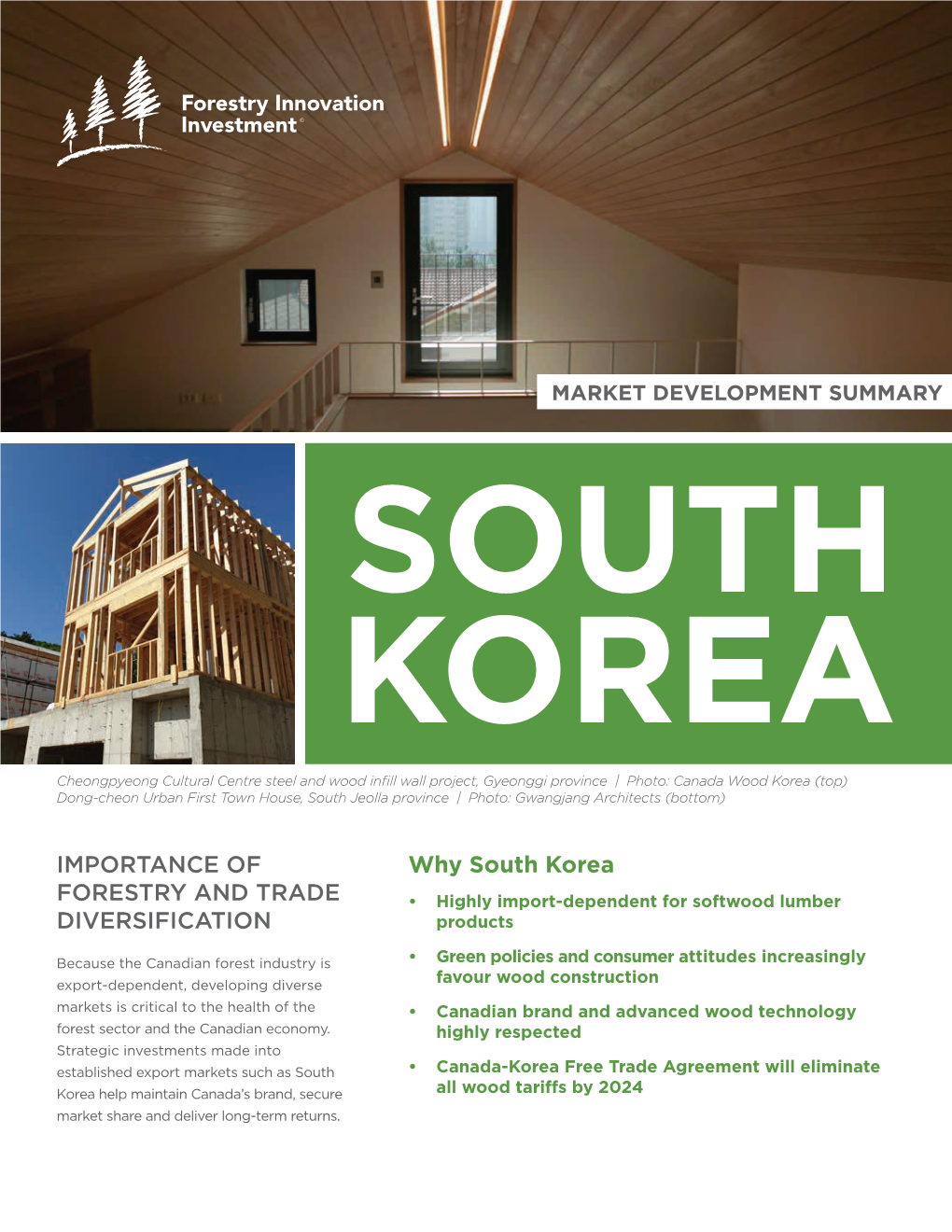

Why South Korea FORESTRY and TRADE • Highly Import-Dependent for Softwood Lumber DIVERSIFICATION Products

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Metro Lines in Gyeonggi-Do & Seoul Metropolitan Area

Gyeongchun line Metro Lines in Gyeonggi-do & Seoul Metropolitan Area Hoeryong Uijeongbu Ganeung Nogyang Yangju Deokgye Deokjeong Jihaeng DongducheonBosan Jungang DongducheonSoyosan Chuncheon Mangwolsa 1 Starting Point Destination Dobongsan 7 Namchuncheon Jangam Dobong Suraksan Gimyujeong Musan Paju Wollong GeumchonGeumneungUnjeong TanhyeonIlsan Banghak Madeul Sanggye Danngogae Gyeongui line Pungsan Gireum Nowon 4 Gangchon 6 Sungshin Baengma Mia Women’s Univ. Suyu Nokcheon Junggye Changdong Baekgyang-ri Dokbawi Ssangmun Goksan Miasamgeori Wolgye Hagye Daehwa Juyeop Jeongbalsan Madu Baekseok Hwajeong Wondang Samsong Jichuk Gupabal Yeonsinnae Bulgwang Nokbeon Hongje Muakjae Hansung Univ. Kwangwoon Gulbongsan Univ. Gongneung 3 Dongnimmun Hwarangdae Bonghwasan Sinnae (not open) Daegok Anam Korea Univ. Wolgok Sangwolgok Dolgoji Taereung Bomun 6 Hangang River Gusan Yeokchon Gyeongbokgung Seokgye Gapyeong Neunggok Hyehwa Sinmun Meokgol Airport line Eungam Anguk Changsin Jongno Hankuk Univ. Junghwa 9 5 of Foreign Studies Haengsin Gwanghwamun 3(sam)-ga Jongno 5(o)-gu Sinseol-dong Jegi-dong Cheongnyangni Incheon Saejeol Int’l Airport Galmae Byeollae Sareung Maseok Dongdaemun Dongmyo Sangbong Toegyewon Geumgok Pyeongnae Sangcheon Banghwa Hoegi Mangu Hopyeong Daeseong-ri Hwajeon Jonggak Yongdu Cheong Pyeong Incheon Int’l Airport Jeungsan Myeonmok Seodaemun Cargo Terminal Gaehwa Gaehwasan Susaek Digital Media City Sindap Gajwa Sagajeong Dongdaemun Guri Sinchon Dosim Unseo Ahyeon Euljiro Euljiro Euljiro History&Culture Park Donong Deokso Paldang Ungilsan Yangsu Chungjeongno City Hall 3(sa)-ga 3(sa)-ga Yangwon Yangjeong World Cup 4(sa)-ga Sindang Yongmasan Gyeyang Gimpo Int’l Airport Stadium Sinwon Airprot Market Sinbanghwa Ewha Womans Geomam Univ. Sangwangsimni Magoknaru Junggok Hangang River Mapo-gu Sinchon Aeogae Dapsimni Songjeong Office Chungmuro Gunja Guksu Seoul Station Cheonggu 5 Yangcheon Hongik Univ. -

Nansook Hong

Not logged in Talk Contributions Create account Log in Article Talk Read Edit View history Search Wikipedia Nansook Hong From Wikipedia, the free encyclopedia This is a Korean name; the Main page Korean name Contents family name is Hong. Hangul 홍난숙 Featured content Nansook Hong (born 1966), is Current events Hanja 洪蘭淑 the author of the Random article Revised Romanization Hong Nan-suk autobiography, In the Shadow Donate to Wikipedia McCune–Reischauer Hong Nansuk Wikipedia store of the Moons: My Life in the Reverend Sun Myung Moon's Interaction Family, published in 1998 by Little, Brown and Company. It gave her account Help of her life up to that time, including her marriage to Hyo Jin Moon, the first About Wikipedia son of Unification Church founder and leader Sun Myung Moon and his wife Community portal Hakja Han Moon.[1] Recent changes Contact page Contents [hide] Tools 1 In the Shadow of the Moons What links here 2 Hyo Jin Moon Related changes 3 Notes Upload file 4 References Special pages Permanent link Page information In the Shadow of the Moons [ edit ] Wikidata item Cite this page In the Shadow of the Moons: My Life in the Reverend Sun Myung Moon's Family is a 1998, non-fiction work by Hong and Boston Globe reporter Eileen Print/export McNamara, published by Little, Brown and Company (then owned by Time Create a book Warner). It has been translated into German[2] and French.[3] Download as PDF Author and investigative reporter Peter Maass, writing in the New Yorker Printable version Magazine in 1998, said that Hong's divorce was the Unification Church's Languages "most damaging scandal", and predicted that her then unpublished book 日本語 would be a "tell-all memoir".[4] In October 1998, Hong participated in an Edit links online interview hosted by TIME Magazine, in which she stated: "Rev. -

I Love Korea!

I Love Korea! TheThe story story of of why why 33 foreignforeign tourists tourists fellfell in in love love with Korea. Korea. Co-plannedCo-planned by bythe the Visit Visit Korea Korea Committee Committee & & the the Korea Korea JoongAng JoongAng Daily Daily I Love Korea! The story of why 33 foreign tourists fell in love with Korea. Co-planned by the Visit Korea Committee & the Korea JoongAng Daily I Love Korea! This book was co-published by the Visit Korea Committee and the Korea JoongAng Daily newspaper. “The Korea Foreigners Fell in Love With” was a column published from April, 2010 until October, 2012 in the week& section of the Korea JoongAng Daily. Foreigners who visited and saw Korea’s beautiful nature, culture, foods and styles have sent in their experiences with pictures attached. I Love Korea is an honest and heart-warming story of the Korea these people fell in love with. c o n t e n t s 012 Korea 070 Heritage of Korea _ Tradition & History 072 General Yi Sun-sin 016 Nature of Korea _ Mountains, Oceans & Roads General! I get very emotional seeing you standing in the middle of Seoul with a big sword 018 Bicycle Riding in Seoul 076 Panmunjeom & the DMZ The 8 Streams of Seoul, and Chuseok Ah, so heart breaking! 024 Hiking the Baekdudaegan Mountain Range Only a few steps separate the south to the north Yikes! Bang! What?! Hahaha…an unforgettable night 080 Bukchon Hanok Village, Seoul at the Jirisan National Park’s Shelters Jeongdok Public Library, Samcheong Park and the Asian Art Museum, 030 Busan Seoul Bicycle Tour a cluster of -

Chronology of the Life and Works of True Parents ~ Guide to the Chronology

Chronology of the Life and Works of True Parents ~ Guide to the Chronology 1. Major providential events and achievements that True Parents initiated or conducted are recorded in order of date. If no precise date is known the entry is marked n.d. 2. In choosing which events to include, priority was given to events that True Parents directly presided over or participated in. 3. For conferences, the date indicates when the event began or the day on which True Parents attended. For international speaking tours, dates reflect the full span of the tour plus the day on which True Parents arrived in the country. 4. Where dates on the lunar calendar or heavenly calendar are included, they are written in a shortened form, with the month and date, followed by LC for lunar calendar or HC for heavenly calendar. For example, l .13 HC would mean the 13th day of the l st month by the heavenly calendar. 5. To look up material related to itemized events in the Cheon 11 Guk scriptures, the number of the corresponding page and extract number are indicated for content that can be found in Chambumo Gyeong and Cheon Seong Gyeong, and for Pyeong Hwa Gyeong the beginning page number of the speech that contains the related material is listed. For example, [CBG 122-6) refers the reader to excerpt number 6 on page 122 of Chambumo Gyeong. [CSG 1240- 22) refers the reader to excerpt number 22 on page 1240 of Cheon Seong Gyeong; and [PHG 20 I] informs the reader that related content may be found in a speech beginning on page 201 of Pyeong Hwa Gyeong. -

Bf File220150922161930.Pdf

True Parents’ Message and News September 2015 English Version No. 16 天一國 3年 天曆 8 ARTICLE ONE Welcoming True Father’s Third Universal Seonghwa By Ryu Kyeong Seok rue Father came to earth as the savior of mankind, the Messiah and True Parent and completed all his missions in the providence of restoration. Three years have now passed since he went to heaven. Looking back, True Mother had meaningfully named the past three years as a period of dedicated mourning. She looked after the Bonhyangwon, True Father’s grave, with a heart of loyalty, filial piety and passion as she struggled on earth to liberate True Father forever. Moreover, this dedication period was also one to establish Tthe 7.5 billion people, starting from members and blessed families, in front of Heaven’s will. On the foundation of this dedication, a great ceremony for True Father’s Third Universal Seongwha Anniversary was held on August 30 (7.17 on heavenly calendar) with the catchphrase “Let’s Connect the World with Peace.” Thirty thousand members from around the world attended this me- morial. This event became an opportunity for members from around the globe to resolve firmly to carry on True Parents’ achievements and work for world peace. It was a precious time in which True Parents’ noble status could be raised high as the will of the Family Federation and twenty other providential institutes and organizations was streamed on the internet live to 194 countries, The First Sunhak Peace Prize Award Ceremony occurred among many other events. It was a meaningful moment as globally prominent figures, including the Sunhak laureates, received proof of our deep respect for True Parents. -

June 2005 Unification News

UnificationUnification NewsNews $2 Volume 24, No. 6 T HE N EWSPAPER OF THE U NIFICATION C OMMUNITY June 2005 TheThe Forty-thirdForty-third DayDay ofof AllAll TrueTrue ThingsThings CelebrationCelebration inin KoreaKorea Era was a period during which You established the way of Abel through offering the blood of animals representing all creatures!" True Father reported his heart and love toward the world of creation to Heavenly Father. For hoondokhae, Dr. Kwak read from the page 99 of the Cheon Seong Gyeong. As there were some Korean politicians among the participants, Father spoke simply, briefly and joyfully and in the end he asked some of the elder members to sing songs. Father, Mother, Kook-jin nim and Kwon-jin nim also joined in the singing. Father said the conclusion is he Forty-third Day of All True Things was will for the world of creation will be fulfilled. that with absolute love, absolute faith and absolute celebrated in Korea on June 7, 2005 at The commemorative service ended with a prayer obedience we should relate to all things; then God's the Cheongpyeong Heaven and Earth from Dr. Kwak and three cheers of mansei guided Training Center. by Rev. Yang Chang-shik The altar for this historic day is quite different TTo celebrate the forty-third Day of All True Things from our past offering tables. The front is is lined with True Parents, around 7,000 people traveled with beautiful pants and flowers symbolizing the from around Korea to the Cheongpyeong Heaven creation. Then seven tall white candles line the next and Earth Training Center, arriving at different times area in front of the fruit. -

Information Concerning the Cheongpyeong Workshop Schedule for April, 2012

세계통일교 선교본부 Unification Church World Mission Headquarters 13F Dowon Bldg., Dohwa 2 dong Mapo-gu, Seoul, Republic of Korea 121-728 Tel: (82-2) 3275-4200 Fax: (82-2) 3275-4220 E-mail: [email protected] Ref. No. WMH 2012-34 To : Regional Presidents, National Messiahs, National Leaders From : Unification Church World Mission Headquarters Date : 2.28 by the Heavenly Calendar (March 20, 2012) Re. : Information concerning the Cheongpyeong Workshop Schedule for April, 2012 May God and True Parents’ blessings and love be with all regions, mission nations and providential organizations. Ancestor Liberation Ceremonies and Ancestor Blessing Ceremonies for generations 1-210 have begun from October. Please make a 21-day condition of devotion (breakfast fast or 50 bows) regardless of the number of generations you are liberating before coming to participate in an Ancestor Liberation Ceremony. True Parents instructed the following: “All Blessed Families throughout the world must finish the Ancestor Liberation and Blessing up to and including the 210th generation by December 31, 2012, before the Foundation Day.” All members throughout the world can liberate all possible groups of ancestors at any of the 2-day Workshops held throughout the year. During this time of the blessing of the True Parents of Heaven, Earth and Humankind, ancestor liberation ceremonies for the generations from 211 until 420 are being carried out (from October, 2011). Furthermore, the ancestor blessing ceremony for the next set of 7 generations will be conducted from March. See below for more detailed information. Members from all over the world that cannot come to Cheongpyeong can apply for ancestor liberation and ancestor blessing ceremony from their countries until December 31, 2012. -

The Unification Church: a Kaleidoscopic Introduction Barker, Eileen

www.ssoar.info The unification church: a kaleidoscopic introduction Barker, Eileen Veröffentlichungsversion / Published Version Zeitschriftenartikel / journal article Empfohlene Zitierung / Suggested Citation: Barker, E. (2018). The unification church: a kaleidoscopic introduction. Society Register, 2(2), 19-62. https:// doi.org/10.14746/sr.2018.2.2.03 Nutzungsbedingungen: Terms of use: Dieser Text wird unter einer CC BY-NC Lizenz (Namensnennung- This document is made available under a CC BY-NC Licence Nicht-kommerziell) zur Verfügung gestellt. Nähere Auskünfte zu (Attribution-NonCommercial). For more Information see: den CC-Lizenzen finden Sie hier: https://creativecommons.org/licenses/by-nc/4.0 https://creativecommons.org/licenses/by-nc/4.0/deed.de Diese Version ist zitierbar unter / This version is citable under: https://nbn-resolving.org/urn:nbn:de:0168-ssoar-62323-4 SOCIETY REGISTER | 2018 | 2(2): 19–62 | ISSN 2544–5502 http://societyregister.eu/ | DOI: 10.14746/sr.2018.2.2.03 Article EILEEN BARKER1 London School of Economics and Political Sciences, United Kingdom ORCID 0000-0001-5247-7204 THE UNIFICATION CHURCH: 2 A KALEIDOSCOPIC INTRODUCTION Abstract: The Unification Church, or the Unificationism, also known as HAS-UWC (Holy Spirit Association for the Unification of World Christianity) or ‘Moonies’ (the term deemed now as disre- spectful) but originating from the name of the founder Sun Myung Moon, who set up this Christian religious movement in Northern Korea in 1954 has approximately 3 million followers worldwide. Its existence and popularity are a global phenomenon, interesting not only for sociologists of religion but for politicians, philosophers and people of faith. The impact of this movement and the two-way social change remain a rare subject of study and this paper aims to fill the gaps and to discuss contemporary situation in regards to its followers. -

한국과 베트남의 성공적 수원 사례 Successful ASIAN RECIPIENTS : Case Studies of Korea and VIETNAM1)

한국과 베트남의 성공적 수원 사례 Successful ASIAN RECIPIENTS : Case Studies of Korea and VIETNAM1) Woojin Jung KOICA Policy Analyst ([email protected]) 목차 Ⅰ. Introduction Ⅱ. The Case of South Korea Ⅲ. The Case of Vietnam Ⅳ. Common Themes from Case Studies Ⅴ. Implications for Paris ++ Ⅵ. Conclusion * 본문은 KOICA, JICA, 브루킹스가 공동으로 추진 중인 국제공동연구 ‘Catalyzing Development : A New Vision for Aid’ 중 Aid Works 부분임. 1) This is a draft paper written as a part of the KOICA-JICA-Brookings joint study “Catalyzing Development: A New Vision for Aid” in preparation for the 4th High Level Forum on Aid Effectiveness. This version of the paper does not include the Indonesia and Cambodia case studies. The study is drawn upon literature reviews, semi-structured interviews, and workshops with various experts in Korea, Vietnam and the U.S. representing a wide array of development players including bilateral donor agencies, partner countries, non-state actors, international organizations, think-tanks, and universities (see the list of interviewees and workshop participants). 120 한국국제협력단 Ⅰ. Introduction Ⅱ Given that the 4th High Level Forum on Aid Effectiveness (HLF-4) will be held in Asia, 개 it offers an excellent opportunity to showcase successful episodes of growth facilitated 발 협 through aid in Asian countries. This essay aims to explore the successful utilization of aid 력 in selected countries and sharpen the dialogue on themes leading up to the HLF-4. The 논 Busan Declaration will be an opportunity to shift the story from “aid is wasted and does 단 not work” to “aid works, and we now have simpler and constant principles to make it work even better.” Among countries which received a sizable amount of development assistance, South Korea and Vietnam, are exemplary models that catalyze development and reduce poverty with a relatively modest increase in inequality. -

Gapyeong Circle Bus Timetable

Circle Tour Bus Service Hours Information on Gapyeong Circle Tour Bus and Frequency for Going Up Gapyeong Terminal The Garden of Morning Calm Bus Route Map GGGaaapppyyyeeeooonnnggg Bus Route 1st 2nd 3rd 4th 5th Departure: Boarding Place by Course Gapyeong Terminal 09:00 11:00 13:00 15:00 17:00 Tour Course: Gapyong Terminal Jara Island (Ewhawon, Camping Site) Jara Island 09:05 11:05 13:05 1:05 17:05 Gapyeong Station CCCiiirrrcccllleee TTTooouuurrr BBBuuusss Nami Island (Zip-wire) Geumdae-ri Hall Gapyeong Station 09:10 11:10 13:10 15:10 17:10 Petite France (Chongpyong Ferries, Nami Island 09:15 11:15 13:15 15:15 17:15 Ryu Mi-jae Gallery House) Cheongpyeong Terminal Geumdae-ri Hall 09:25 11:25 13:25 15:25 17:25 Cheongpyeong Station In front of Imcho Bridge Petite France 19:40 11:40 13:40 15:40 17:40 The Garden of Morning Calm (Chi-Ong Art Center) Cheongpyeong Terminal 10:00 12:00 14:00 16:00 18:00 Cheongpyeong Station 10:05 12:05 14:05 16:05 18:05 In front of Imcho Bridge 10:20 12:20 14:20 16:20 18:20 The Garden of Morning Calm 10:30 12:30 14:.30 16:30 18:30 Gapyeong Terminal Jara Island Gapyeong Station Nami Island Geumdae-ri Ewhawon Campground Zip-wire Hall Tour Bus Service Hours The Garden of Morning Calm InfrontofImcho Cheongpyeong Cheongpyeong Petite France Traditional Korean style Bridge Station Terminal Chongpyong Ferries and Frequency for Going Down Chi-ong Art Center Ryu Mi-jae Gallery House The Garden of Morning Calm Gapyeong Terminal Bus Route 1st 2nd 3rd 4th 5th How to Use The Garden of Morning Calm 11:00 13:00 15:00 17:00 Within the Bus Route, Free Unlimited Bus Ride with One Day Pass In front of Imcho Bridge 11:10 13:10 15:10 17:10 Sightseeing after Getting on/off at each boarding place by course Cheongpyeong Station 08:25 11:25 13:25 15:25 17:25 Entrance Fee for Each Tourist Destination and use fare is not included. -

Information Concerning the 167Th Cheongpyeong 40-Day Workshop and the 81St 40- Day Special Workshop for Blessed Wives

세계통일교 선교본부 Unification Church World Mission Headquarters 13F Dowon Bldg., Dohwa 2 dong Mapo-gu, Seoul, Republic of Korea 121-728 Tel: (82-2) 3275-4200 Fax: (82-2) 3275-4220 E-mail: [email protected] Ref. No. WMH 2012-110 To : Regional Presidents, National Messiahs, National Leaders From : Unification Church World Mission Headquarters Date : 8.13 by the Heavenly Calendar (September 28, 2012) Re. : Information Concerning the 167th Cheongpyeong 40-day Workshop and the 81st 40- day Special Workshop for Blessed Wives May God and True Parents’ blessings and love be with all regions, mission nations and providential organizations. The Cheongpyeong 40-day Workshop, as an important workshop for inheriting True Parents’ victorious realm and completing the three great blessings, was started from March 12, 1996 based on True Parents’ words, and now the 166th Cheongpyeong 40-day workshop is being held in the midst of grace. The Cheongpyeong 40-day Workshop will be held for the purpose of double- checking one’s faith, making a new start and solving individual and family problems. Regarding the Cheongpyeong 40-day Special Workshop for Blessed Wives, True Father said; “There is no way to resolve all the wrong things that you have done after receiving the Blessing without reporting them. Because of that, if you report all those things during the 40-day period, then Heavenly Father can record all of it thoroughly, and will solve the contents one by one. Without doing this, you will never be able to resolve things. Father spoke of the significance of the Cheongpyeong 40-day Special Workshop for Blessed Wives saying that it is a period during which God remembers the details of the lives of the members of each blessed family, as well as providing an opportunity to engraft each blessed family to Heavenly Fortune. -

The Peace Palace Grand Opening June 13, 2006, Seorak-Myon, Korea Welcome to the Peace Palace!

“God, please forgive all people who are wait- ing for Your embrace. Please make this a time for them to be filled with joyfulness by the special pardon of heavenly grace.” Sun Myung Moon, A prayer at Cheongpyeong Lake The Peace Palace Grand Opening June 13, 2006, Seorak-myon, Korea Welcome to the Peace Palace! oing up into the mountains for meditation has long been a tradition among Over the years, the first wood pavilion built by Father Moon and a few followers the peace-loving people of Korea. Before Rev. Sun Myung Moon came to one summer has grown into a large campus, with a graduate theological seminary, a GAmerica, Cheongpyeong Lake was his retreat from the pressures of Seoul. middle school, meditation center, prayer hall, thermal bathhouse, senior citizens’ The world was in the throes of the Cold War, his country was rebuilding from the residence and more. Its modern hospital draws on the best of Oriental and Western devastation of war, and his church had limited resources. As he prayed, the vision medicine to bring healing to the spirit and body. The palace will be the setting for grew that one day there would be a peace village here and people from all over the peace conferences, and its museum will chronicle peace-building initiatives. world would come to his homeland to learn the ways of peace. The June 13 festivities evoke the spirit of King Sejong the Great, and the golden age Cheongpyeong is place of beauty for communing with nature, God, our fellow hu- of Korean culture in the 15th century.