A Database of Regulated Markets Across the EEA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nord-Pool-Spot-Glossary.Pdf

GLOSSARY Issued by Nord Pool Spot Date: September 29, 2011 Glossary Nord Pool Spot Area Price Whenever there are grid congestions, the Elspot area is divided into two or more price areas. Each of these prices are referred to as area prices. Balancing market A market system for maintaining the operational balance between consumption and generation of electricity in the overall power system. Also called regulating power market. Bidding area The area for which a bid is posted. There are at least six bidding areas: Sweden, Finland, Denmark East, Denmark West, and at least two Norwegian areas. Bilateral contract A contract between two parties, as opposed to a trade on the exchange. Block bid The block bid is an aggregated bid for several hours, with a fixed price and volume throughout these hours. The purchase/sale is activated if the average price over the given time period is lower (for a purchase bid) or higher (for a sales bid) than the bid price. Clearing customer Responsible for settlement, but their trading and clearing representative performs the trade. Cross border Cross border optimization (CBO) was a service offered by Nord Pool Spot to optimization improve effeciency of the cross border trade between Jutland and Germany until the German - Danish market coupling was introduced. Curtailment Curtailment of the bids in Elspot will take place in a situation where the aggregated supply and bid curves within a price area do not intersect. Delivery hour The hour when the power is produced and consumed Direct participant A direct participant trades on their own behalf and are responsible for settlement. -

ANNA Annual Report.Indd

Association of National Numbering Agencies scrl AAnnualnnual RReporteport 22014013 Contents 3 Chairman’s Report 2014 5 Objectives and mission statements of ANNA 6 General meetings – ANNA administrative review 2014 13 ANNA Service Bureau – report for 2014 14 Securities business and state of ISIN implementation – worldwide 16 Allocation of ISIN for new financial instruments 19 Working Groups, Task Forces and Reginal Groups 25 List of members by COUNTRY as per May 2015 Appendices 29 A ISO 6166 – an outline of the standard 30 B ANNA Guidelines for ISO 6166, Version 12, August 2014 40 C Geographical division of countries among substitute agencies as per May 2015 50 D ISO 10962 – outline of the CFI-(Classification of financial Instruments-) Code 2 www.anna-web.com Chairman’s Report 2014 Dear ANNA Members and Partners, Association strategy, re-evaluating the approved short, medium and long term The year 2014 has been referred to as the direction. Some modifications were made transitionary year from the Age of Recovery to and the Association strategy was presented the Age of Divergence. for validation by the members at the last EGM; Looking at the events of 2014, Central Bank - A growing number of ANNA members actions and divergence have been the under- continued to contribute to the evolution of lying themes. The view remains that these the ISO 17442 – Legal Entity Identifier (LEI) two factors are having and will continue to standard, to promote ANNA’s federated have, significant influence on the global model and the value added benefits of our financial markets and the direction they will model and the National Numbering Agencies take in the near future. -

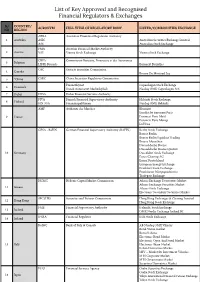

List of Key Approved and Recognised Financial Regulators & Exchanges

List of Key Approved and Recognised Financial Regulators & Exchanges S/ COUNTRY/ ACRONYM FULL TITLE OF REGULATORY BODY LISTED/COMMODITIES EXCHANGE NO REGION APRA Australian Prudential Regulation Authority 1 Australia ASIC Australian Securities Exchange Limited ASE Australian Stock Exchange FMA Austrian Financial Market Authority 2 Austria VSE Vienna Stock Exchange Vienna Stock Exchange CBFA Commission Bancaire, Financiere et des Assurances 3 Belgium LIFFE Brussels Euronext Bruxelles OSC Ontario Securities Commission 4 Canada Bourse De Montreal Inc 5 *China CSRC China Securities Regulatory Commission Finanstilsynet Copenhagen Stock Exchange 6 Denmark Dansk Autoriseret Markedsplads Nasdaq OMX Copenhagen A/S 7 Dubai DFSA Dubai Financial Services Authority FIVA Finnish Financial Supervisory Authority Helsinki Stock Exchange 8 Finland FIN-FSA Finansinspektionen Nasdaq OMX Helsinki AMF Authorite des Marches Bluenext Eurolist by Euronext Paris 9 France Euronext Paris Matif Euronext Paris Monep LCH SA GFSA - BaFIN German Financial Supervisory Authority (BAFIN) Berlin Stock Exchange Boerse Berlin Boerse Berlin Equiduct Trading Boerse Muenchen Duesseldorfer Boerse Duesseldorfer Boerse Quotrix 10 Germany Dusseldorf Stock Exchange Eurex Clearing AG Eurex Deutschland European Energy Exchange Frankfurt Stock Exchange Frankfurter Wertpapierboerse Tradegate Exchange HCMC Hellenic Capital Market Commission Athens Exchange Derivatives Market Athens Exchange Securities Market 11 Greece Athens Stock Exchange Electronic Secondary Securities Market SFC (HK) -

B3 Transfers Equities to Its Multi-Asset Clearing Platform

Press release 29 August 2017 B3 transfers equities to its multi-asset clearing platform Cinnober’s real-time clearing solution now handles post trading process for both the equities and the derivatives markets in Brazil • BRL 21 billion of collateral returned to the market (approx. USD 6,4 billion) • Phase two completed of major Post-Trade Integration Project going from two clearinghouses to one for equities and derivatives • More efficient risk management by analyzing the risk on entire portfolios B3 (the Brazilian exchange and clearinghouse) successfully launched on Monday the equities, corporate bonds, and equities lending markets on its new multi-asset clearing platform. The clearing solution is delivered by Cinnober, built on its TRADExpress RealTime Clearing system. The migration of the equities clearinghouse was the target for phase two of B3’s Post-Trade Integration Project that will consolidate B3’s originally four clearinghouses into one integrated entity (managing equities, derivatives, government and corporate debt securities and FX). Derivatives and OTC products were the first to launch on the new platform in phase one. With the new integrated clearinghouse, B3 manages risk more efficiently. By analyzing the risk on entire portfolios, the clearinghouse can compensate if an investor has opposite positions in the same underlying asset across product groups and markets. When financial and commodity derivatives, along with OTC products, migrated to the new clearinghouse in phase one, the total systemic benefit in terms of margin release amounted to around BRL 20 billion. The estimated effect from Monday’s launch of phase two is BRL 21 billion of collateral that was returned to the market with complete preservation of the clearinghouse’s safety system. -

Annotated Presentation of Regulated Markets and National Provisions

15.7.2011 EN Official Journal of the European Union C 209/21 Annotated presentation of regulated markets and national provisions implementing relevant requirements of MiFID (Directive 2004/39/EC of the European Parliament and of the Council) (2011/C 209/13) Article 47 of the Markets in Financial Instruments Directive (Directive 2004/39/EC, OJ L 145, 30.4.2004) authorises each Member State to confer the status of ‘regulated market’ on those markets constituted on its territory and which comply with its regulations. Article 4, paragraph 1, point 14 of Directive 2004/39/EC defines a ‘regulated market’ as a multilateral system operated and/or managed by a market operator, which brings together or facilitates the bringing together of multiple third-party buying and selling interests in financial instruments — in the system and in accordance with its non-discretionary rules — in a way that results in a contract, in respect of the financial instruments admitted to trading under its rules and/or systems, and which is authorised and functions regularly and in accordance with the provisions of Title III of Directive 2004/39/EC. Article 47 of Directive 2004/39/EC requires that each Member State maintains an updated list of regulated markets authorised by it. This information should be communicated to other Member States and the European Commission. Under the same article (Article 47 of Directive 2004/39/EC), the Commission is required to publish a list of regulated markets, notified to it, on a yearly basis in the Official Journal of the European Union. The present list has been compiled pursuant to this requirement. -

Euronext Amsterdam Notice

DEPARTMENT: Euronext Amsterdam Listing Department ISSUE DATE: Tuesday 13 April 2021 EFFECTIVE DATE: Tuesday 13 April 2021 Document type: Euronext Amsterdam Notice Subject: EURONEXT AMSTERDAM PENALTY BENCH END DATE INTRODUCTION Pursuant to Rule 6903/3, Euronext Amsterdam may decide to include a Security to the Penalty Bench if the Issuer fails to comply with the Rules. This Notice sets out Euronext Amsterdam’s policy with respect to the term a Security can be allocated to the Penalty Bench after which it may be removed from trading. DETAILS Policy for delisting of issuers on the Penalty Bench When Euronext Amsterdam establishes that an Issuer fails to remedy the violation(s) of the Rule(s) that caused the transfer of its instruments to the Penalty Bench and the instruments have been on the Penalty bench for at least 24 months(*), Euronext will consider the violation(s) as a manifest failure of the Issuer to comply with the obligations imposed and the requirements set pursuant to the Rules in accordance with 6905/1(a). The process to come to a decision to remove the Securities will then commence. The final decision will be taken taking all relevant circumstances into account including but not limited to the the investors’ interests and the orderly functioning of the market. The process to delist will be applied in accordance with Rule 6905/1(ii) jo 6905/2 with the following specifications: - The date of the delisting will be at least 6 months after the formal decision. In the meantime, the instrument remains on the Penalty Bench and trading is possible, provided that trading is not suspended. -

Fallback to the Future – Creating a More Robust Day-Ahead Fallback Solution Find out More at WHITEPAPER JUNE 2021

Fallback to the Future – WHITEPAPER Creating a More Robust JUNE 2021 Day-Ahead Fallback Solution In partnership with our customers, Nord Pool has handled coupled power trading markets since 1996. That long-term experience and expertise means we have strong views on the best fallback solution for the European power market in the single day-ahead coupling (SDAC). Since its inception in 2014, SDAC has grown in terms of geography, technical complexity, products and liquidity. The increasing connectivity and reliance of markets on the SDAC solution serves to emphasise the importance of ensuring it delivers results in a robust and reliable manner and without having to fall back on splitting up market liquidity by decoupling NEMOs or bidding zones. Resorting to splitting up market liquidity in this way, means leaving market participants with sub-optimal trades, as well as risking unpredictable, erratic price results. The current on-going revision of the Capacity Allocation and Congestion Management (CACM) regulation, as well as recent ENTSO-E consultation around potential fallback solutions, has cast a welcome spotlight on an issue which has troubled the experts here at Nord Pool, and our many day-ahead customers, for some time. Highlighting the Problem The Situation Today Decoupling situations happen – and when they happen they Currently, in CWE (soon to be part of the ‘Core’ region), are both challenging and disruptive for market participants, decoupling automatically splits market liquidity into local Transmission System Operators (TSOs) and Nominated NEMO liquidity pools and, in case of the decoupling of an Electricity Market Operators (NEMOs) alike. These incidents entire bidding zone, triggers explicit cross-border capacity also cast unwarranted doubt on the robustness and allocation in ‘shadow auctions’ for cross-zonal capacities reliability of price formation in the power market. -

I2PO SPAC Lists on Euronext Paris • €275 Million Raised • 16Th SPAC Listing on Euronext in 2021 • 1St European SPAC Dedicated to the Entertainment and Leisure Sector

Contacts Media Contact Investor Relations Amsterdam +31 20 721 4133 Brussels +32 2 620 15 50 +33 1 70 48 24 27 Dublin +353 1 617 4249 Lisbon +351 210 600 614 Milan +39 02 72 42 62 12 Oslo +47 22 34 19 15 Paris +33 1 70 48 24 45 I2PO SPAC lists on Euronext Paris • €275 million raised • 16th SPAC listing on Euronext in 2021 • 1st European SPAC dedicated to the entertainment and leisure sector Paris – 20 July 2021 – Euronext today congratulates I2PO, a Special Purpose Acquisition Company (SPAC) dedicated to the entertainment and leisure sector, on its listing on the professional compartment of Euronext’s regulated market in Paris (ticker code: I2PO). Iris Knobloch, along with Artemis, a patrimonial holding from the Pinault family represented by François-Henri Pinault and Alban Gréget, and Combat Holding, the entity which co-founded the 2MX Organic and Mediawan SPACs, have partnered to create the I2PO SPAC. The first SPAC in Europe to be co-founded and led by a woman, I2PO is also the first European SPAC in the entertainment and leisure sector. I2PO aims at one or several targets in the sub-sectors such as streaming and content distribution, music, intellectual property of media and services, electronic games and sports, online learning, and leisure platforms. I2PO was listed through the admission to trading of the 27.5 million units making up its equity. In total, I2PO raised €275 million in a private placement from qualified investors, exceeding the €250 million initially announced during the introductory offer. Iris Knobloch, President of the Executive Board and Director General of I2PO, said: “Launching I2PO, we succeeded in creating, with Artemis and Combat Holding, the first SPAC listed in Europe dedicated to entertainment and leisure. -

Case M.9564 – LSEG/REFINITIV BUSINESS REGULATION (EC)

EUROPEAN COMMISSION DG Competition Case M.9564 – LSEG/REFINITIV BUSINESS Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Decision on the implementation of the commitments - Purchaser approval Date: 26/2/2021 EUROPEAN COMMISSION Brussels, 26.2.2021 C(2021) 1483 final PUBLIC VERSION In the published version of this decision, some information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. London Stock Exchange Group Plc. 10 Paternoster Square EC4M 7LS - London United Kingdom Dear Sir/Madam, Subject: Case M.9564 – LONDON STOCK EXCHANGE GROUP/ REFINITIV BUSINESS Approval of Euronext N.V. as purchaser of the Divestment Business following your letter of 16.10.2020 and the Trustee’s opinion of 22.02.2021 1. FACTS AND PROCEDURE (1) By decision of 13 January 2021 (the "Decision”) based on Article 8(2) of Council Regulation (EC) No 139/20041 and Article 57 of the EEA Agreement2, the 1 OJ L 24, 29.1.2004, p. 1 (the ‘Merger Regulation’). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes, such as the replacement of "Community" by "Union" and "common market" by "internal market". The terminology of the TFEU will be used throughout this decision. For the purposes of this Decision, although the United Kingdom withdrew from the European Union as of 1 February 2020, according to Article 92 of the Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community (OJ L 29, 31.1.2020, p. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

Xpand März 08 E 18.03.2008 18:39 Uhr Seite 1

März 08 Inhalt D, E 18.03.2008 18:40 Uhr Seite 2 March 2008 CONTENT (Click on Title to view Article) Cooperations Eurex Plans to Increase Stake in European Energy Exchange Equity Derivatives 20 New Single Stock Futures on MDAX® and TecDAX® Components Equity Index Derivatives CFTC Approves Further Eurex Futures for Trading in the U.S. Interest Rate Derivatives New Designated Market-Making Scheme for Euro-Buxl® Futures Inflation Derivatives Hedging Using Euro-Inflation Futures: A Practical Example Cooperations OSE and ISE Plan to Launch New Options Platform Eurex Repo New Open and Variable Repo Contracts Offer More Flexibility in Repo Trading Market Trends Mutual Recognition in the U.S. in Progress Events Apr/May Education Apr/May Key Figures Feb February 2008 With 179 Million Contracts Traded Eurex Monthly Statistics March 2008 Interest Rate Derivatives Equity Index Derivatives - Equity Index Futures - Equity Index Options Equity Derivatives - Single Stock Futures - Equity Options Credit Derivatives Volatility Index Derivatives Inflation Derivatives Exchange Traded Funds® Derivatives Eurex Total Xpand März 08 E 18.03.2008 18:39 Uhr Seite 1 March 2008 Eurex Plans to Increase Stake in European Energy Exchange Eurex has entered into agreements to increase its stake in the European Energy Exchange AG CONTENT (EEX) by up to 20.85 percent to then 44.07 percent for a consideration of EUR 55.15 million. Cooperations This move underscores the strategic partnership of EEX and Eurex. Eurex Plans to Increase Stake in European Energy Exchange (1) Eurex plans to acquire 3.46 percent of EEX’s own shares for EUR 9.15 million, translating into Equity Derivatives EUR 6.60 per share. -

EU Emissions Trading the Role Of

School of Management and Law EU Emissions Trading: The Role of Banks and Other Financial Actors Insights from the EU Transaction Log and Interviews SML Working Paper No. 12 Johanna Cludius, Regina Betz ZHAW School of Management and Law St.-Georgen-Platz 2 P.O. Box 8401 Winterthur Switzerland Department of Business Law www.zhaw.ch/abl Author/Contact Johanna Cludius [email protected] Regina Betz [email protected] March 2016 ISSN 2296-5025 Copyright © 2016 Department of Business Law, ZHAW School of Management and Law All rights reserved. Nothing from this publication may be reproduced, stored in computerized systems, or published in any form or in any manner, including electronic, mechanical, reprographic, or photographic, without prior written permission from the publisher. 3 Abstract This paper is an empirical investigation of the role of the financial sector in the EU Emissions Trading Scheme (EU ETS). This topic is of particular interest because non-regulated entities are likely to have played an important part in increasing the efficiency of the EU ETS by reducing trading transaction costs and providing other services. Due to various reasons (new rules and regulations, reduced return prospects, VAT fraud investigations) banks have reduced their engagement in EU Emissions Trading and it is unclear how this will impact on the functioning of the carbon market. Our regression analysis based on data from the EU Transaction Log shows that large companies and companies with extensive trading experience are more likely to interact with the financial sector, which is why we expect banks’ pulling out of the EU ETS to affect larger companies more significantly.