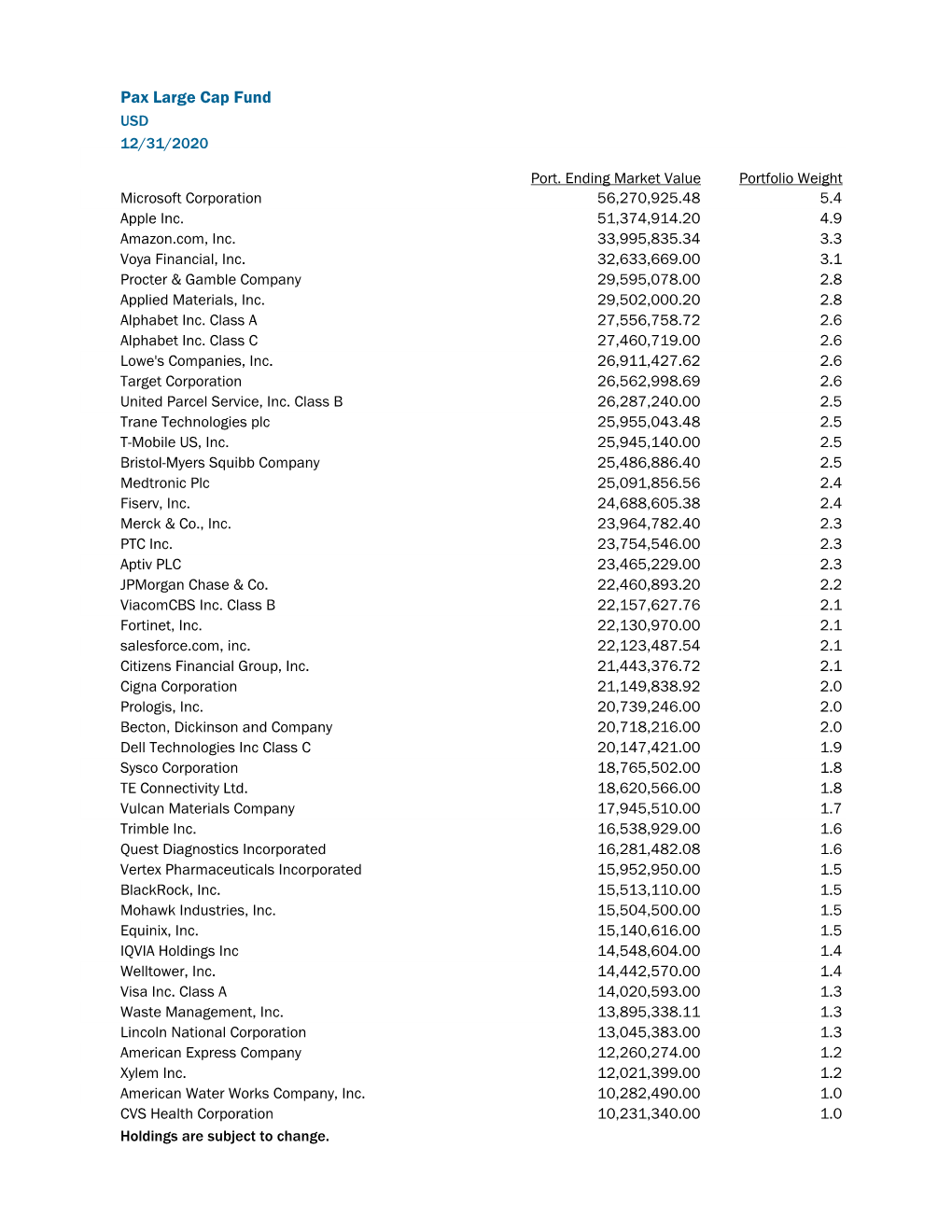

Pax Large Cap Fund USD 12/31/2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

Adevinta Announces That OLX Brazil Is to Acquire Grupo ZAP and Strengthen Its Position in the Real Estate Segment in the Country

Adevinta ASA (ADE) – Adevinta announces that OLX Brazil is to acquire Grupo ZAP and strengthen its position in the real estate segment in the country § The deal values Grupo ZAP at approximately R$ 2.9 billion § The partnership promises an improved user experience and service offering § The transaction is subject to approval by Brazil’s Antitrust Agency (CADE) Oslo, 03 March 2020: OLX Brazil, the 50/50 joint venture between Adevinta ASA (OSE: ADE) and Prosus NV (AMS: PRX), and one of the fastest growing tech companies in Brazil, has entered into an agreement to acquire 100% of the shares of Grupo ZAP for a total cash amount of approximately R$ 2.9 billion. The investment will be equally financed by OLX Brazil’s two existing shareholders, with Adevinta financing its share through existing bank facilities. OLX Brazil and Grupo ZAP, currently among the most relevant players in the online real estate classifieds and advertising sector in Brazil, are highly complementary platforms. The acquisition therefore will offer a great opportunity for synergies and value creation. The merger will help boost the real estate market, offering a better range of services with a broader database of properties. With Grupo ZAP, OLX Brazil will be able to offer its users more than 12 million listings from more than 40,000 real estate agencies and thousands of private listers, as well as allowing its advertisers to reach a larger audience. In 2018, Grupo ZAP had net revenues of R$ 217 million and EBITDA of R$ -18 million, with an average of 28 million visits per month in 2019. -

Adevinta Q3 2019 Results Presentation 0835 241019

Rolv Erik Ryssdal, CEO Q3 2019 Results Uvashni Raman, CFO Antoine Jouteau, CEO, Leboncoin Group 24 October 2019 Creating perfect matches on the world’s most trusted marketplaces Disclaimer IMPORTANT: You must read the following before continuing. The following applies to this document, the oral presentation of the information in this document by Adevinta ASA (the “Company”) or any person on behalf of the Company, and any question-and-answer session that follows the oral presentation (collectively, the “Information”). In accessing the Information, you agree to be bound by the following terms and conditions. The Information does not constitute or form part of, and should not be construed as an offer or the solicitation of an offer to subscribe for or purchase securities of the Company, and nothing contained therein shall form the basis of or be relied on in connection with any contract or commitment whatsoever, nor does it constitute a recommendation regarding such securities. Any securities of the Company may not be offered or sold in the United States or any other jurisdiction where such a registration would be required unless so registered, or an exemption from the registration requirements of the U.S. Securities Act of 1933, as amended, or other applicable laws and regulations is available. The Information is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of, or located in, any locality, state, country or other jurisdiction where such distribution or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. -

Sustainable Investing for a Changing World Annual Report 2016 About Schroders

Sustainable investing for a changing world Annual Report 2016 About Schroders At Schroders, asset management is our only business and our goals are completely aligned with those of our clients: the creation of long-term value to assist them in meeting their future financial requirements. We have responsibility for £397.1 billion As responsible investors and signatories (€465.2 billion/$490.6 billion) on behalf to the UN’s Principles for Responsible of institutional and retail investors, Investment (PRI) we consider the long-term financial institutions and high net worth risks and opportunities that will affect the clients from around the world, invested resilience of the assets in which we invest. across equities, fixed income, multi-asset, This approach is supported by our alternatives and real estate. Environmental, Social and Governance (ESG) Policy and our Responsible Real Estate Investment Policy. Presence in 41 offices P 27 countries globally £397.1 bn assets 4,100+ under management employees and administration 15% 15% 4% 4% 10% 10% 39% 39% 40% 40% 21% 21% by client by client By product domicile domicile By product 21% 21% 25% 25% 25% 25% United KingdomUnited Kingdom Asia Pac ific Asia Pacific uities uities ultiasset ultiasset urope iddleurope ast and iddle frica ast and fricamericas mericas Wealth manaementWealth manaementied income ied income merin maretmerin debt commoditiesmaret debt andcommodities real estate and real estate Source: Schroders, as at 31 December 2016 1 The companies and sectors mentioned herein are for illustrative purposes only and are not to be considered a recommendation to buy or sell. % W P X AA AAA 2016 has shown that the social and environmental backdrop facing companies is changing quickly and pressures are coming to a head. -

Snapshot of Notable Global Financial Services CFO Moves, Appointments, Themes and Trends

Snapshot of notable global financial services CFO moves, appointments, themes and trends “Increasing examples of senior finance leaders making a move out of the tier one banking groups.” January 2016 - April 2016 CFO Themes Page 1/5 Next update due: 19/9/2016 Summary of key themes and trends Jan - Apr 2016 Growing appetite from and drive overall US banks investing heavily non-banking financial efficiency savings after in global FP&A functions services firms to five years of cross industry in a continued response significantly upgrade their investment to CCAR and augmented audit functions with a reporting requirements focus on improved Increasing examples of business partnering, senior finance leaders regulatory interface and making a move out of data analytics the tier one banking groups given the Significant activity in the increasingly challenging Audit COO space as regulatory environment large banking groups look and the role of the CFO to streamline global in it methodology, improve training & development Leathwaite: London | Zürich | Hong Kong | New York Twitter @L3athwaite www.leathwaite.com CFO Moves Page 2/5 Next update due: 19/9/2016 Key global people moves and appointments: UK market: Ekene Ezulike, CFO Infrastructure at Deutsche Christopher Hill joins Hargreaves Lansdown as Bank is made Chief Procurement Officer. His CFO. Previously he served as CFO for IG Group Insurance previous role is being covered by Neil Smith. and Travelex. Glynn Jones joins ANZ as the Head of Financial Helen Pickford is appointed UK Life CFO at Audit Planning & Analysis for the markets business. He Zurich. Helen replaces Neil Evans who joins was previously the CFO for Financial Markets at Graham Mason joins Lombard Odier as Global Aviva as the Head of Financial Reporting for the Standard Chartered. -

Focusing for the Future

Trane Technologies 2019 Annual and ESG Report ESG Report and 2019 Annual Technologies Trane Focusing for the Future Trane Technologies 2019 Annual and ESG Report About Trane Technologies Trane Technologies is a global climate innovator. Through our strategic brands Trane and Thermo King, and our environmentally responsible portfolio of products and services, we bring efficient and sustainable climate solutions to buildings, homes and transportation. www.tranetechnologies.com We are committed to using environmentally conscious print practices. ©2020 Trane Technologies 372176_2019_AR_Cover_8.25x10.75_FINAL_040620.indd 1-3 4/7/20 12:06 AM Annual General Meeting New York Stock Exchange The company’s 2019 Annual Report on Form 10-K as filed with the United States TT Securities and Exchange Commission, Focusing for the Future and other company information, is available through Trane Technologies’ website, At Trane Technologies, we look ahead, pushing what’s possible for our customers, our business www.tranetechnologies.com. Securities and the world. We innovate to create opportunities, overcome climate challenges and as the analysts, portfolio managers and Transfer Agent and Registrar past decade has shown—boldly make the connection between sustainability and business results. representatives of institutional inves tors Computershare seeking information about the company Telephone Inquiries: 866-229-8405 This report shares the results of our Climate and Industrial segments known in 2019 as should contact: Website: www.computershare.com/Investor “Ingersoll-Rand plc.” On February 29, 2020, Ingersoll Rand and Gardner Denver completed Shane Lawrence a transaction whereby Ingersoll Rand separated its Industrial segment and combined with Address shareholder inquiries with standard priority: Director, Investor Relations Gardner Denver, creating a global industrial leader in mission critical flow creation and industrial Computershare 704-655-5651 technologies, which was renamed Ingersoll Rand Inc. -

M&G Index Tracker Fund

M&G Index Tracker Fund a sub-fund of M&G Investment Funds (2) Annual Short Report May 2021 For the year ended 31 May 2021 M&G Index Tracker Fund Fund information The Authorised Corporate Director (ACD) of and local movement restrictions that have been enacted by M&G Investment Funds (2) presents its Annual Short Report for various governments. M&G Index Tracker Fund which contains a review of the fund’s investment activities and investment performance during the Investment objective and policy up to period. The ACD’s Annual Long Report and audited Financial 27 May 2021 Statements for M&G Investment Funds (2), incorporating all the sub-funds and a Glossary of terms is available free of charge The fund is designed to track the FTSE All-Share Index. The fund either from our website at www.mandg.co.uk/reports or by calling manager has full discretionary investment management powers M&G Customer Relations on 0800 390 390. within the confines of this investment objective of the fund. An annual assessment report is available which shows the value Investment objective from 28 May 2021 provided to investors in each of M&G’s UK-based funds. The assessment report evaluates whether M&G’s charges are justified The fund aims to track the performance of the FTSE All-Share in the context of the overall service delivered to its investors. The Index, gross of the ongoing charge figure (OCF). The return report can be found at www.mandg.co.uk/valueassessment received by shareholders will be reduced by the effects of charges. -

Fifth World Forestry Congress

Proceedings of the Fifth World Forestry Congress VOLUME 1 RE University of Washington, Seattle, Washington United States of America August 29September 10, 1960 The President of the United States of America DWIGHT D. EISENHOWER Patron Fifth World Forestry Congress III Contents VOLUME 1 Page Chapter1.Summary and Recommendations of the Congress 1 Chapter 2.Planning for the Congress 8 Chapter3.Local Arrangements for the Congress 11 Chapter 4.The Congress and its Program 15 Chapter 5.Opening Ceremonies 19 Chapter6. Plenary Sessions 27 Chapter 7.Special Congress Events 35 Chapitre 1.Sommaire et recommandations du Congrès 40 Chapitre 2.Preparation des plans en vue du Congrès 48 Chapitre 3.Arrangements locaux en vue du Congrès 50 Chapitre 4.Le Congrès et son programme 51 Chapitre 5.Cérémonies d'ouverture 52 Chapitre 6.Seances plénières 59 Chapitre 7.Activités spéciales du Congrès 67 CapItullo1. Sumario y Recomendaciones del Congreso 70 CapItulo 2.Planes para el Congreso 78 CapItulo 3.Actividades Locales del Congreso 80 CapItulo 4.El Congreso y su Programa 81 CapItulo 5.Ceremonia de Apertura 81 CapItulo 6.Sesiones Plenarias 88 CapItulo 7.Actos Especiales del Congreso 96 Chapter8. Congress Tours 99 Chapter9.Appendices 118 Appendix A.Committee Memberships 118 Appendix B.Rules of Procedure 124 Appendix C.Congress Secretariat 127 Appendix D.Machinery Exhibitors Directory 128 Appendix E.List of Financial Contributors 130 Appendix F.List of Participants 131 First General Session 141 Multiple Use of Forest Lands Utilisation multiple des superficies boisées Aprovechamiento Multiple de Terrenos Forestales Second General Session 171 Multiple Use of Forest Lands Utilisation multiple des superficies boisées Aprovechamiento Multiple de Terrenos Forestales Iv Contents Page Third General Session 189 Progress in World Forestry Progrés accomplis dans le monde en sylviculture Adelantos en la Silvicultura Mundial Section I.Silviculture and Management 241 Sessions A and B. -

PCT Gazette, Weekly Issue No. 17, 2005

17/2005 28 Apr/avr 2005 PCT Gazette - Section III - Gazette du PCT 10931 SECTION III WEEKLY INDEXES INDEX HEBDOMADAIRES INTERNATIONAL APPLICATION NUMBERS AND CORRESPONDING INTERNATIONAL PUBLICATION NUMBERS NUMÉROS DES DEMANDES INTERNATIONALES ET NUMÉROS DE PUBLICATION INTERNATIONALE CORRESPONDANTS International International International International International International Application Publication Application Publication Application Publication Numbers Numbers Numbers Numbers Numbers Numbers Numéros des Numéros de Numéros des Numéros de Numéros des Numéros de demandes publication demandes publication demandes publication internationales internationale internationales internationale internationales internationale AT BR CN PCT/AT2004/000289 WO 2005/037097 PCT/BR2004/000216 WO 2005/039243 PCT/CN2004/000931 WO 2005/037496 PCT/AT2004/000330 WO 2005/037565 PCT/CN2004/000973 WO 2005/038191 PCT/AT2004/000348 WO 2005/037472 CA PCT/CN2004/000975 WO 2005/037046 PCT/AT2004/000354 WO 2005/036997 PCT/CA2003/001603 WO 2005/038473 PCT/CN2004/001033 WO 2005/037351 PCT/AT2004/000356 WO 2005/037476 PCT/CA2004/000627 WO 2005/038335 PCT/CN2004/001050 WO 2005/038122 PCT/CA2004/001723 WO 2005/037386 PCT/CN2004/001061 WO 2005/039190 AU PCT/CA2004/001829 WO 2005/038378 PCT/CN2004/001062 WO 2005/038643 PCT/AU2003/001368 WO 2005/038476 PCT/CA2004/001835 WO 2005/037403 PCT/CN2004/001087 WO 2005/037335 PCT/AU2003/001371 WO 2005/037381 PCT/CA2004/001836 WO 2005/037541 PCT/CN2004/001092 WO 2005/039207 PCT/AU2003/001598 WO 2005/037666 PCT/CA2004/001838 WO 2005/037536 -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Q1 2021 Quarterly Report.Docx

1 Adevinta Highlights Highlights of Q1 2021 Solid revenue performance despite challenging environment ● Total revenues1 up 6% at €200m ● Organic growth2 of 7% yoy ● Online classifieds revenues1 up 8% yoy (of which 5% from transactional services) ● Display advertising revenues1 up 2% yoy EBITDA1 up 33% yoy to €57m ● Top line growth ● Lower administrative costs and one-off items ● Favorable phasing of marketing expenses ● Partially offset by increase in transactional costs due to the ramp-up of the service Successful delivery of product roadmap ● Additional features and reinforced safety in transactional solutions ● Further improvement to image recognition models available for all integrated marketplaces ● Deployment of bundled products in multi-platform markets Further progress ahead of the eBay Classifieds Group acquisition ● Good progress on operational integration planning ● Upfront buyer for Shpock identified - public consultation launched on April 27 ● Closing expected in Q2 subject to regulatory approvals Report on second-hand effect3 ● 19.1 million tonnes of CO2 emissions potentially saved by our users ● Equivalent to yearly emissions of 2.1 million Europeans 1Proportionate basis incl JVs - for definition of EBITDA please see section Definitions and reconciliations. 2Growth at constant foreign exchange rate and excluding M&A and disposals 3Based on 7 marketplaces in our portfolio 1 Key financial numbers Alternative performance measures (APM) used in this report are described and presented in the Definitions and Reconciliations section at -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM