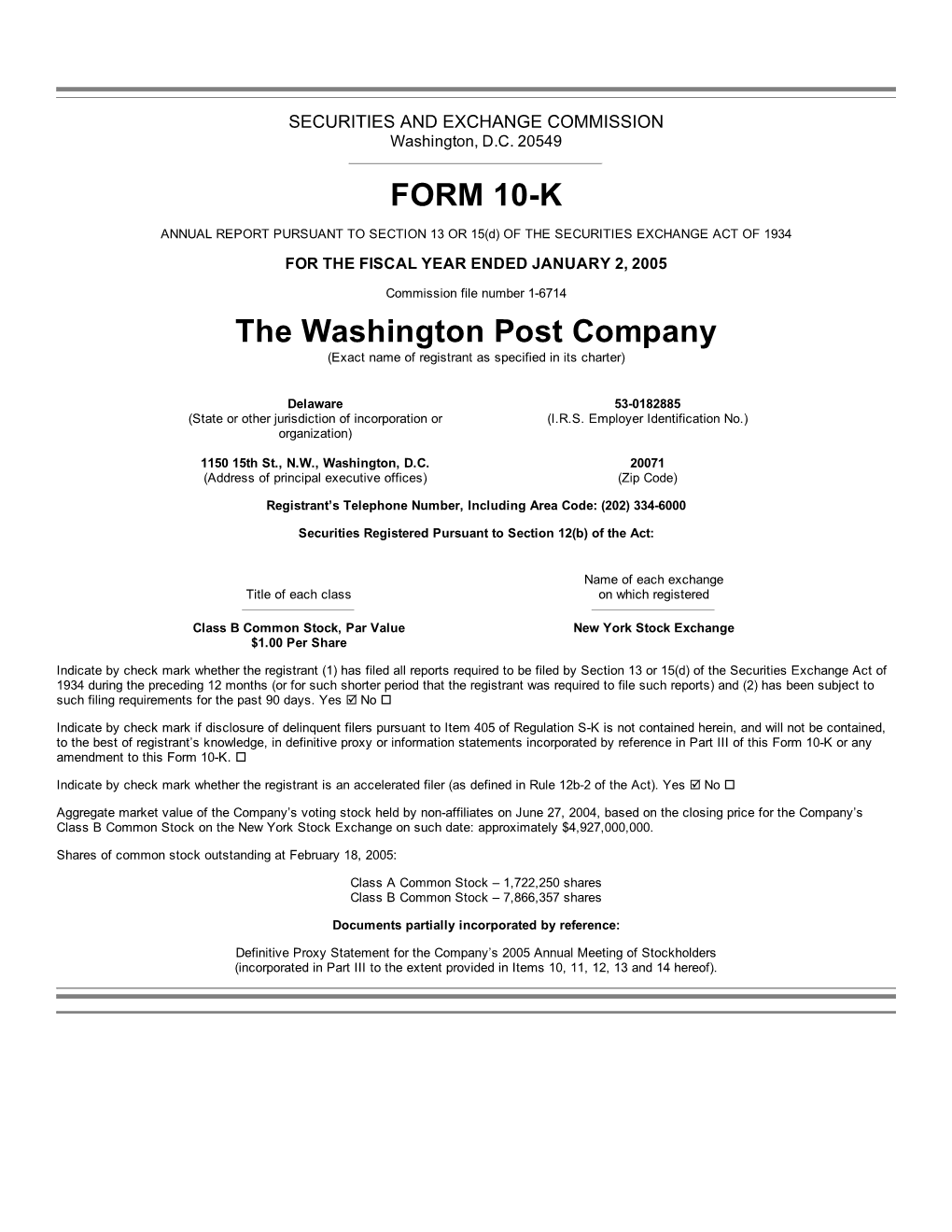

FORM 10-K the Washington Post Company

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2004 Annual Report Contents

NEWSPAPER/ONLINE PUBLISHING TELEVISION BROADCASTING MAGAZINE PUBLISHING CABLE TELEVISION 04EDUCATION The Washington Post Company 2004 Annual Report Contents Financial Highlights, 1 Letter to Shareholders, 2 Corporate Directory, 12 Form 10-K Financial Highlights (in thousands, except per share amounts) 2004 2003 % Change Operating revenue $ 3,300,104 $ 2,838,911 + 16% Income from operations $ 563,006 $ 363,820 + 55% Net income $ 332,732 $ 241,088 + 38% Diluted earnings per common share $ 34.59 $ 25.12 + 38% Dividends per common share $ 7.00 $ 5.80 + 21% Common shareholders’ equity per share $ 251.93 $ 217.46 + 16% Diluted average number of common shares outstanding 9,592 9,555 – Operating Revenue Income from Operations Net Income ($ in millions) ($ in millions) ($ in millions) 04 3,300 04 563 04 333 03 2,839 03 364 03 241 02 2,584 02 378 02 204 01 2,411 01 220 01 230 00 2,410 00 340 00 136 Diluted Earnings Return on Average Common per Common Share Shareholders’ Equity ($) 04 34.59 04 14.8% 03 25.12 03 12.3% 02 21.34 02 11.5% 01 24.06 01 14.4% 00 14.32 00 9.5% 1 2004 ANNUAL REPORT A LETTER FROM DONALD E. GRAHAM To Our Shareholders For Red Sox fans and The Washington Post Company, 2004 was annus mirabilis, an amazing year. Many, many things went well for our company. Some were long planned and the result of careful work; others were strokes of luck. One statistic sums it up. Operating income of $563 million was $175 million higher than the best year we ever had, $388 million in 1999. -

Calculation of Registration Fee

Table of Contents Filed pursuant to Rule 424(b)(5) Registration No. 333-155374 CALCULATION OF REGISTRATION FEE Proposed Proposed maximum maximum Amount of Title of each class of securities to be Amount to be offering price aggregate registration registered registered per unit offering price fee (1)(2) 7.250 % Notes due 2019 $400,000,000 99.614% $398,456,000 $15,720.00 (1) Pursuant to Rule 415(a)(6) under the Securities Act of 1933, as amended, (the “Securities Act”) the filing fee of $100,000 related to $400,000,000 principal amount of debt securities that were registered under registration statement no. 333-72162 filed on October 24, 2001 (the “Previously Registered Securities”) and have not been issued and sold will be applied to the filing fee for this registration statement. (2) This completely exhausts the filing fee paid for the Previously Registered Securities. Going forward, the Registrant will be issuing securities on a pay-as-you-go basis pursuant to Rule 456(b) under the Securities Act. Table of Contents Prospectus Supplement To Prospectus dated November 14, 2008 The Washington Post Company $400,000,000 7.250% Notes due 2019 Issue price: 99.614% Interest payable February 1 and August 1. The 7.250% Notes due 2019 (the “Notes”) are an issue of the debt securities described in the accompanying prospectus. Interest on the Notes will be payable semi-annually on February 1 and August 1 of each year commencing August 1, 2009. The Notes will mature on February 1, 2019. We may redeem the Notes in whole or in part at any time and from time to time prior to their maturity at the redemption price described in this prospectus supplement under the heading “Description of Notes—Optional Redemption.” Upon the occurrence of a Change of Control Repurchase Event, we will be required to make an offer to purchase the Notes at a price equal to 101% of their principal amount to the date of repurchase plus any accrued and unpaid interest. -

2005 Annual Report 1 to Our Shareholders

THE WASHINGTON POST COMPANY NEWSPAPER/ONLINE PUBLISHING TELEVISION BROADCASTING MAGAZINE PUBLISHING CABLE TELEVISION EDUCATION 2005 Annual Report CONTENTS Financial Highlights, 1 Letter to Shareholders, 2 Corporate Directory, 12 Form 10-K FINANCIAL HIGHLIGHTS (in thousands, except per share amounts) 2005 2004 % Change Operating revenue $ 3,553,887 $ 3,300,104 + 8% Income from operations $ 514,914 $ 563,006 – 9% Net income $ 314,344 $ 332,732 – 6% Diluted earnings per common share $ 32.59 $ 34.59 – 6% Dividends per common share $ 7.40 $ 7.00 + 6% Common shareholders’ equity per share $ 274.79 $ 251.11 + 9% Diluted average number of common shares outstanding 9,616 9,592 – OPERATING REVENUE INCOME FROM OPERATIONS NET INCOME ($ in millions) ($ in millions) ($ in millions) 05 3,554 05 515 05 314 04 3,300 04 563 04 333 03 2,839 03 364 03 241 02 2,584 02 378 02 204 01 2,411 01 220 01 230 DILUTED EARNINGS RETURN ON AVERAGE COMMON PER COMMON SHARE SHAREHOLDERS’ EQUITY ($) 05 32.59 05 12.4% 04 34.59 04 14.9% 03 25.12 03 12.3% 02 21.34 02 11.6% 01 24.06 01 14.4% 2005 ANNUAL REPORT 1 TO OUR SHAREHOLDERS 2005 was a somewhat disappointing year. Our newspaper, TV and magazine businesses turned in poor- er results than their managers expected when the year began. Cable ONE was having a spectacular year until Hurricane Katrina devastated our Mississippi Gulf Coast systems. Kaplan’s brick-and-mortar college business missed its goals badly, disappointing Jonathan Grayer and me. These are the facts, and I’ll set them out for you in detail. -

Graham Holdings Annual Report 2021

Graham Holdings Annual Report 2021 Form 10-K (NYSE:GHC) Published: February 24th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 FOR THE FISCAL YEAR ENDED December 31, 2020 or ☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Commission file number 001-06714 Graham Holdings Company (Exact name of registrant as specified in its charter) Delaware 53-0182885 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 1300 North 17th Street, Arlington, Virginia 22209 (Address of principal executive offices) (Zip Code) Registrant’s Telephone Number, Including Area Code: (703) 345-6300 Securities Registered Pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Class B Common Stock, par value GHC New York Stock Exchange $1.00 per share Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2016 Annual Report

GRAHAM HOLDINGS GRAHAM HOLDINGS 1300 NORTH 17TH STREET p SUITE 1700 ARLINGTON p VA 22209 2016 ANNUAL REPORT 703 345 6300 p GHCO.COM REVENUE BY PRINCIPAL OPERATIONS n EDUCATION 64% n BROADCASTING 17% n OTHER BUSINESSES 19% FINANCIAL HIGHLIGHTS (in thousands, except per share amounts) 2016 2015 Change Operating revenues $2,481,890 $2,586,114 (4%) Income (loss) from operations $ 303,534 $ (80,825) — Net income (loss) attributable to common shares $ 168,590 $ (101,286) — Diluted earnings (loss) per common share from continuing operations $ 29.80 $ (25.23) — Diluted earnings (loss) per common share $ 29.80 $ (17.87) — Dividends per common share $ 4.84 $ 9.10 (47%) Common stockholders’ equity per share $ 439.88 $ 429.15 3% Diluted average number of common shares outstanding 5,589 5,818 (4%) OPERATING REVENUES INCOME (LOSS) FROM OPERATIONS ($ in millions) ($ in millions) 2016 2,482 2016 304 2015 2,586 2015 (81) 2014 2,737 2014 233 2013 2,601 2013 149 2012 2,585 2012 (6) NET INCOME (LOSS) ATTRIBUTABLE TO COMMON SHARES RETURN ON AVERAGE COMMON ($ in millions) STOCKHOLDERS’ EQUITY* 2016 169 2016 7.5% 2015 (101) 2015 (4.1%) 2014 1,293 2014 46.6% 2013 236 2013 9.0% 2012 131 2012 5.2% DILUTED EARNINGS (LOSS) PER COMMON SHARE DILUTED EARNINGS (LOSS) PER COMMON SHARE FROM CONTINUING OPERATIONS ($) ($) 2016 29.80 2016 29.80 2015 (25.23) 2015 (17.87) 2014 115.40 2014 195.03 2013 8.61 2013 32.05 2012 (7.17) 2012 17.39 * Computed on a comparable basis, excluding the impact of the adjustment for pensions and other postretirement plans on average common stockholders’ equity. -

Transforming Education Transforming Lives

Transforming Education Transforming Lives CORPORATE BROCHURE Kaplan helps individuals achieve their educational and career goals. We build futures one success story at a time. By the Numbers 80 years TRANSFORMING LIVES 1.2M+ 13K+ 10K+ 1K+ 30+ 100+ 20+ STUDENTS EMPLOYEES BUSINESS EDUCATIONAL COUNTRIES COUNTRIES CITIES worldwide worldwide clients partners where we have in which online globally with operations courses are student recruitment delivered services Message from the CEO Kaplan is a global education powerhouse. We excel at providing education We provide professional training to improve THE GRAHAM HOLDINGS COMPANY programs and services, because of employees’ productivity and their opportunities our incomparable array of assets and for career advancement. capabilities and the ability to draw upon Kaplan, Inc. is the largest subsidiary a one-of-a-kind network of partners, Kaplan has a long history and deep experience of the Graham Holdings Company affiliates, and relationships with providing educational services to institutions and (NYSE: GHC), a diversified education schools, businesses, and professional businesses. These take the form of university and media company whose principal organizations worldwide. pathway programs, international student operations include educational recruitment, university hosting, residential design services; television broadcasting; We have built a reputation for quality and an array of student support services, such as online, print and local TV news; and innovation. Kaplan pioneered those we provide to Purdue University Global or home health and hospice care; the test prep business. We were an the University of Essex. For corporations, Kaplan and manufacturing. early leader in online instruction and provides expert exam preparation for professional digital learning. -

Serving Students Serving Students by the Numbers

SERVING STUDENTS SERVING STUDENTS BY THE NUMBERS 1M+ 15K+ Students Worldwide Employees 30+ 2600+ Countries Business Clients 1K+ 75+ Education Partners Years transforming students’ lives 2 3 MESSAGE FROM THE CEO aplan is one of the world’s largest and most diverse education providers. Throughout our almost 80-year history, Kaplan has been a beacon for expanding educational access and a leader in instructional innovation. We prep high school students for the SAT, so they can enter college and become teachers or engineers or whatever they dream. We help doctors and nurses pass their licensing tests, so they can save lives. We help adult learners—many of whom are working individuals juggling competing responsibilities of home, work, and school—change or start careers with a college degree. We enable global educational experiences—via language study and travel programs—that expose young people to new ideas and cultures; we also help universities across the globe better serve these international students. We provide corporate training to improve employees’ productivity, so enterprises can serve their Kaplan is one of the world’s largest and most diverse education providers. 4 customers better and support the communities in which they do business. Kaplan has long been a pioneer and a leader. The Graham Holdings We created the test prep business and were Company an early leader in online education. We’re one of the largest English-language training and Kaplan, Inc. is the largest subsidiary of university preparation providers in the world. the Graham Holdings Company (NYSE: Our professional education programs in finance GHC). and accountancy are top-ranked in the U.S., Based in Arlington, VA, Graham Holdings U.K., and Australia. -

Downloaded the Top 100 the Seed to This End

PROC. OF THE 11th PYTHON IN SCIENCE CONF. (SCIPY 2012) 11 A Tale of Four Libraries Alejandro Weinstein‡∗, Michael Wakin‡ F Abstract—This work describes the use some scientific Python tools to solve One of the contributions of our research is the idea of rep- information gathering problems using Reinforcement Learning. In particular, resenting the items in the datasets as vectors belonging to a we focus on the problem of designing an agent able to learn how to gather linear space. To this end, we build a Latent Semantic Analysis information in linked datasets. We use four different libraries—RL-Glue, Gensim, (LSA) [Dee90] model to project documents onto a vector space. NetworkX, and scikit-learn—during different stages of our research. We show This allows us, in addition to being able to compute similarities that, by using NumPy arrays as the default vector/matrix format, it is possible to between documents, to leverage a variety of RL techniques that integrate these libraries with minimal effort. require a vector representation. We use the Gensim library to build Index Terms—reinforcement learning, latent semantic analysis, machine learn- the LSA model. This library provides all the machinery to build, ing among other options, the LSA model. One place where Gensim shines is in its capability to handle big data sets, like the entirety of Wikipedia, that do not fit in memory. We also combine the vector Introduction representation of the items as a property of the NetworkX nodes. In addition to bringing efficient array computing and standard Finally, we also use the manifold learning capabilities of mathematical tools to Python, the NumPy/SciPy libraries provide sckit-learn, like the ISOMAP algorithm [Ten00], to perform some an ecosystem where multiple libraries can coexist and interact. -

The Washington Post Company

Mid-Year Media Review New York June 22, 2004 Remarks by Donald E. Graham Chairman of the Board and Chief Executive Officer The Washington Post Company Mid-Year Media Review New York Tuesday, June 22, 2004 The presentation at this meeting contains certain forward-looking statements that are based largely on the Company’s current expectations. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results and achievements to differ materially from those expressed in the forward-looking statements. For more information about these forward-looking statements and related risks, please refer to the section titled “Forward-looking Statements” in Part 1 of the Company’s Annual Report on Form 10-K and the section titled “Risk Factors” under “Shareholders” on the Company’s website, www.washpostco.com. For the past three years, I’ve had to come up here and say that business was various shades of terrible. I can now give you a different message: business isn’t great, but it’s not bad. Results vary across our advertising-based businesses, with Newsweek pretty good, the newspaper better, and our TV division strengthening in this political and Olympics year. Cable continues to make progress. And Kaplan is firing on most cylinders. Let’s look briefly at our operations one at a time. Recruitment Ad Revenue ($/millions) Print ($/millions) Online 8 7 2 1.8 6 1.6 5 1.4 1.2 4 1 3 0.8 2 0.6 0.4 1 0.2 0 0 Jan Feb Mar Apr May Jan Feb Mar Apr May 2003 2004 2003 2004 Newspaper division reports on a 5-4-4 basis Advertising revenue at The Washington Post has bounced around month to month, but like other newspaper companies you’ll be hearing from, help-wanted is a bright spot. -

2019 Annual Report Suite 1700 Arlington, Va 22209

GRAHAM HOLDINGS 1300 NORTH 17TH STREET 2019 ANNUAL REPORT SUITE 1700 ARLINGTON, VA 22209 703 345 6300 GHCO.COM REVENUE BY PRINCIPAL OPERATIONS EDUCATION 50% BROADCASTING 16% MANUFACTURING 15% HEALTHCARE 5% SOCIALCODE 2% OTHER BUSINESSES 12% FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 2019 2018 CHANGE Operating revenues $2,932,099 $2,695,966 9% Income from operations $ 144, 546 $ 246,161 (41%) Net income attributable to common shares $ 327,855 $ 271,206 21% Diluted earnings per common share $ 61.21 $ 50.20 22% Dividends per common share $ 5.56 $ 5.32 5% Common stockholders’ equity per share $ 624.83 $ 550.24 14% Diluted average number of common shares outstanding 5,327 5,370 (1%) OPERATING REVENUES INCOME (LOSS) FROM OPERATIONS ($ in millions) ($ in millions) 2019 2,932 2019 145 2018 2,696 2018 246 2017 2,592 2017 136 2016 2,482 2016 223 2015 2,586 2015 (158) NET INCOME (LOSS) ATTRIBUTABLE TO COMMON SHARES RETURN ON AVERAGE COMMON ($ in millions) STOCKHOLDERS’ EQUITY 2019 328 2019 10.5% 2018 271 2018 9.3% 2017 302 2017 11.3% 2016 169 2016 6.8% 2015 (101) 2015 (3.6%) DILUTED EARNINGS (LOSS) PER COMMON SHARE DILUTED EARNINGS (LOSS) PER COMMON SHARE FROM CONTINUING OPERATIONS ($) ($) 2019 61.2 1 2019 61.21 2018 50.20 2018 50.20 2017 53.89 2017 53.89 2016 29.80 2016 29.80 2015 (25.23) 2015 (17.87) TO OUR SHAREHOLDERS Last year I opened the Letter to Shareholders ■ A $29 million gain on the sale of the with these words: “…through a combination Company’s interest in Gimlet Media. -

GRAHAM HOLDINGS 2017 Annual Report

GRAHAM HOLDINGS 2017 ANNUAL REPORT REVENUE BY PRINCIPAL OPERATIONS n EDUCATION 59% n BROADCASTING 16% n MANUFACTURING 16% n HEALTHCARE 6% n SOCIALCODE 2% n OTHER BUSINESSES 1% FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 2017 2016 CHANGE Operating revenues $2,591,846 $2,481,890 4% Income from operations $ 209,102 $ 303,534 (31%) Net income attributable to common shares $ 302,044 $ 168,590 79% Diluted earnings per common share from continuing operations $ 53.89 $ 29.80 81% Diluted earnings per common share $ 53.89 $ 29.80 81% Dividends per common share $ 5.08 $ 4.84 5% Common stockholders’ equity per share $ 529.59 $ 439.88 20% Diluted average number of common shares outstanding 5,552 5,589 (1%) OPERATING REVENUES INCOME (LOSS) FROM OPERATIONS ($ in millions) ($ in millions) 2017 2,592 2017 209 2016 2,482 2016 304 2015 2,586 2015 (81) 2014 2,737 2014 233 2013 2,601 2013 149 NET INCOME (LOSS) ATTRIBUTABLE TO COMMON SHARES RETURN ON AVERAGE COMMON ($ in millions) STOCKHOLDERS’ EQUITY* 2017 302 2017 12.4% 2016 169 2016 7.5% 2015 (101) 2015 (4.1%) 2014 1,293 2014 46.6% 2013 236 2013 9.0% DILUTED EARNINGS (LOSS) PER COMMON SHARE DILUTED EARNINGS (LOSS) PER COMMON SHARE FROM CONTINUING OPERATIONS ($) ($) 2017 53.89 2017 53.89 2016 29.80 2016 29.80 2015 (25.23) 2015 (17.87) 2014 115.40 2014 195.03 2013 8.61 2013 32.05 * Computed on a comparable basis, excluding the impact of the adjustment for pensions and other postretirement plans on average common stockholders’ equity. -

2020 Annual Report

2020 ANNUAL REPORT GRAHAM HOLDINGS 1300 NORTH 17TH STREET SUITE 1700 ARLINGTON, VA 22209 703 345 6300 GHCO.COM Revenue by Principal Operations EDUCATION 45% BROADCASTING 18% MANUFACTURING 14% HEALTHCARE 7% OTHER BUSINESSES 16% “2020 was a pivotal year at Graham Holdings Company. Against the backdrop of a global health crisis, we delivered stronger results than I would have forecast when COVID took hold in the spring…” Financial Highlights (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 2020 2019 CHANGE Operating revenues $2,889,121 $2,932,099 (1%) Income from operations $ 100,407 $ 144, 546 (31%) Net income attributable to common shares $ 300,365 $ 327,855 (8%) Diluted earnings per common share $ 58.13 $ 61.21 (5%) Dividends per common share $ 5.80 $ 5.56 4% Common stockholders’ equity per share $ 754.45 $ 624.83 21% Diluted average number of common shares outstanding 5,139 5,327 (4%) OPERATING REVENUES INCOME FROM OPERATIONS ($ in millions) ($ in millions) 2020 2,889 2020 100 2019 2,932 2019 145 2018 2,696 2018 246 2017 2,592 2017 136 2016 2,482 2016 223 NET INCOME ATTRIBUTABLE TO COMMON SHARES RETURN ON AVERAGE COMMON ($ in millions) STOCKHOLDERS’ EQUITY 2020 300 2020 8.5% 2019 328 2019 10.5% 2018 271 2018 9.3% 2017 302 2017 11.3% 2016 169 2016 6.8% DILUTED EARNINGS PER COMMON SHARE ($) 2020 58.13 2019 61.2 1 2018 50.20 2017 53.89 2016 29.80 To Our Shareholders 2020 was a pivotal year at Graham Holdings for someone to get an item framed without Company.