Economic Fluctuations and Macroeconomic Theory

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unemployment Insurance and Macroeconomic Stabilization

153 Unemployment Insurance and Macroeconomic Stabilization Gabriel Chodorow-Reich, Harvard University and the National Bureau of Economic Research John Coglianese, Board of Governors of the Federal Reserve System Abstract Unemployment insurance (UI) provides an important cushion for workers who lose their jobs. In addition, UI may act as a macroeconomic stabilizer during recessions. This chapter examines UI’s macroeconomic stabilization role, considering both the regular UI program which provides benefits to short-term unemployed workers as well as automatic and emergency extensions of benefits that cover long-term unemployed workers. We make a number of analytic points concerning the macroeconomic stabilization role of UI. First, recipiency rates in the regular UI program are quite low. Second, the automatic component of benefit extensions, Extended Benefits (EB), has played almost no role historically in providing timely, countercyclical stimulus while emergency programs are subject to implementation lags. Additionally, except during an exceptionally high and sustained period of unemployment, large UI extensions have limited scope to act as macroeconomic stabilizers even if they were made automatic because relatively few individuals reach long-term unemployment. Finally, the output effects from increasing the benefit amount for short-term unemployed are constrained by estimated consumption responses of below 1. We propose five changes to the UI system that would increase UI benefits during recessions and improve the macroeconomic stabilization role: (I) Expand eligibility and encourage take-up of regular UI benefits. (II) Make EB fully federally financed. (III) Remove look-back provisions from EB triggers that make automatic extensions turn off during periods of prolonged unemployment. (IV) Add additional automatic extensions to increase benefits during periods of extremely high unemployment. -

The Microfoundations of the Multiplier Process

The Microfoundations of the Multiplier Process Peter Howitt Brown University January 2, 2002 This is the Þrst draft of a paper to be presented at the ASSA meetings in the HES Session on “Keynes and General Equilibrium Theory,” Atlanta, January 4, 2002. 1Introduction The Keynesian multiplier process is the economist’s paradigmatic positive feedback loop. It causes an initial departure from full-employment equilibrium to cumulate instead of being corrected. The existence of some such process in actual economies is attested to by the typical hump-shaped impulse response pattern of GDP to a random shock in estimated times-series models. For example, Chari, Kehoe and McGrattan (1998) report that quarterly movements in the log of detrended US GDP are well approximated by the following AR2 process: yt =1.30yt 1 0.38yt 2 (1) − − − according to which a negative shock that reduces GDP by 1 percent this quarter is expected to reduced it by 1.3 percent next quarter, and by 1.31 percent the following quarter. The theoretical foundations of this process are not well understood. As originally pre- sented by Kahn and Keynes, and as still presented in undergraduate textbooks, it derives from a consumption function that links consumption to disposable income. Clower (1965) showed how such a link can arise in a Walrasian general equilibrium setting if price ad- justment takes place in real transaction time; when labor is in excess supply unemployed workers will not present their notional consumption demands to the auctioneer but will in- stead present demands that are constrained by realized sales income. -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 112 CONGRESS, FIRST SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 112 CONGRESS, FIRST SESSION Vol. 157 WASHINGTON, TUESDAY, DECEMBER 6, 2011 No. 186 House of Representatives The House met at 10 a.m. and was endured 125 years of change, growth, day, December 4, New York Times enti- called to order by the Speaker pro tem- and service. Today, Consumers Energy tled, ‘‘How the Food Industry Eats pore (Ms. FOXX). delivers electricity and natural gas to Your Kids’ Lunch.’’ This has serious f 6.8 million of Michigan’s 10 million consequences for the 32 million chil- residents in all 68 counties of the dren who rely on school lunches, and DESIGNATION OF SPEAKER PRO State’s Lower Peninsula. often the breakfast program as well. TEMPORE For the past 125 years, Consumer En- Unfortunately, when one-third of our The SPEAKER pro tempore laid be- ergy has operated under the timeless children of school age, 6 to 19, are over- fore the House the following commu- principle: provide customers with safe, weight or obese, this matters. nication from the Speaker: reliable, and affordable energy service. There’s no denying that the institu- WASHINGTON, DC, This principle has played an integral tional and political forces combine to December 6, 2011. role of improving the quality of life for favor giving our kids unhealthy food. It I hereby appoint the Honorable VIRGINIA generations of Michigan residents. It doesn’t just shortchange the children FOXX to act as Speaker pro tempore on this also has been responsible for the and their families with huge medical day. -

Mpcs, Mpes, and Multipliers: a Trilemma for New Keynesian Models

MPCs, MPEs, and Multipliers: A Trilemma for New Keynesian Models Adrien Auclert* Bence Bardóczy† Matthew Rognlie‡ March 2021 Abstract We show that New Keynesian models with frictionless labor supply face a challenge: given standard parameters, they cannot simultaneously match plausible estimates of marginal propen- sities to consume (MPCs), marginal propensities to earn (MPEs), and fiscal multipliers. A HANK model with sticky wages provides a solution to this trilemma. Introduction In recent decades, macroeconomics has experienced a micro-moment revolution. As the field has recognized the importance of heterogeneity for macroeconomic outcomes, it has increasingly used estimates from disaggregated data to discipline its models. One moment that epitomizes this revolution is the marginal propensity to consume (MPC): the amount by which consumption increases in response to a one-time transitory increase in income. Recent research has established that MPCs are extremely important for the macroeconomic effects of shocks and policy, both in partial equilibrium (e.g. Kaplan and Violante 2014, Auclert 2019, Berger, Guerrieri, Lorenzoni and Vavra 2018) and in general equilibrium (e.g. Kaplan, Moll and Violante 2018, Auclert, Rognlie and Straub 2018). Moreover, there exists a widespread consensus on the average level of MPCs in the data. We summarize this consensus as: Fact 1. Average MPCs are high in the data, around 0.25 quarterly and 0.5 annually. *Stanford University, CEPR and NBER. Email: [email protected]. †Northwestern University. Email: [email protected]. ‡Northwestern University and NBER. Email: [email protected]. An earlier version of this paper circulated under the title “A Note on Multipliers in NK Models with GHH Preferences”. -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 113 CONGRESS, SECOND SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 113 CONGRESS, SECOND SESSION Vol. 160 WASHINGTON, THURSDAY, JANUARY 9, 2014 No. 5 House of Representatives The House met at 10 a.m. and was the world, many of them trafficked for This January designated as National called to order by the Speaker pro tem- labor, but increasingly for underaged Slavery and Human Trafficking Pre- pore (Mr. MESSER). girls. For young women, this is a case vention Month is a perfect time to f where they are exploited in this traf- shine a spotlight on the dark issue of ficking as well. trafficking, but awareness is only a DESIGNATION OF SPEAKER PRO Even in my work as chairman of the first step. More needs to be done. TEMPORE Foreign Affairs Committee, I have To that end, I would urge my col- The SPEAKER pro tempore laid be- learned that human trafficking is no leagues to join me in cosponsoring H.R. fore the House the following commu- longer just a problem ‘‘over there.’’ It 3344, the Fraudulent Overseas Recruit- nication from the Speaker: is a problem in our communities here. ment and Trafficking Elimination Act, It is a problem in developing econo- to combat one critical form of recur- WASHINGTON, DC, ring abuse: namely, that is unscrupu- January 9, 2014. mies, but also it is a problem in the I hereby appoint the Honorable LUKE United States and in Europe. It is a lous recruiters. By targeting the re- MESSER to act as Speaker pro tempore on scourge even in the communities that cruiters we can do a lot—these recruit- this day. -

Microfoundations

TI 2006-041/1 Tinbergen Institute Discussion Paper Microfoundations Maarten Janssen Department of Economics, Erasmus Universiteit Rotterdam, and Tinbergen Institute. Tinbergen Institute The Tinbergen Institute is the institute for economic research of the Erasmus Universiteit Rotterdam, Universiteit van Amsterdam, and Vrije Universiteit Amsterdam. Tinbergen Institute Amsterdam Roetersstraat 31 1018 WB Amsterdam The Netherlands Tel.: +31(0)20 551 3500 Fax: +31(0)20 551 3555 Tinbergen Institute Rotterdam Burg. Oudlaan 50 3062 PA Rotterdam The Netherlands Tel.: +31(0)10 408 8900 Fax: +31(0)10 408 9031 Please send questions and/or remarks of non- scientific nature to [email protected]. Most TI discussion papers can be downloaded at http://www.tinbergen.nl. MICROFOUNDATIONS Maarten C.W. Janssen1 Erasmus University Rotterdam and Tinbergen Institute Abstract. This paper gives an overview and evaluates the literature on Microfoundations. Key Words: Representative Agents, New Keynesian Economics, and New Classical Economics JEL code: B22, D40, E00 1 Correspondence Address: Erasmus University Rotterdam and Tinbergen Institute, Postbus 1738, 3000 DR Rotterdam, The Netherlands, e-mail: [email protected]. This paper is prepared as an entry for The New Palgrave Dictionary of Economics (3rd edition) that is currently being prepared. I thank the editors, Steven Durlauf and David Easley, for comments on an earlier version. 1 The quest to understand microfoundations is an effort to understand aggregate economic phenomena in terms of the behavior of -

The Keynesian Multiplier, Credit-Money and Time∗

The Keynesian Multiplier, Credit-Money and Time∗ Sebastian Gechert†‡ October 19, 2011 Abstract. We analyze whether the standard serial multiplier is con- sistent with an endogenous credit-money framework and whether it is applicable to time series data. In order to integrate these terms, we draw on the velocity multiplier approach and a reformulation of the sources and uses of funds in the standard multiplier process. We ar- gue that both the standard multiplier and the velocity multiplier are incomplete; however, they can benefit from each other. Their useful properties are integrated to a new version of the multiplier drawing on the income propagation period and a distinction between saving in terms of debt settlement and saving in terms of accumulating receiv- ables. While the comparative-static stability condition can be dropped, our integrated multiplier reveals a dynamic stability condition for the multiplier process. Keywords. Keynesian multiplier; endogenous money; velocity of money; credit cycles JEL classification. B22, E12, E51, E62 1 Introduction The discussion of fiscal multipliers has lasted for decades and still economists struggle on the value of the multiplier. Stimulus packages facing the great reces- ∗Preliminary draft—not to be cited without author’s permission. †Chemnitz University of Technology, Department of Economics & BA, Germany. [email protected] ‡I would like to thank the participants of the KIEnet conference in Roskilde 2011, those of the 6th Meeting of the Keynes Society in Izmir 2011, and those of the 14th FMM conference in Berlin 2010 for their helpful comments. Of course, they bear no responsibility for any mistakes. -

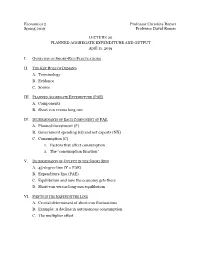

Economics 2 Professor Christina Romer Spring 2019 Professor David Romer LECTURE 20 PLANNED AGGREGATE EXPENDITURE and OUTPUT Ap

Economics 2 Professor Christina Romer Spring 2019 Professor David Romer LECTURE 20 PLANNED AGGREGATE EXPENDITURE AND OUTPUT April 11, 2019 I. OVERVIEW OF SHORT-RUN FLUCTUATIONS II. THE KEY ROLE OF DEMAND A. Terminology B. Evidence C. Source III. PLANNED AGGREGATE EXPENDITURE (PAE) A. Components B. Short run versus long run IV. DETERMINANTS OF EACH COMPONENT OF PAE p A. Planned investment (I ) B. Government spending (G) and net exports (NX) C. Consumption (C) 1. Factors that affect consumption 2. The “consumption function” V. DETERMINANTS OF OUTPUT IN THE SHORT RUN A. 45-degree line (Y = PAE) B. Expenditure line (PAE) C. Equilibrium and how the economy gets there D. Short-run versus long-run equilibrium VI. SHIFTS IN THE EXPENDITURE LINE A. Crucial determinant of short-run fluctuations B. Example: A decline in autonomous consumption C. The multiplier effect Economics 2 Christina Romer Spring 2019 David Romer LECTURE 20 Planned Aggregate Expenditure and Output April 11, 2019 Announcements • We have handed out Problem Set 5. • It is due at the start of lecture on Thursday, April 18th. • Problem set work session Monday, April 15th, 6:00–8:00 p.m. in 648 Evans. • Research paper reading for next time. • Romer and Romer, “The Macroeconomic Effects of Tax Changes.” I. OVERVIEW OF SHORT-RUN FLUCTUATIONS Real GDP in the United States, 1948–2018 Source: FRED (Federal Reserve Economic Data); data from Bureau of Economic Analysis. Short-Run Fluctuations • Times when output moves above or below potential (booms and recessions). • Recessions are costly and very painful to the people affected. Deviation of GDP from Potential and the Unemployment Rate Unemployment Rate Percent Deviation of GDP from Potential Source: FRED; data from Bureau of Labor Statistics. -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 112 CONGRESS, FIRST SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 112 CONGRESS, FIRST SESSION Vol. 157 WASHINGTON, THURSDAY, FEBRUARY 10, 2011 No. 21 House of Representatives The House met at 10 a.m. and was The Lillian Trasher Orphanage, loudest voice on the field because called to order by the Speaker pro tem- begun in 1911 by an American from that’s the kind of person that she is. pore (Mr. CHAFFETZ). Jacksonville, Florida, is one of the old- She is passionate, she is fierce in her f est and longest-serving charities in the dedication to her friends, and she has world. It currently serves over 600 chil- devoted her entire life to making her DESIGNATION OF SPEAKER PRO dren, along with widows and staff. This community, her State, and her country TEMPORE pillar of the community has been home a better place for all Americans. The SPEAKER pro tempore laid be- to thousands of children who needed Bev recently had a curveball thrown fore the House the following commu- food, shelter, and a family. Orphanage at her when she was diagnosed with nication from the Speaker: graduates serve around the world as amyotrophic lateral sclerosis, also WASHINGTON, DC, bankers, doctors, pastors, teachers, and known as ALS—Lou Gehrig’s Disease. February 10, 2011. even in the U.S. Government. Bev has always taken life head-on, and I hereby appoint the Honorable JASON Despite many challenges over the that’s how she addressed this chal- CHAFFETZ to act as Speaker pro tempore on years, the wonderful staff, now led by lenge, the same way she has lived her this day. -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 112 CONGRESS, FIRST SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 112 CONGRESS, FIRST SESSION Vol. 157 WASHINGTON, TUESDAY, DECEMBER 6, 2011 No. 186 House of Representatives The House met at 10 a.m. and was endured 125 years of change, growth, day, December 4, New York Times enti- called to order by the Speaker pro tem- and service. Today, Consumers Energy tled, ‘‘How the Food Industry Eats pore (Ms. FOXX). delivers electricity and natural gas to Your Kids’ Lunch.’’ This has serious f 6.8 million of Michigan’s 10 million consequences for the 32 million chil- residents in all 68 counties of the dren who rely on school lunches, and DESIGNATION OF SPEAKER PRO State’s Lower Peninsula. often the breakfast program as well. TEMPORE For the past 125 years, Consumer En- Unfortunately, when one-third of our The SPEAKER pro tempore laid be- ergy has operated under the timeless children of school age, 6 to 19, are over- fore the House the following commu- principle: provide customers with safe, weight or obese, this matters. nication from the Speaker: reliable, and affordable energy service. There’s no denying that the institu- WASHINGTON, DC, This principle has played an integral tional and political forces combine to December 6, 2011. role of improving the quality of life for favor giving our kids unhealthy food. It I hereby appoint the Honorable VIRGINIA generations of Michigan residents. It doesn’t just shortchange the children FOXX to act as Speaker pro tempore on this also has been responsible for the and their families with huge medical day. -

AGGREGATE DEMAND and ECONOMIC FLUCTUATIONS Principles of Economics in Context (Goodwin, Et Al.), 2Nd Edition

Chapter 24 AGGREGATE DEMAND AND ECONOMIC FLUCTUATIONS Principles of Economics in Context (Goodwin, et al.), 2nd Edition Chapter Overview This chapter first introduces the analysis of business cycles, and introduces you to the two stylized facts of the business cycle. The chapter then presents the Classical theory of savings-investment balance through the market for loanable funds. Next, the Keynesian aggregate demand analysis in the form of the traditional "Keynesian Cross" diagram is developed. You will learn what happens when there’s an unexpected fall in spending, and the role of the multiplier in moving to a new equilibrium. Chapter Objectives After reading and reviewing this chapter, you should be able to: 1. Describe how unemployment and inflation are thought to normally behave over the business cycle. 2. Model consumption and investment, the components of aggregate demand in the simple model. 3. Describe the problem that “leakages” present for maintaining aggregate demand, and the classical and Keynesian approaches to leakages. 4. Understand how the equilibrium levels of income, consumption, investment, and savings are determined in the Keynesian model, as presented in equations and graphs. 5. Explain how, in the Keynesian model, the macroeconomy can equilibrate at a less-than-full-employment output level. 6. Describe the workings of “the multiplier,” in words and equations. Key Terms Okun’s “law” behavioral equation “full-employment output” (Y*) marginal propensity to consume aggregate expenditure (AE) marginal propensity to save accounting identity paradox of thrift Chapter 24 – Aggregate Demand and Economic Fluctuations 1 Active Review Fill in the Blank 1. The macroeconomic goal that involves keeping the rate of unemployment and inflation at acceptable levels over the business cycle is the goal of . -

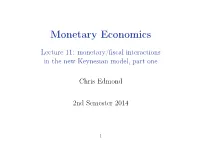

Lecture 11: Monetary/fiscal Interactions in the New Keynesian Model, Part One

Monetary Economics Lecture 11: monetary/fiscal interactions in the new Keynesian model, part one Chris Edmond 2nd Semester 2014 1 This class Monetary/fiscal interactions in the new Keynesian model, part one • Fiscal policy and multipliers • Reading • Woodford “Simple analytics of the government expenditure ⇧ multiplier” AEJ: Macroeconomics,2011 Available from the LMS 2 This class 1- Benchmark fiscal multipliers – long-run multiplier (neoclassical case) – short-run multiplier (for constant real rate) 2- Detailed new Keynesian example – illustrates how multiplier depends on monetary policy reaction, price stickiness, etc 3 Neoclassical benchmark Household utility function • U(C) V (N) − Goods market • C + G = Y = F (N) Standard optimality conditions • V 0(N) W = = F 0(N) U 0(C) P Utility cost of producing Y output • 1 V 0(N) V˜ (Y ) V (F − (Y )), V˜ 0(Y )= ⌘ F 0(N) 4 Neoclassical benchmark (cont) Key optimality condition can then be written • U 0(Y G)=V˜ 0(Y ) − Implicitly differentiating and using U (C)=V˜ (Y ) gives • 0 0 U 00(C) dY U (C) U (C) Y = 00 = − 0 ˜ U (C) V˜ (Y ) dG U 00(C) V 00(Y ) 00 00 U (C) Y + ˜ Y − − 0 V 0(Y ) ⌘ = u (0, 1) ⌘u + ⌘v 2 where ⌘u > 0 and ⌘v > 0 are elasticities of U 0(C) and V˜ 0(Y ) with respect to Y 5 Imperfect competition Not much changes with constant markup • W " P = , MF (N) M⌘" 1 0 − Key condition can then be written • U 0(Y G)= V˜ 0(Y ) − M Again, implicitly differentiating and using U (C)= V˜ (Y ) gives • 0 M 0 dY ⌘ = u (0, 1) dG ⌘u + ⌘v 2 Constant markup reduces level of Y , but does not affect multiplier • 6 Aside: countercyclical markups? Suppose markup depends on output, (Y ).