TIM Brasil - Meeting with Investors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gsma Lança Iniciativas De Serviços Móveis Com O Governo E As Operadoras Brasileiras

GSMA LANÇA INICIATIVAS DE SERVIÇOS MÓVEIS COM O GOVERNO E AS OPERADORAS BRASILEIRAS 25 de fevereiro de 2014, Barcelona: A GSMA anunciou hoje várias iniciativas para melhorar o alcance e a escala dos serviços móveis no Brasil, em benefício de seus cidadãos e empresas. Paulo Bernardo, ministro das Comunicações do Brasil, e Anne Bouverot, diretora geral da GSMA, assinaram um acordo sob o qual a GSMA e o Governo brasileiro vão trabalhar juntos para acelerar a adoção da banda larga móvel e a entrega de novos serviços móveis no Brasil. Além disso, a GSMA e todas as operadoras de celular do Brasil – Algar Telecom, Claro, Nextel, Oi, Sercomtel, TIM Brasil e Vivo – anunciaram sua colaboração para proporcionar aos usuários experiências móveis mais convenientes e seguras, por meio de um conjunto de iniciativas que abordam questões como spam por SMS, roubo de aparelhos e proteção à criança. “Com aproximadamente 115 milhões de assinantes exclusivos e 277 milhões de conexões móveis, o Brasil é o maior mercado móvel na América Latina,” afirmou Anne Bouverot, diretora geral, GSMA. “Trabalhando em conjunto com o governo do Brasil e as operadoras móveis do país, continuaremos a expandir o alcance das redes e serviços móveis no Brasil, e a garantir que todos os clientes possam desfrutar dos benefícios de um ambiente mais confiável e protegido.” GSMA e Memorando de Entendimento com o Brasil A GSMA e o Ministério das Comunicações vão abordar uma série de áreas principais para acelerar a adoção de redes de banda larga móvel e serviços em todo o país. A GSMA vai oferecer sua experiência global e facilitar o diálogo em áreas como comunicações máquina a máquina (M2M), mHealth e mEducation, entre outras. -

Comissão Parlamentar De Inquérito - Cpi Da Telefonia

Assembléia Legislativa do Estado do Tocantins Coordenação de Assistência às Comissões COMISSÃO PARLAMENTAR DE INQUÉRITO - CPI DA TELEFONIA 7ª LEGISLATURA - 3ª SESSÃO LEGISLATIVA ATA DA QUARTA REUNIÃO EXTRAORDINÁRIA EM 13 DE DEZEMBRO DE 2013 Às noves horas, do dia treze de dezembro de dois mil e treze, reuniu-se a Comissão Parlamentar de Inquérito - CPI da Telefonia, no Plenarinho da Assembléia Legislativa, nesta Capital. A Senhora Presidente, Deputada Josi Nunes, sob a proteção de Deus, havendo número legal e em nome do povo tocantinense, declaro aberta a presente reunião da Comissão Parlamentar de Inquérito, com a presença dos Srs. Deputados Marcello Leis, Eli Borges, Carlão da Saneatins e eu, Josi Nunes, que presido a Comissão Parlamentar de Inquérito da Telefonia do Estado do Tocantins. Eu quero agradecer cada um por sua presença. Eu quero agradecer também a presença aos representantes das operadoras de telefonia: Da operadora Tim: agradeço ao assessor de comunicação da operadora Tim, Rafael Guimarães; executivo de relações institucionais da operadora Tim, Roger Monteiro; gerente executivo de relações institucionais norte-nordeste da Tim, Luiz Fortes; e a advogada da operadora Tim, Márcia Bonito. Da operadora Vivo: o assessor executivo da Diretoria de Relações Institucionais da operadora, Eduardo Leal Macedo, e gerente de vendas da operadora Vivo no Tocantins, Orlan Alves Cardoso. Da operadora Claro: Quero aqui agradecer a presença à advogada da operadora Claro no Tocantins, Luma Mayara, e ao gerente da filial da Claro, Rainer Oliveira da Cruz. Da operadora Oi: agradeço a presença ao diretor re relações institucionais no Distrito Federal, da Diretoria de Planejamento Executivo, João Antônio Monteiro Tavares; representante de relações institucionais da referida operadora no Estado do Tocantins, Cláudio Roberto; e o advogado da operadora Oi, Alexandre Nunes Cachoeira. -

A Situação Do Serviço De Telefonia Na Amazônia Ção Do Serviço De Telefoni a N Am Zôni a Si T U a Ção Do Serviço

Biblioteca Digital da Câmara dos Deputados Centro de Documentação e Informação Coordenação de Biblioteca http://bd.camara.gov.br "Dissemina os documentos digitais de interesse da atividade legislativa e da sociedade.” Câmara dos Deputados ação parlamentar A Situação do Serviço de Telefonia na Amazônia A SI T U A ÇÃO DO SERVIÇO DE TELEFONI A N A AM A ZÔNI A Comissão da Amazônia, Integração Nacional e de Desenvolvimento Regional Brasília ı 2010 Mesa da Câmara dos Deputados 53ª Legislatura – 4ª Sessão Legislativa 2010 Presidente Michel Temer 1O Vice-Presidente Marco Maia 2O Vice-Presidente Antônio Carlos Magalhães Neto 1O Secretário Rafael Guerra 2O Secretário Inocêncio Oliveira 3O Secretário Odair Cunha 4O Secretário Nelson Marquezelli Suplentes de Secretário 1O Suplente Marcelo Ortiz 2O Suplente Giovanni Queiroz 3O Suplente Leandro Sampaio 4O Suplente Manoel Junior Diretor-Geral Sérgio Sampaio Contreiras de Almeida Secretário-Geral da Mesa Mozart Vianna de Paiva ação parlamentar Câmara dos Deputados Comissão da Amazônia, Integração Nacional e de Desenvolvimento Regional A Situação do Serviço de Telefonia na Amazônia Audiência pública realizada pela Comissão da Amazônia, Integração Nacional e de De- senvolvimento Regional so- bre a “A Situação do Serviço de Telefonia na Amazônia”, em 5 de maio de 2009, na Câmara dos Deputados. Centro de Documentação e Informação Edições Câmara Brasília | 2010 CÂMARA DOS DEPUTADOS DIRETORIA LEGISLATIVA Diretor Afrísio Vieira Lima Filho CENTRO DE DOCUMENTAÇÃO E INFORMAÇÃO Diretor Adolfo C. A. R. Furtado COORDENAÇÃO -

Prospecto-Preliminar-Gvt.Pdf

Prospecto Preliminar de Oferta Pública de Distribuição Primária de Ações Ordinárias de Emissão da GVT (Holding) S.A. ospecto Preliminar está sujeito a a sujeito está Preliminar ospecto GVT (HOLDING) S.A. Companhia Aberta de Capital Autorizado - CVM nº 02011-7 CNPJ nº 03.420.904/0001-64 - NIRE nº 41300071331 Rua Lourenço Pinto, nº 299, 4º andar, Curitiba, PR Código ISIN BRGVTTACNOR8 52.000.000 Ações Valor da Distribuição: R$[●] odo de distribuição. No contexto desta Oferta (conforme definido abaixo), estima-se que o Preço por Ação (conforme definido abaixo) estará situado entre R$11,00 e R$16,00, ressalvado, no entanto, que o Preço por Ação poderá, eventualmente, ser fixado fora dessa faixa indicativa. nifestou a seu respeito. O presente Pr A GVT (Holding) S.A. (“Companhia”) está realizando uma oferta pública primária de 52.000.000 ações ordinárias (“Oferta”), todas nominativas, escriturais, sem valor nominal (“Ações”), a ser realizada na República Federativa do Brasil (“Brasil”), sob a coordenação do Banco de Investimentos Credit Suisse (Brasil) S.A. (“Coordenador Líder”) e do Banco UBS Pactual S.A. (“UBS Pactual” e, em conjunto com o Coordenador Líder “Coordenadores”), com esforços de colocação no exterior a serem realizados por Credit Suisse Securities (USA) LLC, UBS Securities LLC, ABN AMRO Inc. e J.P. Morgan Securities, Inc. A Oferta e o aumento de capital com a emissão das Ações foram aprovados por deliberação do Conselho de Administração da Companhia, em reunião realizada em 12 de janeiro de 2007, conforme ata a ser publicada no Diário Oficial do Estado do Paraná e nos jornais “Gazeta do Povo” de Curitiba e “Valor Econômico”, edição nacional. -

Grupo Oi Anexo 2.6 – Laudo Econômico-Financeiro

Grupo Oi Anexo 2.6 – Laudo Econômico-Financeiro Rio de Janeiro, 21 de dezembro de 2017 Sumário Considerações Gerais ................................................................................................. 4 Limitações ................................................................................................................. 6 Atualizações do Laudo Econômico-Financeiro ............................................................. 8 Contextualização ........................................................................................................ 9 Breve Histórico do Setor .......................................................................................... 9 Histórico do Grupo Oi ............................................................................................ 11 Situação Econômico-Financeira do Grupo Oi ........................................................... 14 A Companhia e o Mercado de Telecom ...................................................................... 17 Estrutura Societária da Oi ...................................................................................... 17 Descrição das Recuperandas ................................................................................. 19 Análise de Mercado ............................................................................................... 21 Indicadores Financeiros da Oi e do Mercado ........................................................... 23 Projeção Econômico-Financeira ............................................................................... -

TELEFÓNICA, S.A. (Exact Name of Registrant As Specified in Its Charter)

As filed with the Securities and Exchange Commission on April 12, 2006 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2005 Commission file number: 1-9531 TELEFÓNICA, S.A. (Exact name of Registrant as specified in its charter) KINGDOM OF SPAIN (Jurisdiction of incorporation or organization) Gran Vía, 28, 28013 Madrid, Spain (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Name of each Title of each class exchange on which registered Ordinary Shares, nominal value €1.00 per share* New York Stock Exchange American Depositary Shares, each representing three New York Stock Exchange Ordinary Shares * Not for trading, but only in connection with the listing of American Depositary Shares, pursuant to the requirements of the New York Stock Exchange. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None The number of outstanding shares of each class of capital stock of Telefónica, S.A. at December 31, 2005 was: Ordinary Shares, nominal value €1.00 per share: 4,921,130,397 Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ⌧ No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. -

Brasil Telecom Holding Co

SECURITIES AND EXCHANGE COMMISSION FORM 6-K/A Current report of foreign issuer pursuant to Rules 13a-16 and 15d-16 Amendments [amend] Filing Date: 2005-08-31 | Period of Report: 2005-09-30 SEC Accession No. 0001292814-05-001467 (HTML Version on secdatabase.com) FILER BRASIL TELECOM HOLDING CO Mailing Address Business Address SIA/SUL ASP LOTE D BLOCO SIA/SUL ASP LOTE D BLOCO CIK:1066115| IRS No.: 000000000 B 1ST FLOOR B 1ST FLOOR Type: 6-K/A | Act: 34 | File No.: 001-14477 | Film No.: 051059893 BRASILIA DF D5 71215000 BRASILIA DF D5 71215000 SIC: 4813 Telephone communications (no radiotelephone) 55 61 415-1140 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K/A REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934 THROUGH AUGUST 30, 2005 (Commission File No. 1-14477) BRASIL TELECOM PARTICIPAÇÕES S.A. (Exact name of registrant as specified in its charter) BRAZIL TELECOM HOLDING COMPANY (Translation of Registrant's name into English) SIA Sul, Área de Serviços Públicos, Lote D, Bloco B Brasília, D.F., 71.215-000 Federative Republic of Brazil (Address of Regristrant's principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F ______ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)__. -

Processo Nº 53500.010080/2019-55 Interessado: Algar Telecom S/A, ALGAR CELULAR S.A., Algar Multimídia S/A, Brasil Telecom Comunicação Multimídia Ltda

13/06/2019 2301 Página 1 de 1 Imprimir Boletim de Serviço Eletrônico em 13/06/2019 AGÊNCIA NACIONAL DE TELECOMUNICAÇÕES DESPACHO DECISÓRIO Nº 3/2019/RCTS/SRC Processo nº 53500.010080/2019-55 Interessado: Algar Telecom S/A, ALGAR CELULAR S.A., Algar Multimídia S/A, Brasil Telecom Comunicação Multimídia Ltda. (02.041.460/0001-93), OI S.A. - EM RECUPERAÇÃO JUDICIAL, OI MÓVEL S.A. - EM RECUPERAÇÃO JUDICIAL, Telemar Norte Leste S.A., Claro S.A., TELMEX DO BRASIL S/A, Embratel TVsat Telecomunicações S.A., Empresa Brasileira de Telecomunicações S.A. (Embratel), Nextel Telecomunicações Ltda., Sercomtel Participações S.A., Sercomtel S.A. - Telecomunicações, Telefônica Brasil S.A., TIM S.A., Sky Serviços de Banda Larga Ltda. A SUPERINTENDENTE DE RELAÇÕES COM CONSUMIDORES DA AGÊNCIA NACIONAL DE TELECOMUNICAÇÕES, no uso de suas atribuições legais e regulamentares, em especial a disposta no art. 160, I e IV, do Regimento Interno da ANATEL, aprovado pela Resolução nº 612, de 29 de abril de 2013, considerando: - as razões e justificativas constantes do Informe nº 49/2019/RCTS/SRC (4265244), e - a conveniência e oportunidade da proposta de implementação de mecanismo nacional e centralizado para o registro de intenções de bloqueio dos consumidores para que não recebam ligações de telemarketing, apresentada pelos Interessados em correspondências protocoladas nos autos dos processos nº 53500.012093/2019-69 (Grupo Oi), 53500.012094/2019-11 (Grupo Algar), 53500.012095/2019-58 (Grupo Claro), 53500.012098/2019-91 (Nextel), 53500.012100/2019-22 (Grupo Sercomtel), 53500.012102/2019-11 (Sky), 53500.012103/2019-66 (Grupo Tim), 53500.012104/2019-19 (Grupo Telefônica), DECIDE, com fundamento nos arts. -

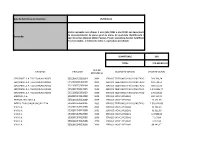

Data De Referência Do Relatório: 05/06/2012 Demanda

Data de Referência do Relatório: 05/06/2012 Multas aplicadas nos últimos 3 anos (abr/2009 a abr/2012) em decorrência de descumprimento de plano geral de metas de qualidade identificando o Demanda: tipo de serviço (Serviço Móvel Pessoal, TV por assinatura, Serviço Telefônico Fixo Comutado), o motivo da multa e a operadora penalizada. QUANTIDADE 190 TOTAL 275.429.825,32 ANO DE ENTIDADE PROCESSO DESCRIÇÃO SERVIÇO VALOR APLICADO REFERÊNCIA SERCOMTEL S.A. TELECOMUNICACOES 535160049302004 2009 SERVICO TELEFONICO FIXO COMUTADO 519.399,24 SERCOMTEL S.A. TELECOMUNICACOES 535000238592008 2009 SERVICO TELEFONICO FIXO COMUTADO 878.744,51 SERCOMTEL S.A. TELECOMUNICACOES 535160075292004 2009 SERVICO TELEFONICO FIXO COMUTADO 489.531,50 SERCOMTEL S.A. TELECOMUNICACOES 535000139942005 2009 SERVICO TELEFONICO FIXO COMUTADO 1.240.985,77 SERCOMTEL S.A. TELECOMUNICACOES 535160016202003 2009 SERVICO TELEFONICO FIXO COMUTADO 476.625,50 AMERICEL S.A. 535000134932008 2009 SERVIÇO MOVEL PESSOAL 485.313,33 TELEMIG CELULAR S.A 535000134912008 2009 SERVIÇO MOVEL PESSOAL 17.451,69 INTELIG TELECOMUNICACOES LTDA 535000152642005 2009 SERVICO TELEFONICO FIXO COMUTADO 1.820.426,88 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 34.556,34 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 35.315,00 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 147.886,96 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 7.117,84 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 3.312,94 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 88.443,17 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 65.424,78 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 51.447,53 VIVO S.A. -

Brasil Telecom Participações SA

www.brasiltelecom.com.br Brasil Telecom Participações S.A. Relatório Anual 2001 Annual Report Relatório Anual 2001 2001 Annual Report Perfil corporativo Mensagem do Presidente do Conselho de Administração Corporate profile Message from the Chairman of the Board of Directors Nome Name O ano de 2001 representou mais um desafio para a Brasil Telecom. O dinamismo do setor The year 2001 was a big challenge for Brasil Telecom. The Brasil Telecom Participações S.A. Brasil Telecom Participações S.A. dinamism of the telecom sector demanded the commitment of the Incorporation de telecomunicações exigiu o comprometimento de toda a Empresa, que pode ser constata- Fundação Incorporated on May 22, 1998, from the spin-off of Sistema Telebrás, whole Company, which can be seen in the year´s achieved results. Constituída em 22 de maio de 1998, a partir da cisão do Sistema Telebrás, a Brasil Telecom do nos resultados alcançados. Brasil Telecom Participações S.A. (then Tele Centro Sul Participações As CEO and Investor Relations Officer of Brasil Telecom Participações Participações S.A. (à época Tele Centro Sul Participações S.A.) foi adquirida em leilão de privati- S.A.) was acquired through a privatization auction, held on July 29 of Henrique Neves contribuiu para essa conquista enquanto Presidente e Diretor de Relações S.A., Henrique Neves contributed to this achievement. The execu- zação, realizado no dia 29 de julho do mesmo ano, pela Solpart Participações S.A., que hoje the same year, by Solpart Participações S.A., which now holds 19% of the Company’s total capital. com Investidores da Brasil Telecom Participações S.A. -

Wireline Market Analysis Assessment Using Arcgis Geostatistical Analyst Extension

Wireline Market Analysis Assessment using ArcGIS Geostatistical Analyst Extension Maria da Conceição Pereira (Marketing - Brasil Telecom) Adriano Martins Junqueira (Business Development – Imagem) George Eduardo Serra Almeida (Geoprocessing Analyst – Imagem) Abstract The solution was customized to understand the structural factors of the Brazilian cities for cross- selling proposes. The ArcGIS Geostatistical Analyst extension was used for exploratory spatial data analysis and to create a statistically valid surface. The analisys was developed using a municipal Geodatabase (more than 800 variables and 5561 cities). The final cluster (market segments) was composed for 12 groups with different patterns for cultural, infrastructural and urban behavior. The results were integrated to marketing users of Brasil Telecom - a brazilian wireline operator - for forecasts and cross-selling proposes. The results presented herre are fictitious, ilustrating the employed method and the potential of ESRI Tools for the generation of models for estimating market potential. 1. Environment The Brasil Telecom S.A. – Brt - is a telecom company and provides services in Brazil in Region II, covering the states of Acre, Rondônia, Mato Grosso, Mato Grosso do Sul, Tocantins, Goiás, Santa Catarina, Paraná e Rio Grande do Sul, as in Distrito Federal. Nowadays, the working area correspondes about 23% of the population, 25% of the GDP and 33% of the national territory (aproximately 2,8 million Km2). The Brt provides voice services for local and long distance modalities, in national intra-sectorial and intra-regional areas, as for the public telephoning system, data communication, network services (infrastructure for other telecom companies or network capacity rental), value added services and supplementary services, sech as conference, call identification, virtual answering machine, 0800 and others. -

OECD Telecommunication and Broadcasting Review of Brazil 2020 Brazil 2020 Brazil of Review Broadcasting and Telecommunication OECD

OECD Telecommunication and Broadcasting Review of azil 2020 Br OECD Telecommunication and Broadcasting Review of Brazil 2020 OECD Telecommunication and Broadcasting Review of Brazil 2020 This work is published under the responsibility of the Secretary-General of the OECD. The opinions expressed and arguments employed herein do not necessarily reflect the official views of OECD member countries. This document, as well as any data and map included herein, are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area. The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law. Please cite this publication as: OECD (2020), OECD Telecommunication and Broadcasting Review of Brazil 2020, OECD Publishing, Paris, https://doi.org/10.1787/30ab8568-en. ISBN 978-92-64-31744-4 (print) ISBN 978-92-64-93255-5 (pdf) Photo credits: Cover © Sarunyu_foto/Shutterstock; © ElenVD/Shutterstock. Corrigenda to publications may be found on line at: www.oecd.org/about/publishing/corrigenda.htm. © OECD 2020 The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions. FOREWORD 3 Foreword The OECD Directorate for Science, Technology and Innovation (DSTI) carried out this study under the auspices of the Committee on Digital Economy Policy (CDEP) and the Working Party of Communication Infrastructures and Services Policy (WPCISP).