invited; action requested). a. Joint Resolution with East Grand Rapids Schools Regarding Playground Equipment Replacement. b. Resolution Authorizing Ballot Proposal for Park Improvement Bonds. 7. Advisory Board appointments for FY 2021-22 (no hearing required; approval requested). 8. Determination of annual required contribution and funding plan for Defined Benefit Plan (no hearing required; action requested). 9. Contract for reconfiguration of the Lakeside/Lakeside/Greenwood intersection (no hearing required; approval requested). 10. Purchase of wetlands mitigation credits (no hearing required; approval requested). 11. Contract for legal representation services (no hearing required; approval requested). 12. Discussion of work session date for Chapter 79C: Marijuana Establishments and Facilities (no hearing required; action requested). 13. Discussion of ordinance change to establish a separate Zoning Board of Appeals Facilities (no hearing required; action requested). Consent Agenda Items (no hearing required; approval requested unless noted). -

Michael Kors® Make Your Move at Sunglass Hut®

Michael Kors® Make Your Move at Sunglass Hut® Official Rules NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCES OF WINNING. VOID WHERE PROHIBITED BY LAW OR REGULATION and outside the fifty United States (and the District of ColuMbia). Subject to all federal, state, and local laws, regulations, and ordinances. This Gift ProMotion (“Gift Promotion”) is open only to residents of the fifty (50) United States and the District of ColuMbia ("U.S.") who are at least eighteen (18) years old at the tiMe of entry (each who enters, an “Entrant”). 1. GIFT PROMOTION TIMING: Michael Kors® Make Your Move at Sunglass Hut® Gift Promotion (the “Gift ProMotion”) begins on Friday, March 22, 2019 at 12:01 a.m. Eastern Time (“ET”) and ends at 11:59:59 p.m. ET on Wednesday, April 3, 2019 (the “Gift Period”). Participation in the Gift Promotion does not constitute entry into any other promotion, contest or game. By participating in the Gift Promotion, each Entrant unconditionally accepts and agrees to comply with and abide by these Official Rules and the decisions of Luxottica of America Inc., 4000 Luxottica Place, Mason, OH 45040 d/b/a Sunglass Hut (the “Sponsor”) and WYNG, 360 Park Avenue S., 20th Floor, NY, NY 10010 (the “AdMinistrator”), whose decisions shall be final and legally binding in all respects. 2. ELIGIBILITY: Employees, officers, and directors of Sponsor, Administrator, and each of their respective directors, officers, shareholders, and employees, affiliates, subsidiaries, distributors, -

Portage Retail Market Analysis Gibbs Planning Group, Inc

Retail Market Analysis City of Portage, Michigan April 2020 TABLE OF CONTENTS INTRODUCTION ............................................................................................................... 1 Executive Summary ............................................................................................................. 1 Background .......................................................................................................................... 2 Methodology ........................................................................................................................ 3 RETAIL TRADE AREAS ................................................................................................... 4 Primary Trade Area .............................................................................................................. 4 Secondary Trade Area .......................................................................................................... 6 Lifestyle Tapestry Demographics ........................................................................................ 7 Employment Base ................................................................................................................ 11 PORTAGE AREA CHARACTERISTICS .......................................................................... 14 Location ............................................................................................................................... 14 General Retail Market Conditions ...................................................................................... -

Q207 Supplemental 073107 Final

Pennsylvania Real Estate Investment Trust Supplemental Financial and Operating Information Quarter Ended June 30, 2007 www.preit.com NYSE: (PEI) Pennsylvania Real Estate Investment Trust Supplemental Financial and Operating Information June 30, 2007 Table of Contents Introduction Company Information 1 Press Release Announcements 2 Market Capitalization and Capital Resources 3 Operating Results Income Statement-Proportionate Consolidation Method - Three Months Ended June 30, 2007 and 2006 4 Income Statement-Proportionate Consolidation Method - Six Months Ended June 30, 2007 and 2006 5 Net Operating Income - Three Months Ended June 30, 2007 and 2006 6 Net Operating Income - Six Months Ended June 30, 2007 and 2006 7 Computation of Earnings per Share 8 Funds From Operations and Funds Available for Distribution 9 Operating Statistics Leasing Activity Summary 10 Summarized Rent Per Square Foot and Occupancy Percentages 11 Mall Sales and Rents Per Square Foot 12 Mall Occupancy - Owned GLA 13 Power Center and Strip Center Rents Per Square Foot and Occupancy Percentages 14 Top Twenty Tenants 15 Lease Expirations 16 Gross Leasable Area Summary 17 Property Information 18 Balance Sheet Balance Sheet - Proportionate Consolidation Method 21 Balance Sheet - Property Type 22 Investment in Real Estate 23 Property Redevelopment and Repositioning Summary 25 Development Property Summary 26 Capital Expenditures 27 Debt Analysis 28 Debt Schedule 29 Shareholder Information 30 Definitions 31 FORWARD-LOOKING STATEMENTS This Quarterly Supplemental Financial and Operating Information contains certain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. -

State of Ohio Fishing License Agent Locations

License Agent List County: ADAMS Name Street State City Zipcode Phone CABIN FEVER 104 N MAIN ST OH PEEBLES 45660 (937)587-1100 DAILEY'S OUTFITTERS 110 BRANSCOME RD OH PEEBLES 45660 (937)587-3337 HAROVER'S EAST END CARRYOUT 737 E SECOND STREET OH MANCHESTER 45144 (937)549-3414 KNAUFF'S GROCERY 21309 ST. RT. 125 OH BLUE CREEK 45616 (937)544-5147 MOSCOW 1ST STOP INC 1783 ST. RT. 52 OH MOSCOW 45153 (513)553-0145 PEEBLES 1ST STOP #72 18856 ST. RT 136 OH WINCHESTER 45697 (937)695-0318 TOWN & COUNTRY WEST UNION 11142 ST RT 41 OH WEST UNION 45693 (937)544-2913 WAL-MART #1368 11217 SR 41 OH WEST UNION 45693 (937)544-7198 WALLINGFORD'S ACE HDWE. 94 N. MAIN ST. OH PEEBLES 45660 (937)587-2944 County: ALLEN Name Street State City Zipcode Phone KMART #7532 2250 HARDING HWY OH LIMA 45804 (419)227-2156 LIMA BARGAIN CENTER 3700 S. DIXIE HWY OH LIMA 45806 (419)991-3701 MEIJER #110 3240 ELIDA RD OH LIMA 45805 (419)331-6456 WAL-MART #1330 2450 ALLENTOWN RD OH LIMA 45805 (419)224-3168 WAL-MART #3206 2400 HARDING HIGHWAY OH LIMA 45804 (419)222-4466 County: ASHLAND Name Street State City Zipcode Phone CALLIHAN'S CORNER STORE 917 US RT 224 OH NOVA 44859 (419)652-3224 CC'S COUNTRY CONVENIENCE LLC 360 CO RD 620 STE 4 OH WEST SALEM 44287 (419)945-1500 CHARLES MILL MARINA 1277 S.R. 430 OH MANSFIELD 44903 (419)368-0011 DISCOUNT DRUG MART #44 1631 CLAREMONT ST OH ASHLAND 44805 (419)281-7880 FIN FEATHER FUR OUTFITTERS ASHLAND 652 STATE ROUTE 250E OH ASHLAND 44805 (419)289-0071 FIN FEATHER FUR OUTFITTERS MIDDLEBURG 18030 BAGLEY RD OH MIDDLEBURG HEIGHTS 44130 (419)281-2557 JEROMESVILLE MARKET 6 SOUTH HIGH ST. -

YIR Retail Bankruptcy

The Year Brick & Mortar Got a Bankruptcy Makeover What Fashion and Luxury Goods Companies Need to Know About Restructuring and Bankruptcy Los Angeles / New York / San Francisco / Washington, DC arentfox.com Introduction Understanding the Issues, Causes, Tools for Distressed Retail Situations & What Lies Ahead for 2018 2017 was a watershed year for retail bankruptcies. More than 300 retailers fi led for bankruptcy in 2017,1 many being smaller “Mom & Pop” shops. As of the end of 2017, there have been no less than thirty major retail bankruptcy fi lings, exceeding the total number of major retail cases fi led in 2016.2 As of the end of the third quarter of 2017, more than 6,400 store closings occurred—triple the number of closings during the fi rst half of 2016.3 Analysts predict the total number of storing closings for the year ending 2017 will be between approximately 8,600 to more than 9,000, well above the 6,200 closings during the 2008 fi nancial crisis, and signifi cantly more than that of 2016.4 At this rate, at least 10% of the total physical US retail landscape is estimated to have closed during 2017. These cutbacks resulted in an estimated 76,084 job cuts by retail employers in 2017, a 26% increase over 2016, unseen in any other industry in 2017.5 Retailers are confronted with market pressures and unique legal issues in bankruptcy that make successful reorganizations more diffi cult to attain. It is clear that the trend of failing retailers will intensify before it improves. -

State of the System Report Comprehensive Operational Analysis the Rapid

The Rapid Comprehensive Operational Analysis | State of the System The Rapid State of the System Report Comprehensive Operational Analysis The Rapid FINAL November 2019 Nelson\Nygaard Consulting Associates Inc. | i Comprehensive Operational Analysis | State of the System The Rapid Table of Contents Page 1 Introduction ......................................................................................................................1-1 Project Goals .......................................................................................................................................... 1-1 Report Organization ............................................................................................................................. 1-2 2 Document Review ............................................................................................................2-1 Key Findings ............................................................................................................................................ 2-1 Plan Review ............................................................................................................................................. 2-2 3 Market Analysis ...............................................................................................................3-1 Key Findings ............................................................................................................................................ 3-2 Population .............................................................................................................................................. -

Leonard St NENE CONFIDENTIALITY and CONDITIONS

36th St SE 3.38 Acres 600’ +/- Frontage Leonard StSt NENE 250’ +/- Frontage North Ave NE 301 Leonard Street NE, Grand Rapids OFFERING MEMORANDUM COLLIERS INTERNATIONAL | 1 Plainfield AveAve NENE David Rapp Gary Albrecht Davd Wiener Vice President Senior Associate Senior Vice President EXCLUSIVELY PREPARED BY PREPARED EXCLUSIVELY DIR 616 988 5819 DIR 616 988 5819 DIR 616 988 5849 MOB 616 325 9235 MOB 616 218 3928 MOB 616 304 3274 [email protected] [email protected] [email protected] Leonard St NENE CONFIDENTIALITY AND CONDITIONS This Off ering Memorandum was prepared by Colliers International (“Advisor”) on behalf of the Owner, and is confi dential. This Off ering Memorandum is being furnished to prospective purchasers of the property described herein subject to the terms of the Confi dentiality Agreement previously provided to and executed by such prospective purchasers. This Off ering Memorandum is intended solely to assist prospective purchasers in their evaluation of the property and their consideration of whether to purchase the property. It is not to be used for any other purpose or made available to any other person without the prior written consent of Owner or Advisor. This Off ering Memorandum is subject to errors, omissions, changes or withdrawal without notice and does not constitute a recommendation or endorsement as to the value of the property by Owner/Advisor and their sources. Financial projections are provided as a reference and are based on assumptions made by Owner/Advisor and their sources. Prospective purchasers should make their own projections and reach their own conclusions of value. -

GART SPORTS COMPANY (Exact Name of Registrant As Specified in Its Charter)

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OFTHE SECURITIES EXCHANGE ACT OF1934 For the Fiscal Year ended February 2, 2002 Commission file number 000-23515 GART SPORTS COMPANY (Exact name of registrant as specified in its charter) Delaware 84-1242802 (State or other jurisdiction (I.R.S. Employer of incorporation or organization) Identification No.) 1050 West Hampden Avenue Englewood, Colorado 80110 (Address of principal executive office)(Zip Code) (303) 200-5050 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $.01 per share (title of class) Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes È No ‘ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. È As of April 16, 2002, there were outstanding 11,014,797 shares of the registrant’s common stock, $.01 par value, and the aggregate market value of the shares (based upon the closing price on that date of the shares on the NASDAQ National Market) held by non-affiliates was approximately $211,336,000.