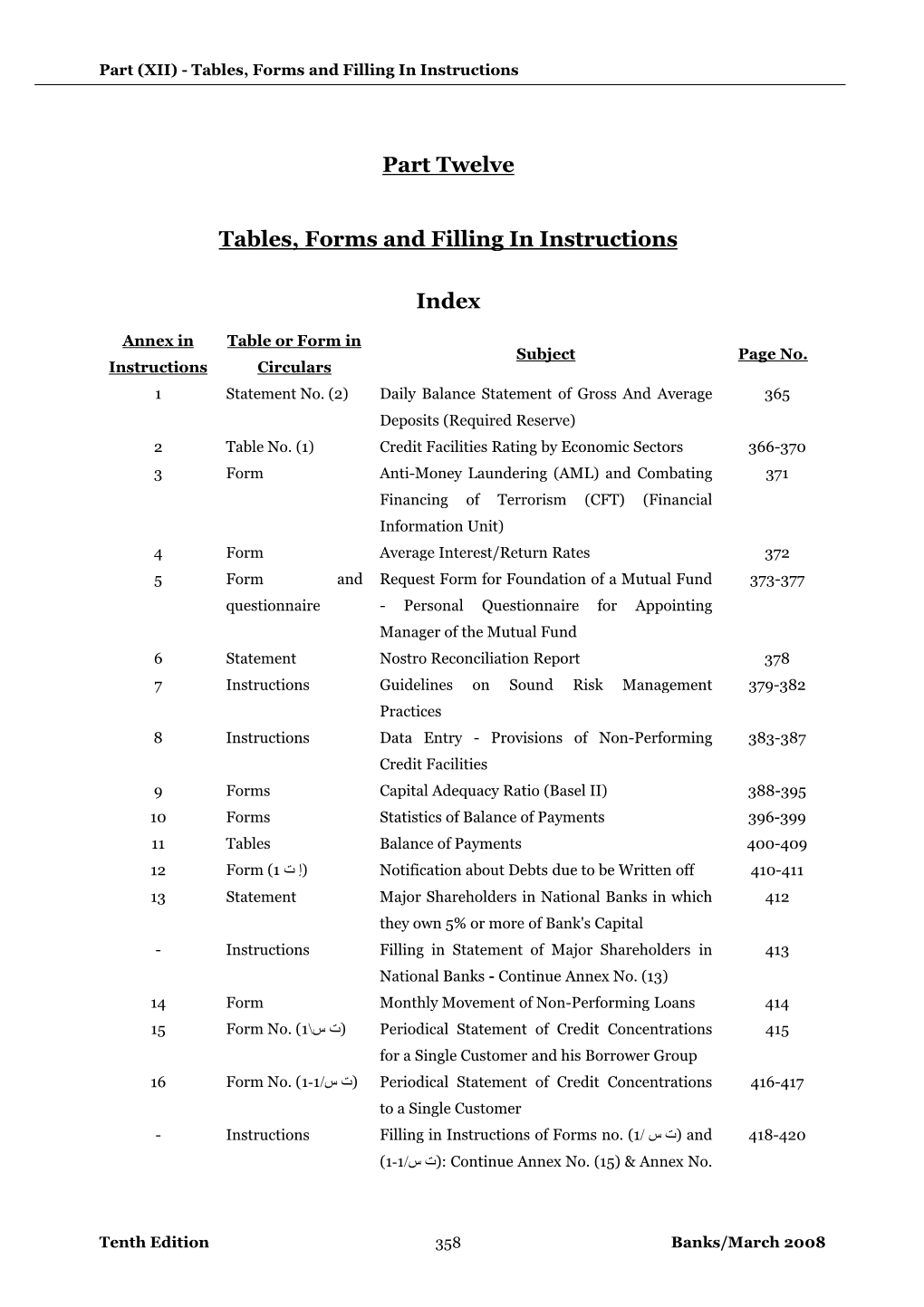

Part Twelve Tables, Forms and Filling in Instructions Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Qatar Centre for Global Banking & Finance

Qatar Centre for Global Banking & Finance 2019–20 The Qatar Centre for Global Banking & Finance ANNUAL REPORT 2019–20 Contents Thank you from the Chairman of Council, King’s College London 3 Welcome from the Provost & Senior Vice-President (Arts & Sciences) 5 A message from the Executive Dean of King’s Business School 8 Introduction from the Director of the Qatar Centre for Global Banking & Finance 9 People: Key appointments 11 People: Joint Steering Committee members 13 People: Executive board members 15 People: Visiting research fellows and PhD students 17 Our partnership 19 Events and engagement 21 Research 27 Global Leader Experience 35 News and updates 37 Thank you 39 Thank you from the Chairman of Council, King’s College London The Rt Hon the Lord Geidt GCB GCVO OBE QSO FKC On behalf of King’s College London, I would serve society. Through our education, our research like to express my sincere gratitude to Qatar and our partnerships, we are committed to making a Central Bank for their generosity and support positive difference in the world. Our partnership with in the creation of the Qatar Centre for Global Qatar Central Bank supports and strengthens our Banking & Finance at King’s Business School. mission. As we work together to address the profound financial challenges the world now faces, we strive to As Chairman, I have the honour of witnessing make a valuable impact on the society of tomorrow. first-hand the strengthening of the partnership between King’s, Qatar and Qatar Central On behalf of King’s College London, we are Bank. -

List of Certain Foreign Institutions Classified As Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms

NOT FOR PUBLICATION DEPARTMENT OF THE TREASURY JANUARY 2001 Revised Aug. 2002, May 2004, May 2005, May/July 2006, June 2007 List of Certain Foreign Institutions classified as Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms The attached list of foreign institutions, which conform to the definition of foreign official institutions on the Treasury International Capital (TIC) Forms, supersedes all previous lists. The definition of foreign official institutions is: "FOREIGN OFFICIAL INSTITUTIONS (FOI) include the following: 1. Treasuries, including ministries of finance, or corresponding departments of national governments; central banks, including all departments thereof; stabilization funds, including official exchange control offices or other government exchange authorities; and diplomatic and consular establishments and other departments and agencies of national governments. 2. International and regional organizations. 3. Banks, corporations, or other agencies (including development banks and other institutions that are majority-owned by central governments) that are fiscal agents of national governments and perform activities similar to those of a treasury, central bank, stabilization fund, or exchange control authority." Although the attached list includes the major foreign official institutions which have come to the attention of the Federal Reserve Banks and the Department of the Treasury, it does not purport to be exhaustive. Whenever a question arises whether or not an institution should, in accordance with the instructions on the TIC forms, be classified as official, the Federal Reserve Bank with which you file reports should be consulted. It should be noted that the list does not in every case include all alternative names applying to the same institution. -

Tax Relief Country: Italy Security: Intesa Sanpaolo S.P.A

Important Notice The Depository Trust Company B #: 15497-21 Date: August 24, 2021 To: All Participants Category: Tax Relief, Distributions From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers Tax Relief Country: Italy Security: Intesa Sanpaolo S.p.A. CUSIPs: 46115HAU1 Subject: Record Date: 9/2/2021 Payable Date: 9/17/2021 CA Web Instruction Deadline: 9/16/2021 8:00 PM (E.T.) Participants can use DTC’s Corporate Actions Web (CA Web) service to certify all or a portion of their position entitled to the applicable withholding tax rate. Participants are urged to consult TaxInfo before certifying their instructions over CA Web. Important: Prior to certifying tax withholding instructions, participants are urged to read, understand and comply with the information in the Legal Conditions category found on TaxInfo over the CA Web. ***Please read this Important Notice fully to ensure that the self-certification document is sent to the agent by the indicated deadline*** Questions regarding this Important Notice may be directed to Acupay at +1 212-422-1222. Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions, delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any special, consequential, exemplary, incidental or punitive damages. -

Doha-Bank-Annual-Report-2020-En

www.dohabank.com Going further for the greater good ANNUAL REPORT His Highness His Highness Sheikh Hamad Bin Khalifa Al-Thani Sheikh Tamim Bin Hamad Al-Thani Father Emir of the State of Qatar Emir of the State of Qatar Contents Doha Bank Awards 08 Global Network 11 Financial Highlights 12 Chairman ,s Message 13 Board of Directors 14 Executive Management 15 International Network 16 Management Report 18 Corporate Governance Report 52 Financial Results 94 Doha Bank Contact Directory 206 Doha Bank Branch Directory 207 Pay Offices & E-Branches 207 Overseas Branches & Representative Offices 208 8 9 DOHA BANK Best Trade Best Trade Outstanding Finance Bank Finance Provider Crisis Leadership – New Age Banking Global Finance Community Award AWARDS Summit Awards Global Finance 2020 2020 2020 Doha Bank has been recognized by various professional institutions for its consistent and strong financial performance as well as its innovative banking GOLDEN PEACOCK products and services. Doha Bank’s international expansion strategy has also GLOBAL AWARDS been identified as one of the key factors of its success and recognized by the W I N N E R Sustainability Awarding institutions. The awards stand testament to the commitment of Doha 2020 Bank to ensure continuous improvement in its product and service quality as Best Employer Best Digital The Golden Peacock well as offer the best possible customer service. Brand Award Bank Global Award for World HRD Congress Global Economics Awards Sustainability Institute of Directors 2020 2020 2020 01 04 Best Trade Finance -

Participant List

Participant List 10/20/2019 8:45:44 AM Category First Name Last Name Position Organization Nationality CSO Jillian Abballe UN Advocacy Officer and Anglican Communion United States Head of Office Ramil Abbasov Chariman of the Managing Spektr Socio-Economic Azerbaijan Board Researches and Development Public Union Babak Abbaszadeh President and Chief Toronto Centre for Global Canada Executive Officer Leadership in Financial Supervision Amr Abdallah Director, Gulf Programs Educaiton for Employment - United States EFE HAGAR ABDELRAHM African affairs & SDGs Unit Maat for Peace, Development Egypt AN Manager and Human Rights Abukar Abdi CEO Juba Foundation Kenya Nabil Abdo MENA Senior Policy Oxfam International Lebanon Advisor Mala Abdulaziz Executive director Swift Relief Foundation Nigeria Maryati Abdullah Director/National Publish What You Pay Indonesia Coordinator Indonesia Yussuf Abdullahi Regional Team Lead Pact Kenya Abdulahi Abdulraheem Executive Director Initiative for Sound Education Nigeria Relationship & Health Muttaqa Abdulra'uf Research Fellow International Trade Union Nigeria Confederation (ITUC) Kehinde Abdulsalam Interfaith Minister Strength in Diversity Nigeria Development Centre, Nigeria Kassim Abdulsalam Zonal Coordinator/Field Strength in Diversity Nigeria Executive Development Centre, Nigeria and Farmers Advocacy and Support Initiative in Nig Shahlo Abdunabizoda Director Jahon Tajikistan Shontaye Abegaz Executive Director International Insitute for Human United States Security Subhashini Abeysinghe Research Director Verite -

Strategic Plan for Financial Sector Regulation (2013-2016)

His Highness Sheikh Tamim bin Hamad Al Thani Emir of the State of Qatar Contents 2 Foreword 6 Executive Summary 10 Challenges and Opportunities 16 Mission, Vision and Values 20 Key Objectives 22 Strategic Goal 1: Enhancing regulation Strengthening risk-based regulation Banking Insurance Capital markets Promoting Islamic financial institutions and markets Improving governance and transparency Corporate governance Strengthening transparency Reinforcing disclosure practices 24 Strategic Goal 2: Expanding macro-prudential oversight Financial Stability and Risk Control Committee (FSRCC) Identifying and monitoring the sources of systemic risk Developing macro-prudential policy instruments Undertaking research and analysis Promoting the role of the Qatar Credit Bureau 26 Strategic Goal 3: Strengthening market infrastructure Enhancing payment system resilience Strengthening the payments and settlements system Expanding participation in the payments and settlements system Permanent Constitution Developing the debt market Government debt market The corporate debt market Broadening investor participation Implementing a deposit protection regime Financing small and medium-sized enterprises (SMEs) The State shall guarantee freedom of 28 Strategic Goal 4: Protecting consumers and investors economic enterprise on the basis of Developing standards of conduct Addressing regulatory gaps in Qatar social justice and balanced cooperation Protecting credit information Raising public awareness between private and public activity 30 Strategic Goal 5: Promoting -

November 2020 List of Participants 1 Afghanistan

NOVEMBER 2020 LIST OF PARTICIPANTS AFGHANISTAN ALGERIA Mr. Ajmal Ahmady Mr. Loumi Chaâbane Governor Subdirector of Statistics Afghanistan Central Bank MOF, General Tax Directorate Pashtonistan Watt Cité Malki-Ben Aknoun Kabul 1001 Algiers 16000 AFGHANISTAN ALGERIA Mr. Mustafa Sameh Mrs. Kendil Fatma Zohra Manager, Financial Stability Section On-site Supervisor Da Afghanistan Bank Banking Supervision & Inspection Dept. Pashtonistan Watt Bank of Algeria Kabul 1001 38 Ave. Franklin Roosevelt AFGHANISTAN Algiers 16000 ALGERIA Mr. Gul Mohammad Noori Ms. Fatma Zohra Dahmani Deputy Manager, Financial Stability Inspector, Off Site Supervision Dept . Da Afghanistan Bank Bank of Algeria Pashtonistan Watt 38, avenue Franklin Roosevelt Kabul 1001 Alger 16000 AFGHANISTAN ALGERIA ALBANIA ARMENIA Mr. Deniz Deralla Ms. Mariam Yeghiazaryan Director of Supervision Dept. Head of Banking System Regulation Division Bank of Albania Central Bank of Armenia Sheshi Skënderbej No. 1 Vazgen Sargsyan 6 Tirana 1001 Yerevan ALBANIA ARMENIA 0010 ALGERIA AUSTRALIA Ms. Sara Kennouche Mr. Wayne Byres Directorate General of Politics and Provision Chair Finance Ministries Australian Prudential Regulation Authority Ahmed Francis bldg. Level 12, 1 Martin Place Ben aknoun -Algiers Sydney 2000 ALGERIA AUSTRALIA 1 NOVEMBER 2020 LIST OF PARTICIPANTS AUSTRIA BAHRAIN Mr. Eduard Mueller Mr. Nabeel Juma Executive Director Superintendent, Financial Institutions Financial Market Authority Austria Regulatory Policy Otto Wagner Platz 5 Central Bank of Bahrain Vienna 1090 King Faisal Highway, Diplomatic Area, Block 317, AUSTRIA Road 1702, Building 96 Manama BAHRAIN Mrs. Katharina Muther-Pradler Head of Department of Integrated Supervision Ms. Reema Mandeel Financial Market Authority Austria Superintendent, Regulatory Policy Otto Wagner Platz 5 Central Bank of Bahrain Vienna 1090 King Faisal Highway, Diplomatic Area, Block 317, AUSTRIA Road 1702, Building 96 Manama BAHRAIN Dr. -

Central Bank of Different Countries List of Central Banks of Different

Central Bank Of Different Countries List Of Central Banks Of Different Countries Country name Central Bank Afghanistan Bank of Afghanistan Albania Bank of Albania Algeria Bank of Algeria Argentina Central Bank of Argentina Armenia Central Bank of Armenia Aruba Central Bank of Aruba Australia Reserve Bank of Australia Austria Austrian National Bank Azerbaijan National Bank of Azerbaijan Bahamas Central Bank of The Bahamas Bahrain Central Bank of Bahrain Bangladesh Bangladesh Bank Barbados Central Bank of Barbados Belarus National Bank of the Republic of Belarus Belgium National Bank of Belgium Belize Central Bank of Belize Benin Central Bank of West African States (BCEAO) Bermuda Bermuda Monetary Authority Bhutan Royal Monetary Authority of Bhutan Bolivia Central Bank of Bolivia Bosnia Central Bank of Bosnia and Herzegovina Botswana Bank of Botswana Brazil Central Bank of Brazil Bulgaria Bulgarian National Bank Burkina Faso Central Bank of West African States (BCEAO) Cambodia National Bank of Cambodia Cameroon Bank of Central African States Canada Bank of Canada – Banque du Canada Cayman Islands Cayman Islands Monetary Authority Page 1 Central Bank Of Different Countries Central African Bank of Central African States Republic Chad Bank of Central African States Chile Central Bank of Chile China The People’s Bank of China Colombia Bank of the Republic Comoros Central Bank of Comoros Congo Bank of Central African States Costa Rica Central Bank of Costa Rica Côte d’Ivoire Central Bank of West African States (BCEAO) Croatia Croatian National -

Sheikh Abdulla Bin Saoud Al-Thani Governor Qatar Central Bank

IV. Interviews Sheikh Abdulla bin Saoud Al-Thani Governor Qatar Central Bank Gulf Affairs: What role is the Qatar Central Bank (QCB) playing in Qatar’s national vision 2030? Sheikh Abdulla bin Saoud Al-Thani: QCB is committed to achieving the goals of Qatar’s National Vi- sion (QNV) 2030 by maintaining monetary and financial stability in Qatar. QCB, along with Qatar Finan- cial Centre Regulatory Authority and Qatar Financial Markets Authority, launched the Second Strategic Plan in 2017, an extension of the First Strategic Plan 2013-2016, for financial sector development. In the Second Strategic Plan 2017-2022, QCB promotes financial market development which supports the QNV 2030 goals of modernisation, economic growth and social development that will help Qatar achieve the status of ‘developed nation’ by 2030. A well-developed financial sector is a necessary condition for transforming Qatar into a developed coun- try by the year 2030. Accordingly, in the second strategic plan, QCB aims to enhance financial sector regulation and to promote institutional cooperation for the development of financial markets. In terms of financial market development, QCB recognises the role of financial innovation and Fintech in meeting future challenges. As for human development, QCB is making efforts for enhancing financial inclusion and financial literacy in Qatar. Financial literacy and wider financial inclusion are also important for the 30 Gulf Affairs IV. Interviews encouragement of young entrepreneurs, innovation and human development, and for economic diversi- fication more generally. In sum, the developed financial market will create opportunities for lending and investment and help in economic diversification needed to attain the goals of QNV 2030. -

Qatar Central Bank

Part (XIII) - Tables, Forms and Filling Up Instructions E-Banking Instructions IBAN Standard Annex No. (193) IBAN Standards Ver. 2.0 - QATAR QATAR CENTRAL BANK INTERNATIONAL BANK ACCOUNT NUMBER (IBAN) - QATAR STANDARDS DOCUMENT JULY 2013 Circular no. (66/2013) dated 14/8/2013. Fifteenth Edition 1304 September 2013 Part (XIII) - Tables, Forms and Filling Up Instructions IBAN Standards Ver. 2.0 - QATAR Contents 1. Introduction ................................................................................................. 1306 1.1 Definitions ................................................................................................ 1307 2. Standards.................................................................................................... 1308 2.1 IBAN Specification ....................................................................................... 1308 2.1.1 Qatar Banks Swift Code and Identifier ............................................... 1309 2.1.2 Use of Uppercase ................................................................................. 1309 2.2 Presentation Format of IBAN ....................................................................... 1309 3. Scope .......................................................................................................... 1310 3.1 Where IBAN is required ........................................................................... 1310 3.2 Validation ................................................................................................. 1310 4. Example of -

09901-9781451886757.Pdf

© 2009 International Monetary Fund January 2009 IMF Country Report No. 09/32 Qatar: Statistical Appendix This Statistical Appendix for Qatar was prepared by a staff team of the International Monetary Fund as background documentation for the periodic consultation with the member country. It is based on the information available at the time it was completed on December 30, 2008. The views expressed in this document are those of the staff team and do not necessarily reflect the views of the government of Qatar or the Executive Board of the IMF. The policy of publication of staff reports and other documents by the IMF allows for the deletion of market-sensitive information. Copies of this report are available to the public from International Monetary Fund ● Publication Services 700 19th Street, N.W. ● Washington, D.C. 20431 Telephone: (202) 623-7430 ● Telefax: (202) 623-7201 E-mail: [email protected] ● Internet: http://www.imf.org International Monetary Fund Washington, D.C. ©International Monetary Fund. Not for Redistribution This page intentionally left blank ©International Monetary Fund. Not for Redistribution INTERNATIONAL MONETARY FUND QATAR Statistical Appendix Prepared by a staff team consisting of Gene Leon (head), Ananthakrishnan Prasad, Francis Kumah, Oral Williams, and Raphael Espinoza (all MCD) Approved by the Middle East and Central Asia Department December 30, 2008 Contents Page 1. Basic Data: Social and Demographic Indicators and Selected Economic and Financial Indicators, 2002–07..........................................................................................................2 2. Gross Domestic Product at Current Prices by Economic Sectors, 2002–07........................4 3. Gross Domestic Product at Constant Prices by Sectors, 2002–07.......................................4 4. GDP by Expenditure Categories, 2002–07..........................................................................5 5. -

Monetary Policy in Qatar and Qatar's Attitude Towards the Proposed

Monetary policy in Qatar and Qatar’s attitude towards the proposed single currency for the Gulf Cooperation Council Fahad Faisal Al-Thani 1. Monetary policy in Qatar, 1940s-2002 A review of the monetary situation, 1940s-1993 Until the early 1970s Qatar was under British influence, and so had all the economic features of the countries linked to the sterling currency area. For most of this period, Qatar did not have its own national currency and remained dependent on foreign banks. The first such bank was a branch of the Eastern Bank (now known as Standard Chartered), which opened in 1950. The situation changed in 1965 when the first domestic bank, Qatar National Bank, was established. Subsequently: · In March 1966 a currency agreement signed between Qatar and Dubai established the Qatar and Dubai Currency Board. A new currency, the Qatar-Dubai riyal, replaced the foreign currencies in circulation in the second half of 1966. · In September 1971 Qatar gained independence. When Dubai merged with the United Arab Emirates in May 1973, the government issued Law no 7 establishing the Qatar Monetary Agency and granting it the powers of a central bank. The Qatari riyal replaced the Qatar- Dubai riyal as the national currency. · In April 1974, Decree no 72 declared that the Qatari riyal would continue to be pegged to the US dollar in the same manner as the Qatar-Dubai riyal. · In March 1975 the basis for the riyal peg was changed from the US dollar to the Special Drawing Right (SDR) at a rate of 4.7619 riyal per SDR with a marginal variation of ±2.25%.