Supreme Court

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Office Space for Rent in Manapakkam, Chennai

https://www.propertywala.com/P34919804 Home » Chennai Properties » Commercial properties for rent in Chennai » Office Spaces for rent in Manapakkam, Chennai » Property P34919804 Office Space for rent in Manapakkam, Chennai 32 lakhs Ready To Move Office Space In Manapakkam, Advertiser Details Chennai Manapakkam, Manapakkam, Chennai - 600040 (Tamil Na… Area: 40000 SqFeet ▾ Bathrooms: Eight Monthly Rent: 3,200,000 Rate: 80 per SqFeet Available: Immediate/Ready to move Description Scan QR code to get the contact info on your mobile 40000 sqft office for rent in dlf tech park, Manapakkam View all properties by Credenz Realty Dlf cybercity-Chennai is a unique multi-Block development that combines form and functionality with a Pictures perfect blend of work and leisure. The project is built aligning with the requirement of a new age corporate address and is fully operational and occupied Today it is the largest operational it sez in Chennai that is spread over 44 acres with 5.6 mn sq. Ft. Of workspace, Operational and occupied by top indian & international it/ites companies like ibm, Cognizant, Symantec, Csc, Logica cmg, Barclays, Igate, Tcs eserve to name a few. Highlights • independent campus development in a 44 acre plot with 5.6 mn sqft • 100% occupied and operational • best in master planning and amenities • platinum leed certified. • awarded the best private sez , By the ministry of commerce and industries for 3 years • dedicated fire station with bronto skylift of 61 mts reach and disaster management cell. • clients: Ibm, Cognizant, Barclays, -

Realty News Invest in Commercial Projects Demand, Says a Survey Rules ITAT Vol.1, Issue 4, April 2021 for PRIVATE CIRCULATION ONLY

A Comprehensive Page -> 2 Page -> 3 Page -> 4 Update On Realty Scenario In And Around APPCC Chennai Realty Industrial & Logistics TAX PLANNING Data Sectors Outlook Rental from unsold Chennai continues to attract Industrial & Logistics sectors commercial properties leading developers to come and will make up the bulk of is house-property income, Realty News invest in commercial projects demand, says a survey rules ITAT Vol.1, Issue 4, April 2021 FOR PRIVATE CIRCULATION ONLY OVERVIEW Defying the odds against second wave of Covid pandemic impacting normalcy, end users are active in the housing market to avail multiple benefits like multi-decade low of sub 7% interest rate, correction in prices and increased household savings, reports V Nagarajan Residential Mart Sales Up in Q1, 2021 he residential market is gradually pick- Mogappair, Anna Nagar and Porur, says H ing up across India, thanks to a pleth- Balasubramanian of APPCC. ora of opportunities across metros for A significant development is the spurt in sales homebuyers. Housing sales have im- of layouts in the area range of 600-800 sqft in proved and new project launched the price region of Rs 15-20 lakh. Here again, it Tupped by 38 per cent year on year. Despite the is said, that end users are active who wish to go second wave impacting the return of normalcy, for construction of villa etc. property developers are unperturbed in that On the commercial front, despite the increasing they are bullish about the long-term growth the spread of COVID-19 due to the onset of the sec- housing sector. -

Divine City Brochure Low

Development partner Site address: Shriram Divine City (Cybercity Mangadu Project Pvt Ltd) Kundranthur Main Road, Opp. Kamakshi Amman Temple, Mangadu, Chennai - 602101 Periya city. Office address: Shriram Properties Private Limited Lakshmi Neela Rite Choice Chamber, 1st floor, #9 Bazullah Road, T. Nagar, Chennai – 600 017 044 4001 4444 | www.shriramproperties.com/divinecity Niraya happiness. Disclaimer: *T&C apply. The information available on or through this advertisement/brochure is intended to provide general information and shall not be deemed to constitute any invitation, solicitation, offer or sale of any of our product offerings. The material is for customer’s reference, the company reserves the right to add, alter or delete material from the advertisement/brochure at any time. DEVELOPED BY CYBERCITY BUILDERS Mangadu gets it’s 2nd landmark A LOCALITY WITH A 1000 YEAR LEGACY NOW BECOMES YOUR HOME. Mangadu is a hidden jewel in West Porur visited by people from all over South India for its famous Amman temple. Strategically located off Mt. Poonamallee Road, just 10 mins from Outer Ring Road, it offers great connectivity to all parts of Chennai. Now the trusted brand Shriram Properties, part of the 90,000 Cr Shriram Group, brings you an incredible mini city, packed with conveniences and indulgences, all within the safety of a mega gated community. ’ Golden location. Great connectivity. COME, INVEST IN A LOCATION Multiple THAT TICKS conveniences. ALL THE BOXES Outer Ring Road MOGAPPAIR AVADI Road High Niraya Poonamallee connectivity MADURAVOYAL advantage Mt. Poonamallee Rd. Saveetha Kamakshi Medical College Amman Temple Road MainSHRIRAM JUST 5KM FROM PORUR, THIS AREA ENJOYS EASY CONNECTIVITY DIVINE CITY PORUR DLF IT TO AND MANGADU Park Kundrathur AND WILL SEE IN THE COMING YEARS. -

Agenda of 37Th BOA Meeting – 15Th December, 2009 Size

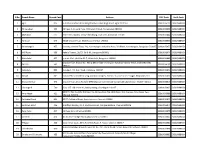

Agenda for the 37th meeting of the Board of Approval to be held on 15th December 2009 Item No. 37.1: Proposals for setting up of SEZs S. No Name of the Location Sector Area Land Whether Status of Developer (in ha) Possession SGR* applica- received tion i. Malayalee Manjapra, IT/ITES 13.14 Yes Yes New Realtors India Ernakulam (10.96 ha) Limited District, Kerala ii Redi Port Ltd. At Post Redi, FTWZ 40 No Yes New District Sindhudurg, Maharashtra iii Delhi State Baprola IT 10.52 Yes Yes New Industrial & village, Delhi Infrastructure Development Corporation Ltd. iv Delhi State Baprola Gems & 16.73 Yes Yes New Industrial & village, Delhi Jewellery Infrastructure Development Corporation Ltd. v Uralungal Nellikode IT/ITES 10.16 Yes Yes New Labour village, Contract Kozhikode, Cooperative Kerala Society Limited (ULCCS Ltd.) vi Sterlite TV Puram, Copper 197 Yes Yes New Industries Tuticorin, (Appro (191 ha) (State (India) Ltd. Tamil Nadu x) Govt. has recommend ed IP Approval though the developer has the requisite land in possession) 1 vii Empire Ambernath, IT/ITES 14.16 Yes Yes New Industries Thane District, and Limited (EIL) Maharashtra Hardware viii Larsen & Village Suvali Heavy 136.877 Yes Yes New Toubro Ltd & Mora, Engineeri (L&T) Taluka, ng Choryasi, District Surat, Gujarat * State Government’s recommendation Item No. 37.2: Proposals for conversion of in-principle to formal approval S. Developer Location Sector Area Remarks No. (in ha.) i Lanco Solar Ramdaspur Solar PV 101 In-principle approval was Private Cuttack granted in the meeting of BoA on Limited District, Orissa 11th August 2009. -

Master Plan for Chennai Port

Master Plan Report - Final March 2017 MASTER PLAN FOR CHENNAI PORT Master Plan for Chennai Port Prepared for Ministry of Shipping / Indian Ports Association Transport Bhawan, 1st Floor, South Tower, NBCC Place Sansad Marg, B. P Marg, Lodi Road New Delhi,110001 New Delhi - 110 003 www.shipping.nic.in www.ipa.nic.in Prepared by AECOM India Private Limited 9th Floor, Infinity Tower C, DLF Cyber City, DLF Phase II, Gurgaon, Haryana, India, Pin 122002, India Telephone: +91 124 4830100, Fax: +91 124 4830108 www.aecom.com March 2017 © AECOM India Private Limited 2017 The information contained in this document produced by AECOM India Private Limited is solely for the use of the Client identified on the cover sheet for the purpose for which it has been prepared and AECOM India Private Limited undertakes no duty to or accepts any responsibility to any third party who may rely upon this document. All rights reserved. No section or element of this document may be removed from this document, reproduced, electronically stored or transmitted in any form without the written permission of AECOM India Private Limited. Quality Information Client: Ministry of Shipping / Indian Ports Association Contract No. (if any): Project Title: SAGARMALA: Master Plan for Chennai Port Project No.: DELD15005 Document No: DELD15005-REP-0000-CP-1005 Controlled Copy No: SharePoint Ref: Document Title: Master Plan for Chennai Port Covering Letter/ Transmittal Ref. No: Date of Issue: 31 March 2017 Revision, Review and Approval Records Master Plan for Chennai Port - ASM SG SG F. Final 31.03.2017 31.03.2017 31.03.2017 Master Plan for Chennai Port - ASM SJ SG E. -

S.No. Branch Name Branch Code Address IFSC Code Swift Code 1

S.No. Branch Name Branch Code Address IFSC Code Swift Code 1 Agra 825 4, Krishna Enclave,Near Bhagat Halwai,Dayal Bagh Road, Agra 282005 SCBL0036100 SCBLINBBXXX 2 Ahmedabad 233 Abhijeet II, Ground Floor, Mithakali 6 Road, Ahmedabad 380006 SCBL0036051 SCBLINBBXXX 3 Allahabad 625 Hotel UR Complex; 7/3 A/1 MG Marg, Civil Lines, Allahabad 211001 SCBL0036044 SCBLINBBXXX 4 Amritsar 543 35/13 Ground Floor, Mall Road, Amritsar 143001 SCBL0036038 SCBLINBBXXX 5 Koramangala 455 Serenity, Ground Floor, 112, Koramangala Industrial Area, 5th Block, Koramangala, Bangalore 560095 SCBL0036073 SCBLINBBXXX 6 M G Road 456 Raheja Towers, 26/27, M G Rd, Bangalore 560001 SCBL0036074 SCBLINBBXXX 7 Whitefield 457 In orbit Mall, Unit No G2-7, Whitefield, Bangalore 560066 SCBL0036089 SCBLINBBXXX Ground Floor, Khasra No 356 & 357,Village Mohanpura Nakatia,Pargana Tehsil, District Bareilly 8 Bareilly 554 SCBL0036101 SCBLINBBXXX 243123 9 Vadodara 802 Gokulesh, R C Dutt Road, Vadodara 390007 SCBL0036062 SCBLINBBXXX 10 Bhopal 801 Ground floor, Northern wing, Alankar Complex, Plot no. 10,Zone II, M.P. Nagar, Bhopal 462011 SCBL0036061 SCBLINBBXXX 11 Bhubaneshwar 345 Ground Floor ,Shop No.B/2, BMC Bhawani Commercial Complex,Bhubaneshwar 751007 Odisha SCBL0036018 SCBLINBBXXX 12 Chandigarh 700 SCO, 137-138 Sector 9C, Madya Marg, Chandigarh 160017 SCBL0036035 SCBLINBBXXX NEWRY, Plot No.106, Old Door No.11,New Door No.19,B-Block, 2nd Avenue, Anna Nagar East, 13 Anna Nagar 421 SCBL0036088 SCBLINBBXXX Chennai 600040 14 Cathedral Road 424 80/57 Cathedral Road, Gopalapuram, Chennai 600086 SCBL0036072 SCBLINBBXXX 15 Haddows Road 426 Grindlays Garden, No 1, Haddows Road, Nungambakkam, Chennai 600006 SCBL0036079 SCBLINBBXXX 16 Rajaji Salai 427 19,Rajaji Salai, Chennai 600001 SCBL0036078 SCBLINBBXXX 17 Sorrento 428 No.6 Lattice Bridge Road, Adyar,Chennai 600020 SCBL0036080 SCBLINBBXXX 18 T Nagar 436 Sagar Amar Court, 59-G.N. -

List of HDFC Bank Branches Accepting Cash Transactions

List of HDFC bank for deposit of Cash Bank Name Branch Code Branch Name Address 1 Address 2 Address 3 City Pin code Phone Number HDFC Bank 1285 Jodhpur X Road Gr Floor, Iscon Park, Opp. Star India Bazaar Jodhpur Cross Roads Ahmedabad 380015 079-61606161 HDFC Bank 300 Maninagar Nakshatra Building Nr Sales India Maninagar Char Rasta Maninagar Ahmedabad 380008 079-61606161 HDFC Bank 237 Sarangpur First Floor, Block D,Shri Ghantakaran Mahavir Cloth Market Opp Sarangpur Gate Ahmedabad 380002 079-61606161 Opp Chandanbala Towers, Nr. Suvidha Shopping HDFC Bank 299 Paldi 101, Shaival Complex, Center Mahalaxmi Cross Road, Ahmedabad 380007 079-61606161 HDFC Bank 383 Naranpura Divya Sadbhav - Ground Floor,6 Dipak Colony Near Shanker Society No.1, Near Municipal Garden Mirambika School Road Ahmedabad 380013 079-61606161 Shop No. 45-46, Ground Floor & 104 - 1St Floor New Aman HDFC Bank 461 Shahibaug Owners Assn Aust Mangal Complex Nr. Rajsthan Hospital Shahibaug Ahmedabad 380004 079-61606161 HDFC Bank 305 Bopal Samarpan Complex, 200 Ft Ring Road, Bopal Junction Bopal Ahmedabad 380058 079-61606161 HDFC Bank 970 Gandhi Road Shree Krishna Complex Old Model Cinema Gandhi Road Ahmedabad 380001 079-61606161 HDFC Bank 888 Ambawadi Ground Floor, The Grand Mall Opp Sbi Zonal Office S M Road Ambawadi Ahmedabad 380015 079-61606161 HDFC Bank 1086 Sabarmati Ground Floor,Shree Balaji Complex Ramnagar Sabarmat Ahmedabad 380005 079-61606161 HDFC Bank 1229 Vasna Shop No 3 & 4, Haash Business Centre Nearankur School , Paldi- Vasna Road Ahmedabad 380007 079-61606161 -

List of EOU SEZ Units and Developers

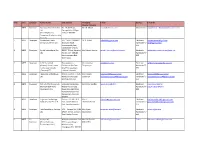

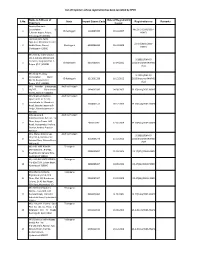

S.No. Zone Category Name of unit Unit address Managing E-mail Services E-mail ID Director/Director 1 MEPZ Developer Gateway Office Parks Pvt No. 16, GST Road, Mr. M. Murali [email protected] Multi Product [email protected] Ltd Perungalathur Village (FormerlyShriram chennai- 600 063 Properties & Infrastructure Pvt. Ltd.) 2 MEPZ Developer Coimbatore Hitech 365, " KGISL CAPMUS", Dr. B. Ashok [email protected] Electronic [email protected] Infrastructure Pvt. Ltd. thudiyalur Road, Hardware/IT/ [email protected] Saravampatty Post, IEES Coimbatore- 641 035 3 MEPZ Developer Syntel International Pvt. SIPCOT IT Park, Navalur ( Mr. Rakesh Khanna [email protected] Electronic [email protected] Ltd. P0) Sirv seri - 603103 Hardware/IT/ Kancheepuram Dsit. IEES Tamil Nadu 4 MEPZ Developer IG3 Infra Limited Thoraipakkam - Mr. Unnamali [email protected] Electronic [email protected] (formerly Indian Green Pallavaram 200 Feet Thiagarajan Hardware/IT/ Grid Group Limited) Road Thoraipakkam, IEES (Formerly ETL Chennai - 600 096 Infrastructrue Services 5 MEPZ Developer Hexaware Technologies Plot # H5 SIPCOT IT Park Mr. K. Baala [email protected] Electronic [email protected] Ltd. Navalur Post Siruseri Sundaram [email protected] Hardware/IT/ [email protected] Kanchipuram Dist. IEES 6 MEPZ Developer DLF Info City Chennai Ltd. 1/124, Shivaji Garden, Mr. Sriram Khattar [email protected] Electronic [email protected] (Formerly DLF Home Mount Poonamalee Hardware/IT/ [email protected] Developers Ltd.) Road, Moonlight Stop, IEES Nandam Pakkam Post Ramapuram, Chennai- 600089 7 MEPZ Developer Cognizant Technology Plot no.: H4, SIPCOT IT Mr. R. [email protected] Electronic [email protected] Solutions India Pvt. -

Divine City Brochure

Development partner Site address: Shriram Divine City (Cybercity Mangadu Project Pvt Ltd) Kundranthur Main Road, Opp. Kamakshi Amman Temple, Mangadu, Chennai - 602101 Periya city. Office address: Shriram Properties Private Limited Lakshmi Neela Rite Choice Chamber, 1st floor, #9 Bazullah Road, T. Nagar, Chennai – 600 017 Ph: 044-4001-4444 | Website : www.shriramdivinecity.com Niraya happiness. Disclaimer: *T&C apply. The information available on or through this advertisement/brochure is intended to provide general information and shall not be deemed to constitute any invitation, solicitation, offer or sale of any of our product offerings. The material is for customer’s reference, the company reserves the right to add, alter or delete material from the advertisement/brochure at any time. Mangadu gets it’s 2nd landmark A LOCALITY WITH A 1000 YEAR LEGACY NOW BECOMES YOUR HOME. Mangadu is a hidden jewel in West Porur visited by people from all over South India for its famous Amman temple. Strategically located off Mt. Poonamallee Road, just 10 mins from Outer Ring Road, it offers great connectivity to all parts of Chennai. Now the trusted brand Shriram Properties, part of the 90,000 Cr Shriram Group, brings you an incredible mini city, packed with conveniences and indulgences, all within the safety of a mega gated community. ’ Golden location. Great connectivity. COME, INVEST IN A LOCATION Multiple THAT TICKS conveniences. ALL THE BOXES Outer Ring Road MOGAPPAIR AVADI Road High Niraya Poonamallee connectivity MADURAVOYAL advantage Mt. Poonamallee Rd. Saveetha Kamakshi Medical College Amman Temple Road Main DIVINE JUST 5KM FROM PORUR, THIS AREA ENJOYS EASY CONNECTIVITY CITY PORUR DLF IT TO AND MANGADU Park Kundrathur AND WILL SEE IN THE COMING YEARS. -

Tiruvottiyur Municipality - Administrative Status

Tamil Nadu Urban Infrastructure Financial Services Limited City Corporate Plan cum Business Plan for Tiruvottriyur Municipality Final Report March 2008 ICRA Management Consulting Services Limited Contents 1. INTRODUCTION ............................................................................................................................................ 1 1.1 BACKGROUND TO THE STUDY ..................................................................................................................... 1 1.2 OBJECTIVES, SCOPE OF WORK AND STUDY MODULES .................................................................................. 1 1.3 APPROACH AND METHODOLOGY ................................................................................................................ 2 1.4 ORGANIZATION OF THIS REPORT ................................................................................................................. 2 2. TOWN PROFILE AND CITY DEMOGRAPHICS ........................................................................................... 3 2.1 LOCATION ................................................................................................................................................ 3 2.2 TIRUVOTTIYUR MUNICIPALITY - ADMINISTRATIVE STATUS ............................................................................... 3 2.3 POPULATION ............................................................................................................................................ 1 2.4 POPULATION PROJECTIONS....................................................................................................................... -

News Alert 16 December, 2011

www.pwc.co m/in Sharing insights News Alert 16 December, 2011 AAR ruling on taxability of reimbursement of salary costs of seconded employees to group company not based on proper reasoning – Madras High Court In brief Facts In a recent direction on the writ petition by Verizon Data Services India Pvt. Ltd. • VDSL is engaged in providing services relating to development and (VDSL) 1, the Madras High Court has set aside the Ruling of the Authority for maintenance of telecom software solutions and information technology Advance Rulings (AAR) and remanded to AAR for re-examining the issue relating enabled services to Verizon Data Services LLC, US (Verizon US) . to the taxability of reimbursement of salary costs to group company pertaining to seconded employees as per the Double Taxation Avoidance Agreement between • In order to meet the business requirement of VDSL, three employees of GTE India and the USA (tax treaty). Overseas Corporation, USA (GTE US), an affiliate company of Verizon US, were seconded to VDSL. In relation to this, a secondment agreement was entered into between VDSL and GTE US. 1 Verizon Data Services India Pvt. Ltd. v. AAR [ TS-725-HC-2011(MAD)] 1 PwC News Alert December 2011 • As per the secondment agreement, each employee functioned and acted Issues exclusively under the direction, control and supervision of VDSL. GTE US was not responsible for the work of any employee and did not undertake any 1. Whether the Ruling could be subject to judicial review under the writ obligation or risk in relation to the quality of the results produced from the jurisdiction of the Court in light of its binding nature under section 245S of work performed by these employees. -

List of Importers Whose Registration Has Been Cancelled by CPCB

List of Importers whose registration has been cancelled by CPCB Name & Address of Date of Registration S.No. State Import Export Code Registration no Remarks Importers issued Sonata Overseas Corporation, B- No.23-17 (534)/2007- 1 Chhattisgarh 1104007436 19.10.2007 5, Kavita Nagar, Raipur, HSMD Chhattisgarh-492 001 Jaishree Auto Parts, Opp.Gass Memorial Centre, 23-17(1010)/2009- 2 Sindhi Bazar, Raipur, Chattisgarh 6308001066 26.10.2009 HSMD Chattisgarh-492001 M/s Infinity International OG-3, Ashoka Millennium B-29016/BMHR/ Complex, Ring Road No. 1, 3 Chhattisgarh 6307000597 07.04.2011 2011/Importer/HWMD Raipur (C.G.) 492001 /244 M/s Balaji Trading B-29016/BMHR/ Corporation Ward 4 Chhattisgarh 6312001326 10.12.2012 2012/Importer/HWMD No.39, Banjari Road, /622 Raipur (C.G.)-492001 M/s Navakar Enterprises, Andhra Pradesh 5 18/207, Sikharamvari 0904012000 04.08.2005 23-17(110)/2005-HSMD Street, Nallore – 524001 M/s Shabnam Battery Andhra Pradesh Spares H.O. 32-12-20, Jandachetu Jn., Bowdara 6 2604002141 28.12.2005 23-17(144)/2005-HSMD Road, Besides Jagannadh Lodge, Viasakhapatnam – 530 004 Arka Leisure & Andhra Pradesh Entertainments Pvt.Ltd., 1st Floor, Surya Tower, MG 7 905010272 12.06.2009 23-17(945)/2009-HSMD Road, Vijayawada, Krishna District, Andhra Pradesh- 520 010 M/s. Mataji Enterprises, Andhra Pradesh B-29016/BMHR/ Shop No.6, Varalakshmi 8 0910006776 19.10.2011 2011/Importer/HWMD Golden Plaza, Chinna Bazar, /389 Nellore-01 M/s HBL NIFE POWER Telangana SYSTEMS LTD., 8-2-601, 9 0988000687 01.09.2004 23-17(37)/2004-HSMD Road No.10, Banjara Hills, Hyderabad-500034 M/s AAR BEE ENTERPRISES, Telangana 4-5-896//3/A.