Middlesex Regional Educational Services Commission Piscataway, New Jersey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Students Praised As Woodbridge Academy Celebrates Blue Ribbon Award

M I S S I O N S T A T E M E N T To be College and Career Ready To prepare students for employment in the competitive labor force and for lifelong learning by providing a program that stresses the expectation that all students achieve the New Jersey Curriculum Standards at all grade levels; the work ethic; technology; industry driven occupational skills competency; broadly transferable academic thinking, problem-solving, and communication skills; diversity and equity behaviors, and the rights and responsibilities of citizenship. Educational Philosophy The Middlesex County Vocational and Technical Schools have been providing high school students and adults with the opportunity to receive a quality vocational and academic education for 100 years. The passing rate on nationally certified occupational competency tests, the job placement rate for our graduates, and the passing rate on the New Jersey High School Graduation Assessments demonstrates our commitment to help students achieve high educational standards through career training and academic competency. The schools include the Academy for Science, Mathematics and Engineering Technologies on the campus of Middlesex County College in Edison, the Academy for Allied Health and Biomedical Sciences in Woodbridge and three traditional career technical education campuses located in East Brunswick, Perth Amboy and Piscataway. The district offers career training programs with courses at the secondary and post-secondary levels, adult evening school, and apprenticeship training. There are also many programs which serve special education students. High school students must meet the academic requirements for graduation which are mandated by the New Jersey Department of Education. Message to the Community The 2014-2015 school year marked the beginning of the second century of the Middlesex County Vocational and Technical Schools. -

Environmental Assessment, Kin Buc Landfill Operable Unit II, Edison

SDMS Document 56333 OJ n o o CDM FEDERAL PROGRAMS CORPORATION fv .fc. o o # FINAL RISK ASSESSMENT PART II - ENVIRONMENTAL ASSESSMENT KIN BUG LANDFILL OPERABLE UNIT II EDISON, NEU JERSEY 0 Prepared for U.S. ENVIRONMENTAL PROTECTION AGENCY Office of Waste Programs Enforcement Washington, D.C. 20A60 EPA Work. Assignment No. C02004 EPA Region II Site No. 2P0A Contract No. 68-W9-0002 CDM Federal Programs Corporation Document No. TESV-C02004-FR-CJZL Prepared By CDM FPC CD Work Assignment Project Manager Jeanne Litwin Telephone Number (212) 393-9634 o o EPA Work Assignment Manager Alison Barry o Telephone Number (212) 264-8678 Date Prepared February 27, 1992 o I ABLr E OF CONTENTS ! .0 introGuction . ; \ 1.1 Objectives and Scope 2 1.1.1 Objectives of the Environmental Assessment . 2 1.1.2 Scope of the Environmental Assessment- 2 1.2 Site Description •. 2 1.2.1 Description of the Ecosystems and Habitats that may be Impacted 2 1.2.2 Division of Site for Analysis of Contaminant Pathways and Effects 2 1.3 Identification of Chemicals of Potential Concern 4 1.3.1 Calculation of Summary Statistics 4 1.3.2 Compansons with Background Locations 7 1.3.3 Chemicals in Surface Water ; . 7 1.3.4 Chemicals in Sediments 10 1.3.5 Biota . /. 25 2.0 Environmental Exposure 30 2.1 Potential Ecological Receptors 30 2.1.1 Aquatic Biota 30 2.1.2 Plants . 30 2.1.3 Birds 31 2.1.4 Mammals 31 2.1.5 Identification of Rare, Threatened, and Endangered Species 31 2.2 Exposure Assessment 31 2.2.1 Pathways for Exposure of Aquatic Biota 36 2.2.2 Pathways for Exposure of Wetland Species 36 3.0 Toxicity Assessment 43 3.1 Methods for Assessing Toxicity and Risks of Contaminants to Aquatic Species 43 3.1.1 Surface Water Exposure 43 3.1.2 Sediment Exposure . -

Registered Schools

Moody’s Mega Math Challenge A contest for high school students SIAM Society for Industrial and Applied Mathematics 3600 Market Street, 6th Floor Philadelphia, PA 19104 USA [email protected] M3Challenge.siam.org 2009 M3 Registered Schools Connecticut Fairfield County Bethel High School, Bethel Bassick High School, Bridgeport New Canaan High School, New Canaan (two teams) Brien McMahon High School, Norwalk Ridgefield High School, Ridgefield Stamford High School, Stamford (two teams) Weston High School, Weston (two teams) Staples High School, Westport Hartford County Miss Porter's School, Farmington Greater Hartford Academy of Math and Science, Hartford (two teams) Newington High School, Newington Conard High School, West Hartford Litchfield County Kent School, Kent New Milford High School, New Milford (two teams) Northwestern Regional High School, Winsted (two teams) Middlesex County Valley Regional High School, Deep River East Hampton High School, East Hampton New Haven County Hamden High School, Hamden (two teams) Francis T. Maloney High School, Meriden Joseph A. Foran High School, Milford Wilbur Cross High School, New Haven Wolcott High School, Wolcott (two teams) New London County East Lyme High School, East Lyme New London Public Schools, New London Norwich Free Academy, Norwich Delaware New Castle County Sanford School, Hockessin Pencader Charter, New Castle Charter School of Wilmington, Wilmington (two teams) Salesianum School, Wilmington District of Columbia Coolidge High School, Washington, D.C. Benjamin Banneker Academic High -

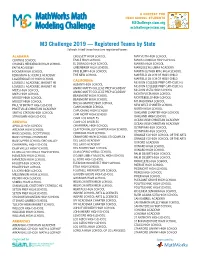

M3 Challenge 2019 — Registered Teams by State Schools Listed Twice Have Two Registered Teams

A contest for high school students M3Challenge.siam.org [email protected] M3 Challenge 2019 — Registered Teams by State Schools listed twice have two registered teams. ALABAMA CROSSETT HIGH SCHOOL MAR VISTA HIGH SCHOOL CENTRAL SCHOOL EARLE HIGH SCHOOL MARIA CARRILLO HIGH SCHOOL CHARLES HENDERSON HIGH SCHOOL EL DORADO HIGH SCHOOL MARINA HIGH SCHOOL FAITH ACADEMY GREENBRIER HIGH SCHOOL MARQUEZ HS-LIBRA ACADEMY HOOVER HIGH SCHOOL PINE BLUFF HIGH SCHOOL MARTIN LUTHER KING HIGH SCHOOL IQRA MATH & SCIENCE ACADEMY THE NEW SCHOOL MAYFIELD SR SCH OF HOLY CHILD MAYFIELD SR SCH OF HOLY CHILD LAUDERDALE CO HIGH SCHOOL CALIFORNIA LOVELESS ACADEMIC MAGNET HS MISSION COLLEGE PREP CATHOLIC HS ALBANY HIGH SCHOOL LOVELESS ACADEMIC MAGNET HS MISSION COLLEGE PREP CATHOLIC HS ANIMO WATTS COLLEGE PREP ACADEMY MCPS HIGH SCHOOL MISSION VISTA HIGH SCHOOL ANIMO WATTS COLLEGE PREP ACADEMY MCPS HIGH SCHOOL MONTA VISTA HIGH SCHOOL BEAUMONT HIGH SCHOOL MOODY HIGH SCHOOL MONTEBELLO HIGH SCHOOL BEAUMONT HIGH SCHOOL MOODY HIGH SCHOOL MT MADONNA SCHOOL BOLSA GRANDE HIGH SCHOOL PAUL W BRYANT HIGH SCHOOL NEW WEST CHARTER SCHOOL CANYON HIGH SCHOOL PRATTVILLE CHRISTIAN ACADEMY NORTH HIGH SCHOOL CAPUCHINO HIGH SCHOOL SMITHS STATION HIGH SCHOOL OAKLAND CHARTER HIGH SCHOOL CARLMONT HIGH SCHOOL STRAUGHN HIGH SCHOOL OAKLAND HIGH SCHOOL CAVA-LOS ANGELES OCEAN VIEW CHRISTIAN ACADEMY CAVA-LOS ANGELES ARIZONA OCEAN VIEW CHRISTIAN ACADEMY CHAPARRAL HIGH SCHOOL APOLLO HIGH SCHOOL OLYMPIAN HIGH SCHOOL CLAYTON VALLEY CHARTER HIGH SCHOOL ARCADIA HIGH SCHOOL OLYMPIAN HIGH SCHOOL CORDOVA -

Public School Directory 2017-2018

PUBLICPUBLIC SCHOOL SCHOOL DIRECTORY DIRECTORY 2017-20182017-2018 www.middlesexcountynj.govwww.middlesexcountynj.gov Middlesex County Superintendent of Schools 13-15 Kennedy Boulevard East Brunswick, New Jersey 08816 Telephone: 732-249-2900 Fax: 732-296-6567 MISSION STATEMENT The Middlesex County Superintendent’s Office provides timely support with programs, certification and services that help school districts to operate efficiently and successfully. The office supports collaborative efforts for districts to share services that support student achievement and best practices for district operations. Yasmin E. Hernández-Manno, M.Ed. Interim Executive County Superintendent of Schools Debra Hudson, Secretary to the Interim Executive County Superintendent (ext. 1-3425) John Nemeth (ext.1-3406) Executive County School Business Official Barbara Ryan, Secretary to the Executive County School Business Official (ext. 1-3551) Naomi Vliet (ext. 1-3422) Educational Specialist/Generalist Carmen Engleman, Secretary to the Educational Specialist/Generalist (ext. 1-3488) Mark Lanzi (ext. 1-3421) Educational Specialist/Special Needs Carmen Engleman, Secretary (ext. 1-3488) TEACHER CERTIFICATION Ann Zampino (ext. 1-3495) Teacher Certification Raksha Parikh (ext. 1-3564) Substitute Certification SCHOOL TRANSPORTATION Rosemary Lepri (ext. 1-3584) School Transportation 1 NEW JERSEY DEPARTMENT OF EDUCATION 100 RIVERVIEW PLAZA (Physical Address) P. O. Box 500 (Mailing Address) Trenton, NJ 08625-0500 Toll-Free Number 877-900-6960 Kimberly Harrington, Commissioner -

Things to Consider When Hosting a CJML Contest Reserve a Room To

Things to consider when hosting a CJML contest Reserve a room to accommodate students taking the contest. Contact our statistician to approximate the number of students that are attending our events. The approximate numbers are: 20 schools and 150 students. Reserve a room for our coaches’ meeting. Provide refreshments that can be reimbursed by the treasurer from the teacher fund. Have students check in our schools as they arrive. Use the list on page 2 to check in schools and list the number of students and advisors present. Distribute tickets to students as they arrive so they can exchange the ticket for pizza and a drink. Pizza and Drinks: You should order about 22 pies for the kids, so that there is a margin of error, plus a couple of pies for the teachers (to be reimbursed from the teacher fund, of course). There is no directive to serve the kids soda. Water is great. You can pay for things in advance and then the treasurer will reimburse you by check. You can get reimbursed up to $400 for the refreshments that you provide for the kids. (Refreshments that you provide the teachers are not included in this $400 figure.) Photocopy the contest You should photocopy a lot of extra copies of the contest, so that each coach can have a few -- about 230 copies. And just as many copies of the solutions. We only need about 25 copies of the answer key, since that's just to help the coaches while scoring. Items to have during the contest. Microphone for the event. -

Spring 2015 Vol

SPRING 2015 VOL. 33 NO. 2 MRESCUpdate M IDDLESEX R EGIONAL E DUCATIONAL S ERVICES C OMMISSION Cooperative, Cost Efficient, Quality Services New Program For Young Adults With Special Needs Opens partnership between the Middlesex ARegional Educational Services Commission and The Arc Middlesex County has resulted in the creation of the Piscataway Career Center (PCC), a program for adults with intellectual and/or developmental disabilities who at 21, have aged out of their public schools. The program runs daily from 9:00 a.m. - 3:00 p.m. and is located at 1670 Stelton Road, within the Piscataway Regional Day School. Participants receive ongoing life skills training, community-based job experiences, and academic instruction. According to Superintendent of Schools Mark J. Finkelstein, the effort is something the MRESC has been interested in starting for several years. “It is wrong for students and families that have relied on public special education to be left to fend for themselves when the student turns 21, Coordinator Eric Ware working at the new young adult Piscataway Career Center and the PCC is a significant first step in Program with Noor Amjad (Center) and Edem Berson. our attempt to address this issue,” said Mr. Finkelstein. (See New Program on page 2) MRESC Launches New Superintendent Search Service he Middlesex Regional Educational Services Commission has of effectively serving their school district and Tlaunched a Superintendent Search Service to help boards of community,” Mr. Caldwell added. education identify and hire outstanding superintendents. Heading the MRESC’s Superintendent “As an Educational Services Commission, our mission includes Search Service is Dr. -

Moody's Mega Math Challenge 2011 Triage Survivors (Listed by State

MiamiDade Gulliver Prep Miami Beach High Sarasota Pine View School Seminole Seminole High School Volusia Moody’s Mega Math Challenge 2011 Spruce Creek High School Triage Survivors (Listed by state and county) Georgia Connecticut DeKalb Chamblee Charter High School Fairfield Brien McMahon High School (1 team) Forsyth Fairfield Ludlowe High School North Forsyth High School Fairfield Warde High School New Canaan High School (2 teams) Fulton Ridgefield High School (2 teams) Northview High School Staples High School (2 teams) Roswell High School Hartford Gwinnett Greater Hartford Academy of Math and Science, Mill Creek High School Delaware Maine New Castle Wilmington Friends School Cumberland Cape Elizabeth High School Florida Kennebec Maranacook Community High School Alachua Eastside High School, Gainesville, FL (2 teams) Maryland Duval Stanton College Preparatory School Montgomery Georgetown Preparatory School Hillsborough Montgomery Blair High School T R Robinson High School Massachusetts Martin Essex Jensen Beach High School Haverhill High School Moody’s Mega Math Challenge 2011 – Triage Survivors Page 1 Middlesex Academy for Allied Health and Biomedical Advanced Math and Science Academy Sciences Arlington High School Carteret High School Belmont High School Middlesex County Academy Westford Academy (2 teams) North Brunswick High School St. Joseph High School Norfolk The Middlesex County Academy for Science, Needham High School Mathematics, and Engineering Technologies Wardlaw‐Hartridge School Plymouth West Windsor‐Plainsboro High School -

Middlesex County Vocational and Technical High Schools

MIDDLESEX COUNTY VOCATIONAL AND TECHNICAL HIGH SCHOOLS COMPREHENSIVE ANNUAL FINANCIAL REPORT FOR THE FISCAL YEAR ENDED JUNE 30, 2017 The Board of Education of the Vocational and Technical High Schools County of Middlesex, New Jersey Comprehensive Annual Financial Report For the Year Ended June 30, 2017 Middlesex County Vocational and Technical High Schools East Brunswick, New Jersey Prepared by Business Office Table of Contents Page INTRODUCTORY SECTION Letter of Transmittal 1 Organizational Chart 7 Roster of Officials 8 Independent Auditors and Advisors 9 FINANCIAL SECTION Independent Auditors' Report 10 Required Supplementary Information - Part I Management's Discussion and Analysis 13 Basic Financial Statements Government-wide Financial Statements: A-1 Statement of Net Position 27 A-2 Statement of Activities 28 Fund Financial Statements: Governmental Funds: B-1 Balance Sheet 29 8-2 Statement of Revenues, Expenditures and Changes in Fund Balance 30 B-3 Reconciliation of the Statement of Revenues, Expenditures and Changes in Fund Balances of Governmental Funds to the Statement of Activities 31 Enterprise Fund: B-4 Statement of Net Position 32 8-5 Statement of Revenues, Expenses and Changes in Fund Net Position 33 8-6 Statement of Cash Flows 34 Fiduciary Funds: B-7 Statement of Fiduciary Net Position 35 B-8 Statement of Changes in Fiduciary Net Position 36 Notes to the Basic Financial Statements 37 Table of Contents (continued) Page FINANCIAL SECTION (continued) Required Supplementary Information and Note to the RSI- Part II Schedules -

Board of Chosen Freeholders

Administration Building Middlesex County 75 Bayard Street New Brunswick, NJ 08901 Meeting Minutes Board of Chosen Freeholders Thursday, October 6, 2016 7:00 PM Freeholders' Meeting Room Regular Meeting CALL TO ORDER MOMENT OF SILENCE SALUTE TO THE FLAG OPEN PUBLIC MEETINGS ACT STATEMENT Clerk: The notice of this meeting, pursuant to the "Open Public Meetings Act", NJSA 10:4-10 has been complied with and shall be entered into the minutes of this meeting. ROLL CALL Attendee Name Title Status Arrived Kenneth Armwood Freeholder Present Carol Bellante Freeholder Absent Charles Kenny Freeholder Present H. James Polos Freeholder Present Charles E. Tomaro Freeholder Present Blanquita B. Valenti Freeholder Present Ronald G. Rios Freeholder Director Present RECOGNITIONS Recognizing the 100th Anniversary of St. George Orthodox Church Recognizing the Honorees of the Roberto Clemente Gala Recognizing the Lebanese Information Center-NJ Chapter and Lebanese-Americans Proclamation For Breast Cancer Awareness Month - October 2016 PRESENTATIONS CORRESPONDENCE Clerk: Each Freeholder has been provided with a list of correspondence received by the Clerk's Office since our last meeting. This correspondence will be kept on file in the Office of the Clerk of the Board for reference. Motion to accept the Correspondence Middlesex County Page 1 Board of Chosen Freeholders Meeting Minutes October 6, 2016 RESULT: APPROVED [UNANIMOUS] MOVER: Blanquita B. Valenti, Freeholder SECONDER: Charles E. Tomaro, Freeholder AYES: Kenneth Armwood, Charles Kenny, H. James Polos, Charles E. Tomaro, Blanquita B. Valenti, Ronald G. Rios ABSENT: Carol Bellante MINUTES APPROVAL Board of Chosen Freeholders - Regular Meeting - Sep 15, 2016 7:00 PM RESULT: ACCEPTED [UNANIMOUS] MOVER: Blanquita B. -

Top School Listing.Xlsx

ICES Top High School List 2020 School Name City State Homer High School Homer AK Mat‐Su Career and Tech Ed High School Wasilla AK Petersburg High School Petersburg AK Arab High School Arab AL Auburn High School Auburn AL Bob Jones High School Madison AL Cullman High School Cullman AL Enterprise High School Enterprise AL Fairhope High School Fairhope AL Hartselle High School Hartselle AL Helena High School Helena AL Hewitt‐Trussville High School Trussville AL Homewood High School Homewood AL Huntsville High School Huntsville AL James Clemens High School Madison AL Mt Brook High School Mountain Brook AL Muscle Shoals High School Muscle Shoals AL Northridge High School Tuscaloosa AL Oak Mt High School Birmingham AL Oneonta High School Oneonta AL Ramsay High School Birmingham AL Spain Park High School Hoover AL Vestavia Hills High School Vestavia Hills AL Bentonville High School Bentonville AR Bismarck High School Bismarck AR Central High School Little Rock AR Concord High School Concord AR Eureka Springs High School Eureka Springs AR Fayetteville High School East Fayetteville AR Greenbrier High School Greenbrier AR Greenwood High School Greenwood AR Lakeside High School Hot Springs AR Prairie Grove High School Prairie Grove AR Rogers High School Rogers AR Southside High School Fort Smith AR Valley View High School Jonesboro AR Arizona College Prep ‐‐ Erie Campus Chandler AZ Catalina Foothills High School Tucson AZ Chaparral High School Scottsdale AZ Desert Mountain High School Scottsdale AZ Empire High School Tucson AZ Gilbert Classical -

Participating Schools

Moody’s Mega Math Challenge A contest for high school students SIAM Society for Industrial and Applied Mathematics 3600 Market Street, 6th Floor Philadelphia, PA 19104 USA [email protected] M3Challenge.siam.org 2008 M3 Participating Schools Connecticut Fairfield County Brien McMahon High School, Norwalk (two teams) New Canaan High School, New Canaan Newtown High School, Sandy Hook Ridgefield High School, Ridgefield Staples High School, Westport (two teams) Wilton High School, Wilton Hartford County Farmington High School, Farmington Greater Hartford Academy of Math and Science, Hartford (two teams) Newington High School, Newington (two teams) Litchfield County Northwestern Regional High School, Winsted Middlesex County Valley Regional High School, Deep River New Haven County Francis T. Maloney High School, Meriden Hamden High School, Hamden (two teams) West Haven High School, West Haven Wilby High School, Waterbury New London County East Lyme High School, East Lyme Delaware New Castle County St. Elizabeth High School, Wilmington The Charter School of Wilmington, Wilmington (two teams) Wilmington Christian School, Hockessin Massachusetts Barnstable County Barnstable High School, Hyannis (two teams) Nauset Regional High School, North Eastham Bristol County Fairhaven High School, Fairhaven Essex County Central Catholic High School, Lawrence (two teams) North Andover High School, North Andover Peabody Veterans Memorial High School, Peabody St. Mary's Jr/Sr High School, Lynn -continued- Organized by SIAM Funded by Society for Industrial