4.Project Overview[PDF:4.53MB]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Certified Facilities (Cooking)

List of certified facilities (Cooking) Prefectures Name of Facility Category Municipalities name Location name Kasumigaseki restaurant Tokyo Chiyoda-ku Second floor,Tokyo-club Building,3-2-6,Kasumigaseki,Chiyoda-ku Second floor,Sakura terrace,Iidabashi Grand Bloom,2-10- ALOHA TABLE iidabashi restaurant Tokyo Chiyoda-ku 2,Fujimi,Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku 1-8-1 Yurakucho, Chiyoda-ku banquet kitchen The Peninsula Tokyo hotel Tokyo Chiyoda-ku 24th floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Peter The Peninsula Tokyo hotel Tokyo Chiyoda-ku Boutique & Café First basement, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku Second floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Hei Fung Terrace The Peninsula Tokyo hotel Tokyo Chiyoda-ku First floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Lobby 1-1-1,Uchisaiwai-cho,Chiyoda-ku TORAYA Imperial Hotel Store restaurant Tokyo Chiyoda-ku (Imperial Hotel of Tokyo,Main Building,Basement floor) mihashi First basement, First Avenu Tokyo Station,1-9-1 marunouchi, restaurant Tokyo Chiyoda-ku (First Avenu Tokyo Station Store) Chiyoda-ku PALACE HOTEL TOKYO(Hot hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku Kitchen,Cold Kitchen) PALACE HOTEL TOKYO(Preparation) hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku LE PORC DE VERSAILLES restaurant Tokyo Chiyoda-ku First~3rd floor, Florence Kudan, 1-2-7, Kudankita, Chiyoda-ku Kudanshita 8th floor, Yodobashi Akiba Building, 1-1, Kanda-hanaoka-cho, Grand Breton Café -

Evaluation of the Effect of Regional Pollutants and Residual Ozone on Ozone Concentrations in the Morning in the Inland of the Kanto Region

Asian Journal of Atmospheric Environment Vol. 9-1, pp. 1-11, March 2015 Ozone Concentration in the Morning in InlandISSN(Online) Kanto Region 2287-11601 doi: http://dx.doi.org/10.5572/ajae.2015.9.1.001 ISSN(Print) 1976-6912 Evaluation of the Effect of Regional Pollutants and Residual Ozone on Ozone Concentrations in the Morning in the Inland of the Kanto Region Yusuke Kiriyama*, Hikari Shimadera1), Syuichi Itahashi2), Hiroshi Hayami2) and Kazuhiko Miura Tokyo University of Science, Tokyo, Japan 1)Center for Environmental Innovation Design for Sustainability, Osaka University, Osaka, Japan 2)Central Research Institute of Electric Power Industry, Abiko, Japan *Corresponding author. Tel: +81-3-5228-8215, E-mail: [email protected] of stratospheric ozone, and the effect of domestic pol- ABSTRACT lutant sources. Focusing on the Kanto region in Japan (the area in and around metropolitan Tokyo on the Increasing ozone concentrations are observed over Pacific coast of Japan) during summer, seasonal wind Japan from year to year. One cause of high ozone from the Pacific Ocean dominates wind patterns and concentration in the Kanto region, which includes blocks air masses approaching from inland. Pocha- areas inland from large coastal cities such as metro- nart et al. (2002) showed reduced inland air mass to politan Tokyo, is the transportation of precursors by sea breezes. However, high ozone concentrations the Pacific coast of Japan in summer relative to other are also observed in the morning, before sea breezes seasons by monitoring pollutants at remote islands approach inland areas. In this point, there would be and performing backward trajectory analyses. -

Recent Declines in Warming and Vegetation Greening Trends Over Pan-Arctic Tundra

Remote Sens. 2013, 5, 4229-4254; doi:10.3390/rs5094229 OPEN ACCESS Remote Sensing ISSN 2072-4292 www.mdpi.com/journal/remotesensing Article Recent Declines in Warming and Vegetation Greening Trends over Pan-Arctic Tundra Uma S. Bhatt 1,*, Donald A. Walker 2, Martha K. Raynolds 2, Peter A. Bieniek 1,3, Howard E. Epstein 4, Josefino C. Comiso 5, Jorge E. Pinzon 6, Compton J. Tucker 6 and Igor V. Polyakov 3 1 Geophysical Institute, Department of Atmospheric Sciences, College of Natural Science and Mathematics, University of Alaska Fairbanks, 903 Koyukuk Dr., Fairbanks, AK 99775, USA; E-Mail: [email protected] 2 Institute of Arctic Biology, Department of Biology and Wildlife, College of Natural Science and Mathematics, University of Alaska, Fairbanks, P.O. Box 757000, Fairbanks, AK 99775, USA; E-Mails: [email protected] (D.A.W.); [email protected] (M.K.R.) 3 International Arctic Research Center, Department of Atmospheric Sciences, College of Natural Science and Mathematics, 930 Koyukuk Dr., Fairbanks, AK 99775, USA; E-Mail: [email protected] 4 Department of Environmental Sciences, University of Virginia, 291 McCormick Rd., Charlottesville, VA 22904, USA; E-Mail: [email protected] 5 Cryospheric Sciences Branch, NASA Goddard Space Flight Center, Code 614.1, Greenbelt, MD 20771, USA; E-Mail: [email protected] 6 Biospheric Science Branch, NASA Goddard Space Flight Center, Code 614.1, Greenbelt, MD 20771, USA; E-Mails: [email protected] (J.E.P.); [email protected] (C.J.T.) * Author to whom correspondence should be addressed; E-Mail: [email protected]; Tel.: +1-907-474-2662; Fax: +1-907-474-2473. -

From Africa to Eurasia * Early Dispersals Ofer Bar-Yosef! *, A

Quaternary International 75 (2001) 19}28 From Africa to Eurasia * early dispersals Ofer Bar-Yosef! *, A. Belfer-Cohen" !Department of Anthropology, Peabody Museum, Harvard University, Cambridge, MA 02138, USA "Institute of Archaeology, Hebrew University, Jerusalem 91905, Israel Abstract The dispersals of early hominins in the late Pliocene or early Pleistocene into Eurasia were essentially sporadic. Little geographic and temporal continuity is observed between the various dated archaeological contexts, and the lithic assemblages do not demonstrate a techno-morphological continuity. The archaeological evidence from 1.8 to 0.7 Ma indicates at least three waves of early migrations. The earliest sortie involved bearers of core-chopper industries sometime around 1.7}1.6 Ma. Early Acheulean producers followed possibly around 1.4 Ma. The third wave occurred sometime around 0.8 Ma, and is represented by Acheulean groups who manufactured numerous #ake cleavers. The geographic scope of each of these waves is not yet well known.The reasons for &why' early humans dispersed from Africa into Eurasia include the &push' of environmental change and relative &demographic pressure', as well as the opening of new niches. Humans may have gained their meat supplies either from carcasses or through active predation. The archaeological and fossil records demonstrate that Homo erectus was a successful species, and like other successful species it enlarged its geographic distribution at all costs. Even if the trigger for the initial dispersal of Homo erectus remains unknown or controversial, the success of the hominid occupation of the Eurasian habitats was not primarily facilitated by the availability of food, or the human #exibility in food procuring techniques, but by the absence of the zoonotic diseases that plagued and constrained hominins in their African &cradle of evolution'. -

No. 1 Demography and Health in Eastern Europe and Eurasia

Working Paper Series on the Transition Countries No. 1 DEMOGRAPHY AND HEALTH IN EASTERN EUROPE AND EURASIA Ayo Heinegg Robyn Melzig James Pickett and Ron Sprout June 2005 Program Office Bureau for Europe & Eurasia U.S. Agency for International Development 1 Demography and Health in Eastern Europe and Eurasia Ayo Heinegg Academy for Educational Development Email: [email protected] Robyn Melzig U.S. Agency for International Development, Washington DC Email: [email protected] James Pickett U.S. Agency for International Development, Washington DC Email: [email protected] Ron Sprout U.S. Agency for International Development, Washington DC Email: [email protected] Abstract: Eastern Europe and Eurasia is the only region worldwide experiencing a contraction in population, which stems from both a natural decrease in the population (i.e., crude death rates exceeding crude birth rates) and emigration. The highest crude death rates in the world are found among the transition countries; so too the lowest fertility rates. This study analyzes these trends and attempts to assess some of the underlying health factors behind them. The report also examines the evidence regarding migration patterns, both political aspects (including trends in refugees and internally displaced persons) and economic aspects (including remittances, urbanization, and brain drain). 2 USAID/E&E/PO Working Paper Series on the Transition Countries September 2006 No.1 Demography and Health (June 2005) No.2 Education (October 2005) No.3 Economic Reforms, Democracy, and Growth (November 2005) No.4 Monitoring Country Progress in 2006 (September 2006) No.5 Domestic Disparities (forthcoming) No.6 Labor Markets (forthcoming) No.7 Global Economic Integration (forthcoming) The findings, interpretations, and conclusions expressed in these working papers are entirely those of the authors. -

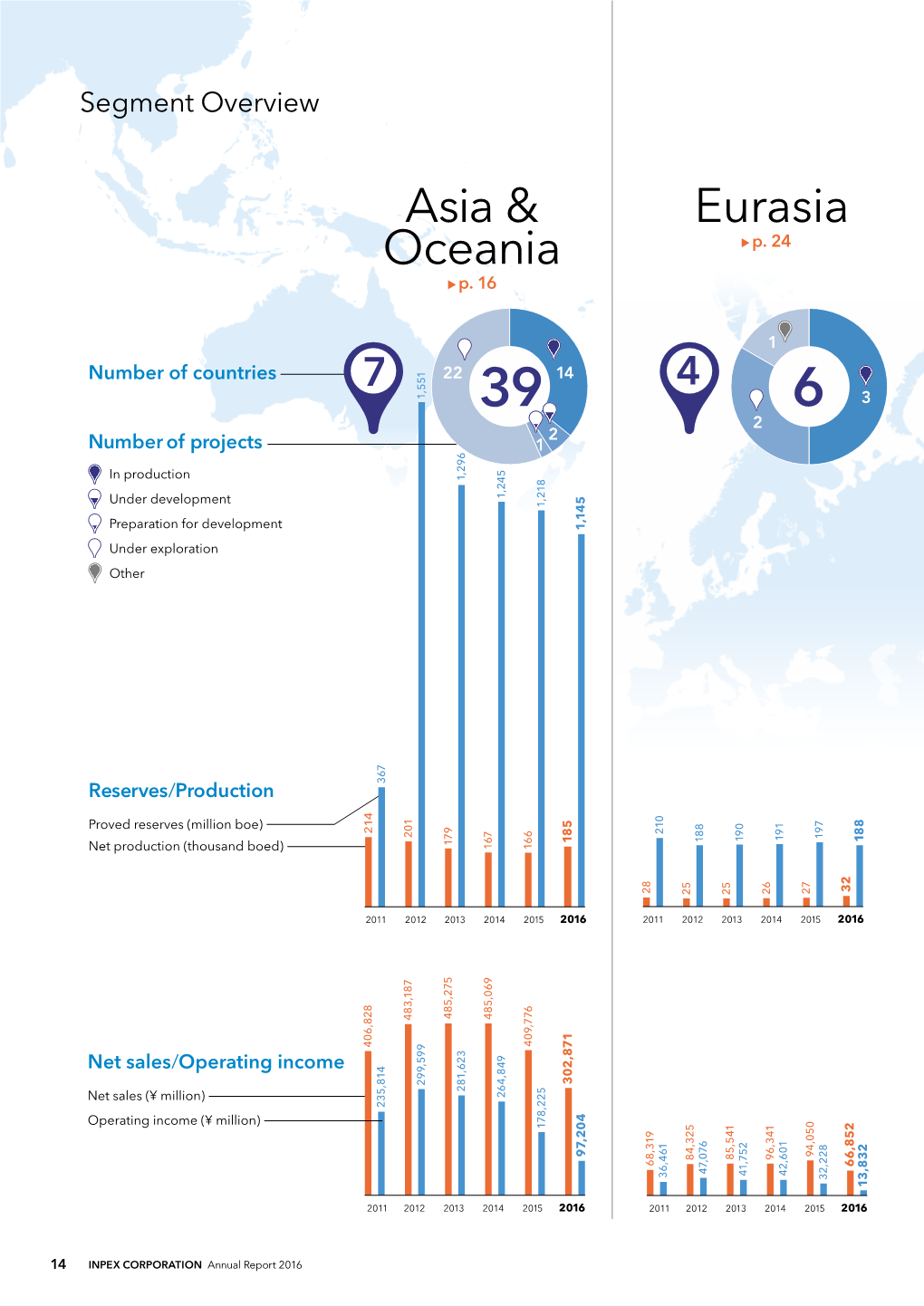

Eurasia Asia & Oceania

Segment Overview Asia & Eurasia Oceania u p. 28 u p. 20 Number of countries 7 4 1,551 ,296 1 1,245 1,218 1 16 14 Number of projects 1 3 In production 2 43 1 1 6 Under development 10 Preparation for development Under exploration (oil and gas reservoirs confirmed) Under exploration Other 466 Production/Reserves 367 Proved reserves (million boe) 214 201 195 210 207 191 Net production (thousand boed) 179 197 190 188 167 166 28 27 27 26 25 25 2010 2011 2012 2013 2014 2015 2010 2011 2012 2013 2014 2015 485,275 485,069 483,187 406,828 409,776 / 352,383 Net sales 299,599 281,623 Operating income 264,849 235,814 Net sales (¥ million) 191,070 178,225 Operating income (¥ million) 96,341 94,050 85,541 84,325 73,574 68,319 47,076 41,752 42,601 39,769 36,461 32,228 2010 2011 2012 2013 2014 2015 2010 2011 2012 2013 2014 2015 018 INPEX CORPORATION Annual Report 2015 Middle East Americas Japan & Africa u p. 32 u p. 36 u p. 30 6 7 1 Minami-Nagaoka 1 2 Gas Field 1 Naoetsu LNG 3 Terminal 9 7 1 16 10 Natural gas pipeline network (Approx. 1,400 km) etc. 783 857 636 4 Project Overview Project 583 518 505 174 168 169 158 163 155 138 135 132 130 126 117 74 68 65 40 36 30 29 30 27 28 20 25 25 21 21 21 17 18 2010 2011 2012 2013 2014 2015 2010 2011 2012 2013 2014 2015 2010 2011 2012 2013 2014 2015 524,528 520,835 500,033 621,513 421,184 357,343 354,136 350,735 333,213 303,819 243,113 205,572 129,522 120,268 118,937 ) 113,662 104,525 93,959 32,555 28,568 25,959 22,771 24,607 16,692 16,693 12,673 11,435 13,351 15,303 5,945 5,525 (7,646) (3,035) 1,028 (6,089) (5,518) ( 2010 2011 2012 2013 2014 2015 2010 2011 2012 2013 2014 2015 2010 2011 2012 2013 2014 2015 INPEX CORPORATION Annual Report 2015 019 Project Overview by Region Asia & Oceania In the Asia and Oceania region, INPEX holds participating interests in the Offshore Mahakam Block in Indonesia, which is contributing significantly to earnings, and the large-scale Ichthys and Abadi LNG projects, where development and preparatory development activities are under way. -

Russia and Eurasia Steven Pifer

14 Russia and Eurasia Steven Pifer Russia for the past 4 years has been on an economic roll fueled by high energy prices. The Kremlin in parallel has pursued an increasingly assertive foreign policy, raising the prospect of a more contentious Russia that will challenge U.S. interests in the former Soviet space, Europe, and elsewhere. The challenges posed by a more assertive Russia will command greater time and attention from U.S. national security planners. It is not only a resurgent Russia that could test the United States in coming years, however. A frail, unstable Russian state is not in the U.S. interest. Russian weakness raises less obvious, but nevertheless serious, possible challenges. Demographic, societal, and economic trends within Russia have the potential, particularly in combination, to create strategic shocks over the next 10 to 30 years that would have major implications for U.S. national security interests. This chapter examines those trends and potential shocks and outlines implications for U.S. national security. The strategic shocks that trends within Russia could combine to produce include collapse of the Russian state, expansion to take in more ethnic Russians, revolution (leading to a lurch toward democracy or, more likely, to the right), playing the energy card, and a military/technical surprise. While these shocks each have a very low likelihood, any of them would pose critical implications and challenges for key U.S. security interests. This chapter also looks at possible shocks elsewhere in the former Soviet space: Islamic revolution in a Central Asian state and Georgian-Russian military conflict, with the latter being the most likely shock of those addressed. -

Eurasia Foundation Network

Engaging Citizens Empowering Communities Eurasia2009 Network Foundation Yearbook Engaging Citizens, Empowering Communities Eurasia Foundation Network EURASIA FOUNDATION OF CENTRAL ASIA TABLE OF CONTENTS Advisory Council, Board of Trustees.....................1 2009 Letter from the Chair and President..............................2 The Eurasia Foundation Network......................................3 Yearbook Overview.....................................4 New Eurasia Foundation.................................5 Eurasia Foundation of Central Asia..........................6 Eurasia Partnership Foundation.................................7 East Europe Foundation.................................8 Youth Engagement...................9 Local Economic Development...........................11 Public Policy and The Eurasia Foundation Network comprises New Eurasia Foundation (Russia), Eurasia Foundation of Central Asia, Eurasia Partnership InstitutionFoundation Building.................13 (Caucasus), East Europe Foundation (Ukraine, Belarus, Moldova) and Eurasia Foundation (United States). Since 1993, Eurasia Foundation and the network have invested more than $360 million in local and cross-border projects to promote civic and economic inclusion throughout the Eurasia region.Independent Media.................15 For more information about the Eurasia Foundation Network, please visit http://www.eurasia.org/ Cross-Border Programs ........17 Eurasia Foundation Financials..................................19 EAST EUROPE EURASIA FOUNDATION EFFOUNDATION Network -

Arabian Peninsula from Wikipedia, the Free Encyclopedia Jump to Navigationjump to Search "Arabia" and "Arabian" Redirect Here

Arabian Peninsula From Wikipedia, the free encyclopedia Jump to navigationJump to search "Arabia" and "Arabian" redirect here. For other uses, see Arabia (disambiguation) and Arabian (disambiguation). Arabian Peninsula Area 3.2 million km2 (1.25 million mi²) Population 77,983,936 Demonym Arabian Countries Saudi Arabia Yemen Oman United Arab Emirates Kuwait Qatar Bahrain -shibhu l-jazīrati l ِش ْبهُ ا ْل َج ِزي َرةِ ا ْلعَ َربِيَّة :The Arabian Peninsula, or simply Arabia[1] (/əˈreɪbiə/; Arabic jazīratu l-ʿarab, 'Island of the Arabs'),[2] is َج ِزي َرةُ ا ْلعَ َرب ʿarabiyyah, 'Arabian peninsula' or a peninsula of Western Asia situated northeast of Africa on the Arabian plate. From a geographical perspective, it is considered a subcontinent of Asia.[3] It is the largest peninsula in the world, at 3,237,500 km2 (1,250,000 sq mi).[4][5][6][7][8] The peninsula consists of the countries Yemen, Oman, Qatar, Bahrain, Kuwait, Saudi Arabia and the United Arab Emirates.[9] The peninsula formed as a result of the rifting of the Red Sea between 56 and 23 million years ago, and is bordered by the Red Sea to the west and southwest, the Persian Gulf to the northeast, the Levant to the north and the Indian Ocean to the southeast. The peninsula plays a critical geopolitical role in the Arab world due to its vast reserves of oil and natural gas. The most populous cities on the Arabian Peninsula are Riyadh, Dubai, Jeddah, Abu Dhabi, Doha, Kuwait City, Sanaʽa, and Mecca. Before the modern era, it was divided into four distinct regions: Red Sea Coast (Tihamah), Central Plateau (Al-Yamama), Indian Ocean Coast (Hadhramaut) and Persian Gulf Coast (Al-Bahrain). -

The Role of Eurasia in a Multi-Polar World

THE ROLE OF EURASIA IN A MULTI-POLAR WORLD AHMET EVIN MEGAN GISCLON Istanbul Policy Center Bankalar Caddesi No: 2 Minerva Han 34420 Karaköy, İstanbul TURKEY +90 212 292 49 39 +90 212 292 49 57 @ [email protected] ISBN: 978-605-2095-47-8 w ipc.sabanciuniv.edu THE ROLE OF EURASIA IN A MULTI-POLAR WORLD AHMET EVIN MEGAN GISCLON March 2019 Ahmet Evin is a senior scholar at Istanbul Policy Center and professor emeritus at Sabanci University. Megan Gisclon is managing editor and researcher at Istanbul Policy Center. About Istanbul Policy Center Istanbul Policy Center is an independent policy research institute with global outreach. Our mission is to foster academic research in social sciences and its application to policy making. We are firmly committed to providing decision makers, opinion leaders, academics, and the general public with innovative and objective analyses in key domestic and foreign policy issues. IPC has expertise in a wide range of areas, including—but not exhaustive to—Turkey-EU-U.S. relations, conflict resolution, education, climate change, current trends of political and social transformation in Turkey, as well as the impact of civil society and local governance on this metamorphosis. PREFACE As part of its Observatory Program, Istanbul Policy of gravity of global trade, and more recently, of the Center (IPC), in cooperation with the German Council centrifugal forces acting upon the Western world, on Foreign Relations (Deutsche Gesellschaft für the present conference was organized to address the Auswärtige Politik, DGAP), organized a conference increasing number of questions regarding Eurasia: the on “The Role of Eurasia in a Multi-Polar World.” This vast landmass between Europe and China, dominated one-day roundtable took place on December 6, 2017 at since the middle of the nineteenth century by Russia, DGAP’s Berlin office. -

Arctic Report Card 2018 Effects of Persistent Arctic Warming Continue to Mount

Arctic Report Card 2018 Effects of persistent Arctic warming continue to mount 2018 Headlines 2018 Headlines Video Executive Summary Effects of persistent Arctic warming continue Contacts to mount Vital Signs Surface Air Temperature Continued warming of the Arctic atmosphere Terrestrial Snow Cover and ocean are driving broad change in the Greenland Ice Sheet environmental system in predicted and, also, Sea Ice unexpected ways. New emerging threats Sea Surface Temperature are taking form and highlighting the level of Arctic Ocean Primary uncertainty in the breadth of environmental Productivity change that is to come. Tundra Greenness Other Indicators River Discharge Highlights Lake Ice • Surface air temperatures in the Arctic continued to warm at twice the rate relative to the rest of the globe. Arc- Migratory Tundra Caribou tic air temperatures for the past five years (2014-18) have exceeded all previous records since 1900. and Wild Reindeer • In the terrestrial system, atmospheric warming continued to drive broad, long-term trends in declining Frostbites terrestrial snow cover, melting of theGreenland Ice Sheet and lake ice, increasing summertime Arcticriver discharge, and the expansion and greening of Arctic tundravegetation . Clarity and Clouds • Despite increase of vegetation available for grazing, herd populations of caribou and wild reindeer across the Harmful Algal Blooms in the Arctic tundra have declined by nearly 50% over the last two decades. Arctic • In 2018 Arcticsea ice remained younger, thinner, and covered less area than in the past. The 12 lowest extents in Microplastics in the Marine the satellite record have occurred in the last 12 years. Realms of the Arctic • Pan-Arctic observations suggest a long-term decline in coastal landfast sea ice since measurements began in the Landfast Sea Ice in a 1970s, affecting this important platform for hunting, traveling, and coastal protection for local communities. -

The Case of Weaving Districts in the Meiji Japan1 Tomok

On the Historical Process of the Institutionalizing Technical Education: The Case of Weaving Districts in the Meiji Japan1 Tomoko Hashino2 <Abstract> This paper explores the process of the institutionalizing technical education in modern Japan. In particular, this research attempts to elucidate why people in local weaving districts needed such educational institutions and how it is related with the introduction of western technology. This process is found to be much different from the government-led introduction of modern industries through establishment of technical high schools and universities to nurture engineers. In the case of traditional Japanese weaving districts, it was trade associations that voluntarily and actively established institutes for training, which were later supported by prefectural governments and the Ministry of Agriculture and Commerce and finally institutionalized as public technical schools by the Ministry of Education. 1 The author is grateful Mataji Umemura and Hoshimi Uchida for fulfilling discussions in the early stages of this research. A previous version of this research benefited from a lot of comments of participants at the Kinki-Section of Socio-Economic Society, the national conference of Socio-Economic History Society and in a seminar at the Institute for Monetary and Economic Studies, Bank of Japan. She also appreciates the valuable comments and suggestions by Keijiro Otsuka in the process of revising this paper. This research was partially supported by Grant-in-Aid for Scientific Research, (C)19530308 and (A) 18203024. 2 Associate professor of business and economic history, Graduate School of Economics, Kobe University. Address: 2-1 Rokko, Nada, Kobe, Hyogo 6578501, JAPAN Email: [email protected] Phone &Fax: +81-78-803-6824 1 1.