Growing Support for ESG Resolutions, but the Largest Lag Behind

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Spotlight: Shareholders Are Dispersed and Diverse

POLICY SPOTLIGHT APRIL 2019 Shareholders Are Dispersed And Diverse Index funds have democratized access to diversified investment for millions of savers, who are investing for long-term goals, like retirement. As index funds are currently growing more quickly than actively managed funds, some critics have expressed concern about increasing concentration of public company ownership in the hands of index fund managers. While it is true that assets under management (or ‘AUM’) in index portfolios have grown, index funds and ETFs represent less than 10% of global equity assets.1 Further, equity investors, and hence public company shareholders, are dispersed across a diverse range of asset owners and asset managers. As of year-end 2017, Vanguard, BlackRock, and State Street manage $3.5 trillion, $3.3 trillion, and $1.8 trillion in global equity assets, respectively.2 These investors represent a minority position in the $83 trillion global equity market. As shown in Exhibit 1, the combined AUM of these three managers represents just over 10% of global equity assets. The largest 20 asset managers only account for 22%. Moreover, about two-thirds of all global equity investment is conducted by asset owners choosing to invest in equities directly rather than by employing an asset manager to make investments on their behalf. Exhibit 1: Equity Market Investors3 Total Equity Market Capitalization 100% All Asset Managers 35% Top 20 Managers 22% Top 10 Managers 17% VGD 4% BLK 4% SSgA 2% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Exhibit 1 alone does not paint a complete picture of the diversity of equity market investors, as there is significant variation amongst asset managers and asset owners. -

Fidelity® International Sustainability Index Fund

Fidelity® International Sustainability Index Fund Annual Report October 31, 2020 See the inside front cover for important information about access to your fund’s shareholder reports. Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity’s web site or call Fidelity using the contact information listed below. You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary. Account Type Website -

Geode Capital Management , LLC Subadvisor: Geode Capital Management , LLC Advisor: Fidelity Investments

Index Investing with Fidelity Product overview August 2021 Not FDIC Insured May Lose Value No Bank Guarantee For institutional use only. Index Investing with Fidelity 1. Overview 2. Investment Philosophy 3. Offerings 4. Equity and Specialty 5. Fixed Income 6. Index Fund Performance Summary 7. Securities Lending 8. Appendix 9. Important Information See Important Information for a discussion of performance data, some of the principal risks related to any of the investment strategies referred to in this presentation, and other information related to this presentation. 2 For institutional use only. Why Fidelity for Index? Broad Range Index Fund Low of Market Management Cost and Index Expertise Exposures Some of the most Fidelity’s lineup offers Fidelity is the second competitively priced investors access to all largest index mutual mutual funds and pools core asset class fund provider in the in the industry. exposures as well as industry, with more than more specialized indexes. 30 years of index fund experience.* *Based on $906 billion in index fund assets under management (AUM) as of 6/30/2021. Source: Morningstar. 3 For institutional use only. Fidelity Index Funds Investment Philosophy Fidelity seeks to provide investors with low-cost portfolios that tightly track their benchmarks by focusing on data integrity and employing state-of-the-art trading and risk management tools. Tracking Risk Tools Securities Error Management Lending Work to achieve the Manage multiple risk Utilize state-of-the-art Employ securities lowest possible factors relative to trading and liquidity lending policies that tracking error benchmarks management tools seek to generate revenue and benefit investors 4 For institutional use only. -

Fidelity® International Enhanced Index Fund

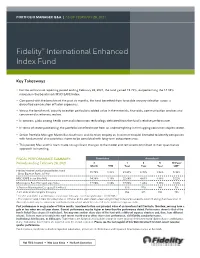

PORTFOLIO MANAGER Q&A | AS OF FEBRUARY 28, 2021 Fidelity® International Enhanced Index Fund Key Takeaways • For the semiannual reporting period ending February 28, 2021, the fund gained 15.72%, outperforming the 14.38% increase in the benchmark MSCI EAFE Index. • Compared with the benchmark the past six months, the fund benefited from favorable security selection across a diversified combination of factor exposures. • Versus the benchmark, security selection particularly added value in the materials, financials, communication services and consumer discretionary sectors. • In contrast, picks among health care and information technology detracted from the fund's relative performance. • In terms of sector positioning, the portfolio benefited most from an underweighting in the lagging consumer staples sector. • Senior Portfolio Manager Maximilian Kaufmann and his team employ an investment model intended to identify companies with fundamental characteristics shown to be correlated with long-term outperformance. • This period, Max and his team made no significant changes to the model and remained committed to their quantitative approach to investing. FISCAL PERFORMANCE SUMMARY: Cumulative Annualized Periods ending February 28, 2021 6 1 3 5 10 Year/ Month YTD Year Year Year LOF1 Fidelity International Enhanced Index Fund 15.72% 1.95% 21.81% 3.45% 9.56% 5.48% Gross Expense Ratio: 0.59%2 MSCI EAFE Index (Net MA) 14.38% 1.16% 22.68% 4.81% 9.96% 5.22% Morningstar Fund Foreign Large Value 17.50% 3.24% 17.86% 1.48% 7.68% 3.36% % Rank in Morningstar Category (1% = Best) -- -- 32% 15% 14% 7% # of Funds in Morningstar Category -- -- 354 325 283 185 1 Life of Fund (LOF) if performance is less than 10 years. -

Geode Firm Brochure

Geode Capital Management, LLC Form CRS Customer Relationship Summary, March 30, 20211 Introduction Geode Capital Management, LLC (“GCM”, “we”, “our”, or “us”) is registered with the Securities and Exchange Commission (“SEC”) as an investment adviser. Brokerage and investment advisory services and fees differ and it is important for you to understand the differences. Free and simple tools are available to research firms and financial professionals at Investor.gov/CRS, which also provides educational materials about broker-dealers, investment advisers, and investing. What We offer investment advisory services to certain retail investors2, including serving as a sub-adviser investment for discretionary managed account services through Fidelity Automated Managed Platform (the “AMP services Service”) and as an adviser or sub-adviser providing investment advisory services for certain high and advice net worth individuals. We generally have discretionary investment authority to select brokers and to can you buy, sell, and allocate investments within your accounts consistent with the investment model, provide strategies and guidelines you have selected, including any restrictions you may impose on your me? account. This means that we make these investment decisions on your behalf without needing to provide prior notice and without soliciting your consent. Clients who use the AMP Service will generally be limited to investments in certain mutual funds and Exchange Traded Funds (“ETFs”). GCM will monitor and review your account as often as specified by the AMP Service or our agreement with you. For accounts using the AMP Service, only retail investors who meet certain qualification criteria (including, account minimums) may participate. For other retail investors, GCM may require different minimum investment amounts based on the investment strategy and type of account. -

Best Practices When Using an Independent Fiduciary in Proxy Voting

Investment Stewardship Spotlight Best practices when using an independent fiduciary in proxy voting Introduction Asset managers, who invest on behalf of their clients, asset owners, are usually responsible for voting at the shareholder meetings of the companies in which they invest.1 Proxy voting is an important component of an asset manager’s stewardship of its clients’ assets as it is the formal mechanism for holding boards and management to account for their actions and performance. In fulfilling its duty, there may be a small number of situations where an asset manager may determine not to vote itself due to regulatory restrictions or a perceived or actual conflict of interest. In such cases, an asset manager may use an independent third party, here referred to as an independent fiduciary, to instruct the votes on its clients’ holdings. This way, the asset manager can comply with regulatory obligations and address potential conflicts while simultaneously demonstrating that vote decisions were made solely to advance its clients’ long-term economic interests. There are a wide range of practices around the use of independent fiduciaries. This Spotlight discusses why an asset manager may retain an independent fiduciary, explains the role of the independent fiduciary in these situations and proposes some best practices. Why would an asset manager use an independent fiduciary? There are a number of reasons an asset manager may be required, or determine it would be prudent, to retain an independent fiduciary to vote its clients’ holdings at certain shareholder meetings. Most commonly, it would be to manage situations where the asset manager has, or may be perceived to have, a conflict of interest with its clients in relation to proxy voting at a company’s shareholder meeting. -

Pacific Ex Japan Fund P Income Shares FIDELITY INVESTMENT FUNDS MONTHLY FACTSHEET INDEX PACIFIC EX JAPAN FUND P INCOME SHARES 31 AUGUST 2021

ret.en.xx.20210831.GB00BP8RYR23.pdf Index Pacific ex Japan Fund P Income Shares FIDELITY INVESTMENT FUNDS MONTHLY FACTSHEET INDEX PACIFIC EX JAPAN FUND P INCOME SHARES 31 AUGUST 2021 Strategy Fund Facts The fund is managed to track the performance of the MSCI Pacific ex Japan index. Launch date: 06.02.14 ‘Index tracking’ is also known as passive investment management. While the fund is Fund size: £556m designed to replicate the characteristics of the index, it may not necessarily hold all the company shares that make up the index, or hold shares in exactly the same weightings Number of positions in fund: 128 as the index. The costs that the fund incurs mean that its returns may not match the Fund reference currency: UK Sterling (GBP) combined performance of the shares included in the index. Fund domicile: United Kingdom Fund legal structure: OEIC The fund is managed by Geode Capital Management LLC, which is based in Boston and is a leading specialist in the management of index-based strategies. They have Management company: FIL Investment Services (UK) Limited managed equity index strategies with a team-based approach since 2002. Capital guarantee: No Objectives & Investment Policy Share Class Facts • The fund aims to track the performance (before fees and expenses are applied) of the MSCI Other share classes may be available. Please refer to the prospectus for more details. Pacific ex Japan (Net Total Return) Index, thereby seeking to increase the value of your investment over 5 years or more. • The fund uses an index tracking (passive) investment approach whereby it aims to replicate the Launch date: 04.08.14 composition of the index. -

Small Biotech Cap Quarterly

COMPANY BLOOMBERG TICKER: February 2016 Paratek Pharmaceuticals, Inc (PRTK) SMALL CAP BIOTECH QUARTERLY SHAREHOLDER ANALYSIS FEBRUARY 2016 Holders Overview CBAY US Equity SmallCap Biotech Company Shareholder Overview Top Institutional Holders Institution Style City Recent Pos. % Inst Shs % Shs. Out. Δ Change Last Pos. 1 Fidelity Management & Research Company Growth Boston 2,641,292 16.5 15.0 230,271 2,411,021 2 Omega Fund Management (U.S.), Inc. Alternative Boston 2,138,872 13.3 12.1 0 2,138,872 3 HBM Partners AG Growth Zug 1,747,680 10.9 9.9 0 1,747,680 4 The Baupost Group, LLC Alternative Boston 1,544,498 9.6 8.8 0 1,544,498 5 Abingworth, LLP Alternative London 1,301,413 8.1 7.4 0 1,301,413 6 Tekla Capital Management, LLC Aggressive Growth Boston 762,581 4.8 4.3 0 762,581 7 Aisling Capital, LLC Alternative New York 682,680 4.3 3.9 0 682,680 8 Broadfin Capital, LLC Alternative New York 530,283 3.3 3.0 0 530,283 9 Interwest Partners Venture Capital Menlo Park 512,367 3.2 2.9 0 512,367 10 BlackRock Fund Advisors Index San Francisco 462,719 2.9 2.6 21,306 441,413 11 Brown Brothers Harriman & Company (Asset ManagemeValuent) New York 367,902 2.3 2.1 0 367,902 12 Great Point Partners, LLC Alternative Greenwich 355,459 2.2 2.0 (98,419) 453,878 13 The Vanguard Group, Inc. Index Malvern 351,266 2.2 2.0 16,942 334,324 14 Granahan Investment Management, Inc. -

Fidelity® Series Commodity Strategy Fund

Fidelity® Series Commodity Strategy Fund Semi-Annual Report January 31, 2021 Contents Note to Shareholders 3 Consolidated Investment 4 Summary Consolidated Schedule of 5 Investments Consolidated Financial 17 Statements Notes to Consolidated 21 Financial Statements Shareholder Expense 28 Example Board Approval of 30 Investment Advisory Contracts and Management Fees To view a fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines. Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation. Other third-party marks appearing herein are the property of their respective owners. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved. This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus. A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. -

Fidelity® Total International Index Fund (FTIHX)

International Equity Fidelity® Total International Index Fund (FTIHX) NTF No Transaction Fee 1 Hypothetical Growth of $10,0002,3 (6/7/2016-3/31/2021) Morningstar® Snapshot*4 (AS OF 3/31/2021) n Fidelity® Total International Index Fund $15,392 n Foreign Large Blend $14,596 Morningstar Category Foreign Large Blend 15.40K 14.00K Risk of this Category LOWER HIGHER 12.60K Overall Rating 11.20K 9.80K Returns LOW AVG HIGH 2017 2018 2019 2020 2021 Expenses LOW AVG HIGH The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when *Data provided by Morningstar you sell your shares. Current performance may be higher or lower than the performance data quoted. ® 7 Performance3,5,6 Average Annual Total Returns Equity StyleMap * (AS OF 2/28/2021) Monthly (AS OF 3/31/2021) YTD (Monthly) 1 Yr 3 Yrs 5 Yrs 10 Yrs Life Large Blend Fidelity® Total International Index *96.03% Fund Assets Covered 3.91% 52.17% 6.42% -- -- 9.37% Fund MSCI ACWIxUS IMI (Net MA) 3.81% 52.15% 6.69% 10.02% 5.26% 9.67% Foreign Large Blend 3.71% 48.07% 5.94% 8.81% 5.40% -- Details Rank in Morningstar Category 31% 42% -- -- -- Fund Inception 6/7/2016 # of Funds in Morningstar Category 751 654 563 370 -- Quarter-End (AS OF 3/31/2021) NAV on 3/31/2021 $14.10 Fidelity® Total International Index 52.17% 6.42% -- -- 9.37% Exp Ratio (Gross) 0.06% Fund 12/30/2020 Exp Ratio (Net) 0.06% Calendar Year Returns3,5 Top 10 Holdings8 12/30/2020 (AS -

UNIQUE Annual Report, Dated September 30, 2015

Annual Report September 30, 2015 Contents Trustee’s Message to Participants 5 Performance: The Bottom Line 6 Market Recap 42 Fund Talk: The Managers’ Overview 43 UNIQUE College Portfolio (Fidelity Funds) 45 Investment Summary 46 Investments 47 Financial Statements UNIQUE Portfolio 2015 (Fidelity Funds) 49 Investment Summary 50 Investments 51 Financial Statements UNIQUE Portfolio 2018 (Fidelity Funds) 53 Investment Summary 54 Investments 55 Financial Statements UNIQUE Portfolio 2021 (Fidelity Funds) 57 Investment Summary 58 Investments 59 Financial Statements UNIQUE Portfolio 2024 (Fidelity Funds) 61 Investment Summary 62 Investments 63 Financial Statements UNIQUE Portfolio 2027 (Fidelity Funds) 65 Investment Summary 66 Investments 67 Financial Statements UNIQUE Portfolio 2030 (Fidelity Funds) 69 Investment Summary 70 Investments 71 Financial Statements UNIQUE Portfolio 2033 (Fidelity Funds) 73 Investment Summary 74 Investments 75 Financial Statements UNIQUE Conservative Portfolio (Fidelity Funds) 77 Investment Summary 78 Investments 79 Financial Statements UNIQUE Moderate Growth Portfolio 81 Investment Summary (Fidelity Funds) 82 Investments 83 Financial Statements UNIQUE Aggressive Growth Portfolio 85 Investment Summary (Fidelity Funds) 86 Investments 87 Financial Statements UNIQUE Money Market Portfolio 89 Financial Statements UNIQUE College Portfolio (Fidelity Index) 91 Investment Summary 92 Investments 93 Financial Statements UNIQUE Portfolio 2015 (Fidelity Index) 95 Investment Summary 96 Investments 97 Financial Statements Annual -

Vote Tracker

Vote Tracker Wells FargoFargo & Company& Company - 25th - April25th 2017 April 2017 Key: ✓ For Against t Abstain SP Split Investor Elect J.D. Baker,Elect II J. S. ChenElect L.H. DeanElect E.A. DukeElect E. Hernandez,Elect D.M. Jr. JamesElect C.H. MilliganElect K.B. PeetzElect F.F. PeñaElect J.H. QuigleyElect S.W. SangerElect R.L. SargentElect T.J. SloanElect S.G. SwensonElect S.M. VautrinotAdvisory SaySay on onPay Pay FrequencyRatify KPMGReport Auditors Bus. ProvideStandards Cum.Reporting Voting ChangesReport GenderReport Pay LobbyingIndigenous Policy Vanguard Group, Inc. ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ BlackRock ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 3 Yrs ✓ SSgA Funds Management, Inc. (State Street) ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ t t Fidelity Management & Research Co. (FMR) ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ Capital World Investors t t t ✓ ✓ t ✓ ✓ ✓ t ✓ ✓ 1 Yr ✓ ✓ Wellington Management Company ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ SP ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ Dodge & Cox, Inc. ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ JPMorgan Investment Management, Inc. ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ T. Rowe Price Associates, Inc. ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ Northern Trust Investments ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ Norges Bank Investment Management ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ MFS Investment Management, Inc. ✓ ✓ ✓ ✓ 1 Yr ✓ Capital Research Global Investors ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 1 Yr ✓ ✓ Geode Capital Management ✓ ✓ ✓ ✓ 1 Yr ✓ ✓ t t t Franklin