Options Trading and Hedging Strategies Based on Market Data Analytics

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Options Strategy Guide for Metals Products As the World’S Largest and Most Diverse Derivatives Marketplace, CME Group Is Where the World Comes to Manage Risk

metals products Options Strategy Guide for Metals Products As the world’s largest and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. CME Group exchanges – CME, CBOT, NYMEX and COMEX – offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate. CME Group brings buyers and sellers together through its CME Globex electronic trading platform and its trading facilities in New York and Chicago. CME Group also operates CME Clearing, one of the largest central counterparty clearing services in the world, which provides clearing and settlement services for exchange-traded contracts, as well as for over-the-counter derivatives transactions through CME ClearPort. These products and services ensure that businesses everywhere can substantially mitigate counterparty credit risk in both listed and over-the-counter derivatives markets. Options Strategy Guide for Metals Products The Metals Risk Management Marketplace Because metals markets are highly responsive to overarching global economic The hypothetical trades that follow look at market position, market objective, and geopolitical influences, they present a unique risk management tool profit/loss potential, deltas and other information associated with the 12 for commercial and institutional firms as well as a unique, exciting and strategies. The trading examples use our Gold, Silver -

What Drives Index Options Exposures?* Timothy Johnson1, Mo Liang2, and Yun Liu1

Review of Finance, 2016, 1–33 doi: 10.1093/rof/rfw061 What Drives Index Options Exposures?* Timothy Johnson1, Mo Liang2, and Yun Liu1 1University of Illinois at Urbana-Champaign and 2School of Finance, Renmin University of China Abstract 5 This paper documents the history of aggregate positions in US index options and in- vestigates the driving factors behind use of this class of derivatives. We construct several measures of the magnitude of the market and characterize their level, trend, and covariates. Measured in terms of volatility exposure, the market is economically small, but it embeds a significant latent exposure to large price changes. Out-of-the- 10 money puts are the dominant component of open positions. Variation in options use is well described by a stochastic trend driven by equity market activity and a sig- nificant negative response to increases in risk. Using a rich collection of uncertainty proxies, we distinguish distinct responses to exogenous macroeconomic risk, risk aversion, differences of opinion, and disaster risk. The results are consistent with 15 the view that the primary function of index options is the transfer of unspanned crash risk. JEL classification: G12, N22 Keywords: Index options, Quantities, Derivatives risk 20 1. Introduction Options on the market portfolio play a key role in capturing investor perception of sys- tematic risk. As such, these instruments are the object of extensive study by both aca- demics and practitioners. An enormous literature is concerned with modeling the prices and returns of these options and analyzing their implications for aggregate risk, prefer- 25 ences, and beliefs. Yet, perhaps surprisingly, almost no literature has investigated basic facts about quantities in this market. -

A Guide to WL Indicators

A GUIDE TO WL INDICATORS GETTING TECHNICAL ABOUT TRADING: USING EIGHT COMMON INDICATORS TO How is it different from other MAs? MAKE SENSE OF TRADING While other MA calculations may weigh price or time frame differently, the SMA is calculated by weighing the closing prices equally. What’s a technical indicator and why should I use them? Traders usually use more than one SMA to determine market momentum; when an SMA with a short- term time What’s the market going to do next? It is a question that’s almost always on traders’ minds. Over time, traders period (for instance, a 15-day SMA) crosses above an SMA with a long-term time frame (a 50-day SMA), it usually have looked at price movements on charts and struggled to make sense of the ups, downs, and sometimes means that the market is in an uptrend. sideways movements of a particular market. When an SMA with a shorter time period crosses below an SMA with a longer time period, it usually means That’s given rise to technical indicators - a set of tools that use the real-time market moves of an instrument to that the market is in a downtrend. Traders also use SMAs to detect areas of support when a trend changes give traders a sense of what the market will do next. There are hundreds of different indicators that traders can direction. Generally, an SMA with a longer time period identifies a stronger level of support. use, but whether you’re a new trader or an old hand at it, you need to know how to pick one, how to adjust its settings, and when to act on its signals. -

Options Application (PDF)

Questions? Go to Fidelity.com/options. Options Application Use this application to apply to add options trading to your new or existing Fidelity account. If you already have options trading on your account, use this application to add or update account owner or authorized agent information. Please complete in CAPITAL letters using black ink. If you need more room for information or signatures, make a copy of the relevant page. Helpful to Know Requirements – Margin can involve significant cost and risk and is not • Entire form must be completed in order to be considered appropriate for all investors. Account owners must for Options. If you are unsure if a particular section pertains determine whether margin is consistent with their investment to you, please call a Fidelity investment professional at objectives, income, assets, experience, and risk tolerance. 800-343-3548. No investment or use of margin is guaranteed to achieve any • All account owners must complete the account owner sections particular objective. and sign Section 5. – Margin will not be granted if we determine that you reside • Any authorized agent must complete Section 6 and sign outside of the United States. Section 7. – Important documents related to your margin account include • Trust accounts must provide trustee information where the “Margin Agreement” found in the Important Information information on account owners is required. about Margins Trading and Its Risks section of the Fidelity Options Agreement. Eligibility of Trading Strategies Instructions for Corporations and Entities Nonretirement accounts: • Unless options trading is specifically permitted in the corporate • Business accounts: Eligible for any Option Level. -

Trading System Development David Francis Zielinski Worcester Polytechnic Institute

Worcester Polytechnic Institute Digital WPI Interactive Qualifying Projects (All Years) Interactive Qualifying Projects June 2017 Trading System Development David Francis Zielinski Worcester Polytechnic Institute Muhaimin Islam Worcester Polytechnic Institute Obianuli Ebubechukwu Obiora Worcester Polytechnic Institute Follow this and additional works at: https://digitalcommons.wpi.edu/iqp-all Repository Citation Zielinski, D. F., Islam, M., & Obiora, O. E. (2017). Trading System Development. Retrieved from https://digitalcommons.wpi.edu/iqp- all/1892 This Unrestricted is brought to you for free and open access by the Interactive Qualifying Projects at Digital WPI. It has been accepted for inclusion in Interactive Qualifying Projects (All Years) by an authorized administrator of Digital WPI. For more information, please contact [email protected]. Trading System Development An Interactive Qualifying Project Submitted to the Faculty Of In Partial Fulfillment of the requirements for the Degree of Bachelor of Science By: David Zielinski Obi Obiora Muhaiman Islam Submitted to: Professors Michael Radzicki Fred Hutson 1 Abstract: 4 Chapter 1: 5 Introduction 5 Chapter 2: 7 Trading and Investing 7 Pros and Cons 8 Day Trading Pros and Cons 9 Swing Trading Pros and Cons 11 Pros 11 Cycle and Trend 12 Four Asset Classes and Inter Market Analysis 14 Equities: 14 Currencies: 15 Commodities: 15 Intermarket Analysis: 17 How Businesses Respond to the Business Cycle 18 Advantages and Disadvantages 19 Taxing Asset Classes: 20 Account Requirements and Position -

© 2012, Bigtrends

1 © 2012, BigTrends Congratulations! You are now enhancing your quest to become a successful trader. The tools and tips you will find in this technical analysis primer will be useful to the novice and the pro alike. While there is a wealth of information about trading available, BigTrends.com has put together this concise, yet powerful, compilation of the most meaningful analytical tools. You’ll learn to create and interpret the same data that we use every day to make trading recommendations! This course is designed to be read in sequence, as each section builds upon knowledge you gained in the previous section. It’s also compact, with plenty of real life examples rather than a lot of theory. While some of these tools will be more useful than others, your goal is to find the ones that work best for you. Foreword Technical analysis. Those words have come to have much more meaning during the bear market of the early 2000’s. As investors have come to realize that strong fundamental data does not always equate to a strong stock performance, the role of alternative methods of investment selection has grown. Technical analysis is one of those methods. Once only a curiosity to most, technical analysis is now becoming the preferred method for many. But technical analysis tools are like fireworks – dangerous if used improperly. That’s why this book is such a valuable tool to those who read it and properly grasp the concepts. The following pages are an introduction to many of our favorite analytical tools, and we hope that you will learn the ‘why’ as well as the ‘what’ behind each of the indicators. -

Simple Robust Hedging with Nearby Contracts Liuren Wu

Journal of Financial Econometrics, 2017, Vol. 15, No. 1, 1–35 doi: 10.1093/jjfinec/nbw007 Advance Access Publication Date: 24 August 2016 Article Downloaded from https://academic.oup.com/jfec/article-abstract/15/1/1/2548347 by University of Glasgow user on 11 September 2019 Simple Robust Hedging with Nearby Contracts Liuren Wu Zicklin School of Business, Baruch College, City University of New York Jingyi Zhu University of Utah Address correspondence to Liuren Wu, Zicklin School of Business, Baruch College, One Bernard Baruch Way, B10-225, New York, NY 10010, or e-mail: [email protected]. Received April 12, 2014; revised June 26, 2016; accepted July 25, 2016 Abstract This paper proposes a new hedging strategy based on approximate matching of contract characteristics instead of risk sensitivities. The strategy hedges an option with three options at different maturities and strikes by matching the option function expansion along maturity and strike rather than risk factors. Its hedging effective- ness varies with the maturity and strike distance between the target and the hedge options, but is robust to variations in the underlying risk dynamics. Simulation ana- lysis under different risk environments and historical analysis on S&P 500 index op- tions both show that a wide spectrum of strike-maturity combinations can outper- form dynamic delta hedging. Key words: characteristics matching, hedging, jumps, Monte Carlo, payoff matching, risk sensi- tivity matching, strike-maturity triangle, stochastic volatility, S&P 500 index options, Taylor expansion JEL classification: G11, G13, G51 The concept of dynamic hedging has revolutionized the derivatives industry by drastically reducing the risk of derivative positions through frequent rebalancing of a few hedging in- struments. -

Technical Indicators Defined & Explained

Technical Indicators Defined & Explained A guide to understanding and applying the most popular technical indicators by BDSwiss Trading Academy Any information appearing on this graph or text is based solely on reasonable assumptions and does not December 2020 represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. Index Page 01 RSI - Relative Strength Index 03 02 Average Directional Index 07 03 Parabolic SAR 10 04 Moving Average Convergence and Divergence MACD 13 05 Bollinger Bands® 16 06 Linearly Weighted Moving Average 19 07 Exponential Moving Average 22 08 Simple Moving Average 25 09 Stochastic Oscillator 28 Any information appearing on this graph or text is based solely on reasonable assumptions and does not represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. 2 01 RSI Relative Strength Index Any information appearing on this graph or text is based solely on reasonable assumptions and does not represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. 3 Indicator Profile • RSI was developed in 1978 by J. Welles Wilder Jr. • It is among the most widely used trading indicators in technical analysis. • RSI is a momentum indicator, which means it helps measure the velocity of a particular assets price changes. • In its initial form, the RSI was designed for stock trading. As it started proving efficient, traders began applying it to other assets as well. The Relative Strength Index is an indicator that helps traders capture market momentum by measuring the magnitude of price fluctuations. -

Timeframeset

QuantShare Programming Language Table of contents 1. QuantShare Language 1.1 Application Info 1.1.1 NbGroups 1.1.2 NbIndexes 1.1.3 NbIndustries 1.1.4 NbInGroup 1.1.5 NbInIndex 1.1.6 NbInIndustry 1.1.7 NbInMarket 1.1.8 NbInSector 1.1.9 NbMarkets 1.1.10 NbSectors 1.2 Candlestick Pattern 1.2.1 Cdl2crows (0) 1.2.2 Cdl2crows (1) 1.2.3 Cdl3blackcrows (0) 1.2.4 Cdl3blackcrows (1) 1.2.5 Cdl3inside (0) 1.2.6 Cdl3inside (1) 1.2.7 Cdl3linestrike (0) 1.2.8 Cdl3linestrike (1) 1.2.9 Cdl3outside (0) 1.2.10 Cdl3outside (1) 1.2.11 Cdl3staRsinsouth (0) 1.2.12 Cdl3staRsinsouth (1) 1.2.13 Cdl3whitesoldiers (0) 1.2.14 Cdl3whitesoldiers (1) 1.2.15 CdlAbandonedbaby (0) 1.2.16 CdlAbandonedbaby (1) 1.2.17 CdlAdvanceblock (0) 1.2.18 CdlAdvanceblock (1) 1.2.19 CdlBelthold (0) 1.2.20 CdlBelthold (1) 1.2.21 CdlBreakaway (0) 1.2.22 CdlBreakaway (1) 1.2.23 CdlClosingmarubozu (0) 1.2.24 CdlClosingmarubozu (1) 1.2.25 CdlConcealbabyswall (0) 1.2.26 CdlConcealbabyswall (1) 1.2.27 CdlCounterattack (0) 1.2.28 CdlCounterattack (1) 1.2.29 CdlDarkcloudcover (0) 1.2.30 CdlDarkcloudcover (1) 1.2.31 CdlDoji (0) 1.2.32 CdlDoji (1) 1.2.33 CdlDojistar (0) 1.2.34 CdlDojistar (1) 1.2.35 CdlDragonflydoji (0) 1.2.36 CdlDragonflydoji (1) 1.2.37 CdlEngulfing (0) 1.2.38 CdlEngulfing (1) 1.2.39 CdlEveningdojistar (0) 1.2.40 CdlEveningdojistar (1) 1.2.41 CdlEveningstar (0) 1.2.42 CdlEveningstar (1) 1.2.43 CdlGapsidesidewhite (0) 1.2.44 CdlGapsidesidewhite (1) 1.2.45 CdlGravestonedoji (0) 1.2.46 CdlGravestonedoji (1) 1.2.47 CdlHammer (0) 1.2.48 CdlHammer (1) 1.2.49 CdlHangingman (0) 1.2.50 -

Technical Indicators Defined & Explained

Technical Indicators Defined & Explained A guide to understanding and applying the most popular technical indicators by BDSwiss Trading Academy Any information appearing on this graph or text is based solely on reasonable assumptions and does not December 2020 represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. Index Page 01 RSI - Relative Strength Index 03 02 Average Directional Index 07 03 Parabolic SAR 10 04 Moving Average Convergence and Divergence MACD 13 05 Bollinger Bands® 16 06 Linearly Weighted Moving Average 19 07 Exponential Moving Average 22 08 Simple Moving Average 25 09 Stochastic Oscillator 28 Any information appearing on this graph or text is based solely on reasonable assumptions and does not represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. 2 01 RSI Relative Strength Index Any information appearing on this graph or text is based solely on reasonable assumptions and does not represent a reliable indication of future performance, nor does it represent a recommendation for trading decisions. 3 Indicator Profile • RSI was developed in 1978 by J. Welles Wilder Jr. • It is among the most widely used trading indicators in technical analysis. • RSI is a momentum indicator, which means it helps measure the velocity of a particular assets price changes. • In its initial form, the RSI was designed for stock trading. As it started proving efficient, traders began applying it to other assets as well. The Relative Strength Index is an indicator that helps traders capture market momentum by measuring the magnitude of price fluctuations. -

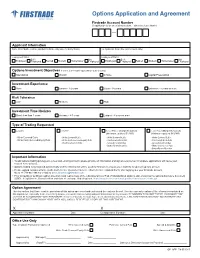

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (If Application Is for an Existing Account – Otherwise Leave Blank)

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (if application is for an existing account – otherwise leave blank) Applicant Information Name (First, Middle, Last for individual / indicate entity name for Entity/Trusts) Co-Applicant’s Name (For Joint Accounts Only) Employment Status Employment Status Self- Not Self- Not Employed Employed Retired Student Homemaker Employed Employed Employed Retired Student Homemaker Employed Options Investment Objectives (Level 2, 3 & 4 require “Speculation” to be checked) Speculation Growth Income Capital Preservation Investment Experience None Limited - 1-2 years Good - 3-5 years Extensive - 5 years or more Risk Tolerance Low Medium High Investment Time Horizon Short- less than 3 years Average - 4-7 years Longest - 8 years or more Type of Trading Requested Level 1 Level 2 Level Three (Margin Required) Level Four (Margin Required) (Minimum equity of $2,000) (Minimum equity of $10,000) • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Cash-Secured Equity Puts • Write Cash-Secured Equity Puts • Purchase Calls & Puts • Purchase Calls & Puts • Purchase Calls & Puts • Spreads & Straddles • Spreads & Straddles • Buttery and Condor • Write Uncovered Puts • Buttery and Condor Important Information To add options trading privileges to a new and existing account, please provide all information and signature(s) below. Incomplete applications will cause your request to be delayed. Options trading is not granted automatically and the information will be used by Firstrade to assess your eligibility to open an options account. Please upload completed form via the Form Center (Customer Service ->Form Center ->Upload Form) after logging into your Firstrade account, fax to +1-718-961-3919 or e-mail to [email protected] Prior to buying or selling an option, investors must read a copy of the Characteristics & Risk of Standardized Options, also known as the options disclosure document (ODD). -

By the Wall Street Daily Research Team the 3 BEST TECHNICAL INDICATORS on EARTH

by The Wall Street Daily Research Team THE 3 BEST TECHNICAL INDICATORS ON EARTH “Those who cannot remember the past are condemned to repeat it.” This oft-quoted warning also forms the basis for technical analysis. Only I’d tweak it to say, “Those who do remember the past are likely to profit from it.” THAT’S TECHNICAL ANALYSIS IN A NUTSHELL. After all, technical analysis is based on the idea that all the information is represented in price and volume. So by comparing what’s happening in the market today to what’s happened in the past, you can tell what will (most likely) occur in the future. The Three Best Technical Indicators on Earth How to Start Killing the Market and Never Look Back 2 In other words, while fundamental analysis involves screening businesses’ balance sheets, earnings reports and economic conditions to try to predict stock returns, technical analysis relies on the participants in the market to distill all that information into meaningful data. And by watching price and volume, you can interpret the emotions driving the market. Some believe that technical analysis is simply about drawing lines on a chart – and that it’s essentially the equivalent of Hogwash!financial astrology. Granted, some methods have failed to produce real returns. And I agree that not all technical indicators are worthy of your attention. That’s why it’s important to focus only on the key indicators that have proven successful – time after time. Lucky for you, we’ve found the top three, best of breed, technical rundown of each… indicators that you can use to maximize your profits.