MAKING the WORLD STRONGER Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

We Want to Help the World Reach Net Zero and Improve People's Lives

BP Sustainability Report 2019 Our purpose is reimagining energy for people and our planet. We want to help the world reach net zero and improve people’s lives. We will aim to dramatically reduce carbon in our operations and production and grow new low carbon businesses, products and services. We will advocate for fundamental and rapid progress towards Paris and strive to be a leader in transparency. We know we don’t have all the answers and will listen to and work with others. We want to be an energy company with purpose; one that is trusted by society, valued by shareholders and motivating for everyone who works at BP. We believe we have the experience and expertise, the relationships and the reach, the skill and the will, to do this. Introduction Message from Bernard Looney 2 Our ambition 4 2019 at a glance Energy in context 8 Sustainability at BP UN Sustainable Development Goals 11 Sustainability at BP 11 Key sustainability issues 14 Our focus areas Climate change and the energy transition 16 Our role in the energy transition 18 Our ‘reduce, improve, create’ framework 20 Accrediting our lower carbon activities 22 Reducing emissions in our operations 23 Improving our products 26 Creating low carbon businesses 30 Safety 36 Process safety 38 Personal safety 39 Safety performance 41 Our value to society 42 Creating social value 44 Social investment 45 Local workers and suppliers 46 Human rights 47 Community engagement 48 Our impact on communities 49 Labour rights 50 Doing business responsibly Environment 54 People 60 Business ethics 68 Navigating our reports Governance Our quick read Human rights governance 74 provides a summary of the Executive oversight of sustainability 74 Sustainability Report, including key Managing risks 75 highlights and performance in 2019. -

FTSE Factsheet

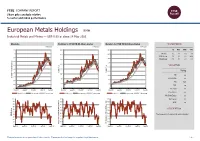

FTSE COMPANY REPORT Share price analysis relative to sector and index performance European Metals Holdings EMH Industrial Metals and Mining — GBP 0.69 at close 14 May 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-May-2021 14-May-2021 14-May-2021 1.1 450 900 1D WTD MTD YTD 1 Absolute 0.0 -6.8 -4.2 7.8 400 800 Rel.Sector 1.2 -2.9 -7.5 -20.3 0.9 700 Rel.Market -1.1 -5.5 -4.8 -1.3 350 0.8 600 300 0.7 VALUATION 500 0.6 250 400 Trailing Relative Price Relative 0.5 Price Relative 200 300 PE -ve 0.4 Absolute Price (local currency) (local Price Absolute 150 EV/EBITDA -ve 200 0.3 PB 12.3 100 0.2 100 PCF -ve 0.1 50 0 Div Yield 0.0 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Price/Sales +ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.0 100 90 90 Div Payout 0.0 90 80 80 ROE -ve 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 40 40 The Company is focusing in tin mining industry. -

Prospectus Front and Back 2016

IMPORTANT NOTICE THE PROSPECTUS (THE “PROSPECTUS”) FOLLOWING THIS PAGE MAY ONLY BE DISTRIBUTED TO PERSONS WHO ARE EITHER (1) QUALIFIED INSTITUTIONAL BUYERS (“QIBs”) WITHIN THE MEANING OF RULE 144A (“RULE 144A”) UNDER THE U.S. SECURITIES ACT OF 1933 (THE “SECURITIES ACT”), OR (2) NON-U.S. PERSONS OUTSIDE THE UNITED STAT ES WITHIN THE MEANING OF REGULATION S (“REGULATION S”) UNDER THE SECURITIES ACT. IMPORTANT: You must read the following before continuing. The following applies to the Prospectus following this page, and you are therefore advised to read this carefully before reading, accessing or making any other use of this document. In accessing the Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from us as a result of such access. RESTRICTIONS: NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER TO SELL OR A SOLICITAT ION OF AN OFFER TO BUY THE NOTES IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. ANY NOTE TO BE ISSUED HAS NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES ACT, OR WITH ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE OF THE UNITED STATES OR OTHER JURISDICTION. THE NOTES MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED DIRECTLY OR INDIRECTLY WITHIN THE UNITED STAT ES OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S) EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. -

NOISE and MILITARY SERVICE Implications for Hearing Loss and Tinnitus

NOISE AND MILITARY SERVICE Implications for Hearing Loss and Tinnitus Committee on Noise-Induced Hearing Loss and Tinnitus Associated with Military Service from World War II to the Present Medical Follow-up Agency Larry E. Humes, Lois M. Joellenbeck, and Jane S. Durch, Editors THE NATIONAL ACADEMIES PRESS Washington, DC www.nap.edu THE NATIONAL ACADEMIES PRESS • 500 Fifth Street, N.W. • Washington, DC 20001 NOTICE: The project that is the subject of this report was approved by the Governing Board of the National Research Council, whose members are drawn from the councils of the National Academy of Sciences, the National Academy of Engineering, and the Insti- tute of Medicine. The members of the committee responsible for the report were chosen for their special competences and with regard for appropriate balance. This study was supported by Contract No. V101(93)P-1637 #29 between the Na- tional Academy of Sciences and the Department of Veterans Affairs. Any opinions, find- ings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the view of the organizations or agencies that provided support for this project. Library of Congress Cataloging-in-Publication Data Noise and military service : implications for hearing loss and tinnitus / Committee on Noise-Induced Hearing Loss and Tinnitus Associated with Military Service from World War II to the Present, Medical Follow- up Agency ; Larry E. Humes, Lois M. Joellenbeck, and Jane S. Durch, editors. p. ; cm. Includes bibliographical references. ISBN 0-309-09949-8 — ISBN 0-309-65307-X 1. Deafness—Etiology. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Ftse4good UK 50

2 FTSE Russell Publications 19 August 2021 FTSE4Good UK 50 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.81 UNITED GlaxoSmithKline 5.08 UNITED Rentokil Initial 0.67 UNITED KINGDOM KINGDOM KINGDOM Anglo American 2.56 UNITED Halma 0.74 UNITED Rio Tinto 4.68 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.36 UNITED HSBC Hldgs 6.17 UNITED Royal Dutch Shell A 4.3 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.56 UNITED InterContinental Hotels Group 0.64 UNITED Royal Dutch Shell B 3.75 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 8.25 UNITED International Consolidated Airlines 0.47 UNITED Schroders 0.28 UNITED KINGDOM Group KINGDOM KINGDOM Aviva 1.15 UNITED Intertek Group 0.65 UNITED Segro 0.95 UNITED KINGDOM KINGDOM KINGDOM Barclays 2.1 UNITED Legal & General Group 1.1 UNITED Smith & Nephew 0.99 UNITED KINGDOM KINGDOM KINGDOM BHP Group Plc 3.2 UNITED Lloyds Banking Group 2.39 UNITED Smurfit Kappa Group 0.74 UNITED KINGDOM KINGDOM KINGDOM BT Group 1.23 UNITED London Stock Exchange Group 2.09 UNITED Spirax-Sarco Engineering 0.72 UNITED KINGDOM KINGDOM KINGDOM Burberry Group 0.6 UNITED Mondi 0.67 UNITED SSE 1.13 UNITED KINGDOM KINGDOM KINGDOM Coca-Cola HBC AG 0.37 UNITED National Grid 2.37 UNITED Standard Chartered 0.85 UNITED KINGDOM KINGDOM KINGDOM Compass Group 1.96 UNITED Natwest Group 0.77 UNITED Tesco 1.23 UNITED KINGDOM KINGDOM KINGDOM CRH 2.08 UNITED Next 0.72 UNITED Unilever 7.99 UNITED KINGDOM KINGDOM -

Participating Organizations

PARTICIPATING ORGANIZATIONS Company Name Company Name Company Name Company Name Company Name ABB City and County of Denver Hewlett Packard Enterprise Nextworld Shell ABS Cobham Semiconductor Solutions Hitachi Consulting NLMK Shimmick Construction Advanced Micro Devices Coeur Mining Holland & Hart LLP Noble Energy Sierra Nevada Corporation AECOM CollegeDrive Test Prep and Tutoring HollyFrontier Northrop Grumman Corporation SM Energy Aera Energy LLC Collimare LLC HomeAdvisor Northwestern Mutual Solar Turbines, Inc Colorado Department of Transporta- Alarm.com Hunting Titan Nucor Steel Southwestern Energy tion Alight, Inc. Colorado Law Illinois Institute of Technology Oasis Petroleum Spectranetics Allegion Colorado Lighting, Inc IM Flash Occidental Petroleum Corporation Stanley Consultants, Inc. AMERICAN Cast Iron Pipe Company CO School of Mines Graduate Studies IMERYS Olin Corporation Statoil Ames Construction Computronix, Inc. IMI Precision Engineering Olsson Associates Stillwater Mining Company Anadarko Petroleum Corporation Condon - Johnson & Associates, Inc. Intelligent Software Solutions OppenheimerFunds Summit Materials Andeavor Connexta J.R. Butler, Inc. ORAU - Maryland Office SUNDT Apache Corp. ConocoPhillips Jacobs Orbital ATK TEAM-UP: Teacher Education Alliance Apex Engineers, Inc. Covenant Testing Technologies, LLC. Johns Manville Orica Tenaris Applied Control Equipment, LLLP Credera Jviation, Inc. OSIsoft Texas Instruments Arcadis, Inc. CTL Thompson, Inc. Kahuna Ventures LLC Parsons The RMH Group Inc. ArcelorMittal Daily Thermetrics Kansas Department of Transportation Pathfinder Systems Inc The Trade Desk Arch Coal, Inc. Dal-Tile Corp. Keane Group PDC Energy The Vertex Companies, Inc. ARCO/Murray National Construction Davidson Technologies Inc. Kenzan Peabody Energy Tierra Group International, Ltd. Arista Networks DENSO International America, Inc. Kiewit Peace Corps TimkenSteel Corporation APS- Palo Verde Generating Station DPS - Denver Teacher Residency Kimley-Horn Pearl Harbor Naval Shipyard Traylor Bros., Inc. -

CHAPTER ONE What Is Biomedia?

CHAPTER ONE What Is Biomedia? Can I Download It? Cultural anxieties concerning biotechnologies are often played out in the news media, where the latest reports on genetic cloning, stem cell research, gene therapy, and bio- terrorism all command a significant amount of reportage on current events. Each of these issues is a discourse of the body, and a discourse that articulates specific kinds of bodies (the body of nuclear transfer cloning, the body of adult stem cells, etc.). The issues they raise are difficult and contentious ones: In which cases should experimen- tation of human embryos be allowed? In which cases is human cloning warranted? How can engineered biological agents be detected in time to deter a bioterrorist attack? Too often, however, the solutions that come up are haphazard, ad hoc modifica- tions of existing legislation. For instance, the temporary U.S. presidential ban on human embryonic stem cell research in 2000 pertained only to federally funded research, not biotech companies such as Geron.1 Alternately, when policy changes are made, resolu- tions usually fall back on more traditional ethical models. An example is the U.S. pol- icy on human embryonic stem cell research, which in essence is a version of "the greatest good for the greatest number of people."2 That continued attempts are being made to formulate ethical approaches to such complicated issues is in itself encouraging. Yet, what often goes unquestioned, and un- contested, is whether the foundations on which such decisions are being made is in the process -

Berezovsky-Judgment.Pdf

Neutral Citation Number: [2012] EWHC 2463 (Comm) Royal Courts of Justice Rolls Building, 7 Rolls Buildings, London EC4A 1NL Date: 31st August 2012 IN THE HIGH COURT OF JUSTICE Case No: 2007 Folio 942 QUEEN’S BENCH DIVISION COMMERCIAL COURT IN THE HIGH COURT OF JUSTICE Claim Nos: HC08C03549; HC09C00494; CHANCERY DIVISION HC09C00711 Before: MRS JUSTICE GLOSTER, DBE - - - - - - - - - - - - - - - - - - - - - Between: Boris Abramovich Berezovsky Claimant - and - Roman Arkadievich Abramovich Defendant Boris Abramovich Berezovsky Claimant - and - Hine & Others Defendants - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Laurence Rabinowitz Esq, QC, Richard Gillis Esq, QC, Roger Masefield Esq, Simon Colton Esq, Henry Forbes-Smith Esq, Sebastian Isaac Esq, Alexander Milner Esq, and Ms. Nehali Shah (instructed by Addleshaw Goddard LLP) for the Claimant Jonathan Sumption Esq, QC, Miss Helen Davies QC, Daniel Jowell Esq, QC, Andrew Henshaw Esq, Richard Eschwege Esq, Edward Harrison Esq and Craig Morrison Esq (instructed by Skadden, Arps, Slate, Meagher & Flom LLP) for the Defendant Ali Malek Esq, QC, Ms. Sonia Tolaney QC, and Ms. Anne Jeavons (instructed by Freshfields Bruckhaus Deringer LLP) appeared for the Anisimov Defendants to the Chancery Actions David Mumford Esq (instructed by Macfarlanes LLP) appeared for the Salford Defendants to the Chancery Actions Jonathan Adkin Esq and Watson Pringle Esq (instructed by Signature Litigation LLP) appeared for the Family Defendants to the Chancery Actions Hearing dates: 3rd – 7th October 2011; 10th – 13th October 2011; 17th – 19th October 2011; 24th & 28th October 2011; 31st October – 4th November 2011; 7th – 10th November 2011; 14th - 18th November 2011; 21st – 23 November 2011; 28th November – 2nd December 2011; 5th December 2011; 19th & 20th December 2011; 17th – 19th January 2012. -

Zoning Regulations

CITY OF BOX ELDER TITLE 15 CHAPTER 153: ZONING REGULATIONS SECTION PAGE General Provisions 153.001: Title 153-6 153.002: Short Title 153-6 153.003: Purpose and jurisdiction 153-6 153.004: Definitions 153-6 153.005: Severability and Separability 153-31 Adoption of a Comprehensive Plan, a Major Street Plan, Regulations, and Codes 153.015 Adoption of a comprehensive plan 153-31 153.016 Adoption of a major street plan 153-31 153.017 Adoption of flood damage prevention regulations 153-31 Permit Regulations 153.055 General permit requirements 153-32 153.056 Approach permit requirements 153-32 153.057 Conditional use permit requirements 153-33 153.058 Grading permit requirements 153-33 153.060 Manufactured home park requirements 153-34 153.061 Moving permit requirements 153-34 153.062 Inspection of factory-built homes 153-35 153.063 Structure parking permit requirements 153-35 153.064 Grounds for moving or parking permit denial 153-36 Zoning Regulations 153.095 Purpose 153-36 153.096 General regulations 153-36 153.097 Zoning districts and the zoning map 153-38 153.098 Rules for interpretation of zoning district boundaries 153-39 153.099 Conditional use permits 153-40 153.100 District regulations 153-41 (A) Agricultural District (AD3) 153-41 (B) Park Land District (PK) 153-44 (C) Public Land District (PUB) 153-46 (D) General Residential District I (Low Density) (GR-1) 153-48 (E) General Residential District II (Moderate Density) (GR-2) 153-53 (F) Mixed Use Residential (High Density) (GR-3) 153-59 153-1 CITY OF BOX ELDER TITLE 15 SECTION PAGE (G) -

Domestic and International Consequences How—And Why—The U.K

Russian corruption: Domestic and international consequences How—and why—the U.K. should bolster anti-corruption efforts in the Russian Federation By Julia Pettengill First published in 2013 by The Henry Jackson Society The Henry Jackson Society 8th Floor – Parker Tower, 43-49 Parker Street, London, WC2B 5PS Tel: 020 7340 4520 www.henryjacksonsociety.org © The Henry Jackson Society, 2013 All rights reserved The views expressed in this publication are those of the author and are not necessarily indicative of those of The Henry Jackson Society or its directors Designed by Genium, www.geniumcreative.com ISBN 978-1-909035-06-5 2 About The Henry Jackson Society The Henry Jackson Society: A cross-partisan, British think-tank. Our founders and supporters are united by a common interest in fostering a strong British, European and American commitment towards freedom, liberty, constitutional democracy, human rights, governmental and institutional reform and a robust foreign, security and defence policy and transatlantic alliance. The Henry Jackson Society is a company limited by guarantee registered in England and Wales under company number 07465741 and a charity registered in England and Wales under registered charity number 1140489. For more information about Henry Jackson Society activities, our research programme and public events please see www.henryjacksonsociety.org. 3 Russian corruption: Domestic and international consequences CONTENTS FOREWORD 5 ACKNOWLEDGEMENTS 6 EXECUTIVE SUMMARY 8 INTRODUCTION 11 CHAPTER 1 – CORRUPTION IN RUSSIA: RECENT HISTORY 13 Anti-Corruption activities in Russian civil society 17 The government’s anti-corruption drive: Potemkin politics or serious initiative? 18 FACT BOX: The Serdyukov Case 20 Corruption and human rights in Russia: Two case studies 22 Mikhail Khodorkovsky and the Yukos case: “The world’s biggest threat is corruption, not nuclear weapons” 22 Sergei Magnitsky: Silencing the whistle-blower 24 Sergei Magnitsky’s death: International impact 25 CHAPTER 2 – RUSSIAN CORRUPTION: A DOMESTIC AND INTERNATIONAL PROBLEM 28 The U.K. -

THE DUNEDIN ISSUE Issue 26 – 03Rd October 2011

THE DUNEDIN ISSUE Issue 26 – 03rd October 2011 VSM finally passes | OUSA election extravaganza The other side to Dunedin | How to deal with the ‘real world’ Dai Henwood | OUSA budget excitement More news that you can shake a stick at Critic Issue 26 – 1 Critic Issue 26 – 2 Critic – Te Arohi P.O. Box 1436, Dunedin (03) 479 5335 [email protected] www.critic.co.nz contents Editor: Julia Hollingsworth THE DUNEDIN ISSUE Designer: Issue 26 – 03rd October 2011 Andrew Jacombs News Editor: Gregor Whyte News Reporters: Aimee Gulliver, Editorial 5 Lozz Holding Sub Editor: Letters to the Editor 6 Lisa McGonigle Feature Writers: Notices 7 Charlotte Greenfield, Phoebe Harrop, Snippets 8 Siobhan Downes, Joe Stockman News 10 Ad Designer: Karl Mayhew OUSA Election Special 17 Elections are a tricky beast. We equip you with Feature Illustrator: candidates’ blurbs and presidential pundits to Tom Garden make the decision just a little easier. Music Editor: Sam Valentine Celebrate Hidden Dunedin 22 Phoebe Harrop talks to some well-known Film Editor: Dunedinophiles, and discovers Dunedin has Sarah Baillie more to it than goons and stubbies. Books Editor: Sarah Maessen Welcome to the Real World 26 Joe Stockman eases us into the post-graduation Performance Editor: real world of pay slips and boardrooms. Bronwyn Wallace Food Editor: Profile: Dai Henwood 30 Georgie Fenwicke interviews New Zealand Niki Lomax comedy royalty, Dai Henwood. Games Editor: Toby Hills Opinion 31 Art Editor: Hana Aoake Review 37 Food, Games, Theatre, Books, Film, Art, Music Poetry Editor: Tash Smillie State of the Nation 46 Comics Editor: Spencer Hall Summer Lovin 47 And a whole heap of lovely volunteers Poetry and Style 48 Advertising: Comics 49 Kate Kidson, Tim Couch, Dave Eley, OUSA Page 51 Logan Valentine For Ad sales contact: (03) 479 5361 [email protected] www.planetmedia.co.nz Critic Issue 26 – 3 ay With Wo Got a W rds? Critic wants you baby..