Contactless Mobile Payments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mobile Customer Engagement and the Rise of the App-Based Banking

MOBILE CUSTOMER ENGAGEMENT AND THE RISE OF THE APP-BASED BANKING LANDSCAPE APRIL 2019 | TATA COMMUNICATIONS © 2019 Tata Communications. All Rights Reserved. TATA COMMUNICATIONS and TATA are trademarks of Tata Sons Limited in certain countries. TRANSFORMATION: MOBILE MESSAGING EXCHANGE Contents A new golden age of mobile banking? ....................................................... 3 Creating the right service delivery channel ................................................ 4 What role will traditional SMS services have to play in a new banking landscape? ... 5 Finding a way forward ......................................................................... 6 Working with Tata Communications for Mobile Customer Engagement in the Banking Industry ................................................................................ 7 2 For more information, visit us at www.tatacommunications.com. © 2019 Tata Communications. All Rights Reserved. TATA COMMUNICATIONS Contact us Share and TATA are trademarks of Tata Sons Limited in certain countries. TRANSFORMATION: MOBILE MESSAGING EXCHANGE A NEW GOLDEN AGE OF MOBILE BANKING? The ubiquity of mobile phones has made them an ideal channel for mobile banking services. Research from Ovum indicates that retail bank investment into digital banking technology will achieve 5.2% CAGR (2018-2022) 1, It is to be assumed that a significant portion of this will target mobile banking applications and related services, and the growth rate is significantly higher than comparable investment in other IT areas, such as ATM, contact centre services or even fraud and security spending1. Emerging markets have proven particularly open to mobile banking services as the mobile infrastructures in these regions is often more advanced (and less expensive to deploy) than the fixed-line alternative. Traditionally SMS-based services have been the mainstay of mobile banking, but this has changed in developed markets with the advent of smartphones and the rise of the app economy. -

A Survey on Contactless Payment Methods for Smartphones

Thesis no: BCS-2016-05 A survey on contactless payment methods for smartphones David Andersson Faculty of Computing Blekinge Institute of Technology SE–371 79 Karlskrona, Sweden This thesis is submitted to the Faculty of Computing at Blekinge Institute of Technology in partial fulfillment of the requirements for the degree of BSC. The thesis is equivalent to 10 weeks of full time studies. Contact Information: Author(s): David Andersson E-mail: [email protected] University advisor: Adjunct Lecturer Francisco Lopez Luro Department of Creative Technologies Faculty of Computing Internet : www.bth.se Blekinge Institute of Technology Phone : +46 455 38 50 00 SE–371 79 Karlskrona, Sweden Fax : +46 455 38 50 57 Abstract Context. The use of smartphones has increased drastically in the last years. More and more areas of use are discovered each day. One of the new fields of use is to make contactless payments with the help of a smartphone. A contactless payment system for a smartphone is a solution that will allow the user to make a payment by placing the smartphone in near proximity of the payment terminal in order to make a payment instead of using a regular credit card or cash. Objectives. The aim of this thesis is to present the current state of the smartphone systems used to conduct contactless payments, how they are implemented, possible flaws, and suggested solutions to re- move the flaws. Methods. A literature study was conducted in order to find reli- able information regarding how the systems works. Since the field of contactless payments is still new, there are several knowledge gaps re- garding how parts of the systems works. -

A Tale of Regulation in the European Union and Japan: Does Characterizing the Business of Stored-Value Cards As a Financial Activity Impact Its Development?

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by UW Law Digital Commons (University of Washington) Washington International Law Journal Volume 18 Number 3 8-1-2009 A Tale of Regulation in the European Union and Japan: Does Characterizing the Business of Stored-Value Cards as a Financial Activity Impact Its Development? Jean J. Luyat Follow this and additional works at: https://digitalcommons.law.uw.edu/wilj Part of the Banking and Finance Law Commons, and the Comparative and Foreign Law Commons Recommended Citation Jean J. Luyat, Comment, A Tale of Regulation in the European Union and Japan: Does Characterizing the Business of Stored-Value Cards as a Financial Activity Impact Its Development?, 18 Pac. Rim L & Pol'y J. 525 (2009). Available at: https://digitalcommons.law.uw.edu/wilj/vol18/iss3/4 This Comment is brought to you for free and open access by the Law Reviews and Journals at UW Law Digital Commons. It has been accepted for inclusion in Washington International Law Journal by an authorized editor of UW Law Digital Commons. For more information, please contact [email protected]. Copyright © 2009 Pacific Rim Law & Policy Journal Association A TALE OF REGULATION IN THE EUROPEAN UNION AND JAPAN: DOES CHARACTERIZING THE BUSINESS OF STORED-VALUE CARDS AS A FINANCIAL ACTIVITY IMPACT ITS DEVELOPMENT? † Jean J. Luyat Abstract: The use of stored-value cards is growing rapidly in urban areas in Japan and gaining acceptance as a major means of payment. While institutional and cultural factors as well as business strategies go far in explaining the rapid growth of stored-value cards in Japan, regulation has also played an important role in enabling their use. -

Mobile Banking Authentication Secures Your App Security Platform While Eliminating the Need for Hardware Tokens Or One-Time Passwords

Account Entersekt Protection solutionsMobile 2015 Banking authentication The Entersekt Entersekt’s solution for mobile banking authentication secures your app security platform while eliminating the need for hardware tokens or one-time passwords. Our product, Transakt, lies at the center of all of our solutions. Transakt uses industry-standard digital certificates to deliver the strongest possible device identification. These can be combined with a PIN, password, or fingerprint scan to identify the user and enable easy yet secure access to your mobile banking app. Transakt also creates a secure communication channel between your financial institution and your customers’ mobile devices. This enables you to send real-time requests to your users to authenticate sensitive transactions. Their responses are digitally signed, supporting nonre- pudiation, then encrypted and returned. Because the Transakt channel is truly out of band, Transakt counters all phishing attacks, man-in-the- middle exploits, and other kinds of digital fraud. Your institution retains complete control over user registration, which is independent of mobile networks and SIM cards. If a user’s phone is stolen, the certificate is revoked, immediately rendering the application unusable. What makes Transakt deploys a unique X.509 digital certificate to each mobile device. This robustly Transakt unique? identifies the device and creates a secure, mutually authenticated connection between it and the Transakt Secure Gateway – a FIPS 140-2 Level 3 hardware appliance installed behind the bank’s firewall. Typical implementation Mobile device A security token is retrieved from the Transakt Secure Gateway via a completely out-of-band channel. This token is used to Mobile banking app App server authenticate transaction requests originat- Application request and token ing from the mobile banking app. -

Aeon Report Report 20172017 Creating a Future Where Communities Flourish Trees Grow And

Aeon Report Report 20172017 Creating a future where communities flourish trees grow and AEON Report 2017 1 Aeon Basic Principles Pursuing peace, respecting humanity, and contributing to local communities, always with the customer’s point of view as its core. Peace The Customer People Community The word (Aeon) has its origins in a Latin root meaning “eternity.” The customers’ beliefs and desires comprise the central core of our philosophy. At Aeon, our eternal mission as a corporate group is to benefit our customers, and our operations are thus customer-focused to the highest degree. “Peace” Aeon is a corporate group whose operations are dedicated to the pursuit of peace through prosperity. “People” Aeon is a corporate group that respects human dignity and values personal relationships. “Community” Aeon is a corporate group rooted in local community life and dedicated to making a continuing contribution to the community. On the basis of the Aeon Basic Principles, Aeon practices its “Customer-First” philosophy with its everlasting innovative spirit. Editorial Policy Aeon Co., Ltd. believes its business activities contribute to a from the aspects of the environment and society. In addition, sustainable society. To further deepen its stakeholders’ with regard to its seven priority issues, including the four understanding of its business activities, from the current society-related priority issues newly specified in a materiality fiscal year Aeon has decided to publish an Integrated Report assessment conducted during fiscal 2016, this section reports that incorporates the Aeon Environmental and Social Report. in detail on management approaches, progress toward key The first half of the Report introduces the orientation of performance indicators and individual activities. -

Internet Self Service Faqs

Internet Self Service FAQs General Questions .............................................................................................................................................. 2 What is Mobile Banking? 2 Is Mobile Banking secure? 3 Is my personal or financial information stored on my phone? 3 Are there fees to use Mobile Banking? 3 Which accounts can I access in Mobile Banking? 3 How current is the account and transaction information? 3 Can I add more than one mobile phone? 3 What if my phone number changes? 3 What if my phone is lost or stolen? 3 Which phones can I use for Mobile Banking? 4 Which mobile service carriers support Mobile Banking? 4 I have a prepaid plan. Can I use Mobile Banking? 4 How do I stop using Mobile Banking on my phone? 4 Registration Questions ..................................................................................................................................... 4 How do I get started with Mobile Banking? 4 Do I have to agree to the Terms and Conditions to use Mobile Banking? 4 Can I register multiple users to the same phone? 4 I received my activation code but never used it—what do I do now? 4 I haven’t received the activation code on my mobile phone. What should I do? 4 Alert Questions .................................................................................................................................................... 6 What are alerts? 6 What is the difference between the text messaging service and the alerts service? 6 How do I stop receiving alerts? 6 Text Messaging Service -

2014 Annual Report

For the year ended March 31, 2014 Annual Report 2014 FAITH IN THE POSSIBILITIES FAITH Annual Report 2014 East Japan Railway Company INTERCONNECTED Value Our Businesses AN OVERWHELMINGLY SOLID AND ADVANTAGEOUS RAILWAY NETWORK The railway business of the JR East Group covers the eastern half of PROPORTION OF TRANSPORT CARRIED BY DIFFERENT MEANS OF TRANSPORT IN Honshu island (Japan’s main island), which includes the Tokyo metropoli- ToKYO URBAN AREA tan area. We provide transportation services via our Shinkansen network, 23 4 25 2 13 34 which connects Tokyo with regional cities in five directions, as well as 1978 conventional lines in the Kanto area and other networks. Our networks 25 3 28 3 15 27 combine to cover 7,474.2 kilometers and serve 17 million people daily. 1988 We are the largest railway company in Japan and one of the largest in the world. 25 2 33 2 15 22 1998 The Tokyo metropolitan area, where we are based, has seen a dra- matic increase in railway convenience in recent years. Consequently the 30 3 29 2 14 22 share of railways in the transportation mix is rising even higher. In fiscal 2008 2015, JR East will spare no effort in preparing for the opening of the Hokuriku Shinkansen Line to Kanazawa and the Ueno–Tokyo Line. The 0 100 % Train Bus Car Motorcycle Bicycle Foot added convenience from the lines opening will then be leveraged to the • The 5th Tokyo urban area person trip survey, Tokyo urban area traffic plan meeting, Nov. 2009. hilt by JR East to maximize railway usage. -

Mobile Payments

Mobile Payments - A study of the emerging payments ecosystem and its inhabitants while building a business case. By: Cherian Abraham Principal Analyst – Mobile Commerce & Payments Practice / Co-Founder - DROP Labs Twitter @ http://twitter.com/cherian abraham LinkedIn @ http://www.linkedin.com/in/cherianabraham For more information on this study and associated research, contact me at EXECUTIVE SUMMARY: The advent of the ubiquitous smart phone has along with it brought dramatic shifts in customer behavior and payment modalities. Banks are finding themselves in an unenviable position of choosing to wait until a secure and safe standard emerges for "Digital", or take the plunge in to these murky payment waters. There is a battle waging for the customer mind-share and emerging revenue streams, between traditional and non-traditional players - who are ever more emboldened by advances in technology and disappearing barriers to entry. The objective of this study is to build a business case for banks evaluating the opportunities and challenges present in building out mobile payment solutions, including direct and indirect revenue generation. This study paints a roadmap of current mobile payment initiatives undertaken by Financial institutions, MNO's and technology upstarts, and to highlight the risks of building payment solutions which are not centered on the payment context. This study summarizes the challenges ahead for mobile payments, including a lack of interoperability, consumer apathy and a general lack of understanding of its merits. It is targeted at financial institutions that may be making first steps, by building out their own mobile wallet initiatives or partnering with others, and seeks clarity. -

Secured Edge Infrastructure for Contactless Payment System

Secured edge infrastructure for Contactless Payment System A case study on EV charging solution based on StarlingX Zu lijun, UnionPay Sun, Yih Leung, Intel DCG Wang Haitao, Intel IAGS/SSP Legal Notices and Disclaimers This document contains information on products, services and/or processes in development. All information provided here is subject to change without notice. Contact your Intel representative to obtain the latest forecast, schedule, specifications and roadmaps. No license (express or implied, by estoppel or otherwise) to any intellectual property rights is granted by this document. Intel disclaims all express and implied warranties, including without limitation, the implied warranties of merchantability, fitness for a particular purpose, and non-infringement, as well as any warranty arising from course of performance, course of dealing, or usage in trade. The products and services described may contain defects or errors known as errata which may cause deviations from published specifications. Current characterized errata are available on request. No product or component can be absolutely secure. Copies of documents which have an order number and are referenced in this document may be obtained by calling 1-800-548-4725 or by visiting www.intel.com/design/literature.htm. Intel technologies' features and benefits depend on system configuration and may require enabled hardware, software or service activation. Performance varies depending on system configuration. No product or component can be absolutely secure. Check with your system manufacturer or retailer or learn more at intel.com. Intel, the Intel logo, Pentium, Celeron, Atom, Core, Xeon, Movidius and others are trademarks of Intel Corporation in the U.S. -

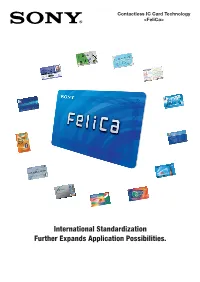

International Standardization Further Expands Application Possibilities

Contactless IC Card Technology <FeliCa> International Standardization Further Expands Application Possibilities. Single-Card, Multi-Application FeliCa Technology Now Established as International Communication Standard Typical Uses of FeliCa Technology Commuter Tickets ID Card FeliCa is Sony's contactless IC card technology that allows easy access to multiple services through a single In Japan, FeliCa is providing an ideal solution for a variety of AFC The FeliCa advantage of card, as well as exceptionally secure, high-speed processing. Building on the ISO/IEC approval of its (Automatic Fare Collection) systems, including JR East's "Suica iO" card multi-application communication format (ISO/IEC 18092), this technology will now find an even wider range of applications. that completely eliminates the need to buy tickets. In the central part of capability makes the country, a similar service using the "ICOCA" card has been it possible to With no need to carry many cards, FeliCa continues to add convenience and efficiency to daily life. introduced by JR West, and the "PiTaPa" card that can be used for 42 apply a single transportation systems is being planned by SURUTTO KANSAI card to a variety Association. FeliCa is also used for the commuter bus service in of requirements, Nagasaki under the name "Nagasaki such as employee Smart Card." identification, access control ID Card Sample Access Control and recording of clock-in/out times. When cash card functions are added, the same card can also be used to make payment at in-house shops and cafeterias. Internet Shopping Suica Pass and Suica iO Card Ticket Gate, JR East Simply by putting the card on a FeliCa reader/writer connected to a PC, the "eLIO" card of Sony Finance International lets you identify yourself instantly and shop safely on the web. -

Payment Solutions Built for Mobility

Payment Solutions Built for Mobility shift4.com | 800.265.5795 | [email protected] © 2020 Shift4 Payments, LLC. All rights reserved. Picking the Right Mobile Payment Solution for Your Business No matter what role you want mobility to play in your payment processing, you have choices from Shift4 Payments. We have put together a variety of solutions that support the latest mobile payment terminals and cover the most comprehensive set of features and implementation options. There are several supported options for ISVs and businesses that want to incorporate mobile payment processing into their offering. Below are several mobile payment solutions for your business: PAX Sleek and Modern. PAX’s line of mobile payment tablets — including their handheld A920 and A930 models — manages to pack an impressive amount of tech into its designs, including dual camera, 1D/2D scanner, and a built-in printer. These devices connect via 4G, Wi-Fi, or Bluetooth, and supports mobile acceptance of MSR, EMV, and NFC payments. ID TECH Versatile and Compact. ID TECH’s EMV Common Kernel family of devices includes OEM payment modules that are built into a variety of mobile hardware options, allowing businesses to expand their mobile payment capabilities to securely accept MSR, EMV, and NFC payments. Innowi Powerful and Portable. The ChecOut M from Innowi delivers an all-in-one mobile point of sale (mPOS) that fits in your pocket. This device supports Android and Windows OS and 4G, Wi-Fi, and Bluetooth connectivity options. Merchants of all types can accept MSR, EMV (w/chip & PIN), and NFC payments. Ingenico Advanced and Reliable. -

Jasmin 2010 Paper V.2.3

モバイル決済サービス:総合的なリサーチモデルへ向けて Mobile Payment Industry: Toward a Comprehensive Research Model Donald L. AMOROSO Rémy MAGNIER-WATANABE Kennesaw State University, GA, USA University of Tsukuba, Tokyo, Japan 要約 モバイル・コマースは携帯電話技術 (モバイル・バンキング、モバイル・ショッピング、モバイル・マーケ ティング等の機能を含む )を使用したあらゆるアプリケーションに適用されており、その結果として非接触 型の決済システムが生じている。日本はかねてから、これらの技術を発展させ自らの文化に適合させてきた が、いまだ総合的なフレームワークは明らかにされていない。私たちはモバイル決済についての 24の実証 的研究報告を基にして、 11の構成要素から成る統合的モデルを提示する。このフレームワークを使って、 日本における Suica/Pasmoのモバイル決済システムの実情を発表する。 Abstract Mobile commerce refers to all applications using mobile technology that involve functions such as mobile banking, mobile shopping, and mobile marketing, resulting in a contactless payment system. Japan has been developing and integrating such technology into their culture for some time, yet no single comprehensive framework has emerged. Based upon the review of 24 empirical studies on mobile payments, we propose an integrated model with eleven constructs for mobile payment adoption. Using this proposed framework, we present the case of the Suica/Pasmo mobile payment system in Japan. mobile phone mobile wallet application, and then pay 1. Introduction their bills at any Sevel Eleven convenience store in Japan has some of the most advanced and diverse Japan by holding their over the card readers set up at mobile applications in the world (ITIF, 2009). the counter (Seven-Eleven Japan, 2009). According to a survey conducted by the Bank of Japan Yasuoka (2009) reports that the decrease by in April 2010, when asked about the meaning of 0.04% in the circulation of money announced by the electronic payments, more people think of payment Bank of Japan in 2006, the first time since 1971, can be systems using value-stored IC cards or mobile phones attributed in part to the increase usage of electronic that they wave in front of dedicated card readers (Bank money.