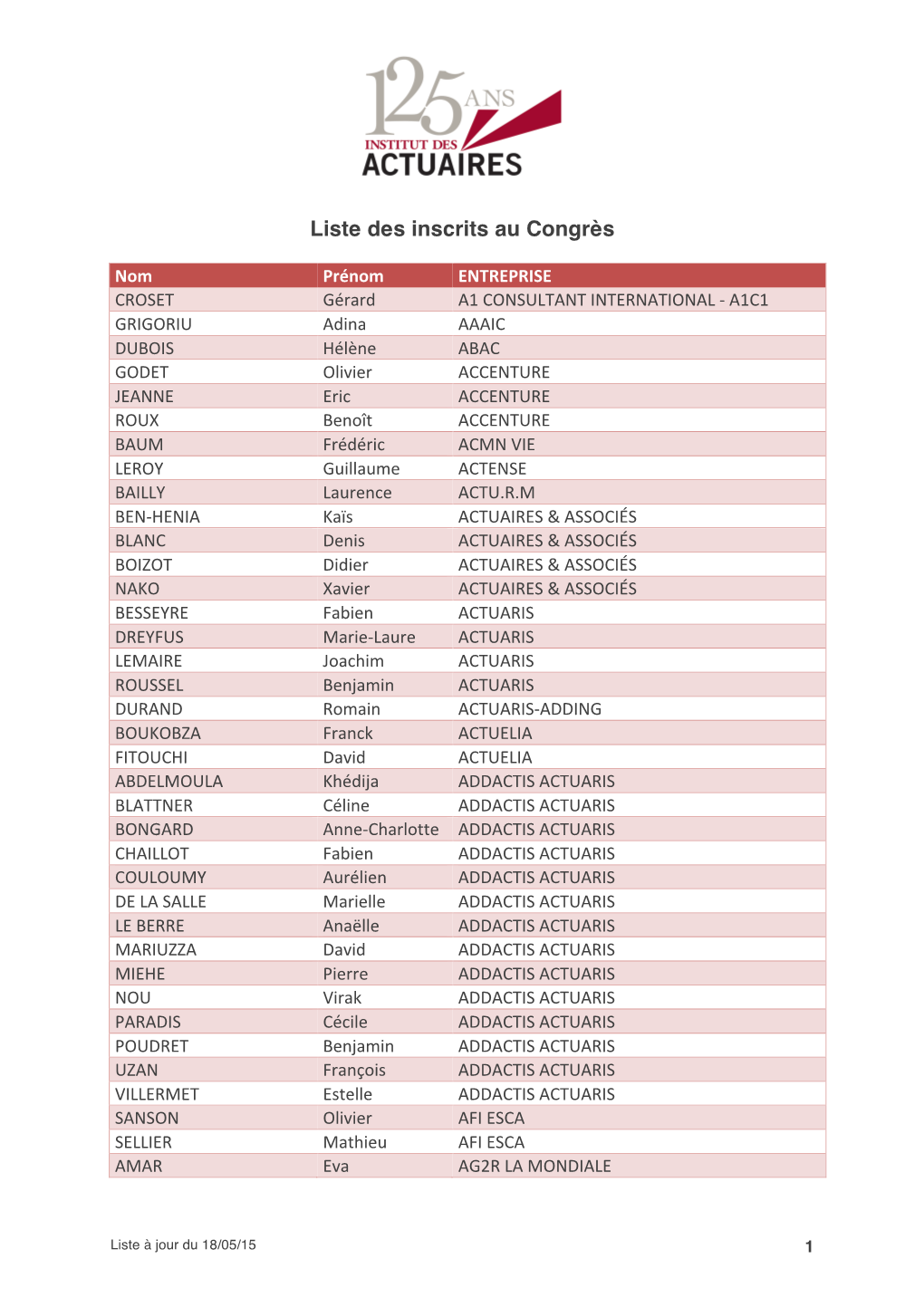

Liste Des Inscrits Au Congrès

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liste Des Organismes D'assurance Et Des Groupes Actifs Au 1Er Janvier 2015

Liste des organismes d'assurance et des groupes actifs au 1er janvier 2015 SIREN Matricule Dénomination Type d'organisme Adresse Ville CP 7 RUE LEON PATOUX CS 776466963 776466963 BPCE MUTUELLE Mutuelle REIMS Cedex 2 51686 51032 525EME MUTUELLE D ENTREPRISES DE L AUTOMOBILE ET DU VEHICULE 779926294 779926294 Mutuelle 15 RUE MARCEL PAGNOL VENISSIEUX 69200 INDUSTRIEL (RENAULT TRUCK ET IRISBUS) 30 AVENUE PIERRE MENDES 352259717 4021042 ABP PREVOYANCE Entreprise d’assurance Non Vie PARIS 75013 FRANCE 30 AVENUE PIERRE MENDES 349004341 5021028 ABP VIE Entreprise d’assurance Mixte PARIS 75013 FRANCE 780004099 780004099 ACORIS MUTUELLES Mutuelle 137 RUE SAINT DIZIER NANCY 54000 493466254 4021308 ACTA ASSURANCE Entreprise d’assurance Non Vie PARC DES TUILERIES LIMONEST CEDEX 69578 14 AVENUE DE L EUROPE 332948546 4022100 ACTE IARD Entreprise d’assurance Non Vie ESPACE EUROPEEN DE L SCHILTIGHEIM 67300 ENTREPRISE 14 AVENUE DE L EUROPE 343030748 1021018 ACTE VIE Entreprise d’assurance Vie ESPACE EUROPEEN DE L SCHILTIGHEIM 67300 ENTREPRISE 311799878 311799878 ADREA MUTUELLE Mutuelle 104 AVENUE DE SAXE LYON 69003 380138644 4021079 AFI ESCA IARD Entreprise d’assurance Non Vie 4 SQUARE DUTILLEUL LILLE 59800 STRASBOURG 548502517 1020113 AFI-ESCA Entreprise d’assurance Vie 2 QUAI KLEBER CS 30441 67008 CEDEX SAINT DENIS 392813028 3120962 AG2R MACIF PREVOYANCE Institution de prévoyance 84 RUE CHARLES MICHELS 93284 CEDEX 333232270 3120942 AG2R PREVOYANCE Institution de prévoyance 35 BOULEVARD BRUNE PARIS 75014 519490080 4021319 AGA INTERNATIONAL Entreprise -

2020 Insurance M&A Outlook Pursuing Growth Amid Uncertainty

2020 insurance M&A outlook Pursuing growth amid uncertainty 2020Brochure insurance / report M&A title outlook goes here | Pursuing | Section growth title goes amid here uncertainty Contents Overview and outlook 1 2019 in review 1 2020 outlook 7 2020 insurance M&A drivers and trends 8 Portfolio optimization 8 Improving the customer experience 8 Maturing InsurTech market 9 Integration imperative 10 Accelerating insurance innovation 11 Accounting, regulatory, and tax influences on M&A activity 11 Moving forward on 2020 insurance M&A opportunities 14 Appendix 15 Spotlight: Insurance industry M&A in major global markets 15 2 2020 insurance M&A outlook | Pursuing growth amid uncertainty Overview and outlook Projected economic, interest rate, and financial market uncertainty— However, that proved not to be the case in the property and casualty along with a presidential election—are among the headwinds that (P&C) sector, as evidenced by declines in deal volume, aggregate may give pause to insurance companies contemplating M&A in 2020. deal value, and average deal value (figure 1). In the life and health Despite these potential challenges, companies continue to view (L&H) sector, the decrease in the aggregate deal volume was not alliances, investments, and acquisitions as attractive options when material, and the average deal value actually increased. However, market factors make organic growth more difficult. Organizations these metrics were heavily influenced by the announced $6.3 billion that select targets that are accretive, synergistic, and -

Exploring the Co-Operative Economy

EXPLORING THE CO-OPERATIVE ECONOMY REPORT 2014 EXPLORING THE CO-OPERATIVE ECONOMY Download PDF http://goo.gl/eNBjqF THE WORLD CO-OPERATIVE MONITOR IS AN ALLIANCE INITIATIVE WITH THE SCIENTIFIC SUPPORT OF EURICSE THE 2014 WORLD CO-OPERATIVE MONITOR EXPLORING THE CO-OPERATIVE ECONOMY The importance of the co-operative sector and its impact co-operative movement. around the world continues to be ever more studied and Our goal is to increasingly move beyond both the 300 highlighted. However, the economic and social dimensions largest groups and the measure of annual turnover. To are yet to be fully understood and demonstrated. The accomplish this, the Alliance and Euricse partner with ongoing goal of the World Co-operative Monitor, now in its other co-operative lists, by country and sector, sharing data third edition, is to increase and enhance the available data where possible and making it available to the co-operative on co-operatives in order to present a more nuanced view community. Our aim is to also deepen collaboration with MADE POSSIBLE BY THE SUPPORT OF OUR ORGANISATIONAL PARTNERS of their actual contributions to the socio-economic welfare local researchers, national statistics agencies, local of countries around the world. representatives, and global institutions such as the Food and The World Co-operative Monitor, an ambitious Agriculture Organization (FAO) and the International Labour partnership between the International Co-operative Organization (ILO). We also invite co-operative enterprises, Alliance (the Alliance) and the European Research groups and federations to share their data directly at www. Institute on Cooperative and Social Enterprises (Euricse) monitor.coop (see the full list of contributing organizations collects available economic and social data on the world’s in Appendix 3). -

International Insurance Fact Book 2016

International Insurance Fact Book 2016 110 William Street New York, NY 10038 212.346.5500 www.iii.org In response to the globalization of the insurance business and the need for readily available data on world insurance, the Insurance Information Institute produces a Fact Book for international insurance statistics. We could not have undertaken this project without help from many organizations that collect international insurance data. We are especially grateful for the generous assistance of Axco Insurance Information Services (www.axcoinfo.com), a London-based insurance information service, and Swiss Re (www.swissre.com), which publishes the international research journal, sigma. The information included, which covers some 90 countries, comes from a variety of other sources as well. We have attempted to standardize the information as much as possible. We hope you find this Fact Book useful. Robert P. Hartwig, Ph.D., CPCU President Insurance Information Institute 110 William Street New York, NY 10038 212 346-5500 www.iii.org 2016 International Insurance Fact Book updates at www.iii.org/international/ 1 Axco Insurance Information Services is the leading supplier of global insurance and employee benefits market information. With over 40 years’ experience in researching and delivering insurance industry intelligence, Axco provides business-critical compliance and market data on no-life, life and benefits, personal accident, healthcare and employee benefits markets across the globe. Axco’s unique business model and methods of research have developed an extensive suite of products comprising in-depth reports, focused profiles, Q&A databases, intelligent questioning tools, and email services. Axco products are delivered to every corner of the globe and Axco is committed to continually improving its technical capabilities, enhancing existing products in both content and design, and developing new and innovative methods of information delivery. -

THE INSURER INVESTOR 2019/2020 Forwards

THE INSURER INVESTOR 2019/2020 Forwards Each year gener8tor hosts the OnRamp Insurance Conference with the goal of facilitating connections between insurance startups, corporations and investors. While this year has certainly gone off plan we are grateful for the 23 corporate partners who joined us for a virtual Startup Track on April 7 where we facilitated more than 250 virtual 1:1 pitch meetings between insurance corporations and startups. We are proud to work with Coverager to present our inaugural Annual Insurer Investor Report. This report explores trends around active corporate venture capital (CVC) investors and some of the notable recent deals that transform the industry. In future reports, we hope to dive deeper into data around strategic partnerships between insurers and startups. Over the past five years, we’ve seen insurtech and fintech startups emerge to advance an industry overdue for modernization. Startups are intent on improving policyholder experience, streamlining back-end processes, and developing new products across the insurance value chain. With each passing year, these startups have enjoyed increasing investment by insurance incumbents eager to evolve with consumer demands. 2019 marked a record year for insurer-backed deals, jumping 176 percent from 2015. It is clear that strategic investors play a significant role in helping startups grow and develop. In particular, insurance CVCs offer financial strength, dedicated teams and access to business resources, making them attractive to entrepreneurs seeking investment. As we all experience the impact of COVID-19, we can be certain that the insurance industry will adapt and put customers first. Entrepreneurs will continue to imagine and create. -

EIOPA Insurance Stress Test 2014

EIOPA-BOS-14-203 28 November 2014 EIOPA Insurance stress test 2014 1 Contents I. Executive summary ..........................................................................4 A. Background ....................................................................................4 1. Participation, data quality and interpretation .....................................5 2. A Note on Long Term Guarantee (LTG) Measures ...............................5 B. Core Module ...................................................................................6 1. Baseline /Pre-Stress Situation ..........................................................6 2. Scenario CA1 – Description and Results ............................................8 3. Scenario CA2 – Description and Results .......................................... 10 4. Qualitative Analysis of the Response to the CA2 Scenario .................. 11 5. Post Single-Factor Insurance Stresses (SFIS) .................................. 13 C. Low Yield Module Description and Results ............................................ 16 1. Description .................................................................................. 16 2. Baseline/Pre-Stress Scenario ......................................................... 16 3. Results of the Low Yield Module ..................................................... 19 D. Next Steps .................................................................................... 24 II. Framework, outcomes and disclaimer ............................................. 25 A. Framework: -

Message Not Delivered!

2018 Message not delivered! SUMMARY OF WWF FRANCE’S SECOND REPORT ON FRENCH INSURER’S CLIMATE REPORTING UNDER ARTICLE 173 EXECUTIVE SUMMARY1 For the second time WWF France has analyzed climate-related financial disclosures of the top 17 French insurance companies according to Article 173 (vi) of the of the French Energy Transition Act. This year, the second since the new transparency requirements for institutional investors entered into force in 2017, WWF-France looks at insurance companies’ climate-related financial disclosures from a fresh perspective: more than hundred WWF volunteers have conducted 180 interviews with sales representatives in local retail branches of their banks and insurance companies. The result is mixed: while it is noteworthy that disclosures have improved and new tools have emerged since last year, retail investors still don’t have access to clear information about the link between their savings and climate change. AFTER TWO YEARS OF REPORTING, TIME TO TAKE STOCK OF ARTICLE 173 Since July 2017 French institutional investors, including insurance companies, have been required to disclose information related to climate-related risks and opportunities under Article 173 (vi) of the French Energy Transition for Green Growth Act. Through a flexible approach, emphasising pilot testing, investors are required to comply with these new requirements or explain why they do not apply to them (approach called "comply or explain"), yet without the law imposing a prescriptive method. With article 173(vi), France became the first country in the world requiring by law that institutional investors incorporate climate risk and environmental and social factors into their public communications. -

2019 Global Benefits Financing Matrix and Poolable Coverages

2019 Global benefits financing matrix and poolable coverages Complete listing of the eight global benefits networks and their affiliated insurers across 200 countries 2019 Global benefits financing matrix and poolable coverages Zurich Global AIG Global Allianz Global Swiss Life Country Generali GEB IGP Insurope Maxis GBN Employee Benefits Network Benefits Global Solutions Solutions Number of countries and territory members 105 98 125 67 78 115 78 131 Afghanistan None None None None None None None None SIGAL Life UNIQA Albania None None None None Group Austria Life, None None None Albania (L,A,D) AXA Assurances Salama, Globus Algeria None None Macir Vie None None None Algérie Vie SPA Networks Andorra None None None None None None None Zurich Spain Universal Seguros, GA Angola Seguros Angola None None None None None None Globus Network (L,A,D) (L,D,A,M) Pan-American Life Pan-American Life Pan-American Life Insurance Company Insurance Company of Insurance Company of Antigua and Barbuda None None None Sagicor Life (L,A,D,M) None of the Eastern the Eastern Caribbean the Eastern Caribbean Caribbean (L,A,D,M) (L,A,D,M) (L,A,D,M) Allianz Argentina HSBC Seguros Galicia Vida Prudential Seguros La Caja de Seguros Argentina Compañía de Seguros SMG LIFE (L,A,D) de Vida Argentina MetLife Argentina Compañía de Zurich (L,A,D) S.A. (L,A,D) (L,A,D) S.A. (L,A,D) Seguros (L,A,D) Alfastrakhovanie Armenia None Ingo Armenia (A,M) None None None None None (L,A,D) Pan-American Life Pan-American Life Pan-American Life Insurance Company Insurance Company of Aruba None None None Sagicor Life (L,A,D,M) Insurance Company of None of the Eastern the Eastern Caribbean Aruba V.B.A. -

'Relance'1 Equity Loans for the Recovery of Smes and Employment

PRESS RELEASE Paris, 26 April 2021 Insurers are getting involved with the ‘Relance’1 Equity Loans for the recovery of SMEs and employment In order to support SMEs in the face of the consequences of the health crisis, insurers are getting involved to stimulate the recovery by investing massively in the unprecedented scheme promoted by the French Ministry of the Economy, Finance and Recovery. This scheme was set up in a few weeks by the French Treasury, the French Insurance Federation and the main French banking groups. Implemented to support the recovery, this initiative will fuel the investment capacity of SMEs- ETIs by strengthening their balance sheet over the long term. This initiative will contribute to the growth of employment in our country. 18 insurers have joined forces for this first round of fund raising, in favour of SMEs and ETIs, which will be carried out through an ad hoc investment fund called ‘Relance’ Equity Loan Fund managed by several French asset managers selected by the French Insurance Federation. This first round of financing amounts to €11 billion, an unprecedented volume in France and in Europe, which will make it possible to finance up to 90% of the equity loans distributed by banks to dynamic companies. A second round is already planned for June 2021. Paris, 26 April 2021 - Since the beginning of the health crisis, the insurance sector has demonstrated that it is fully commited to the economic recovery of our country. In the summer of 2020, the insurers and Caisse des Dépôts structured and implemented ‘Relance Durable France’2, a €2.3 billion investment programme for the sectors most affected by the crisis, including in healthcare and tourism. -

THE INSURER INVESTOR 2019/2020 Forwards

THE INSURER INVESTOR 2019/2020 Forwards Each year gener8tor hosts the OnRamp Insurance Conference with the goal of facilitating connections between insurance startups, corporations and investors. While this year has certainly gone off plan we are grateful for the 23 corporate partners who joined us for a virtual Startup Track on April 7 where we facilitated more than 250 virtual 1:1 pitch meetings between insurance corporations and startups. We are proud to work with Coverager to present our inaugural Annual Insurer Investor Report. This report explores trends around active corporate venture capital (CVC) investors and some of the notable recent deals that transform the industry. In future reports, we hope to dive deeper into data around strategic partnerships between insurers and startups. Over the past five years, we’ve seen insurtech and fintech startups emerge to advance an industry overdue for modernization. Startups are intent on improving policyholder experience, streamlining back-end processes, and developing new products across the insurance value chain. With each passing year, these startups have enjoyed increasing investment by insurance incumbents eager to evolve with consumer demands. 2019 marked a record year for insurer-backed deals, jumping 176 percent from 2015. It is clear that strategic investors play a significant role in helping startups grow and develop. In particular, insurance CVCs offer financial strength, dedicated teams and access to business resources, making them attractive to entrepreneurs seeking investment. As we all experience the impact of COVID-19, we can be certain that the insurance industry will adapt and put customers first. Entrepreneurs will continue to imagine and create. -

Ghislain Perisse, Head of Insurance Business Development at AXA IM Manager of the EWG

European Working Group PRIIPs Ghislain Perisse, Head of insurance business development at AXA IM Manager of the EWG 28th June THIS DOCUMENT IS CLASSIFIED RESTRICTED Its distribution is limited solely to the AXA IM Staff members and service providers appearing in the circulation perimeter shown. PRIIPS: What is about? PRIIPs is an initiative of the European Commission for all non-professional investors (private investors) in relation to: – Transparency on financial products – Standardised data and financial information communications – Comparability of products The aim of PRIIPS is to simplify the information around financial products in which individuals invest. This regulatory requirement is in line with the MIFID 2 Directive, which has already been imposed on banks and credit institutions. RESTRICTED Property of AXA IM. Reproduction prohibited without the prior consent of AXA IM Which financial products apply to PRIIPS? Not all, but many, including: – Structured bonds – UCITS – Life insurance contracts and capitalisation contracts Among those excluded are: – Non-life insurance products – Professional and individual retirement contracts. RESTRICTED Property of AXA IM. Reproduction prohibited without the prior consent of AXA IM PRIIP starts on 1st January 2018 The European Commission published the final RTS on March 8th, that have been validated by the Parlement The RTS introduce the possibility for the insurers to choose the type of document that they can give for UCITS funds The UCITS KIDs until 31st December 2019 The PRIIPS KIDs The RTS introduce the possibility for the insurers to provide for MOPs: All PRIIPs KIDs and/or UCITS KIDs A generic KIDs, without any descriptive information RESTRICTED Property of AXA IM. -

Introduction to Responsible Investment and the PRI

An Introduction to Responsible Investment and the PRI Matthew McAdam Director, Asia Pacific - RESPONSIBLE INVESTMENT - What we offer Support roadmap Fiduciary Investment Strategy Investment Obligations Principles Formulation Policy Alignment with AO Guidance & definitions Investment toolkits RI policy toolkits requirements Scenario planning Client engagement Outlining legal obligations Peer best practice resources resources Understanding stakeholder Applying ESG Defining and measuring ESG considerations ESG preferences considerations sustainability outcomes 2 What is responsible investment? Incorporates ‘value’ and ‘values-based’ investing Responsible investment is a strategy and practice to incorporate environmental, social and governance (ESG) factors in investment decisions and active ownership 3 Approaches to responsible investment ESG incorporation and active ownership ESG Incorporation ESG Integration ESG Screening Active Ownership The process of integrating ESG The process of excluding or seeking Interactions between the investor issues and information into exposure to securities based on and current or potential investees: investment analysis: investor values or other criteria: Environmental – e.g. chemical Voting pollution, water management, Exclusionary – negative (e.g. AGM, EGM or special meeting) greenhouse gas emissions, renewable energy etc. Social – e.g. labour standards, Shareholder engagement Best in class – positive freedom of association, (e.g. Shareholder resolutions, calling (e.g. impact investing) controversial business