Spotlight: Shareholders Are Dispersed and Diverse

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Emerging Markets Debt Survey Q4 2017 the EMD Market Deconstructed

The EMD market deconstructed Emerging Markets Debt Survey Q4 2017 Report run on 14 March 2018 Clear and Independent Institutional Investment Analysis We provide institutional investors, including pension funds, insurance companies and consultants, with data and analysis to assess, research and report on their investments. We are committed to fostering and nurturing strong, productive relationships across the institutional investment sector and are continually innovating new solutions to meet the industry’s complex needs. We enable institutional investors, including pension funds, insurance companies and consultants, to conduct rigorous, evidence-based assessments of more than 5,000 investment products offered by over 700 asset managers. Additionally, our software solutions enable insurance companies to produce consistent accounting, regulatory and audit-ready reports. To discuss your requirements +44 (0)20 3327 5600 [email protected] Find us at camradata.com Join us on LinkedIn Follow us on Twitter @camradata The CAMRADATA Emerging Market Debt (‘EMD’) survey is based on all USD EMD vehicles in CAMRADATA Live four weeks after the end of the report quarter. Contents Section 1: Market Commentary Section 6: Distribution of Returns 3 Years 1. Market Commentary 23. Distribution of Monthly Returns - All EM Debt Funds 2. Survey Highlights 24. Distribution of Monthly Returns - Broad Bond Funds 25. Distribution of Monthly Returns - Corprate Funds 26. Distribution of Monthly Returns - Government Funds Section 2: EM Debt Universe Section 7: Risk Return 3. Number of Products 27. 12 Month Risk Return – All Emerging Market Debt Funds 4. Number of Products over time 28. 36 Month Risk Return – All Emerging Market Debt Funds 5. -

Swiss Asset Management Study 2020 an Overview of Swiss Asset Management

1 Inhaltsverzeichnis Inhaltsverzeichnis Swiss Asset Management Study 2020 An Overview of Swiss Asset Management Editors Jürg Fausch, Thomas Ankenbrand Institute of Financial Services Zug IFZ www.hslu.ch/ifz 1 Table of Contents Swiss Asset Management Study 2020 Table of Contents Preface 2 Executive Summary 3 1. Definition & Framework of Asset Management 5 2. The Swiss Asset Management Environment 12 3. Asset Management – An International Perspective 39 4. Asset Management Companies in Switzerland 47 5. Active versus Passive Investing – A Differentiated View on a Heated Debate 69 6. Conclusion & Outlook 77 7. Factsheets of Asset Management Companies in Switzerland 78 Authors 108 References 109 Appendix 120 2 Swiss Asset Management Study 2020 Preface The asset management industry is a growing segment of the Swiss financial center and offers a differentiating value proposition relative to private banking and wealth management. The strong expertise in asset manage- ment is highly relevant for Switzerland since it helps to diversify and complete the Swiss financial center. In this regard, the Asset Management Association Switzerland has the goal to further establish Switzerland as a leading provider of high quality asset management services and products domestically and abroad. In this context, the following study provides a comprehensive overview of the current status and various develop- ments in the Swiss asset management industry and consists of two parts. The first part starts with Chapter 1 in which a definition of asset management is provided and the methodological framework of the study is outlined. Chapter 2 gives an overview of the environment and discusses the political/legal, economic, social and technolog- ical developments relevant for the asset management industry. -

Monthly Factsheet

AMUNDI FUNDS PIONEER US EQUITY FUNDAMENTAL GROWTH - A USD FACTSHEET 31/08/2021 EQUITY ■ Objective and Investment Policy The Sub-Fund is a financial product that promotes ESG characteristics pursuant to Article 8 of the Disclosure Regulation. Seeks to increase the value of your investment over the recommended holding period. The Sub-Fund invests mainly in a broad range of equities of companies that are based in, or do most of their business in the U.S.A. The Sub-Fund makes use of derivatives to reduce various risks, for efficient portfolio management and as a way to gain exposure (long or short) to various assets, markets or other investment opportunities (including derivatives which focus on equities). Benchmark : The Sub-Fund is actively managed by reference to and seeks to outperform the Russell 1000 Growth Index. The Sub-Fund is mainly exposed to the issuers of the Benchmark, however, the management of the Sub-Fund is discretionary, and will be exposed to issuers not included in the Benchmark. The Sub-Fund monitors risk exposure in relation to the Benchmark however the extent of deviation from the Benchmark is expected to be significant. Further, the Sub-Fund has designated the benchmark as a reference benchmark for the purpose of the Disclosure Regulation. The Benchmark is a broad market index, which does not assess or include constituents according to environmental characteristics, and therefore is not aligned with the environmental characteristics promoted by the Sub-Fund. Management Process : The Sub-Fund integrates Sustainability Factors in its investment process as outlined in more detail in section "Sustainable Investment" of the Prospectus. -

Asset Management One Stewardship Report 2020/2021 Contents

Asset Management One Stewardship Report 2020/2021 Contents Chapter1: Our approach to ESG investment and stewardship 2 投資の力で未来をはぐくむ Creating a sustainable future Chapter2: Governance, processes and resources 8 through the power of investment Chapter3: How we manage conflicts of interest 11 Chapter4: Addressing market-wide and systemic risks 14 お客さまとの信頼関係に裏付けられた「投資の力で」 Chapter5: Review of policies and processes 28 地球と社会の、お客さまと私たちの、すべての世代にとって豊かな「未来を」 情熱をもって大切に「はぐくむ」 Chapter6: Stewardship reporting and communications 31 "Creating" with passion and respect. Chapter7: Our approach to ESG integration 33 "A sustainable future" for the planet, society, our clients and future generations. "Through the power of investment" as a trusted steward of our clients’ assets. Chapter8: Monitoring of service providers 42 Chapter9: Engagement for sustainable value creation 44 Chapter10: Collaborative engagement for effective stewardship 55 Chapter11: Escalation of stewardship activities 60 Chapter12: Exercising rights and responsibilities 62 1 Chapter 1: Our approach to ESG investment and stewardship Introduction to Asset Management One Ltd. and Shinko Asset Management Co., Ltd. to developing and defining our purpose, the integrate their asset management functions, management and employees at Asset Headquartered in Tokyo, Asset Management One effective from 1 October 2016. As of 31 Management One have debated and discussed Co., Ltd. (Asset Management One “AMO”) is a December 2020, AMO's assets under extensively about key challenges and issues leading asset manager of Japanese institutional management are approximately US$526bn facing the economy, environment and the society assets and offers a broad and diverse range of (please refer to Chapter 6 of this report for the (such as climate change, social inequality, bespoke investment strategies to some of the AUM breakdown by asset class). -

MGT Teesside Biomass Power Station United Kingdom

MGT Teesside biomass power station United Kingdom Sectors: Biomass Electric Power Generation On record This profile is no longer actively maintained, with the information now possibly out of date Send feedback on this profile By: BankTrack, Biofuelwatch, Dogwood Alliance, Markets for Change & NOAH (Friends of the Earth Denmark) Created on: Dec 9 2016 Last update: Aug 14 2020 Contact: Adam Macon, Dogwood Alliance. Bente Hessellund Andersen, NOAH (Friends of the Earth Denmark) Project website Status Planning Design Agreement Construction Operation Closure Decommission Sectors Biomass Electric Power Generation Location Status Planning Design Agreement Construction Operation Closure Decommission Website http://www.mgtteesside.co.uk/ This project has been identified as an Equator Project About MGT Teesside biomass power station MGT Teesside recently started building a 299 MW biomass power station at Teesport in the northeast of England. This will be the world's biggest purpose-built biomass power station. It will burn up to 1.5 million tonnes of pellets per year, made from around 3 million tonnes of green wood: wood that has been recently cut and therefore has not had an opportunity to dry by evaporation of the internal moisture. MGT Teesside has entered into a sourcing contract with Enviva, the biggest US pellet producer, for one million tonnes of pellets each year. NGOs and reporters have gathered evidence that Enviva is sourcing a significant proportion of their wood from the clearcutting of highly biodiverse coastal wetland forests on the North American Coastal Plain, which has been declared a Global Biodiversity Hotspot. Latest developments Environmental campaigners in US and Denmark urge key investor to withdraw investment from large biomass power station project MGT Teesside Nov 17 2016 MGT Teesside biomass power station reaches financial close Aug 11 2016 What must happen PKA and Macquarie should immediately divest their 50% equity stakes in MGT Power. -

Fidelity® International Sustainability Index Fund

Fidelity® International Sustainability Index Fund Annual Report October 31, 2020 See the inside front cover for important information about access to your fund’s shareholder reports. Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity’s web site or call Fidelity using the contact information listed below. You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary. Account Type Website -

Annual Report

LAZARD EQUITY SRI French SICAV (open-end investment company) ANNUAL REPORT At September 30th, 2019 Management company: Lazard Frères Gestion SAS Custodian: Caceis Bank Statutory auditor: Ernst & Young et Autres Lazard Frères Gestion SAS - 25 rue de Courcelles - 75008 - Paris - France CONTENTS 1. Characteristics of the UCI 3 2. Changes affecting the UCI 9 3. Management report 12 4. Regulatory information 20 5. Certification by the Statutory Auditor 31 6. Annual financial statements 39 2 1. CHARACTERISTICS OF THE UCI • LEGAL FORM French open-end investment company (Société d'Investissement à Capital Variable - SICAV) with a board of directors. • CLASSIFICATION Eurozone country equities. • ALLOCATION OF DISTRIBUTABLE INCOME Distributable income consists of: 1) net income plus retained earnings, plus or minus the balance of the revenue adjustment account; Net income for the financial year is equal to the amount of interest, arrears, dividends, bonuses and prizes, directors’ fees and all income generated by the securities that make up the Fund’s portfolio, plus income generated by temporary cash holdings, minus management fees and borrowing costs. 2) realised capital gains, net of expenses, minus realised capital losses, net of expenses, recognised for the financial year, plus any net capital gains of the same kind recognised over previous years that have not been distributed or accumulated, plus or minus the balance of the capital gains adjustment account. The amounts referred to in 1) and 2) may be accumulated and/or distributed and/or retained independently of each other, in whole or in part. For the C, PC EUR, RC EUR, PC H-GBP, PC H-USD, RC H-USD, PC H-CHF and RC H-CHF shares, distributable income shall be fully accumulated, with the exception of those amounts subject to distribution by law. -

Geode Capital Management , LLC Subadvisor: Geode Capital Management , LLC Advisor: Fidelity Investments

Index Investing with Fidelity Product overview August 2021 Not FDIC Insured May Lose Value No Bank Guarantee For institutional use only. Index Investing with Fidelity 1. Overview 2. Investment Philosophy 3. Offerings 4. Equity and Specialty 5. Fixed Income 6. Index Fund Performance Summary 7. Securities Lending 8. Appendix 9. Important Information See Important Information for a discussion of performance data, some of the principal risks related to any of the investment strategies referred to in this presentation, and other information related to this presentation. 2 For institutional use only. Why Fidelity for Index? Broad Range Index Fund Low of Market Management Cost and Index Expertise Exposures Some of the most Fidelity’s lineup offers Fidelity is the second competitively priced investors access to all largest index mutual mutual funds and pools core asset class fund provider in the in the industry. exposures as well as industry, with more than more specialized indexes. 30 years of index fund experience.* *Based on $906 billion in index fund assets under management (AUM) as of 6/30/2021. Source: Morningstar. 3 For institutional use only. Fidelity Index Funds Investment Philosophy Fidelity seeks to provide investors with low-cost portfolios that tightly track their benchmarks by focusing on data integrity and employing state-of-the-art trading and risk management tools. Tracking Risk Tools Securities Error Management Lending Work to achieve the Manage multiple risk Utilize state-of-the-art Employ securities lowest possible factors relative to trading and liquidity lending policies that tracking error benchmarks management tools seek to generate revenue and benefit investors 4 For institutional use only. -

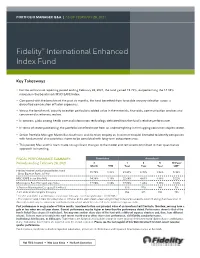

Fidelity® International Enhanced Index Fund

PORTFOLIO MANAGER Q&A | AS OF FEBRUARY 28, 2021 Fidelity® International Enhanced Index Fund Key Takeaways • For the semiannual reporting period ending February 28, 2021, the fund gained 15.72%, outperforming the 14.38% increase in the benchmark MSCI EAFE Index. • Compared with the benchmark the past six months, the fund benefited from favorable security selection across a diversified combination of factor exposures. • Versus the benchmark, security selection particularly added value in the materials, financials, communication services and consumer discretionary sectors. • In contrast, picks among health care and information technology detracted from the fund's relative performance. • In terms of sector positioning, the portfolio benefited most from an underweighting in the lagging consumer staples sector. • Senior Portfolio Manager Maximilian Kaufmann and his team employ an investment model intended to identify companies with fundamental characteristics shown to be correlated with long-term outperformance. • This period, Max and his team made no significant changes to the model and remained committed to their quantitative approach to investing. FISCAL PERFORMANCE SUMMARY: Cumulative Annualized Periods ending February 28, 2021 6 1 3 5 10 Year/ Month YTD Year Year Year LOF1 Fidelity International Enhanced Index Fund 15.72% 1.95% 21.81% 3.45% 9.56% 5.48% Gross Expense Ratio: 0.59%2 MSCI EAFE Index (Net MA) 14.38% 1.16% 22.68% 4.81% 9.96% 5.22% Morningstar Fund Foreign Large Value 17.50% 3.24% 17.86% 1.48% 7.68% 3.36% % Rank in Morningstar Category (1% = Best) -- -- 32% 15% 14% 7% # of Funds in Morningstar Category -- -- 354 325 283 185 1 Life of Fund (LOF) if performance is less than 10 years. -

R&I Fund Award 2019

NEWS RELEASE May 7, 2019 R&I Announces Winners of "R&I Fund Award 2019" - Investment Trust-related Categories - Rating and Investment Information, Inc. (R&I) has announced winners of "R&I Fund Award 2019" (supported by Nikkei Inc.) for investment trust-related categories. This year's Award, the first in the series presented in Japan's new imperial era "Reiwa", includes a new subcategory "Tactical Asset Allocation Fund" in the Investment Trusts Category. Among balanced funds, the core product for long-term asset accumulation, this subcategory covers variable allocation funds, whose performance is affected by fund managers' investment skills more strongly. By utilizing its current quantitative approach, R&I acknowledges funds, investment strategies and so forth that showed excellent performance in each category of investment trusts, iDeCo & DC, NISA and defined benefit pension. Winners are selected in a non-discretionary process from an independent point of view, and as such, the Award is widely recognized by many asset managers and related parties. (Winners for the Defined Benefit Pension Category will be announced around mid or late May.) Award Categories & Subcategories and a List of Winners [Investment Trusts/Aggregate Category] Category Prize Fund Manager The First Prize Tokio Marine Asset Management Co., Ltd. Japanese Equity Fund SPARX Asset Management Co., Ltd. Aggregate The Second Prize Meiji Yasuda Asset Management Company Ltd. The First Prize Goldman Sachs Asset Management Co., Ltd. Global Equity Fund UBS Asset Management (Japan) Ltd Aggregate The Second Prize AllianceBernstein Japan Ltd. The First Prize FIL Investments(Japan)Limited Global Bond Fund DWS Investments Japan Limited Aggregate The Second Prize Amundi Japan, Ltd. -

List of Institutional Investors Signing up to “Principles for Responsible Institutional Investors” ≪Japan's Stewardship

List of institutional investors signing up to “Principles for Responsible Institutional Investors” ≪Japan’s Stewardship Code≫ - To promote sustainable growth of companies through investment and dialogue - As of June 30, 2021 【Total︓309】 Website (URL) where the announcement of the Website (URL) where the disclosure items described in Updates Updates Disclosure of Voting Stewardship Activity Institution’s name (alphabetical order) acceptance of the Code has been disclosed the Code have been disclosed for 2017 Revision for 2020 Revision Results Reasons for Votes Reports Website (URL) Trust banks(subtotal︓6) Mitsubishi UFJ Trust and Banking 1 https://www.tr.mufg.jp/ippan/release/pdf_mutb/200515_1.pdf https://www.tr.mufg.jp/houjin/jutaku/pdf/stewardship_ja_pdf.pdf ○ ○ ○ ○ ○ https://www.tr.mufg.jp/houjin/jutaku/pdf/stewardship_mutb_pdf.pdf?180905 Corporation 2 Mizuho Trust & Banking Co,. Ltd. https://www.mizuho-tb.co.jp/corporate/unyou/pdf/stewardship.pdf https://www.mizuho-tb.co.jp/corporate/unyou/pdf/stewardship.pdf ○ ○ ○ ○ ○ https://www.mizuho-tb.co.jp/corporate/unyou/stewardship_katsudo.html 3 Resona Bank, Limited. http://www.resonabank.co.jp/nenkin/sisan/prii/index.html https://www.resonabank.co.jp/nenkin/sisan/prii/pdf/Stewardship_code_policy.pdf ○ ○ ○ ○ ○ https://www.resona-am.co.jp/investors/ssc.html 4 Sumitomo Mitsui Trust Bank, Limited https://www.smtb.jp/business/instrument/voting/stewardship.html https://www.smtb.jp/business/instrument/voting/stewardship.html ○ ○ ○ ○ ○ https://www.smtb.jp/business/instrument/voting/stewardship_activity.html 5 The Nomura Trust and Banking Co., Ltd. http://www.nomura-trust.co.jp/news/140528.html https://www.nomura-trust.co.jp/company/stewardship/ ○ ○ △ ○ https://www.nomura-trust.co.jp/company/stewardship/pdf/hyouka2020.pdf The Norinchukin Trust and Banking 6 http://www.nochutb.co.jp/about/governance.html http://www.nochutb.co.jp/about/governance.html ○ ○ △ ○ http://www.nochutb.co.jp/about/pdf/2020_stewardship.pdf Co.,Ltd. -

INVESTMENT UPDATE Report As on 31St January 2021 INDEX Content Category No

INVESTMENT UPDATE Report as on 31st January 2021 INDEX Content Category No. From the Managing Director’s Desk 04 ...................................................................................................................................................................... Market Overview 05 ...................................................................................................................................................................... From the Chief Business Officer's Desk 08 ...................................................................................................................................................................... Snapshot of Equity Funds & Other Categories 09 ...................................................................................................................................................................... SBI Blue Chip Fund Equity - Large Cap 12 ...................................................................................................................................................................... SBI Magnum Equity ESG Fund (Previously known as SBI Magnum Equity Fund) Equity - Thematic Fund 13 ...................................................................................................................................................................... SBI Flexicap Fund 14 (Previously known as SBI Magnum Multicap Fund) Equity - Flexicap Fund .....................................................................................................................................................................