Profiling Problem Projects Uganda's Bujagali

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Part of a Former Cattle Ranching Area, Land There Was Gazetted by the Ugandan Government for Use by Refugees in 1990

NEW ISSUES IN REFUGEE RESEARCH Working Paper No. 32 UNHCR’s withdrawal from Kiryandongo: anatomy of a handover Tania Kaiser Consultant UNHCR CP 2500 CH-1211 Geneva 2 Switzerland e-mail: [email protected] October 2000 These working papers provide a means for UNHCR staff, consultants, interns and associates to publish the preliminary results of their research on refugee-related issues. The papers do not represent the official views of UNHCR. They are also available online at <http://www.unhcr.org/epau>. ISSN 1020-7473 Introduction The Kiryandongo settlement for Sudanese refugees is located in the north-eastern corner of Uganda’s Masindi district. Part of a former cattle ranching area, land there was gazetted by the Ugandan government for use by refugees in 1990. The first transfers of refugees took place shortly afterwards, and the settlement is now well established, with land divided into plots on which people have built houses and have cultivated crops on a small scale. Anthropological field research (towards a D.Phil. in anthropology, Oxford University) was conducted in the settlement from October 1996 to March 1997 and between June and November 1997. During the course of the fieldwork UNHCR was involved in a definitive process whereby it sought to “hand over” responsibility for the settlement at Kiryandongo to the Ugandan government, arguing that the refugees were approaching self-sufficiency and that it was time for them to be absorbed completely into local government structures. The Ugandan government was reluctant to accept this new role, and the refugees expressed their disbelief and feelings of betrayal at the move. -

Bujagali Final Report

INDEPENDENT REVIEW PANEL COMPLIANCE REVIEW REPORT ON THE BUJAGALI HYDROPOWER AND INTERCONNECTION PROJECTS June 20, 2008 1 ACKNOWLEDGEMENTS The IRM Compliance Review Panel could not have undertaken and completed this report without the generous assistance of many people in Uganda and at the African Development Bank. It wishes to express its appreciation to all of them for their cooperation and support during the compliance review of the Bujagali Hydropower and Interconnection projects. The Panel thanks the Requesters and the many individuals from civil society and the communities that it met in the Project areas and in Kampala for their assistance. It also appreciates the willingness of the representatives of the Government of Uganda and the projects’ sponsors to meet with the Panel and provide it with information during its visit to Uganda. The Panel acknowledges all the help provided by the Resident Representative of the African Development Bank in Uganda and his staff and the willing cooperation it has received from the Bank’s Management and staff in Tunis. The Panel appreciates the generous cooperation of the World Bank Inspection Panel which conducted its own review of the “UGANDA: Private Power Generation Project”. The Compliance Review Panel and the World Bank Inspection Panel coordinated their field investigations of the Bujagali projects and shared consultants and technical information during this investigation in order to enhance the efficiency and cost effectiveness of each of their investigations. While this collaboration between the Panel and the World Bank Inspection Panel worked to the mutual benefit of both parties, each Panel focused its compliance review on its own Bank’s policies and procedures and each Panel has made its own independent judgments about the compliance of its Management and staff with its Bank’s policies and procedures. -

Legend " Wanseko " 159 !

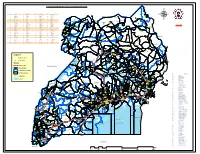

CONSTITUENT MAP FOR UGANDA_ELECTORAL AREAS 2016 CONSTITUENT MAP FOR UGANDA GAZETTED ELECTORAL AREAS FOR 2016 GENERAL ELECTIONS CODE CONSTITUENCY CODE CONSTITUENCY CODE CONSTITUENCY CODE CONSTITUENCY 266 LAMWO CTY 51 TOROMA CTY 101 BULAMOGI CTY 154 ERUTR CTY NORTH 165 KOBOKO MC 52 KABERAMAIDO CTY 102 KIGULU CTY SOUTH 155 DOKOLO SOUTH CTY Pirre 1 BUSIRO CTY EST 53 SERERE CTY 103 KIGULU CTY NORTH 156 DOKOLO NORTH CTY !. Agoro 2 BUSIRO CTY NORTH 54 KASILO CTY 104 IGANGA MC 157 MOROTO CTY !. 58 3 BUSIRO CTY SOUTH 55 KACHUMBALU CTY 105 BUGWERI CTY 158 AJURI CTY SOUTH SUDAN Morungole 4 KYADDONDO CTY EST 56 BUKEDEA CTY 106 BUNYA CTY EST 159 KOLE SOUTH CTY Metuli Lotuturu !. !. Kimion 5 KYADDONDO CTY NORTH 57 DODOTH WEST CTY 107 BUNYA CTY SOUTH 160 KOLE NORTH CTY !. "57 !. 6 KIIRA MC 58 DODOTH EST CTY 108 BUNYA CTY WEST 161 OYAM CTY SOUTH Apok !. 7 EBB MC 59 TEPETH CTY 109 BUNGOKHO CTY SOUTH 162 OYAM CTY NORTH 8 MUKONO CTY SOUTH 60 MOROTO MC 110 BUNGOKHO CTY NORTH 163 KOBOKO MC 173 " 9 MUKONO CTY NORTH 61 MATHENUKO CTY 111 MBALE MC 164 VURA CTY 180 Madi Opei Loitanit Midigo Kaabong 10 NAKIFUMA CTY 62 PIAN CTY 112 KABALE MC 165 UPPER MADI CTY NIMULE Lokung Paloga !. !. µ !. "!. 11 BUIKWE CTY WEST 63 CHEKWIL CTY 113 MITYANA CTY SOUTH 166 TEREGO EST CTY Dufile "!. !. LAMWO !. KAABONG 177 YUMBE Nimule " Akilok 12 BUIKWE CTY SOUTH 64 BAMBA CTY 114 MITYANA CTY NORTH 168 ARUA MC Rumogi MOYO !. !. Oraba Ludara !. " Karenga 13 BUIKWE CTY NORTH 65 BUGHENDERA CTY 115 BUSUJJU 169 LOWER MADI CTY !. -

Executive Summary

KARUMA HPP (600 MW) __________________________________________ EIPL Executive Summary Uganda is currently facing a huge electricity supply deficit; it has one of the world’s lowest levels of electricity development as well as the lowest per capita electricity consumption. Over 90 percent of the country's population is not connected to the national grid, much of the electricity network at present is poorly maintained and country the experiences frequent power cuts. According to the National Development Plan (NDP- 2010/11-2014) the present peak demand of Uganda is about 400 MW or more which has been growing at an annual rate of 8%, to meet this growth with demand about 20 MW of new generating capacity needs to be added each year. NDP further identifies that, current levels of electricity supply cannot support heavy industries limited generation capacity and corresponding limited transmission and distribution network as among other key constraints to the performance of the energy sector in the country. Given the large and growing gap between electricity supply and demand in Uganda, a number of electricity generation alternatives were explored under Rural Electrification Programme for next 20 years. Studies over various planning horizons were also examined and prioritized for the country under the Hydropower Master Plan. The conclusions from the evaluation of these generation alternatives reveals that large scale hydroelectric development is the most economical way forward for the country in the short-medium term. Therefore, to meet the growing electricity demand seven potential hydropower sites have been examined downstream of Bujagali Hydro Power Project (which is already under construction) over River Victoria Nile from Lake Victoria to Lake Albert as river is the primary hydrological resource available in country. -

Ministry of Energy and Mineral Development

THE REPUBLIC OF UGANDA Ministry of Energy and Mineral Development Energy and Mineral Development Sector Sector Development Plan 2015/16 – 2019/20 June 2015 Foreword The Energy and Mineral Development Sector Development Plan (EMDSDP) defines the sector development agenda for the next 05 (five) financial years from FY2015/16 to 2019/20. This plan is a culmination of a comprehensive sector review process grounded on a new National Planning Framework, the Vision 2040, the second National Development Plan (NDP II) and the various sector policies. The theme for the vision 2040 is, “a transformed Ugandan society from a peasant to a modern and a prosperous country with 30 years”. The theme for the second National Development Plan (NDP II) is “strengthening Uganda’s competitivesness for sustainable wealth creation, employment and inclusive growth”. In line with the vision 2040 and the NDP II theme, the Energy and Mineral Development (EMD) sector, through the Ministry of Energy and Mineral Development is set to continue implementing its prioirities under its mandate. The Ministry’s mandate is to: “Establish, promote the development, strategically manage and safeguard the rational and sustainable exploitation and utilization of energy and mineral resources for social and economic development”. The medium term priorities of the ministry are: - (i) increase electricity generation capacity and expand the transmission network; (ii) increase access to modern energy services through rural electrification and renewable energy development; (iii) promote and monitor petroleum exploration and development in order to achieve sustainable production of oil and gas resources; (iv) develop petroleum refining and pipeline transportation infrastructure; (v) streamline petroleum supply and distribution to promote free and fair competition in petroleum supply and marketing industry; and (vi) promote and regulate mineral exploration, development, production and value addition. -

THE UGANDA WILDLIFE ACT. Statutory Instrument 200—6

THE UGANDA WILDLIFE ACT. Statutory Instrument 200—6. The Uganda Wildlife (Wildlife Reserve Declaration) (No. 2) Instrument. Arrangement of Paragraphs. Paragraph 1. Citation. 2. Declaration of Karuma Wildlife Reserve. Schedule Schedule Boundaries of the Karuma Wildlife Reserve. THE UGANDA WILDLIFE ACT. Statutory Instrument 200—6. The Uganda Wildlife (Wildlife Reserve Declaration) (No. 2) Instrument.1 (Under sections 17 and 18 of the Act.) 1. Citation. This Instrument may be cited as the Uganda Wildlife (Wildlife Reserve Declaration) (No. 2) Instrument. 2. Declaration of Karuma Wildlife Reserve. The area of land specified in the Schedule to this Instrument is declared a wildlife reserve to be known as the Karuma Wildlife Reserve. _____ Schedule. para. 2. Boundaries of the Karuma Wildlife Reserve. The area comprised within the following boundaries— Commencing at the Karuma Falls Bridge; thence southerly along the west side of the road to Kiryandongo until it is crossed by the boundary between the Sabagabo and Mumyuka gombololas at map reference VT 093 265; thence westerly along that boundary to map reference VT 053 278; thence westerly along the southern edge of a swamp and river to a river junction at map reference UT 984 261; thence southwesterly in a straight line to the junction of the rivers Titi and Nyakinombo; thence westerly in a straight line to the junction of the rivers Weiga and Nyamiringa; thence southerly along the thalweg of the River Weiga to its junction with the River Nyamizi; thence along the thalweg of the River Nyamizi to map reference UT 572 048; thence along the straight line to the Kyabatwa triangulation station until it crosses the Masindi- 1See the footnote to S.I. -

World Bank Document

Report No: ACS12528 . Public Disclosure Authorized Republic of Uganda Leveraging Oil and Gas Industry for the Development of a Competitive Private Sector in Uganda Public Disclosure Authorized . March 25, 2015 . Public Disclosure Authorized GTCDR AFRICA . Public Disclosure Authorized 1 Standard Disclaimer: This volume is a product of the staff of the International Bank for Reconstruction and Development/ The World Bank. The findings, interpretations, and conclusions expressed in this paper do not necessarily reflect the views of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Copyright Statement: The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development/ The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. For permission to photocopy or reprint any part of this work, please send a request with complete information to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, USA, telephone 978-750-8400, fax 978-750-4470, http://www.copyright.com/. All other queries on rights and licenses, including subsidiary rights, should be addressed to the Office of the Publisher, The World Bank, 1818 H Street NW, Washington, DC 20433, USA, fax 202-522-2422, e-mail [email protected]. -

Heroes of Modern Africa, True Stories of the Intrepid Bravery and Stirring Adventures of the Pioneers, Explorers and Founders Of

' ^$? -^ K^ ^ *^ ^^ «^ *^ <^ *i^ «*• ^> x^ <*^ ^ tf^aiMikaaMiaiMMfiMl HEROES OF MODERN AFRICA /;^^^ !>f--4 if 1 tUifA >Cv'^ i vi^ <;- ;^!! I' ' 7 ,^^^ -C \k,— ^^ ' "' '^-^-— • *^' i I i frw T /. •*li'T-ni ! n iiiirririf MTMiti '4^/' ->^ ^ <^ ^- 4> ^'^ ^' ', y / LcM^i^ THE LIBRARY OF THE UNIVERSITY OF CALIFORNIA LOS ANGELES — THE LIBRARY OF ROMANCE Lavishly Illustrated. Ex. Crown Svo. ss. tach volume " Splendid volumes." TA* Outlaoh "Gift Books whose value it would be difficult to over-estimate. "—r/4f.S"//i«<Ajrrf "This series has now won a considerable and well-deserved rcRutatioa." The Guardian THE ROMANCE OF Continued THE LIBRARY OF ROMANCE Each volume profusely illustrated. Ex. Crown %vo. t^s, " The Library of Romance offers a splendid choice."—GMe. THE ROMANCE OF AERONAUTICS HEROES OF MODERN AFRICA £*4j»7'<£J!!fi^ The Bombardment of Algiers V\ hen Lord Exniouth attacked this den of piracy and cruelty, even the British women served at the same guns as their husbands, and never shrank. HEROES OF MODERN AFRICA TRUE STORIES OF THE INTREPID BRAVERY AND STIRRING ADVENTURES OF THE PIONEERS, EXPLORERS, AND FOUNDERS OF MODERN AFRICA BY EDWARD GILLIAT, M.A. (Oxon.) SOMETI.MF. MASTER AT HARROW SCHOOL AUTHOR OF "forest OUTLAWS," "HEROES OF MODERN INDIA, &'C. &>€. WITH SIXTEEN ILLUSTRATIONS LONDON SEELEY, SERVICE b' CO. LIMITED 38 Great Russell Street 1911 — UNIFORM WITH THIS VOLUME HEROES OF THE WORLD SERIES Extra Crown Sva. IVith many illustrations, s^. each. HEROES OF MISSIONARY ENTERPRISE. By the Rev. Claud Field, M.A., sometime C.M.S. Missionary in the Punjaub. "Every chapter is an inspiration."— G^^u-y News. -

NAPE Lobby 39Th Edition-Modified.Indd

April 2008 February 2012 39th Edition Dubious Oil Deals in Africa The Uganda oil industry is currently at the epicenter of corruption amidst efforts to introduce greater transparency in the manage- ment of the resource. Human factors in oil-related corruption is seen to play a bigger role in lifting the pending oil resource curse. Public demand for transparency and accountability is necessary, but not enough to solve the problem. Government officials named in corrupt practices must desist from the vice. To reduce the degree of severity of corrupt practices, genuine efforts must be made to assist people to recognize the negative significance of these human factors and work towards reducing them. The primary sources of political-corporate corruption is decay of transparency and accountability which lead to economic scandals and total national de-development. Oil and other natural resources are present across Africa. But how have the Africans benefited from the abandat resource? Editorial The Uganda oil industry started on a wrong footing. It is has exhibiting corrupt tendencies even before a drop of oil begins to flow. Bribery scandals involving millions of dollars and high profile government officials have stunned the country. News Uganda’s increasingly skeptical population fears that .....................................3 the oil wealth will not actually benefit the impoverished masses but a few in power and manifests a curse! .....................................6 The recent extraordinary events have been, to a great ............................8 degree, inspired by a collective sense of resentment at the mystery involving oil revenue sharing agreements .....................................10 hurriedly signed between Uganda government and Tullow Oil .....................................13 The local press, for some time now, has been reporting .....................................16 scandals in Uganda oil industry. -

Railways and Development in Uganda

EAST AFRICAN STUDIES m <8 RAILWAYS AND DEVELOPMENT IN UGANDA A. M. O'Connor EAST AFRICAN INSTITUTE OF SOCIAL RESEARCH OXFORD UNIVERSITY PRESS RAILWAYS AND DEVELOPMENT IN UGANDA A Study in Economic Geography A. M. O'CONNOR LECTURER IN GEOGRAPHY AT MAKERERE UNIVERSITY COLLEGE, KAMPALA Published on behalf of The East African Institute of Social Research by OXFORD UNIVERSITY PRESS NAIROBI 1965 Oxford University Press, Amen House, London E.C.4 GLASGOW NEW YORK TORONTO MELBOURNE WELLINGTON BOMBAY CALCUTTA MADRAS KARACHI LAHORE DACCA CAPE TOWN SALISBURY NAIROBI IBADAN ACCRA KUALA LUMPUR HONG KONG © East African Institute of Social Research 1965 RAILWAYS AND DEVELOPMENT IN UGANDA Oxford University Press, Amen House, London E.C.4 GLASGOW NEW YORK TORONTO MELBOURNE WELLINGTON BOMBAY CALCUTTA MADRAS KARACHI LAHORE DACCA CAPE TOWN SALISBURY NAIROBI 1BADAN ACCRA KUALA LUMPUR HONG KONG © East African Institute of Social Research 1965 RAILWAYS AND DEVELOPMENT IN UGANDA MAPS 1. Uganda: Cotton Production 2. Uganda: Sugar Movements 3. Uganda: Petrol Prices 4. Mukono Area: Settlement Pattern. 5. Western Uganda: Mean Annual Rainfall 6. Western Uganda: Density of Population .. 7. Western Railway: Anticipated Traffic 8. Western Railway: 1960-1962 Traffic 9. Northern Uganda: Mean Annual Rainfall 10. Northern Uganda: Density of Population East Africa: Railways Uganda: Transport Facilities, 1960 Uganda: Transport Facilities, 1964 PREFACE VISITORS to Uganda often see the country as a green oasis in a predomi- nantly brown continent, even as a land of plenty where man does not have to struggle against a harsh environment as in much of Africa. Yet Uganda is by no means a rich country: its people have an annual cash income of only about £15 per head, and the figure is not rising at all at present. -

12023784 10.Pdf

Annex 3: Baseline Survey Report <Fish> 1 Survey objectives The purpose of the survey was to identify important areas for the various fish species in and around the Ayago Hydropower Project area. The results of the survey would indicate the location of the critical areas/habitat types for various resident fish species. Physical water quality would be measured in the field using electronic probes to give a quick indication on habitat quality. A comparison with results of similar surveys on River Nile would be made to gauge the importance of Ayago hydropower project area as habitats for fishery biodiversity. 2 Survey methodology The fish survey was conducted along the south and north banks of River Nile within the Ayago Hydropower Project area. In particular fish surveys were made in the following zones: i The south and north banks of the proposed inflow and outflow zones of the hydropower generation tunnel; ii The zone of convergence of River Ayago and other selected tributaries, with River Nile along the north and south banks. Six survey points with a total of 17 sites were identified and surveyed. Selection of the survey sites was representative of the major habitat types including river mouths, bays, water flow characteristics notably turbulent waters close to rapid, areas of counter currents, and waters with moderate flow. The handline with a long cable, basket traps and gillnets of various sizes were the most practical sampling gear from the river banks. A castnet was at times deployed. Hand lines were often deployed to less than 30 m offshore due to heavy presence of hippos. -

A Quick Analysis of Karuma Hydro Power Project's Social and Environmental Concerns

A quick Analysis of Karuma Hydro Power Project’s Social and Environmental Concerns. By National Association of Professional Environmentalists. August 2013 Produced With financial assistance from Isvara Foundation and Friends of the Earth International Karuma Hydro Power Issues 1 Frame work / Table of contents 1. Background / introduction 3 2. Karuma tender awarded without competitive bidding 4 3. Environment Concerns a) Submergence of Land and Vegetation b) Earth / soil material dumping c) River water divergence d) Air and water pollution 4. Poor Valuation and Compensations 4 5. Resettlement 5 6. Failure to consider alternatives 6 7. Peoples Issues of concern on ground 7 i) No Compensation 7 ii) Poor compensations 8 iii) Delay of compensation 8 iv) Militarization of the place 8 v) Suppression of the community actions against the project activities 9 8. Lessons from Bujagali 9 9. Has Karuma’s Developers learnt any lessons from Bujagali controversies? 10 10. Information disclosure, power parches agreement and affordability 11 11. Local leaders 11 12. Ministry of Energy position 11 13. Raised Expected 12 14. Observations 13 15. Issues to follow up 13 2 Karuma Hydro Power Issues 1. Introduction / Background Karuma Hydro-Electric Station is a 600MW proposed power plant that will be located on Victoria Nile down-stream of Lake Kyoga. The project will be jointly developed by the Ministry of Energy and Mineral Development (MEMD) and Electricity Generation Company Limited (UECDL). Specifically, the new Karuma Hydro Power Project will be located at Karuma at Latitude 20 15’ N and Longitude 320 15’ E on Victoria Nile with project area falling in Kiryandongo and Oyam Districts OF Uganda.