Opel/Vauxhall to Join PSA Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lambeth College

Further Education Commissioner assessment summary Lambeth College October 2016 Contents Assessment 3 Background 3 Assessment Methodology 4 The Role, Composition and Operation of the Board 4 The Clerk to the Corporation 4 The Executive Team 5 The Qualify of Provision 5 Student Numbers 5 The College's Financial Position 6 Financial Forecasts beyond 2015/2016 6 Capital Developments 6 Financial Oversight by the Board 6 Budget-setting Arrangements 7 Financial Reporting 7 Audit 7 Conclusions 7 Recommendations 8 2 Assessment Background The London Borough of Lambeth is the second largest inner London Borough with a population of 322,000 (2015 estimate). It has experienced rapid population growth, increasing by over 50,000 in the last 10 years up until 2015. There are five key town centers: Brixton, Clapham and Stockwell, North Lambeth (Waterloo, Vauxhall, Kennington), and Norwood and Streatham. Lambeth is the 5th most deprived Borough in London. One in five of the borough’s residents work in jobs that pay below the London Living Wage. This is reflected by the fact that nearly one in four (24%) young people live in families who receive tax credits. Major regeneration developments and improvements are underway for Waterloo and Vauxhall and the Nine Elms Regeneration project which will drive the transformation of these areas. Lambeth College has three main campuses in the borough, based in Clapham, Brixton and Vauxhall. Approximately a quarter of the student cohort in any given academic year are 16‐18 learners. In addition to this, there is also a significantly growing proportion of 16-18 learners on Apprenticeship programmes, moderate numbers on workplace‐training provision for employers and school link programmes which are offered to relatively smaller learner volumes. -

Download Network

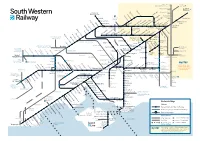

Milton Keynes, London Birmingham and the North Victoria Watford Junction London Brentford Waterloo Syon Lane Windsor & Shepherd’s Bush Eton Riverside Isleworth Hounslow Kew Bridge Kensington (Olympia) Datchet Heathrow Chiswick Vauxhall Airport Virginia Water Sunnymeads Egham Barnes Bridge Queenstown Wraysbury Road Longcross Sunningdale Whitton TwickenhamSt. MargaretsRichmondNorth Sheen BarnesPutneyWandsworthTown Clapham Junction Staines Ashford Feltham Mortlake Wimbledon Martins Heron Strawberry Earlsfield Ascot Hill Croydon Tramlink Raynes Park Bracknell Winnersh Triangle Wokingham SheppertonUpper HallifordSunbury Kempton HamptonPark Fulwell Teddington Hampton KingstonWick Norbiton New Oxford, Birmingham Winnersh and the North Hampton Court Malden Thames Ditton Berrylands Chertsey Surbiton Malden Motspur Reading to Gatwick Airport Chessington Earley Bagshot Esher TolworthManor Park Hersham Crowthorne Addlestone Walton-on- Bath, Bristol, South Wales Reading Thames North and the West Country Camberley Hinchley Worcester Beckenham Oldfield Park Wood Park Junction South Wales, Keynsham Trowbridge Byfleet & Bradford- Westbury Brookwood Birmingham Bath Spaon-Avon Newbury Sandhurst New Haw Weybridge Stoneleigh and the North Reading West Frimley Elmers End Claygate Farnborough Chessington Ewell West Byfleet South New Bristol Mortimer Blackwater West Woking West East Addington Temple Meads Bramley (Main) Oxshott Croydon Croydon Frome Epsom Taunton, Farnborough North Exeter and the Warminster Worplesdon West Country Bristol Airport Bruton Templecombe -

Brand New 19,000 Sq Ft Grade a Office

BRAND NEW 19,000 SQ FT GRADE A OFFICE 330 CLAPHAM ROAD•SW9 If I were you... I wouldn’t settle for anything less than brand new Let me introduce you to LUMA. 19,000 sq ft of brand new premium office space conveniently located just a short stroll from Stockwell and Clapham North underground stations. If I were you, I know what I would do... 330 Clapham Road SW9 LUMA • New 19,000 sq ft Office HQ LUMA • New 330 Clapham Road SW9 LUMA • New 19,000 sq ft Office HQ LUMA • New I’d like to see my business in a new light Up to 19,000 sq ft of Grade A office accommodation is available from lower ground to the 5th floor, benefiting from excellent views and full height glazing. 02 03 A D R O N D E E A M I L 5 1 Holborn 1 A E D G W £80 per sq ft A R E R O A City of London D Soho A 1 3 C O M M E Poplar R C I A L R City O A D D £80 per sq ft A O White City R A 1 2 0 3 T H E H I G H W A Y Mayfair E Midtown G D Hyde I R Park B £80 per sq ft R E W O T 0 0 A 3 Holland 1 3 A 2 0 Park St James Waterloo Park Southwark D £71 per sq ft A O R L £80 per sq ft L E W M O R Westminster C E S T A 4 W O A D per sq ft W E S T C R O M W E L L R £75 Vauxhall Belgravia £55 per sq ft D V 330 Clapham Road SW9 A R U Isle of Dogs Pimlico X K H R A L A L P B R N I A D O 2 G E T N G E W N I C auxa R D N O R O A S O R N S S V E N E R R O K O G A 2 1 2 D A 3 3 A B Oa A A 2 T 0 Oval T 3 LUMA • New 19,000 sq ft Office HQ LUMA • New Battersea E R S S Battersea E L £50 per sq ft A Park £50 per sq ft A M A Fulham B 2 R B 0 D D E 2 I A D O T A C G R H A K O M E R R A R B P E D R A R N W D E Peckham R S E E T O L A T L B T 5 N E 2 0 X W R O 3 I A D A R B D per Camberwell I’d want my business A 3 O £45 sq ft 2 R A A tocwe 3 andswort S located in Central London’s 2 R 2 A oad 0 D E Louborou E most cost effective C L unction S 6 P 1 E 2 T R 3 A L U C Capam R I H C H T A U O S 5 R i t. -

Buses from Battersea Park

Buses from Battersea Park 452 Kensal Rise Ladbroke Grove Ladbroke Grove Notting Hill Gate High Street Kensington St Charles Square 344 Kensington Gore Marble Arch CITY OF Liverpool Street LADBROKE Royal Albert Hall 137 GROVE N137 LONDON Hyde Park Corner Aldwych Monument Knightsbridge for Covent Garden N44 Whitehall Victoria Street Horse Guards Parade Westminster City Hall Trafalgar Square Route fi nder Sloane Street Pont Street for Charing Cross Southwark Bridge Road Southwark Street 44 Victoria Street Day buses including 24-hour services Westminster Cathedral Sloane Square Victoria Elephant & Castle Bus route Towards Bus stops Lower Sloane Street Buckingham Palace Road Sloane Square Eccleston Bridge Tooting Lambeth Road 44 Victoria Coach Station CHELSEA Imperial War Museum Victoria Lower Sloane Street Royal Hospital Road Ebury Bridge Road Albert Embankment Lambeth Bridge 137 Marble Arch Albert Embankment Chelsea Bridge Road Prince Consort House Lister Hospital Streatham Hill 156 Albert Embankment Vauxhall Cross Vauxhall River Thames 156 Vauxhall Wimbledon Queenstown Road Nine Elms Lane VAUXHALL 24 hour Chelsea Bridge Wandsworth Road 344 service Clapham Junction Nine Elms Lane Liverpool Street CA Q Battersea Power Elm Quay Court R UE R Station (Disused) IA G EN Battersea Park Road E Kensal Rise D ST Cringle Street 452 R I OWN V E Battersea Park Road Wandsworth Road E A Sleaford Street XXX ROAD S T Battersea Gas Works Dogs and Cats Home D A Night buses O H F R T PRINCE O U DRIVE H O WALES A S K V Bus route Towards Bus stops E R E IV A L R Battersea P O D C E E A K G Park T A RIV QUEENST E E I D S R RR S R The yellow tinted area includes every Aldwych A E N44 C T TLOCKI bus stop up to about one-and-a-half F WALE BA miles from Battersea Park. -

Registration Document

20 REGISTRATION DOCUMENT Including the annual financial report 17 GROUPE PSA - 2017 REGISTRATION DOCUMENT -1 ANALYSIS OF THE BUSINESS AND GROUP OPERATING RESULTS IN 2017 AND OUTLOOK Capital Expenditure in Research & Development 4.4.2. Banque PSA Finance, signature of a framework agreement with the BNP Paribas Group to form a car financing Partnership for Opel Vauxhall vehicles On 6 March 2017, when the Master Agreement was concluded with BNP Paribas Personal Finance, will from an accounting point of view General Motors, the Company simultaneously signed a Framework retain the current European platform and staff of GM Financial. The Agreement with BNP Paribas and BNP Paribas Personal Finance, to Opel Vauxhall finance companies will distribute financial and organise the joint purchase of Opel Vauxhall’s finance companies insurance products over a territory initially including the following and the setting up of a car financing partnership for Opel Vauxhall countries: Germany, United Kingdom, France, Italy, Sweden, Austria, vehicles. Ireland, Netherlands, Belgium, Greece and Switzerland. The The acquisition of Opel Vauxhall’s finance companies will be cooperation may potentially be extended thereafter to other completed through a holding company. This joint venture, owned in countries where Opel Vauxhall has a presence. equal shares and on the same terms by Banque PSA Finance and 4.5. CAPITAL EXPENDITURE IN RESEARCH & DEVELOPMENT Automotive Expertise to deliver useful technologies Innovation, research and development are powerful levers for Every year, Groupe PSA invests in research and development to developing competitive advantages by addressing the major stay ahead, technologically, of environmental and market changes. challenges faced in the automotive industry (environmental, safety, emerging mobility and networking needs, etc.). -

Elephant Park

Retail & Leisure 2 Embrace the spirit Retail at Elephant Park Embrace the spirit Retail at Elephant Park 3 Over 100,000 sq ft of floorspace Elephant Park: including affordable retail Opportunity-packed 50+ Zone 1 retail & shops, bars leisure space in & restaurants Elephant & Castle Four curated retail areas 4 Embrace the spirit Retail at Elephant Park Embrace the spirit Retail at Elephant Park 5 Be part of 2,700 a £2.3 billion new homes regeneration scheme at 97,000 sq m largest new park in Elephant Park Central London for 70 years Introducing Elephant Park, set to become the new heart of Elephant & Castle. This ambitious new development will transform and reconnect the area with its network of walkable streets and tree-lined squares, offering residents £30m transport investment and workers a place to meet, socialise and relax. Goodge Street Exmouth Market 6 Embrace the spirit Retail at Elephant Park Embrace the spirit Retail at Elephant Park 7 Barbican Liverpool Street Marylebone Moorgate Fitzrovia Oxford Circus Shopping Holborn Oxford Circus Farringdon Bond Street Tottenham Marble Arch Court Road Covent Garden THE STRAND Cheapside Soho Shopping Whitechapel City St Paul’s City of The Gherkin Thameslink Catherdral THE STRANDTemple Covent Garden London Leadenhall Market Tower Hill Leicester Shopping WATERLOO BRIDGE Monument Mayfair Square BLACKFRIARS BRIDGE SouthwarkPiccadilly One of London’s fastest-developing areas Circus Embankment LONDON BRIDGE Tower of St James’s Charing Tate Modern London Cross Southbank Centre London Green Park Borough Bridge Food Markets Market Flat Iron A3200 TOWER BRIDGE Elephant Park will offer an eclectic range of retail, leisure and F&B, all crafted to meet the demands Southwark Markets The Shard of the diverse customer profile. -

The European Markets and Strategies to Watch for Maximum Opportunity

THE EUROPEAN MARKETS AND STRATEGIES TO WATCH FOR MAXIMUM OPPORTUNITY BRIAN MADSEN ONLINE AUCTIONS IT SOLUTIONS SMART DATA 1 THE SPEED OF CHANGE IS FASTER THAN EVER 2 THE NEW NORMAL 3 CHANGE OF INCREASE IN INCREASES YOUNG DEMAND AND SUPPLY OWMERSHIP PRIVATE LEASINGCHALLENGESUSED CAR INVENTORY 4 WE FIGHT WITH CHANGES AND AGAINST OTHER NEEDS 5 PRODUCT MIX ONLINE OEM SALES NEW PLAYERS 6 CHANGE OF INCREASE IN INCREASES YOUNG DEMAND AND SUPPLY OWMERSHIPHOW TO CREATEPRIVATE OPPORTUNITIES LEASING USED CAROUT INVENTORY OF CHALLENGES 7 USED CAR USE DIGITAL SOLUTIONS TO MOBILE ADAPT COMMUNICATION LEASING MATCH CARS WITH BUYERS SOLUTIONS TO CUSTOMER NEEDS 8 WE ALL NEED TO BE BETTER ONLINE 9 216 MILLION 16 MILLION 45 MILLION 6 MILLION PASSENGERS CARS NEW CARS SOLD USED CARS SOLD CARS FOR SALE ON THE ROAD PER YEAR PER YEAR ONLINE EVERY DAY 10 43% 47% 33% 4% PUBLISHED ONLINE WITHOUT PRICE CHANGE 2 MIO CARS ARE WITHOUT PHOTO FOR MORE FOR MORE MISSING INFORMATION FOR MORE THAN 90 DAYS THAN 30 DAYS THAN 30 DAYS 11 TIME IS IMPORTANT FOR THE RETAIL SELLER 12 TIME STARTS BEFORE AND IS PART OF REMARKETING 13 PRIVATE LEASE INVENTORY TCO MONTHLY COST DEMAND UC PRICE RV SALES USED CARS 14 REMARKETING WORKFLOW MANAGEMENT 15 38 % 6 % 49 % 24% FOUND A BUYER HIGHER PRICES PAID BY USED CARS SOLD BY NON CARS OFFERED OUTSIDE THE COUNTRY NON FRANCHISE DEALERS FRANCHISE DEALERS AND SOLD UPSTREAM AUTOROLA CASE STUDY 16 RETAIL DRIVEN REMARKETING 17 HOW DO WE FIND THE RIGHT BUYER FOR EACH VEHICLE ? 18 GEO PRICING VALUE REMARKETING CHALLENGES RV TCO MORE CHAIN DATA SALES SMART -

Wessex Capacity Alliance

Project Waterloo Station upgrade Location London, UK Client Network Rail Expertise Rail systems, civil, structural, building services, geotechnical, environmental and fire engineering; security and ergonomic design International rescue Joined-up thinking and clever engineering have allowed a former international terminal to be brought back to life as part of a bigger, better Waterloo Station Waterloo Station upgrade I Mott MacDonald I 3 “ By signing up to the charter we are all pulling in the same direction, delivering value for money.” David Barnes Wessex Capacity Alliance deputy manager Britain’s Improving the passenger experience for the 99M people who use Waterloo Station every year involves busiest railway much more than the word ‘upgrade’ implies. There station, London is major viaduct reconstruction, a new connection to London Underground, demolition of some sections Waterloo, is of platforms and extension of others, construction undergoing a of a new roof and pedestrian bridge, and a huge amount of new railway infrastructure to be installed. £400M upgrade to increase Programmed around the normal working of the station and right under the public’s nose, the first nine months capacity. on site saw demolition taking place only a nibble at a time – a portion of track removed here or a new piece of infrastructure installed there – to limit disturbance. Waterloo Station is served by the South West Mainline, the Reading and Windsor lines and suburban lines connecting London with the South and South West of England. By 2043, the number of journeys made on the route is expected to increase by 40%. Anyone using the service at peak time will be familiar with how busy trains can become. -

Power Transmission Group Automotive Aftermarket Contents Introduction

WORK BOOK Power Transmission Group Automotive Aftermarket Contents Introduction Page High mechanical output on demand, completely independent of wind or water power – the spread of the steam engine un- Introduction 3 leashed the industrial revolution in the factories. The individual production machines were driven via steel shafts mounted on Timing belts 4 the ceiling of the building, pulleys and flat drive belts made of Function 5 leather. Design/materials 6 Profiles/handling 9 The first cars and motorcycles also used this power transmis- Maintenance and replacement 10 sion principle. However, the flat belts in this application were Changing the timing belt 12 soon replaced by something better: the V-belt with its trapezoi- Timing chains 13 dal cross-section transmitted the necessary forces with a signifi- Tools 14 cantly lower pretension and became the accepted standard for ancillary component drives. Timing belt drive components 18 Idlers and guide pulleys 19 The multi V-belt, a further development of the V-belt, has been Tensioners 20 taking over automotive applications since the early 1990s. Its Water pumps 22 long ribs enable it to transmit even greater loads. Its flat design allows multiple units to be incorporated and driven at the same V-belts and multi V-belts 26 time. This gives new impetus to the ever more compact design Function, handling 27 of engines. Timing belts have been used for synchronous pow- Design, materials, profiles 28 er transmission to drive the camshaft in automotive engines – V-belts since the 1960s. – multi V-belts – Elastic multi V-belts The next generations of the old transmission belts are now Maintenance and replacement 34 high-tech products. -

The Comparative Competitiveness of PSA, Renault and VW, 1990-2015 Origins of Differences and Strategic Choices to Do

The comparative competitiveness of PSA, Renault and VW, 1990-2015 Origins of differences and strategic choices to do Freyssenet Michel CNRS Paris, GERPISA Scientific symposium The competitiveness of automobile industry in France and Germany. Economical, political and cultural context Forschungsinstitut für Arbeit, Technik und Kulture (F.A.T.K.), Tübingen, Institut für Politikwissenschaft, Lehrstuhl für Policy Analyse und politische Wirtschaftslehre, Eberhard Karls Universität Tübingen, Hochschule Pforzheim, Deutsch-Französisches Institut (DFI), Ludwigsburg Tübingen, 23-24 of june 2016 According to managerial mainstream," the conditions for firms competitiveness" at globalization era are outsourcing labour costs reduction offshoring We now have a sufficient basis for judging the relevance of these recommendations 2 synopsis • Volkswagen is the most competitive European generalist carmaker since twelve years (2003-2015) in terms of profits, sales volume and market shares • Volkswagen is nevertheless the less outsourced, the higher labour costs carmaker and the less offshored, comparatively to PSA and Renault • the explanation of these counterintuitive facts is to find in the difference of relevancy and consistency of the profit strategies of the three carmakers 3 % (VA-DC/DC) x 100 Elaboration: Jetin B. 1998, Freyssenet M.updating Jetin B.1998,Freyssenet 2012and Elaboration: Sources: Annual reports ofcompanies. 100 120 -80 -60 -40 -20 20 40 60 80 0 1 945 1 947 Groups 1 949 Average margin rate above break even point, since 2009 point, even break above rate margin Average 1 951 Volkswagen Auto, PSA, Renault and even pointofFiat tobreak compared Margin 1 953 1 955 +49,4% VW +13,1% -2,5%Renault PSA : 1 957 1 959 1 961 1 963 1 965 1 967 1 969 1 971 1 973 1 975 1947-2015 Groups, 1 977 year 1 979 1 981 1 983 1 985 1 987 1 989 1 991 1 993 Fiat Auto Fiat 1 995 1 997 1 999 2 001 Renault PSA 2 003 VW 2 005 2 007 2009 2011 4 2013 2015 Elaboration: Jetin B.1998, Freyssenet M.2012and updating Jetin Elaboration: reports ofcompanies. -

Buses from Upper Norwood (Beulah Hill) X68 Russell Square Tottenham for British Museum Court Road N68 Holborn Route Finder Aldwych for Covent Garden Day Buses

Buses from Upper Norwood (Beulah Hill) X68 Russell Square Tottenham for British Museum Court Road N68 Holborn Route finder Aldwych for Covent Garden Day buses Bus route Towards Bus stops River Thames Elephant & Castle Ǩ ǫ ǭ Ǯ Waterloo Westwood Hill Lower Sydenham 196 VAUXHALL for IMAX Theatre, London Eye & South Bank Arts Centre Sydenham Bell Green 450 Norwood Junction ɧ ɨ ɩ ɰ Sydenham Lower Sydenham Vauxhall 196 468 Sainsburys Elephant & Castle Fountain Drive Kennington 249 Anerley ɧ ɨ ɩ ɰ Lansdowne Way Lane Route X68 runs non-stop between West Norwood and Walworth Road Waterloo during the Monday-Friday morning peak only. Kingswood Drive SYDENHAM Clapham Common Ǩ ǫ ǭ Ǯ College Road Stockwell Passengers cannot alight before Waterloo. Ā ā 249 Camberwell Green 450 Lower Sydenham Clapham Common Stockwell Green Kingswood Drive Old Town Bowen Drive West Croydon ˓ ˗ Brixton Effra Denmark Hill Road Kings College Hospital Dulwich Wood Park Kingswood Drive 468 Elephant & Castle Ǩ ǫ ǭ Ǯ Brixton Herne Hill Clapham Common South BRIXTON Lambeth Town Hall Dulwich Wood Park CRYSTAL South Croydon ɧ ɨ ɩ ɰ Norwood Road College Road Deronda Road HERNE PALACE Clapham South Norwood Road Crystal Palace Parade HILL College Road Night buses Thurlow Park Road Anerley Road Thicket Road BALHAM Tulse Hill Crystal Palace Anerley Road Bus route Towards Bus stops TULSE Parade Ridsdale Road Balham Anerley Road Norwood Road Hamlet Road Old Coulsdon ɧ ɨ ɩ ɰ HILL Lancaster Avenue N68 Norwood Road Crystal Palace for National Sports Centre Anerley Tottenham Court Road Ǩ ǫ -

FCA-PSA Merger

Alert FCA-PSA Merger 1 November 2019 Executive Summary • Fiat Chrysler Automobiles (FCA) and Groupe PSA have announced that they are working together towards creating one of the world’s largest automotive groups, with the aim of reaching a binding agreement in coming weeks. • The new entity would see global scale and resources owned 50% by Groupe PSA shareholders and 50% by FCA shareholders, with Carlos Tavares the merged group’s CEO. • This news follows on from the breakdown in merger discussions between FCA and Renault earlier this year. • LMC Automotive believes that there is a strong business case for such a consolidation; this latest merger announcement once again highlighting the cost pressures faced by the industry. • The high R&D expenditure relating to platform development, electrification, and other technologies, is expected to remain a drag on industry profitability over the course of the next decade, and further consolidation is likely. • A combined FCA-PSA group would become the fourth-largest OEM globally, with an annual production volume exceeding 8 million Light Vehicles per year. On that basis, it would surpass Hyundai Group, General Motors, Ford and Honda. • In Europe, the new group would challenge Volkswagen Group as the region’s number one OEM in sales volumes terms; however, in the world’s single largest vehicle market, China, FCA and PSA have both struggled to gain a footing, which this tie-up would not readily resolve. • Assuming a binding agreement is reached to create a new automotive giant, there remain significant execution risks associated with combining two sizeable entities. © 2019 LMC Automotive Limited, All Rights Reserved.