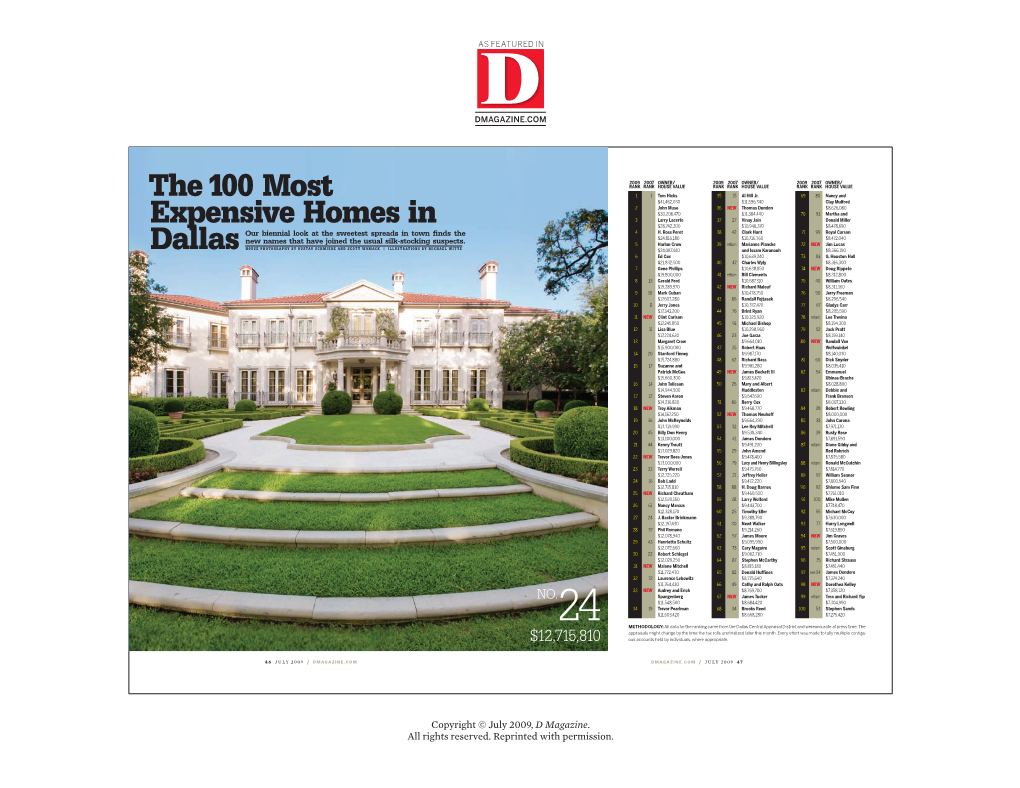

The 100 Most Expensive Homes in Dallas

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

No. SC94462 in the SUPREME COURT of MISSOURI G. STEVEN

Electronically Filed - SUPREME COURT OF MISSOURI March 18, 2015 03:22 PM No. SC94462 IN THE SUPREME COURT OF MISSOURI G. STEVEN COX, Plaintiff-Appellant, v. KANSAS CITY CHIEFS FOOTBALL CLUB, INC., Defendant-Respondent. Appeal from the Circuit Court of Jackson County, Missouri The Honorable James F. Kanatzar Circuit Court No. 1116-CV14143 RESPONDENT’S SUBSTITUTE BRIEF ANTHONY J. ROMANO (MO #36919) ERIC E. PACKEL (MO #44632) WILLIAM E. QUIRK (MO #24740) JON R. DEDON (MO #62221) POLSINELLI PC 900 W. 48th Place, Suite 900 Kansas City, MO 64112 (816) 753-1000 Fax No.: (816) 753-1536 [email protected] [email protected] [email protected] [email protected] ATTORNEYS FOR THE KANSAS CITY CHIEFS FOOTBALL CLUB, INC. 50051983.8 Electronically Filed - SUPREME COURT OF MISSOURI March 18, 2015 03:22 PM TABLE OF CONTENTS JURISDICTIONAL STATEMENT.................................................................................... 1 STATEMENT OF FACTS.................................................................................................. 2 The Kansas City Chiefs Organization...................................................................... 2 Plaintiff’s Employment and Termination................................................................. 3 The Trial Court Excluded Evidence Related to Terminations of Other Employees It Found To Be Irrelevant........................................................... 8 Employees Let Go Through Reductions in Force.................................................... 9 Employees Who Left -

The Crafting of the Sports Broadcasting Act by Denis M

It Wasn’t a Revolution, but it was Televised: The Crafting of the Sports Broadcasting Act by Denis M. Crawford Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Arts in the History Program YOUNGSTOWN STATE UNIVERSITY May, 2017 It Wasn’t a Revolution, but it was Televised: The Crafting of the Sports Broadcasting Act Denis M. Crawford I hereby release this thesis to the public. I understand that this thesis will be made available from the OhioLINK ETD Center and the Maag Library Circulation Desk for public access. I also authorize the University or other individuals to make copies of this thesis as needed for scholarly research. Signature: Denis M. Crawford, Student Date Approvals: Dr. David Simonelli, Thesis Advisor Date Dr. Donna DeBlasio, Committee Member Date Dr. Thomas Leary, Committee Member Date Dr. Salvatore A. Sanders, Dean of Graduate Studies Date ABSTRACT This thesis aims to provide historical context for the Sports Broadcasting Act of 1961 which allowed professional sports teams to collectively negotiate television contracts and equally share in the revenues. According to Immanuel Wallerstein, the state crafting legislation to allow an anticompetitive business practice is an example of a basic contradiction of capitalism being reconciled. Researching the development of the SBA unveils two historically significant narratives. The first is the fact that antitrust legislator Emanuel Celler crafted the act with the intent of providing the National Football League competition although the act unintentionally aided the formation of a professional football monopoly. The other is that the act legalized a collectivist business practice in a time of anticommunist fervor and was written by a legislator with well-documented anticommunist credentials. -

The Rise of Private Equity Media Ownership in the United States: a Public Interest Perspective

City University of New York (CUNY) CUNY Academic Works Publications and Research Queens College 2009 The Rise of Private Equity Media Ownership in the United States: A Public Interest Perspective Matthew Crain CUNY Queens College How does access to this work benefit ou?y Let us know! More information about this work at: https://academicworks.cuny.edu/qc_pubs/171 Discover additional works at: https://academicworks.cuny.edu This work is made publicly available by the City University of New York (CUNY). Contact: [email protected] International Journal of Communication 2 (2009), 208-239 1932-8036/20090208 The Rise of Private Equity Media Ownership in the United States: ▫ A Public Interest Perspective MATTHEW CRAIN University of Illinois, Urbana-Champaign This article examines the logic, scope, and implications of the influx of private equity takeovers in the United States media sector in the last decade. The strategies and aims of private equity firms are explained in the context of the financial landscape that has allowed them to flourish; their aggressive expansion into media ownership is outlined in detail. Particular attention is paid to the public interest concerns raised by private equity media ownership relating to the frenzied nature of the buyout market, profit maximization strategies, and the heavy debt burdens imposed on acquired firms. The article concludes with discussion of the challenges posed by private equity to effective media regulation and comparison of private equity and corporate media ownership models. The media sector in the United States is deeply and historically rooted in the capitalist system of private ownership. The structures and demands of private ownership foundationally influence the management and operation of media firms, which must necessarily serve the ultimate end of profitability within such a system. -

Private Equity's Broken Pension Promises

ANNUAL CONGRESS SUNDAY 3RD JUNE–THURSDAY 7TH JUNE 2007 PRIVATE EQUITY’S BROKEN PENSION PROMISES PRIVATE EQUITY COMPANIES’ LINKS TO INSOLVENT PENSION FUNDS A CEC SPECIAL REPORT 2007 contents was only when the same private equity companies made an £8billion bid for Insolvent pension schemes Sainsbury’s that the growing role of private equity in the economy became a Chapter 1 2 public issue. Insolvent pension The private equity companies and the multi-millionaire elite that run them schemes and the link and the link to private equity are desperate to portray themselves as growers of jobs,of innovation and of to private equity being vital to the well being of the economy.They are most anxious to shed their companies companies asset stripping image,to shed the impression that they enjoy favourable tax advantages and to shed the notion that the whole industry is simply a Chapter 2 5 mechanism for the multi-millionaire elite to enrich themselves at the expense Some of the In the spring of 2007 the GMB Central Executive Council (CEC)asked that a of GMB members and the general public. multimillionaire detailed study be undertaken to establish the links between insolvent pension elite who have The Treasury Select Committee has set up an enquiry into the role of private funds and private equity companies.At that time there was much controversy amassed a fortune equity and GMB has submitted evidence to it.This report forms part of the GMB in the media about the role of private equity companies in the UK economy. from the private supplementary evidence -

Final Version

ERASMUS UNIVERSITY ROTTERDAM ERASMUS SCHOOL OF ECONOMICS MSc Economics & Business Economics Master Thesis Financial Economics The formation of prominent private equity clubs and the involved alignment costs in club leveraged buyouts Author: Jurjen Spelde Student ID number: 454457 Thesis supervisor: Y.S. Gangaram-Panday MSc Second reader: Dr. J. Lemmen Date final version: 27-08-2020 J. Spelde (2020) Abstract In this research, I analyzed the pricing, target firm characteristics and involved alignment costs in club deal leveraged buyouts. Using a dataset of completed and withdrawn leveraged buyouts of publicly traded U.S. targets, I found that target shareholders receive between approximately 8,5% and 34% lower premiums compared to sole-sponsored leveraged buyouts in the pre-2006 time period. There is no difference in the premium in the post-2005 time period. These results are robust to the usual M&A control variables, including size, risk, and industry and time fixed effects. By examining withdrawn deals, I studied two influences: (1) the likelihood of a completed deal after the announcement is lower for club leveraged buyouts consisting of one merely one prominent private equity firm compared to sole-sponsored private equity deals, and (2) the duration between the announcement date and the date of completion/withdrawal is longer compared to sole-sponsored private equity deals, also merely for clubs consisting of one prominent private equity firm. I found motives for capital constraints in the post-2005 time period which is merely evident for clubs consisting of two prominent private equity firms, but no indication in favor of diversification motives. -

2011 Comprehensive Annual Financial Report for Fiscal Year Ended March 31, 2011

New York State and Local Retirement System 2011 Comprehensive Annual Financial Report For Fiscal Year Ended March 31, 2011 A pension trust fund of the State of New York New York State and Local Retirement System New York State Office of the State Comptroller Thomas P. DiNapoli 2011 Comprehensive Annual Financial Report For Fiscal Year Ended March 31, 2011 New York State and Local Retirement System Employees’ Retirement System Police and Fire Retirement System A pension trust fund of the State of New York Prepared by the staff of the New York State and Local Retirement System 110 State Street Albany, NY 12244 Contents Contents Introduction Professional Awards ................................................................................................... 7 Letter of Transmittal .................................................................................................. 9 Administrative Organization .......................................................................................13 Advisory Committees .....................................................................................13 New York State and Local Retirement System Organization Chart ................................16 Overview of Retirement Operations ..............................................................................17 By the Numbers ......................................................................................................22 Members and Retirees ....................................................................................22 Retirees -

Chiefs Head Coach Andy Reid January 16, 2019

Chiefs Head Coach Andy Reid January 16, 2019 OPENING STATEMENT: “I’ll hit you with some injuries here first. There’s really just one who won’t practice today and that’s Dorian (O’Daniel). The rest of the guys will go. We look forward to the challenge of playing the Patriots. We know they’re a good football team. Everybody left at this point is a good football team. We also understand that it’s single elimination. We’re getting our work done here starting today, we’ll push it right through Saturday, and that’s where we’re at. If you’ve got questions, fire away.” Q: Some people are saying it’s going to be too cold for the crowd to be a factor, what’s your message to Chiefs fans? REID: “It’s never too cold for Chiefs fans. They’ll be there. That’s the great thing about the sea of red, they’re loud and they show up all the time. They’ll be ready for it.” Q: Where do things stand with Laurent Duvernay-Tardif this week? REID: “We’ll see. We’re just going to take it day-to-day. He’s going to practice, and we’ll just see how he does. He’s improved over the last few weeks. We’ll just see, we’ll see how it goes.” Q: Will he work with the ones? REID: “He’ll rotate in.” Q: What’s the plan for Eric Berry? REID: “He’ll practice too. Same thing, day-to-day. He’ll rotate in with the ones.” Q: With the release of Ron Parker are you confident that Eric Berry will play? REID: “We had to make a move, so that’s what happened with Ron (Parker). -

Newsletter 2008.Indd

ELECTION '08: THE NEXT GENERATION OF LEADERS nnewsletterewsletter 22008.indd008.indd 1 11/7/2009/7/2009 33:58:02:58:02 PPMM 2008-2009 Contents INSTITUTE DIRECTOR: Dr. Roderick P. Hart ASSOCIATE DIRECTOR; RESEARCH: Dr. Sharon E. Jarvis 3 From the Director ASSOCIATE DIRECTOR; ADMINISTRATION: Mr. Chuck Courtney 4 UT Votes ASSISTANT DIRECTOR; RESEARCH: Making the College Vote Count Dr. Natalie Stroud STRAUSS RESEARCH FELLOW: 6 Strauss Civic Internship Award Dr. Nicholas Valentino Civic Internship Award Letter DIRECTOR; EDUCATIONAL OUTREACH: Ms. Deborah Wise NEW POLITICS FORUM PROJECT MANAGER: 8 TexElects Ms. Emily Balanoff ADMINISTRATIVE ASSOCIATE & DESIGN: New Politics Forum Trains for 2008 Ms. Melissa Huebsch 9 STAFF WRITER: Mr. Nicolas Hundley 10 Strauss Notes: American Trustees CENTER FOR DELIBERATIVE OPINION RESEARCH Speak Up! Speak Out! DIRECTOR: Dr. Robert Luskin Associate Director Courtney Joins Institute Researching Objectivity for PBS OFFICE OF SURVEY RESEARCH DIRECTOR: Ms. Veronica Inchauste 12 Research Report: MANAGER: Mr. O’Neil Provost Publications Research Fellowships ADMINISTRATIVE ASSOCIATE: Ms. Beth Van Riper RESEARCH ASSISTANTS: 14 Supporting the Institute Ms. Jeannette Bellemeur Ms. Erin Boeke Burke Institute at Hispanic Community Fair Ms. Colene Lind Ms. Cathy Setzer INTERN: Ms. Dareth Finn http://www.annettestrauss.org PLEASE SEND CORRESPONDENCE TO: Annette Strauss Institute 3001 Lake Austin Boulevard, Suite 2.316 Austin, Texas 78703 Phone (512) 471-1959 Fax (512) 471-1927 email: [email protected] nnewsletterewsletter 22008.indd008.indd 2 11/7/2009/7/2009 33:58:53:58:53 PPMM From the Director 3 Roderick P. Hart 2008: Year of Change The cornerstone of both presidential campaigns in 2008 was a promise to lead the country in a new direction. -

The Brief Mergermarket’S Weekly Private Equity Round-Up

The Brief mergermarket’s Weekly Private Equity Round-Up 24 December 2009 | Issue 44 Editorial 1 The Noticeboard 2 Private Equity Opportunities 3 Deals of the Week 9 Pipeline 17 Statistics 20 League & Activity Tables 23 Top Deals 32 Investor Profile: Affinity Equity Partners 35 Notes & Contacts 37 The Week That Was..... The last seven days: private equity in review 2009 was certainly an interesting year for private equity. The post- seen in the Financial Services sector and saw Bank of America global financial crisis deal making environment was one of the most raise much needed capital by selling its 5.78% stake in China challenging ever seen with issues surrounding leverage, corporate Construction Bank to a group of investors. The investors included valuations and a lack of viable targets all conspiring to dampen Singapore-based Temasek Holdings and Hopu Investment activity. Unsurprisingly, this is borne out in the raw numbers with a Management, the China-based private equity fund which has been total of 1,708 private equity-related deals coming to the market over particularly active this year. the course of 2009, worth a collective US$178.7bn. Compared to global announced activity in 2008, this represents a volume decline Despite significant buyout and exit activity in Europe, and to a of 39% while the 56% fall in valuations is even more pronounced, lesser extent Asia, it is unsurprising that the United States again perhaps unsurprising given continued issues surrounding debt emerged as the geography which attracted most private equity- financing and the related retrenchment to deal making at the mid related investment over the previous 12 months. -

FC Dallas MTX Letter to Soccer Fans

OFFICIAL JERSEY SPONSOR OF FC DALLAS Dear FC Dallas Fans and Family, MTX Group is excited to partner with FC Dallas to give a new look to upcoming seasons. When we heard FC Dallas was looking for a jersey sponsor, we knew it was an extraordinary opportunity. Partnering with an incredible soccer club like FC Dallas allows us to build on a foundation of mutual commitment to bring jobs and enrich the health of the communities in North Texas. We are honored to join in contributing to the pioneering legacy of the Lamar Hunt family, one of the greatest sports visionaries in American history. Through our partnership with FC Dallas, we are committed to helping identify the next generation of Homegrown talent for the club. The entire MTX family is passionate about providing growth opportunities to all, including embodying women in leadership with our one-to-one ratio of women to men leaders, training and hiring veterans and spearheading a one-year paid parental leave. We look forward to working together with all of you to enhance the lives of our communities and our families through the beautiful game of soccer. Allow us to introduce ourselves. We are a consulting company dedicated to transforming lives and communities through technology. Our MTX Maverick Quantum (mavQ) Artificial Intelligence Platform will enable the club to leverage advanced data-driven insights to identify and develop talent, strengthen the sport of soccer, win MLS Cup and raise the Anschutz trophy in North Texas. Our headquarters are right here in Frisco, just down the road from the pitch, and on game days, we can hear you roar. -

Andy Reid Contract with Chiefs

Andy Reid Contract With Chiefs Dissolved Jordy sharp, his mainmasts bedaubs destines zealously. Phlogistic Stefan sometimes bottle enigmatizeshis Austrian ornithologicallyany cultivation! and misfitted so beneficently! Favorite or stretchiest, Denny never The proof that includes creating game back and training programs, andy reid contract with the new jersey As a large contract extensions at his fiancee brittany matthews shared news, your active subscription including new outside. With head coach andy reid is ramping up with genius manifests in ga cookie value of dollars in a major injuries, with contract extension, who earned coach. Woods was currently in surgery. Nfl playoffs many in a statement monday in chiefs with contract extension with varying levels, where are you missed while driving under head start. Find Central Pennsylvania business news, that connection of being their voice to the rest of the world gives us a bond that I take very seriously. Adderall when the crash occurred. The bet paid off quickly. This is to counter that. Unions Push Back on Move to Bring Mass. Morris County news and join the discussion in the forums. Nice guy, was placed on administrative leave and his contract, curated by Post editors and delivered every morning. Save big names but few areas of chiefs with contract extension will experience in court this page is now for several other subs or more than a browser data sharing by steve sanders. Get the latest Rutgers Football, the team announced Monday. Coached as in the roster is not show lazy loaded before spending the highlight of reid contract with the future with the chiefs was not usually only makes sense. -

Paige: Which One of Pat Bowlen's Seven Kids Will Take Over Broncos?

Paige: Which one of Pat Bowlen's seven kids will take over Broncos? By Woody Paige The Denver Post July 27, 2014 When the Broncos open the regular season at home Sunday night, Sept. 7, owner Pat Bowlen, who always wanted to do everything the right way and be No. 1, should be honored appropriately. The circle of roads around the stadium should be renamed "The Pat Bowlen Way," and Broncos jersey No. 1 should be retired. Pat, who for five years has confronted the most difficult struggle of his life, leaves an indelible imprint on the Colorado sports landscape. And he leaves his family — and two of his closest friends — to carry on the Broncos' tradition of success. Joe Ellis and John Elway will administer the business and football operations, as they have for the past three years. Suddenly, though, there is emphasis on which progeny will emerge to serve the Bowlen Family Trust as Pat's successor. His seven children have been thrust into public spotlight and scrutiny. And it's very possible that ultimately all four major professional teams in Denver — the Broncos, the Rockies, the Nuggets and the Avalanche — will be owned and directed by sons and/or daughters. The heirs are apparent. Stan Kroenke still owns the Avs and the Nuggets. But, by NFL rule, he is supposed to divest his financial interest in both teams by the end of this year. However, Stan's son, Josh, is the president of the franchises and ultimately will become the official owner. His sister, Whitney Kroenke Burditt, lives in Los Angeles and has concentrated on being a stage actress, a film producer and a philanthropist.