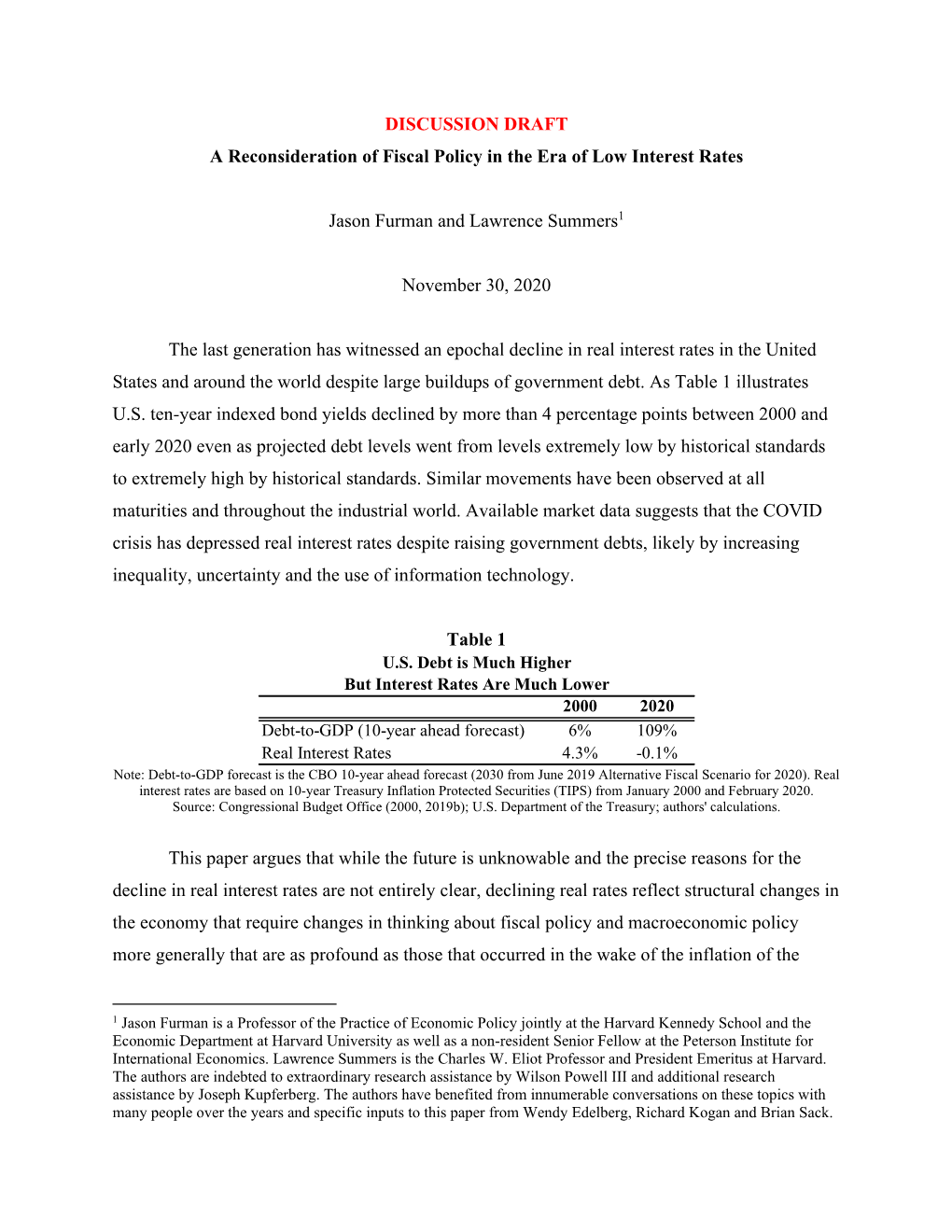

A Reconsideration of Fiscal Policy in the Era of Low Interest Rates

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Economic Analysis by Nobel Laureate Joseph Stiglitz

BEFORE THE UNITED STATES DEPARTMENT OF JUSTICE UNITED STATES OF AMERICA, Plaintiff, v. Civil Action No. 98-1232 (CKK) MICROSOFT CORPORATION, Defendant. STATE OF NEW YORK ex rel. Attorney General Eliot Spitzer, et al., Plaintiffs, v. Civil Action No. 98-1233 (CKK) MICROSOFT CORPORATION, Defendant. DECLARATION OF JOSEPH E. STIGLITZ AND JASON FURMAN TABLE OF CONTENTS I. QUALIFICATIONS ........................................................................................................... 1 II. PURPOSE............................................................................................................................ 2 III. INTRODUCTION............................................................................................................... 2 IV. THE MODERN ECONOMIC THEORY OF COMPETITION AND MONOPOLY .6 A. Acquisition of a monopoly............................................................................................ 7 B. Potential for competition............................................................................................ 10 C. Consequences of monopoly ........................................................................................ 12 D. Monopolies and innovation ........................................................................................ 14 V. FACTS AND LEGAL CONCLUSIONS RELATING TO MICROSOFT.................. 16 A. Monopoly power.......................................................................................................... 16 B. Anticompetitive behavior .......................................................................................... -

Commercial Real Estate Grapples with Going Green in Recession

Print California Real Estate Journal Online Article Page 1 of 4 California Real Estate Journal Newswire Articles www.carealestatejournal.com © 2009 The Daily Journal Corporation. All rights reserved. • select Print from the File menu above CREJ FRONT PAGE • Jan. 26, 2009 Commercial Real Estate Grapples With Going Green in Recession California developers and manufacturers await details of Obama's stimulus plan Developers and manufactures await details of Obama's stimulus plan By KEELEY WEBSTER CREJ Staff Writer Even as U.S. President Barack Obama has been making headlines for his "green team" and a proposal to invest $150 billion over the next 10 years in green energy, Hayward-based Optisolar was forced to lay off 130 employees, or 50 percent of its workforce. Optisolar Inc., a vertically integrated manufacturer of solar panels, is down, but not out. "We are hopeful that the new attitude in Washington will enable us to come out of this holding pattern," said Alan Bernheimer, the company's vice president of corporate communications. The employees who were laid off were hired to deal with the exponential growth the company was expecting after the interest in all-things-green took off and a series of federal, state and local policies and legislative initiatives took form to promote green business and development. But when Optisolar was not able to access the equity investment it needed for its planned manufacturing expansion, it was forced to trim staffing to what the current state of the business could support, Bernheimer said. That state includes a solar farm under construction in Canada. -

Politics Aside, a Common Bond for Two Economists by N

The New York Times, June 30, 2013 Politics Aside, a Common Bond for Two Economists By N. GREGORY MANKIW ONE of the cool things about hanging around a place like Harvard, where I have been a professor for almost 30 years, is that you get to meet some supertalented people long before the world recognizes their talents. I had a vivid reminder of this just a few days ago, when President Obama appointed Jason Furman as chairman of the Council of Economic Advisers, a position that I held under George W. Bush. Jason was once a student of mine at Harvard. As the president noted in announcing the appointment, I was chairman of Jason’s Ph.D. dissertation committee. He and I have remained friends ever since. In Washington these days, comity between Republicans and Democrats is rare. Yet my relationship with Jason has never been hampered by our differing political affiliations. During the campaign of 2004, I was part of the Bush administration and he was working for two Democratic candidates, first for Wesley K. Clark in the primary season and then for John Kerry during the general election. Yet the fact that our bosses were steeped in a political battle at the highest level did not stop us from enjoying regular dinners together. For me, and I suspect for Jason as well, friendship trumps politics. Our friendship is based in part on the common bond of all economists. The field of economics offers a lens through which to view the world. For those who buy into it and pursue it as a career, it provides a foundation of a personal and political philosophy. -

A Reconsideration of Fiscal Policy in the Era of Low Interest Rates

A Reconsideration of Fiscal Policy in the Era of Low Interest Rates Jason Furman & Lawrence Summers Presentation to the Hutchins Center on Fiscal & Monetary Policy and Peterson Institute for International Economics December 1, 2020 Interest rates are low despite debt being high Note: Debt-to-GDP forecast is the CBO 10-year ahead forecast (2030 from June 2019 Alternative Fiscal Scenario for 2020). Real interest rates are based on 10-year Treasury Inflation Protected Securities (TIPS) from January 2000 and February 2020. Source: Congressional Budget Office; U.S. Department of the Treasury; authors' calculations. Interest rates have fallen everywhere, starting before the financial crisis and continuing after it Real Ten-Year Benchmark Rate Percent 12 Canada France Germany Italy 10 United Kingdom Japan United States 8 6 4 2 0 -2 -4 1985 1990 1995 2000 2005 2010 2015 2020 Note: Inflation measured by one-year changes in the core consumer price index (core personal consumption expenditures for United States). Source: Bank of Canada; Statistics Canada; Eurostat; Japanese Statistics Bureau; U.S. Bureau of Economic Analysis; Macrobond; authors’ calculations. Interest rates are expected to stay low Ten-Year Treasury Rate Percent 16 2030:Q4 Market expectations: 14 72% probability FFR < 0.25 12 five years from now 10 Historical 1.4% FFR a decade from 8 now 6 -0.9% real FFR a decade from now 4 CBO 2 2% nominal 10-year rate a Market-implied decade from now 0 1964 1974 1984 1994 2004 2014 2024 Note: Dashed lines are projections. Market-implied rates as of November 27, 2020. -

HAMILTON Achieving Progressive Tax Reform PROJECT in an Increasingly Global Economy Strategy Paper JUNE 2007 Jason Furman, Lawrence H

THE HAMILTON Achieving Progressive Tax Reform PROJECT in an Increasingly Global Economy STRATEGY PAPER JUNE 2007 Jason Furman, Lawrence H. Summers, and Jason Bordoff The Brookings Institution The Hamilton Project seeks to advance America’s promise of opportunity, prosperity, and growth. The Project’s economic strategy reflects a judgment that long-term prosperity is best achieved by making economic growth broad-based, by enhancing individual economic security, and by embracing a role for effective government in making needed public investments. Our strategy—strikingly different from the theories driving economic policy in recent years—calls for fiscal discipline and for increased public investment in key growth- enhancing areas. The Project will put forward innovative policy ideas from leading economic thinkers throughout the United States—ideas based on experience and evidence, not ideology and doctrine—to introduce new, sometimes controversial, policy options into the national debate with the goal of improving our country’s economic policy. The Project is named after Alexander Hamilton, the nation’s first treasury secretary, who laid the foundation for the modern American economy. Consistent with the guiding principles of the Project, Hamilton stood for sound fiscal policy, believed that broad-based opportunity for advancement would drive American economic growth, and recognized that “prudent aids and encouragements on the part of government” are necessary to enhance and guide market forces. THE Advancing Opportunity, HAMILTON Prosperity and Growth PROJECT Printed on recycled paper. THE HAMILTON PROJECT Achieving Progressive Tax Reform in an Increasingly Global Economy Jason Furman Lawrence H. Summers Jason Bordoff The Brookings Institution JUNE 2007 The views expressed in this strategy paper are those of the authors and are not necessarily those of The Hamilton Project Advisory Council or the trustees, officers, or staff members of the Brookings Institution. -

Uncorrected Transcript

1 CEA-2016/02/11 THE BROOKINGS INSTITUTION FALK AUDITORIUM THE COUNCIL OF ECONOMIC ADVISERS: 70 YEARS OF ADVISING THE PRESIDENT Washington, D.C. Thursday, February 11, 2016 PARTICIPANTS: Welcome: DAVID WESSEL Director, The Hutchins Center on Monetary and Fiscal Policy; Senior Fellow, Economic Studies The Brookings Institution JASON FURMAN Chairman The White House Council of Economic Advisers Opening Remarks: ROGER PORTER IBM Professor of Business and Government, Mossavar-Rahmani Center for Business and Government, The John F. Kennedy School of Government at Harvard University Panel 1: The CEA in Moments of Crisis: DAVID WESSEL, Moderator Director, The Hutchins Center on Monetary and Fiscal Policy; Senior Fellow, Economic Studies The Brookings Institution ALAN GREENSPAN President, Greenspan Associates, LLC, Former CEA Chairman (Ford: 1974-77) AUSTAN GOOLSBEE Robert P. Gwinn Professor of Economics, The Booth School of Business at the University of Chicago, Former CEA Chairman (Obama: 2010-11) PARTICIPANTS (CONT’D): GLENN HUBBARD Dean & Russell L. Carson Professor of Finance and Economics, Columbia Business School Former CEA Chairman (GWB: 2001-03) ALAN KRUEGER Bendheim Professor of Economics and Public Affairs, Princeton University, Former CEA Chairman (Obama: 2011-13) ANDERSON COURT REPORTING 706 Duke Street, Suite 100 Alexandria, VA 22314 Phone (703) 519-7180 Fax (703) 519-7190 2 CEA-2016/02/11 Panel 2: The CEA and Policymaking: RUTH MARCUS, Moderator Columnist, The Washington Post KATHARINE ABRAHAM Director, Maryland Center for Economics and Policy, Professor, Survey Methodology & Economics, The University of Maryland; Former CEA Member (Obama: 2011-13) MARTIN BAILY Senior Fellow and Bernard L. Schwartz Chair in Economic Policy Development, The Brookings Institution; Former CEA Chairman (Clinton: 1999-2001) MARTIN FELDSTEIN George F. -

Blanchard and Summers 1984 for the U.K., Germany and France; See Buiter 1985 for a More De- Tailed Study of U.K

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: NBER Macroeconomics Annual 1986, Volume 1 Volume Author/Editor: Stanley Fischer, editor Volume Publisher: MIT Press Volume ISBN: 0-262-06105-8 Volume URL: http://www.nber.org/books/fisc86-1 Publication Date: 1986 Chapter Title: Hysteresis and the European Unemployment Problem Chapter Author: Olivier J. Blanchard, Lawrence H. Summers Chapter URL: http://www.nber.org/chapters/c4245 Chapter pages in book: (p. 15 - 90) — Olivier I. Blanchard andLawrenceH. Summers MASSACHUSETTS INSTITUTE OF TECHNOLOGY AND NBER, HARVARD UNWERSITY AND NBER Hysteresis and the European Unemployment Problem After twenty years of negligible unemployment, most of Western Europe has since the early 1970s suffered a protracted period of high and ris- ing unemployment. In the United Kingdom unemployment peaked at 3.3 percent over the period 1945—1970, but has risen almost continu- ously since 1970, and now stands at over 12 percent. For the Common Market nations as a whole, the unemployment rate more than doubled between 1970 and 1980 and has doubled again since then. Few forecasts call for a significant decline in unemployment over the next several years, and none call for its return to levels close to those that prevailed in the 1950s and 1960s. These events are not easily accounted for by conventional classical or Keynesian macroeconomic theories. Rigidities associated with fixed- length contracts, or the costs of adjusting prices or quantities, are un- likely to be large enough to account for rising unemployment over periods of a decade or more. -

Who Should Be the Next Fed Chairman?

A SYMPOSIUM OF VIEWS THE MAGAZINE OF INTERNATIONAL ECONOMIC POLICY 888 16th Street, N.W. Suite 740 Washington, D.C. 20006 Phone: 202-861-0791 Fax: 202-861-0790 www.international-economy.com [email protected] Who Should Over the next several years, commentators will speculate Be the on the identity of the next Chairman of the Federal Reserve Board of Governors once Alan Greenspan’s Next Fed tenure ends in 2006. Instead of speculation centered on who is likely to be next, per- haps the initial question should relate to who should Chairman? assume the post many describe today as “central banker to the world”? 44 THE INTERNATIONAL ECONOMY FALL 2004 TIE ASKED DOZENS OF EXPERTS Among those mentioned as possible replacements:* Bob Rubin Martin Feldstein Larry Summers Ben Bernanke William McDonough Joseph Stiglitz Lawrence B. Lindsey Robert McTeer Janet Yellen Glen Hubbard David Malpass Robert Barro Ian Macfarlane Bill Gross *Note: Selections made prior to November 2 U.S. presidential election. FALL 2004 THE INTERNATIONAL ECONOMY 45 BARNEY FRANK Member, U.S. House of Representatives, and senior GEORGE SOROS Democrat on the Financial Chairman, Soros Fund Services Committee Management f John Kerry is elected President, I will urge strongly Bob Rubin is by far the most qualified. the appointment of Nobel Prize winner Joseph Stiglitz Ito chair the Fed. That position has become the single most influential office affecting national economic pol- icy, and Stiglitz’s commitment to and understanding of the importance of combining economic growth with a concern for economic fairness are sorely needed. Given the increasing role that globalization plays, his interna- tional experience is also a great asset. -

Maurice Obstfeld

February 1, 2019 CURRICULUM VITAE OF MAURICE OBSTFELD PERSONAL DATA Address: Department of Economics University of California, Berkeley 549 Evans Hall #3880 Berkeley, CA 94720-3880 Telephone: 510-643-9646 Fax: 510-642-6615 E-mail: [email protected] Homepage: http://elsa.berkeley.edu/~obstfeld EDUCATION 1975-79: Massachusetts Institute of Technology (Cambridge, MA) Ph.D., September 1979. Dissertation: Capital Mobility and Monetary Policy under Fixed and Flexible Exchange Rates. Adviser: Rudiger Dornbusch. 1973-75: King's College, Cambridge University (Cambridge, U.K.) M.A., June 1975 (Mathematical Tripos, Parts II and III). 1969-73: University of Pennsylvania (Philadelphia, PA) B.A., Summa Cum Laude with Distinction in Mathematics, May 1973. 1 PRINCIPAL EMPLOYMENT EXPERIENCE Class of 1958 Professor of Economics, University of California, Berkeley, from July 1, 1995. Chair, Department of Economics, University of California, Berkeley, July 1, 1998-June 30, 2001. Professor of Economics, University of California, Berkeley, July 1, 1989-June 30, 1995. Visiting Professor of Economics, Harvard University, July 1, 1989—January 31, 1991. Professor of Economics, University of Pennsylvania, July 1, 1986—June 30, 1989. Professor of Economics, Columbia University, July 1, 1985—June 30, 1986. Associate Professor of Economics, Columbia University, July 1, 1981—June 30, 1985. Assistant Professor of Economics, Columbia University, July 1, 1979—June 30, 1981. OTHER EXPERIENCE Senior Nonresident Fellow, Peterson Institute of International Economics, Washington, DC, from February 2019. Economic Counselor and Director of the Research Department, International Monetary Fund, September 2015-December 2018. Member, President’s Council of Economic Advisers, Washington, DC, July 2014 – August 2015. One-Week Training Course, Bank of Korea Academy, August 2011, August 2013. -

The Future of Economics in a Lakatos–Bourdieu Framework

Munich Personal RePEc Archive The Future of Economics in a Lakatos–Bourdieu Framework. Heise, Arne University of Hamburg 2014 Online at https://mpra.ub.uni-muenchen.de/80024/ MPRA Paper No. 80024, posted 05 Jul 2017 05:42 UTC The Future of Economics in a Lakatos-Bourdieu framework Prof. Arne Heise University of Hamburg Dep. of Socioeconomics VMP 9 D-20146 Hamburg [email protected] Abstract The global financial crisis has clearly been a matter of great consternation for the busi- ness-as-usual faction of mainstream economics. Will the World Financial Crisis turn out to be that ‘experimentum crucis’ which triggered a scientific revolution? In this paper, we seek to assess the likelihood of a paradigm shift towards heterodox approaches and a more pluralist setting in economics emerging from the academic establishment in the U.S. – that is, from the dominant center of knowledge production in the economic disci- pline. This will be done by building the analysis on a combined Lakatosian framework of ‘battle of research programmes’ and a Bourdieuian framework of ‘power struggle’ within the academic field and highlighting the likelihood of two main proponents of the mainstream elite to become the promulgator of change? Keywords: Paradigm, heterodox economics, scientific revolution JEL codes: A 11, E 11, E 12 1 1. The Keynesian Revolution and Pragmatic Pluralism – A Fruitful Competition Between Theories or a Crisis in Economics? John Maynard Keynes concludes ‘The General Theory of Employment, Interest, and Money’ (1936: 383-84) with the following, now-famous words: „At the present moment people are unusually expectant of a more funda- mental diagnosis; more particularly ready to receive it; eager to try it out, if it should be even possible. -

International Investors, the U.S. Current Account, and the Dollar

OLIVIER BLANCHARD Massachusetts Institute of Technology FRANCESCO GIAVAZZI Universitá Commerciale Luigi Bocconi FILIPA SA Massachusetts Institute of Technology International Investors, the U.S. Current Account, and the Dollar TWO MAIN FORCES underlie the large U.S. current account deficits of the past decade. The first is an increase in U.S. demand for foreign goods, partly due to relatively faster U.S. growth and partly to shifts in demand away from U.S. goods toward foreign goods. The second is an increase in foreign demand for U.S. assets, starting with high foreign private demand for U.S. equities in the second half of the 1990s, and later shifting to foreign private and then central bank demand for U.S. bonds in the 2000s. Both forces have contributed to steadily increasing current account deficits since the mid-1990s, accompanied by a real dollar appreciation until late 2001 and a real depreciation since. The depreciation acceler- ated in late 2004, raising the issues of whether and how much more is to come and, if so, against which currencies: the euro, the yen, or the Chinese renminbi. We address these issues by developing a simple model of exchange rate and current account determination, which we then use to interpret the recent behavior of the U.S. current account and the dollar and explore what might happen in alternative future scenarios. The model’s central assumption is that there is imperfect substitutability not only between An earlier version of this paper was circulated as MIT working paper WP 05-02, January 2005. We thank Ben Bernanke, Ricardo Caballero, Menzie Chinn, William Cline, Guy Debelle, Kenneth Froot, Pierre-Olivier Gourinchas, Søren Harck, Maurice Obstfeld, Hélène Rey, Roberto Rigobon, Kenneth Rogoff, Nouriel Roubini, and the participants at the Brook- ings Panel conference for comments. -

Peter R. Orszag

PETER R. ORSZAG Peter R. Orszag is Vice Chairman of Corporate and Investment Banking and Chairman of the Financial Strategy and Solutions Group at Citigroup, Inc. He is also a Nonresident Senior Fellow in Economic Studies at the Brookings Institution and a Contributing Columnist at Bloomberg View. Prior to joining Citigroup in January 2011, Dr. Orszag served as a Distinguished Visiting Fellow at the Council on Foreign Relations and a Contributing Columnist at the New York Times. He previously served as the Director of the Office of Management and Budget in the Obama Administration, a Cabinet-level position, from January 2009 until July 2010. From January 2007 to December 2008, Dr. Orszag was the Director of the Congressional Budget Office (CBO). Under his leadership, the agency significantly expanded its focus on areas such as health care and climate change. Prior to CBO, Dr. Orszag was the Joseph A. Pechman Senior Fellow and Deputy Director of Economic Studies at the Brookings Institution. While at Brookings, he also served as Director of The Hamilton Project, Director of the Retirement Security Project, and Co-Director of the Tax Policy Center. During the Clinton Administration, he was a Special Assistant to the President for Economic Policy and before that a staff economist and then Senior Advisor and Senior Economist at the President's Council of Economic Advisers. Orszag has also founded and subsequently sold an economics consulting firm. Dr. Orszag graduated summa cum laude in economics from Princeton University and obtained a Ph.D. in economics from the London School of Economics, which he attended as a Marshall Scholar.