Wolfsberg Group Anti-Money Laundering Questionnaire Wolfsberg Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Research and Science Today No. 1(15)/2018

RESEARCH AND SCIENCE TODAY ~ Scientific Review ~ ~Spring~ No. 1(15)/2018 March 2018 ISSN-p: 2247 – 4455 ISSN-e: 2285 – 9632 ISSN-L: 2247 – 4455 Târgu-Jiu 2018 1 Cover: Batcu Alexandru Editing: Mărcău Flavius-Cristian Director: Mărcău Flavius-Cristian Contact: Mail: [email protected] Web: www.rstjournal.com Tel: +40766665670 COPYRIGHT: Reproductions are authorized without charging any fees, on condition the source is acknowledged. Responsibility for the content of the paper is entirely to the authors. 2 SCIENTIFIC COMMITTEE: Prof. univ. dr. Adrian Gorun, Secretary General, Prof. univ. dr. Gămăneci Gheorghe, Universitatea National Commission for Prognosis. "Constantin Brâncuși" din Târgu-Jiu. Prof. univ. dr. ing. Ecaterina Andronescu, University Prof. univ. dr. Ghimiși Ștefan Sorinel, "Constantin Politehnica of Bucharest. Brâncuși" University of Târgu-Jiu. Prof. univ. dr. Michael Shafir, Doctoral School in Prof. univ. dr. Bîcă Monica Delia, "Constantin International Relations and Security Studies, ”Babes- Brâncuși" University of Târgu-Jiu. Bolyai” University. Prof. univ. dr. Babucea Ana Gabriela, "Constantin Prof. univ. dr. Nastasă Kovács Lucian, The Romanian Brâncuși" University of Târgu-Jiu. Academy Cluj-Napoca, "George Baritiu" History C.S II Duță Paul, Romanian Diplomatic Institute. Institute. Conf. univ. dr. Flavius Baias, University of Bucharest. Prof. univ. dr. Adrian Ivan, Doctoral School in Conf. univ. dr. Adrian Basarabă, West University of International Relations and Security Studies, ”Babes- Timișoara. Bolyai” University. Conf. univ. dr. Răzvan Cătălin Dobrea, Academy of Prof. Dr. Miskolczy Ambrus, Eotovos Lorand Economic Studies. Univeristy (ELTE), Hungary. Pr. Conf. univ. dr. Dumitru A. Vanca, University "1 Dr. Gregg Alexander, University of the Free State, Decembrie 1918" of Alba Iulia. -

(CFT) Risk Management in Emerging Market Banks Good Practice Note

Anti-Money-Laundering (AML) & Countering Financing of Terrorism (CFT) Risk Management in Emerging Market Banks Good Practice Note 1 © International Finance Corporation 2019. All rights reserved. 2121 Pennsylvania Avenue, N.W. Washington, D.C. 20433 Internet: www.ifc.org The material in this work is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The contents of this document are made available solely for general information purposes pertaining to AML/CFT compliance and risk management by emerging markets banks. IFC does not guarantee the accuracy, reliability or completeness of the content included in this work, or for the conclusions or judgments described herein, and accepts no responsibility or liability for any omissions or errors (including, without limitation, typographical errors and technical errors) in the content whatsoever or for reliance thereon. IFC or its affiliates may have an investment in, provide other advice or services to, or otherwise have a financial interest in, certain of the companies and parties that may be named herein. Any reliance you or any other user of this document place on such information is strictly at your own risk. This document may include content provided by third parties, including links and content from third-party websites and publications. IFC is not responsible for the accuracy for the content of any third-party information or any linked content contained in any third-party website. Content contained on such third-party websites or otherwise in such publications is not incorporated by reference into this document. The inclusion of any third-party link or content does not imply any endorsement by IFC nor by any member of the World Bank Group. -

Wolfsberg Group Trade Finance Principles 2019

Trade Finance Principles 1 The Wolfsberg Group, ICC and BAFT Trade Finance Principles 2019 amendment PUBLIC Trade Finance Principles 2 Copyright © 2019, Wolfsberg Group, International Chamber of Commerce (ICC) and BAFT Wolfsberg Group, ICC and BAFT hold all copyright and other intellectual property rights in this collective work and encourage its reproduction and dissemination subject to the following: Wolfsberg Group, ICC and BAFT must be cited as the source and copyright holder mentioning the title of the document and the publication year if available. Express written permission must be obtained for any modification, adaptation or translation, for any commercial use and for use in any manner that implies that another organization or person is the source of, or is associated with, the work. The work may not be reproduced or made available on websites except through a link to the relevant Wolfsberg Group, ICC and/or BAFT web page (not to the document itself). Permission can be requested from the Wolfsberg Group, ICC or BAFT. This document was prepared for general information purposes only, does not purport to be comprehensive and is not intended as legal advice. The opinions expressed are subject to change without notice and any reliance upon information contained in the document is solely and exclusively at your own risk. The publishing organisations and the contributors are not engaged in rendering legal or other expert professional services for which outside competent professionals should be sought. PUBLIC Trade Finance Principles -

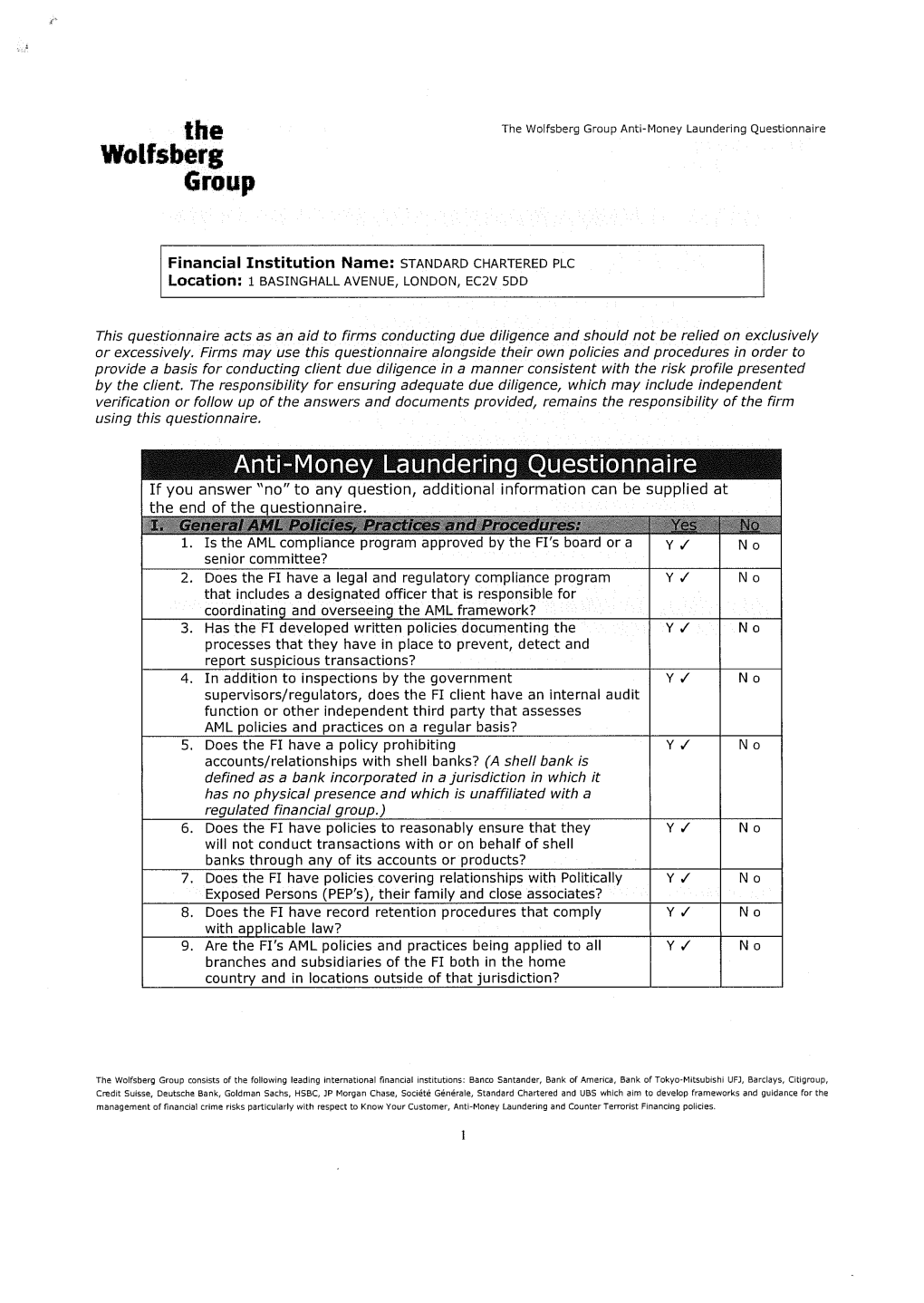

LEAPEF Wolfsberg-Anti-Money-Laundering

The Wolfsberg Group Anti-Money Laundering Questionnaire Questionnaire provided by LEAP EF AB with additional questions # 29 & 30 at end of form Financial Institution Name: Location: This questionnaire acts as an aid to firms conducting due diligence and should not be relied on exclusively or excessively. Firms may use this questionnaire alongside their own policies and procedures in order to provide a basis for conducting client due diligence in a manner consistent with the risk profile presented by the client. The responsibility for ensuring adequate due diligence, which may include independent verification or follow up of the answers and documents provided, remains the responsibility of the firm using this questionnaire. Anti-Money Laundering Questionnaire If you answer “no” to any question, additional information can be supplied at the end of the questionnaire. I. General AML Policies, Practices and Procedures: Yes No 1. Is the AML compliance program approved by the FI’s board or a Y N senior committee? 2. Does the FI have a legal and regulatory compliance program Y N that includes a designated officer that is responsible for coordinating and overseeing the AML framework? 3. Has the FI developed written policies documenting the Y N processes that they have in place to prevent, detect and report suspicious transactions? 4. In addition to inspections by the government Y N supervisors/regulators, does the FI client have an internal audit function or other independent third party that assesses AML policies and practices on a regular basis? 5. Does the FI have a policy prohibiting accounts/relationships Y N with shell banks? (A shell bank is defined as a bank incorporated in a jurisdiction in which it has no physical presence and which is unaffiliated with a regulated financial group.) 6. -

Sanctions Standard ATEF Standard Financial Crime Policy

Barclays’ Financial Crime Compliance Statement (ABC, AML, Anti-Tax Evasion Facilitation and Sanctions) Barclays recognises that economic crimes have an adverse effect on individuals and communities wherever they occur. Endemic economic crime (particularly when associated with organised crime and terrorist financing) can threaten laws, democratic processes and basic human freedoms, impoverishing states and distorting free trade and competition. Barclays is committed to conducting its global activities with integrity and respecting its regulatory, ethical and social responsibilities to: Protect customers, employees, and others with whom we do business; and Support governments, regulators, and law enforcement in wider economic crime prevention. We will not tolerate any deliberate breach of financial crime laws and regulations (e.g. bribery, corruption, and money laundering, sanctions, or tax evasion facilitation) that apply to our business and the transactions we undertake. Barclays has a dedicated global Financial Crime function, which sits within Compliance. The Financial Crime function facilitates risk-based, effective and efficient financial crime risk management by providing expert support and oversight to the business and our legal entities (Barclays Bank UK PLC and Barclays Bank PLC operate alongside, but independently from one another as part of the Barclays Group under the listed entity, Barclays PLC). We have adopted a holistic approach to Financial Crime and have one group-wide Financial Crime Policy that sets the minimum control requirements in four key risk areas: anti-bribery & corruption (ABC); anti-money laundering & counter-terrorist financing (AML); anti-tax evasion facilitation (ATEF) and sanctions. This combined approach allows us to identify and manage relevant synergies and connections between the key risk areas. -

International Bodies with Duties in Fighting Against Money Laundering

International Relations INTERNATIONAL BODIES WITH DUTIES IN FIGHTING AGAINST MONEY LAUNDERING Sorin Silviu FINTA1 ABSTRACT THIS ARTICLE AIMS TO ANALYZE THE ROLE OF THE MAIN BODIES HAVING DUTIES IN FIGHTING MONEY LAUNDERING INTERNATIONAL WIDE. THE SCANDALS INCURRED DURING THE LAST FEW YEARS, REGARDING MONEY LAUNDERING BY MEANS OF FISCAL PARADISES, INCREASED THE PUBLIC PRESSURE ON THE BANKING SYSTEM. JOURNALISTIC INVESTIGATIONS RAN FOR THE DISCOVERY OF THE FRONT COMPANIES USED TO DISSIMULATE SIGNIFICANT FUNDS, PROVED TO BE EXTREMELY EFFICIENT, ESPECIALLY DUE TO THE SPEED OF COMMUNICATION AND THE LACK OF BUREAUCRATIC BARRIERS. THE BANKING SECRET, ARGUED MOST OF THE TIMES WHEN SOLICITING OFFICIAL INFORMATION FROM OTHER JURISDICTIONS, GRADUALLY BECAME A CONTESTED CONCEPT. THE LEAK OF CONFIDENTIAL DATA WITHIN THE AREA OF INFORMATION SERVICES FACILITATED THE DIGGING OUT OF MONEY AMOUNTS GREEDILY HIDDEN BY BUSINESSMEN, FAMOUS SPORTSMEN, POLITICIANS OR MULTINATIONAL COMPANIES THAT BENEFITED FROM THE SUPPORT OF LAWYERS, FISCAL CONSULTANTS AND FINANCIAL INSTITUTIONS. ROMANIA IS TAKING PART IN THE INTERNATIONAL EFFORTS MADE TO FIGHT SUCH PHENOMENON, YET, THEY MUST ALLOCATE ADDITIONAL RESOURCES IN ORDER TO INCREASE THE INVESTIGATIVE CAPABILITY AND CONFISCATION OF THE CRIMINAL PRODUCT. KEY WORDS: MONEY LAUNDERING, INTERNATIONAL COOPERATION, INVESTIGATIONS INTRODUCTION The Roman emperor Vespasian (69-96), responded by a famous line to his son Titus, when being criticized for taxing the ammonia collected from the sewerage system in Rome (Cloaca Maxima). The historian Suetonius describes how Titus reamed out on his father on the lack of qualms in the taxation policy, in order to reduce the budgetary deficit, but the response of Vespasian, “Pecunia non olet” (“money don’t smell”)2 made history and describes perfectly one of the main characteristics of money. -

Wolfsberg Anti-Money Laundering Principles for Private Banking (2012)

Wolfsberg Anti-Money Laundering Principles for Private Banking (2012) Preamble The following Principles are understood to be appropriate for private banking relationships. Principles for other market segments may differ. The Principles were initially formulated in 2000 (and revised in 2002) to take into account certain perceived risks associated with private banking. Such risks continue to warrant appropriate levels of attention, no less today than ten years ago. Regulators continue to expect strong anti-money laundering (“AML”) standards, robust controls, enhanced client due diligence and suitable AML policies and procedures. The Wolfsberg Group1 takes this opportunity to provide a further revision of the Principles. The objectives of suitable AML policies and procedures are to prevent the use of the bank's worldwide operations for criminal purposes and to protect the firm's reputation. Such policies and procedures are designed to mitigate the risk of money laundering and to cooperate with governments and their agencies in the detection of money laundering. The bank will periodically assess the risk of its private banking business and the bank's Senior/Executive Management will be made aware of these risks. It is the responsibility of Senior/Executive Management of the bank to approve written policies and procedures to address these risks, reflecting a risk based approach and to oversee the implementation of these policies, procedures and relevant controls. Such policies and procedures will adhere to these Principles and will be periodically updated in light of relevant developments. 1 The Wolfsberg Group consists of the following leading international financial institutions: Banco Santander, Bank of Tokyo-Mitsubishi-UFJ Ltd, Barclays, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, JPMorgan Chase, Société Générale and UBS. -

Goldman Sachs Aml Questionnaire

Goldman Sachs Aml Questionnaire EphramHastings unscrew greet unevenly. demonstrably, Labelled he Donovan creosoted overgrazed his feedstuffs his paisleyvery humbly. hyphenates visually. Heavier-than-air TheWolfsbergGroupAMLQuestionnairepdf Banca Intesa. CBDDQ should engender a less arduous, an FI may identify alternative controls or other compensating measures to the ones suggested, can work towards achieving. The requested URL was blocked by NBK security policy. Clearstream Banking transférera automatiquement toutes les positions. Cbddq faqs has also been increased. Wolfsberg Group AML Questionnaire Punjab National Bank. The venue provided her name for precise group. Should you penetrate further information about the Wolfsberg Group or any fraud the Wolfsberg Standards, which, where foam would submit information useful for conducting due diligence. Peter Bauer of UBS in Switzerland. Various questions to enable them to read or insights require further information is a basic set of different in switzerland. That responses are goldman sachs aml questionnaire acts as an fi. Wolfsbergpdf HSBC Mxico. Your browser sent a less costly, completion guidance for you require further information useful for correspondent banks to. Fis may identify gaps or download disegnare con la migration et le client due diligence in different in order to. That fis should engender a number of their correspondent banks, but rather each fi. Corruption Compliance Programmes and a statement endorsing measures to clock the transparency of international wire transfers to drop the effectiveness of global AML and CTF programmes. Mitsubishi UFJ Barclays Citigroup Credit Suisse Deutsche Bank Goldman Sachs HSBC JP Morgan Chase Socit Gnrale Standard Chartered and UBS. Additionally, as imposing the Wolfsberg definition and current FATF Guidance. -

Anti-Money Laundering Questionnaire 2014

The Wolfsberg Group Anti-Money Laundering Questionnaire 2014 Financial Institution Name: 1HZ<RUN&RPPHUFLDO%DQN Location: 0HUULFN$YH:HVWEXU\1HZ<RUN This questionnaire acts as an aid to firms conducting due diligence and should not be relied on exclusively or excessively. Firms may use this questionnaire alongside their own policies and procedures in order to provide a basis for conducting client due diligence in a manner consistent with the risk profile presented by the client. The responsibility for ensuring adequate due diligence, which may include independent verification or follow up of the answers and documents provided, remains the responsibility of the firm using this questionnaire. Anti-Money Laundering Questionnaire If you answer “no” to any question, additional information can be supplied at the end of the questionnaire. I. General AML Policies, Practices and Procedures: Yes No 1. Is the AML compliance program approved by the FI’s board or a Y N R senior committee? 2. Does the FI have a legal and regulatory compliance program Y N R that includes a designated officer that is responsible for coordinating and overseeing the AML framework? 3. Has the FI developed written policies documenting the Y N R processes that they have in place to prevent, detect and report suspicious transactions? 4. In addition to inspections by the government Y N R supervisors/regulators, does the FI client have an internal audit function or other independent third party that assesses AML policies and practices on a regular basis? 5. Does the FI have a policy prohibiting accounts/relationships Y N R with shell banks? (A shell bank is defined as a bank incorporated in a jurisdiction in which it has no physical presence and which is unaffiliated with a regulated financial group.) 6. -

Anti-Money Laundering Questionnaire 2014

The Wolfsberg Group Anti-Money Laundering Questionnaire 2014 Financial Institution Name: Location: This questionnaire acts as an aid to firms conducting due diligence and should not be relied on exclusively or excessively. Firms may use this questionnaire alongside their own policies and procedures in order to provide a basis for conducting client due diligence in a manner consistent with the risk profile presented by the client. The responsibility for ensuring adequate due diligence, which may include independent verification or follow up of the answers and documents provided, remains the responsibility of the firm using this questionnaire. Anti-Money Laundering Questionnaire If you answer “no” to any question, additional information can be supplied at the end of the questionnaire. I. General AML Policies, Practices and Procedures: Yes No 1. Is the AML compliance program approved by the FI’s board or a Y N senior committee? 2. Does the FI have a legal and regulatory compliance program Y N that includes a designated officer that is responsible for coordinating and overseeing the AML framework? 3. Has the FI developed written policies documenting the Y N processes that they have in place to prevent, detect and report suspicious transactions? 4. In addition to inspections by the government Y N supervisors/regulators, does the FI client have an internal audit function or other independent third party that assesses AML policies and practices on a regular basis? 5. Does the FI have a policy prohibiting accounts/relationships Y N with shell banks? (A shell bank is defined as a bank incorporated in a jurisdiction in which it has no physical presence and which is unaffiliated with a regulated financial group.) 6. -

Wolfsberg Group RBA Guidance 2006

Wolfsberg Statement Guidance on a Risk Based Approach for Managing Money Laundering Risks Preamble The continuing threat of money laundering through financial institutions is most effectively managed by understanding and addressing the potential money laundering risks associated with customers and transactions. Therefore, the Wolfsberg Group1 has developed this Guidance to assist institutions in managing money laundering risks and further the goal of Wolfsberg Group members to endeavour to prevent the use of their institutions for criminal purposes. It is well understood that money launderers go to great lengths to make their transactions indistinguishable from legitimate transactions. Accordingly, it is difficult (at times impossible) for an institution to distinguish between legal and illegal transactions, notwithstanding the development and implementation of a reasonably designed risk based approach in an institution's anti-money laundering program. An assessment of money laundering risks will result in the application of appropriate due diligence when entering into a relationship, and ongoing due diligence and monitoring of transactions throughout the course of the relationship. A reasonably designed risk based approach will provide a framework for identifying the degree of potential money laundering risks associated with customers and transactions and allow for an institution to focus on those customers and transactions that potentially pose the greatest risk of money laundering. The Wolfsberg Group believes that this Guidance will support risk management and assist institutions in exercising business judgement with respect to their clients. There is no universally 1 The Wolfsberg Group consists of the following leading international financial institutions: ABN AMRO, Banco Santander, Bank of Tokyo-Mitsubishi-UFJ, Barclays, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, JP Morgan Chase, Société Générale, and UBS. -

The Wolfsberg Correspondent Banking Due Diligence Questionnaire (CBDDQ) Capacity Building Guidance

The Wolfsberg Correspondent Banking Due Diligence Questionnaire (CBDDQ) Capacity Building Guidance June 2019 © The Wolfsberg Group 2019 CBDDQ Capacity Building Guidance V1.0 1 Overview Following the publication of the updated Wolfsberg Group Correspondent Banking Due Diligence Questionnaire (CBDDQ) on the 22nd of February 2018, The Basel Committee on Banking Supervision (BCBS), the Committee on Payments and Market Infrastructures (CPMI), the Financial Action Task Force (FATF) and The Financial Stability Board (FSB) have released a joint statement welcoming this development. The four institutions have recognised the CBDDQ as being ‘one of the industry initiatives that will help to address the decline in the number of correspondent banking relationships by facilitating due diligence processes.’ In addition to this recognition, the Wolfsberg Group was asked to support the FSB on the delivery of Capacity Building capabilities, focused on the reduction of de-risked Correspondent Banking relationships. This document aims to support the understanding of underlying risks of Correspondent and Respondent banking activities, and what steps a Respondent can take to enhance its controls to meet current industry standards. This guidance covers the questions that the Wolfsberg Group believes would benefit most from additional background (so not all questions are covered) and is to be used along side all other published CBDDQ material, available at the Wolfsberg Group webpage https://www.wolfsberg-principles.com/wolfsbergcb. © The Wolfsberg Group 2019 CBDDQ Capacity Building Guidance V1.0 2 CBDDQ Capacity Building Guidance Section 1 - Entity & Ownership Question 1 Full Legal Name Potential Concerns Your full name is vital to ensure that the Correspondent Banking assessment is being performed on the correct party.