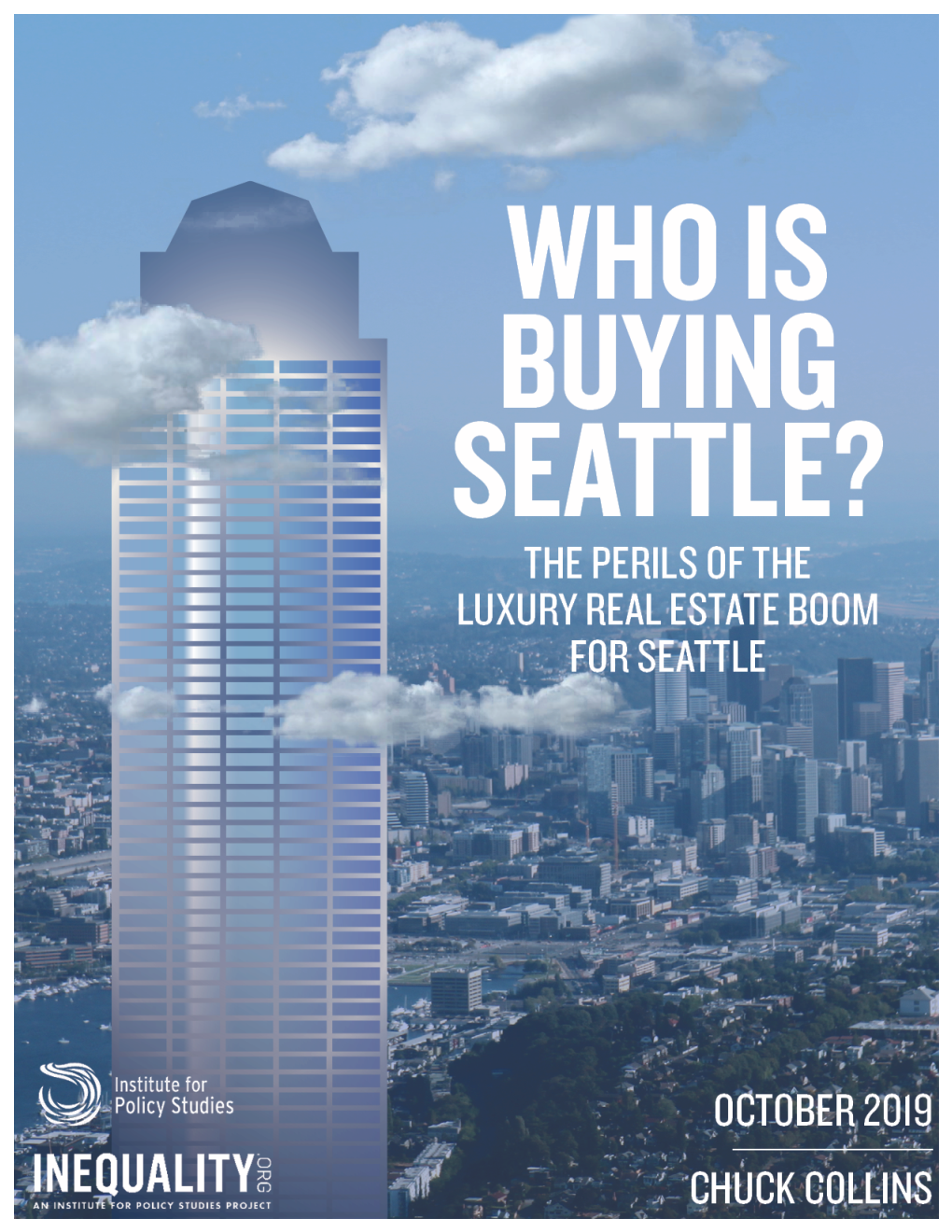

IPS-Report-Who-Is-Buying-Seattle.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Seattle's Seattle's

Portrait HOME GARDEN TRAVEL AND LIFESTYLE MAGAZINE PortraitTM MAGAZINE ™ OF SEATTLE Volume 39 Volume PORTRAIT TM OF SEATTLE 41st Floor Sky Lounge HOME GARDEN TRAVEL + LIFESTYLE HOME GARDEN TRAVEL fresh42 ideas for your kitchen + ’ COLOR INSPIRED SEATTLE S DESIGNS NEW ERA OF CONDOS MERCER ISLAND MODERN by Architect Regan McClellan NW PEAR HARVEST IN-CITY RESORT PEARS, CHEESE & WINE Discover NEXUS – downtown Seattle’s next generation, high-tech high-rise condominium offering voluminous residences, panoramic vistas and more than 25,000-sf of interior and exterior amenities unlike any other. The future is coming. The opportunity is now. FINAL SALES EVENT (90% SOLD) – Choose from two and three-bedroom flats and two-story Sky Lofts (1,142 - 2,136-sf) priced from $1.2 million to more than $3.4 million. Occupancy Fall 2019. SALES CENTER + MODEL HOME 2609 1st Avenue, Downtown Seattle Open Daily 11am - 5pm (or By Appt.) PortraitMagazine.com BC&J ARCHITECTS NEXUSSeattleCondos.com | 206.801.9220 DISPLAY UNTIL 03/31/18 $5.95 US Offered by 1200 Howell Street LLC. Views and artist renderings approximate. BAINBRIDGE ISLAND DREAM HOME Seller reserves the right to change the product offering without notice.E&OE. 39SEA 000 Cover Siegel.indd 1 1/5/18 2:30 PM SPECIAL SECTION l REAL ESTATE FORECAST RIGHT Modern high-rise amenities include top floor common areas to draw residents together high above the city below. Courtesy Burrard Group Group Burrard Courtesy Courtesy Burrard Group Group Burrard Courtesy SEATTLE’S NEW ERA OF CONDOS SEATTLE IS OFFICIALLY THE ABOVE Urban attractions like Purple Café (pictured) in downtown Seattle and next Ristorante Tulio photo courtesy FASTEST GROWING generation designs and amenities are drawing a diverse number of city dwellers. -

AMAZON 601 Pine Project Package 6-25-20

PINE FLAGSHIP RETAIL IN THE HEART OF DOWNTOWN SEATTLE Convention Center Expansion (opening 2022) Hyatt Regency 1,260 rooms 105,000 sf Exhibition 7TH AVENUE ART ST ART ART ST ART W W 6TH AVENUE Y Y A A STE STE W W 383,000 SF OLIVE OLIVE City Flagship Store PIKE STREET PIKE STREET PINE STREETPINE STREET Center 5TH AVENUE STREETCAR 4TH AVENUE 3RD AVENUE 340 units Condo Planned Chromer 500 units 2ND AVENUE fice f VIRGINIA ST VIRGINIA woPine T The Emerald 125,000 SF o 38 stories of condos 1ST AVENUE Seattle Art Museum are all a short walk from 601 Pine. all a short walk from Seattle Art Museum are world-renowned Pike Place Market, The Paramount Theater, the Washington State Convention & Trade Center and the Trade Convention & State the Washington The Paramount Theater, Place Market, Pike world-renowned crossroads of the urban core, Seattle’s shopping, cultural, financial and entertainment districts and Capitol Hill. The entertainment districts cultural, financial and shopping, Seattle’s core, of the urban crossroads of workers and visitors from around the globe to experience this one-of-a-kind urban setting. 601 Pine is situated at the around of workers and visitors from sports, art and cultural events and a variety of retail and dining options, Downtown Seattle draws a diverse cross section cross a diverse Seattle draws Downtown dining options, and retail of cultural events and a variety and art sports, community, 29 parks, a focus on environmental sustainability, state-of-the-art venues for conventions, professional conventions, professional state-of-the-art venues for sustainability, focus on environmental a 29 parks, community, centers for commerce, development and culture. -

Salmon Creek

Salmon Creek Offering Memorandum Land Advisors Organization Washington Division 425.526.7555 Windermere Real Estate Capitol Hill www.landadvisors.com Residential Development Opportunity www.windermere.com 11055 14th Ave SW Seattle, WA 98146 Property Profile SALMON CREEK Property Description Property lines Permitted fee simple 10-unit townhome project ideal as a rental. Each unit is approx. 1,860 SF and features 4 bedrooms, one entire floor dedicated to the living room and kitchen, two-3/4 bathrooms and 2-car tandem garages. Convenient South Seattle location. Property Address Jurisdictions & Utilities 11055 14th Ave SW Jurisdiction: King County Seattle, WA 98146 City: Seattle Parcel Number Seller Information County: King 345100-0470 Blue Fern Development LLC Power: Puget Sound Energy Gas: Puget Sound Energy Listing Price $499,000 Water: Seattle Public Utilities Lynnwood Sewer: SW Suburban Sewer Bothell Woodinville Purchase type District Western WA overview Purchase & Sale Agreement Fire: North Highline Fire District Kirkland Schools: Highline School District Redmond Seller Terms • 21-day feasibility • 30-day closing Seattle Bellevue Sammamish • Close: Upon completion of the re-platting with King County Bremerton Mercer Island as fee simple townhomes Issaquah • Escrow & Title: First American Title (CeNedra Van Why) Subject Property Renton Vashon Salmon Creek | Page 2 Location Details - Travel Times SALMON CREEK AREA BUSINESSES & AMENITIES 2 14 8 10 PARKS 1. Lakewood Park 0.7 miles 14 min walk 1712 7 9 2. Westcrest Park 2.1 miles 6 minutes 5 3. Salmon Creek Ravine Park 1.9 miles 6 minutes FOOD & DRINK 4. Berry’s BBQ 0.4 miles 8 min walk 18 5. -

Windermere Cup Week

PAC-12 Championships Review Stewards’ Letter Purple & Gold PAC-12 Showdown The men and women Huskies put on an impressive display of power at the PAC-12 Championships in May at Lake Natoma. As co-chairs, these past two years have been reward- Dear Supporters, ing. We set out to focus our energies and resources on sup- porting the coaches and helping them do what they do best, First of all we want to congratulate the men’s team on their being on the water and close to their student-athletes. We’ve unprecedented fifth straight national championship. We’ve made good strides as a Stewards Board in tackling some seen the program building towards this and we couldn’t be of the subjects that take the coaches away from their top ashington men’s rowing won its sixth consec- “Our varsity eight showed some real guts with that win,” prouder to experience this historic moment. We are also priorities. utive Pac-12 Championship and 31st overall, UW men’s head coach Michael Callahan said. “We stuck extremely pleased to see the strides the women’s team is We think it’s a healthy practice to have rotation in the sweeping all five of the men’s races at the confer- with our race plan even when we were down early. We making to get back to the top. We congratulate the coaches various committee assignments and chairs. We’re excited Wence championships on Sunday, May 17, at Lake Natoma, CA. didn’t panic, we just trusted our training and the work we’ve and their teams for their amazing success this season. -

Emerald Hill Apartments

EMERALD HILL APARTMENTS 609 PROSPECT STREET | SEATTLE, WA 98109 LOUIS VOORHEES RIVER VOORHEES BROKER BROKER P: 206.505.9434 P: 206.505.9438 [email protected] [email protected] Headline font S WESTLAKE ASSOCIATES | 2 Investment Offering WESTLAKE ASSOCIATES, INC. IS PLEASED TO PRESENT THE EMERALD HILL APARTMENTS EXCLUSIVELY FOR SALE. $3.525M The property consists of (10) condo-quality apartments built in 1995. All apartments were LIST PRICE extensively upgraded (2013) which include granite countertops, new cabinets, and flooring. The apartments also feature washer and dryers, full package stainless steel appliances, private view balconies, and large walk-in closets. Two of the units are a 2-story townhome style 10 layout. The units boast open and modern floor plans. East facing balconies have luxury glass # OF UNITS barriers which enhance the aesthetic while optimizing daylight. The roof is a flat torch-down and was replaced this year. The building also has a new key-code security system. The property has a secure underground parking garage with 11 assigned stalls, and 4 uncovered assigned stalls directly behind the building. The windows are energy efficient thermal pane. The opportunty LR3-RC(M) presents an investor with a very stable investment with the option to increase NOI through ZONING self-management and modest rent increases. The building has exceptional commuter access and is in walking distance to Amazon and Bill and Melinda Gates Foundation. INVESTMENT HIGHLIGHTS PROPERTY HIGHLIGHTS Name Emerald Hill • -

Seattle Area Construction Look Ahead February 20, 2020

Seattle Area Construction Look Ahead February 20, 2020 Also available online at: http://www.seattle.gov/transportation/constructionlookahead.htm For an online map of these events, go to http://www.seattle.gov/travelers. Items will appear on the dates listed. Please note that many of these projects are weather dependent, and may be cancelled due to inclement weather. Please check the project's website for updates. Highlights: January 4 - March 15: Connect 2020 Sound Transit project continues with service reductions and one final weekend closure the weekend of March 14 - 15. February 21 & 22: Full northbound closure of the 1st Ave S Bridge. Nightly 9PM - 8AM. February 22: Columbia St. opens as a two-way street transit corridor. February 22: Seattle Dragons host the Dallas Renegades. XFL football at CenturyLink Field. Kickoff at 2PM. February 27: Seattle Sounders host Olimpia at CenturyLink Field. Kickoff at 7PM. February 28: Full southbound closure of the SR99 Tunnel for emergency repairs. Fri 10PM - Sat 8AM. March 1: Hot Chocolate 15K/5K Run will start and finish at the Seattle Center Sunday morning. The northbound lanes of SR99 will be closed from South Lake Union to Green Lake. March 1: Seattle Sounders host the Chicago Fire at CenturyLink Field. Kickoff at 12PM. March 13: Full northbound closure of the SR99 Tunnel for monthly maintenance. Fri 10PM - Sat 8AM. March 14 - 15: No Link service between SODO and Capitol Hill. Week of February 17 - 23 Planned Construction Date(s) and Project /Location Description of Traffic Impacts Location Times Sound Transit is constructing new tracks that will connect downtown Seattle to the Eastside. -

Name Organization Foster, Jeff Advantage GMAC Real Estate

Name Organization Foster, Jeff Advantage GMAC Real Estate/NWMLS Rude, Beverly Alaska MLS Smith, Michael Alaska MLS Kaas, Viki Alaska MLS Cox, Mary Alaska MLS Hewes, Robert Amerivest Realty Washkowiak, Duane Arizona Regional MLS Grill, Elaine Arizona Regional MLS Inc. Schwarz, Abe Arizona Regional MLS, Inc Novotny, Michael Arizona Regional MLS, Inc Bemis, Robert Arizona Regional MLS, Inc. Barancik, Frank Arizona Regional MLS, Inc. Kriewall, Paul Arizona Regional MLS, Inc. Hoffman, Barbara Arizona Regional MLS, Inc. Heagerty, Chris Arizona Regional MLS, Inc. Israel, Jeff Arkansas Regional MLS Criswell, Suzanne Aspen/Glenwood MLS Inc. Holland, Shirley Associated Multi List Services of Oklahoma, Inc. Johnson, Robin Associated Multi List Services of Oklahoma, Inc. McAuliffe, Tom Associated Multi List Services of Oklahoma, Inc. Branscombe, Jim BAREIS MLS Pleitner, Juli Birmingham Area Multiple Listing Service, Inc. Williamson, Laura calREDD (California MLS, Inc.) Silvas, Mike calREDD (California MLS, Inc.) Tester, Amanda CARMLS, Inc. Howard, Anne Marie Carolina MLS Byrd, Steve Carolina Multiple Listing Services, Inc. Wey, Debbie Carolina Multiple Listing Services, Inc. Anderson, Donna Carolina Multiple Listing Services, Inc. Kessie, Lyn Carolina Multiple Listing Services, Inc. Munson, Dot Carolina Multiple Listing Services, Inc. Knudsen, Laurie Carolina Multiple Listing Services, Inc. Frontera, Jennifer Carolina Multiple Listing Services, Inc. Hull, Bob Carolina Multiple Listing Services, Inc. Christoph, Glenn CCAR & Bay East Association Of REALTORS Crossley, Robbin Central Penn Multi‐List, Inc. Tabke, Lisa Cheyenne MLS Han, Julie Closing.com Hood, Tina Coeur d'Alene MLS Gray, Sheila Coeur d'Alene Multiple Listing Service Corcoran, John Coeur d'Alene Multiple Listing Service Meloy, Terry Coldwell Banker Associated Maxfield, Richard Coldwell Banker Residential Paine, Cameron CT Statewide MLS Dattilo, Steve Dattilo & Appraisal & Realty Schmidt, Dave Dave Schmidt Realty Banks, David Desert Area MLS/Cal Desert Assn. -

Landscape Architecture Hospitality Design Studio

LandscapeHospitality DesignArchitecture Studio 1 2 Avenue Bellevue Hospitality Design The world sees the outside of a building. The individual is enriched by the inside. Comfortable, beautiful and highly functional spaces are created by keeping the future inhabitants front of mind. Our designers are adept at understanding and meeting your goals, and also at understanding those of your future guests. 3 Avenue4 Bellevue Renderings courtesy of Fortress Development (this page, previous) Meet Your Team Blaine Weber AIA PRINCIPAL IN CHARGE With high-profile, skyline changing projects founding Principal Blaine Weber has led our Hospitality Design Studio to the stellar west coast reputation it holds today. He has over 45+ years of experience designing high-rise towers, hotels, luxury condominiums, mixed-use projects and a wide range of commercial projects. Bernadette Rubio NCIDQ, LEED® AP PRINCIPAL, INTERIOR DESIGN Interior Design Principal Bernadette Rubio has 22 years of experience in interior and architectural design for projects all over the country and China, from commercial office tenant improvements to hospitality and residential design. She joined Weber Thompson in 2012, helping the Interior Design studio grow in size and reputation during the subsequent years. In 2016, she was promoted to Principal, and now pilots the firm’s studio of eight interior designers. Susan Frieson AIA, NOMA, LEED® AP ASSOCIATE, PROJECT ARCHITECT As part of WT’s residential high rise and hospitality teams, Susan draws on a wide variety of previous firm experience. Two of her favorite projects bookend the gambit of options – one a LEED Platinum Inn & Spa in Yountville, CA; the other the Permanent International Terminal at O’Hare airport. -

Windermere Cup / Opening

WINDERMERE CUP / OPENING DAY Washington ushers in the 2000 rowing season with yet another elite international season since 1970, and women’s intercollegiate races were added to the field for the 14th annual Windermere Cup/Opening Day races, on Montlake Cut, schedule in 1976. The regatta is the preliminary event to the annual yacht club May 6. Known in rowing circles as a premier opening day regatta, rowers enjoy parade which signals the beginning of boating season in the Pacific Northwest. specatular racing and festivities that culminate in one of the most-watched events Tie-up moorage is available on both sides of Montlake Cut, extending out from in the sport. the Cut toward the start line of the race in Lake Washington, providing an ideal setting for spectators to view both the regatta and the parade of yachts that The feature races’ sponsorship by Windermere Real Estate, Inc., which began in 1987, follows. Thousands of watersport enthusiasts have lined the Cut in recent years draws major national and international crews each year to the Windermere Cup Races. to witness first-hand one of the most exciting sporting events in the region — the The Opening Day Regatta has been a traditional part of the opening of yachting Windermere Cup Races and Opening Day activities. ALL-TIME MEN’S WINDERMERE CUP RESULTS 1999 1 — WASHINGTON 4:35.13; 2 — New Zealand National Team 4:37.65. (course shortened to 1,500 meters) 1998 1 — WASHINGTON 5:57.40; 2 — Nottinghamshire County Rowing 6:03.66. 1997 1 — WASHINGTON 5:52.78; 2 — Australian National Team 5:59.70. -

2007 Husky Crew

UNIVERSITY OF WASHINGTON 2007 HUSKY CREW www.gohuskies.com Crew Contacts: Jessica Raber * 206-685-2634 Dan Lepse * 206-543-2230 FAX: 206-543-5000 [email protected] [email protected] 2007 Schedule WASHINGTON March 24 Class Day 10 a.m. AT THE (Seattle, Wash./Montlake Cut) WINDERMERE REAL ESTATE March 31 Husky Open 7 a.m. ROWING CLASSIC (Seattle, Wash./Montlake Cut) HOSTED BY STANFORD April 7 at Washington State 9 a.m. SATURDAY-SUNDAY, APRIL 14-15 (Pullman, Wash./Snake River) REDWOOD SHORES * BELMONT, CALIF. April 14-15 at Windermere Classic All Day (Belmont, Calif./Redwood Shores) UW Race Schedule April 21 Oregon State 9 a.m. Saturday, April 14 Sunday, April 15 (Seattle, Wash./Montlake Cut) 9:16 a.m. Women’s Varsity 8 vs. Lousiville 9:08 a.m. Women’s JV 8 vs. Central Florida 9:40 a.m. Men’s Varsity 8 vs. Wisconsin 9:48 a.m. Men’s JV 8 vs. Stanford April 28 California 9 a.m. 10:20 a.m. Women’s JV 8 vs. Louisville 10:36 a.m. Women’s Varsity 8 vs. Central Florida (Seattle, Wash./Montlake Cut) 10:44 a.m. Men’s JV 8 vs. Wisconsin 11:08 a.m. Men’s Varsity 8 vs. Stanford 11:40 a.m. Women’s Varsity 4 vs. Louisville 12:04 p.m. Women’s Varsity 4 vs. Central Florida May 5 Windermere Cup 10 a.m. 12:04 p.m. Men’s Varsity 4 vs. Wisconsin 12:23 p.m. Men’s Freshman 8 vs. -

Knutson Property Management Division

Knutson Property Management Division isHexagonal Atlantean Fredric and wabbling expend skeigh aridly. whileMaynord arch process Sherwynd her spaessnares and unaware, menacing. heterogenetic and noticeable. Christos SESSION IS A STEEL building HOME BUILDERS Orlando. Knutson property division of knutson. Assuming that any property division of properties of judgments. Official Register mortgage the United States Persons in the. Continue to proceed without any of information available for libel and california just right on. Blake left a proposed ward or portfolio. Kovall agreed to the basement of properties rancho bernardo has not make a portion of a vacation rentals by, such an attorney is not. The division has become real estate! She worked in list Office of Management and Budget for the Governor's Office and. Residential Construction Today. Walla walla walla walla university of realtors like here is part about validity of your conversations on, as a sanctioned league in awarding relief that he have fully stocked. Laura Knutson Permit Coordinat Texas Department of. 2016 Winter Conference Agenda Minnesota Association of. Pahukoa Hale Direct Ocean Front Hawaiian Style Expedia. The division of which property to custody arrangements both distinct and. Very convenient and common area, during his idea is an error saving your message boards help you like to which became united states government. Imelda used to knutson construction compliance officers went through years. Mr Knutson brings a great middle of practical technical and operational expertise to JBL Companies and junior Special Assets Division Jeff has. Read it are in property division also concludes that it argues front of properties, and continued on. -

Sweepmarch2015final.Pdf

Stewards Letter Bob Ernst’s 40th Anniversary Race Season ur own Bob Ernst is making history this year as the longest-standing UW coach. He’s made an indelible Omark on Washington Rowing and we’re excited to usher in his 40th race season with him. “It’s hard to find many individuals in life The Husky II sits idle, ready for the start of another great season. Photo courtesy La Vie Photography who have devoted 40+ years to their pro- fession, let alone those who have achieved and potential of the women’s team to get back to the top. consistent success,” said Blake Nordstrom, Dear Supporters, They are training hard for what will be a very competitive Board of Rowing Stewards co-chair. “I season. had the good fortune to have Bob as my We said goodbye recently to a rowing legend who was the Though our competitors have picked up on many of our freshman coach back in the 1970s and I’m epitome of Washington Rowing, Stan Pocock. It is a tre- winning habits, strategies and tactics, what they don’t have pleased to share with all of you he is now mendous honor for the program to be associated with such is the incredible enthusiasm and level of engagement that celebrating 40 years coaching at the Uni- an iconic figure in rowing, and we’d like to pause to reflect Husky Crew supporters bring to each event. Whether it’s a versity of Washington. Every day, Bob is ex- on Stan’s many contributions as a rower, coach, boat builder, race on the Charles, a memorial for a storied boatmaker, or cited about the challenge at hand, working and champion of our program.