Avnet, Inc. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Securities and Exchange Commission Has Not Necessarily Reviewed the Information in This Filing and Has Not Determined If It Is Accurate and Complete

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete. The reader should not assume that the information is accurate and complete. UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB APPROVAL Washington, D.C. 20549 OMB Number: 3235-0006 FORM 13F Expires: Oct 31, 2018 FORM 13F COVER PAGE Estimated average burden hours per response: 23.8 Report for the Calendar Year or Quarter Ended: 03-31-2014 Check here if Amendment Amendment Number: This Amendment (Check only one.): is a restatement. adds new holdings entries. Institutional Investment Manager Filing this Report: Name: PNC FINANCIAL SERVICES GROUP, INC. Address: ONE PNC PLAZA 249 FIFTH AVENUE PITTSBURGH, PA 15222 Form 13F File Number: 028-01235 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: William S. Demchak Title: President & Chief Executive Officer Phone: (412) 762-2000 Signature, Place, and Date of Signing: /s/ William S. Demchak Pittsburgh, PA 05-09-2014 [Signature] [City, State] [Date] Report Type (Check only one.): X 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) 13F NOTICE. (Check here if no holdings reported are in this report, and all holdings are reported by other reporting manager(s).) 13F COMBINATION REPORT. -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

State of Illinois State Universities Retirement System

State of Illinois State Universities Retirement System Compliance Examination For the Year Ended June 30, 2017 Performed as Special Assistant Auditors for the Auditor General, State of Illinois State Universities Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2017 Table of Contents Schedule Page(s) State Universities Retirement System Officials 1 Management Assertion Letter 2 Compliance Report Summary 3 Independent Accountant’s Report on State Compliance, on Internal Control Over Compliance, and on Supplementary Information for State Compliance Purposes 5 Independent Auditors’ Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards 9 Schedule of Findings Current Findings – State Compliance 11 Prior Findings Not Repeated 14 Financial Statement Report The System’s financial statement report for the year ended June 30, 2017, which includes the Independent Auditor’s Report, Management Discussion and Analysis, Basic Financial Statements and Notes to the Basic Financial Statements, Required Supplementary Information Other than Management Discussion and Analysis, Supplementary Information, and the Independent Auditor’s Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Basic Financial Statements performed in accordance with Government Auditing Standards has been issued separately. Supplementary Information for -

Case M.8248 - TECH DATA / AVNET's TECHNOLOGY SOLUTIONS

EUROPEAN COMMISSION DG Competition Case M.8248 - TECH DATA / AVNET'S TECHNOLOGY SOLUTIONS Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 23/02/2017 In electronic form on the EUR-Lex website under document number 32017M8248 EUROPEAN COMMISSION In the published version of this decision, some Brussels, 23.2.2017 information has been omitted pursuant to Article C(2017) 1391 final 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are PUBLIC VERSION shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying party Subject: Case M.8248 - TECH DATA / AVNET'S TECHNOLOGY SOLUTIONS Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 19 January 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Tech Data Corporation ("Tech Data" or the "Notifying Party", United States of America) acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the Technology Solutions business of Avnet, Inc. ("Avnet TS", United States of America) by way of purchase of shares (the "Proposed Transaction").3 Tech Data and Avnet TS are designated hereinafter as the "Parties". 1. THE PARTIES (1) Tech Data is a distributor of technology products. -

Avnet, Inc. (Exact Name of Registrant As Specified in Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 _______________ FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of report (Date of earliest event reported): April 20, 2018 Avnet, Inc. (Exact Name of Registrant as Specified in Charter) New York 1-4224 11-1890605 (State or Other (Commission (IRS Employer Jurisdiction File Number) Identification No.) of Incorporation) 2211 South 47th Street, Phoenix, Arizona 85034 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code: (480) 643-2000 N/A (Former Name or Former Address, if Changed Since Last Report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Annual Report John Hancock Multifactor Etfs ETF

Annual report John Hancock Multifactor ETFs ETF April 30, 2021 A message to shareholders Dear shareholder, The global equity markets were propelled to strong gains for the 12 months ended April 30, 2021. The U.S. Federal Reserve and other world central banks maintained their policies of ultra-low short-term interest rates. With little in the way of yield available on safer assets, investors gravitated toward equities in search of more attractive total returns. The approval and subsequent rollout of multiple COVID-19 vaccines also boosted investor sentiment by providing a clearer path for economic conditions to return to normal in 2021. The passing of fiscal stimulus packages in the United States was an additional source of support for the markets. In combination, these developments helped the major stock indexes gradually recapture, and ultimately exceed, the levels at which they stood prior to the global outbreak of the coronavirus in early 2020. Despite the overall good news, there are still obstacles. Some economies may have reopened too early, the pace of vaccinations varies widely from country to country, and many industries will take time to recover from the losses suffered. In these uncertain times, your financial professional can assist with positioning your portfolio so that it’s sufficiently diversified to help meet your long-term objectives and to withstand the inevitable bouts of market volatility along the way. On behalf of everyone at John Hancock Investment Management, I’d like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you’ve placed in us. -

Market Dynamics Fuel Semiconductor Evolution

Global Semiconductor Alliance ENABLING THE AUTOMOTIVE DESIGN CHAIN WITH VIRTUALIZATION CLOUD COMPUTING EVOLUTION: DISRUPTING THE IT SUPPLY CHAIN IP INNOVATION: AT THE CORE OF CONSUMER ELECTRONICS DESIGN SHIFT IN CONSUMER FOCUS DRIVES EVOLUTION OF THE SEMICONDUCTOR INDUSTRY ONSHORE SILICON FOR LONG-TERM SUPPLY SECURITY: FOUNDRY SELECTION FOR MILITARY APPLICATIONS Market Dynamics Fuel Semiconductor Evolution Vol.17 No.2 June 2010 Published by GSA $60 (U.S.) 1 The First Truly Global Foundry Congratulations to the new GLOBALFOUNDRIES, the merged operations of GLOBALFOUNDRIES and Chartered. To our continued mutual success from your Global Customers and Partners ARTICLES CONTENTS 2 Enabling the Automotive Design Chain with Virtualization Frank Schirrmeister, Director, Product Marketing, System-level Solutions, Synopsys Inc. ACCELERATE THE Mark Williams, Director, Solutions Marketing, Synopsys Inc. GROWTH AND 6 Cloud Computing Evolution: Disrupting the IT Supply Chain Chris Weitz, Director, Technology Strategy and Architecture, Deloitte Consulting LLP INCREASE THE John La Bouff, Senior Manager, Deloitte Consulting LLP RETURN ON 10 IP Innovation: At the Core of Consumer Electronics Design Frank Ferro, Director, Marketing, Sonics Inc. INVESTED CAPITAL 15 Shift in Consumer Focus Drives Evolution of the Semiconductor Industry OF THE GLOBAL John Brewer, Vice President, Corporate and Business Development, SiGe Semiconductor SEMICONDUCTOR 19 Onshore Silicon for Long-term Supply Security: Foundry Selection for Military Applications INDUSTRY BY Kirk Peterson, CFD Foundry Manager, ON Semiconductor FOSTERING A MORE 24 Integrated Power Management Platforms: The Entry of Fabless Design Houses to Power Management System Design EFFECTIVE FABLESS Dr. Shye Shapira, Director, Research and Development, Power Management Platforms, TowerJazz Todd Mahlen, Director, Marketing, Power Management Platforms, TowerJazz ECOSYSTEM Dr. -

AVNET, INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents As filed with the Securities and Exchange Commission on December 30, 2005 Registration No. 333- UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM S-3 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 AVNET, INC. (Exact Name of Registrant as Specified in Its Charter) New York (State or Other Jurisdiction of Incorporation) 11-1890605 (I.R.S. Employer Identification Number) 2211 South 47th Street Phoenix, Arizona 85034 (480) 643-2000 (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) David R. Birk, Esq. Senior Vice President and General Counsel Avnet, Inc. 2211 South 47th Street Phoenix, Arizona 85034 (480) 643-2000 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service) Copy to: Barbara Becker Gibson, Dunn & Crutcher LLP 200 Park Avenue New York, NY 10166 (212) 351-4000 Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement. If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☑ If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. -

Vanguard Russell 1000 Index Funds Annual Report August 31, 2020

Annual Report | August 31, 2020 Vanguard Russell 1000 Index Funds Vanguard Russell 1000 Index Fund Vanguard Russell 1000 Value Index Fund Vanguard Russell 1000 Growth Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. -

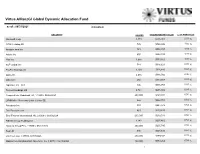

Virtus Allianzgi Global Dynamic Allocation Fund

Virtus AllianzGI Global Dynamic Allocation Fund as of : 08/31/2021 (Unaudited) SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO Microsoft Corp 2,373 $716,361 2.03 % ASML Holding NV 705 $586,446 1.66 % Amazon.com Inc 161 $558,797 1.59 % Adobe Inc 697 $462,599 1.31 % Visa Inc 1,655 $379,161 1.08 % S&P Global Inc 781 $346,623 0.98 % PayPal Holdings Inc 1,130 $326,186 0.93 % Apple Inc 2,085 $316,566 0.90 % MSCI Inc 494 $313,483 0.89 % Alphabet, Inc.- Cl A 106 $306,759 0.87 % Tencent Holdings Ltd 4,781 $295,806 0.84 % Cooperatieve Rabobank UA, 1.1060% 02/24/2027 250,000 $248,082 0.70 % LVMH Moet Hennessy Louis Vuitton SE 328 $242,751 0.69 % Facebook Inc 593 $224,972 0.64 % Dsv Panalpina A/s 861 $219,413 0.62 % Enel Finance International NV, 2.6500% 09/10/2024 200,000 $210,531 0.60 % Alibaba Group Holding Ltd 1,242 $207,402 0.59 % Natwest Group PLC, 2.3590% 05/22/2024 200,000 $205,545 0.58 % Sea Ltd 596 $201,639 0.57 % LG Chem Ltd, 1.3750% 07/07/2026 200,000 $199,342 0.57 % Massachusetts Mutual Life Insurance Co, 5.0770% 02/15/2069 150,000 $189,264 0.54 % 1 SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO Ford Motor Credit Co LLC, 3.3500% 11/01/2022 185,000 $189,070 0.54 % Square Inc 696 $186,577 0.53 % StoneCo Ltd 3,934 $183,088 0.52 % NIKE Inc 1,107 $182,367 0.52 % Deutsche Lufthansa AG 18,000 $180,336 0.51 % adidas AG 504 $178,797 0.51 % Popular Inc, 6.1250% 09/14/2023 165,000 $177,788 0.50 % Sika AG 489 $176,270 0.50 % Edwards Lifesciences Corp 1,495 $175,184 0.50 % Zoetis Inc 840 $171,830 0.49 % Verizon Communications Inc, 4.1250% 03/16/2027 -

AVNET, INC. (Name of Subject Company (Issuer) and Filing Person (Issuer))

Table of Contents SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE TO/A TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1) OF THE SECURITIES EXCHANGE ACT OF 1934 (Amendment No. 2) AVNET, INC. (Name of Subject Company (Issuer) and Filing Person (Issuer)) 2% Convertible Senior Debentures due 2034 053807AL7 (Title of Class of Securities) (CUSIP Number of Class of Securities) DAVID R. BIRK, Esq. Senior Vice President and General Counsel Avnet, Inc. 2211 South 47th Street Phoenix, Arizona 85034 (480) 643-2000 (Name, Address and Telephone Number of Person Authorized to Receive Notice and Communications on Behalf of Filing Person) COPIES TO: Joseph P. Richardson, Esq. Squire, Sanders and Dempsey L.L.P. 40 N. Central Avenue, Suite 2700 Phoenix, Arizona 85004 Telephone: (602) 528-4000 CALCULATION OF FILING FEE Transaction Valuation* Amount of Filing Fee** $300,000,000 $11,790 * Calculated solely for purposes of determining the filing fee. The purchase price of the 2% Convertible Senior Debentures due 2034 (the “Debentures”), as described herein, is $1,000 per $1,000 principal amount outstanding. As of February 13, 2009, there was $300,000,000 in aggregate principal amount of Debentures outstanding, resulting in an aggregate maximum purchase price of $300,000,000. ** The amount of the filing fee was calculated in accordance with Rule 0-11(b) of the Securities Exchange Act of 1934, as amended, and equals $39.30 for each $1,000,000 of the value of the transaction. The filing fee was paid on February 13, 2009 in connection with the filing by Avnet, Inc. -

Tech Data Corp

TECH DATA CORP FORM 10-K (Annual Report) Filed 03/22/18 for the Period Ending 01/31/18 Address 5350 TECH DATA DR CLEARWATER, FL, 33760 Telephone 7275397429 CIK 0000790703 Symbol TECD SIC Code 5045 - Wholesale-Computers and Peripheral Equipment and Software Industry Computer & Electronics Retailers Sector Consumer Cyclicals Fiscal Year 01/31 http://www.edgar-online.com © Copyright 2018, EDGAR Online, a division of Donnelley Financial Solutions. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, a division of Donnelley Financial Solutions, Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended January 31, 2018 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission File Number 0-14625 TECH DATA CORPORATION (Exact name of Registrant as specified in its charter) Florida 59-1578329 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 5350 Tech Data Drive Clearwater, Florida 33760 (Address of principal executive offices) (Zip Code) (Registrant’s Telephone Number, including Area Code): (727) 539-7429 Securities registered pursuant to Section 12(b) of the Act: Common stock, par value $.0015 per share Securities registered pursuant to Section 12 (g) of the Act: None Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.