Interim Report and Unaudited Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Samsung Electronics Co., Ltd. and Its Subsidiaries NOTES to INTERIM

Samsung Electronics Co., Ltd. and its Subsidiaries NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS 1. General Information 1.1 Company Overview Samsung Electronics Co., Ltd. (“SEC”) was incorporated under the laws of the Republic of Korea in 1969 and listed its shares on the Korea Stock Exchange in 1975. SEC and its subsidiaries (collectively referred to as the “Company”) operate four business divisions: Consumer Electronics (“CE”), Information technology & Mobile communications (“IM”), Device Solutions (“DS”) and Harman. The CE division includes digital TVs, monitors, air conditioners and refrigerators and the IM division includes mobile phones, communication systems, and computers. The DS division includes products such as Memory, Foundry and System LSI in the semiconductor business (“Semiconductor”), and LCD and OLED panels in the display business (“DP”). The Harman division includes connected car systems, audio and visual products, enterprise automation solutions and connected services. The Company is domiciled in the Republic of Korea and the address of its registered office is Suwon, the Republic of Korea. These interim consolidated financial statements have been prepared in accordance with Korean International Financial Reporting Standards (“Korean IFRS”) 1110, Consolidated Financial Statements. SEC, as the controlling company, consolidates its 256 subsidiaries including Samsung Display and Samsung Electronics America. The Company also applies the equity method of accounting for its 41 associates, including Samsung Electro-Mechanics. -

How Corporate Giants Can Better Collaborate with Deep-Tech Start-Ups

Open Innovation How Corporate Giants Can Better Collaborate with Deep-Tech Start-ups. The Case of East and Southeast Asia Index Executive Summary 6 1. Introduction: The Stories of Toyota, Samsung, Alibaba, and Lenovo 9 2. Corporate Venturing in Deep Tech: An Emerging Trend 12 2.1 What Is Deep Tech? 12 2.2 What Is Corporate Venturing and What Is Its Connection to Deep Tech? 16 2.3 The Case of East and Southeast Asia 17 3. Corporate Venturing in Deep Tech: What We Don’t Know 19 3.1 Unsolved Questions in the Literature 19 3.2 A Relevant Field 21 4. Our Results 22 4.1 Analyzed Population and Sample 22 4.2 Corporate Venturing in Deep Tech: Adoption Rates 22 4.3 Corporate Venturing in Deep Tech: What Keeps Chief Innovation Officers Up at Night 25 4.4 Corporate Venturing in Deep Tech: Tackling Problems with Architecture 28 5. Connecting the Dots: Now What? 37 5.1 How Can These Results Help Chief Innovation Officers Around the World? 37 6. Appendixes 41 2 IESE Business School Open Innovation 3 Authors Josemaria Siota Mª Julia Prats IESE Business School IESE Business School [email protected] [email protected] Researcher Vittoria Emanuela Bria IESE Business School Published in May 2021 4 IESE Business School Corporate Venturing Corporate Giants Innovating with Deep-Tech Start-ups The Case of East and Southeast Asia The Term Deep Tech Is Not New Understand this concept to implement, measure and improve it properly. Artificial intelligence Robotics and drones Deep tech is “a group of emerging technologies based on scientific discoveries or meaningful Advanced materials Photonics and electronics engineering innovations, offering a substantial advance over established technologies, and Biotechnology Quantum computing seeking to tackle some of the world’s fundamental Blockchain challenges.” Corporate Venturing In Deep Tech Is Growing at Speed Don’t miss the opportunity: Consider partnerships in this field with (and from) East and Southeast Asia too. -

TECHNOLOGY and INNOVATION REPORT 2021 Catching Technological Waves Innovation with Equity

UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT TECHNOLOGY AND INNOVATION REPORT 2021 Catching technological waves Innovation with equity Geneva, 2021 © 2021, United Nations All rights reserved worldwide Requests to reproduce excerpts or to photocopy should be addressed to the Copyright Clearance Center at copyright.com. All other queries on rights and licences, including subsidiary rights, should be addressed to: United Nations Publications 405 East 42nd Street New York, New York 10017 United States of America Email: [email protected] Website: https://shop.un.org/ The designations employed and the presentation of material on any map in this work do not imply the expression of any opinion whatsoever on the part of the United Nations concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. This publication has been edited externally. United Nations publication issued by the United Nations Conference on Trade and Development. UNCTAD/TIR/2020 ISBN: 978-92-1-113012-6 eISBN: 978-92-1-005658-8 ISSN: 2076-2917 eISSN: 2224-882X Sales No. E.21.II.D.8 ii TECHNOLOGY AND INNOVATION REPORT 2021 CATCHING TECHNOLOGICAL WAVES Innovation with equity NOTE Within the UNCTAD Division on Technology and Logistics, the STI Policy Section carries out policy- oriented analytical work on the impact of innovation and new and emerging technologies on sustainable development, with a particular focus on the opportunities and challenges for developing countries. It is responsible for the Technology and Innovation Report, which seeks to address issues in science, technology and innovation that are topical and important for developing countries, and to do so in a comprehensive way with an emphasis on policy-relevant analysis and conclusions. -

CES 2018 Highlights Global Innovation “VMI's Best of the Best”

CES 2018 Highlights Global Innovation “VMI’s Best of the Best” By Vanguard Marketing International, Inc. www.e-vmi.com v.2 February 2018 ©2018 Vanguard Marketing International, Inc. www.e-vmi.com VMI’s 2018 CES Best of the Best - January 2018 480-488-5707 Pg | 1 Welcome to CES® 2018 – The Year of Artificial Intelligence CES is the largest global gathering of innovation and connectivity! Top takeaways: Partnerships are driving innovation via underlying advancements in autonomy and Artificial Intelligence (AI) Significant US and Chinese AI cooperation, communication and creativity with no boundary; a good thing? Human Augmentation, Assistants and Health/Wellness… providing extraordinary benefits for all of us! Broke last year’s record of more than 184,000 attendees – Each VMI analyst walked 27+ miles over 4 days! From more than 150 countries At Eureka Park: Over 900 startups 55,000 international attendees ➢ National Science Foundation, Kickstarter 4,000 exhibiting companies Indiegogo, and International Incubators 2.75 million ft2 of exhibit space 6,500 members of the media See What’s Next, Be What’s Next! 20+ years attending CES, 10+ Annual VMI CES Best-of-the-Best Reports VMI Analysts canvas the halls, uncover enabling technologies and breakthroughs, and help our clients apply them to new growth initiatives For a personal or executive team webinar tour – contact us at 480-488-5707 or [email protected] Source 2018 CES is a registered trademark of Consumer Technology Association ©2018 Vanguard Marketing International, Inc. -

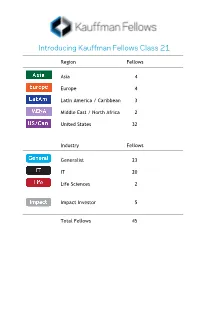

Introducing Kauffman Fellows Class 21

Introducing Kauffman Fellows Class 21 Region Fellows Asia 4 Europe 4 Latin America / Caribbean 3 Middle East / North Africa 2 United States 32 Industry Fellows Generalist 23 IT 20 Life Sciences 2 Impact Investor 5 Total Fellows 45 NICOLAS BERMAN Partner KaszeK Ventures [email protected] +54 (11) 4786-3426 www.kaszek.com Professional Nik is a Partner at KaszeK Ventures, a venture capital firm investing in high-impact technology-based companies whose main focus is Latin America. In addition to capital deployment, the firm actively supports its portfolio companies through value-added strategic guidance and hands-on operational help, leveraging its partners’ successful entrepreneurial backgrounds and extensive network. Before joining KaszeK Ventures, Nik worked for 13 years at MercadoLibre, where he was VP of Advertising, VP of Marketing, Marketing Manager, and covered several roles in the company’s technology and product areas. He led several key projects in search, business intelligence (BI), user experience (UX), and SEO, and created the company’s affiliate program, which is the largest in Latin America. During all these years, Nik has also been a very active advisor and angel investor in the Latin American startup scene. Prior to MercadoLibre, Nik was a Commercial Manager at LG Electronics, where he received the “LG Global Hit Idea” award for his innovative thinking. He currently sits on the boards of several technology companies, including DogHero, Contabilizei, and Pitzi. Education/Personal Nik earned a bachelor’s degree in business administration from the University of Buenos Aires (Argentina). He served as President of AMDIA (Argentina’s direct marketing association), received an Echo Award by the DMA in 2000, is currently an active mentor for Endeavor Argentina, and sits in the board of Educatina, a company focused on democratizing high-quality education across Latin America. -

When Brands Become Banks.Indd

When Brands Become Banks The development of embedded finance as evidenced by the German e-commerce industry Content 3 Foreword 4 Executive summary 5 What is embedded finance? The development and function of embedded finance The origins of embedded finance The current development What is the impact of embedded finance? Why is embedded finance relevant today? 10 Key dimensions of embedded finance Identification/KYC Account From user account to bank account Payments Cards The growing importance of virtual credit cards Credit Digital Assets The potential of embedded finance 24 Industry development and potential Embedded Finance at the industry level 27 Deep dive: e-commerce in Germany E-commerce in Germany – an overview The digitalization of retail in Germany Embedded finance in e-commerce The conversion potential in German e-commerce The e-commerce matrix Conversion potential based on trust indicators Conversion potential based on the direct survey Using an account Using a credit card Using a credit product Conversion potential – conclusion Market potential of embedded finance in Germany 41 What’s next? Content 2 Foreword Traditional banks are having a tough time. Years of These brands have recognized that by enriching low interest rates have squeezed margins to a sliver their products with financial services they are able and Basel IV has dampened their maneuverability – to benefit from higher customer stickiness, more or so they say. But what if external factors are not touchpoints and additional revenue streams. Further, the key driver -

Read Our 2018 IBC Industry Overview

2018 To Our Colleagues and Friends at IBC 2018 MediaBridge Capital Advisors is pleased to be attending IBC 2018. MediaBridge Co-founders and Managing Partners Ethan Jacks and John Bowen, and Industry Executive Advisors Courtney Spencer, Tom Ohanian (IBM Watson Media), Graham Sharp, David Schleifer, and Jeff Allen (Brandlive) will be in attendance throughout the Show. We look forward to meeting with our colleagues and partners in all market segments of the industry, discussing your strategic growth plans and options, and sharing our perspective on our recent transactions and other significant M&A and Private Equity financing transactions since last IBC. Ethan E. Jacks John C. Bowen Managing Partner Managing Partner [email protected] [email protected] 617.592.2739 (m) 617.921.0075 (m) 2 MediaBridge – Recent Transactions … advising eight top-tier media technology companies over the last several years in both M&A and capital-raising transactions: Solid State Logic (‘SSL’), the iconic manufacturer of high-end broadcast, live and studio mixing consoles and systems in its sale to Audiotonix, a global market leader in the design, engineering and manufacturing of professional audio mixing consoles and related products for the professional broadcast and live sound markets. Ultimatte, the industry standard chroma key/matting technology for broadcast and virtual Production Suites, in its acquisition by Blackmagic Design. Final Draft, the maker of the industry-standard Final Draft scriptwriting software for the film, television and other media industries, in its acquisition by Cast & Crew, a Silver Lake Partners portfolio company. Minnetonka Audio Software, the recognized world leader in file-based audio processing solutions for the professional marketplace, was acquired by The Telos Alliance. -

Govt Should Cut Stake in Public Banks: Abhijit

c m y k c m y k THE LARGEST CIRCULATED ENGLISH DAILY IN SOUTH INDIA CHENNAI I WEDNESDAY 23 I OCTOBER 2019 WEATHER Max: 31OC Min: 25OC WORLD TABLOID Rainfall: 3 mm Trudeau poised to form ‘Shaadi soon, but ASTROGUIDE minority govt invite fake’ Vikari: Aippasi 6 7 17 Tithi: Dashami www.facebook.com/deccannews, www.twitter.com/deccanchronicle, www.deccanchronicle.com Vol. 15 No. 207 Established 1938 | 32 PAGES | ` 3.00 Star:Aayilyam/ Magam Rahukalam: 12 noon to 1.30 pm INX MEDIA CASE Yamagandam: Indo-Pak pact on 7.30 am to 9 am PRAYERS Kartarpur likely to Fajar: 4.49 am SC grants bail to Chidambaram Zohar: 11.58 am be inked tomorrow Asar: 3.14 pm New Delhi, Oct. 22: India Maghrib: 5.46 pm and Pakistan have deferred but ED custody to continue by a day the signing of an Isha: 6.58 pm agreement to opera- SUNSET TODAY 5.47 PM tionalise the Kartarpur cor- New Delhi, Oct. 22: have any bearing in any SUNRISE TOMORROW 6.01 AM ridor due to logistical issu- Former finance minister other proceedings. MOONRISE TODAY 1.04 AM es, and the deal is now P. Chidambaram, who The statement made by the CBI that Chida- MOONSET TOMORROW 2.07 PM expected to be sealed Thur- spent 2 months in custody sday, official sources said. of enforcement agencies mbaram has influenced The ministry of external and jail, was on Tuesday witnesses and there was a affairs on Monday said granted bail in the INX likelihood of his further India would be ready to media corruption case influencing them cannot sign the agreement on the filed by the CBI but he be the ground to deny bail corridor on Wednesday. -

1000 UK AI Companies Profiles 110.%

1000 UK AI Companies Profiles 110.% Formerly 110%, Untapped is fueled by ambition. 110% untaps people, 110% untaps companies, 110% untaps social mobility. 110%'s mission is to empower people, organisations and society by combining the best human emotional intelligence expertise with the constantly evolving power of AI. 110% is accessible, scalable, and impactful. Everyone has a handpicked emotionally intelligent Accelerator at the end of their AI powered app. Everyone learns about themselves via data created from video consultations, messaging, daily reflection and handpicked content Web site: http://110percent.io/ Number of Employees: 1-10 Founded in: 2015 Based in: London, United Kingdom Founders: N/A Funding To Date: N/A Investors: N/A 636 10x 10x is a data-driven innovation consultancy. 10x helps brands get closer to their customers with data. 10x team features some of the world’s most talented innovation consultants & data scientists from firms like Google, M&C Saatchi & IDEO. Services: ● Strategy. 10x helps clients identify the key questions they need to answer about their business. 10x then works backwards to create a data strategy that delivers; ● Data Collection. Many clients have limited customer data so 10x provides a range of digital products which can be quickly deployed to collect customer data. 10x also creates bespoke data products for clients, when required; ● Analasys&Action. 10x employs machine learning algorithms to gain insights from the customer data they collect. Crucially these insights are turned into actionable recommendations which help increase sales & boost efficiencies. Web site: http://www.weare10x.com/ Number of Employees: 1-10 Founded in: 2015 Based in: London, United Kingdom Founders: Hew Leith Funding To Date: N/A Investors: N/A 637 11derma 11 derma is a cloud based platform that makes the early detection of melanoma a simple, more collaborative and effective process. -

Responder Technology Alert Monthly (Oct-Nov 2014) January 2015

PNNL-24014 Responder Technology Alert Monthly (Oct-Nov 2014) January 2015 JF Upton SL Stein PNNL-24014 Responder Technology Alert Monthly (Oct-Nov 2014) JF Upton SL Stein January 2015 Prepared for the Department of Homeland Security Science and Technology Directorate under Contract HSHQPM-14-X-00058. Pacific Northwest National Laboratory Richland, Washington 99352 PNNL RTA Monthly Report – October/November 2014 Acronyms and Abbreviations ACC accelerometer AR augmented reality CC carbon cotton DARPA Defense Advanced Research Projects Agency DCRS Dipole Coil Resonant System DHS Department of Homeland Security FCB fabric circuit board GPS global positioning system HRV heart rate and rate variability IoT Internet of things MA motion artefact NPL National Physical Laboratory PNNL Pacific Northwest National Laboratory RTA Responder Technology Alliance WHMS Wearable healthcare monitoring systems iii PNNL RTA Monthly Report – October/November 2014 Contents Acronyms and Abbreviations ........................................................................................................... iii 1.0 Introduction ............................................................................................................................. 1.1 2.0 Sensors ..................................................................................................................................... 2.2 2.1 Physiological ................................................................................................................... 2.2 2.1.1 3L Labs: Footlogger