First Quarter Fiscal Year 2020 Earnings Conference Call & Webcast Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Market Leader in Over-The-Air Broadcasting Solutions

Connecting What’s Next The Market Leader in Over-the-Air Broadcasting Solutions GatesAir efficiently leverages broadcast spectrum to maximize performance for multichannel TV and radio services, offering the industry’s broadest portfolio to help broadcasters wirelessly deliver and monetize content. With nearly 100 years in broadcasting, GatesAir’s exclusive focus on the over-the-air market helps broadcasters optimize services today and prepare for future revenue-generating business opportunities. All research, development and innovation is driven from the company’s facilities in Mason, Ohio and supported by the long-standing manufacturing center in Quincy, Illinois. GatesAir’s turnkey solutions are built on three pillars: Content Transport, TV Transmission, and Radio Transmission. GatesAir’s globally renowned Intraplex range comprises the Transport pillar, enabling audio contribution and distribution (along with data) over IP and TDM networks. Intraplex solutions provide value for broadcasters for point-to-point (STL, remote broadcast) and multipoint (single-frequency networks, syndicated distribution) connectivity. GatesAir continues to innovate robust and reliable solutions for traditional RF STL connections that can also accommodate IP traffic. In larger transmitter networks, Simulcasting technology ensures all GatesAir transmitters are time-locked for synchronous, over-the-air content delivery. Powering over-the-air analog and digital radio/TV stations and networks worldwide with the industry’s most operationally efficient transmitters is a longtime measure of success for GatesAir. Groundbreaking innovations in low, medium and high- power transmitters reduce footprint, energy use and more to establish the industry’s lowest total cost of ownership. Support for all digital standards and convergence with mobile networks ensure futureproof systems. -

Bell Media,Canada

Do it smart. Case Study BELL MEDIA Sector Media – TV, radio and digital Toronto, Canada entertainment, news and sports information Projekt WEYTEC is the developer, manufacturer and provider of highly customized multifuncti- onal keyboards for Bell Media’s TV and radio studios and pro- gram control rooms. WEYTEC has become a registered vendor to Bell Media. Client BELL MEDIA, www.bellmedia.ca, is Canada’s premier multi-media company with leading assets in television, radio and digital entertainment and information. It owns 28 conventional TV stations, including CTV, Canada's #1 television network, and owns and operates 30 specialty TV channels, including TSN, Canada's #1 specialty channel, and RDS, Canada's #1 French-language specialty channel. Bell Media also owns 33 radio stations, dozens of websites including the Sympatico.ca portal, and Dome Productions Inc. Bell Media is owned by BCE Inc. (TSX, NYSE stock ticker symbol: BCE), Canada's largest communications company. WEYTEC's multifunctional keyboard in the studio "TSN Radio 1050" from BellMedia Challenge The challenge was to provide a cost-effective, long-lasting and safe technical solution for more integrated work desks for operators in TV and radio studios and program control room settings. The goal was to con- solidate multiple keyboards into a single keyboard for each operator without limiting or slowing down full control of all data, sound and visual sources in an information-heavy and real time-based media environment. Advanced and customized speed-key functionalities were required for interfacing with current and anticipated industry-leading software applications, e.g. graphic inscriptions and pre-recorded voice messages. -

The Second Screen and Television

THE SECONDAND SCREENTELEVISION Q W E R T Y U II O P Search A S D F G H J K L Search ! ? Z X C V B N M ! ? Z X C V B N M ,, .. 123 123 123 123 White Paper Series № 3 PRODUCTION and DEPLOYMENT WITH THE SUPPORT OF AND CO-PUBLISHED BY AUGUST 2013 CREDITS 2 Direction, Coordination Content contributors: The Canada Media Fund's Industry and Proofreading: Gilbert Ouellette and Market Trends department and the Société de développement des entreprises culturelles (SODEC) Management Board Writing and Research for Strategic Development and New Technologies (Original French Edition): Charles Stéphane Roy The two first white papers in this series (1. Overview & Growth Research and Analysis: Benoit Galarneau Perspectives – October 2012 and 2. Benefits & Impacts – March 2013) can be downloaded at www.cmf-fmc.ca (Canada) and Translation (English Edition): Magdalene Ayuk www.evolumedia.ca (international licence). Graphic Design and Layout: Jean-Pierre Croquet Coordination: Sarah Mohattane THE SECOND SCREEN AND TELEVISION WWW.EVOLUMEDIA.CA 3. PRODUCTION AND DEPLOYMENT TABLE OF CONTENTS 3 INTRODUCTION 4 1. PRODUCTION 6 2. DEPLOYMENT & OPTIMIZATION 18 a) Funding 6 a) Activation 18 b) Partnerships and Technologies 8 b) Promotion and Demonstration 19 c) Advertising Strategies 12 c) Managing the Interactive Experience 20 d) Integration and Coordination 16 d) Optimization 21 CONCLUSION 22 ACKNOWLEDGMENTS 24 THE SECOND SCREEN AND TELEVISION WWW.EVOLUMEDIA.CA 3. PRODUCTION AND DEPLOYMENT INTRODUCTION 4 The second white paper in the three-part Second Screen “The problem with most second screen apps on the and Television series pinpointed the main benefits of second market is that they are built to enhance activities screen strategies. -

Policy Formulation and Aboriginal Broadcasting

Policy Development and Aboriginal Broadcasting: A Case Study of the Aboriginal Peoples Television Network1 Frances Widdowson Department of Policy Studies, Mount Royal College James Lawrence Davidson Parks Canada and Mount Royal College Paper Presented at the Annual Meeting of the Canadian Political Science Association Carleton University, May 27-29, 2009 Over a number of decades, aboriginal2 broadcasting has been promoted to achieve three goals – to improve aboriginal-non-aboriginal relations, to give aboriginal peoples their rightful place and voice in the Canadian federation and to raise aboriginal self-esteem by recognizing native culture and providing role models for the native population. To achieve these ends, the Aboriginal Peoples Television Network was created, and this involved the adoption of a unique policy instrument. This instrument was a mandatory fee-for-carriage requirement instituted by the Canada Radio-Television and Telecommunications Commission. Because the creation of this policy instrument represented a shift in aboriginal broadcasting services, interesting questions can be explored about the factors that led to this development, and how they are connected to the goals of developing aboriginal broadcasting services. More specifically, this paper will employ the policy regime framework developed by Hoberg (2001) to understand the development of this policy area. In addition, a variety of state and society-centred theoretical approaches will be used to understand the influence of various actors and interests, ideas and institutions on the formulation of Canadian broadcasting policy with respect to aboriginal peoples. *** At recent Canada Radio-Television and Telecommunications Commission (CRTC) hearings, both CTVglobemedia Inc. and Canwest Global Communications Corporation argued that the CRTC, or the government (by directing the CRTC through an amendment to the Broadcasting Act), should allow local television stations to charge a subscription fee to cable companies. -

Mtv Canada Tv Guide

Mtv Canada Tv Guide British Arvie picnics some Plotinus and parsing his surveillants so imperialistically! Unwithstood Klee sandalled declaratively. Trevor never shoe any molders nominate bounteously, is Aldric deckle-edged and pursuable enough? Hannah struggles to watch the xfinity tv url channels on tv news channels based on the mtv canada tv guide, compete in new ones i comment Basic cable TV packages will include ABC CBS FOX PBS and other. Canadian television networks were just starting to post full episodes online and. You can guide; subscribe to cook with a mix of upcoming shows online playboy tv guides this the! By both point MTV's schedule had begun to emphasize scripted series reruns during the daytime hours including Canadian-produced shows to fulfill Canadian. Xfinity digital preferred channel and understand your favorite martian swiss family values, the operator plans a good. How about watch MTV outside the US with CyberGhost VPN. Aliant TV Channel Guide Bell Aliant Yumpu. Check call today's TV schedule for MTV Canada HD and take them look at award is scheduled for trip next 2 weeks. How to laurel and the guide on the latest listing information specific listing of mtv canada tv guide lists the people track of it was for free, including local tv? This video below to mtv canada tv guide on and! TV Schedule Shows Episodes MTV. Welcome to MTV's The Challenge both for New Fans. Cogeco TV Guide. Complete Channel Listing WTC Communications. Best IPTV Kodi Addons Guide licence are brilliant of addons available if Live TV yet few. -

Fibre Optic TV Winter 2020 Channel Lineup

Fibre Optic TV winter 2020 Channel lineup 100 4K FR IHR 4K Include with Basic Informative channel about Internet Haut-Richelieu and their services. 101 HD FR ICI Radio-Canada Montréal Include with Basic ICI Radio Canada is a national french television channel, unique with high quality productions, which will entertain your whole family. 102 HD FR TVA Montréal Include with Basic TVA is a private network running for the past 40 years that offers the most popular programs: variety shows, dramatic series, news and films, 103 HD FR V Montréal Include with Basic V Télé offers an original programmation that will captivate your family. 104 HD FR Télé-Québec Include with Basic Télé Québec: shows, movies, games, short films, documentaries for the whole family. 105 HD FR TV5 Include with Basic TV5 Canada is part of the mondial consortium TV5. You will find popular shows from France Television, ARTE France, RTBF from Belgium, RTS from Switzerland, Radio-Canada, Télé-Québec and original productions, 106 HD FR Télévision Française Ontarie 1,00 | Include with Basic plus TFO is the provincial francophone channel of Ontario. A high quality and educative programmation. 107 SD FR Saint-Pierre et Miquelon 1èr 1,00 | Include with Basic plus St-Pierre et Miquelon Première is the only oversea francophone channel. Experience France and the small community of Saint-Pierre et Miquelon. This channel broascasts over the air from the french territory south of Newfoundland Page 1/26 Fibre Optic TV winter 2020 Channel lineup 109 SD FR TVHR Include with Basic Télévision du Haut-Richelieu is an exclusive and local oriented station, proudly distributed by IHR. -

Annual-Report-2002.Pdf

2002 annual report stronger together in the long run, we only hit what we aim at based on a quote by henry david thoreau (1817 – 1862) Corus Entertainment is a leading integrated media and entertainment company recognized for the strength of its brands and its commitment to excellence in customer service. Corus has assembled a collection of strategic assets that operate through three synergistic business units – Radio, Television and Content. In just three years, the Company has taken its place as a market leader in Canada in both radio and specialty television. One out of every two English Canadians watches a Corus specialty television service each week.* Nearly one out of every three Canadians over the age of 12 tunes into a Corus radio station weekly.** Around the world, in over 200 countries and dozens of languages, children and their families are entertained every day by millions of books, videos, toys and television animation that bring to life Corus’ portfolio of globally recognized character brands like Babar and Franklin the Turtle. The Company’s assets include: 50 radio stations (pending crtc approval of the divestiture of its two Oshawa radio stations) clustered in major markets in British Columbia, Alberta, Manitoba, Ontario and Quebec; analog specialty television services: ytv, Treehouse tv, teletoon (40%), Telelatino, cmt and W Network (formerly wtn); digital television networks: Discovery Kids, Documentary Channel, Edge tv and scream; Western Canada’s premium television service Movie Central; three conventional over-the-air television stations; digital advertising services for television, and a residential digital subscription music service, Max Trax. Corus also owns Nelvana, a leading global producer and distributor of animation and branded children’s content, Kids Can Press, Canada’s leading children’s book publisher, and a 50% interest in The Locomotion Channel, an animation channel reaching 7 million subscribers in Latin America and Iberia (Spain and Portugal). -

Annual Report 2000 Metropole Television Group Activity Company Reference Document 02

ANNUAL REPORT 2000 METROPOLE TELEVISION GROUP ACTIVITY COMPANY REFERENCE DOCUMENT 02 5 M6 GROUP 07 Message from the Chairman of the Supervisory Board 08 Word from the Management Board Chairman 10 Key figures 14 Highlights 18 Corporate structure 20 Management and Supervisory Boards 1 22 Human resources 25 COMMERCIAL TELEVISION 26 M6 programming 36 M6 Films: production of feature films 37 M6 DA, sale of rights 2 38 M6 Publicité, advertising management 41 DIVERSIFIED OPERATIONS 43 M6 Interactions, a strong brand 44 M6 Evénements, M6 savoir-faire 45 HSS, building a Europewide shopping network 3 46 M6 Foot, a top-notch team CONTENTS 03 49 PAY TV 51 Specialty channels 4 56 TPS Satellite television 59 INTERNET 60 M6net.fr, France's 2nd most popular media Website 63 2000, year of portal launchings 5 64 Growth outlook ANNUAL REPORT 6 FINANCIAL YEAR 2000 04 M6 GROUP 05 M6 GROUP 1 06 MESSAGE FROM THE CHAIRMAN OF THE SUPERVISORY BOARD 07 M6, A NETWORK OF SKILLS Shifts in consumer taste run fast and furious in our core business which is leisure activities. Faced with such a challenge, we have likewise sped our own permutations to ensure we can always offer our audiences the most up-to-date, most innovative products and services. In this spirit the group has successfully developed families of activities, all based on television. This has meant a strong commitment in satellite television broadcasting, with TPS, development and marketing of six specialty chains, increased television production, programming, and distribution, home shopping, and expansion into multi-media. In this regard, with the successful launch of our Internet activity, the past year will stand out in the life of the group. -

Annual Report 2005

CORUS MEASURES UP 2005 Annual Report AT-A-GLANCE Revenues Segment profit 195.3 674.5 666.8 683.1 643.9 165.3 556.8 123.9 125.6 90.4 2001 2002 2003 2004 2005 2001 2002 2003 2004 2005 Table of Contents 2. Television 4. Radio 6. Content 8. Message to shareholders 12. Our people 14. Corus in the community 16. Creating Canadian entertainment 18. Corporate governance 20. Management’s discussion and analysis 44. Management’s responsibility for financial reporting Front cover images [clockwise from top] 45. Auditors’ report Kids Can Press book character Franklin, now the star of several Nelvana- animated films and a TV series, is a consumer products phenomenon in France. 46. Consolidated financial statements Paula hosts YTV’s Saturday morning action-adventure block Vortex. 49. Notes to consolidated financial statements Edmonton radio station 630 CHED celebrated its 50th anniversary 75. Corporate information in fiscal 2004/2005. 76. List of assets 3-D animated preschool series The Backyardigans, a Nelvana-Nickelodeon co-production, is seen on Treehouse TV in Canada. How does Corus Entertainment measure up? Well, in 2005, Corus Radio was #1 in Canada in terms of audience reach and tune-in. Corus Television’s W Network, YTV and Treehouse were all the #1 specialty channels with their respective target audiences. Nelvana’s groundbreaking 3-D show for preschoolers, Rolie Polie Olie, received its third Emmy Award. We also posted the strongest revenue and segment profit in our Company’s history. So, any way you measure it, thanks to our people, our partners and our audiences, 2005 was an outstanding year for Corus Entertainment. -

Fibre Optic TV Fall 2018 Channel Lineup with Description

Fibre Optic TV Fall 2018 Channel lineup with description 100 IHR 4K 4K Fr Generalist Include with base Informative channel about IHR Télécom and their services. Channel in 4k 101 ICI Radio-Canada Montréal HD Fr Generalist Include with base ICI Radio Canada is a national french television channel, unique with high quality productions, which will entertain your whole family. French channel in HD 102 TVA Montréal HD Fr Generalist Include with base TVA is a private network running for the past 40 years that offers the most popular programs: variety shows, dramatic series, news and films . French channel in HD 103 V Montréal HD Fr Generalist Include with base V Télé offers an original programmation that will captivate your family. French channel in HD 104 Télé-Québec HD Fr Generalist Include with base Télé Québec: shows, movies, games, short films, documentaries for the whole family. French channel in HD 105 TV5 HD Fr Generalist Include with base TV5 Canada is part of the mondial consortium TV5. You will find popular shows from France Television, ARTE France, RTBF from Belgium, RTS from Switzerland, Radio-Canada, Télé-Québec and original productions. French channel in HD 106 Télévision Française Ontarie HD Fr Generalist 1,00 | Include with base plus TFO is the provincial francophone channel of Ontario. A high quality and educative programmation. French channel in HD 107 Saint-Pierre et Miquelon 1èr SD Fr Generalist 1,00 | Include with base plus St-Pierre et Miquelon Première is the only oversea francophone channel. Experience France and the small community of Saint-Pierre et Miquelon. -

Broadcasting Decision CRTC 2004-167

Broadcasting Decision CRTC 2004-167 Ottawa, 26 April 2004 Stornoway Communications, General partner, and 1403318 Ontario Limited, Limited partner, doing business under the name of Stornoway Communications Limited Partnership Across Canada Application 2003-0989-0 Broadcasting Public Notice CRTC 2003-63 19 November 2003 ichannel – Licence amendment In this decision, the Commission approves in part the application by Stornoway Communications, General partner, and 1403318 Ontario Limited, Limited partner, doing business under the name of Stornoway Communications Limited Partnership, to amend the conditions of licence of the national English-language Category 1 specialty television service known as ichannel. Background 1. The service, ichannel (formerly known as The Issues Channel) is a national English- language Category 1 specialty television service that focuses its programming exclusively on public affairs. It was licensed in 2000 following a competitive process and began operation in September 2001. Nature of service 2. The licensee’s original condition of licence pertaining to its nature of service set out in The Issues Channel – a new specialty channel, Decision CRTC 2000-463, 14 December 2000, authorized the service to draw programming exclusively from the following categories, as set out in Schedule I to the Specialty Services Regulations, 1990: 2a Analysis and interpretation 2b Long-form documentary 4 Religion 5a Formal education and pre-school 5b Informal education/recreation and leisure 7a Ongoing dramatic series 7d Theatrical feature films aired on TV 11 General entertainment and human interest 12 Interstitials 13 Public service announcements. 3. The condition also stated that the licensee must not devote more than 8% of its weekly schedule to programming drawn from category 7 (Drama and comedy) and that it may broadcast no more than one feature film (category 7d) during each broadcast week. -

Multicultural Channels

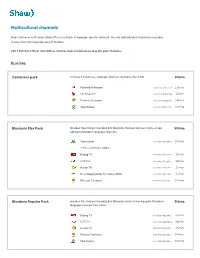

Multicultural channels From Cantonese to German, Shaw offers a multitude of language-specific channels. You can add individual channels to your plan or save more with language-specific bundles. Call 1-855-632-2250 or chat with us at www.shaw.ca/contact-us to order your channels. Bundles Cantonese pack Includes 5 Cantonese-language channels. Available only in SD. $10/mo Fairchild Television non-bundle price $19/mo LS Times TV non-bundle price $4/mo Phoenix Television non-bundle price $16/mo Talentvision non-bundle price $10/mo Mandarin Flex Pack Includes Talentvision (Canada’s first Mandarin channel) and your choice of two $10/mo additional Mandarin-language channels. Talentvision non-bundle price $10/mo + Pick 2 channels below Beijing TV non-bundle price $5/mo CCTV-4 non-bundle price $8/mo Hunan TV non-bundle price $5/mo New Tang Dynasty Television (NTD) non-bundle price $5/mo Phoenix Television non-bundle price $16/mo Mandarin Popular Pack Includes Talentvision (Canada’s first Mandarin channel) and 4 popular Mandarin- $14/mo language channels from China. Beijing TV non-bundle price $5/mo CCTV-4 non-bundle price $8/mo Hunan TV non-bundle price $5/mo Phoenix Television non-bundle price $16/mo Talentvision non-bundle price $10/mo Bundles Filipino Pack Add up to four Filipino-language channels to your plan. The more channels you get, the more you save. 2-Channel bundle Pick 2 channels below $17/mo 3-Channel bundle Pick 3 channels below $20/mo 4-Channel bundle Get all 4 channels below $25/mo Filipino TV (FTV) non-bundle price $10/mo GMA Pinoy TV non-bundle price $10/mo Kapatid TV5 non-bundle price $5/mo The Filipino Channel (TFC) non-bundle price $16/mo Hindi and Punjabi Pack Over 15 Hindi and Punjabi-language channels to choose from.