ESSAYS in PUBLIC ECONOMICS Divya Singh Submitted in Partial

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Meet 22 of the Region's Top Brand Builders & Advisers at Malaysia's

14th 2017 The 14th Superlative Annual Brand Marketing Conference 15 & 16 May, 2017 www.brandfest.com.my Meet 22 of the Region’s Top Brand Builders & Advisers at Malaysia’s Most Informative Annual Brand Marketing Conference 100% HRDF Claimable! Special Group Rate: RM1320.00 nett per pax (3 delegates and more) www.brandfest.com.my The 14th Brandfest 2017: Malaysia’s Not-to-be-Missed Annual Conference on Contemporary Brand Marketing 15 May 2017, Monday (DAY 1) 7.45 Registration and Morning Coffee this key transformation in brand marketing in Southeast Asia and in particular, Malaysia. 9.00 Welcome Remarks by the Chair: • How brands can reach to relevant and targeted audiences Andreas Vogiatzakis, CEO, Havas Media Group Malaysia • How to maximize your Marketing ROI online • What are some ways to become engaging and more relevant to KEYNOTE ADDRESS your customers online REBRANDING BEST PRACTICES & FAILURES • Valuable lessons for Brand Builders. 9.15 The Experiences of Brands that Have Evolved & Andrew is currently the Chief Marketing Officer of Lazada Malaysia, Malaysia’s Stepped Up to the Times with Strategic Rebranding #1 e-commerce marketplace - where he leads their digital marketing, brand building and conversion optimization efforts. Prior to Lazada, Andrew consulted for the Boston Consulting Group, the World Bank and Endeavor Zayn Khan, Chief Executive Officer (SEA) Global - helping companies in various stages of growth to scale up their Dragon Rouge, Singapore operations and enter new markets. Andrew is obsessed about making data- Brand Custodians will in time pass by a red flag that clearly states “Rebrand!” driven decisions, nailing product-market fit and building border-less, high History has shown that some act fast; and others after customers have performance teams. -

India Legal Forum Presents Webinar Series on "Intellectual Property Rights: an Overview and Its Implications in the Pharmaceutical Industry.”

ALL INDIA LEGAL FORUM ALL INDIA LEGAL FORUM PRESENTS WEBINAR SERIES ON "INTELLECTUAL PROPERTY RIGHTS: AN OVERVIEW AND ITS IMPLICATIONS IN THE PHARMACEUTICAL INDUSTRY.” Event collaborators ABOUT THE ORGANISER: All India Legal Forum, the brainchild of several legal luminaries and eminent personalities across the country and the globe, is a dream online platform which aims at proliferating legal Knowledge and providing an ingenious understanding and cognizance of various fields of law, simultaneously aiming to generate diverse social, political, legal and constitutional discourse on law-related topics, making sure that legal knowledge penetrates to every nook and corner of the ever-growing legal fraternity. All India Legal Forum also houses a blog that addresses contemporary issues in any field of law. We at All India Legal Forum don’t just publish blogs, we also guide the authors when their research paper is not up to the mark. HONORARY BOARD: All India Legal Forum is pleased to have support of diverse group of eminent personalities, comprising: Justice Arjan Kumar Sikri, Justice Mukundakam Sharma, Justice Bellur Srikrishna, Justice S.L. Bhayana, Justice Amarnath Jindal, Dr. Vinod Surana, CEO and Partner, Surana and Surana International Attorneys, Mr. Ajit Prakash Shah, Former Chairman, 20th Law Commission of India, Mr. Rishabh Gupta, Partner, Shardul Amarchand and Mangal Das, Mr. M S Bharath, Senior Partner, Anand and Anand Associates, Mr. Safir Anand, Senior Partner, Anand and Anand Associates, Mr. JLN Murthy and many more. ABOUT THE WEBINAR SERIES: All India Legal Forum after conducting a successful Webinar Tri-Series on the Cyber Laws now has come up with another First National Mega Webinar Series on Intellectual Property Rights. -

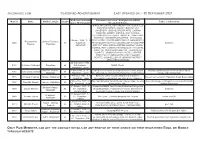

Jogsanjog.Com Classified Adveritsement Last Updated on :- 30 September 2021

JOGSANJOG.COM CLASSIFIED ADVERITSEMENT LAST UPDATED ON :- 30 SEPTEMBER 2021 DOB, time and birth Education Profession / Salary/Income PM/PA Matri id Name Nanihal , Origin Height Father 's information place 'M' if manglik /Occupation Details M.PHIL IN CLINICAL PSYCHOLOGY (RCI LICENCED) MASTERS IN PSYCHOLOGY (BANASTHALI UNIVERSITY ) BACHELORS OF ARTS ( SOPHIA COLLEGE, AJMER) , CONSULTANT CLINICAL PSYCHOLOGIST AT GOYAL HOSPITAL, MANIDHARI HOSPITAL, VASUNDHRA HOSPITAL, VRINDAVAN 5 October 1994 , 3 : 32 PSYCHIATRIC CENTRE DIRECTOR AT AMELIORATE ( Priyadarshini Udawat (Rathore) , 8240 63 , Rajasthan , PSYCHOLOGY CENTRE) COUNSELLOR AT JODHPUR Business Rajawat Rajasthan JODHPUR DISTRICT ARMY ORGANISATION MONTHLY 90,000, CONSULTANT CLINICAL PSYCHOLOGIST AT GOYAL HOSPITAL, MANIDHARI HOSPITAL, VASUNDHRA HOSPITAL, VRINDAVAN PSYCHIATRIC CENTRE DIRECTOR AT AMELIORATE ( PSYCHOLOGY CENTRE) COUNSELLOR AT JODHPUR DISTRICT ARMY ORGANISATION 20 September 1990 , 8123 Dr Kusum Nathawat Rajasthan 66 Not Available , MBBS, Doctor Rajasthan , Jaipur Rathore- mertiya , 7 May 1996 , 2 : 45 , DVM (doctor of veterinary medicine) from CVAS, bikane, Assistant administrative officer at govt.medical 8173 Yashmita Shekhawat 64 Rajasthan Rajasthan , Jaipur Inte, ship student, Pursuing internship from CVAS, bikaner college and hospital,sikar 1 February 1991 , 5 : 0 Bachelor of Homeopathy Medicine and Surgery, 7515 Dr Neha Chauhan Tanwar , Rajasthan 64 Government servant in Rajasthan Khadi Board Jaipur , Rajasthan , Jaipur Successfully running Her own clinic at our residence -

Against PDF for Women Scheme for the Year 2012-13 & 2013-14

A list of shortlisted candidates (1101) against PDF for women scheme for the year 2012-13 & 2013-14 is being uploaded on the UGC website. Shortlisted candidates are requested to keep themselves ready to reach UGC office as per schedule of dates fixed (Subject-wise) during the period from 18.03.2014 to 28.03.2014. All candidates may also carry their CVC/Biodata a copy of their proposal alongwith record of their publications/books. Presentation can also be done , if required & necessary. Schedule will follow in coming one or two days. List of Shortlisted Candidates under Post Doctroal Fellowship for Women (2012-13 & 2013-14) S.No. Candidate ID Name DOB Place of Research Subject 1 PDFWM-2013-14-OB-TAM- D.MURUGANANTHI 5/23/1982 Tamil Nadu Agricultural university Agriculture 21816 2 PDFWM-2012-13-OB-TAM- ANBUKKARASI K 5/25/1981 TamilNadu Agricultural University Agriculture 20045 3 PDFWM-2013-14-SC-UTT- VANDANA KUMARI 09-12-1981 Dr Bhimrao Ambedkar University Agriculture 17466 Agra 4 PDFWM-2012-13-GE-GUJ- POONAM RAJWANSHI 12/14/1968 University Agriculture 18265 5 PDFWM-2013-14-GE-WES- ADITI CHATTOPADHYAY 2/25/1984 Bidhan Chandra Krishi Agriculture 19117 Viswavidyalaya 6 PDFWM-2013-14-GE-UTT- ARPITA SHARMA 3/27/1985 G.B.P.U.A&T. PANTNAGAR, Agriculture 13707 UTTARAKHAND-263145 7 PDFWM-2013-14-GE-ASS- PUSPA BHUYAN 3/1/1973 Gauhati University Agriculture 21628 8 PDFWM-2013-14-GE-JAM- AMARDEEP KOUR 4/2/1980 Punjab Agricultural University, Agriculture 17049 Ludhiana 9 PDFWM-2012-13-GE-WES- KANTA BOKARIA 2/8/1964 INDIAN STATISTICAL Agriculture 12396 -

Dr Pathy Book.Pdf

dinanath Published by Third Eye Communications A unit of Ketaki Enterprises Pvt. Ltd. N-4/252, IRC Village, Bhubaneswar Odisha. India 751015 E [email protected] With Support from IPCA ILa Panda Centre for Arts Bhubaneswar Dr. Dinanath Pathy left this material and world doing what he loved most; working for the cause of art and for Print-Tech Offset Pvt. Ltd. what he believed to be right. He left behind a vast expanse of memories and Bhubaneswar experiences which can never be filled in. In this publication we have earnestly tried Concept, Layout and Design to create the memories of the legendary Jyotiranjan Swain painter, writer and art philosopher Satyabhusan Hota through a collection of pictures. There are many more images and memories Photographs which could not be included due to limitations of time and immediate Ramahari Jena, A. Prathap, PC Dhir, availability of materials. We are looking Jyotiranjan Swain, Subrat Das, Sangram forward to touching other aspects of his Jena, Soubhagya Pathy, Abtin Javid, life in our future publications. IPCA, Angarag and Sutra Foundation Dr. Dinanath Pathy 1942-2016 Painter, Writer and Art Historian A distinguished practicing painter and pioneer of the Modern and Contemporary Art Movement of Odisha, Dr. Dinanath Pathy was brought up in a family of artists and poets in the traditional town of Digapahandi, Ganjam in Odisha. In education and training, he combined both traditional Guru-Sisya Parampara as well as the modern university system. He studied at Khallikote, Bhubaneswar, Santiniketan and Zurich. He wrote two dissertations: History of Orissan Painting, and Art and Regional Traditions. -

Diplomatic and Consular List

DIPLOMATIC AND CONSULAR LIST September 2019 DEPARTMENT OF PROTOCOL MINISTRY OF FOREIGN AFFAIRS BANGKOK It is requested that amendment be reported without delay to the Protocol Division, Ministry of Foreign Affairs. This List is up-to-date at the time of printing, but there are inevitably frequent changes and amendments. CONTENTS Order of Precedence of Heads of Missions ............................................................................... 1 - 7 Diplomatic Missions ............................................................................................................. 8 - 232 Consular Representatives .................................................................................................. 233 - 250 Consular Representatives (Honorary) ............................................................................... 251 - 364 United Nations Organizations ........................................................................................... 365 - 388 International Organizations ............................................................................................... 389 - 403 Public Holidays for 2019 .................................................................................................. 404 - 405 MINISTRY OF FOREIGN AFFAIRS BANGKOK Order of Precedence of Heads of Missions ORDER OF PRECEDENCE Ambassadors Extraordinary and Plenipotentiary * Belize H.E. Mr. David Allan Kirkwood Gibson…………………………………………... 12.02.2004 Order of Malta H.E. Mr. Michael Douglas Mann…………………………………………………... 29.09.2004 * Dominican -

Leadership with Integrity C

8 EDUCATION ETHICS LEADERSHIP WITH INTEGRITY (EDS.) GALGALO, S. KOBIA C. STÜCKELBERGER, J. HIGHER EDUCATION FROM VOCATION TO FUNDING «This is a person with Integrity.” It summarizes the values and virtues such as honesty, credibility, justice and respect. Persons with integrity are needed on all levels, from parents to heads of states, from students to Vice-chancellors, from cleaning to accounting, from student elections to national elections. The book encourages in three parts for integrity in leadership, vocation in the professional life and integrity in elections. The book is the fruit of the partnership between Globethics.net and the Ecumenical St. Paul’s University SPU in Kenya, ranked by UniRank as the best private university in Kenya. Most of the authors are from SPU. CHRISTOPH STÜCKELBERGER Founder and President of LEADERSHIP WITH INTEGRITY Globethics.net, Professor emeritus of (theological) Ethics at Basel University and visiting professor in Nigeria, UK, Russia, China. Student at SPU in Kenya 1974/75. LEADERSHIP WITH INTEGRITY JOSEPH GALGALO Vice-Chancellor of St. Paul’s University until December 2020. Professor of Systematic Theology, since HIGHER EDUCATION FROM VOCATION 2021 serving the Anglican Church in Kenya as the Provincal TO FUNDING Secretary. SAMUEL KOBIA Chancellor of St. Paul’s University until 2019, PhD in Ethics: Chairman of the National Cohesion and Integration Commission of Kenya. Former General Secretary C. STÜCKELBERGER, J. GALGALO, S. KOBIA (EDITORS) of the World Council of Churches. Former Board member of 8 Globethics.net. Globethics.net Leadership with Integrity Higher Education from Vocation to Funding Leadership with Integrity Higher Education from Vocation to Funding Editors: Christoph Stückelberger / Joseph Galgalo / Samuel Kobia Globethics.net Education Ethics No. -

Kai Senior National Karate Championship2015

KAI SENIOR NATIONAL KARATE CHAMPIONSHIP201 5 HELD AT TALKATORA INDOOR STADIUM, NEW DELHI FROM 18-20 Feb.2015 RESULTS SENIOR INDIVIDUAL MALE KATA NAME STATE MEDAL CERTIFICATE NO. NITIN SINGH ITBP GOLD 00005 NAEEM KHAN SERVICES (SSCB) SILVER 00006 ANIKET GUPTA DELHI BRONZE 00007 AJAY YADAV MP BRONZE 00008 SENIOR MALE TEAM KATA NAME STATE MEDAL CERTIFICATE NO. KUNAL DEY WB GOLD 00021 SUBHAS GHATANE GOLD 00022 ARINDAM SINGH GOLD 00023 RASHID KHAN CHHATTISGARH SILVER 00024 MOHNISH K. SILVER 00025 SRINU M. SILVER 00026 ANIKET GUPTA DELHI BRONZE 00027 YASHPAL SINGH KALSI BRONZE 00028 NISHANT RATHI BRONZE 00029 K K KARTHIK TAMILNADU POLICE BRONZE 00030 P. SARVANAN BRONZE 00031 R. SHANMNGAM BRONZE 00032 SENIOR MENS -50KG MALE NAME STATE MEDAL CERTIFICATE NO. MAZID KHAN MADHYA PRADESH GOLD 00041 CH. DURGESH ANDRA PRADESH SILVER 00042 SUNN RAPHAEL S MEGHALAYA BRONZE 00043 BALVEER SINGH TELENGANA BRONZE 00044 SENIOR MENS-55 KG KUMITE NAME STATE MEDAL CERTIFICATE NO. GAUTAM SAUD MADHYA PRADESH GOLD 00082 ANAND MANE MAHARASHTRA SILVER 00083 J. VANLALENLAWLA SERVICES (SSCB) BRONZE 00084 SASI KUIMAR TAMILNADU BRONZE 00085 SENIOR MENS-60KG KUMITE NAME STATE MEDAL CERTIFICATE NO. SANDEEP RATHOR SERVICES (SSCB) GOLD 00033 TUSHAL LADKAT MAHARASHTRA SILVER 00034 GAURAV SINDHIYA MADHYA PRADESH BRONZE 00035 S. PRIYANANDA SINGH ASSAM RIFEL BRONZE 00036 SENIOR MENS-67KG KUMITE NAME STATE MEDAL CERTIFICATE NO. ANMOL SINGH HARYANA GOLD 00062 SARATH J KUMAR KARNATAKA SILVER 00063 SAURAV SINGH SERVICES (SSCB) BRONZE 00064 BHARAT BHUSHAN NAGALAND BRONZE 00065 SENIOR MENS -75 KG KUMITE NAME STATE MEDAL CERTIFICATE NO. KULDEEP MADHYA PRADESH GOLD 00074 SUMIT SAINI HARYANA POLICE SILVER 00075 SAGAR HARYANA BRONZE 00076 AMAN SHOERAN CHANDIGARH BRONZE 00077 SENIOR MENS-84KG KUMITE NAME STATE MEDAL CERTIFICATE NO. -

Kho-Kho, and Volleyball Are Explained

TEAM GAMES 5 Any game which provides opportunities to two or more players working together towards a shared objective is called a team game. A team game is an activity in which individuals are organised in a team to compete with the opposing team, in accordance with a set of laws/rules to win. Games like Basketball, Cricket, Football, Handball, Hockey, Volleyball, etc., are some of the classic examples of major team games. However, over a period of time, the popularity of team games has grown continuously. These games have positively influenced not just the players, but also their fans, local and national economies. All over the world, the impact of team games can be seen resulting in professional players to live out their dreams. Star players have become role models to youth. Young athletes/players develop life skills which are followed as footsteps of their role models. In this chapter, some of the team games like Basketball, Cricket, Football, Handball, Hockey, Kabaddi, Kho-Kho, and Volleyball are explained. BASKETBALL Basketball is a team game played between two teams of five players each, on the court. Very high amount of energy (calories) expenditure is there in this game. It also helps in building bone and muscle strength and boosts the immune system. This game also develops self-discipline and concentration among young players. History Basketball originated in the United States of America and was invented by Dr. James Naismith in December, 1891, who was a Physical Educator at the International Young Men’s Christian Association Training School (YMCA) (now known 2021-22 Chap-5.indd 129 31-07-2020 15:27:24 130 Health and Physical Education - XI as Springfield College of Physical Education) in Springfield, Massachusetts. -

Ethics-In-Higher-Education-Values-Driven-Leaders-For-The-Future.Pdf

ISBN 978-2-88931-165-1 1 EDUCATION ETHICS DIVYA SINGH / CHRISTOPH STÜCKELBERGER SINGH / CHRISTOPH DIVYA ETHICS IN HIGHER EDUCATION The 26th ICDE VALUES-DRIVEN LEADERS FOR THE FUTURE World Confe rence The values and virtues practised in universities heavily influence the leaders of the future, but outside the limelight of excelling education institutions there Growing capacities for sustainable is a concerning violation of good practises and rise in unethical behaviour. distance e-learning provision This book offers diverse insights from 19 different authors, writing from eight countries in five continents, providing explanations and recommendations for Pre-conference workshops: 13 October 2015 the ethical crisis present around the world which can be mitigated by suitable Conference: 14 - 16 October 2015 education in ethics, particularly in higher education institutions. ETHICS IN HIGHER EDUCATION Sun City, South Africa DIVYA SINGH holds an LL D, a Master in Tertiary Education Managment and is an admitted Advocate of the High Court of South Africa and vice Principal Advisory and Assurance Service at the University of South Africa, where she introduced the Institutional Ethics Office. ETHICS IN HIGHER EDUCATION CHRISTOPH STÜCKELBERGER is the Founder and President of Globethics.net Foundation in VALUES-DRIVEN LEADERS FOR THE FUTURE Geneva, Switzerland. He is Prof. em. at the University of Basel and visiting Professor for Ethics at the Moscow Engineering DIVYA SINGH / CHRISTOPH STÜCKELBERGER (editors) Institute in Russia, the Kingdom Business College in Beijing, 1 China, and the Godfrey Okoye University in Enugu/Nigeria. Ethics in Higher Education Values-driven Leaders for the Future Ethics in Higher Education Values-driven Leaders for the Future Divya Singh / Christoph Stückelberger (Eds.) Globethics.net Education Ethics No. -

And Chairperson, VB Padode Centre for Sustainability, JAGSOM

Editor: Dr. Nina Jacob, Professor, Jagdish Sheth School of Management (JAGSOM), and Chairperson, V.B. Padode Centre for Sustainability, JAGSOM Reviewers: Prof. Anand Narasimha Prof. Parvathi Jayaprakash Text © JAGSOM, 2021 ISBN Number: 978-93-5445-734-0 Cover design: Prof. Pravin Mishra, Dean – School of Design, Vijaybhoomi University, Karjat TABLE OF CONTENTS Editorial……………………………………………………………………………………..…i Social Responsibility and Future Managers About the Editor ……………………………………………………………………………..ii EFFECTIVE WASTE MANAGEMENT: A STUDY ALIGNED WITH SDG NO. 11: SUSTAINABLE CITIES AND COMMUNITIES .......................................................... 1 Dr. Nina Jacob and Saishwari Patil EDUCATING SLUM CHILDREN: A STUDY ALIGNED WITH SDG NO. 4: ENSURE INCLUSIVE AND EQUITABLE QUALITY EDUCATION ........................................... 8 Dr. Sangita Dutta Gupta and Ankit Sharma, Astha Jangid, Dhiraj Kumar Agrawal, Divya Singh, Felsia D., Poulami Banik, Priyanka Deka, Sheetal Singh, Shrobona Ghosh, Soumya S., and Susant Kumar Behara REDUCING FOOD WASTAGE: A STUDY ALIGNED WITH SDG NO. 2: END HUNGER AND ACHIEVE FOOD SECURITY .......................................................... 16 Prof. Soumya Choudhury and Anshika Gupta ENHANCING QUALITY OF LIFE: A STUDY ALIGNED WITH SDG NO. 16: PROMOTE PEACEFUL AND INCLUSIVE SOCIETIES FOR SUSTAINABLE DEVELOPMENT ...................................................................................................... 21 Prof. Sarthak Daing and Sakshee Singh EDUCATING INDIAN CHILDREN ABOUT PUBERTY AND ADOLESCENCE -

13Th Annual Conference on Economic Growth and Development December 18-20, 2017 Indian Statistical Institute, New Delhi

13th Annual Conference on Economic Growth and Development December 18-20, 2017 Indian Statistical Institute, New Delhi Papers Accepted for Presentation 1. Mukesh Eswaran (University of British Columbia): "Can For-Profit Business Alleviate Extreme Poverty in Developing Countries?" 2. Nicolas Gravel (Centre for Social Sciences and Humanities, Delhi), Edward Levavasseur (GREQAM, Aix-Marseille University) & Patrick Moyes (GRETHA, University of Bordeaux): "Evaluating Education Systems" 3. V Bhaskar (University of Texas at Austin) & Caroline Thomas (University of Texas at Austin): "The design of credit information systems" 4. Lata Gangadharan (Monash University), Tarun Jain (Indian School of Business), Pushkar Maitra (Monash University) & Joseph Vecci (University of Gothenburg): "The fairer sex? Women leaders and the strategic response to the social environment" 5. Maarten Janssen (University of Vienna) & Santanu Roy (Southern Methodist University): "Regulating False Disclosure" 6. Shankha Chakraborty (University of Oregon), Andrea Giusto (University of Dalhousie) & Jayanta Sarkar (Queensland University of Technology): "Growth in a Graying Economy" 7. Diva Dhar (Bill and Melinda Gates Foundation), Tarun Jain (Indian School of Business) & Seema Jayachandran (Northwestern University): "Can Gender Attitudes be Changed? Evidence from a School-based Experiment in India" 8. "Shesadri Banerjee (MIDS, Chennai), Parantap Basu (Durham University), Chetan Ghate (Indian Statistical Institute, Delhi), Pawan Gopalakrishnan (Reserve Bank of India) & Sargam