| Book Reviews |

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interviewed Bernard L. Madoffat the Metropolitan Correctional Center, 150 Park Row, New York, NY

This document contains information that has been collected in connection with an investigation conducted by the U.S. Securities and Exchange Commission Office of Inspector General (OIG). It contains confidential, privileged and sensitive information and should not be recopied or distributed without the express consent of the GIG. Interview of Bernard L. Madoff At approximately 3:00pm on June 17, 2009, Inspector General H. David Kotz and DeputyInspector General Noelle Frangipaneinterviewed Bernard L. Madoffat the Metropolitan Correctional Center, 150 Park Row, New York, NY. Madoff was accompanied by his attorney, Ira Lee Sorkin of the firm of Dickstein Shapiro, LLP, as well as an associate from that firm, Nicole DeBello. The interview began with IG Kotz advising Madoff of the general nature of the OIG investigation, and advising that we were investigating interactions the Securities and Exchange Commission (SEC) had with Madoff and his firm, Bernard L. Madoff Investment Securities, LLP (BLM), going back to 1992. At that point, Sorkin advised Madoff that his only obligation was to tell the truth during the interview. The interview began with Madoff stating that the prosecutor and trustee in the criminal case "misunderstood" things he said during the proffer, and as a result, there is a lot of misinformation being circulated about this scandal, however, he added, "I'm not saying I'm not guilty." 2006 Exam: Madoff recalled that with respect to the 2006 OCIE exam, "two young fellows," (Lamore and Ostrow) came in "under the guise of doing a routine exam;" He said that during that time period, sweeps were being done of hedge funds that focused on ~-ont- running, and that was why he believed Ostrow and Lamore were at BLM. -

Exhibit a Pg 1 of 40

09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 1 of 40 EXHIBIT A 09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 2 of 40 Baker & Hostetler LLP 45 Rockefeller Plaza New York, NY 10111 Telephone: (212) 589-4200 Facsimile: (212) 589-4201 Attorneys for Irving H. Picard, Trustee for the substantively consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC and the Estate of Bernard L. Madoff UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, No. 08-01789 (SMB) Plaintiff-Applicant, SIPA LIQUIDATION v. (Substantively Consolidated) BERNARD L. MADOFF INVESTMENT SECURITIES LLC, Defendant. In re: BERNARD L. MADOFF, Debtor. IRVING H. PICARD, Trustee for the Liquidation of Bernard L. Madoff Investment Securities LLC, Plaintiff, Adv. Pro. No. 09-1161 (SMB) v. FEDERICO CERETTI, et al., Defendants. 09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 3 of 40 TRUSTEE’S FIRST SET OF REQUESTS FOR PRODUCTION OF DOCUMENTS AND THINGS TO DEFENDANT KINGATE GLOBAL FUND, LTD. PLEASE TAKE NOTICE that in accordance with Rules 26 and 34 of the Federal Rules of Civil Procedure (the “Federal Rules”), made applicable to this adversary proceeding under the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”) and the applicable local rules of the United States District Court for the Southern District of New York and this Court (the “Local Rules”), Irving H. -

589-4201 Irving H

08-01789-smb Doc 7470 Filed 07/21/14 Entered 07/21/14 18:09:56 Main Document Pg 1 of 77 Baker & Hostetler LLP Hearing Date: August 19, 2014 45 Rockefeller Plaza Hearing Time: 10:00 a.m. (EST) New York, New York 10111 Objection Deadline: August 12, 2014 Telephone: (212) 589-4200 Time: 4:00 p.m. (EST) Facsimile: (212) 589-4201 Irving H. Picard Email: [email protected] David J. Sheehan Email: [email protected] Seanna R. Brown Email: [email protected] Heather R. Wlodek Email: [email protected] Attorneys for Irving H. Picard, Trustee for the Substantively Consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC and Bernard L. Madoff UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, Adv. No. 08-01789 (SMB) Plaintiff, SIPA Liquidation v. (Substantively Consolidated) BERNARD L. MADOFF INVESTMENT SECURITIES LLC, Defendant. In re: BERNARD L. MADOFF, Debtor. FIFTEENTH APPLICATION OF TRUSTEE AND BAKER & HOSTETLER LLP FOR ALLOWANCE OF INTERIM COMPENSATION FOR SERVICES RENDERED AND REIMBURSEMENT OF ACTUAL AND NECESSARY EXPENSES INCURRED FROM DECEMBER 1, 2013 THROUGH MARCH 31, 2014 08-01789-smb Doc 7470 Filed 07/21/14 Entered 07/21/14 18:09:56 Main Document Pg 2 of 77 TABLE OF CONTENTS Page I. PRELIMINARY STATEMENT ....................................................................................... 1 II. BACKGROUND ............................................................................................................... 6 A. THE SIPA LIQUIDATION .................................................................................. -

589-4201 Irving H

Baker & Hostetler LLP Hearing Date: May 12, 2011 45 Rockefeller Plaza Hearing Time: 10:00 A.M. EST New York, New York 10111 Telephone: (212) 589-4200 Objection Deadline: May 5, 2011 Facsimile: (212) 589-4201 Time: 4:00 P.M. EST Irving H. Picard Email: [email protected] David J. Sheehan Email: [email protected] Seanna R. Brown Email: [email protected] Jacqlyn R. Rovine Email: [email protected] Attorneys for Irving H. Picard, Trustee for the Substantively Consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC And Bernard L. Madoff UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, Adv. Pro. No. 08-01789 (BRL) Plaintiff, SIPA Liquidation v. (Substantively Consolidated) BERNARD L. MADOFF INVESTMENT SECURITIES LLC, Defendant. In re: BERNARD L. MADOFF, Debtor. SIXTH APPLICATION OF TRUSTEE AND BAKER & HOSTETLER LLP FOR ALLOWANCE OF INTERIM COMPENSATION FOR SERVICES RENDERED AND REIMBURSEMENT OF ACTUAL AND NECESSARY EXPENSES INCURRED FROM OCTOBER 1, 2010 THROUGH JANUARY 31, 2011 300147484 TO THE HONORABLE BURTON R. LIFLAND, UNITED STATES BANKRUPTCY JUDGE: Baker & Hostetler LLP (“B&H”), as counsel to Irving H. Picard, Esq., as trustee (the “Trustee”) for the substantively consolidated liquidation proceeding of Bernard L. Madoff Investment Securities LLC (“BLMIS”) under the Securities Investor Protection Act (“SIPA”), 15 U.S.C. § 78aaa et seq.,1 and Bernard L. Madoff (“Madoff”), individually (collectively, “Debtor”), respectfully submits this sixth application -

Criminal Lawyer : Issue 248 December 2020

The Criminal LAWYER ISSN 2049-8047 Issue No. 248 October- December 2020 Fraudster Bernard Madoff and the Accountant Harry Markopolos who blew the whistle on the gigantic $65,000,000,000 Ponzi fraud years before 2008, but it fell on the deaf ears of the U.S. SEC S Ramage pp 2-16. Relationships between the Arab occupation and the concept of the "mafia” with special reference to Arab clans in Germany I. Kovacs pp 17-37 Criminal Law Updates pp 38-43 Book Review-China –Law and Society pp 44-47 Legal notice p 48 1 Fraudster Bernard Madoff and the Accountant Harry Markopolos who blew the whistle on the gigantic $65,000,000,000 Ponzi fraud years before 2008, but it fell on the deaf ears of the U.S. Securities Exchange Commission By Sally S Ramage http://www.criminal-lawyer.org.uk/ Keywords Ponzi; securities; hedge funds; deception; fraud; Laws and case law Mental Health Act 1983 (UK) section 136 Public Law 109-171 (Deficit Reduction Act of 2005) The Federal Civil False Claims Act, Section 1902(a)(68) of the Social Security Act The Federal Civil False Claims Act, Section 3279 through 3733 of title 31 of the United States Code. The Michigan Medicaid False Claims Act, Public Act 72 of 1977 Abstract Mr. Harry Markopolos, a financial derivatives specialist, and some colleagues, realised that the Bernard Madoff Investment company must be falsifying performance data on their investment fund. The truth was then revealed about one man’s psychopathic roam in the investment industry in the United States and Europe including the United Kingdom and Russia. -

The Madoff Fraud

MVE220 Financial Risk The Madoff Fraud Shahin Zarrabi – 9111194354 Lennart Lundberg – 9106102115 Abstract: A short explanation of the Ponzi scheme carried out by Bernard Madoff, the explanation to how it could go on for such a long period of time and an investigation on how it could be prevented in the future. The report were written jointly by the group members and the analysis was made from discussion within the group 1. Introduction Since the ascent of money, different techniques have been developed and carried out to fool people of their assets. These methods have evolved together with advances in technology, and some have proved to be more efficient than other. One of the largest of these schemes ever carried out occurred in modern times in the United States, it was uncovered as recently as in late 2008. The man behind it managed to keep the scheme running for over 15 years in one of most monitored economic systems in the world. The man in charge of the operation, Bernard L. Madoff, got arrested for his scheme and pled guilty to the embezzling of billions of US dollars. It struck many as unimaginable how such a fraud could occur in an environment so carefully controlled by regulations and supervised by different institutions. The uncovering of the scheme rose questions on how this could go undetected for such a long time, and what could be done to avoid similar situations in the future. This report gives an insight on how the Madoff fraud was carried out, how it could go unnoticed for so long and if similar frauds could be prevented in the future. -

Report of Investigation Executive Summary

REPORT OF INVESTIGATION UNITED STATES SECURITIES AND EXCHANGE COMMISSION OFFICE OF INSPECTOR GENERAL Case No. OIG-509 Investigation of Failure of the SEC To Uncover Bernard Madoff's Ponzi Scheme Executive Summary The OIG investigation did not find evidence that any SEC personnel who worked on an SEC examination or investigation of Bernard L. Madoff Investment Securities, LLC (BMIS) had any financial or other inappropriate connection with Bernard Madoff or the Madoff family that influenced the conduct of their examination or investigatory work. The OIG also did not find that former SEC Assistant Director Eric Swanson's romantic relationship with Bernard Madoffs niece, Shana Madoff, influenced the conduct of the SEC examinations of Madoff and his firm. We also did not find that senior officials at the SEC directly attempted to influence examinations or investigations of Madoff or the Madofffirm, nor was there evidence any senior SEC official interfered with the staffs ability to perform its work. The OIG investigation did find, however, that the SEC received more than ample information in the form of detailed and substantive complaints over the years to warrant a thorough and comprehensive examination and/or investigation of Bernard Madoff and BMIS for operating a Ponzi scheme, and that despite three examinations and two investigations being conducted, a thorough and competent investigation or examination was never performed. The OIG found that between June 1992 and December 2008 when Madoff confessed, the SEC received six! substantive complaints that raised significant red flags concerning Madoffs hedge fund operations and should have led to questions about whether Madoffwas actually engaged in trading. -

Features Links to Source Documents Referenced in Articles, a Full-Text Search Feature, and a Topical Index of Past Articles

INSIDE... Suggestions for Use of Social Networking ... 3 Commenters Cash In on Money Markets .... 5 You Can Now Read FINRA Sweep Letter .. 6 The SEC Finds Glenn Manterfield .............. 6 September 14, 2009 Paper offers strategies for coping with New OIG report to look at why Madoff’s smaller budgets, larger responsibilities RIA was never examined Increase the chances of persuading your superiors to As early as November the SEC’s Inspector General support your compliance initiatives by indicating how expects to release another investigative report – this one they would “lead to a quantifiable return on investment,” peering into why OCIE examiners never visited Bernard states a new whitepaper that probes the intersection of L. Madoff Investment Securities after it registered as an flat or falling compliance budgets and anticipated greater adviser in 2006 (IA Week , Jan. 12, 2009). regulatory requirements. IG David Kotz announced the inquiry before a The paper, pinned to a new study by Complinet, Senate Banking Committee hearing last week that took encourages compliance officers to weave terms and up the IG’s recent report (see story below) and how the business benefits, such as “time to market, improved agency has responded to what Sen. Christopher Dodd operational efficiency, decreased employee turnover, (D-Conn.) called a “colossal failure.” improved client retention and even increased revenues,” The SEC has taken many steps to prevent another into their reports to bosses and to produce follow-up Madoff, and Kotz previewed two other upcoming reports benchmarks to demonstrate the success. that will include more recommendations for changes “Compliance officers who understand the rules and within OCIE and the Commission’s Enforcement regulations, but are unable to communicate successfully Division. -

Cuaderno De Documentacion

SECRETARIA DE ESTADO DE ECONOMÍA, MINISTERIO SECRETARÍA GENERAL DE POLÍTICA ECONÓMICA DE ECONOMÍA Y ECONOMÍA INTERNACIONAL Y HACIENDA SUBDIRECCIÓN GENERAL DE ECONOMÍA INTERNACIONAL CUADERNO DE DOCUMENTACION Número 86-23º (alcance) ¡Feliz año 2009! Alvaro Espina Vocal Asesor 30 Diciembre de 2008 (14 horas) CD 86-23º de alcance 30 de Diciembre de 2008 [A] “Los sistemas de propiedad no son autónomos, sino que dependen en su definición de toda una constelación de procedimientos legales, civiles y penales. La evolución de la legalidad tampoco puede ser contemplada como algo derivado del sistema de precios. Los jueces y la policía deben ser remunerados, pero el sistema mismo desaparecería si estos agentes tuvieran que estar vendiendo en cada momento sus servicios y decisiones. De modo que la definición de los derechos de propiedad, basados en el sistema de precios, depende precisamente de la no-universalidad del sistema de precios y de propiedad privada. El sistema de precios no es universal, y probablemente en un sentido profundo no puede serlo. En la medida en que es un sistema incompleto debe estar complementado por un contrato social, implícito o explícito”. [B] “Con independencia de nuestras teorías omnicomprensivas acerca del mercado, los economistas debemos reconocer que hay bienes que podrían ser comprados y vendidos, pero que no lo son. Pueden aducirse muchos ejemplos. Las decisiones judiciales y los votos no pueden ir hacia el mejor postor. Los individuos no pueden renunciar a ciertos derechos legales. Los valores que se ofrecen a la venta en el mercado tienen que respetar, entre otras, la regulación sobre transparencia: no está permitido ofrecer valores sin proporcionar esa información, incluso cuando lo que se notifica al comprador es que tales valores no respetan la regulación. -

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT of NEW YORK for PUBLICATION ------X in Re: BERNARD L

09-01503-brl Doc 55 Filed 09/22/11 Entered 09/22/11 13:09:45 Main Document Pg 1 of 58 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK FOR PUBLICATION --------------------------------------------------------X In re: BERNARD L. MADOFF INVESTMENT SIPA LIQUIDATION SECURITIES LLC, No. 08-01789 (BRL) Debtor. (Substantively Consolidated) --------------------------------------------------------X IRVING H. PICARD, as Trustee for the Liquidation of BERNARD L. MADOFF INVESTMENT SECURITIES LLC, Adv. Pro. No. 09-1503 (BRL) Plaintiff, v. PETER B. MADOFF, MARK D. MADOFF, ANDREW H. MADOFF, and SHANA D. MADOFF Defendants. ---------------------------------------------------------X APPEARANCES: BAKER & HOSTETLER LLP 45 Rockefeller Plaza New York, NY 10111 Telephone: (212) 589-4200 Facsimile: (212) 589-4201 By: David J. Sheehan John Siegal Marc D. Powers Attorneys for Plaintiff Irving H. Picard, Trustee for the Substantively Consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC and Bernard L. Madoff PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP 1285 Avenue of the Americas New York, NY 10019 Telephone: (212) 373-3000 Facsimile: (212) 757-3990 By: Martin Flumenbaum Stephen J. Shimshak Andrew J. Ehrlich Hannah S. Sholl Attorneys for Defendant Andrew H Madoff, individually and as Executor of the Estate of Mark D. Madoff 09-01503-brl Doc 55 Filed 09/22/11 Entered 09/22/11 13:09:45 Main Document Pg 2 of 58 LANKLER SIFFERT & WOHL LLP 500 Fifth Avenue 33rd Floor New York, NY 10110 Telephone: (212) 921-8399 Facsimile: (212) 764-3701 By: Charles T. Spada Attorney for Defendant Peter B. Madoff SMITH VALLIERE PLLC 75 Rockefeller Center 21st Floor New York, NY 10019 Telephone: (212) 755-5200 Facsimile: (212) 755-5203 By: Timothy A. -

May 16, 2011 Fifth Interim Report

Baker & Hostetler LLP 45 Rockefeller Plaza New York, NY 10111 Telephone: (212) 589-4200 Facsimile: (212) 589-4201 Irving H. Picard Email: [email protected] David J. Sheehan Email: [email protected] Seanna R. Brown Email: [email protected] Jacqlyn R. Rovine Email: [email protected] Attorneys for Irving H. Picard, Trustee for the Substantively Consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC And Bernard L. Madoff UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, Adv. Pro. No. 08-01789 (BRL) Plaintiff-Applicant, SIPA Liquidation v. (Substantively Consolidated) BERNARD L. MADOFF INVESTMENT SECURITIES LLC, Defendant. In re: BERNARD L. MADOFF, Debtor. TRUSTEE’S FIFTH INTERIM REPORT FOR THE PERIOD ENDING MARCH 31, 2011 TABLE OF CONTENTS Page I. EXECUTIVE SUMMARY............................................................................................... 1 II. BACKGROUND ............................................................................................................... 5 III. FINANCIAL CONDITION OF ESTATE......................................................................... 5 IV. ADMINISTRATION OF THE ESTATE .......................................................................... 7 A. Marshalling And Liquidating The Estate Assets ................................................... 7 B. Retention Of Professionals .................................................................................... 8 C. Efficient Administration Of Litigations................................................................ -

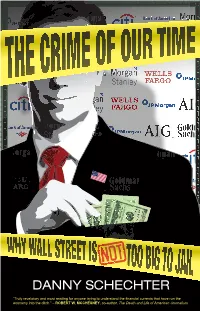

The Crime of Our Time, Is a Hard-Hitting Investigation That Shows How the fi Nancial Crisis Was Built on a Foundation of Criminal Activity

SCHECHTER “Fully living up to his reputation as the ‘News Dissector,’ Danny Schechter goes right for the jugular DANNY in this rich and informative analysis of the fi nancial crisis and its roots. Not errors, accident, market NOAM CHOMSKY uncertainty and so on, but crime: major and serious crime. A harsh judgment, but it is not easy to dismiss the case he constructs.” – “There are many forms of terrorism. And this economic terrorism, as Schechter writes, is perhaps even more dangerous to the nation than the attacks of 9/11.” – CHRIS HEDGES, author of Empire of Illusion: The End of Literacy and the Triumph of Spectacle In 2006, fi lmmaker Danny Schechter was denounced as an “alarmist” for his fi lm In Debt We Trust, which warned of the coming credit crisis. He was labeled a “doom and gloomer” until the economy melted down, vin- dicating his warnings. His prescient new book, The Crime Of Our Time, is a hard-hitting investigation that shows how the fi nancial crisis was built on a foundation of criminal activity. To tell this story, Schechter speaks with bankers involved in these activi- ties, respected economists, insider experts, top journalists including Paul Krugman, and even a convicted white-collar criminal, Sam Antar, who blows the whistle on these intentionally dishonest practices. The Crime Of Our Time looks into how the crisis developed, from the mysterious collapse of Bear Stearns to the self-described “shitty deals” of Goldman Sachs. Schechter calls for a full criminal investigation and structural reforms of fi nancial institutions to insure accountability by the white-collar perpetrators who profi ted from the misery of their victims.