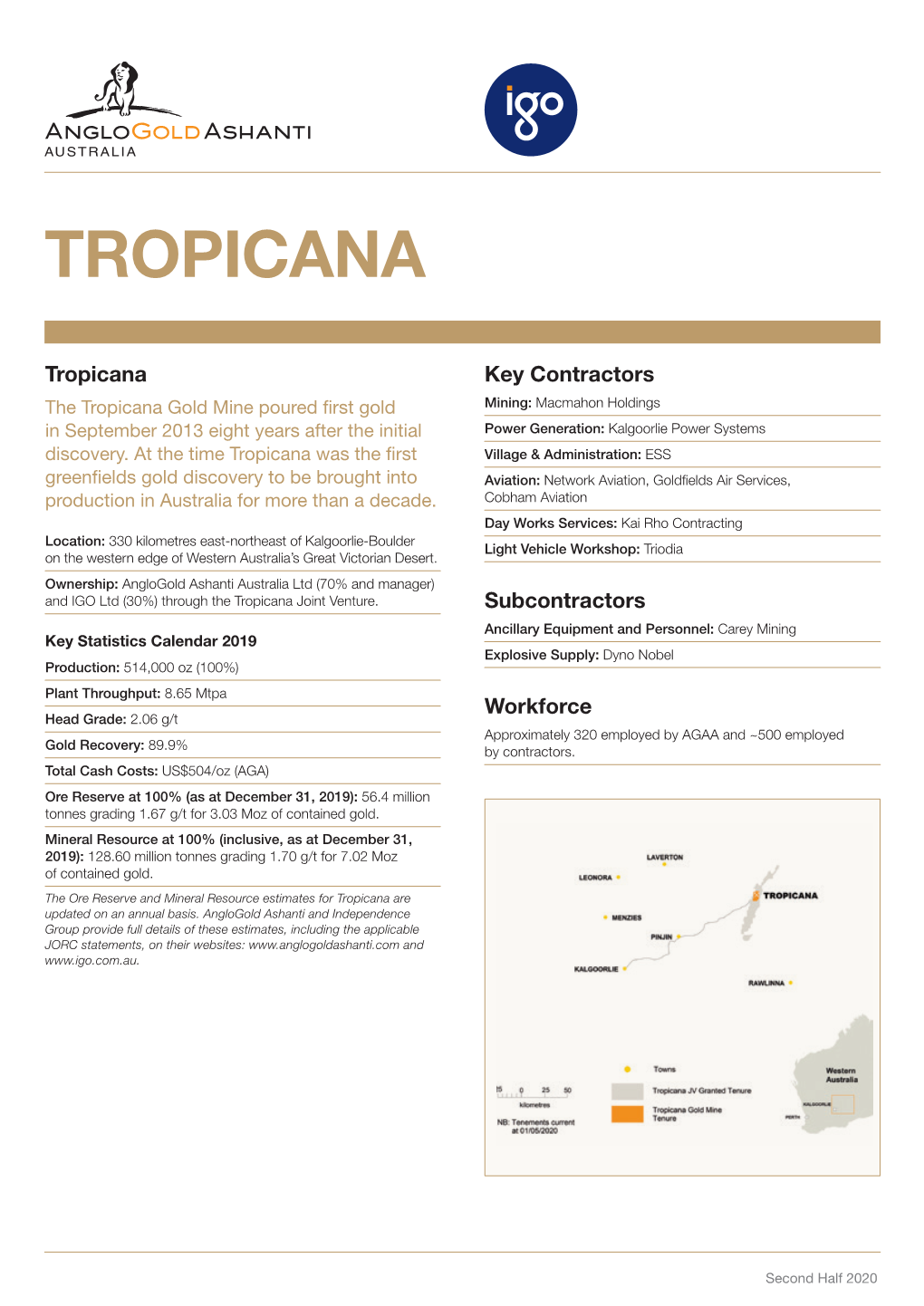

Fact Sheet Second Half 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Group Information

Group information AngloGold Limited was founded in June 1998 through the consolidation of the gold mining interests of Anglo American. The company, AngloGold Ashanti as it is now, was formed on 26 April 2004 following the business combination between AngloGold and Ashanti Goldfields Company Limited. AngloGold Ashanti is currently the third largest gold producing mining company in the world. CURRENT PROFILE AngloGold Ashanti Limited, headquartered in Johannesburg, South Africa, is a global gold company with a portfolio of long-life, relatively low-cost assets and differing orebody types in key gold producing regions. The company's 21 operations are located in 10 countries (Argentina, Australia, Brazil, Ghana, Guinea, Mali, Namibia, South Africa, Tanzania and the United States of America), and are supported by extensive exploration activities. The combined Proved and Probable Ore Reserves of the group amounted to 74.9 million ounces as at 31 December 2008. The primary listing of the company's ordinary shares is on the JSE Limited (JSE) in South Africa. Its ordinary shares are also listed on stock exchanges in London, Paris and Ghana, as well as being quoted in Brussels in the form of International Depositary Receipts (IDRs), in New York in the form of American Depositary Shares (ADSs), in Australia, in the form of Clearing House Electronic Subregister System Depositary Interests (CDIs) and in Ghana, in the form of Ghanaian Depositary Shares (GhDSs). AngloGold Ashanti Limited (Registration number 1944/017354/06) was incorporated in the Republic of South Africa in 1944 under the name of Vaal Reefs Exploration and Mining Company Limited and operates under the South African Companies Act 61 of 1973, as amended. -

IGO Interactive Annual Report 2020

2021 ANNUAL REPORT We believe in a green energy future. IGO Limited is an ASX 100 listed ACKNOWLEDGEMENTS Company focused on creating a We acknowledge the Traditional Owners of the land on better planet for future generations by which we operate and on which we work. We recognise their connection to land, waters and culture, and pay our discovering, developing, and delivering respects to their Elders past, present and emerging. products critical to clean energy. We would like to thank Neil Warburton who retired from the IGO Board in FY21 for his significant contribution to IGO over the last five years. WHO WE ARE We are also pleased to welcome two new appointments IGO Limited is an ASX 100 listed Company focused on to the Board, Xiaoping Yang as a Non-executive Director creating a better planet for future generations by discovering, and Michael Nossal as a Non-executive Director who developing, and delivering products critical to clean energy. transitioned to the Chair role on 1 July 2021. As a purpose-led organisation with strong, embedded values and a culture of caring for our people and our stakeholders, We would also like to take this opportunity to thank Peter we believe we are Making a Difference by safely, sustainably Bilbe, who was appointed to the IGO Board in 2009, for his and ethically delivering the products our customers need substantial contribution to the Company. Over his tenure, to advance the global transition to decarbonisation. Peter has overseen the positive transformation of IGO, culminating in the announcement on 30 June 2021 of the Through our upstream mining and downstream processing completion of the transaction with Tianqi Lithium Corporation. -

Anglogold Ashanti Limited (Anglogold Ashanti) Publishes a Suite of Reports to Record Its Overall Performance Annually

ANNUAL FINANCIAL ANNUAL FINANCIAL STATEMENTS ANNUAL FINANCIAL STATEMENTS STATEMENTS 2013 2013 GUIDE TO REPORTING AngloGold Ashanti Limited (AngloGold Ashanti) publishes a suite of reports to record its overall performance annually. The Annual Financial Statements 2013 addresses our statutory reporting requirements. The full suite of 2013 reports for AngloGold Ashanti Limited comprises: Annual Integrated Report 2013, the primary report; Annual Financial Statements 2013; Annual Sustainability Report 2013; and Mineral Resource and Ore Reserve Report 2013. Other reports available for the financial year are the operational and project profiles and country fact sheets. The full suite of 2013 reports have been furnished to the United States Securities and Exchange Commission (SEC) on Form 6-K. These reports are all available on our annual report portal at www.aga-reports.com. FOR NOTING: The following key parameters should be noted in respect of our reports: Production is expressed on an attributable basis unless otherwise indicated; Unless otherwise stated, $ or dollar refers to US dollars throughout this suite of reports; Group and company are used interchangeably, except for in the group and company annual financial statements; Statement of financial position and balance sheet are used interchangeably; and The company implemented an Enterprise Resource Planning System (ERP), i.e. SAP at all its operations, except for the Continental Africa region. ERP and SAP are used interchangeably. 1 VISION, MISSION AND VALUES To create value for our shareholders, our employees and our business and social partners through safely and responsibly exploring, mining and marketing our products. Our primary focus is gold, but we will pursue value creating opportunities in other minerals where we can leverage our existing assets, skills and experience to enhance the delivery of value. -

Adapting to Climate Change: a Guide for the Mining Industry

Adapting to Climate Change: A Guide for the Mining Industry Julia Nelson, Manager, Advisory Services Ryan Schuchard, Manager, Climate and Energy This guide is part of a BSR This primer on climate change adaptation summarizes how companies in the industry series. For additional mining industry are reporting on climate change risks and opportunities, and highlights current and emerging best practices and guidance for E&U companies climate adaptation briefs, please visit www.bsr.org/adaptation. on how to develop a proactive approach to climate change adaptation. In this brief, mining refers to companies involved in the extraction of a broad range of metals and minerals, including precious metals, base metals, industrial Contents and Methodology minerals, coal, and uranium. This brief covers: Introduction Reporting on Risks and Opportunities: A synopsis Due to the wide geographic distribution of mining operations, climate change, including temperature and precipitation shifts as well as more frequent and based on reporting of climate severe extreme weather events, will have complex impacts on the sector. risk in 2009 by 41 mining Climactic conditions will affect the stability and effectiveness of infrastructure and companies to the Carbon equipment, environmental protection and site closure practices, and the Disclosure Project (CDP). availability of transportation routes. Climate change may also impact the stability and cost of water and energy supplies. Current Practices: An outline of actions related to climate Some examples: Warming temperatures will increase water scarcity in some change adaptation based on locations, inhibiting water-dependent operations, complicating site rehabilitation reporting from the CDP, and bringing companies into direct conflict with communities for water resources. -

Independence Group NL

For personal use only Sustainability Report 2016 Creating a leading diversified mining company For personal use only sustaining our future managing the impact of our growth JOINT MESSAGE FROM THE CHAIRMAN AND CEO 2 ABOUT IGO 5 Who We Are 5 Vision, Mission and Values 6 Our Code of Conduct 8 Governance 9 APPROACH TO SUSTAINABILITY 11 Continual Improvement 12 About this Report 15 743 Stakeholders and Materiality 16 Stakeholder Engagement 18 people are ORGANISATIONAL PROFILE 21 employed at IGO The Mining and Exploration Process 23 Business Strategy 26 Management Systems 26 OPERATIONS 29 Tropicana Gold Mine 30 Independence Group NL (IGO) is an Long Operation 32 Jaguar Operation 34 ASX-listed diversified, mining and exploration GROWTH 37 company that is currently producing gold, Nova Project 38 Stockman Project 40 nickel, copper, zinc and silver from three Exploration 42 mining operations in Western Australia. IGO's Lake MacKay Project 44 Bryah Basin Project 45 world-class Nova Project will commence Salt Creek Project 45 production in December 2016. Fraser Range Project 46 Scandinavian Project 47 ECONOMIC IMPACT 49 Independence Group NL Operating Performance 50 ABN 46 092 786 304 FY16 Financial Performance 50 Socio-economic Contributions 50 Suite 4, Level 5 Procurement 51 South Shore Centre Customers 54 85 South Perth Esplanade South Perth WA 6151 SOCIAL IMPACT 57 Our People 58 Postal: PO Box 496 Safety 60 South Perth WA 6951 Occupational Health 63 Enquiries: Keith Ashby IGO Corporate Giving 66 Sustainability Manager Community Development and Assistance 66 Traditional Land Use 68 Telephone: +61 8 9238 8300 Native Title 70 Email: [email protected] Heritage Protection 71 Website: www.igo.com.au Statutory Compliance 71 Stakeholder Feedback 71 ENVIRONMENTAL IMPACT 73 Statistics related to hours worked as presented in Environmental Conditions 74 this report include both permanent full-time and Land and Biodiversity Management 75 part-time Independence Group NL (IGO) employees Flora and Fauna 76 and contractors. -

The Mineral Industry of Brazil in 2016

2016 Minerals Yearbook BRAZIL [ADVANCE RELEASE] U.S. Department of the Interior March 2021 U.S. Geological Survey The Mineral Industry of Brazil By Philip A. Szczesniak Brazil is one of the leading mining countries in the world, Minerals in the National Economy producing a wide array of industrial minerals, metals, and mineral fuels. In 2016, Brazil’s estimated share of world mined Brazil’s mineral production (excluding crude petroleum and niobium production amounted to 89%; iron ore, 19%; asbestos, natural gas) in 2016 was valued at $24 billion (representing about 16%; vermiculite, 14%; bauxite, 13%; talc and pyrophyllite, 1% of the GDP) compared with $26 billion in 2015. IBRAM 11%; alumina, 9%; tin, 9%; graphite (natural) and tantalum, reported that the value of mineral production had fallen by more 8% each; and manganese, 7%. The World Steel Association than 50% since peaking at $53 billion in 2011. The decrease was reported that Brazil accounted for about 2% of the world’s crude largely attributed to the decrease in global mineral commodity steel production and was the leading producer in South America prices, especially iron ore prices. In the second half of the year, (77% of South America’s steel production) (World Steel 164,807 workers were employed in the mining sector compared Association, 2017, p. 9–10; Anderson, 2018; Bolen, 2018; Bray, with 174,610 (revised) in the second half of 2015. The Economic 2018; Corathers, 2018; Flanagan, 2018; Olson, 2018; Polyak, Commission for Latin America and the Caribbean noted that 2018a, b; Tanner, 2018; Tuck, 2018). Brazil’s foreign direct investment (FDI) increased in 2016 to Brazil ranked 10th in the world in crude petroleum production $79 billion, which was up from $75 billion in FDI in 2015 but and ranked 2d in South America (after Venezuela) in both still below the 5-year high of $101 billion that was reached in crude petroleum and natural gas reserves. -

Water Management in Mining: a Selection of Case Studies

Report Water management in mining: a selection of case studies Environment May 2012 Contents Foreword 3 Flows of water to and from a mine site 4 Introduction 5 Anglo American 10 eMalahleni Water Reclamation Plant, Republic of South Africa Minera Esperanza 12 Minera Esperanza Antofagasta, Chile AREVA 14 Trekkopje uranium mine, Namibia Freeport-McMoRan Copper & Gold 16 Sociedad Minera Cerro Verde copper mine, Peru BHP Billiton 18 Olympic Dam, Australia Xstrata Copper 20 Lomas Bayas mine, Chile Rio Tinto22 Argyle Diamond Mine, Western Australia JX Nippon Mining & Metals 24 Toyoha mine, Japan Barrick 26 Homestake mine, United States of America AngloGold Ashanti 28 Cerro Vanguardia S.A, Argentina Acknowledgements 30 Front cover: Mandena, Madagascar Copyright © 2010 Rio Tinto www.icmm.com/our-work/projects/water Foreword d r o w e r o F 3 Water is a fundamental resource for life. Whether from groundwater or surface water sources, availability of and access to water that meets quality and quantity requirements, is a critical need across the world. We all share responsibility for meeting this need now and in the future. In mining, water is used within a broad range of activities including mineral processing, dust suppression, slurry transport, and employee requirements. Over the last several decades, the industry has made much progress in developing close-circuit approaches that maximize water conservation. At the same time, operations are often located in areas where there are not only significant competing municipal, agricultural and industrial demands but also very different perspectives on the role of water culturally and spiritually. Together, these characteristics lead to tough challenges and there is no simple recipe for water management in mining particularly because the local environments of mines range from extremely low to the highest rainfall areas in the world. -

Mine 2019 Resourcing the Future

Mine 2019 Resourcing the future www.pwc.com/mine Shifting expectations Welcome to our annual review of futures markets, not present markets. And Copper and battery metals, which stand to global trends in the mining industry, when investors and other stakeholders gain as the energy mix moves away from as represented by the Top 40 mining look at the future of the mining industry, combustion engines to electricity including companies by market capitalisation. it is clear they have concerns about the renewable energy, are receiving the bulk industry’s perception on vital issues such of capital investment. (However, as coal Judged by traditional metrics, things are as safety, the environment, technology and contributes 38% to global electricity looking good for the world’s top miners. consumer engagement. generation, it remains an important part In 2018, the world’s 40 largest miners of the basket and continues to receive consolidated the stellar performance In spite of the strong operating substantial capital investment and of 2017. As a group, they increased performance, both investors and transaction focus.) production, boosted cash fl ow, paid down consumers seem to be down on the brand debt, and provided returns to shareholders of mining. They question whether the Mining companies are also streamlining at near record highs. And there was still industry can responsibly create sustainable their operating portfolio by disposing of cash left to increase capital expenditure value for all stakeholders. Discrete events, non-core assets and optimising project for the fi rst time in fi ve years. All while such as safety or environmental incidents, portfolios in line with long-term strategies. -

South Africa, Anglogold Ashanti Is the Third Largest Gold Producer in the World with Operations Around the Globe

FACT SHEET Headquartered in Johannesburg, South Africa, AngloGold Ashanti is the third largest gold producer in the world with operations around the globe. It has 20 operations in 10 countries on four continents as well as several exploration programmes in both the established and new gold producing regions of the world. Group activities are managed in four operational regions: South Africa, Continental Africa, Australasia and the Americas (both North and South America). AngloGold Ashanti – a corporate profile The South African operations employed an average of 32,082 people during the year, of whom 28,176 were contractors and 3,906 AngloGold Ashanti employed 61,242 people, including contractors, permanent employees (2010: 35,660). in 2011 (2010: 62,046) and produced 4.33Moz of gold (2010: 4.52Moz), generating $6.6bn in gold income, excluding joint ventures Capital expenditure for the region totalled $532m, an increase of 25% (2010: $5.3bn). Capital expenditure in 2011 amounted to $1.5bn on the $424m spent in 2010. The bulk of this was spent at Mponeng (2010: $1.0bn). $172m, Moab Khotsong $147m, Kopanang $92m and TauTona $79m. Capital expenditure over the past five years totalled $2bn. As at 31 December 2011, AngloGold Ashanti had a total attributable Ore Reserve of 75.6Moz (2010: 71.2Moz) and a total attributable At 31 December 2011, AngloGold Ashanti had a total Mineral Resource Mineral Resource of 230.9Moz (2010: 220.0Moz). in South Africa of 97.63Moz and a total Ore Reserve of 32.43Moz. These are equivalent to 42% and 43% respectively of group resources AngloGold Ashanti has its primary listing on the Johannesburg Stock Exchange (JSE) and is also listed on the New York, London, and reserves. -

Reef Adjacent to Structures at Tautona Mine, Anglogold Ashanti South African Operations

Reef Adjacent To Structures at TauTona Mine, AngloGold Ashanti South African Operations DE DAVIES Section Manager TauTona Mine, AngloGold Ashanti South African Operations SYNOPSIS The paper describes the extraction of reef adjacent to geological structures in the Carbon Leader Reef Section at TauTona Mine. Traditionally long wall mining has left feasible and economical blocks of ground adjacent to structures when negotiating major geological features. This meant that mining through an up- throw fault, rolling to the reef elevation on the displaced side of the fault left reef in the long wall. High grade areas were abandoned and gold was sterilized. In these tight economic times and with the need to continuously improve safety standards the need arose to develop a technique to extract these blocks economically and safely. It was believed that the structures in these abandoned areas were de-stressed and could now be mined in small volumes at a high grade. The term RATS is an acronym derived from “reef adjacent to structures” and aptly describes the process of identifying and extracting these blocks. The viability of this method was addressed in terms of the mine design, underground investigations and financial risks. The paper concludes with an analysis of the successes achieved to date. 1 INTRODUCTION TauTona Mine is one of the AngloGold Ashanti Southern Africa operations. It is close to the town of Carletonville in the province of Gauteng and about 70km south-west of Johannesburg. TauTona is 46 years old and employs ± 4 000 people. Mining operations are conducted at depths ranging from 1,800m to 3,500m at which the world’s deepest stoping sections are found. -

Mineral Resource and Ore Reserve

MINERAL RESOURCE AND ORE RESERVE REPORT 2013 ANNUAL Forward-looking statements INTEGRATED Certain statements contained in this document, other than statements of REPORT historical fact, including, without limitation, those concerning the economic outlook for the gold mining industry, expectations regarding gold prices, • CEO’s review ANNUAL INTEGRATED production, cash costs, cost savings and other operating results, return • Financial and operating REPORT ANNUAL INTEGRATED REPORT REPORT ANNUAL INTEGRATED 2013 on equity, productivity improvements, growth prospects and outlook of performance and outlook AngloGold Ashanti’s operations, individually or in the aggregate, including • Leadership and governance 2013 the achievement of project milestones, commencement and completion of • Understanding and commercial operations of certain of AngloGold Ashanti’s exploration and mitigating risks production projects and the completion of acquisitions and dispositions, AngloGold Ashanti’s liquidity and capital resources and capital expenditures and the outcome and consequence of any potential or pending litigation or regulatory proceedings or environmental, health and safety issues, are forward-looking statements regarding AngloGold Ashanti’s operations, ANNUAL economic performance and financial condition. These forward-looking SUSTAINABILITY statements or forecasts involve known and unknown risks, uncertainties REPORT and other factors that may cause AngloGold Ashanti’s actual results, performance or achievements to differ materially from the anticipated • Letter from CEO ANNUAL SUSTAINABILITY results, performance or achievements expressed or implied in these • Material sustainability ANNUAL S REPORT 2013 forward-looking statements. Although AngloGold Ashanti believes that the U S issues TAINA B ILIT expectations reflected in such forward-looking statements and forecasts Y REPORT Y REPORT • Approach to risk 2013 are reasonable, no assurance can be given that such expectations will • Sustainability performance prove to have been correct. -

Recommendations for the Mining Sector BSR | Women’S Economic Empowerment in Sub-Saharan Africa: Recommendations for the Mining Sector 1

INDUSTRY BRIEF MARCH 2017 Women’s Economic Empowerment in Sub-Saharan Africa Recommendations for the Mining Sector BSR | Women’s Economic Empowerment in Sub-Saharan Africa: Recommendations for the Mining Sector 1 Photo credit: Jonathan Torgovnik/Reportage by Getty Images BSR | Women’s Economic Empowerment in Sub-Saharan Africa: Recommendations for the Mining Sector 2 About this Brief This brief provides recommendations for mining companies to advance women’s economic empowerment in sub-Saharan Africa (SSA). This brief was developed alongside the BSR report “Women’s Economic Empowerment in Sub-Saharan Africa: Recommendations for Business Action,” which seeks to mobilize private-sector action to enhance women’s economic empowerment in the region. WHAT’S INSIDE » The Mining Industry in SSA: Includes an overview of the role the mining industry plays in SSA. » Impacts of Mining on Women in SSA: Shares key findings on the impact of the industry on women in SSA and some of the challenges to economic advancement for women involved in the mining industry as employees, workers in the supply chain, and members of mining communities. » Recommendations for Business: Provides guidance for mining companies based on the Act, Enable, Influence framework illustrated on page 12. WHO SHOULD READ THIS BRIEF This brief is intended for business leaders in CSR, corporate philanthropy, procurement, supply chain, human resources, and other functions at large-scale mining companies operating in SSA. Some recommendations may also apply to artisanal and small-scale mining (ASM) companies. Many of the recommendations are also relevant for governments, development agencies, and international finance institutions. ABOUT THE RESEARCH METHODOLOGY The methodology for this research series included a literature review, key informant interviews, and primary research conducted in the field.