Meet Our Speakers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ADV Part 2A: Firm Brochure

Firm Brochure Part 2A Natixis Advisors, LLC (“Natixis Advisors”) Natixis Investment Managers Solutions, a division of Natixis Advisors (“Solutions”) Boston Office San Francisco Office 888 Boylston Street 101 Second Street, Suite 1600 Boston, MA 02199 San Francisco, CA 94105 Phone: 617-449-2835 Phone: 617-449-2838 Fax: 617-369-9794 Fax: 617-369-9794 www.im.natixis.com This brochure provides information about the qualifications and business practices of Natixis Advisors. If you have any questions about the contents of this brochure, please contact us at 617-449-2838 or by email at [email protected]. The information in this brochure has not been approved or verified by the United States Securities and Exchange Commission (“SEC”) or by any state securities authority. Additional information about Natixis Advisors is available on the SEC’s website at www.adviserinfo.sec.gov. Registration does not imply that any particular level of skill or training has been met by Natixis Advisors or its personnel. August 4, 2021 1 Important Note about this Brochure This Brochure is not: • an offer or agreement to provide advisory services to any person; • an offer to sell interests (or a solicitation of an offer to purchase interests) in any fund that we advise; or • a complete discussion of the features, risks, or conflicts associated with any advisory service or fund. As required by the Investment Advisers Act of 1940, as amended (the “Advisers Act”), we provide this Brochure to current and prospective clients. We also, in our discretion, will provide this Brochure to current or prospective investors in a fund, together with other relevant offering, governing, or disclosure documents. -

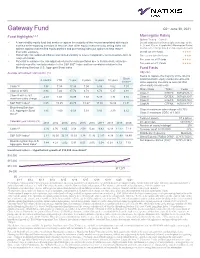

Gateway Fund

Gateway Fund Q2 • June 30, 2021 Fund Highlights1,2,3 Morningstar Rating Options Trading – Class Y • A low-volatility equity fund that seeks to capture the majority of the returns associated with equity Overall rating derived from weighted average of the markets while exposing investors to less risk than other equity investments by selling index call 3-, 5- and 10-year (if applicable) Morningstar Rating options against a diversified equity portfolio and purchasing index put options to help reduce metrics; other ratings based on risk-adjusted returns downside exposure Overall out of 81 funds ★★★★ • Historically has outpaced inflation and limited volatility to a level comparable to intermediate-term to Three years out of 81 funds ★★★ long term bonds Five years out of 57 funds • Potential to enhance the risk-adjusted returns for many portfolios due to its historically attractive ★★★★ risk/return profile, low beta relative to the S&P 500® Index and low correlation relative to the Ten years out of 11 funds ★★★★ Bloomberg Barclays U.S. Aggregate Bond Index Fund Facts Average annualized total returns† (%) Objective Seeks to capture the majority of the returns Since 3 months YTD 1 year 3 years 5 years 10 years associated with equity market investments, 1/1/88** while exposing investors to less risk than Class Y5 3.98 7.34 17.98 7.04 6.98 5.62 7.01 other equity investments Share Class Ticker Cusip Class A at NAV 3.94 7.24 17.72 6.78 6.72 5.37 6.91 Class Y GTEYX 367829-88-4 Class A with 5.75% -2.04 1.08 10.95 4.69 5.47 4.74 6.72 Class A GATEX 367829-20-7 maximum sales charge Class C GTECX 367829-70-2 ® 8 S&P 500 Index 8.55 15.25 40.79 18.67 17.65 14.84 11.31 Class N GTENX 367829-77-7 Bloomberg Barclays U.S. -

Snapshot of Notable Global COO, CIO and CISO Moves and Appointments

Snapshot of notable global COO, CIO and CISO moves and appointments September 2016 For the latest EMEA, Americas and Asia Pacific moves across: Analytics Data Corporate Services Cyber-Security Facilities Operations Procurement Technology Vendor Management Snapshot of notable global Operations and Technology moves and appointments Page 1 / 6 Next update due: January 2017 People Moves FS EMEA John Burns, the former CTO of Pioneer Investments, joins Cyril Reol, former Glencore CIO, has joined Man Group Deutsche Bank as Global CIO, COO Asset Management as Deputy CTO. Garry Beaton, former Global Head of Operations at Core Technology . Andrew Brown, former Barclays UK Private Bank Chief of Ashmore, joins the Abu Dhabi Investment Authority as its Tom Waite, joins Deutsche Bank as an MD within Staff, has joined US Expat and Fatca Specialist Maseco Global Head of Operations. electronic trading. Waite joined from Bank of America, Private Wealth as its COO. Lesley Cairney has joined Artemis Investment where he was also an MD. Before that, he was an MD at Ken Moore, former Head of Citi Innovation Labs, joins Management as COO. She was formerly at Henderson Goldman Sachs for six years until May 2014. MasterCard as EVP Labs, running global innovation. Global Investors as COO. Amish Popat joins Dromeus Capital Group as COO from David Grant has joined Nationwide as Head of IT and Lewis Love, the former Global Chief Procurement Officer New Amsterdam Capital, where he was the Finance and Security Risk from Lloyds Banking Group, where he was for Aon has been named as the COO for Bank of Ireland, Operations Manager. -

Krause Fund Research Spring 2020

Krause Fund Research Spring 2020 The Carlyle Group (CG) April 14, 2020 Stock Rating HOLD Financial Services – Alternative Asset Management Analyst Target Price $25 - 27 Justin Koress Krause Fund DCF Model $27 [email protected] Relative P/E Ratio (EPS20) $21 Relative P/B Ratio $25 Investment Thesis Price Data Current Stock Price $22.68 We recommend a HOLD rating for The Carlyle Group because of its diversified 52Wk RanGe $15.21 - $34.98 investments within key drivers in the Asset Management industry, such as Key Statistics corporate private equity, with an emphasis to capitalize on the ESG investment Market Cap (B) $7.90 trend. However, CG’s use of leverage will expose them to extreme risks associated Shares OutstandinG (M) 348.23 with COVID-19. Five Year Beta 1.77 Current Dividend Yield 4.17% Drivers of Thesis Price/EarninGs (TTM) 8.04x Price/EarninGs (FY1) 13.98x • With private capital dry powder at a record $2.3 trillion dollars, Profitability alternative managers will be able to create high-quality investments at Profit MarGin 35.07% distressed valuations in response to COVID-19. Return on Equity (TTM) 39.88% Return on Assets (TTM) 17.15% • CGs management team has a proven track record in locating Debt to Equity Ratio 365.01% companies that weather economic downturns, providing tremendous investment opportunities in a destabilized market. 25.00 • The alternative asset management business is intensely competitive, with competition based on a variety of factors, including investment 20.00 performance, a record number of private investment funds, and lack of 19.00 20.28 investor liquidity due to COVID-19. -

Golden Capital Large Cap Core Select UMA Wells Fargo Funds Management

Golden Capital Large Cap Core Product Placed on Watch Select UMA Wells Fargo Funds Management, LLC Style: US Large Cap Year Founded: 1971 Sub-Style: Blend GIMA Status: Approved 525 Market Street, 12th Floor Firm AUM: $512.5 billion Firm Ownership: Wells Fargo & Co. San Francisco, California 94105 Firm Strategy AUM: $368.6 million Professional-Staff: 1468 PRODUCT OVERVIEW TARGET PORTFOLIO CHARACTERISTICS PORTFOLIO STATISTICS Wells Fargo Asset Management's large cap core equity investment Number of stock holdings: 45 to 50 ---------------06/21------ 12/20 strategy's primary objective is long-term capital appreciation. Wells ---------- P/E ratio: Below the S&P 500 Wells Index*** Wells Fargo's goal is to produce excess returns above the S&P 500 Index. Fargo Fargo Golden's large cap core investment philosophy is to construct an actively Cash level over market cycle: 0 to 3% Number of stock holdings 52 505 52 managed, core portfolio of companies that exhibit the likelihood to meet Risk (standard deviation): Similar to/Below the S&P 500 or exceed earnings expectations. Golden uses proprietary, multifactor Dividend Yield 1.3% 1.4% 1.4% models that combine valuation, earnings and momentum factors to Average turnover rate: 30 to 60% identify the characteristics within each company that make it Distribution Rate — — — Use ADRs: No unsustainably cheap. Risk is managed through diversification by 19.79x 25.40x 23.00x avoiding concentration in any one security or industry while generally Capitalization: Mega, Large and Medium Wtd avg P/E ratio ¹ adhering to sector weights of +/- 5% to those of the S&P 500 Index. -

Eli 022807Me

ORANGE COUNTY TREASURER-TAX COLLECTOR APPROVED ISSUER LIST COMMERCIAL PAPER / MEDIUM TERM NOTES AS OF: 2/28/2007 CR S/T RATINGS L/T RATINGS PROG RATINGS IND. ISSUER (Shared Structure) # S&P MDY FI S&P MDY FI S&P MDY FI PARENT/ ADMINISTRATOR CODE ADP TAX SERVICES INC 1 A-1+ P-1 NR AAA Aaa NR A-1+ P-1 NR AUTO DATA PROCES 9.4 ALCON CAPITAL CORP 1 A-1+ P-1 NR NR NR NR A-1+ P-1 F1+ NESTLE SA 4.7 AMERICAN HONDA FINANCE 9 A-1 P-1 F1 A+ A1 *+ NR A-1 P-1 F1 AMER HONDA MOTOR 3.3 AMSTERDAM FUNDING CORP 7 NR NR NR NR NR NR A-1 P-1 NR ABN AMRO Bank N.V 7.4 AB AUTOMATIC DATA PROCESSNG 1 A-1+ P-1 NR AAA Aaa NR A-1+ P-1 NR AUTOMATIC DATA PROCESSING, INC. 9.4 AQUINAS FUNDING LLC 3 NR NR NR NR NR NR A-1+ P-1 NR RABOBANK NEDERLAND 7.4 AB ASPEN FUND (w/ Newport Fund) 3 NR NR NR NR NR NR A-1+ P-1 F1+ DEUTSCHE BANK AG 7.4 AB BANK OF AMERICA CORP 5 A-1+ P-1 F1+ AA Aa2 AA A-1+ P-1 F1+ DOMESTIC BANK/FDIC INSURED 7.1 BARCLAYS US FUNDING LLC 4 A-1+ P-1 F1+ AA Aa1 AA+ A-1+ P-1 NR BARCLAYS BK PLC 7.4 BARTON CAPITAL LLC 3 NR NR NR NR NR NR A-1+ P-1 NR SOC GENERALE 7.4 AB BEETHOVEN FUNDING CORP 7 NR NR NR NR NR NR A-1 P-1 NR DRESDNER BANK, AG 7.4 AB BETA FINANCE INC 1 A-1+ P-1 F1+ AAA Aaa AAA A-1+ P-1 F1+ 7.4 AB BMW US CAPITAL LLC 9 A-1 P-1 NR NR A1 NR A-1 P-1 NR BMW AG 3.3 BNP PARIBAS FINANCE INC 5 A-1+ P-1 F1+ AA Aa2 NR A-1+ P-1 NR BNP PARIBAS 7.4 BRYANT PARK FUNDING LLC 7 NR NR NR NR NR NR A-1 P-1 NR HSBC 7.4 AB CALYON NORTH AMERICA INC 6 A-1+ P-1 F1+ AA- Aa2 AA A-1+ P-1 F1+ CALYON 7.1 CATERPILLAR FIN SERV CRP 10 A-1 P-1 F1 A A2 A+ A-1 P-1 F1 CATERPILLAR INC 8.8 CATERPILLAR INC 10 A-1 P-1 F1 A A2 A+ A A2 A+ #N/A N Ap 8.8 CC USA INC 1 A-1+ P-1 NR AAA Aaa NR AAA Aaa NR SECURITY TRUST 7.4 AB CHARIOT FUNDING LLC 7 NR NR NR NR NR NR A-1 P-1 NR JP MORGAN CHASE 7.4 AB CIT GROUP INC 10 A-1 P-1 F1 A A1 A A-1 P-1 F1 #N/A N Ap 7.4 CITIGROUP FUNDING INC 4 A-1+ P-1 F1+ AA Aa1 AA+ A-1+ P-1 F1+ FORMERLY TRAVELERS GROUP INC. -

J.P. Morgan's Expression of Interest to Act As Global Co-Ordinator And

CONFIDENTIAL J.P. Morgan’s expression of interest to act as Global Co-ordinator and Bookrunner in connection with the Íslandsbanki IPO J.P. Morgan is pleased to express its interest to act as Global Co-ordinator and Bookrunner in connection with the sale process of the Icelandic State Financial Investments’ holdings in Íslandsbanki. J.P. Morgan is a leading global investment bank with a market capitalisation of $427bn and total assets of $3.4trn (December 2020). J.P. Morgan’s global headquarters are in New York, while our European headquarters are in London. We have a strong presence and track record in the Nordic region and our commitment to the region is evidenced by our local offices across the region. J.P. Morgan offers ISFI a full range of investment banking services and will provide first class advice in connection with the sale process of its holdings in Íslandsbanki. We are a global leader in areas such as equity and equity linked capital markets, debt capital markets, M&A advisory, ratings advisory and equity and debt sales, research and trading. J.P. Morgan team for Íslandsbanki Senior project leadership and sponsorship Andreas Lindh, Co-Head of EMEA FIG Stefan Weiner, Head of Northern Europe ECM Kari Hallgrimsson, Senior Country Sponsorship Nordic FIG Advisory European ECM Christian Kornhoff, Executive Director Vittorio Rivaroli, Executive Director Filiph Nilsson, Analyst Emese Pavlik, Associate Kim-Jonas Pellikka, Analyst Vincent Collan, Analyst FIG DCM Ratings Advisory Kiran D. Karia, Executive Director Jens Rasmussen, Executive Director J.P. Morgan contact details Andreas Lindh Registered address: Full legal name: Taunustor 1 J.P. -

Private Debt in Asia: the Next Frontier?

PRIVATE DEBT IN ASIA: THE NEXT FRONTIER? PRIVATE DEBT IN ASIA: THE NEXT FRONTIER? We take a look at the fund managers and investors turning to opportunities in Asia, analyzing funds closed and currently in market, as well as the investors targeting the region. nstitutional investors in 2018 are have seen increased fundraising success in higher than in 2016. While still dwarfed Iincreasing their exposure to private recent years. by the North America and Europe, Asia- debt strategies at a higher rate than focused fundraising has carved out a ever before, with many looking to both 2017 was a strong year for Asia-focused significant niche in the global private debt diversify their private debt portfolios and private debt fundraising, with 15 funds market. find less competed opportunities. Beyond reaching a final close, raising an aggregate the mature and competitive private debt $6.4bn in capital. This is the second highest Sixty percent of Asia-focused funds closed markets in North America and Europe, amount of capital raised targeting the in 2017 met or exceeded their initial target credit markets in Asia offer a relatively region to date and resulted in an average size including SSG Capital Partners IV, the untapped reserve of opportunity, and with fund size of $427mn. Asia-focused funds second largest Asia-focused fund to close the recent increase in investor interest accounted for 9% of all private debt funds last year, securing an aggregate $1.7bn, in this area, private debt fund managers closed in 2017, three-percentage points 26% more than its initial target. -

Market Monitor

MARKET MONITOR M&A and financing update 1st Quarter 2020 “There are decades where nothing happens; and there are weeks where decades happen” said Vladimir Lenin Indeed for many of us, the last few weeks of “interesting times” seemed undoubtedly like decades. We are hearing “unprecedented” as often as “coronavirus”. An increasingly common sentiment is that “this time is different.” Lately, the comparisons to past events such as the Great Recession, September 11th, and Black Monday have been questioned. But, relatively little attention has been given to the oil price shock that may have more significant long-term economic implications than COVID-19. The lack of precedent, or our ability to recognize precedent where it’s relevant, will test leadership at all levels of the U.S. economy as monetary, fiscal, and regulatory policy levers are being pulled to create a baseline and a path forward. From February 11th to March 12th, the Dow Industrial average dropped 28%, sending the U.S. into a bear market. On March 9th the stock market experienced its first trading halt when the S&P 500 declined 7%. The capital markets took notice and continued forward. On March 12th when the second trading halt occurred the gravity of the situation intensified and the capital markets began to pause. By noon, almost every M&A sale process was stopped due to the very real threat of COVID-19 on the U.S. economy as the hospitality industry closed its doors, social gathering was restricted by local governments, and employers quickly shifted to work from home models. -

2Q21 GS Earnings Release

Second Quarter 2021 Earnings Results Media Relations: Andrea Williams 212-902-5400 Investor Relations: Carey Halio 212-902-0300 The Goldman Sachs Group, Inc. 200 West Street | New York, NY 10282 Second Quarter 2021 Earnings Results Goldman Sachs Reports Second Quarter Earnings Per Common Share of $15.02 and Increases the Quarterly Dividend to $2.00 Per Common Share “Our second quarter performance and record revenues for the first half of the year demonstrate the strength of our client franchise and our continued progress on our strategic priorities. While the economic recovery is underway, our clients and communities still face challenges in overcoming the pandemic. But, as always, I am proud of the dedication and resilience of our people, who have worked tirelessly to help our clients navigate the ever-changing market environment.” - David M. Solomon, Chairman and Chief Executive Officer Financial Summary Net Revenues Net Earnings EPS 2Q $15.39 billion 2Q $5.49 billion 2Q $15.02 2Q YTD $33.09 billion 2Q YTD $12.32 billion 2Q YTD $33.64 Annualized ROE1 Annualized ROTE1 Book Value Per Share 2Q 23.7% 2Q 25.1% 2Q $264.90 2Q YTD 27.3% 2Q YTD 28.9% YTD Growth 12.2% NEW YORK, July 13, 2021 – The Goldman Sachs Group, Inc. (NYSE: GS) today reported net revenues of $15.39 billion and net earnings of $5.49 billion for the second quarter ended June 30, 2021. Net revenues were $33.09 billion and net earnings were $12.32 billion for the first half of 2021. Diluted earnings per common share (EPS) was $15.02 for the second quarter of 2021 compared with $0.53 for the second quarter of 2020 and $18.60 for the first quarter of 2021, and was $33.64 for the first half of 2021 compared with $3.66 for the first half of 2020. -

Blackstone, Goldman Lead $1.25B Bet on City Offices

July 26, 2021 Link to Article Blackstone, Goldman lead $1.25B bet on city offices Blackstone Group Inc. and Goldman Sachs Group Inc. are leading financing for the $1.25 billion redevelopment of a 19th-century warehouse on Manhattan’s west side into a 21st-century office complex. The financing marks the largest construction deal so far this year in Manhattan, according to a statement Friday by L&L Holding Co. and Columbia Property Trust, developers of the Terminal Warehouse, which occupies an entire block in the West Chelsea neighborhood. The project is moving ahead without a major tenant at an uncertain time for New York’s office market. The city has a record amount of space available, and employees have been slow to return from pandemic work-from-home arrangements. Terminal Warehouse is south of Hudson Yards, where new skyscrapers have drawn major financial and technology tenants. “Our ability to secure financing in this current environment is both a testament to the merits of this project as well as a show of the investment community’s continued faith in the future of New York City’s economy,” Robert Lapidus, L&L’s chief investment officer, said in the statement. Blackstone’s real estate debt platform led the financing, with Goldman and KKR & Co. participating in $974 million of senior debt. Oaktree Capital Management led $274 million in junior mezzanine financing in partnership with Paramount Group. “This property is rich in history and we are excited to be part of another high-quality office addition to the growing Hudson Yards and broader west side area of Manhattan,” Michael Eglit, managing director in Blackstone’s Real Estate Debt Strategies group, said in an email. -

TRS Contracted Investment Managers

TRS INVESTMENT RELATIONSHIPS AS OF DECEMBER 2020 Global Public Equity (Global Income continued) Acadian Asset Management NXT Capital Management AQR Capital Management Oaktree Capital Management Arrowstreet Capital Pacific Investment Management Company Axiom International Investors Pemberton Capital Advisors Dimensional Fund Advisors PGIM Emerald Advisers Proterra Investment Partners Grandeur Peak Global Advisors Riverstone Credit Partners JP Morgan Asset Management Solar Capital Partners LSV Asset Management Taplin, Canida & Habacht/BMO Northern Trust Investments Taurus Funds Management RhumbLine Advisers TCW Asset Management Company Strategic Global Advisors TerraCotta T. Rowe Price Associates Varde Partners Wasatch Advisors Real Assets Transition Managers Barings Real Estate Advisers The Blackstone Group Citigroup Global Markets Brookfield Asset Management Loop Capital The Carlyle Group Macquarie Capital CB Richard Ellis Northern Trust Investments Dyal Capital Penserra Exeter Property Group Fortress Investment Group Global Income Gaw Capital Partners AllianceBernstein Heitman Real Estate Investment Management Apollo Global Management INVESCO Real Estate Beach Point Capital Management LaSalle Investment Management Blantyre Capital Ltd. Lion Industrial Trust Cerberus Capital Management Lone Star Dignari Capital Partners LPC Realty Advisors Dolan McEniry Capital Management Macquarie Group Limited DoubleLine Capital Madison International Realty Edelweiss Niam Franklin Advisers Oak Street Real Estate Capital Garcia Hamilton & Associates