OIBDA Net Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NEW SYLLABUS 345 : 1 : Roll No…………………

OPEN BOOK EXAMINATION NEW SYLLABUS 345 : 1 : Roll No………………… Time allowed : 3 hours Maximum marks : 100 Total number of questions : 6 Total number of printed pages : 7 NOTE : Answer ALL Questions. 1. "Telecom Industry in India" The telecommunication industry in India was one of the most swiftly growing sectors in the world with stupendous growth over the last decade. It was regarded as the third largest in the world and the second largest among the emerging economies of Asia. Besides the public sector, the private segment had made significant contribution that had turned the industry into one of the key contributors to the Indian success story. It had an impressive growth trajectory, adding nearly 9 million subscribers per month, bringing the mobile subscriber base to over 903 million by January, 2012. BCG, in January, 2011, indicated that the Indian telecom market would surpass the US $100 billion mark by 2015. This report contradicted the prevalent common belief that growth in the telecom sector had reached a saturation point. In 1994, when mobile phones were introduced in India, the country was divided into 23 circles and licences were issued as per these circles. The circles were classified into four categories — Metros, A, B and C - on the basis of revenue potential; Metro and A circles were expected to have the highest potential. The telecom market in India was highly competitive compared to other countries, and there were over 11 operators in each circle, which was unheard of anywhere else in the world. Different players included Airtel, Reliance, Vodafone (earlier Hutch), Idea, Tata, state-owned BSNL and many more. -

A Study on Customer Loyalty of Jio Users Towards Jio, Vijayawada, Andhra Pradesh

IAETSD JOURNAL FOR ADVANCED RESEARCH IN APPLIED SCIENCES ISSN NO: 2394-8442 A Study on Customer Loyalty of Jio Users towards Jio, Vijayawada, Andhra Pradesh Dr. B.KISHORE BABU*1 Asso.Prof, Dept. of Management, Koneru Lakshmaiah Education Foundation, Vaddeswaram, Guntur, Andhra Pradesh, India. [email protected] Abstract: Competition in the telecommunications world in India is very firm, brand switching of customers is also very high. That’s why each provider trying to provide the best for its customers so that they can be loyal to the same provider. customer loyalty is defined a relationship between customer with a particular brand name, and company exemplified by their purchase of the customer or consumer buying behavior towards a consistent and profitable brand and measured as recommended to other consumers. In India, there are ten mobile telecom providers operating in the market (Vodafone-Idea, Airtel, Jio, BSNL, Aircel, Reliance communications, Telenor, Tata Docomo, MTS India, MTNL). The rationale of this study is to know the customer loyalty of JIO customers towards JIO After free services time was over. Whether customers are continuing the JIO or not? to know overall satisfaction of customers towards services of JIO, factors which considered to select JIO This study uses data 300 respondents from the population was Reliance JIO users in Vijayawada, Andhra Pradesh, with a structured questionnaire. The questionnaires were scrutinized using MS-Excel. The results of this study show that 63% of the customers are highly satisfied with the performance of JIO services, 45% of the customers are highly agreed that, they will continue the JIO services in coming years and wants to be loyal to the JIO, 52% of the customers are highly agreed that they satisfied with the performance of JIO and suggest others to use JIO Key Words: customer loyalty, telecommunication, satisfaction, Brand switching INTRODUCTION Reliance Jio Infocomm Limited, performing business operations as Jio, is A Long Term Evolution (LTE)mobile network operator in India. -

Study of Telecommunication Industry and Its Contribution to India's Market

© 2019 JETIR June 2019, Volume 6, Issue 6 www.jetir.org (ISSN-2349-5162) Study of telecommunication industry and its contribution to India’s market trends and development 1Rahul Nawale, 2Pushkar Mishra 1,2PG Students, MBA-Operations, Department of Management, MIT World Peace University-School of Management, Pune, Maharashtra-411038. Abstract This paper analyses the telecommunications industry has the characteristics of natural monopoly, economies of scale and the difficulty of monitoring, then the combination of economic and technology trends analysis showed that the telecom industry's future development will be the body the following aspects: technical progress speed to promote the transfer of value, industrial integration to promote business competition, and user involvement to drive the experience economy and depth involved in the process of national information. The telecommunication trade in Bharat is quickly growing and witnessing several developments. it's had many transformations that has crystal rectifier to severe competition within the trade. this text traces the foremost policy reforms within the Indian telecommunication sector. Moreover, the article additionally discusses the changes methods adopted by the 2 key market players-Vodafone and Airtel. The paper can give a comprehensive data on the recent developments within the sector and can facilitate highlight the changes within the telecommunication trade. Keywords - Telecommunications industry, development trend, competitive information. I. Introduction The telecommunications trade in Bharat has witnessed several developments and undergone tremendous changes. it's one in all the quickest growing industries within the world and has established to be international success story. Bharat has developed as the second largest telecommunication market with 898 million subscribers as on March 2013. -

Telecom: a Wider Spectrum of Hope

>> pg 8 THE ECONOMIC TIMES, WEDNESDAY, SEPTEMBER 5, 2012 ADVERTORIAL & PROMOTIONAL FEATURE Telecom: A wider spectrum of hope The way forward Buoyed by new technologies and As the telecom sector looks forward to a new dawn, the soon-to-be-implemented telecom policy is all set to transparent policies, telecom create a transparent and level playing field with impetus for high growth operators in India are looking forward to another glorious aving passed through a turbulent needs of the community. With the power period of growth period in the recent past, the tele- of information and software technology, com industry in India is looking there will be opportunities to explore in s India advances further in the new century, Hforward to high growth in some the areas of education, healthcare, skill A the telecom services are expected to play a of the latest communications technologies development and other relevant communi- key role in its socio-economic development. that have recently emerged. The ET Tele- ty concerns. Particularly important is their role in bridging com Awards 2012 presented by Global Adding to all this will be India’s national- the rural-urban divide by bringing a host of Group, now in its second edition, therefore electronic manufacturing policy that will services at low costs in the hands of consumers. came as a welcome opportunity for indus- aid in making the country a hub of manu- India has an envious scope of scale com- try leaders to meet at a common platform facturing of hardware products. Mr. Sibal pared to the rest of the world. -

Vol.3, Issue-1(2), January, 2016 Impact Factor: 3.075; Email: [email protected]

International Journal of Academic Research ISSN: 2348-7666; Vol.3, Issue-1(2), January, 2016 Impact Factor: 3.075; Email: [email protected] Dr.Rama Krishna Chittajallu, Asst. Professor in Commerce, P.R.Govt.College(a), Kakinada, A.P., India Key words: Relaiance Acquisition, merger of R.Com.&Aircel, Aircel merger scheme and Investments for the potential merger. The potential combination will “The telecom industry is at a stage where exclude RCom's towers and optical fibre players are faced with high operational infrastructure, for which R.Com is costs, be it energy, infrastructure, sales proceeding with an asset sale. or distribution. Given this dynamic nature of the industry, it is inevitable for operators to consider such arrangements Reliance Communications Limited, with each other to offer continued and founded by the late Shri Dhirubhai H seamless mobile services to customers” Ambani (1932-2002), is the flagship Reliance Communications and Aircel company of the Reliance Group. The begun to combine their wireless telecom Reliance Group currently has a net worth operations to create India's second largest in excess of Rs 91,500 crore (US $15.3 mobile operator as intensifying billion), cash flows of Rs 10,200 crore (US competition fuels consolidation in a $1.7 billion) and net profit of Rs 4,700 crowded market. A pact for 90-day crore (US$ 0.8 billion). exclusive talks has been initiated with Reliance Communications is India's Aircel's majority owner, Malaysia's Maxis foremost and truly integrated Communications, and Sindya Securities International Journal of Academic Research ISSN: 2348-7666; Vol.3, Issue-1(2), January, 2016 Impact Factor: 3.075; Email: [email protected] telecommunications service provider. -

The Impact of Reliance Jio on Indian Mobile Industry

International Journal of Applied Research 2017; 3(3): 209-212 ISSN Print: 2394-7500 ISSN Online: 2394-5869 The impact of Reliance Jio on Indian mobile industry- Impact Factor: 5.2 IJAR 2017; 3(3): 209-212 A case study on mergers and acquisitions of idea – www.allresearchjournal.com Received: 03-01-2017 Vodafone and Airtel – Telenor Accepted: 05-02-2017 D Satyanarayana D Satyanarayana, Dr K Sambasiva Rao and Dr S Krishnamurthy Naidu Research Scholar, Rayalaseema University, Kurnool, Andhra Pradesh, Abstract India Indian mobile industry is one of the fastest growing industries in the world. Indians are habituated to touch mobiles within a short span of a time. In the world India is second largest market for mobile Dr K Sambasiva Rao service providers and it is a good avenue for network providers from indigenous and exogenous Professor, Department of CMS, entrepreneurs. Not only Indian network providers but also global providers occupied and earn Andhra University, significant market share in the Indian mobile industry. Reliance Jio’s free tsunami creates lot of radical Visakhapatnam, Andhra and unexpected changes in consumer’s behaviors and competitor’s strategies. The impact of this new Pradesh, India. entrant affects equilibrium in the mobile industry and makes rivals vulnerable that they resort to Dr S Krishnamurthy Naidu mergers and acquisitions in Indian mobile network providers. The major giants in the industry viz, Associate Professor, Airtel and Idea strategically responding in a similar way. To strengthen themselves in the industry, Department of MBA, Sri Airtel and Idea acquiring Telenor and Vodafone respectively. The present research paper makes an Vasavi Engg. -

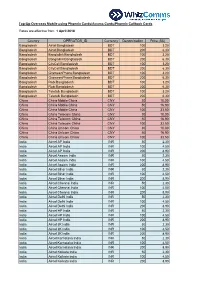

Top-Up Overseas Mobile Rates

Top-Up Overseas Mobile using Phoenix Cards/Access Cards/Phoenix Callback Cards Rates are effective from 1 April 2018 Country OPERATOR_ID Currency Denomination Price (S$) Bangladesh Airtel Bangladesh BDT 100 3.20 Bangladesh Airtel Bangladesh BDT 200 6.30 Bangladesh Banglalink Bangladesh BDT 100 3.20 Bangladesh Banglalink Bangladesh BDT 200 6.30 Bangladesh CityCell Bangladesh BDT 100 3.20 Bangladesh CityCell Bangladesh BDT 200 6.30 Bangladesh GrameenPhone Bangladesh BDT 100 3.20 Bangladesh GrameenPhone Bangladesh BDT 200 6.30 Bangladesh Robi Bangladesh BDT 100 3.20 Bangladesh Robi Bangladesh BDT 200 6.30 Bangladesh Teletalk Bangladesh BDT 100 3.20 Bangladesh Teletalk Bangladesh BDT 200 6.30 China China Mobile China CNY 30 10.00 China China Mobile China CNY 50 16.90 China China Mobile China CNY 100 33.50 China China Telecom China CNY 30 10.00 China China Telecom China CNY 50 16.90 China China Telecom China CNY 100 33.50 China China Unicom China CNY 30 10.00 China China Unicom China CNY 50 16.90 China China Unicom China CNY 100 33.50 India Aircel AP India INR 50 2.30 India Aircel AP India INR 100 4.50 India Aircel AP India INR 200 8.90 India Aircel Assam India INR 50 2.30 India Aircel Assam India INR 100 4.50 India Aircel Assam India INR 200 8.90 India Aircel Bihar India INR 50 2.30 India Aircel Bihar India INR 100 4.50 India Aircel Bihar India INR 200 8.90 India Aircel Chennai India INR 50 2.30 India Aircel Chennai India INR 100 4.50 India Aircel Chennai India INR 200 8.90 India Aircel Delhi India INR 50 2.30 India Aircel Delhi India INR -

MCS-Cradlepoint Installation

APP-092 MCS-Cradlepoint Installation Micro Control Systems APPLICATION NOTE APP-092 MCS Cradlepoint Installation Revision History Date Author Description 07/18/2014 Emmanuel Castillo Created application note APP-092 MCS-Cradlepoint Installation *Prior to installing the MCS‐Cradlepoint you must purchase a USB modem and data plan from a data plan provider. We highly recommend Verizon wireless (We do not support At&t). You must also make sure to have the carrier provide you with a static IP. *The list of supported USB devices are found at the bottom of this Manual. The MCS‐MAGNUM IP address can be verified and changed (with the proper authorization code) from the MCS‐Magnum’s keypad/LCD of a live unit. The following steps will display the IP Address settings: (to change the address you first must be authorized) 1. Press the MENU key and then Using or keys, select Serv Tools then press the ENTER key. 2. Then Using or keys, scroll to Ethernet Network then press Enter. 3. Using or keys, position curser to Dynamic IP then press Enter. 4. Using the keys, set Dyanmic IP to No and press enter. 5. Then using keys, scroll to IP address then press Enter. APP-092 MCS-Cradlepoint Installation 6. Using keys to increase and decrease the first set of values then use the key to select the next set of numbers. Use keys to increase and decrease the second value and repeat the previous steps for the rest of the IP address. Once you have set the desired address press the Enter key. -

IT Case Study | MTS India

Case Study MTS India relies on HPE Vertica in a highly competitive telecom market Objective Use near real-time data analytics to delight customers How analytics keeps customers from moving Approach to the competition Focus on customer loyalty and retention, which required IT to provide high- performance analytics that is easily accessible by marketing to enable the rapid roll out of competitive incentive campaigns IT Matters • Campaign data loads at 2 gigabits per second, with processing done every 30 minutes • HPE Vertica implemented in less than 48 hours, running 24/7 on a standard HPE ProLiant DL380 cluster, providing the required resilience and performance • SAS Market Automation GUI used by MTS marketing for campaign management Business Matters Based in New Delhi, India, MTS is the brand along the mobile phone spectrum. As a • Acceptance of U&R (usage and name for a division of the Russian-based result, MTS experienced a reduced business retention) promotions increased from telecommunications company Sistema Shyam footprint, from 15 to 9 circles (state-centered an industry average 3% to 6.5% TeleServices Ltd, serving approximately 10 geographies). This mandate reduced its client • Marketing teams are now able to run million mobile phone customers on the Indian base from 15 million to 10.5 million subscribers MBonus U&R campaigns independently, without involving IT support subcontinent. In 2012, it decided to invest in at the beginning of 2014. a competitive data analytics solution to help retain existing customers and encourage MTS is now back onto a growth path, with increased usage of its mobile and broadband further increases in its customer base. -

Cdg International Roaming Team

CDG INTERNATIONAL ROAMING TEAM Prepaid Roaming Webinar February 2012 Welcome by BWG Co-Chairs Tue Hermansen, Mach Gerrit Jan Konijnenberg, Vodafone Agenda • Introductions – About CDG IRT – MACH Introduction – Vodafone Introduction • Presentations – Sprint, USA – Visafone, Nigeria – MTS, India History of the International Roaming Team (IRT) • 1998 the CDG initiated a technical team focused on Roaming – Original group: Hutchison Hong Kong, KDDI, Telecom New Zealand and SK Telecom – Roughly 10 members met 2 times a year face to face – First document created: Doc #44 CDMA International Roaming Agreement Template • Organized into a formal structure in 2002 – Formalized and focused group charter on International Roaming with face to face meetings • Current organization formed in 2004 – Average 80-100 participants – 43 published documents – Meets face to face 2 times a year with conference calls in between The purpose of the IRT • Our purpose is to provide a forum and structure for the industry to improve roaming for CDMA carriers and subscribers by: – increasing CDMA roaming coverage for all services – Reducing complexity and time of deployment – Improving the reliability and richness of the subscriber experience • CDMA is a flexible technology with implementation variances – When roaming was added into a carrier’s product line, many found CDMA roaming to be challenging • The only place where CDMA carriers/vendors/OEMs meet to discuss CDMA international roaming Agenda • Introductions – About CDG IRT – MACH Introduction – Vodafone Introduction -

The Composition of Service Providers in India

The composition of Service providers in India BY: LOVISHA AGGARWAL INTRODUCTION Telecom, at present, is one of the fastest-growing industries in India. As of January 2014, according to the Telecom Regulatory Authority of India (TRAI) there are 922 million wireless and over the wire subscribers in India,1 and 56.90 million broadband subscribers including wired, wireless and wimax subscribers.2 India’s overall wireless teledensity was quoted as having 893.31million subscribers, with a 0.79% (7.02 million) monthly addition. Of these, 59.25% are urban subscribers and 40.75% are rural subscribers.3 The conversations engaged by the users on digital platforms range from casual conversations to confidential professional or personal communications. Service providers have often been described as the ‘gate keepers’ to the content on their networks and the subscriber information of their users. As such, service providers play a critical role in state surveillance and actions that service providers take to comply with the law as well as a company’s internal policies impact the privacy of their users. Given the importance of service provides in the context of state surveillance, CIS has researched and provided an overview of the major service providers in India including information about the composition of the company and its overseeing board. REVIEW OF MAJOR TELECOM AND INTERNET SERVICE PROVIDERS IN INDIA There are a number of telecom and internet service providers in India including state owned telecom service providers, multi-national telecom service providers, national and Indian multi-national telecom service providers. A. State owned telecom service providers i. -

Telecom Sector in India and Customer Relationship Management (CRM)

INTERNATIONAL JOURNAL FOR INNOVATIVE RESEARCH IN MULTIDISCIPLINARY FIELD ISSN – 2455-0620 Volume - 2, Issue - 8, Aug - 2016 Telecom sector in India and Customer Relationship Management (CRM) Raja Sarkar - Ph.D. Scholar/ UGC Senior Research Fellow, Department of Business Administration, Utkal University, Bhubaneswar, Odisha, India E-mail- [email protected] Abstract: The Indian telecom sector has evolved over the last two decades significantly. Before the economic liberalization in the 1990’s, it was the state run service providers BSNL(Bharat Sanchar Nigam Limited) & MTNL (Mahanagar Telecom Nigam Limited) who had absolute monopoly in this sector. Landlines used to dominate the Indian telecom space. Mobile phone users were very few and they were mostly from the ultra rich and the elite segment. Call charges were extremely high which kept the ordinary people outside the purview of the telecom service. It was the economic liberalization which opened the floodgates for private and foreign investments in the Indian economy in almost each and every sector and the telecom sector was also not untouched by it. It brought the private players into the telecom space and created a fierce competition which resulted in an ideal atmosphere for the diffusion of the telecom services among all classes and segments. It was the trigger for the subsequent telecom revolution in India which ultimately resulted in India becoming the 2nd largest telecom market in the world with more than a billion customers. Today it’s the mobile phone which dominates the Indian telecom space and landline is fast becoming an extinct species. With one of the cheapest tarrifs in the world along with the numerous value added services, mobile phones have virtually become an inseparable part of our lives.