Payment Solutions Built for Mobility

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Survey on Contactless Payment Methods for Smartphones

Thesis no: BCS-2016-05 A survey on contactless payment methods for smartphones David Andersson Faculty of Computing Blekinge Institute of Technology SE–371 79 Karlskrona, Sweden This thesis is submitted to the Faculty of Computing at Blekinge Institute of Technology in partial fulfillment of the requirements for the degree of BSC. The thesis is equivalent to 10 weeks of full time studies. Contact Information: Author(s): David Andersson E-mail: [email protected] University advisor: Adjunct Lecturer Francisco Lopez Luro Department of Creative Technologies Faculty of Computing Internet : www.bth.se Blekinge Institute of Technology Phone : +46 455 38 50 00 SE–371 79 Karlskrona, Sweden Fax : +46 455 38 50 57 Abstract Context. The use of smartphones has increased drastically in the last years. More and more areas of use are discovered each day. One of the new fields of use is to make contactless payments with the help of a smartphone. A contactless payment system for a smartphone is a solution that will allow the user to make a payment by placing the smartphone in near proximity of the payment terminal in order to make a payment instead of using a regular credit card or cash. Objectives. The aim of this thesis is to present the current state of the smartphone systems used to conduct contactless payments, how they are implemented, possible flaws, and suggested solutions to re- move the flaws. Methods. A literature study was conducted in order to find reli- able information regarding how the systems works. Since the field of contactless payments is still new, there are several knowledge gaps re- garding how parts of the systems works. -

VISA Europe AIS Certified Service Providers

Visa Europe Account Information Security (AIS) List of PCI DSS validated service providers Effective 08 September 2010 __________________________________________________ The companies listed below successfully completed an assessment based on the Payment Card Industry Data Security Standard (PCI DSS). 1 The validation date is when the service provider was last validated. PCI DSS assessments are valid for one year, with the next annual report due one year from the validation date. Reports that are 1 to 60 days late are noted in orange, and reports that are 61 to 90 days late are noted in red. Entities with reports over 90 days past due are removed from the list. It is the member’s responsibility to use compliant service providers and to follow up with service providers if there are any questions about their validation status. 2 Service provider Services covered by Validation date Assessor Website review 1&1 Internet AG Internet payment 31 May 2010 SRC Security www.ipayment.de processing Research & Consulting Payment gateway GmbH Payment processing a1m GmbH Payment gateway 31 October 2009 USD.de AG www.a1m.biz Internet payment processing Payment processing A6IT Limited Payment gateway 30 April 2010 Kyte Consultants Ltd www.A6IT.com Abtran Payment processing 31 July 2010 Rits Information www.abtran.com Security Accelya UK Clearing and Settlement 31 December 2009 Trustwave www.accelya.com ADB-UTVECKLING AB Payment gateway 30 November 2009 Europoint Networking WWW.ADBUTVECKLING.SE AB Adeptra Fraud Prevention 30 November 2009 Protiviti Inc. www.adeptra.com Debt Collection Card Activation Adflex Payment Processing 31 March 2010 Evolution LTD www.adflex.co.uk Payment Gateway/Switch Clearing & settlement 1 A PCI DSS assessment only represents a ‘snapshot’ of the security in place at the time of the review, and does not guarantee that those security controls remain in place after the review is complete. -

In This Issue

Welcome to the January edition of ACT News. This complimentary service is provided by ACT Canada; "building an informed marketplace". Please feel free to forward this to your colleagues. In This Issue 1. Editorial - payment innovation: where is the bar? 2. Desjardins and MasterCard bring new payment options to Canadians 3. Nanopay acquires MintChip from the Royal Canadian Mint 4. Canadian payments market transition: a study by the Canadian Payments Association 5. Suretap and EnStream take big steps forward with Societe de Transport de Montreal in mobile ticketing 6. New credit union association launches in Canada: Canadian Credit Union Association 7. Global study shows increasing security risks to payment data and lack of confidence in securing mobile payment methods 8. Samsung Pay to move online in 2016 9. Elavon delivers Apple Pay for Canadian businesses 10. Beware alleged experts’ scare tactics on mobile payments 11. Ingenico Group accelerates EMV and NFC acceptance in unattended environments with new partner program 12. Paynet delivers a safer payment service with Fraudxpert to its customers 13. VeriFone expands services offering for large retailers in the US and Canada with agreement to acquire AJB Software 14. VISA checkout added to Starbucks, Walmart, Walgreens 15. Gemalto is world's first vendor to receive complete MasterCard approval for cloud based payments 16. ICC Solutions offers a time-saving method and free guide for training staff to process card payments correctly ready for the new year! 17. Walmart adds masterpass as online payment method 18. Equinox and ACCEO partner to deliver integrated retail payment solution 19. UL receives UnionPay qualification for Chinese domestic market 20. -

Mobile Payments

Mobile Payments - A study of the emerging payments ecosystem and its inhabitants while building a business case. By: Cherian Abraham Principal Analyst – Mobile Commerce & Payments Practice / Co-Founder - DROP Labs Twitter @ http://twitter.com/cherian abraham LinkedIn @ http://www.linkedin.com/in/cherianabraham For more information on this study and associated research, contact me at EXECUTIVE SUMMARY: The advent of the ubiquitous smart phone has along with it brought dramatic shifts in customer behavior and payment modalities. Banks are finding themselves in an unenviable position of choosing to wait until a secure and safe standard emerges for "Digital", or take the plunge in to these murky payment waters. There is a battle waging for the customer mind-share and emerging revenue streams, between traditional and non-traditional players - who are ever more emboldened by advances in technology and disappearing barriers to entry. The objective of this study is to build a business case for banks evaluating the opportunities and challenges present in building out mobile payment solutions, including direct and indirect revenue generation. This study paints a roadmap of current mobile payment initiatives undertaken by Financial institutions, MNO's and technology upstarts, and to highlight the risks of building payment solutions which are not centered on the payment context. This study summarizes the challenges ahead for mobile payments, including a lack of interoperability, consumer apathy and a general lack of understanding of its merits. It is targeted at financial institutions that may be making first steps, by building out their own mobile wallet initiatives or partnering with others, and seeks clarity. -

Secured Edge Infrastructure for Contactless Payment System

Secured edge infrastructure for Contactless Payment System A case study on EV charging solution based on StarlingX Zu lijun, UnionPay Sun, Yih Leung, Intel DCG Wang Haitao, Intel IAGS/SSP Legal Notices and Disclaimers This document contains information on products, services and/or processes in development. All information provided here is subject to change without notice. Contact your Intel representative to obtain the latest forecast, schedule, specifications and roadmaps. No license (express or implied, by estoppel or otherwise) to any intellectual property rights is granted by this document. Intel disclaims all express and implied warranties, including without limitation, the implied warranties of merchantability, fitness for a particular purpose, and non-infringement, as well as any warranty arising from course of performance, course of dealing, or usage in trade. The products and services described may contain defects or errors known as errata which may cause deviations from published specifications. Current characterized errata are available on request. No product or component can be absolutely secure. Copies of documents which have an order number and are referenced in this document may be obtained by calling 1-800-548-4725 or by visiting www.intel.com/design/literature.htm. Intel technologies' features and benefits depend on system configuration and may require enabled hardware, software or service activation. Performance varies depending on system configuration. No product or component can be absolutely secure. Check with your system manufacturer or retailer or learn more at intel.com. Intel, the Intel logo, Pentium, Celeron, Atom, Core, Xeon, Movidius and others are trademarks of Intel Corporation in the U.S. -

Frequently Asked Questions Converge Mobile – U.S

Frequently Asked Questions Converge Mobile – U.S. Features and Functionality Which mobile wallets does Converge Mobile support? Converge Mobile, using the NFC contactless capabilities of What is Converge Mobile? the Ingenico iCMP can accept: Converge Mobile is the mobile payment solution that offers • Apple Pay® you a way to accept payments securely while on-the-go. • Android Pay™ Simply download the Converge Mobile app from the Apple ® Store or the Google Play store. Purchase a supported card • Samsung Pay reader device and you’re ready to go! Converge Mobile can • PayPal® (when available) email receipts or it can be paired with one of two portable Does Converge Mobile print receipts? printers. Yes! The Converge Mobile app supports the Star SM‐T300i Which types of mobile devices are compatible with or Star SM‐T220i. Receipts can also be emailed to the Converge Mobile? consumer and a record of the transaction is accessible within Converge Mobile is supported on Android 5.0 (and higher) Converge Mobile and online at www.convergepay.com. and iOS 8.0 (and higher) devices including smartphones, Can my customers receive text receipts? tablets and iPads. Converge Mobile may work on lower Not at this time. We are working on adding this functionality versions but this is not supported by Elavon. in the future. Receipts can be delivered to your customer Can Converge Mobile run on a Windows or Blackberry via email. phone? Can a signature be captured in the app? Not at this time. Yes. A signature is accepted using the mobile app. The What card brands does Converge Mobile accept? signature is stored within Converge so if your customer Converge Mobile accepts Mastercard, Visa, Discover, and chooses to receive his/her receipt via email, a picture of the American Express. -

20Th Aug 2020 Sr. No. Acquirer Bank Name Technology Switch

NPCI/2020-21/RuPay/029 List of Live RuPay Contactless L3 Certified PoS terminals 20th Aug 2020 L3 Certified Terminal Models List RuPay Contactless L3 Certified PoS Terminal List on RuPay Terminal Specification V2.0.0 Technology Terminal PoS Date of Sr. Acquirer L2 Product L3 Certified Scope - RuPay- Switch /Application Terminal application No. Bank Name Approval No. Version qsparc/JCB/UPI Processor Maker / Provider Model Certified qSPARC.V2_ING22 Worldline PAY RuPay - Ingenico IWL 220 12th Jul, 2019 012019_0D55 Version 7.67 qSPARC/JCB/UPI Bank of 1 Worldline qSPARC(2)- Baroda Worldline PAY RuPay - Verifone Vx675 VER23042018:2018 17th Jan, 2020 Version 3.80 qSPARC/JCB/UPI 01 Punjab qSPARC.V2_ING22 Worldline PAY RuPay - 2 National Worldline Ingenico IWL 220 18th Jul, 2019 012019_0D55 Version 7.80 qSPARC/JCB/UPI Bank qSPARC.V2_ING22 CRDB Application RuPay - Ingenico IWL 220 14th Sep, 2019 012019_0D55 version V3.12 qSPARC/JCB/UPI State Bank of 3 Hitachi India PAX Computer qSPARC.V2_PAX18 Plutus V10.1.1 RuPay - Technology PAX A920 07th Feb, 2020 062018_8807 SBI qSPARC/JCB/UPI shenzhen co ltd. City Union qSPARC.V2_ING22 Worldline PAY RuPay - 4 Worldline Ingenico IWL 220 03rd Dec, 2019 Bank 012019_0D55 Version 7.80 qSPARC/JCB/UPI qSPARC.V2_ING22 Worldline PAY RuPay - Ingenico IWL 220 30th Oct 2019 012019_0D55 Version 7.80 qSPARC/JCB/UPI Worldline qSPARC(2)- Worldline PAY RuPay - Verifone Vx675 VER23042018:2018 05th April, 2020 Version 3.81 qSPARC/JCB/UPI 5 Axis Bank 01 Shenzhen Xinguodu qSPARC.V2_NEX20 g20inaxi Version RuPay - Hitachi NexGo G2 28th April, 2020 Technology Co. 052019_2A37 V1.0.2 qSPARC/JCB/UPI Ltd. -

Contactless Payments Technology

22456 sm VISA A4:22456 VISA sm 6/2/08 11:28 Page A Contactless payments technology Catching the new wave Audit.Tax.Consulting.Corporate Finance. 22456 sm VISA A4:22456 VISA sm 6/2/08 11:28 Page B Contents Introduction 1 1. The size of the UK cash segment of the payments market 3 2. The benefits of contactless payments 6 3. The challenges ahead: economics, acceptance, communication 9 Summary 11 Contacts 12 Cover image is a property of Visa Europe. 22456 sm VISA A4:22456 VISA sm 6/2/08 11:28 Page 1 Contactless payments technology Catching the new wave Introduction Despite all the technological developments and new payment Contactless payment cards and readers were launched by a number methods introduced over the last 30 years, cash is still the preferred of banks in London in September 2007, with a view to then rolling payment instrument for everyday, low-value purchases. However, them out nationwide as quickly as possible. To assist in from society’s point of view, it is also amongst the most expensive understanding the overall market opportunity for this technology, payment instruments to operate. A 2003 study authorised by the and to raise awareness amongst all stakeholders, Visa commissioned European Payments Council estimated the total cost of cash Deloitte to undertake a study of the UK’s low-value payments handling to society at €50bn per annum for the EUi . This is market during May and June 2007. equivalent to approximately 0.5% of aggregate EU GDPii , or €108 per annum for every citizeniii . -

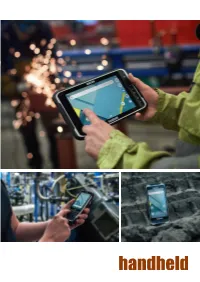

Download Apps from the Play Store and Use Touchscreen Display That’S Sunlight-Readable Maps

NEW! NAUTIZ X41 NAUTIZ X2 NAUTIZ X6 SECOND TO NONE RUGGED MOBILITY OPTIMIZED ULTRA-RUGGED ANDROID PHABLET The Nautiz X41 is a rugged scanning The Nautiz X2 is a true all-in-one: a computer, The Nautiz X6® ultra-rugged Android phablet powerhouse with a physical 23-key keypad. a scanner, a camera and an Android phone. brings the best of a rugged phone and Running Android, it comes with WLAN, BT, It runs on a powerful processor and has a a conventional tablet in a single device. 4G/LTE and NFC, an 8-megapixel camera, high-quality, high-speed 1D/2D scanner with It has the large-screen functionality of a generous storage and integrated GPS. GMS three dedicated scan buttons. tablet, with the work-anywhere ruggedness certification means full access to all Google Google GMS certified allows you to of a handheld. Enjoy an expansive 6-inch apps, including the Play store and Google download apps from the Play Store and use touchscreen display that’s sunlight-readable Maps. Google Maps. and protected by super-hardened Gorilla Glass. An integrated high-speed 1D barcode The integrated 4G capabilities for voice and scanner or 2D imager with high density data transfer, paired with the long range This winning combination is fully dust- and optics offers fast order picking, error-free barcode scanner provides a unique solution waterproof, yet lightweight and slim, making work orders and smooth shipping and for outdoor use. it a perfect ultra-rugged phablet to bring receiving. anywhere — whether you are in utilities, foodservice, field service, GIS, warehousing, or logistics. -

Add Your Debit Card to Your Smartphone for Contactless Payment

Our lobbies our now open and we request you practice all the social distancing protocols set out by the local Health Departments, State of Kentucky and Center for Disease Control (CDC). Our Grayson Branch lobby remains closed but customers can request an appointment for entry. We encourage everyone to use our digital services for self-service banking and around the clock account access. Please visit our website at www.fnbgrayson.com for online enrollment. If you need assistance in signing up for any of our digital services, like online & mobile banking, our employees will be happy to walk you thru the process. We are here to serve you! We appreciate you and your patience during this critical time. First National Bank will continue to monitor this situation and update you as things progress. Stay Connected! Online & Mobile Banking with Remote Deposit Capture provides 24/7 access to your personal and business accounts. You can check balances, view transactions, make payments, deposit checks, make transfers, and find an ATM and more. Go to www.fnbgrayson.com to apply then download our app from the Apple App Store, Google Play, and Amazon Apps or for non-smart phone users go to www.fnbgrayson.mobi Mobile Wallet- Add your debit card to your smartphone for contactless payment CARDVALET allows you to manage your First National Bank Debit card anywhere and anytime. It can be downloaded from any of the app stores for FREE. CardValet allows you to turn your card on/off, set up instant alerts each time the card is used, restrict card activity, and more. -

Than a Year Has Passed Since Three Giant Mergers Promised to Change the Payments World

More than a year has passed since three giant mergers promised to change the payments world. Change has come, but not where many expected to see it. Volume Eighteen, Number Two • DigitalTransactions.net • February 2021 ALSO IN THIS ISSUE: Walmart’s New Fintech An Upshift for Parking Apps Ransomware Runs Rampant A Checklist for Bill Pay DigitalTransactions.net brings you the most important payments market news, in one place, updated the moment it happens Breaking news from the payments market, posted daily Concise, clean interface is easy to navigate Calendar of industry events Complete current and past issues of Digital Transactions magazine Detailed listings of payments market suppliers 13 years of payments news and analysis FEBRUARY 2021 • VOLUME 18, NUMBER 2 The Megamergers’ Subtle Impact 22 More than a year has passed since three giant mergers promised to change the payments world. Change has come, but not where many expected to see it. THE GIMLET EYE The Digital Dollar Revisited 4 TRENDS & TACTICS 6 Walmart Launches The Megamerger Green Dot’s PayPal vs. CFPB: It Trump’s Parting Shot: a Fintech That Wasn’t Latest Bid for the Ain’t Over Til It’s Over A Puzzling Ban on Unlike most startups, A potential FIS-Global Unbanked The U.S. District Court China-Based Apps this one will be a Payments deal blew up, Go2Bank is the latest handed PayPal a The departing president formidable player from but it showed merger initiative from one of big win, but it’s far barred Alipay and the get-go. fever hasn’t subsided. -

Smart Device, Smart

Smart device, smart pay Taking mobile payments from coffee shops to retail stores Deloitte’s mPayments practice brings together capabilities from across Deloitte’s businesses including its Technology, Media, and Telecommunications practice, its Financial Services practice, its Retail practice, and a host of other business functions in its strategy and technology groups. Deloitte’s work in the mPayments space includes strategy, design, and implementation of a wide variety of mPayment capabilities. The Payments Center of Excellence can draw on the support of over 7,700 practitioners with specific industry and functional capabilities. About the authors Dr. Preeta M. Banerjee is a senior manager in Deloitte Services LP and heads cross-sector technol- ogy, media, and telecommunications research. Craig Wigginton, Deloitte & Touche LLP, leads the organization’s telecommunications industry practice in the United States, globally, and for the Americas. Contents Mobile payments: The wave of the future? | 1 The mPay-at-POS ecosystem | 3 Drivers and barriers to adoption | 5 Tipping the scales toward mPay-at-POS solutions | 11 Shaping the future payments landscape | 16 Endnotes | 18 Contacts | 22 Acknowledgements | 22 Taking mobile payments from coffee shops to retail stores Mobile payments: The wave of the future? Howard is a tech-savvy professional who uses his smartphone at least 50 times a day. He starts his day using his favorite coffee shop chain’s mobile payment app, which allows him to pre-order his favorite latte, earn and redeem loyalty points, and self- checkout by paying at the counter with his phone. He wishes he had a similar app for his favorite retail store to facilitate larger purchases that take more effort and time.