CJ ENM Bloomberg: 035760 KS, Reuters: 035760.KS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lei Lo¯Kahi I Ka Lanakila Unity Is Adorned in Victory 2 About OHA

2016 Office Of Hawaiian affairs annUal repOrt Lei lo¯kahi i ka lanakila Unity is adorned in victory 2 About OHA Vision “Ho‘oulu Lāhui Aloha” - To Raise a Beloved Nation. OHA’s vision statement blends the thoughts and leadership of both King Kalākaua, and his sister, Queen Lili‘uokalani. Both faced tumultuous times as we do today, and met their challenges head on. “Ho‘oulu Lāhui” was King Kalākaua’s motto. “Aloha” expresses the high values of Queen Lili‘uokalani. Mission Statement To mālama (protect) Hawai‘i’s people and environmental resources Table of Contents Table and OHA’s assets, toward ensuring the perpetuation of the culture, the enhancement of lifestyle and the protection of entitlements of Native Hawaiians, while enabling the building of a strong and healthy Hawaiian people and nation, recognized nationally and internationally. Overview The Office of Hawaiian Affairs is a public agency with a high degree of autonomy. OHA is responsible for improving the well-being of Native Hawaiians. OHA is governed by a Board of Trustees made up of nine members who are elected statewide for four-year terms to set policy for the agency. OHA is administered by a Ka Pouhana (Chief Executive Officer) who is appointed by the Board of Trustees to oversee a staff of about 170 people. about OHa Our Focus 2 Our Hawaiian ancestors understood that the well-being of our community rested upon Message the inter-relationship of how we conduct ourselves, steward the islands we call home, and 3 fulfill the responsibility of caring for our families, all within the physical and spiritual executives realms. -

Inglish Dikshineri = English

Kriol – Inglish Dikshineri English – Kriol Dictionary Compiled and edited by Yvette Herrera Myrna Manzanares Silvana Woods Cynthia Crosbie Ken Decker Editor-in-Chief Paul Crosbie Belize Kriol Project Cover design: Adapted from Yasser Musa Cover photo: Courtesy Robert Spain at 2008 Crooked Tree Cashew Fest Illustrations in the Introduction are from The Art of Reading, SIL International Literacy Department SIL International provided linguistic consultancy to this publication of the Belize Kriol Project. The Belize Kriol Project is the language development arm of The National Kriol Council. www.sil.org The National Kriol Council House of Culture, Regent Street P.O. Box 2447 Belize City Belize www.kriol.org.bz Belize Kriol Project P.O. Box 2120 Office: 33 Central American Blvd. Belize City, Belize The first printing of this dictionary was in 2007 and was funded by The Ministry of Education and The National Institute of Culture and History House of Culture, Regent Street Belize City, Belize First Edition Copyright © 2007 Belize Kriol Project Second Printing 2009 ISBN # 978-976-95165-1-9 Printed by Print Belize Belmopan, Belize CONTENTS List of Abbreviations .......................................... iv Foreword by Sir Colville Young.............................v Preface ..................................................................... ix Acknowledgements.............................................. xi Introduction.............................................................1 Guide to Using the Dictionary...........................3 The -

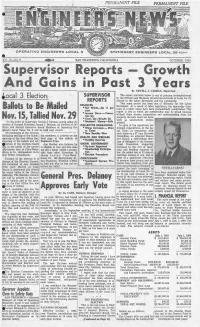

OCTOBER 1960 • • R St Rs (Conthiued Fi.·Om Page 1) Some :Sources in 1959 to 1960 ; Ary Increases for the Business

•.' _, -PERMANENT FILE '•' STATIONARY. ~ ENGfNEERS. ·. '· ... .·. -~· - .. OCTOBER,"1960 • " ~- ~- .,,.,. " J ' • •• r • • '•Ort ~ - r • :• s• "'• Past. -~ .' . --· \! . By NEWELL J. · CA~MAN, Superf isor : ·, io~aL B< Election;,, .·· ·. ;: .c. " , .' SUPElR.V.ISOR TM report-. unfolded ~ below is -~one ::. of .genuine .· accorriplfshmerit : by the Officers and Members toward improvement ·oftoc~l :N·o. 3's - .. REPORTS -~ st~tti:i-e iii: the LabOr Movement and :the community. This same p~dod _has been one of difficulty _·::1\ . :.- ~a~:-:::·-~- ·t· .. _,;·_··;_··· o~/·.:··· a-- ···- e:· < ~_:: ·· a ·ctlle:-=- .l -.-i·. · ;FiNANCES: · .. for the--Laj)or ... _. :- .. ·. ~ __1, ...:- .~ ~. '·. /: u t' Movement: As a result of labor legislation, the day-to;.day £:unc :.ye · ~q~·t W:~rt,h~Op' ll , per tions of a. labor union . · · c;ent have been.. tremendously complicated .. This · . .· .. • · . · · report is one in which · -•Income Down ;.... .Protec:- the membership m<~y be· proud because . -tici'n ·.up,·. · · · withoqt .the~r sincere --cooperation and understanding from the maj~.r,:ity tb,e task could not h<~ up-.;-:Resul!:s.Up _ve •• . Mo•~ " t5~·. l'alliid ·: Nov.,• 2~ -.>•_Cost~ '. been·· · so suec~ssfully · acc'oni- ()n the ord~i: ~ of S_up~~vis.or New ,eli. '"J~ . C~rn~a:n.; a_cting unde;, di · . • Members: , Moriey~Safe plished. · · . , r.ectlon' Qf-Ge)l'eralPresidell,t Joseph JhD_elaney~ an'electlori of' ·cott~ctrve aA.fiG~INI;i\iG - . In spite. of the significant'" ad~ · fleers and -D1§tricf Executive ·J.3oard ·.Memb€rs .of Operating . · ··wage: Increases - 'More 'd'itional expenditures of 'the1' Lo giiie$rs :· LCic<U Union ·· N:o: 3 :will b.e li~la .:ne:xtrnonth . -

Making Out-Of-School-Time Matter: Evidence for an Action Agenda

EDUCATION and RAND LABOR AND POPULATION CHILD POLICY This PDF document was made available CIVIL JUSTICE from www.rand.org as a public service of EDUCATION the RAND Corporation. ENERGY AND ENVIRONMENT HEALTH AND HEALTH CARE Jump down to document6 INTERNATIONAL AFFAIRS NATIONAL SECURITY The RAND Corporation is a nonprofit POPULATION AND AGING research organization providing PUBLIC SAFETY SCIENCE AND TECHNOLOGY objective analysis and effective SUBSTANCE ABUSE solutions that address the challenges TERRORISM AND facing the public and private sectors HOMELAND SECURITY TRANSPORTATION AND around the world. INFRASTRUCTURE Support RAND Purchase this document Browse Books & Publications Make a charitable contribution For More Information Visit RAND at www.rand.org Explore RAND Education RAND Labor and Population View document details Limited Electronic Distribution Rights This document and trademark(s) contained herein are protected by law as indicated in a notice appearing later in this work. This electronic representation of RAND intellectual property is provided for non- commercial use only. Permission is required from RAND to reproduce, or reuse in another form, any of our research documents. This product is part of the RAND Corporation monograph series. RAND monographs present major research findings that address the challenges facing the public and private sectors. All RAND mono- graphs undergo rigorous peer review to ensure high standards for research quality and objectivity. Making Out-of-School- Time Matter Evidence for an Action Agenda Susan Bodilly, Megan K. Beckett Prepared for The Wallace Foundation The research described in this report was conducted by RAND Education and RAND Labor and Population for The Wallace Foundation. Library of Congress Cataloging-in-Publication Data is available for this publication. -

Making the Match: Finding Funding for After School Education and Safety Programs

Making the Match: Finding Funding for After School Education and Safety Programs AUGUST 2007 ASES Basics Making the Match: Finding Funding for After School Education and Safety Programs Kate Sandel, Cheryl Hayes, Brittany Anuszkiewicz, Carol Cohen and Sharon Deich AUGUST 2007 Contents Foreword 5 Finding Funding to Make the ASES Match 7 How to Make Your ASES Match About This Guide The ABCs of ASES 9 Purposes and Objectives Required Program Elements Operational Requirements Funding Priorities and Requirements Key Steps to Get Funding Using the Match to Expand and Enhance ASES Programs 17 Adopting a Strategic Financing Approach Assessing the Potential Value of Funding Sources and Financing Strategies Choosing Funding Sources and Financing Strategies Strategy 1: Accessing School and Community Resources 33 Who Are Potential School and Community Partners? What Types of Resources Do School and Community Partners Provide? How Should Donations Be Valued and Tracked? Tips for Accessing School and Community Resources Strategy 2: Accessing Business and Foundation Support 53 Who Are Potential Business Partners? Who Are Potential Foundation Partners? What Types of Resources Do Business and Foundation Partners Provide? Tips for Making Successful Connections with Businesses Tips for Successfully Accessing Foundation Funding Strategy 3: Accessing Local Government Resources 69 Who Are Potential Local Government Partners? Making the Case for Local Support What Types of Resources Do Local Government Partners Provide? Tips for Building Support Among Local -

Teaser Memorandum

Teaser Memorandum The First Half of 2017 Investment Opportunities In Korea Table of Contents Important Notice ………………………………… 1 Key Summary ………………………………… 2 Expected Method of Investment Promotion …………………………… 3 Business Plan ………………………………… 4 Business Introduct ………………………………… 5 License ………………………………… 11 Capacity ………………………………… 12 Market ………………………………… 13 Financial Figures ………………………………… 14 Key Summary Private & Confidential Investment Highlights RBW is a K-POP (Hallyu) contents production company founded by producer/songwriter Kim Do Hoon, Kim Jin Woo, and Hwang Sung Jin, who have produced numerous K-POP artists such as CNBLUE, Whee-sung, Park Shin Hye, GEEKS, 4MINUTE etc. Based on the “RBW Artist Incubating System’, the company researches and provides various K-POP related products such as OEM Artist & Music Production (Domestic/Overseas), Exclusive Artist Production (MAMAMOO, Basick, Yangpa etc.), Overseas Broadcasting Program Planning & Production (New concept music game show/Format name: RE:BIRTH), and K-POP Educational Training Program. With its business ability, RBW is currently making a collaboration with various domestic and overseas companies, including POSCO, NHN, Human Resources Development Service of Korea, Ministry of Labor & Employment, and KOTRA. • Business with RBW’s Unique Artist Incubating •Affiliation Relationship with International Key Factors System Companies Description • With analyzing the artists’ potentials and market trend, every stage for training and debuting artists (casting, training, producing, and album production) is efficiently processed under this system. Pictures Company Profiles Category Description Establishment Date 2013. 8. 26 Revenue 12 Billion Won (12 Million $) (2016) Website www.rbbridge.com Current Shareholder C.E.O. Kim Jin Woo 29.2%, C.E.O. Kim Do Hoon 29.2%, Institutional Investment 31.7%, Executives and Staff Composition 5.6%, Etc. -

FIVE DIAMONDS Barn 2 Hip No. 1

Consigned by Three Chimneys Sales, Agent Barn Hip No. 2 FIVE DIAMONDS 1 Dark Bay or Brown Mare; foaled 2006 Seattle Slew A.P. Indy............................ Weekend Surprise Flatter................................ Mr. Prospector Praise................................ Wild Applause FIVE DIAMONDS Cyane Smarten ............................ Smartaire Smart Jane........................ (1993) *Vaguely Noble Synclinal........................... Hippodamia By FLATTER (1999). Black-type-placed winner of $148,815, 3rd Washington Park H. [G2] (AP, $44,000). Sire of 4 crops of racing age, 243 foals, 178 starters, 11 black-type winners, 130 winners of 382 races and earning $8,482,994, including Tar Heel Mom ($472,192, Distaff H. [G2] (AQU, $90,000), etc.), Apart ($469,878, Super Derby [G2] (LAD, $300,000), etc.), Mad Flatter ($231,488, Spend a Buck H. [G3] (CRC, $59,520), etc.), Single Solution [G3] (4 wins, $185,039), Jack o' Lantern [G3] ($83,240). 1st dam SMART JANE, by Smarten. 3 wins at 3 and 4, $61,656. Dam of 7 registered foals, 7 of racing age, 7 to race, 5 winners, including-- FIVE DIAMONDS (f. by Flatter). Black-type winner, see record. Smart Tori (f. by Tenpins). 5 wins at 2 and 3, 2010, $109,321, 3rd Tri-State Futurity-R (CT, $7,159). 2nd dam SYNCLINAL, by *Vaguely Noble. Unraced. Half-sister to GLOBE, HOYA, Foamflower, Balance. Dam of 6 foals to race, 5 winners, including-- Taroz. Winner at 3 and 4, $26,640. Sent to Argentina. Dam of 2 winners, incl.-- TAP (f. by Mari's Book). 10 wins, 2 to 6, 172,990 pesos, in Argentina, Ocurrencia [G2], Venezuela [G2], Condesa [G3], General Lavalle [G3], Guillermo Paats [G3], Mexico [G3], General Francisco B. -

“The Social Cut of Black and Yellow Female Hip Hop” Erick Raven

“The Social Cut of Black and Yellow Female Hip Hop” Erick Raven University of Texas at Arlington May 2020 Abstract Korean female hip hop artists are expanding the definition of femininity in South Korea through hip hop. In doing so, they are following a tradition first established by Black female musical performers in a new context. Korean artists are conceiving and expressing, through rap and dance, alternative versions of a “Korean woman,” thus challenging and attempting to add to the dominant conceptions of “woman.” This Thesis seeks to point out the ways female Korean hip hop artists are engaging dominant discourse regarding skin tone, body type, and expression of female sexuality, and creating spaces for the development of new discourses about gender in South Korean society. Contents Introduction – Into the Cut ................................................ 1 Chapter I – Yoon Mi-rae and Negotiating the West and East of Colorism ............................................................. 12 Chapter II – The Performing Black and Yellow Female Body ................................................................................ 31 Chapter III – Performing Sexuality ................................. 47 Chapter IV – Dis-Orientation .......................................... 59 Conclusion .................................................................... 67 Works Cited .................................................................... 70 Introduction – Into the Cut Identities are performed discourse; they are formed when those who identify as a particular personality perform and establish a discourse in a particular social context. As George Lipsitz states, “improvisation is a site of encounter” (61). In South Korea, female Korean hip hop is the site of a social cut in dominant culture and has become a space of improvisation where new, counter-hegemonic identities are constructed and performed. In this Thesis, I argue that Korean female hip hop artists are enacting a social rupture by performing improvised identities. -

Hip-Hop and Cultural Interactions: South Korean and Western Interpretations

HIP-HOP AND CULTURAL INTERACTIONS: SOUTH KOREAN AND WESTERN INTERPRETATIONS. by Danni Aileen Lopez-Rogina, B.A. A thesis submitted to the Graduate Council of Texas State University in partial fulfillment of the requirements for the degree of Master of Arts with a Major in Sociology May 2017 Committee Members: Nathan Pino, Chair Rachel Romero Rafael Travis COPYRIGHT by Danni Aileen Lopez-Rogina 2017 FAIR USE AND AUTHOR’S PERMISSION STATEMENT Fair Use This work is protected by the Copyright Laws of the United States (Public Law 94-553, section 107). Consistent with fair use as defined in the Copyright Laws, brief quotations from this material are allowed with proper acknowledgement. Use of this material for financial gain without the author’s express written permission is not allowed. Duplication Permission As the copyright holder of this work I, Danni Aileen Lopez-Rogina, refuse permission to copy in excess of the “Fair Use” exemption without my written permission. DEDICATION To Frankie and Holly for making me feel close to normal. ACKNOWLEDGEMENTS I want to acknowledge my mom, dad, and sister first and foremost. Without their love and support over the years, I would not have made it this far. They are forever my cheerleaders, no matter how sassy I may be. Professor Nathan Pino was my chosen mentor who took me under his wing when I chose him like a stray cat. His humor and dedication to supporting me helped me keep my head up even when I felt like I was drowning. Professor Rachel Romero was the one to inspire me to not only study sociology, but also to explore popular culture as a key component of society. -

Songliste Koreanisch (Juli 2018) Sortiert Nach Interpreten

Songliste Koreanisch (Juli 2018) Sortiert nach Interpreten SONGCODETITEL Interpret 534916 그저 널 바라본것 뿐 1730 534541 널 바라본것 뿐 1730 533552 MY WAY - 533564 기도 - 534823 사과배 따는 처녀 - 533613 사랑 - 533630 안녕 - 533554 애모 - 533928 그의 비밀 015B 534619 수필과 자동차 015B 534622 신인류의 사랑 015B 533643 연인 015B 975331 나 같은 놈 100% 533674 착각 11월 975481 LOVE IS OVER 1AGAIN 980998 WHAT TO DO 1N1 974208 LOVE IS OVER 1SAGAIN 970863기억을 지워주는 병원2 1SAGAIN/FATDOO 979496 HEY YOU 24K 972702 I WONDER IF YOU HURT LIKE ME 2AM 975815 ONE SPRING DAY 2AM 575030 죽어도 못 보내 2AM 974209 24 HOUR 2BIC 97530224소시간 2BIC 970865 2LOVE 2BORAM 980594 COME BACK HOME 2NE1 980780 DO YOU LOVE ME 2NE1 975116 DON'T STOP THE MUSIC 2NE1 575031 FIRE 2NE1 980915 HAPPY 2NE1 980593 HELLO BITCHES 2NE1 575032 I DON'T CARE 2NE1 973123 I LOVE YOU 2NE1 975236 I LOVE YOU 2NE1 980779 MISSING YOU 2NE1 976267 UGLY 2NE1 575632 날 따라 해봐요 2NE1 972369 AGAIN & AGAIN 2PM Seite 1 von 58 SONGCODETITEL Interpret 972191 GIVE IT TO ME 2PM 970151 HANDS UP 2PM 575395 HEARTBEAT 2PM 972192 HOT 2PM 972193 I'LL BE BACK 2PM 972194 MY COLOR 2PM 972368 NORI FOR U 2PM 972364 TAKE OFF 2PM 972366 THANK YOU 2PM 980781 WINTER GAMES 2PM 972365 CABI SONG 2PM/GIRLS GENERATION 972367 CANDIES NEAR MY EAR 2PM/백지영 980782 24 7 2YOON 970868 LOVE TONIGHT 4MEN 980913 YOU'R MY HOME 4MEN 975105 너의 웃음 고마워 4MEN 974215 안녕 나야 4MEN 970867 그 남자 그 여자 4MEN/MI 980342 COLD RAIN 4MINUTE 980341 CRAZY 4MINUTE 981005 HATE 4MINUTE 970870 HEART TO HEART 4MINUTE 977178 IS IT POPPIN 4MINUTE 975346 LOVE TENSION 4MINUTE 575399 MUZIK 4MINUTE 972705 VOLUME UP 4MINUTE 975332 WELCOME -

Periodo De Reparto : 2019-05 COMUNICACION PUBLICA ( No Identificados )

Detallado por Tocada, por Asociado, Administrado y Mandante Periodo de Reparto : 2019-05 COMUNICACION PUBLICA ( No Identificados ) [9,999] - ( NO IDENTIFICADOS ) ISRC Titulo Nombre del Artista Sello Track Monto Track 2019-05 PEMG98308008 CARAVELI (REMASTERED) "CHOLO" BERROCAL Mgp 0.03 PEMG98310006 EL HUÉRFANO (REMASTERED) "CHOLO" BERROCAL Mgp 0.01 USA2P1850911 AMERIKKA'S NIGHTMARE #9 Council Music 0.01 ARF410700760 LET'S CALL THE WHOLE THING OFF (G.GERSHWIN/I.GERSHWIN) Unassigned 0.00 ARF411100844 THE MAN I LOVE (GERSHWIN/GERSHWIN) Independiente 0.00 ARF411500943 TENDERLY (GROSS/LAWRENCE) Independiente 0.00 JPPO01704270 Party Work (Groovy Workshop Mix) *Groovy Workshop. 16.98 POP *NSYNC Unassigned 0.00 QM4TW1603169 ...POR HABLAR ...POR HABLAR ...Por Hablar 0.11 USHM81186307 ACHA ?? ??? (SUPER JUNIOR) Independiente 0.00 THE TUNE ???? ??? | ROY DAHAN Unassigned 0.00 USQY51437612 ???? ???? RHYTHM POWER Amoeba Culture 0.00 FR0W61316555 COME AND GET YOUR LOVE ?????? ??????? Rendez-Vous Digital 0.01 ITG270800241 DON'T STOP BELIEVIN' ????? Independiente 0.00 KRA381002291 You & I (Korean Version) ??? 0.14 TR0441211505 GÖZLERIMIN ETRAF?NDAKI ÇIZGILER ?EBNEM FERAH Pasaj Müzik 0.01 TR5411300049 SANA NERDEN GÖNÜL VERDIM ?ECAATTIN TANYERLI Independiente 0.00 TR5411300053 SEVDIM BIR GENÇ KAD?N? ?ECAATTIN TANYERLI Independiente 0.00 TR0331108314 BITER K?R?EHIR'IN GÜLLERI ?SMAIL ALTUNSARAY Kalan Ses Görüntü 0.01 L O V E B U R N (L O V E B U R N) ~ D R E X E R ~ Unassigned 0.00 FR04Q9900077 SANS RETOUR 113 CLAN S.M.A.L.L. 0.01 BEDO61600488 WATER MUSIC, -

International Producer/Dj, Yultron & Multi-Platinum

INTERNATIONAL PRODUCER/DJ, YULTRON & MULTI-PLATINUM HIP-HOP ARTIST, JAY PARK RELEASE CROSSOVER EP, ON FIRE ON H1GHR MUSIC Featuring Lead Single, “West Coast” and Three New Tracks The Duo Unveil Music Video for Title Track, “On Fire” Download/Listen to Yultron x Jay Park On Fire EP HERE Watch “On Fire” Music Video HERE Download Album Artwork and Press Images HERE (Credit: H1GHR Music) AUGUST 30, 2019 (LOS ANGELES, CA) – International producer and DJ, Yultron, and multi- platinum hip-hop artist, Jay Park, today released their crossover EP On Fire, along with the music video for their track of the same name “On Fire,” on Park’s label, H1GHR Music. The collaboration mashes up the artists' worlds of dance and hip-hop, east and west, and ranges sonically from smooth pop, energetic dance drops, to hard hip-hop. The EP also includes appearances from emerging Korean artists Sik-K, PH-1, and Haon. “Jay and I have been friends for some time and we really vibe working together,” said Yultron. “All genres inspire me, so I was excited to work on this crossover EP that melds our worlds together. We were both creatively ‘on fire’ throughout the whole process.” “I like to explore new genres and Yultron is a good friend and very chill,” said Jay Park. “We set out to collab using influences of hip-hop, EDM, pop and K-pop. I love the range of the tracks we put out on this EP and its vibe.” Yultron and Jay Park’s kinship spans several years, starting with their first song "BO$$," which hit #1 on Korea's charts in 2015.