County of Los Angeles

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2016-0013 Los Angeles County Public Works Financing Authority

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . MATURITY SCHEDULE $255,855,000 LOS ANGELES COUNTY PUBLIC WORKS FINANCING AUTHORITY Lease Revenue Bonds, 2016 Series D (Base CUSIP: 54473E) Due Principal Interest Due Principal Interest (December 1) Amount Rate Yield CUSIP (December 1) Amount Rate Yield CUSIP 2017 $4,345,000 4.000% 0.600% RY2 2027 $6,935,000 5.000% 2.430%* SJ4 2018 4,510,000 3.000 0.800 RZ9 2028 7,295,000 5.000 2.540* SK1 2019 4,670,000 4.000 0.950 SA3 2029 7,665,000 5.000 2.640* SL9 2020 4,890,000 5.000 1.110 -

2016-1652 Los Angeles County

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . COUNTY OF LOS ANGELES 2016-17 TAX AND REVENUE ANTICIPATION NOTES BOARD OF SUPERVISORS Hilda L. Solis First District, Chair Mark Ridley-Thomas Second District Sheila Kuehl Third District Don Knabe Fourth District Michael D. Antonovich Fifth District Lori Glasgow Executive Officer-Clerk Board of Supervisors COUNTY OFFICIALS Sachi A. Hamai Chief Executive Officer Mary C. Wickham County Counsel Joseph Kelly Treasurer and Tax Collector John Naimo Auditor-Controller No dealer, broker, salesperson or other person has been authorized by the County or the Underwriters to give any information or to make any representations other than those contained herein and, if given or made, such other information or representations must not be relied upon as having been authorized by the County or the Underwriters. This Official Statement does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Notes, by any person -

Report on the Los Angeles Helicopter Noise Initiative

Federal Aviation Administration Report on the Los Angeles Helicopter Noise Initiative May 31, 2013 Table of Contents 1.0 Executive Summary ........................................................................................................................... 3 2.0 Introduction ......................................................................................................................................... 6 3.0 Issues ................................................................................................................................................ 15 Hollywood Sign ....................................................................................................................... 15 Hollywood Bowl ....................................................................................................................... 16 Griffith Park ............................................................................................................................. 17 Carmageddon I and II ............................................................................................................. 18 Van Nuys Airport (VNY) .......................................................................................................... 18 Zamperini Field (formerly Torrance Municipal Airport) (TOA) ................................................. 19 The Getty Center ..................................................................................................................... 19 Santa Monica Airport (SMO) .................................................................................................. -

Introduction

Introduction Los Angeles County is the most populous county in the nation with over 10 million people residing within its borders. To inform the public of available services, the Board of Supervisors ordered the preparation of this Citizens Guide to County Services. This is an update of earlier editions, and the information included was current at the time of publication. Every effort has been made to ensure the accuracy of the material in this booklet, and we hope that it is helpful. For information concerning services not listed or additional assistance, please contact: Countywide Communications Chief Executive Office County of Los Angeles 358 Kenneth Hahn Hall of Administration 500 W. Temple St., Los Angeles, CA 90012 Website: lacounty.gov Phone: (213) 974-1311 Email: [email protected] 1 Table of Contents About Los Angeles County ........................................................................ 4 Elected Officials Salary & Tenure Data ......................................................13 County Organizational Chart ....................................................................14 Map of the County of Los Angeles County ................................................15 88 Cities, Incorporation and Population ...................................................16 Unincorporated Areas ..............................................................................18 Supervisorial District Maps & Cities ..........................................................20 Board of Supervisors Responsibilities .......................................................30 -

Noise Element

NOISE ELEMENT DEPARTMENT OF CITY PLANNING LOS ANGELES, CALIFORNIA Noise Element of the Los Angeles City General Plan City Plan Case No. 97-0085 Council File No. 96-1357 Adopted by the City Council February 3, 1999 Approved by the City Planning Commission November 12, 1998 An Equal Employment Opportunity/Affirmative Action Employer As a covered entity under Title II of the Americans with Disabilities Act, the City of Los Angeles does not discriminate on the basis of disability, and upon request, will provide reasonable accommodation to ensure equal access to its programs, services and activities. i ii City of Los Angeles Richard Riordan, Mayor City Council 1st District — Mike Hernandez 2nd District — Joel Wachs 3rd District — Laura N. Chick 4th District — John Ferraro 5th District — Michael Feuer 6th District — Ruth Galanter 7th District — Richard Alarcón 8th District — Mark Ridley-Thomas 9th District — Rita Walters 10th District — Nate Holden 11th District — Cindy Miscikowski 12th District — Hal Bernson 13th District — Jackie Goldberg 14th District — Richard Alatorre 15th District — Rudy Svorinich City Planning Commission Peter M. Weil, President Robert L. Scott, Vice President Marna Schnabel Nicholas H. Stonnington Jorge Jackson Los Angeles City Planning Department Con Howe, Director of Planning Franklin P. Eberhard, Deputy Director Gordon B. Hamilton, Deputy Director Robert H. Sutton, Deputy Director Citywide Planning Division R. Ann Siracusa, ACIP, Principal City Planner Noise Element Revision Staff Anne V. Howell, City Planner Graphics -

Lines 94/794 (06/23/19) -- Metro Local

ROUTE MAP a Frank Modugno Dr 9 SYLMAR 230 Hubbard St 5 Meyer San Fernando Rd 239 SAN S.F. Mission Bl Maclay Av 234 FERNANDO Brand Bl 234 734 Glenoaks Bl 118 230 118 Paxton St Van Nuys Bl 744 233 8 San Fernando Rd Laurel Cyn Bl 5 92 Osborne St b c 166 364 Branford St SUN Glenoaks Bl VALLEY 152 353 Sheldon St 170 Roscoe Bl 5 Strathern St Webb Av Webb Tuxford St 152 7 Roscoe Bl 222 Sunland Bl Laurel Cyn Bl d 353 Lankershim Bl 224 San Fernando Rd 169 163 INSET 1 – HOLLYWOOD BURBANK AIRPORT Vineland Av 152 Clybourn Av e Terminal A 94 Thornton Av SEE INSET f 6 f B Terminal 1 6 HOLLYWOOD Hollywood Way BURBANK AIRPORT Avon St Hollywood Way Hollywood OntarioEmpire St Av Empire Av Glenoaks Bl BB 165 g Ontario St 222 Victory Pl Burbank Airport - South Station Lincoln St San Fernando Rd SEE INSET INSET 2 – DOWNTOWN BURBANK 2 Olive Av Walnut Av Tujunga Av Cypress Av Grinnell Dr Verdugo Av Harvard Rd Magnolia Bl Alameda Av Angeleno Av Glenoaks Bl Orange Grove Av 3rd St 3rd St San Fernando Rd BURBANK San Fernando Bl 5 1st St Allen Av h Ikea Wy Glenoaks Bl Western Av 5 LO 5 Front St S A N Victory Pl i GEL Sonora Av Bl Burbank ES N Victory Bl RI Downtown 134 V ER Burbank GrandviewGLENDALE Av W Victory Bl 183 ATWATER VILLAGE Pacific Av LEGEND Doran St Line 94 Route 183 134 501 W Broadway Line 94 Route Extension on 5 Pacific Av Saturday and Sunday W Colorado603 St 92 E Broadway Line 794 Route 201 201 183 E Colorado St Local Timepoint Central Av Rapid and Local Timepoint Brand Bl Los Feliz Bl Los Feliz Bl E Chevy Chase Dr 4 Rapid and Local Stop 180 181 Glendale Av 780 j 91 90 Rapid and Local Stop - Glendale Bl GLASSELL Single Direction Only PARK Metro Rail Fletcher Dr Metrolink, Amtrak 603 2 Metro Rail Station 685 Verdugo Rd Eagle Rock Bl N 2 Rd Fernando San Metro Rail Station Entrance 5 Division St Transit Center Arvia St Amtrak Station Cypress Av CYPRESS Metrolink Station PARK BB BurbankBus N Figueroa St CE LADOT Commuter Express 3 81 110 110 GB Glendale Beeline SEE INSET W Ave 26 To Asuza METRO GOLD LINE Lincoln Heights/ SC Santa Clarita Transit 3 Cypress Park East L.A. -

FAA Annual Runway Safety Report 2010

Air Traffic Organization Annual Runway Federal Aviation Administration 800 Independence Avenue, SW Safety Report 2010 Washington, DC 20591 Message from the Administrator Dear Colleague: When serious runway incursions drop by 50 percent over the previous year, you know you’re doing something right. The good news here is every corner of the aviation community is sharing the success. From the airlines to the business aviation community to the pilots, controllers, surface vehicle operators and the GA enthusiasts who just fly for pleasure, everyone has taken a step up. The numbers alone tell the story. With almost 53 million operations in FY 2009, we had 12 serious runway incursions, down from 25 the previous year; two serious incursions involved commercial aircraft. Those are encouraging numbers. When we issued a Call to Action for runway safety almost two years ago, we as a community recognized the need to do a better job of keeping things safe on the airport surface. Even though the number of mistakes is infinitesimally small, given the number of successful operations per day, we nevertheless need to take every opportunity to continue to enhance surface safety. As you’ll clearly see in the runway safety report, that’s what is happening. The emergence of a “just culture” between regulator and regulated has played a huge part. Because we have so few data points, we need for the people in the system to be able to say, “Here’s a problem” without fear of penalty. As a result, we’re learning about the soft spots, the places, and procedures that need to change. -

Citizen's Guide to County Services

Citizen Guide English2012:Layout 1 2/24/2012 12:06 PM Page 1 INTRODUCTION Los Angeles County, with approximately 10 million people within its borders, is the most populous county in the nation. County officials, faced with dwindling revenues, are constantly challenged with providing essential services at the most economical cost to serve this huge population. To inform the public of available services, the Board of Supervisors ordered the preparation of this Citizens Guide to County Services. This is an update of earlier editions, and the information included was current at the time of publication. This booklet, prepared by the County Public Affairs Office, is a directory of services under simply stated headings to help find the appropriate department or agency performing the service. In some instances, telephone numbers and addresses listed are those of central County offices. For local listings of County offices in your neighborhood not listed in this booklet, please consult your local telephone directory under the general section heading of “Los Angeles, County of.” Every effort has been made to ensure the accuracy of the material in this booklet, and we hope that it is helpful. For information concerning services not listed or additional assistance, please contact: Public Affairs Chief Executive Office County of Los Angeles Room 358, Kenneth Hahn Hall of Administration 500 W. Temple St., Los Angeles, CA 90012 Telephone: (213) 974-1311 Website: lacounty.gov E-mail: [email protected] Revised: May 2012 1 Citizen Guide English2012:Layout -

Pacoima Beautiful

Community Action for a Renewed Environment Cooperative Agreement Grantee Final Progress Report Grantee: Pacoima Beautiful Project title: Community Partnership Understanding Toxic Risks Project Manager: Marlene Grossman Telephone: (818) 899-2454 E-mail: [email protected] EPA Project Officer: Karen Henry Telephone: (415) 972-.3844 E-mail: [email protected] Acknowledgements Tim Dagodag, Linda Fidell and John Schillinger, California State University, Northridge; Debrorah Davenport, Olga Vigdorchik, Los Angeles County Department of Public Health; Linda Kite, Healthy Homes Collaborative; Joseph Lyou, California Environmental Rights Alliance; Josh Stehlik, Neighborhood Legal Services of Los Angeles County; Brian Condon, Arnold and Porter; Theresa Nitescu and Deborah Rosen, Northeast Valley Health Corporation; Marlene Grossman, Elvia Hernandez, Blanca Nuñez, Patricia Ochoa, Fernando Rejón and Liseth Romero-Martinez, Pacoima Beautiful; Carl Maida, University of California, Los Angeles; Joni Novosel, Valley Care Community Consortium, Gretchen Hardison and Christopher Patton, Los Angeles Environmental Affairs Department; Sarayeh Amir and Gabriel Farkas, Department of Toxic Substance Control; Dale Shimp, California Air Resources Board; Jonathon Bishop, Stephen Caine, Fran Diamond and the California Regional Water Quality Control Board. We appreciate the support of all our local elected officials: Former Councilmember now State Senator, Alex Padilla; Supervisor Zev Yaroslavsky, Former Assemblymember Cindy Montañez, Former State -

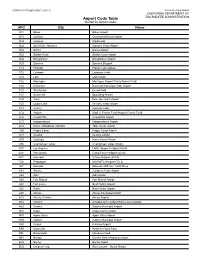

CDTFA-810-FTH Airport Code Table

CDTFA-810-FTH (S1F) REV. 1 (10-17) STATE OF CALIFORNIA CALIFORNIA DEPARTMENT OF Airport Code Table TAX AND FEE ADMINISTRATION (Sorted by Airport Code) APC City Name 0O2 Baker Baker Airport 0O4 Corning Corning Municipal Airport 0O9 Gasquet Ward Field 0Q3 Schellville / Sonoma Sonoma Valley Airport 0Q4 Selma Selma Airport 0Q5 Shelter Cove Shelter Cove Airport 0Q6 Shingletown Shingletown Airport 0Q9 Sonoma Sonoma Skypark 1C9 Hollister Frazier Lake Airpark 1O2 Lakeport Lampson Field 1O3 Lodi Lodi Airport 1O5 Montague Montague Airport (Yreka Rohrer Field) 1O6 Dunsmuir Dunsmuir Municipal-Mott Airport 1Q1 Strathmore Eckert Field 1Q2 Susanville Spaulding Airport 1Q4 Tracy New Jerusalem Airport 1Q5 Upper Lake Gravelly Valley Airport 2O1 Quincy Gansner Field 2O3 Angwin Virgil O. Parrett Field (Angwin-Parrett Field) 2O6 Chowchilla Chowchilla Airport 2O7 Independence Independence Airport 2Q3 Davis / Woodland / Winters Yolo County Airport 36S Happy Camp Happy Camp Airport 3O1 Gustine Gustine Airport 3O8 Coalinga Harris Ranch Airport 49X Chemehuevi Valley Chemehuevi Valley Airport 4C0* Los Angeles LAPD Hooper Heliport (4CA0) 4C3* Pleasanton Camp Parks Heliport (4CA3) 60C* Concord Q Area Heliport (60CA) 7C4* Bridgeport MCMWTC Heliport (7CL4) 9L2 Edwards Edwards AFB Aux. North Base A24 Alturas California Pines Airport A26 Adin Adin Airport A28 Fort Bidwell Fort Bidwell Airport A30 Fort Jones Scott Valley Airport A32 Dorris Butte Valley Airport AAT Alturas Alturas Municipal Airport ACV Arcata / Eureka Arcata Airport AHC Herlong Amedee Army Airfield (Sierra Army Depot) AJO Corona Corona Municipal Airport APC Napa Napa County Airport APV Apple Valley Apple Valley Airport AUN Auburn Auburn Municipal Airport AVX Avalon Catalina Airport BAB Marysville Beale Air Force Base BFL Bakersfield Meadows Field BIH Bishop Eastern Sierra Regional Airport BLH Blythe Blythe Airport BLU Emigrant Gap Blue Canyon - Nyack Airport CDTFA-810-FTH (S1B) REV. -

Governing Board Meeting Agenda

MEETING, JULY 13, 2012 A meeting of the South Coast Air Quality Management District Board will be held at 9:00 a.m., in the Auditorium at AQMD Headquarters, 21865 Copley Drive, Diamond Bar, California. - 2 - CALL TO ORDER Pledge of Allegiance Opening Comments: William A. Burke, Ed.D., Chair Other Board Members Barry R. Wallerstein, D. Env., Executive Officer Presentations to Outgoing Hearing Board Member Alternates Burke Thomas E. Browne and Steve Zikman Staff/Phone (909) 396- CONSENT CALENDAR (Items 1 through 17) Note: Consent Calendar items held for discussion will be moved to Item No. 18 1. Approve Minutes of June 1, 2012 Board Meeting McDaniel/2500 Budget/Fiscal Impact 2. Authorize Purchase of PeopleSoft and Oracle Software Support Marlia/3148 The AQMD uses the PeopleSoft Integrated Financial/Human Resources System. The software package provides purchasing, accounting, asset management, financial management, project reporting, payroll, and human resource functionality for the AQMD. The PeopleSoft system uses Oracle database software. The maintenance support for this system expires August 13, 2012. This action is to obtain approval for the purchase of PeopleSoft and Oracle software maintenance support for another year. Funds for this expense are included in the FY 2012-13 Budget. (Reviewed: Administrative Committee, June 8, 2012; Recommended for Approval) 3. Authorize Purchase of OnBase Software Support Marlia/3148 The AQMD uses the OnBase software for its electronic document management system to manage critical documents and to support the Record Retention Policy. Software subscription and support for OnBase expires on July 31, 2012. This action is to obtain approval for sole source purchase of OnBase software subscription and support for one year. -

5Th ANNUAL INSURANCE DIVERSITY SUMMIT California

5th ANNUAL INSURANCE DIVERSITY SUMMIT California State University of Los Angeles Golden Eagle Building, 3 rd Floor Wednesday, December 7, 2016 Travel Resources for Attendees TRANSPORTATION NEAREST MAJOR AIRPORT Los Angeles International Airport (LAX) (23 miles) Address: 1 World Way Los Angeles, CA 90045 Phone: (310) 646-5252 OTHER NEARBY AIRPORTS El Monte Airport (EMT) (17 miles) 4233 Santa Anita Ave, El Monte, CA 91731 Phone: (626) 448-6129 Bob Hope Airport (BUR) (18 miles) Address: 2627 N Hollywood Way, Burbank, CA 91505 Phone: (818) 840-8840 Compton/Woodley Airport (CPM) (18 miles) Address: 901 W Alondra Blvd, Compton, CA 90220 Phone: (310) 631-8140 Hawthorne Municipal Airport (HHR) (20 miles) Address: 12101 S Crenshaw Blvd, Hawthorne, CA 90250 Phone: (310) 349-1635 Van Nuys Airport (NVY) (30 miles) Address: 16461 Sherman Way, Van Nuys, CA 91406 Phone: (818) 442-6500 Whiteman Airport (WHP) (23 miles) Address: 12653 Osborne St, Los Angeles, CA 91331 Phone: (818) 896-5271 BUS & TRAIN SERVICES Cal State L.A. Transit Center (near campus) http://web.calstatela.edu/classschedule/pdf/fall_book/124TransportationServicesFall11. pdf http://www.calstatela.edu/police/transportation-services NEAREST TNC SERVICES (LYFT/UBER) DROP-OFF & PICK-UP LOCATION 5154 State University Drive, Los Angeles, CA 90032-8636. This is right in front of the Student Union which is across from the Golden Eagle Building. Summit: Resources for Attendees | 1 LODGING OFF CAMPUS Hilton Hotel San Gabriel (4 miles from CSULA) Address: 225 West Valley Blvd, San Gabriel,