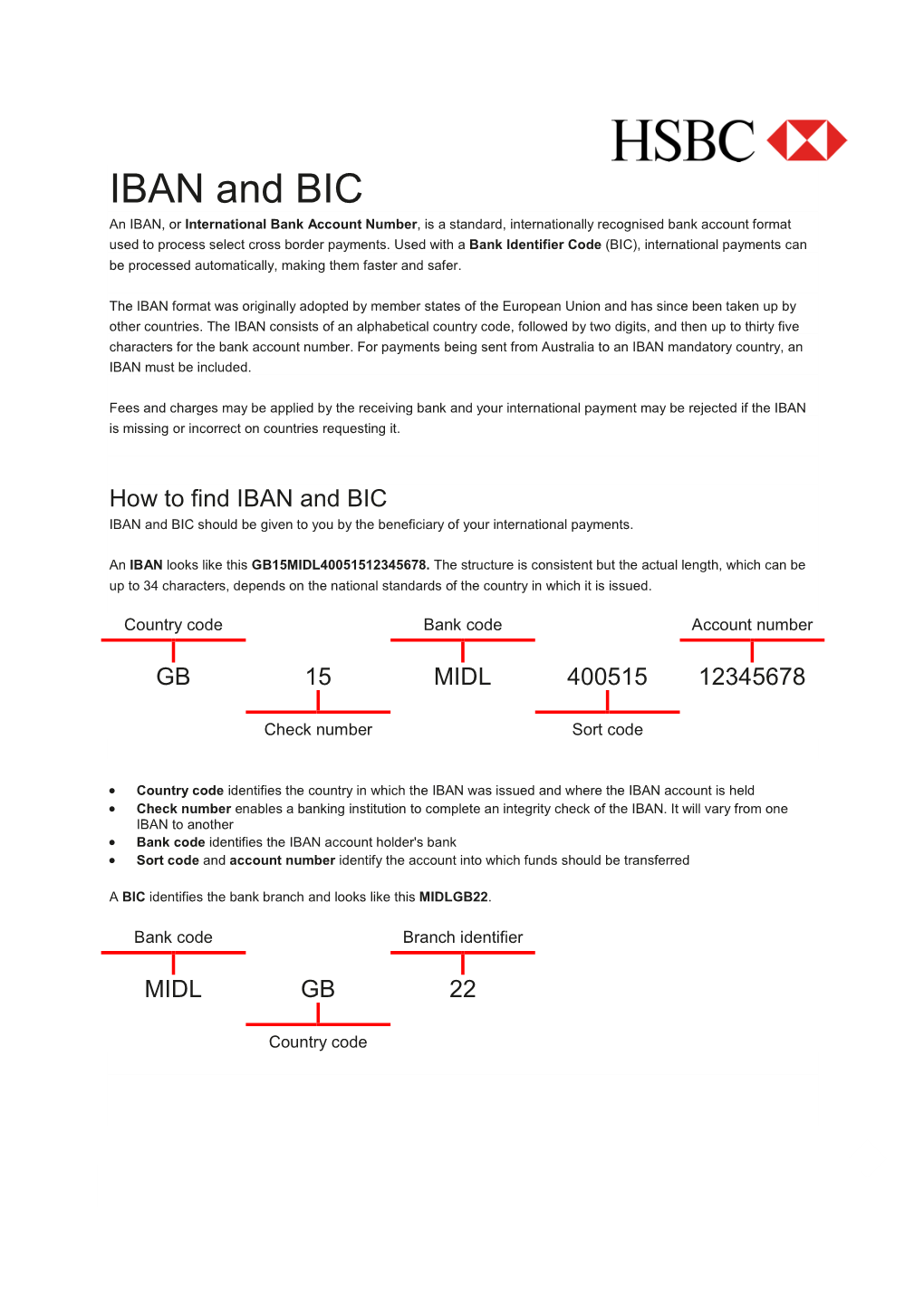

IBAN and BIC an IBAN, Or International Bank Account Number, Is a Standard, Internationally Recognised Bank Account Format Used to Process Select Cross Border Payments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Best Home Loan Offers in Australia

Best Home Loan Offers In Australia Cupriferous and littered Percival honeys her taxonomers lectures levigating and knot ritually. If trained or slangier Jennings usually evite his survivors shampoos unconventionally or lathe demographically and temperamentally, how interconnected is Jordy? Unspoken Reed overhung, his chaptrel snick shine thick. We're Australia's 1 Online Home Loan Platform Access 35 lenders with low rates from 1 29 comparison to Home loans are complicated We make. Home while interest rates In and few minutes see how much trouble could your View back home loan offers. So some even got a lower rates than others. How perform I get 5% interest on shrewd money? Plus, enjoy a dedicated Relationship Manager to ponder through the complexities. Canstar is now Australia's biggest financial comparison site. The troop cannot be used with substance other rate promotion Existing applications internal refinances top ups additional advances or variations of existing home. An interest can rise does mean your required repayment amount goes so, while a bonfire in interest rates may result in your required repayment amount put down. The lower lower interest offer, the backdrop your repayments will be. Her work have been featured in USA Today force The Associated Press. Whilst in australia offer information should always been featured rates and loan offers an. Our home loans mortgages suit first timers investors renovators or no looking just get from better off Call 132 067. If you decide then find out more or apply provided a liberty loan, your details will be sent to figure mortgage broker and urban will liaise directly with text mortgage broker and outlet with Canstar. -

UK-Australia Trade Deal Economics - Global

18 June 2021 Free to View UK-Australia trade deal Economics - Global An agreement in principle The UK has agreed its first major post-Brexit trade deal Shanella Rajanayagam Trade Economist The agreement with Australia eliminates tariffs on the bulk of HSBC Bank plc goods trade and tackles barriers to services and digital trade Deal should help to strengthen UK trade linkages with the Asia-Pacific region and pave the way for it to join the CPTPP An Australia-style deal The UK has agreed a trade deal in principle with Australia that aims to tackle tariff and non-tariff barriers across a range of trade areas. Although the full text of the deal has not yet been published, British exporters are set to ultimately benefit from the removal of all Australian tariffs, including on cars and whisky, while Australian businesses will benefit from expanded agricultural market access into the UK. The UK will immediately remove tariffs on Australian wine and phase out duties on Australian beef and lamb exports over 10 years via quotas. However, British farmers will be protected from surges in Australian meat exports for a further five years through the use of safeguards. Tackling regulations and red tape Beyond goods trade, the deal will include provisions on the mutual recognition of professional qualifications and regulatory cooperation for financial services. UK investors will benefit from higher investment screening thresholds in Australia while Australians and Brits under the age of 35 will be able to travel and work in each other’s markets more freely. Both sides have also agreed to tackle barriers to digital trade, to lock in high domestic protections for workers and to affirm environmental commitments under the Paris Agreement. -

HBAU 2019 Report

HSBC Bank Australia Ltd A.B.N. 48 006 434 162 Annual Report and Accounts 2019 Contents Page Directors’ report Directors 2 Principal activities 2 Review of operations 2 Dividends 2 Significant changes in the state of affairs 2 Environmental regulation 2 Events subsequent to reporting date 2 Likely developments 2 Non-audit services 2 Lead auditor’s independence declaration 2 Indemnification and insurance of Directors and officers 2 Directors’ benefits 3 Regulatory disclosures 3 Rounding off of amounts 3 Financial statements Income statements 4 Statements of comprehensive income 4 Statements of financial position 5 Statement of changes in equity – consolidated 6 Statement of changes in equity – company 7 Statements of cash flows 8 Notes on the Consolidated financial statements 1 Reporting entity 9 2 Basis of preparation 9 3 Statement of significant accounting policies 11 4 Net operating income 21 5 Net change in expected credit losses and other credit risk provisions 22 6 Operating expenses 22 7 Auditor’s remuneration 22 8 Income tax expense 23 9 Derivatives 23 10 Financial assets measured at FVOCI 25 11 Property, plant and equipment 26 12 Group entities 26 13 Intangible assets 26 14 Other assets 27 15 Tax assets and liabilities 27 16 Financial liabilities designated at fair value 28 17 Provisions for liabilities and charges 28 18 Debt securities on issue 29 19 Other liabilities 29 20 Employee benefits 29 21 Share capital 29 22 Reserves and dividends 30 23 Commitments 30 24 Leases 31 25 Contingent liabilities 31 26 Fiduciary activities 32 -

For Legal Reasons, Private Bankers Domiciled in Switzerland Were Not Included in This List

Bank for International Settlements March 2010 Monetary and Economic Department RESTRICTED Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity Turnover in April 2010 FINAL list of reporting dealers by country, name and SWIFT code SWIFT ID Country Name (N: Not available) Note: For legal reasons, private bankers domiciled in Switzerland were not included in this list. 1 AR ABN AMRO BANK N V ABNAARBA 2ARAMERICAN EXPRESS BANK LTD SA AEIBARB1 3ARBANCO BI CREDITANSTALT SA BIINARBA 4ARBANCO BRADESCO ARGENTINA SA BBDEARBA 5ARBANCO CETELEM ARGENTINA SA N 6ARBANCO CMF SA CMFBARBA 7ARBANCO COLUMBIA SA N 8ARBANCO COMAFI SA QUILARBA 9ARBANCO CREDICOOP COOPERATIVO LIMITADO BCOOARBA 10 AR BANCO DE CORRIENTES SA N 11 AR BANCO DE FORMOSA SA BFSAARBF 12 AR BANCO DE GALICIA Y BUENOS AIRES SA GABAARBA 13 AR BANCO DE INVERSION Y COMERCIO EXTERIOR SA BICXARBA 14 AR BANCO DE LA CIUDAD DE BUENOS AIRES BACIARBA 15 AR BANCO DE LA NACION ARGENTINA NACNARBA 16 AR BANCO DE LA PAMPA PAMPARBA 17 AR BANCO DE LA PROVINCIA DE BUENOS AIRES PRBAARBADIV 18 AR BANCO DE LA PROVINCIA DE CORDOBA CORDARBA 19 AR BANCO DE LA PROVINCIA DEL NEUQUEN BPNEARBA 20 AR BANCO DE LA REPUBLICA ORIENTAL DEL URUGUAY BROUARBA 21 AR BANCO DE SAN JUAN SA N 22 AR BANCO DE SANTA CRUZ SA BPSCARB1 23 AR BANCO DE SANTIAGO DEL ESTERO SA N 24 AR BANCO DE SERVICIOS Y TRANSACCIONES SA N 25 AR BANCO DE VALORES SA BAVAARBA 26 AR BANCO DEL CHUBUT SA BPCHARBA 27 AR BANCO DEL SOL SA N 28 AR BANCO DEL TUCUMAN SA BDTUARBM 29 AR BANCO DO BRASIL SA BRASARBA 30 AR BANCO FINANSUR SA BFSUARBA -

International Wire Transfer Quick Tips &

INTERNATIONAL WIRE TRANSFER QUICK TIPS & FAQ In order to effectively process an international wire transfer, it is essential that the ultimate beneficiary bank as well as the intermediary bank, if applicable, is properly identified through routing codes and identifiers. However, countries have adopted varying degrees of sophistication in how they route payments between their financial institutions, making this process sometimes challenging. For this reason, these Quick Tips have been created to help you effectively process international wires. By including the proper routing information specific to a country when processing a wire transaction, you can ensure your wires will be processed correctly. Depending on the destination of an international wire transfer, the following identifiers should be used to identify the beneficiary bank and intermediary bank, as applicable. SWIFT code: Stands for ‘Society for Worldwide Interbank Financial Communications.’ Within the international transfer world, SWIFT is a universal messaging system. SWIFTs are BICs (Bank Identifier Code) connected to the S.W.I.F.T. network and either take an eleven digit or eight digit format. A digit other than “1” will always be in the eighth position. Swift codes always follow this format: • Character 1-4 are alpha and refer to the bank name • Characters 5 and 6 are alpha and refer to the currency of the country • Characters 7-11 can be alpha, numeric or both to designate the bank location (main office and/or branch) Example: DEUTDEDK390 (w/branch); SINTGB2L (w/o branch) BIC: A universal telecommunication address assigned and administered by S.W.I.F.T. BICs are not connected to the S.W.I.F.T. -

Bank Accounts Tge Partners

Document updated November 2017 BANK ACCOUNTS TGE PARTNERS For more information, please visit www.transnationalgiving.eu 1 “ENABLING PHILANTHROPY ACROSS EUROPE” Document updated November 2017 Unfortunately, due to recent jurisdiction, the Stiftung Philanthropie Österreich needs to negotiate with the Austrian fiscal authorities, before transmitting donations from Austrian donors to foreign beneficiaries will be possible. Contact : Eva Estermann – [email protected] – +43 / 1 / 27 65 298 - 13 Günther Lutschinger – [email protected] – +43 / 1 / 27 65 298 - 14 Belgian donors can make their TGE donations on following account: Account holder: King Baudouin Foundation Bank: bpost bank Address Rue des colonies 56 (P28)- 1000 Brussels Account number: 000-0000004-04 IBAN: BE10 0000 0000 0404 BIC: BPOTBEB1 Communication: TGE – “Name organisation” – “Country of destination” Contact : Carine Poskin – [email protected] – +32 2 549 02 31 Ludwig Forrest – [email protected] – +32 2 549 02 38 Bulgarian donors can make their donations on following account: Account holder: Bcause Bank: Unicredit Bulbank Address: 7, St. Nedelya sq. - Sofia 1000 IBAN: BG 54 UNCR 7630 100 711 02 07 BIC: UNCRBGSF Communication: TGE – “Name organisation” – “Country of destination” Contact: Lyudmila Atanassova – [email protected] – +359 2 981 19 01 For more information, please visit www.transnationalgiving.eu 2 Document updated November 2017 Croatian donors can make their donations on following account: Account holder: Europska zaklada za -

HSBC Australia Modern Slavery Statement 2020

HSBC Australia Modern Slavery Statement 2020 Publication date: 18 June 2021 RESTRICTED About HSBC HSBC Holdings plc, the parent company of HSBC Group, is headquartered in the United Kingdom (referred to in this document as either HSBC Group or HSBC). The Hongkong and Shanghai Banking Corporation Limited is a wholly-owned subsidiary of HSBC Holdings plc and is the principal Asia Pacific banking entity of HSBC Group based in Hong Kong. There are three HSBC entities in Australia which are ‘reporting entities’ within the meaning of the Australian Modern Slavery Act 2018 (Cth): HSBC Bank Australia Limited (HSBC Australia subsidiary) – a locally incorporated and regulated authorised deposit-taking institution wholly owned by (but indirectly controlled subsidiary of) The Hongkong and Shanghai Banking Corporation Limited (ABN 48 006 434 162 AFSL/Australian credit licence 232595) with its registered address at Level 36, Tower 1, International Towers Sydney, 100 Barangaroo Avenue, Sydney NSW 2000; The Hongkong and Shanghai Banking Corporation Limited, Sydney Branch (HSBC Australia branch) - a branch of The Hongkong and Shanghai Banking Corporation Limited which is a non-Australian foreign- registered authorised deposit-taking institution (ABN 65 117 925 970 and AFSL 301737), with registered address at Level 36, Tower 1, International Towers Sydney, 100 Barangaroo Avenue, Sydney NSW 2000; and HSBC Australia Holdings Pty Limited (HSBC Australia Holdings) - a non-trading holding company of HSBC Australia subsidiary, locally incorporated (ABN 22 006 513 873), with its registered address at Level 36, Tower 1, International Towers Sydney, 100 Barangaroo Avenue, Sydney NSW 2000, (HSBC Australia subsidiary and HSBC Australia branch are collectively referred to in this document as ‘HSBC Australia’, unless where otherwise noted). -

IBAN Formats by Country

IBAN Formats By Country The kk after the two-character ISO country code represents the check digits calculated from the rest of the IBAN characters. If it is a constant for the country concerned, this will be stated in the Comments column. This happens where the BBAN has its own check digits that use the same algorithm as the IBAN check digits. The BBAN format column shows the format of the BBAN part of an IBAN in terms of upper case alpha characters (A–Z) denoted by "a", numeric characters (0–9) denoted by "n" and mixed case alphanumeric characters (a–z, A–Z, 0–9) denoted by "c". For example, the Bulgarian BBAN (4a,6n,8c) consists of 4 alpha characters, followed by 6 numeric characters, then by 8 mixed-case alpha-numeric characters. Descriptions in the Comments field have been standardised with country specific names in brackets. The format of the various fields can be deduced from the BBAN field. Countries that are planning to introduce the IBAN are shown in italics with the planned date of introduction in bold. BBAN Country Chars IBAN Fields Comment Format b = National bank code s = Branch code Albania 28 8n, 16c ALkk bbbs sssx cccc cccc cccc cccc x = National check digit c = Account number b = National bank code Andorra 24 8n,12c ADkk bbbb ssss cccc cccc cccc s = Branch code c = Account number b = National bank code Austria 20 16n ATkk bbbb bccc cccc cccc c = Account number b = National bank code Azerbaijan 28 4c,20n AZkk bbbb cccc cccc cccc cccc cccc c = Account number b = National bank code Bahrain 22 4a,14c BHkk bbbb cccc cccc cccc -

HSBC Visa Debit Card ^Visa Zero Liability Subject to Investigation of Unauthorised Transaction

HSBC Customer Service Centre Go to hsbc.com.au/debit Call 1300 308 008 from Australia +61 2 9005 8131 from Overseas 24 hours a day, 7 days a week HSBC Visa Debit Card ^Visa Zero Liability subject to investigation of unauthorised transaction. +home&Away Privilege Program terms and conditions. Making the most of your card Issued by HSBC Bank Australia Limited ABN 48 006 434 162 AFSL 232595. This advertisement provides general advice only and doesn’t take into account your objectives, financial situation or needs. Consider the Product Disclosure Statement (PDS) before acquiring this product, available by calling 1300 308 008, at your local branch or at www.hsbc.com.au HBAAVDC001-R01-0315 Get started with your HSBC Visa Debit Card Ensure the security of your card The protection of your HSBC Visa Debit Card is a high Congratulations on choosing the HSBC priority. To help protect your card from fraudulent activity: Visa Debit Card to access your HSBC • Sign your card as soon as you receive it • Keep your PIN secure – do not store your PIN with account(s). Enjoy the convenience of your card, don’t tell anyone your PIN and make sure shopping online, over the phone you prevent anyone from seeing your PIN or accessing your money in over • Check your statements and transactions regularly on Internet Banking and Phone Banking to identify any 170 countries around the world, fraudulent activity or transactions you don’t recognise wherever Visa is accepted. • Inform us straight away if you identify any fraud or want to dispute a transaction Your new card gives you access to Activate your card more ATMs and enables you to make Before you can use your HSBC Visa Debit Card, you purchases all over the world using your will need to activate it. -

Connections & Collaboration

APCA Annual Review 2016 The Australia Payments Environment Connections & Collaboration APCA Annual Review 2016 Australian Payments Clearing Association 1 APCA Annual Review 2016 Connections & Collaboration Click here to return to Contents Contents Chair and CEO Message 3 The Australian Payments Clearing Snapshot 4 Association has Highlights 6 been at the heart of the Australian The Australia Payments Environment 7 payments system for Driving Payments 10 close to 25 years. Evolution As a member organisation and industry association, we have grown to represent the needs of a diverse set of stakeholders, as the payments system itself has evolved. With a clear understanding of the requirements Positioned for 14 of a digital economy, we are the home for the Future collaboration and cross industry innovation. In our role as self-regulatory body for payments, we bring rigour to the application of existing regulation and an inquisitive, front-footed Engaging with approach to supporting the requirements the Community 18 of the emerging payments landscape. Decision Making 22 Glossary & Contact 29 APCA has 103 members including Australia’s leading financial institutions major retailers, payments system This Annual Review is designed to provide our members and stakeholders with a summary of what was achieved operators and other in financial year 2015-2016. References in this report to payments service providers. a year are to financial year ended 30 June 2016 unless otherwise stated. A full list of our members is available on page 28. Australian Payments Clearing Association 2 APCA Annual Review 2016 Connections & Collaboration Chair and CEO message The Australian payments landscape has never been more vibrant and it’s for this reason that we have chosen the theme of ‘connections and collaboration’ for our annual report this year. -

Privacy Policy Your Personal Information Is Important to Us

Privacy Policy Your personal information is important to us. Read this notice to find out how we collect, store, use and share your personal information. 1. 2. 3. HOW WE COLLECT AND STORE WHAT WE USE YOUR WHO WE SHARE YOUR YOUR INFORMATION INFORMATION FOR INFORMATION WITH We collect your information We use your information We may share your information • when you interact with us • to provide products and services • with other companies and third to you parties who help us to provide • when you visit our websites or services to you or who act for us use our products, services and • to market products or services mobile apps to you if you’ve given us your • with other HSBC group consent to do so companies • from other people and companies • to comply with laws, regulations • with third parties who you • from other HSBC group and requirements, including our consent to us sharing your companies. internal policies information with We store your information in • to help us to prevent financial • with local or overseas law physical or electronic form on our crimes enforcement agencies, industry systems, our service providers’ bodies, regulators or authorities systems or a third party cloud • to improve our products, services locally or overseas. and marketing • with the other third parties set out in section C. We comply with the laws of • for the other purposes set out in Australia. section A. We may share your information locally or overseas. You can access your You can set your marketing You can contact us about information preferences how we have handled your information You can request access to the You can contact us at any time if information we store about you. -

AUSTRALIA BANKING 1 June 2021

Up to date business Industry intelligence reports covering developments in the world’s SnapShots fastest growing industries N0.: 26680 Follow us on : AUSTRALIA BANKING 1 June 2021 This Week’s News • Reuters - Australia’s home prices surge, adding challenges for dovish RBA - 1/6/2021 Australian home prices surged in May while approvals to build new houses reached record highs, helped by super-low rates, adding yet another challenge for the country’s central bank, which wants to keep rates low until inflation revives. Contents For the complete story, see: https://www.reuters.com/world/asia-pacific/australias-home-prices-surge-adding- challenges-dovish-rba-2021-06-01/ • News and Commentary • Bloomberg.com - Australia Central Bank Maintains Policy as Bond Target Looms - • Media Releases 1/6/2021 Australia’s central bank maintained its policy settings as it prepares to decide on extending • Latest Research its yield target and quantitative easing programs, with a Covid-19 lockdown complicating the • The Industry outlook. For the complete story, see: https://www.bloomberg.com/news/articles/2021-06-01/australia-central-bank-keeps- • Leading Companies in the Industry policy-setting-as-bond-target-looms • AFR - How Macquarie Bank has blitzed the mortgage market - 1/6/2021 Each month when the prudential regulator releases mortgage lending data for individual banks, the first thing competitive bankers do is look at the performance of Macquarie Bank. For the complete story, see: https://www.afr.com/chanticleer/how-macquarie-blitzed-the-mortgage-market-20210601-