Clark Property Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sec 17-A Fy 2018

12. Check whether the issuer: (a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17 thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of The Corporation Code of the Philippines during the preceding twelve (12) months (or for such shorter period that the registrant was required to file such reports); Yes [ X ] No [ ] (b) has been subject to such filing requirements for the past ninety (90) days. Yes [ X ] No [ ] 13. State the aggregate market value of the voting stock held by non-affiliates of the registrant. P1,931,103,029 as of December 31, 2018 APPLICABLE ONLY TO ISSUERS INVOLVED IN INSOLVENCY/SUSPENSION OF PAYMENTS PROCEEDINGS DURING THE PRECEDING FIVE YEARS: 14. Check whether the issuer has filed all documents and reports required to be filed by Section 17 of the Code subsequent to the distribution of securities under a plan confirmed by a court or the Commission. Yes [ ] No [X] DOCUMENTS INCORPORATED BY REFERENCE 15. If any of the following documents are incorporated by reference, briefly describe them and identify the part of SEC Form 17-A into which the document is incorporated: Consolidated Financial Statements as of and for year ended December 31, 2018 (Incorporated as reference for Item 7 to 12 of SEC Form 17-A) ________________________________________________________________________ CENTURY PROPERTIES GROUP INC. Page 2 of 84 SEC Form 17-A TABLE OF CONTENTS PART I. BUSINESS AND GENERAL INFORMATION 4 Item 1 Business……………………………………………………………………………………………... 4 Item 1.1 Overview…………………………………………………………………………. -

CPGI Bond Prospectus | February 9, 2021

Century Properties Group Inc. (incorporated in the Republic of the Philippines) ₱2,000,000,000 with an Oversubscription Option of up to ₱1,000,000,000 Fixed Rate 3-Year Bonds due 2024 at 4.8467% p.a. Issue Price: 100% of Face Value Sole Issue Manager, Sole Lead Underwriter and Sole Bookrunner The date of this Prospectus is February 9, 2021. THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE AND SHOULD BE REPORTED IMMEDIATELY TO THE SECURITIES AND EXCHANGE COMMISSION. Office Address Contact Numbers Century Properties Group Inc. Trunkline (+632) 7793-5500 21st Floor Pacific Star Building, Cellphone (+63917) 555-5274 Sen. Gil Puyat Avenue corner Makati Avenue, www.century-properties.com Makati City 1200 Century Properties Group Inc. (the “Issuer” or the “Company” or “CPGI” or the “Group”) is offering Unsecured Peso-denominated Fixed-Rate Retail Bonds (the “Bonds”) with an aggregate principal amount of ₱2,000,000,000, with an Oversubscription Option of up to ₱1,000,000,000. The Bonds are comprised of 4.8467% p.a. three-year bonds. The Bonds will be issued by the Company pursuant to the terms and conditions of the Bonds on March 1, 2021 (the "Issue Date"). Interest on the Bonds will be payable quarterly in arrears; commencing on June 1, 2021 for the first Interest Payment Date and on March 1, June 1, September 1 and December 1 of each year for each Interest Payment Date at which the Bonds are outstanding, or the subsequent Business Day without adjustment if such Interest Payment Date is not a Business Day. -

Sec 17-A Fy 2019

SECURITIES AND EXCHANGE COMMISSION ANNUAL REPORT PURSUANT TO SECTION 17 SEC FORM 17-A OF THE SECURITIES REGULATION CODE AND SECTION 141 OF THE CORPORATION CODE OF THE PHILIPPINES 1. For the fiscal year ended: December 31, 2019 2. SEC Identification Number: 60566 3. BIR Tax Identification No.: 004-504-281-000 4. Exact name of issuer as specified in its charter: CENTURY PROPERTIES GROUP INC. 5. Province, Country or other jurisdiction of incorporation or organization: Philippines 6. Industry Classification Code: (SEC Use Only) 7. Address of principal office/Postal Code: 21st Floor, Pacific Star Building, Sen Gil Puyat Avenue corner Makati Avenue, Makati City 8. Issuer's telephone number, including area code: (632) 7938905 9. Former name, former address, and former fiscal year, if changed since last report: 10. Securities registered pursuant to Sections 8 and 12 of the SRC, or Sec. 4 and 8 of the RSA: Title of Each Class No. of Shares of Common Stock Outstanding and as Issued of December 31, 2018 COMMON 11,599,600,690 shares of stock outstanding 100,123,000 treasury shares PREFERRED 3,000,0000,000 11. Are any or all of these securities listed on a Stock Exchange. Yes [ X ] 11,699,723,690 common shares No [ ] If yes, state the name of such stock exchange and the classes of securities listed therein: Philippine Stock Exchange, Inc. Common Shares 12. Check whether the issuer: (a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17 thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of The Corporation Code of the Philippines during the preceding twelve (12) months (or for such shorter period that the registrant was required to file such reports); Yes [ X ] No [ ] (b) has been subject to such filing requirements for the past ninety (90) days. -

2020 Acas Website Updating.Xlsx

ASIA UNITED BANK CORPORATION List of Branches as of October 2020 NO. BRANCH NAME ADDRESS 1 168 MALL Unit 622-623, 6th Floor 168 Shopping Mall Soler Street Binondo, Manila 2 3RD AVENUE 154 - 158 Rizal Ave. Ext., Grace Park, Kalookan City 3 6780 AYALA G/F 6780 Ayala Avenue Building, 6780 Ayala Avenue, Makati City 4 999 MALL 3rd Floor, Unit P1-8, 999 Mall, Soler St. Binondo, Manila 5 ANGELES 351 Miranda St., Brgy. Sto Rosario, Angeles City 6 ANNAPOLIS GREENHILLS Unit 102, Intrawest Center, 33 Annapolis St., Greenhills, San Juan City 7 ANTIPOLO M.L. Quezon St., Brgy. San Roque, Antipolo City, Rizal 8 ANTIQUE RMU 2 Bldg., T.A. Fornier St., San Jose, Antique 9 ARRANQUE 692-694 T. Alonzo St. cor Soler St., Sta. Cruz, Manila 10 ASEANA CITY (PASAY MACAPAGAL AVE.) Macapagal Blvd., Brgy. Tambo, Paranaque City 11 AYALA ALABANG Madrigal Business Park cor. Commerce Ave. Alabang, Muntinlupa City 12 AYALA II G/F, Unit 1D, Multinational Bancorporation Center, 6805 Ayala Avenue, Makati City 13 BACLARAN G/F Parka Shopping Center, Park Ave. corner Kapitan Ambo St., Pasay City 14 BACOLOD G/F JS Bldg., Lacson St. cor. Galo St., Bacolod City, Negros Occidental 15 BACOLOD-BURGOS G/F ESJ Center Lot 1 Blk 5, Burgos St., Bacolod City 16 BACOOR 286 Rotonda Highway, P.F. Espiritu V., Bacoor, Cavite 17 BAGUIO G/F YMCA Bldg., Post Office Loop, Baguio City, Benguet 18 BALIBAGO 192 Diamond Hotel Bldg., McArthur Highway, Balibago, Angeles City 19 BALIUAG Li Bldg., 282 DRT Highway, Bagong Nayon, Baliuag, Bulacan 20 BANAWE 549 RBL Bldg.,Banawe St. -

Deployment Orientation Guide 2 CAMP E X @ Clark

Deployment Orientation Guide 2 CAMP E X @ Clark 2 Welcome to CAMP E X This document was created by the Earth Science Project Office to get you started and answer most of your questions ahead of your arrival to Clark, Philippines. August - September 2019 Table of Contents Mandatory Foreign Travel Security Training 2 High Threat Security Overseas Seminar (HTSOS) 3 Foreign Affairs Counter Threat (FACT): 3 Clark Freeport, Philippines 4 Geographic Location 4 Per Diem Information (as of August 1, 2019) 4 Climate 5 Language 6 Culture 6 Money 6 Local Electricity 7 Local Time 7 Safety 7 Crime 8 Before You Travel 9 Communication Preparation and Group Texting 9 Local ESPO Cell Phone Lines 9 Mobile Phone Settings When Abroad 10 Obtaining a Local Data Plan 11 Mailing Lists 12 Airport Attire 12 Health 13 Over the Counter Medications 13 Health Insurance 13 Vaccinations 14 Dengue Fever and Preventing Mosquito Bites 14 Your Arrival to the Philippines 17 Cash and ATMs 18 Traffic 18 1 Arriving at Manila International Airport (MNL) 19 Traveling by Taxi from MNL to Clark 19 Taking the CAMP2Ex Shuttle from MNL to Clark 20 Arriving at Clark International Airport (CRK) 20 Ride Sharing App: Grab 20 Lodging 21 Early departure Fee 21 Car Rentals 22 CAMP2Ex Operations at Clark 22 CAMP2Ex Mission Check-in 22 Asian Aerospace Hangars 22 CAMP2Ex Workspace Areas 23 General Orientation 27 Local Area 28 Shopping Malls 28 Grocery Markets 28 Local Markets 28 Laundry Services 29 Climate Information 31 Dialing Numbers to/from/in the Philippines 32 Calling the Philippines from the United States 32 How to Dial a Philippines Cellular 32 Calling the US from the Philippines 32 Shipping to/from the US (and other countries) 32 This orientation package is to help you become familiar with our area of operations in the Philippines and to answer some of the most common questions you may have prior to your arrival. -

Preliminary Prospectus to the Primary Offer of Series 2 Preferred Shares Dated 04 November 2020

The prospectus is being displayed in the website to make the prospectus accessible to more investors. The Philippine Stock Exchange (PSE) assumes no responsibility for the correctness of any of the statements made or opinions or reports expressed in the prospectus. Furthermore, the PSE makes no representation as to the completeness of the prospectus and disclaims any liability whatsoever for any loss arising from or in reliance in whole or in part on the contents of the prospectus. MEGAWIDE CONSTRUCTION CORPORATION 20 N. Domingo Street, Brgy. Valencia, Quezon City, Metro Manila Telephone No. +63 2 8655 1111 Preliminary Prospectus relating to the Primary Offer in the Philippines of 30,000,000 Non-Voting Perpetual Series 2 Preferred Shares with an Oversubscription Option for up to 20,000,000 Non-Voting Perpetual Series 2 Preferred Shares consisting of Series 2A Preferred Shares “MWP2A” Series 2B Preferred Shares “MWP2B” at an Offer Price of 100.00 per Preferred Share to be listed and traded on the Main Board of The Philippine Stock Exchange, Inc. Sole Issue Manager Joint Lead Underwriters and Bookrunners Selling Agents Trading Participants of the Philippine Stock Exchange, Inc. THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED THESE SECURITIES OR DETERMINED IF THIS PRELIMINARY PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE AND SHOULD BE REPORTED IMMEDIATELY TO THE SECURITIES AND EXCHANGE COMMISSION. This Preliminary Prospectus is dated November 4, 2020. 1 1 MEGAWIDE CONSTRUCTION CORPORATION -

Clark Global City Welcomes Century Properties Group

Contact: Head of Communications: Terrie Fucanan-Yu: +63 917-8080914; +632 7935040; [email protected] CLARK GLOBAL CITY WELCOMES CENTURY PROPERTIES GROUP Global Gateway Development Corp. (GGDC) and Century Properties Group, Inc. signed a memorandum of agreement on January 9, 2019 to create a Joint Venture (JV) that will develop 2.6 hectares of the 177-hectare Clark Global City into a mix of residential and office buildings. In the photo are (left to right) GGDC Vice-Chairman and President Wilfredo A. Placino; GGDC Chairman Dennis A. Uy; Century Properties Chairman and Chief Executive Officer Amb. Jose E.B. Antonio; and Century Properties Chief Operating Officer Jose Marco R. Antonio. [January 21, 2019] Global Gateway Development Corp. (GGDC) and Century Properties Group, Inc. are joining forces to accelerate the development of Clark Global City. On January 9, the two companies signed a memorandum of agreement for the creation of a joint venture that will develop 2.6 hectares of the 177-hectare leasehold within the Clark Freeport Zone in Mabalacat, Pampanga. “We are delighted to welcome Century Properties as another key partner in developing the country’s new center of business, life and innovation,” GGDC Chairman Dennis A. Uy said. “This is in line with our strategy to fast-track the development of Clark Global City. By joining forces with the country’s leading local developers, we can sooner unlock the potential of Clark Global City, expand our economy’s capacity, nurture businesses and generate more employment opportunities.” The joint venture will develop a mix of residential and office buildings with support retail establishments. -

Clark Green City), BCDA’S Most Ambitious Project to Date, Is Designed to Be the Country’S Frst Smart, Green, Disaster-Resilient City

The vision of a modern Philippines CLARK— 7 36 44 54 58 Belt of The Golden Work-live- A city that Resilient progress Age of play-learn breathes Growth THE VISION OF A MODERN PHILIPPINES BCDA’s projects strategic Venues where New Clark City’s Developers of New from North to South partnership nature, cultures, masterplan calls for Clark City aren’t just feature a varied mix and businesses an unprecedented taking a long- and Commitments of infrastructure and harmoniously 60 percent of land as 360-degree view of from the Japanese land development complement open space resiliency—they’re government will help each other make making it into a reality realize the dream of for dynamic and Build, Build, Build progressive societies Editorial Regina Abuyuan Nieve Aquino Cecile Jusi-Baltasar Patricia Ruth B. Cailao Boo Chanco Alya B. Honasan Tricia V. Morente Julia Nebrija Royal Pineda Eng Kiat-Tan Florian Saint-Vincent Sylvester Wong Josephine Gotianun-Yap Art Josh Argosino Terese Cimafranca Renders by BCDA, AECOM, and BUDJI+ROYAL Architecture+Design (where indicated) Photographs by BCDA, BUDJI+ROYAL, and Filinvest Corporation (where indicated) ________________ Clark-Te Vision of a Modern Philippines Copyright © 2017 Bases Conversion and Development Authority All rights reserved. Tis book or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in a book review. Printed in the Philippines. Sixth printing, 2018 BCDA Corporate Center 2nd Floor, Bonifacio Technology Center 31st Street corner 2nd Avenue Bonifacio Global City, Taguig Metro Manila 1634 Philippines www.bcda.gov.ph 26 An artist’s vision of New Clark City—a well-planned and well-managed city, a place long deserved by Filipinos. -

Download Clark Primer

2019 PRIMER FAST FACTS The BCDA Group is a prime mover of national development. We transform CLARK former military bases and properties into premier centers of economic 32,000 hectares growth in partnership with the private sector with integrity, excellence and New Clark City 9,450 hectares efficiency in the stewardship of government resources. We create sustainable urban communities to uplift the lives of Filipinos. 1 TOLLWAY Airport Area 2,300 hectares 2 AIRPORTS 400 k US $5 B US $10 B SEAPORTS Mixed-Use Area EMPLOYMENT EXPORTS ASSET VALUE 3 Sub-Zone Area 2,100 hectares GENERATED GENERATED 18,000 hectares Clark Freeport Zone The thrust of BCDA in expanding economic opportunities for Filipinos is echoed within special Clark Global Cityeconomic zones under the stewardship of the BCDA Group—composed of the BCDA and its subsidiaries, one of which is the Clark Development Corporation (CDC). CDC manages the Clark Freeport Zone (CFZ) to enable locators to generate productive economic activity to include em- ployment, export and investment. CLARK BY THE NUMBERS LABOR POOL EXPORTS GENERATED 60% USD $5 B 97% 12 M 8 Green and Open Space 2018 Highly-skilled, Population in the Educational English-proficient, surrounding areas of Institutions inside Clark LAND RIGHTS FIRST RATE INFRASTRUCTURE multi-culture adaptable Clark Freeport Freeport labor force 75 Years 300 km Through Lease or Connecting Clark to Metro Manila, Joint Venture Arrangements 200 >40 k Subic Seaport, and other key areas Leading colleges, universities, Annual graduates in and technical schools in Region III 10 minutes 15 minutes surrounding areas from Clark International Travel time within CFZ Airport to the heart of Clark COST OF DOING BUSINESS 45 minutes 55 minutes from CFZ to Subic Seaport Travel time from CFZ to ITEM RATE Metro Manila via railway Power rate per KWH (Distribution Charge) US$0.012 UTILITIES Water rate per cu.m. -

Clark Magazine.Pdf

EDITORIAL inside Cecile Jusi Baltasar Karl R. De Mesa Ramil Digal Gulle A Feast for the Senses 5 Rhea Claire Madarang Experience the memorable Kapampangan cuisine, and the province’s Aimee Morales impressive local art and design. Tricia V. Morente LIVE We Win As One 8 Maan D’Asis Pamaran Rossana L. Unson Find out how Clark successfully prepared for the hosting of the 2019 Kathy Bacosa SEA Games. World-Class Global Gateway 11 ART Therese Cimafranca Everyone is waiting for the 2020 opening of the new 110,000-square Trina Sulit meter passenger terminal. Making Things Work 16 RENDERS BCDA Chairman Greg Garcia talks about the rebranding of Clark and AECOM how his group is making things work smoothly. Budji+Royal Filinvest Corporation Megawide GMR Consortium JV. Inc. No Traffic in Clark! 19 PHOTOGRAPHY Clark Development Corporation wants to make sure that the horrors Samuel Luke Galivo of Manila traffic are not experienced in Clark. Clark Development Corporation Communication PLAY 21 Division Spaces for the People Borj Meneses, Where?House! Studio Clark is being built for people and structures made around natural _ features, not over them. Clark: It works. Like a dream. Trading Urban Noise for Rural Light 24 Copyright 2020 Here is the story about how DOTr Asec. Goddes Libiran’s move to Clark changed her and her family’s life for the better. Bases Conversion and Development Authority Safe, Convenient, Elegant 27 All rights reserved. This book or any portion thereof Find out why huge multinational companies are saying it is easier to do may not be reproduced or used in any manner business in Clark and why they moved their operations to this new metropolis. -

Smart’ Morgan Mouton

Worlding infrastructure in the global South: Philippine experiments and the art of being ‘smart’ Morgan Mouton To cite this version: Morgan Mouton. Worlding infrastructure in the global South: Philippine experiments and the art of being ‘smart’. Urban Studies, SAGE Publications, 2021, 58 (3), pp.621-638. 10.1177/0042098019891011. hal-02977298 HAL Id: hal-02977298 https://hal.archives-ouvertes.fr/hal-02977298 Submitted on 16 Feb 2021 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Special issue article: Smart cities between worlding and provincializing Urban Studies 2021, Vol. 58(3) 621–638 Ó Urban Studies Journal Limited 2020 Worlding infrastructure in the global Article reuse guidelines: sagepub.com/journals-permissions South: Philippine experiments and DOI: 10.1177/0042098019891011 the art of being ‘smart’ journals.sagepub.com/home/usj Morgan Mouton University of Calgary, Canada Abstract This article explores the material dimensions of ‘smart city’ initiatives in the context of postcolo- nial cities where urban utilities are qualified as deficient. It argues that while such projects may very well be another manifestation of urban entrepreneurialism, they should not be dismissed as an already-outdated research object. -

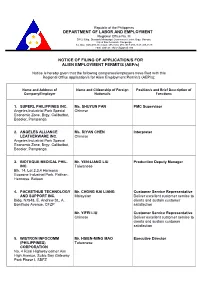

Department of Labor and Employment Notice of Filing

Republic of the Philippines DEPARTMENT OF LABOR AND EMPLOYMENT Regional Office No. III SWLC Bldg., Diosdado Macapagal Government Center, Brgy. Maimpis, City of San Fernando, Pampanga Tel. Nos. (045)-455-1613 (fax): 455-1614; 455-1617; 455-1618; 455-1619 e-mail address : [email protected] NOTICE OF FILING OF APPLICATION/S FOR ALIEN EMPLOYMENT PERMIT/S (AEP/s) Notice is hereby given that the following companies/employers have filed with this Regional Office application/s for Alien Employment Permit/s (AEP/s): Name and Address of Name and Citizenship of Foreign Position/s and Brief Description of Company/Employer National/s Functions 1. SUPERL PHILIPPINES INC. Ms. SHUYUN PAN PMC Supervisor Angeles Industrial Park Special Chinese Economic Zone, Brgy. Calibutbut, Bacolor, Pampanga 2. ANGELES ALLIANCE Ms. RIYAN CHEN Interpreter LEATHERWARE INC. Chinese Angeles Industrial Park Special Economic Zone, Brgy. Calibutbut, Bacolor, Pampanga 3. BIOTEQUE MEDICAL PHIL. Mr. YEN-LIANG LIU Production Deputy Manager INC. Taiwanese Blk. 14, Lot 2,3,4 Hermosa Ecozone Industrial Park, Palihan, Hermosa, Bataan 4. PACKETHUB TECHNOLOGY Mr. CHONG KAI LIANG Customer Service Representative AND SUPPORT INC. Malaysian Deliver excellent customer service to Bldg. N7548, E. Andrew St., A. clients and sustain customer Bonifacio Avenue, CFZP satisfaction Mr. YIFEI LIU Customer Service Representative Chinese Deliver excellent customer service to clients and sustain customer satisfaction 5. WISTRON INFOCOMM Mr. HSIEN-MING MAO Executive Director (PHILIPPINES) Taiwanese CORPORATION No. 4 Rizal Highway corner Aim High Avenue, Subic Bay Gateway Park Phase I, SBFZ 6. CASTAN-ENC Mr. HEECHANG BANG Operations Manager CORPORATION Korean Jaral Bldg., Brgy. Sto.